Escolar Documentos

Profissional Documentos

Cultura Documentos

Value of Gain FactSheet AM GTT 2011

Enviado por

arpit1121Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Value of Gain FactSheet AM GTT 2011

Enviado por

arpit1121Direitos autorais:

Formatos disponíveis

www.agmanager.

info

Value of Gain:

Current Situation and Overview of Available Decision Tools

September 2011

Glynn T. Tonsor (Kansas State University) Kevin C. Dhuyvetter (Kansas State University)

www.agmanager.info

Value of Gain: Current Situation and Overview of Available Decision Tools September 2011 Glynn T. Tonsor (Kansas State University) Kevin C. Dhuyvetter (Kansas State University)

As fall weaning approaches, cow-calf producers that have the facilities and resources for retaining ownership need to make the decision as to whether or not they can increase returns by adding weight to their calves. Likewise, stocker and backgrounding operators having access to feedstuffs, whether it is pasture (wheat, grass, or crop residues) or harvested crops, need to be looking at what they can pay for calves that they want to add weight to. Methods of adding weight to calves in the fall and winter months vary considerably across Kansas. Wheat pasture in southern and central Kansas is common many years, but without moisture soon that might be less of an option this year. Other areas rely on winter grazing of grass supplemented with purchased feeds such as distillers grains. One of the most common programs is to background calves with rations relying heavily upon forages such as silage or hay. Regardless, of the specific program, many of these fall and winter grazing and backgrounding programs begin in mid-October and continue for a period of one to six months depending on market conditions and a host of factors specific to a given producer's situation. Cattle markets constantly provide information regarding economic returns to adding weight to calves such as might be done with fall and winter grazing or backgrounding programs. The purpose of this fact sheet is two-fold: 1) to overview the current market situation for 2011 grazing and backgrounding and 2) to raise awareness of decision tools available to producers and others for evaluating their particular situations.

Current 2011 Projections Given diversity across operations including variation in forage and cattle quality, stocking density, supplemental rations fed, etc., two alternative rates of weight gain are evaluated. Namely an average daily gain (ADG) of 1.75 lbs is included as a conservative estimate of animal performance while an ADG of 2.25 lbs reflects a situation with above-average forage quality or cattle performance.

K-State Dept. of Agricultural Economics (Publication: AM-GTT-2011.5)

Page 2

www.agmanager.info

Table 1 presents the value of gain (VOG) projected for a 500 lb steer purchased in Salina, KS on October 19, 2011 assuming an ADG of 1.75 lbs. 1 Mathematically, VOG is simply the value per head of the animal at the end of the feeding period (sales value) less the value of the animal at the beginning of the period (purchase value) divided by the weight gain. This VOG information reflects the revenue aspects of grazing or backgrounding placement decisions by identifying the expected value suggested by current cattle market conditions for cattle weight gain. Producers vary notably in the weights at which they place cattle, the grazing/backgrounding duration employed, and the final weights achieved. Accordingly, the incremental VOG of each additional 50 lbs gained up to a weight of 800 lbs is presented along with the cumulative VOG for alternative ending weights. For instance, table 1 projects the first 50 lbs gained to be worth $124.77/cwt. The incremental VOG of each additional 50 lbs generally declines as the animal increases in weight. However, this decline in incremental VOG is not constant and is particularly sensitive to market seasonality consistent with the changing nearby feeder cattle futures market contract associated with a given ending weight.

Table 1. Value of Gain, Average Daily Gain of 1.75 lbs Incremental Cumulative Futures Date Weight $/cwt a $/head VOG ($/cwt) VOG ($/cwt) Contract 10/19/2011 500 $144.57 $723 base base Oct 11/16/2011 550 $142.77 $785 $124.77 $124.77 Jan 12/15/2011 600 $139.83 $839 $107.49 $116.13 Jan 1/12/2012 650 $137.69 $895 $112.01 $114.76 Jan 2/10/2012 700 $136.50 $956 $121.03 $116.33 Mar 3/9/2012 750 $133.71 $1,003 $94.65 $111.99 Mar 4/7/2012 800 $130.76 $1,046 $86.51 $107.74 Apr a Expected prices are from www.beefbasis.com (see footnote 1 for additional details) Table 2 presents similar information for the alternative situation of an ADG of 2.25 lbs. Comparing the first column in each table one readily observes the impact of a faster rate of weight gain is earlier marketing of an animal for any given final weight target. The impact of market seasonality on VOG projections given different ADG rates must also be noted. For

We particularly assumed a 100 head lot of Large and Medium-Large, Grade 1-2 steers are purchased and sold in Salina, KS. All projections were made on August 29, 2011.

1

K-State Dept. of Agricultural Economics (Publication: AM-GTT-2011.5)

Page 3

www.agmanager.info

instance, table 2 indicates February 29, 2012 would be the expected day for 300 lbs of weight gain to be achieved given a 2.25 ADG. Conversely, an ADG of 1.75 results in April 7, 2012 being the day 300 lbs of gain would be achieved. The relevance of this difference from a revenue perspective arises upon recognition of different nearby futures contracts being germane for these alternative dates.

Table 2. Value of Gain, Average Daily Gain of 2.25 lbs Incremental Cumulative Futures Date Weight $/cwt a $/head VOG ($/cwt) VOG ($/cwt) Contract 10/19/2011 500 $144.57 $723 base base Oct 11/10/2011 550 $141.20 $777 $107.50 $107.50 Nov 12/2/2011 600 $139.17 $835 $116.84 $112.17 Jan 12/24/2011 650 $136.94 $890 $110.18 $111.51 Jan 1/15/2012 700 $134.68 $943 $105.30 $109.96 Jan 2/7/2012 750 $133.44 $1,001 $116.08 $111.18 Mar 2/29/2012 800 $130.92 $1,047 $93.12 $108.17 Mar a Expected prices are from www.beefbasis.com (see footnote 1 for additional details) Once producers have a projection of what the market is offering as the VOG for a particular weight gain and time frame, they can compare this with their expected cost of gain (COG) to determine if adding weight will be profitable. For example, if a producer felt he could add 250 pounds to his fall-weaned calves for $95 per cwt ($0.95/lb of gain) using a program such that they gain 2.25 lbs per day and then marketing them in early February, he would increase the value of the calves approximately $40 per head compared to selling them at weaning [gain of 2.50 cwt x ($111.18 $95.00) = $40.45].

Available Resources and Decision Tools The VOG information presented in tables 1 and 2 reflects the revenue aspects of grazing or backgrounding placement decisions by identifying the expected value of cattle weight gain. Value of gain projections for alternative scenarios such as purchasing cattle of varying characteristics and using markets besides Salina, KS are easily obtainable. Those interested in alterative scenarios may use the Feeder Cattle Basis Forecast tool available at: www.beefbasis.com, which was used in generating the projections shown in tables 1 and 2. Historical prices and value of gain for different weight-time scenarios for feeder cattle in Kansas

K-State Dept. of Agricultural Economics (Publication: AM-GTT-2011.5)

Page 4

www.agmanager.info

are available in the CattleSeasonalsCash.xls Excel spreadsheet available at www.agmanager.info/Tools/default.asp#LIVESTOCK.

As previously noted, in addition to acquiring an estimate of value of gain (VOG), producers need a parallel assessment of costs facilitating $/head or $/cwt margin projections. Cost of production, and corresponding cost of gain (COG) vary notably across producers making description of "typical" situations problematic. Fortunately there are tools available that can guide producers in estimating their COG. Representative grazing and drylot backgrounding budgets are available in both Adobe PDF and Microsoft Excel format under the title "Winter Wheat Grazing" (MF-1009) and "Drylot Backgrounding of Beef" (MF-600) at: www.agmanager.info/livestock/budgets/projected/default.asp.

Similarly, there are decision tools available for producers to use who already possess a more detailed understanding of their COG. These producers are encouraged to utilize the "Cattle Breakeven Selling and Purchases Prices" resource available in both Web Dashboard and Microsoft Excel format at: www.agmanager.info/Tools/default.asp#LIVESTOCK. Table 3 on the last page shows information that can be generated in the Excel version of this decision tool for the VOG and COG example discussed above. 2

Conclusions Cattle producers looking to add weight to calves this fall, whether they are calves retained from their own cowherd or calves purchased, through grazing or feeding operations can benefit from the improved decisions resulting from enhanced understanding of current revenue, costs, and hence profit projections. Depending on the specific rate of gain and total gain, the market is currently projecting the cumulative value of gain (VOG) to be about $110-$115/cwt. Thus, producers wanting to retain ownership or purchase calves this fall will need to add gain at a cost of gain less than that in order to be profitable. Producers are encouraged to utilize the resources and decision tools introduced here by expanding beyond the representative examples presented to reflect their unique situations.

Additional information includes break-even selling prices for alternative purchase prices or costs of gain.

K-State Dept. of Agricultural Economics (Publication: AM-GTT-2011.5)

Page 5

www.agmanager.info

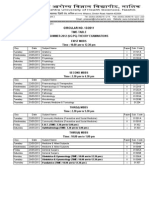

Table 3. Breakeven Selling Price Worksheet (screen capture from Buy-Sell.xls)

Purchase weight (lbs) Purchase price ($/cwt) Purchase date (mm/dd/yy) Average Daily Gain (pay-to-pay) Feeding cost of gain ($/cwt) Interest rate on feeder and feeding cost of gain Percent death loss* Costs per head (trucking, vaccines, backgrounding, etc.)** Desired profit per head

** Do not enter any costs included in feeding cost of gain.

500 $144.57 10/19/11 2.25 $95.00 7.00% 1.50% $0.00 $0.00

* Enter ONLY if death loss is NOT included in feeding cost of gain, otherwise enter zero.

Selling Weight1 500 550 600 650 700 750 800

1 2

$138.57 N/A 135.77 132.92 130.54 128.53 126.81 125.34

$140.57 N/A 137.63 134.63 132.12 130.01 128.20 126.64

Purchase Price ($/cwt) $142.57 $144.57 $146.57 Breakeven Selling Price ($/cwt)2 N/A N/A N/A 139.48 141.33 143.19 136.34 138.04 139.75 133.71 135.29 136.87 131.48 132.96 134.43 129.58 130.96 132.34 127.94 129.24 130.54

$148.57 N/A 145.04 141.46 138.45 135.91 133.73 131.85

$150.57 N/A 146.90 143.16 140.03 137.38 135.11 133.15

Expected sale date 10/19/11 11/10/11 12/02/11 12/24/11 01/15/12 02/07/12 02/29/12

Expected cash price $144.57 $141.20 $139.17 $136.94 $134.68 $133.44 $130.92

Enter the minimum selling (pay) weight you want to consider. Based on a feeding cost of gain of $95/cwt.

Selling Weight 500 550 600 650 700 750 800

1

$87.50 N/A 140.75 136.88 133.63 130.88 128.51 126.47

$90.00 N/A 140.95 137.27 134.19 131.57 129.33 127.39

Feeding Cost of Gain ($/cwt) $92.50 $95.00 $97.50 Breakeven Selling Price ($/cwt)1 N/A N/A N/A 141.14 141.33 141.53 137.66 138.04 138.43 134.74 135.29 135.84 132.26 132.96 133.65 130.15 130.96 131.78 128.32 129.24 130.17

$100.00 N/A 141.72 138.82 136.39 134.34 132.60 131.09

$102.50 N/A 141.91 139.20 136.94 135.03 133.41 132.02

Expected sale date 10/19/11 11/10/11 12/02/11 12/24/11 01/15/12 02/07/12 02/29/12

Expected cash price $144.57 $141.20 $139.17 $136.94 $134.68 $133.44 $130.92

Based on a purchase price of $144.5/cwt. Breakeven Selling Price is below Expected cash price (expect positive returns) Breakeven Selling Price is above Expected cash price (expect negative returns)

K-State Dept. of Agricultural Economics (Publication: AM-GTT-2011.5)

Page 6

Você também pode gostar

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Unit-15 Sales Forecasting and Sales Quotas PDFDocumento8 páginasUnit-15 Sales Forecasting and Sales Quotas PDFbhar4tp100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Chap 008 - RETURN ON INVESTED CAPITAL AND PROFITABILITY ANALYSISDocumento26 páginasChap 008 - RETURN ON INVESTED CAPITAL AND PROFITABILITY ANALYSIShy_saingheng_760260970% (10)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Water Network Design SoftssDocumento18 páginasWater Network Design Softssarpit1121100% (1)

- FINAL Income Tax MatrixDocumento9 páginasFINAL Income Tax MatrixFC EstoestaAinda não há avaliações

- Moisture Correction SheetDocumento1 páginaMoisture Correction Sheetarpit1121100% (1)

- Capital Asset Pricing ModelDocumento20 páginasCapital Asset Pricing ModelSattagouda M PatilAinda não há avaliações

- Synopsis On E-CommerceDocumento9 páginasSynopsis On E-CommerceVikas0% (1)

- Material ManagementDocumento1 páginaMaterial Managementarpit1121Ainda não há avaliações

- Legend: Annexure-"B" POUR PLAN For Minor Bridge No-138 (Wall & Slab) in SS1-CDocumento1 páginaLegend: Annexure-"B" POUR PLAN For Minor Bridge No-138 (Wall & Slab) in SS1-Carpit1121Ainda não há avaliações

- DFCC Project, CTP12 Express Frieght Consortium Equipment InspectionDocumento1 páginaDFCC Project, CTP12 Express Frieght Consortium Equipment Inspectionarpit1121Ainda não há avaliações

- Equipment InspectionDocumento1 páginaEquipment Inspectionarpit1121Ainda não há avaliações

- Optimal Design of Water Supply Networks in Buildings: SÂRBU, IoanDocumento8 páginasOptimal Design of Water Supply Networks in Buildings: SÂRBU, Ioanarpit1121Ainda não há avaliações

- To Whom It May Concern: We Wish Him All The Best in His Future EndeavorsDocumento1 páginaTo Whom It May Concern: We Wish Him All The Best in His Future Endeavorsarpit1121Ainda não há avaliações

- SynopsisDocumento14 páginasSynopsisarpit1121Ainda não há avaliações

- Pozzolanic Activity: Reaction Rate PozzolanDocumento2 páginasPozzolanic Activity: Reaction Rate Pozzolanarpit1121Ainda não há avaliações

- Water Resources Systems Department of Civil Engineering Indian Institute of Science, BangaloreDocumento25 páginasWater Resources Systems Department of Civil Engineering Indian Institute of Science, Bangalorearpit1121Ainda não há avaliações

- Init TT Cir No 13 2011 Ug PG Excep PG Med N Ug IV Bds New Main Final 281211Documento45 páginasInit TT Cir No 13 2011 Ug PG Excep PG Med N Ug IV Bds New Main Final 281211arpit1121Ainda não há avaliações

- CHAPTER 19 - Value AnalysisDocumento35 páginasCHAPTER 19 - Value Analysisarpit1121Ainda não há avaliações

- (MTI) Level of InnovationDocumento11 páginas(MTI) Level of InnovationRafika Hamidah HamdiAinda não há avaliações

- Refit-Value University Hawassa Campus Mathematics For ManagementDocumento2 páginasRefit-Value University Hawassa Campus Mathematics For ManagementTedla GuyeAinda não há avaliações

- What Are The Factors Affecting Brand ImageDocumento21 páginasWhat Are The Factors Affecting Brand ImageManisha Gurnani0% (1)

- M&A - Group 10 - Ride Aid CorporationDocumento11 páginasM&A - Group 10 - Ride Aid CorporationAryan GargAinda não há avaliações

- Job Description - NUVODocumento2 páginasJob Description - NUVOSaumya SinghAinda não há avaliações

- Busaing, Ma. Christina - Chapter#5Documento3 páginasBusaing, Ma. Christina - Chapter#5Tina GandaAinda não há avaliações

- Unit8 Feb2015 PDFDocumento33 páginasUnit8 Feb2015 PDFJared OlivarezAinda não há avaliações

- Barra China Equity Model (CNE5) FactsheetDocumento2 páginasBarra China Equity Model (CNE5) FactsheetDominic TsuiAinda não há avaliações

- The Great Remake Manufacturing For Modern Times Full Compenium October 2017 FinalDocumento134 páginasThe Great Remake Manufacturing For Modern Times Full Compenium October 2017 FinalAxel VanraesAinda não há avaliações

- Finance QuizDocumento4 páginasFinance Quizaoi03Ainda não há avaliações

- Stock Valuation: A Case Study of Texas Instruments: Brinwa Michelle Kra, Brisa Marner, Diana Ruiz, and Mitchell WolfeDocumento7 páginasStock Valuation: A Case Study of Texas Instruments: Brinwa Michelle Kra, Brisa Marner, Diana Ruiz, and Mitchell Wolfesaeed ansariAinda não há avaliações

- Daftar Pustaka - 11-34 CrosbyDocumento6 páginasDaftar Pustaka - 11-34 CrosbyMuhammad Sidiq AAinda não há avaliações

- Klaus Uhlenbruck - Hochland CaseDocumento15 páginasKlaus Uhlenbruck - Hochland CaseAvogadro's ConstantAinda não há avaliações

- FIN3101 Corporate Finance Practice Questions Topic: Capital BudgetingDocumento3 páginasFIN3101 Corporate Finance Practice Questions Topic: Capital BudgetingKelly KohAinda não há avaliações

- Role of Consumer in National Economy & Consumer MovementDocumento46 páginasRole of Consumer in National Economy & Consumer MovementSANJAYSINGHMEENA33% (3)

- Patrick Cantos COMP SHEET 3.11.23!2!1Documento22 páginasPatrick Cantos COMP SHEET 3.11.23!2!1pao reyesAinda não há avaliações

- More Past Exam Practice - Primature and ProtectDocumento2 páginasMore Past Exam Practice - Primature and ProtectRenata SánchezAinda não há avaliações

- FM - Assignment 1 - F & MDocumento1 páginaFM - Assignment 1 - F & MsravanAinda não há avaliações

- Assumptions of CVP AnalysisDocumento10 páginasAssumptions of CVP AnalysisJonathan BausingAinda não há avaliações

- China: Vaccination Rollout Is Relatively SlowDocumento4 páginasChina: Vaccination Rollout Is Relatively Slowahmad.subhan1411Ainda não há avaliações

- International Financial ManagementDocumento23 páginasInternational Financial Managementsureshmooha100% (1)

- Growth Companies Marketing Focus: Corporate Financial StrategyDocumento21 páginasGrowth Companies Marketing Focus: Corporate Financial StrategyAmmara NawazAinda não há avaliações

- 14Mkt Intervention Q&ADocumento14 páginas14Mkt Intervention Q&AJacquelyn ChungAinda não há avaliações

- Multiple Choice Questions For Marketing Aptitude Part 8: For Solved Question Bank Visit and For Free Video Lectures VisitDocumento4 páginasMultiple Choice Questions For Marketing Aptitude Part 8: For Solved Question Bank Visit and For Free Video Lectures VisitDhawal RajAinda não há avaliações

- Peter EnglandDocumento17 páginasPeter Englandkrishna kant guptaAinda não há avaliações