Escolar Documentos

Profissional Documentos

Cultura Documentos

Rafhan AR 2012

Enviado por

M Umair ManiDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Rafhan AR 2012

Enviado por

M Umair ManiDireitos autorais:

Formatos disponíveis

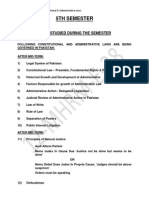

10

Years at a Glance

Net Sales Rs. Million Cost of Sales Rs. Million Gross Prot Rs. Million %age of Sales Prot After Tax Rs. Million Capital Expenditure Rs. Million Dividend Amount Rs. Million Dividend Percentage Earnings per Share

(Rupees)

2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 19,531 18,271 13,913 11,428 10,747 7,578 6,127 5,194 4,534 4,031 15,557 14,471 10,615 8,993 8,006 5,480 4,556 3,997 3,259 3,001 3,975 3,800 3,298 2,435 2,741 2,098 1,571 1,198 1,275 1,030 20 21 24 21 26 28 26 23 28 26 2,040 2,034 1,838 1,297 1,492 1,089 809 615 670 521 1,185 1,122 582 848 606 114 122 302 448 415 1,062 1,062 924 831 924 831 647 323 286 259 1,150 1,150 1,000 900 1,000 900 700 350 310 280 161.57 117.92 87.62 66.57 72.51 56.43 220.86 220.20 198.99 140.43

for the year ended December 31, 2012

Annual Report

In the name of Allah The Most Merciful, The Compassionate

02 Company Information

03 Organogram 04 Notice of Meeting 08 Chief Executives Review 18 Directors Prole 20 Major Events 2012 22 Horizontal Analysis - P&L and B / S 23 Vertical Analysis - P&L and B / S 24 Directors Report 30 Forward Looking Statements 32 Stakeholders Information 33 Summary of Cash Flow Statements 34 Comments on Analysis Results 34 Statement of Value Added & its Distribution 35 Review Report 36 Statement of Compliance 37 Auditors Report 38 Balance Sheet 40 Prot and Loss Account 41 Statement of Comprehensive Income 42 Cash Flow Statement 43 Statement of Changes in Equity 44 Notes to the Financial Statements 69 Pattern of Shareholding Proxy Form

Company Information

Mehran Plant Board of Directors Chairman Jorgen Kokke Vice Chairman Rashid Ali - Non-Executive Legal Advisor M. Ali Seena C/o Surridge & Beecheno, Karachi Shares Registrar - - - - - - - - Non-Executive Non-Executive Non-Executive Non-Executive Non-Executive Non-Executive Independent Executive FAMCO Associates (Pvt.) Ltd. 1st Floor, State Life Building, 1-A I.I. Chundrigar Road, Karachi - 74000: Tel: (92-21) 32427012 - 32425467 Fax: (92-21) 32426752 - 32428310 Registerd Ofce 1st Floor, Finlay House, I.I. Chundrigar Road, Karachi - 74000: Ph: (92-21) 32442516 - 32410848 Fax: (92-21) 32428651 Head Ofce & Shares Department Rakh Canal East Road, Faisalabad, Pakistan Ph: (92-41) 8540121 - 22 - 23 Fax: (92-41) 8711016 - 8502197 Website: www.rafhanmaize.com Email: corporate@rafhanmaize.com Plants: Rakh Canal Plant: Rakh Canal East Road, Faisalabad Ph: (92-41) 8540121 - 22 - 23 Fax: (92-41) 8711016 - 8502197 Cornwala Plant: 5-KM Jaranwala-Khurrianwala Road, Jaranwala - Faisalabad Ph: (92-41) 4316121 - 26 Fax: (92-41) 4315100 Mehran Plant: K.B. Feeder Road, Kotri Jamshoro, Sindh. Ph: (92-223) 870894 - 98 Fax: (92-223) 870893 - Non-Executive Auditors KPMG Taseer Hadi & Co. Chartered Accountants Lahore - Karachi

Chief Executive & Managing Director Ansar Yahya Directors Cheryl K. Beebe Mary A. Hynes James P. Zallie Zulkar Mannoo Mian M. Adil Mannoo Wisal A. Mannoo Sh. Gulzar Hussain Dr. Abid Ali Chief Financial Ofcer Dr. Abid Ali Secretary M. Yasin Anwar Audit Committee Sh. Gulzar Hussain Cheryl K. Beebe Rashid Ali Zulkar Mannoo - - - - Chairman Member Member Member - Executive

Human Resource & Remuneration Committee Jorgen Kokke Cheryl K. Beebe Rashid Ali Ansar Yahya - - - - Chairman Member Member Member

Shares Transfer Committee Rashid Ali Ansar Yahya Dr. Abid Ali Bankers Citibank N.A. Habib Bank Ltd. Meezan Bank Ltd. MCB Bank Ltd. National Bank of Pakistan Standard Chartered Bank (Pakistan) Ltd. - - - Chairman Member Member

for the year ended December 31, 2012

Annual Report

Organogram

Board of Directors

Chief Executive & Managing Director

Chief Financial Ofcer

Deputy Director Operations, Safety & Environment

Director Marketing & Business Development

Senior Procurement Manager (Agri-Produces & General Materials)

Deputy Director HR & Admin

Company Secretary & Compliance Ofcer

Head of Internal Audit

Manager Maize Production

Senior Manager Customer Services & Logistics (South Region)

Manager Warehouse & Stores

Quality Assurance Manager

Notice of Meeting

Notes: 1. The Share Transfer Book of the Company will remain closed from 15th to 22nd March, 2013 (both days inclusive) and no transfer will be accepted for registration during this period. 2. A member entitled to attend, speak and vote at the meeting shall be entitled to appoint another person as his/her proxy to attend, speak and vote instead of him/her, and a proxy so appointed shall have such rights with respect to attending, speaking and voting at the meeting as are available to a member. Proxies in order to be effective must be received by the Company not less than 48 hours before the meeting. A proxy need not be a member of the Company. Form of proxy is attached. 3. Shareholders are requested to notify change of address, if any, to Companys Shares Registrar immediately. 4. CDC shareholders desiring to attend the meeting are requested to bring their original Computerized National Identity Cards, Account and Participants ID numbers, for identication purpose, and in case of proxy, to enclose an attested copy of his/her CNIC. IMPORTANT - DIVIDEND MANDATE & CNIC NO. In accordance with SECPs directives, all shareholders, who have not yet opted for dividend mandate, are requested to authorize the company to directly credit all future cash dividends to their bank account by conveying following particulars to our Shares Registrars M/s FAMCO Associates (Pvt.) Ltd., State Life Building No. 1-A, 1st Floor, I.I. Chundrigar Road, Karachi > Title of Bank Account > Bank Account No. > Bank Name > Branch Name and Address > Cell / Landline Number of Shareholder > CNIC No. CDC shareholders will reply to their respective Stock Exchange Broker. Pursuant to the directives of the SECP, CNIC number is mandatorily required to be mentioned on dividend warrants. In case of non-receipt of the copy of valid CNIC, the Company would be unable to comply with SRO 831(1)/2012 dated 5 July 2012 of SECP and therefore may be constrained under Section 251(2)(a) of the Companies Ordinance, 1984 to withhold dispatch of dividend warrants of such shareholders in future. Please submit a copy of your valid CNIC (only Physical Shareholders), if not already provided to the Shares Registrar of the Company. Please also submit National Tax Number, if not yet submitted.

Notice is hereby given that the 121st General Meeting (Annual Ordinary) of the shareholders of Rafhan Maize Products Co. Ltd. will be held on Friday, March 22, 2013 at 10:30 a.m. at the Overseas Investors Chamber of Commerce and Industrys Hall, Talpur Road, Karachi to transact the following business: 1. To conrm minutes of the last General Meeting (Extraordinary) of the shareholders of the Company held on Friday, September 7, 2012 at Karachi. 2. To receive, consider and adopt the Audited Accounts of the Company for the year ended December 31, 2012 together with the Directors and Auditors Reports thereon. 3. To approve nal cash dividend @750% for the year ended December 31, 2012 as recommended by the Board of Directors. 4. To appoint auditors and x their remuneration. The present auditors Messrs KPMG Taseer Hadi & Co., Chartered Accountants, retire and being eligible, offer themselves for re-appointment. The Board of Directors, on recommendations of the Audit Committee, has proposed appointment of Messrs KPMG Taseer Hadi & Co., Chartered Accountants for the year 2013. By order of the Board Karachi March 1, 2013 M. Yasin Anwar Company Secretary & Compliance Ofcer

CSR A c ti vi ti es

Treatment Expenses for Poor Patients at Liver Center

Eye Camp at Girls High School

SOS Children Village

Beds for ICU - Allied Hospital

Vision

To be the Premier Provider of Rened Agriculturally Based Products and Ingredients in the Region.

Mission Statement

To grow business consistently through positive relationship with customers to attain full customer satisfaction and to bring continual improvement by adopting only those business practices which add value to our customers, employees and shareholders.

for the year ended December 31, 2012

Annual Report

Our Core Values

01 03 05

Nothing is more important Our goal: Zero accidents

Safety

02 04 06

Of the products we make, the services we provide, the relationships we build

Quality

Honesty & trust are the foundation of our business We will maintain the highest standards of conduct

Integrity

Respect

We promote openness, teamwork, trust and mutual cooperation

Excellence

We will relentlessly pursue excellence in all that we do and give employees the resources they need to excel

Innovation

Continue to find new customer solutions and share those breakthroughs around the Ingredion World

Chief Executives Review

Ansar Yahya

Chief Executive & Managing Director

It is my pleasure to present the Annual Report and review of the performance of your Company for the fiscal year ended Dec 31, 2012. Despite difficult economic conditions and a challenging business environment, your Company, by the grace of Almighty Allah, was able to remain on its growth track by achieving 7% higher net sales than last year and net income of Rs.2.04 billion.

Economic Environment

The year 2012 was yet another challenging year for the economy of Pakistan. The widening demand and supply gap of energy and depletion of natural gas reserves adversely impacted the cost of production in the manufacturing sector. The energy shortfall and resultant demand recession, decline in foreign and local investment, high scal decit and overall economic slowdown restricted GDP growth to 3.7% against a desired growth rate of 6-7%. The agriculture sectors performance was less than expected with a repeat of oods which inundated a signicant part of agricultural land in the southern region. Imbalances on the external front and absence of investment inows pushed the value of Rupee to a record low level. A high rate of unemployment resulted in deterioration of disposable income and a rise in cost of living. As such, many of our consuming industries experienced an exceptionally high rise in raw material and energy costs affecting their sales volumes, revenue and protability.

During the year 2012, prices of corn showed a mixed trend and the gross corn prices kept uctuating. The biggest challenge in 2012 from a manufacturing standpoint has been managing spiraling variable costs owing to increased dependence on alternative fuels as a result of the worsening gas and electricity supply situation. Ongoing cost management and controlling initiatives were taken to partially offset the negative impact of escalating input costs but high energy costs radically eroded the margins. Consequently, the net income remained almost at par with the last year. This sustainable performance conrms the effectiveness of Companys long term business strategy and rm commitment to meet its objectives to create value for all the stakeholders.

Business Review

During the last six decades, your Company had been able to build trust with your customers as supplier of ingredients to meet their changing needs. In 2012, we were able to build on growing our volumes, ensuring quality and timely

Operating Results

Year ended December 31 Net Sales Net Income After Tax Earnings Per Share Rs. (Million) Rs. (Million) Rupees 2012 2011 19,531 2,040 220.86 18,271 2,034 220.20

deliverance across the country. Our long-term relationship with our customer is an asset. We provide our customers with sustainable solutions to their needs. Our history of reliable operations, building relationships and delivering on commitment helped us to combat the diverse challenges. Our ingredients and solutions add functionality to products being consumed in diverse consuming industries. The diverse and balanced range of sectors we serve is an important part of our strength and success. The Company believes that customer satisfaction is the driving force behind our spirit to meet those challenges and achieve excellence in whatever we do. Everything starts with our Values Safety, Quality, Integrity, Respect, Excellence and Innovation. We believe that clear and consistent commitment to these values is vital for sustainable business success. Our product portfolio spans a broad range

The nancial results look quite appreciable when reviewed in the context of the overall business and economic conditions during the year 2012 and the energy crisis which impacted Companys operating performance. This achievement is the result of implementing strategic management practices, building operational efciencies and better economies of scale as well as effective product mix management, strong innovation and focused investment.

for the year ended December 31, 2012

Annual Report

Industries We Serve...

of product categories including Industrial, Food and Animal Nutrition & Health Ingredients to serve multifarious consuming segments in the Textiles, Confectionery & Bakery, Paper & Corrugation, Pharmaceuticals, Chemicals & Allied, Livestock feeds and many others.

Food Business

The food business offers a wide spectrum of products, services and solutions to diversied customers including confectionery & baking, desserts, beverages, savory products, ice cream and processed foods. Our product-line covers a wide range of products including Globe & Snowake starches, Rafhan Liquid Glucose, Cerelose Dextrose Monohydrate, Rafhan Liquid Caramel and Golden Syrup to meet different functionalities in food products. Your Company continued to remain a trusted and preferred

Industrial Business

Your Company is one of the premier providers of quality integrated solutions for different industrial applications in more than 50 types of industries. A difcult business environment persisted for the textile industry, which is a major consumer of starches. The downstream textile industry in general was badly affected by the energy crisis but the composite textile mill sector performed comparatively well. The Company offers a diversied portfolio of solutions and products to Textile sector and the sale of those products remained depressed. Paper and paperboard demand in Pakistan has shown growth in line with the overall improvement in education and packaging. The paper industry showed mixed performance. The small scale units faced tough competition from cheaper imports, high cost of inputs and energy shortfall. However, the large scale units operated normally and are bringing structural changes to increase domestic capacities of quality paper and paperboard to meet the growing demand which may create better demand for specialty starches. Corrugation and paper converting units operated normally to meet demand for industrial, electronics, fruits & vegetables, cement and food packaging. We serve the pharmaceutical business with a strong portfolio of leading and innovative brands Snowake, Farmal and Flo-SweetTM. The focus continues to be on developing new products and establishing new applications for existing and new ingredients.

supplier of raw materials to enhance customer base in food segment. Innovative solutions provided to the food sector have opened the door for business expansion. We consider growth as the key to success in the present competitive environment and are very much focused on taking appropriate actions to grow our business in the food sector.

Animal Nutrition and Health Business

Almost all the consuming segments of Poultry, Dairy Cattle and Aquaculture in livestock feeding continued to show growth in business. The poultry sector is the largest consumer of our ANI business. The poultry industry is making investments for mechanization, integrated farming systems, improving biosecurity, processing and value addition. Similarly, development of dairy farming and evolution of cattle feed rationing and growing areas for aquaculture contributed positively to the demand for ANI products. However, the energy crisis impacted our supply line and we could not fully meet the demand from our customers.

10

Chief Executives Review

Exports

The Company, in line with its vision, is on track to pursue new growth opportunities in export markets. The emphasis is on continually improving our export business by focusing on innovation and optimizing our Company portfolio. for the countries like Pakistan. Your Company is working for the last several years to enhance the production and yield of maize crop to meet the growing needs of industrial, food and feed segments. We are vigilant of crucial challenges the agriculture sector might face in the coming years and the role that maize crop may play in maintaining sustainable grain supply chain. We stand committed to the farming community with the support of our talented workforce and robust research & development platform. We also feel proud to have helped the farming community to create success in their lives through innovative farming approaches. We are assisting the corn growers to nd ways and means not only to produce more but also better through the adoption of efcient post-harvest handling measures. We are making efforts to strategically increase the cultivation of maize crop in Sindh and Khyber PK provinces. In KPK, most of the farmers still work without access to the modern agronomic practices and technologies. This is due to barriers such as small holdings, poor infrastructure and traditional farming. We have made arrangements to better train the local farmers about the benets of advanced farm management Your Company maintained a long term outlook and achieved positive growth in export volumes. We believe that there are opportunities in the international market and we can explore those opportunities. During the year, export performance was good despite the economic recession in the regional markets. However, the ever-growing increase in cost of production on account of utilities and other factors remained the major constraint to expand business in the global markets where other countries are heavily subsidizing their exports. Your Companys focus will be to pursue long-term sustainable growth by offering premium quality, superior services and innovative products. Your Company is determined to explore new export markets for maximum capacity utilization and earn valuable foreign exchange for the country. practices. In Sindh, we are focusing to work alongside farmers and societies to add a new crop in the form of maize to their existing cropping pattern. Commercial contract farming has started to ensure improved access to assured local markets, farm advisory services and in time payback. Our Maize Production Department is strongly committed to the development of maize farming in Pakistan and we place great importance on the training and development of the farmers. This agricultural extension program helps to raise the income of farmers, contributes to foods security and is benecial to all involved. Our team of agronomists regularly conducts farmer gatherings, where the latest information about good farming practices is given to help farmers and to improve farm economics as well as provide necessary information to improve their yields and ensure quality.

Raw Materials

Maize, being the highest yielding crop in the world, is important

Investments

We continue to target long term production growth with a balanced, diverse and resilient portfolio. Our focus remains to concentrate on our resources and investment in areas that will support our objective of delivering long-term growth. In 2012, we progressed further on our journey of growth and commenced commercial production at our new Mehran Plant at Kotri (Jamshoro) in the province of Sindh. The new plant will enhance our geographical reach capabilities. A number of projects were also undertaken at our existing production facilities to bring manufacturing optimization as a part of continuous improvement program.

for the year ended December 31, 2012

Annual Report

11

Cornwala Plant

We will continue to pursue capital projects for diversication and expansion in capacities in order to meet the changing and broadening needs of our valuable customers.

the environment and work for continual improvements in Health, Safety, Environment and Quality (HSEQ) systems. We recognize employees inputs towards quality by emphasizing skills development and professionalism.

Operations

Our manufacturing teams remain a key driver behind the sustained growth of our Company. As our business grows, our investment in plants and production infrastructure continues to steward premium quality for our customers. Moving forward, we are working to streamline operations and improve service levels by leveraging overall business synergies to ensure greater efciency and faster delivery. The Company remained engaged in efforts to improve process and administrative efciency through various activities of process re-engineering and review to further improve its product quality and simultaneously boost production efciencies and eliminate non-value added activities. This year, we have taken several steps to save energy and to keep our plants running to meet the demand from our customers. However, these alternate energy arrangements are quite expensive and add signicantly to the costs. The worsening energy crisis in Pakistan is our biggest challenge and we are planning to meet this challenge through strategic investments and improvements. We always strive to meet and exceed customers expectations by delivering the best products and technical services to our valued customers. Your Company continued to focus on reassessing the changing needs of its customers by investing in product quality and capacities. These changes along with inherent strength of its diverse portfolio have helped the Company to attain its overall growth objective. Our commitment

Integrated Quality and Environmental System

Quality Assurance is a top priority at all levels of the organization. Your Company is committed to provide the best quality products in the market, endeavors to protect

12

Chief Executives Review

to deliver Top Quality and Quantity was strengthened in 2012 through customer satisfaction survey and the result showed high satisfaction level. During the year, your Company has undergone successful surveillance audits of its Quality Management System ISO 9001:2008, ISO-14001:2004 EMS and OHSAS 18001: 2007 re-certication without any non-conformity and we endeavor to maintain this record in the future. We also obtained HALAL certication in respect of maintaining plant operations and management system in compliance with food standards. Implementation of ISO-22000:2005 FSMS has been completed this year and certication is achieved. Quality is assured through systematic and effective adoption, implementation, monitoring and continuous enhancement of quality control systems using latest methods of analysis. We have been extremely focused on meeting international standards. We initiated Lean Six Sigma to enhance competencies, improve efciency and creating values. Systematic training program has been kicked off to impart Lean Six Sigma training to a group of employees for Yellow, Green, Black and Master Black belt certications. This may help us to determine the current and future state of our processes in identied projects that can be used to improve our ways of working further. Our production facilities are ably supported by our research and development team to meet the tailor-made requirements of our customers. R&D capability is one of the principal reasons of the Companys strong business relationship with our valued customers. Our R&D expertise allows us to have a strong role in business development and makes us capable of identifying and enhancing the product portfolio to remain a partner of choice for all types of our customers.

Information Technology

Induction of world class business processes driven via Information Technology (IT) continues to be a key focus. IT at your Company offers a variety of services within the core functions of Process Management, Information Security, Customer Relationship Management and Enterprise Resource Planning (SAP) as well as IT Infrastructure and Operational services to support business strategies.

Product Development

Knowing our customers and their needs is the key to our business success. We strive to enhance our product range through product development. Your Company has come a long way from its beginnings to achieve excellence and consistent growth in its business. A major key to our success has been continuous development of innovative ingredients and keeping our products relevant, vibrant and valuable for all kinds of customers to meet different functionalities. Your Company has proved itself as an industry leader when it comes to the introduction of new processes and products, and in providing technical sales services and product application support for the advantage of our customers. Your Company has always been committed to innovation. We use market research to understand the customers needs. We use this insight to drive our own product development to differentiate ourselves from our competitors and importantly to give our customers an advantage from working with Rafhan Maize. Over the years, we have come up with tremendous innovations in our product-line which have contributed and added value to products for different consuming sectors. The implementation of SAP at all plants is a milestone achievement and will enable processes in line with best business practices, delivering values, efciency and effective controls, leading to successful business operations. The IT Team wholeheartedly participated in training and development of their peers that will help to support the growing needs of the Company in a cost effective manner. Your Company recognizes IT as an essential tool for maintaining the current business status and future progress. The production facilities and our ofces in different locations are connected through dedicated communication channels. As a strategic contributor, the IT team plays a vital role in the execution of business strategy and in the simplication of business operations, thereby bringing in efciency, improvement and standardization. The IT Department also spearheaded a string of changes focusing on induction and integration of cost effective and operationally efcient systems into the existing IT portfolio.

SAP Certicates Distribution Ceremony

for the year ended December 31, 2012

Annual Report

13

Health Safety and Environment (HSE)

Safety is one of our top priorities and we base our policies on the belief that all accidents are preventable. We have individual safety plans for all employees at all locations and in 2012 we made improvements in our safety management and control arrangements. The workplaces are made safer by a proactive approach, everybodys participation and use of work permit procedures. Accident reporting and analysis mechanism is dened and follow-up for corrective and preventive measures is being undertaken to avoid recurrence of incidents. The training sessions on OHSE are regularly conducted for employees to enhance the awareness of safety. We continue to improve the Companys environmental, health and safety processes to reach our goal of Zero Accident. Your Company has come a long way to embed a culture of safety within the organization and has achieved zero recordable incidents and lost time case during 2012. Rafhan has achieved 26.59 million man hours for the Company and contractors employees at Rakh Canal Plant and 20.34 million man hours at Cornwala Plant without any lost workday accident. Your Company places Safety, Health and Environment (SHE) at the heart of its business agenda. November was celebrated as a month of Safety with enthusiasm across the organization and excellent participation from all employees. Sites came up with interesting and innovative activities to reiterate the importance of safety and the priority it deserves. Your Company is continually working to promote a quality conscious and environment friendly culture. For the consecutive fourth time, your Company won the Best Practices Award on OHSE and Environment Excellence Award 2012 on account of its excellent safety culture and environmental initiatives and

successful implementation of environmental management system.

HR Management and Employees Relations

Human resources management plays a key role in recruiting, promoting and retaining the best employees. We put in place a targeted recruitment strategy for hiring people with the core skills, expertise and values to ensure that we deploy the right people for right positions. We believe in our people and strive to enable them to adhere to our values every day in every interaction. The Company strongly believes that its employees are the core assets and has remained focused on providing the most conducive environment through strong HR practices. The Company considers its workers as partners in continued success of Rafhan Maize and provides subsidized food at its canteen, subsidized grocery on monthly basis, entertainment facilities and annual awards for good performance and long

14

Chief Executives Review

ANNUAL BUSI NE S S M E E T I NG 2012

service awards to its employees. During 2012, scholarships were awarded to 100 children of employees at different levels. This support enabled our employees to get quality education for their children. Annual Sports Day is a regular feature at our Company. The Company provides all kind of opportunities to its employees to keep them physically and mentally t. A large number of employees take part in different games every year and this year about 300 employees participated. We aim to drive higher quality talent decisions by ensuring that opportunity for growth and challenging varied career experiences are provided to all employees. Our prime focus is to nurture a wining culture based on a high level of engagement, awless execution of HR processes, talent development and retention while ensuring ownership and accountability at all levels. The Company is committed to build a strong organization culture that is shaped by empowered and motivated employees.

and development plays a vital role in modeling employees for current as well as future organizational requirements. Since we consider our human resources as a prime resource, we continuously endeavour to ensure appropriate and systematic enhancement of technical and managerial competence through well rounded training and development, formulated on the basis of training needs assessment, staff career plans, succession plan and other organizational requirements. Training programs are developed and delivered by trainers from within the Company as well as local and international experts. During the year, 50 training programs were conducted by focusing on technical & other skills. More than 250 professionals beneted from these programs. Marketing and Lean Six Sigma. These programs included courses on subjects such as HSE, IT, PM,

Employee Training & Management Development

Your Company considers its human resource as the most valuable asset and remains committed to ensure that all employees are treated with equality, dignity and respect. Training

Social Responsibilities and Sustainability

Corporate social responsibility has become an integral part of the business today. The Company has a long history of carrying out its obligations as a responsible corporate citizen with respect to protection of interest of its customers, employees, shareholders, communities and environment.

for the year ended December 31, 2012

Annual Report

15

LEAN SIX SIGMA CHAMPIONS TRAINING

With a strong sense of corporate social responsibility, we believe in making a difference in the lives of society towards uplifting the economic well-being of the people. Your Company is contributing to society through a structured social investment program that aims to integrate the economic, social and environmental needs of the local communities. We are working with healthcare partners to provide information, advice and support to employees on health matters and share best practices across the Company. The Company allocates appropriate amount for education, health and social development sectors in the form of donations from time to time. During the period under review, your Company sponsored an Eye Camp for 1,700 girls students at a high school, provided nancial assistance to Harmans SOS Children Village, borne annual educational expenses of 10 girls students at college level, donated 3 beds for ICU in a local hospital and shared treatment expenses for poor patients at distinctive hospitals in the community. Internships were offered to 33 students from various academic institutions and 26 students are undergoing apprenticeship training under our ongoing program for the development of youth scheme. We have provided sites to a local bank and a post ofce to facilitate general public. Your Company also maintains a primary school in our locations to impart quality education to children of the locality. Fully equipped dispensaries are maintained to cope with emergencies and provide general health care to the employees. The Company does not employ any child labor and is an equal opportunity employer. Extensive tree plantation and development of green areas inside and outside the plants shows Companys commitment to the environment. 1,100 plants were planted in the premises of our plants and 8,606 square feet green area was developed at Mehran Plant to promote healthy environment. We seek to operate in a way that is environmentally sustainable as practical, while working continuously to reduce our

environmental impact. We believe that the highest standards of corporate behavior are essential to our long term success. We recognize that we cannot have a healthy and growing business unless the communities we serve are healthy and sustainable.

Business Risks, Challenges and Future Prospects

Keeping in view the importance of energy and its role in the economic growth, the Company is on track to continuously explore new opportunities and meeting new challenges through its vision, commitment and management practices. The business outlook for 2013 is prone to various types of risks and to a high degree of dependency on the development in the economic, political and security situation of the country. The energy shortfall is the biggest challenge for the Pakistan economy. Growth revival will depend on expedited implementation of structural reforms and scal improvements. Considering the fact that margins are under pressure due to currency devaluation, rising input costs and the need to use costlier alternate fuels to maintain smooth operations, the Company will focus on increasing volumes, tight cost control, process optimization and efcient working capital management. We shall continue to embark upon various initiatives to withstand business challenges.

Corporate Distinctions and Awards

Your Companys Annual Report for the year 2011was selected by the Joint Committee of the Institute of Chartered Accountants of Pakistan (ICAP) and Institute of Cost and Management Accountants of Pakistan (ICMAP) for the nomination of Best Corporate & Sustainbility Report Award

16

Chief Executives Review

and was ranked rst in the Food & Allied category to secure Best Corporate Report Award. Your Company was also awarded the CSR National Excellence Award. The award was given in appreciation and recognition of services and overall performance in corporate social sector. The Corporate Excellence Awards given by ICMAP & MAP were other achievements to acknowledge policies, practices, processes and products from all sectors of business in the country. Employers Federation of Pakistan in coordination with ILO recognized our Practices in the eld of Occupational Health, Safety and Environment. Your Company was also awarded Merit Trophy by the Federation of Pakistan Chambers of Commerce and Industry for the export promotion of non-traditional items. The Board of Investment in Sindh also recognized your Company by awarding Global Food Safety Award. Global HR Excellence Award was received from Global Media Links in the category of performance management.

Acknowledgment

We take this opportunity to thank our valued customers and consumers who have trust in our products and continue to provide support in ensuring the progress of your Company. We also acknowledge the support and cooperation received from our esteemed suppliers, dealers, bankers and other stakeholders which are helping and contributing towards the continued growth of the Company. We are also thankful for the excellent support and guidance provided to us by our parent Company, Ingredion Incorporated and the trust reposed by the shareholders on the management and the Board of Directors. I offer my sincere thanks to the employees of the Company for their hard work and relentless efforts. Your Company is immensely proud of its employees since without their dedicated efforts, it would not have been possible to achieve those results and performance in various areas. I would like to place on record my sincere appreciation and gratitude to our Board of Directors for their precious guidance and support in steering the Company to build and grow. May Allah give us the courage and wisdom to face the challenges ahead. Ameen!

Board of Directors

During the year 2012, the number of Directors was increased from 10 to 11 to induct an Independent Director in compliance with the Code of Corporate Governance. We welcome Sh. Gulzar Hussain who joined the Board of Directors as an Independent Director on September 07, 2012. Sh. Gulzar Hussain has a long association with Rafhan Maize and the Company will benet from his foresightedness and thoughtful observations in the current challenging business environment. On behalf of the Board

February 12, 2013

Ansar Yahya Chief Executive & Managing Director

for the year ended December 31, 2012

Annual Report

17

Board & Chief Executives Performance Review

Boards Performance

The Board is constituent of professionals of high caliber and diversely experienced. They are fully abreast of the regulations of the Code of Corporate Governance and associated corporate laws as applicable in Pakistan. To meet the requirements of the Code of Corporate Governance, three Directors, Mr. Rashid Ali (Vice Chairman), Dr. Abid Ali (Executive Director and CFO) and Mr. Zulkar Mannoo (Minority Representative), have qualied as Certied Directors from the Pakistan Institute of Corporate Governance. The Board members individually and collectively have been guiding and, when required, complementing management efforts on implementation of corporate strategy and Company policies. Their contribution to the development and adherence to Statement of Ethics, Business Practices, Vision, Mission Statement, the evaluation of internal controls and the recruitment of top ranking executives has been excellent. The Board has been proactive in setting up of its Committees with specic jurisdictions, dening specic roles of Chairman and Chief Executive, conducting periodic meetings at least quarterly; and extending due consideration to signicant business issues.

Chief Executives Performance Review

Chief Executive holds the ofce for three years. The Chief Executive acts and performs subservient to the Responsibilities and Powers prescribed by the Board of Directors. Comprehensive business plans have been developed by the Chief Executive and presented to the Board for its approval and endorsement. The parent Company, Ingredion Incorporated, USA, has a well-structured performance evaluation and review system for periodic review of Chief Executives performance. The performance is measured across all functions with foremost attention to nancial metrics in addition to OHSE, Business, Agility and Relationships.

18

Directors Prole

JORGEN KOKKE

Chairman

Non-Executive Director

RASHID ALI

Vice Chairman

ANSAR YAHYA

Executive Director

Non-Executive Director

Chief Executive & Managing Director He joined the Board in 2001. Presently he is holding the position of Chief Executive of the Company. He is also member of the Boards HR & Remuneration Committee and Shares Transfer Committee.

He joined the Board in 2011. Presently, he is Chairman of the Board. He is also Chairman of the Boards HR & Remuneration Committee. He is representing Ingredion Incorporated, the parent company on the Board. At Ingredion, he is VP & GM EMEA. He holds Masters Degree in Economics from University of Amsterdam.

He joined the Board in 1985. Presently he is the Vice Chairman of the Board. He is Ph.D and has Masters Degree in Chemistry and Business Administration. His business experience spans over 51 years. He is also member of Boards Audit Committee, HR & Remuneration Committee and Chairman of Shares Transfer Committee. He was director on the Board of Faisalabad Electric Supply Company for 10 years and Chairman of its Audit Committee.

CHERYL K. BEEBE

Non-Executive Director

MARY A. HYNES

Non-Executive Director

JAMES P. ZALLIE

Non-Executive Director

She joined the Board in 2008. She is member of the Boards Audit Committee and HR & Remuneration Committee. She is representing Ingredion Incorporated, the parent company, on the Board. At Ingredion, she is Chief Financial Ofcer since October 1, 2010. She holds a Bachelor of Science degree in Accounting from Rutgers University and a Masters of Business Administration degree from Fairleigh Dickinson University.

She joined the Board in 2008. She is representing Ingredion Incorporated, the parent company, on the Board. At Ingredion, she is Senior Vice President, Counsel to the Chairman and Chief Compliance Ofcer. She holds a Bachelor of Political Science and Mathematics Degrees from Loyola University, Juris Doctor and Master of Laws - Taxation degrees from The John Marshall Law School and an Executive Masters of Business Administration degree from the Lake Forest Graduate School of Business in Chicago.

He joined the Board in 2011. He is representing Ingredion Incorporated, the parent company, on the Board. At Ingredion, he is Executive Vice President and President, Global Ingredient Solutions since October 1, 2010. He holds Masters degrees in Food Science and Business Administration from Rutgers University and a Bachelor of Science degree in Food Science from Pennsylvania State University.

for the year ended December 31, 2012

Annual Report

19

DR. ABID ALI

Executive Director

ZULFIKAR MANNOO

Non-Executive Director

MIAN M. ADIL MANNOO

Non-Executive Director

He joined the Board in 2012. He is Ph.D and FCMA with over 20 years of experience in diversied business disciplines. Presently he is holding the position of Chief Financial Ofcer of the Company. He is also member of the Boards Shares Transfer Committee.

He joined the Board in 1990. He is alumni of The Wharton School, University of Pennsylvania and Aitchison College, Lahore. He is member of the Boards Audit Committee and is representing minority shareholders on the Board. He also holds directorship of Unilever Pakistan Foods Ltd.

He joined the Board in 1985. He is graduate and alumni of Aitchison College, Lahore. He is engaged in textile business for the last 20 years. He is representing minority shareholders on the Board. He also holds directorship of Unilever Pakistan Foods Ltd.

WISAL A. MANNOO

Non-Executive Director

SH. GULZAR HUSSAIN

Independent Director

He joined the Board in 2006. He is engaged in textile business for the last 20 years. He is representing minority shareholders on the Board. He is also Member, Executive Committee of All Pakistan Textile Mills Association (APTMA).

Sh. Gulzar Hussain, a Business Executive, is a graduate from Punjab University and has passed Intermediate Examination of the Institute of Cost and Management Accounts, UK. He served Rafhan Maize from 1965 to 1998 in different high prole positions. His last title was Deputy Managing Director.

He has been on Rafhan Board on several terms, the latest one as Independent Director from September 2012. He also remained as member of parent Companys Board in Yugoslavia from 1987-2001.

20

Rafhan Calendar of Major Events - 2012

January 02 January 14 January 17 Annual Managers Meeting at Rakh Canal Plant. Annual Business Meeting at Cornwala Plant. Safety & Environment Training Program for Employees & Contractors was conducted at Mehran Plant. February 09 March 10 March 25 Corn Growers Meeting held at Cornwala Plant in collaboration with Packages Ltd., Lahore. Maize Production Department Meeting at Research Area, Chiniot. Participated in 4th Badin Hari Melo 2012 arranged by Sindh Bank/National Bank under the supervision of State Bank of Pakistan, Hyderabad. March 26-28 March 28 Mr. Jorgen Kokke visited Rakh Canal, Cornwala and Mehran Plants. Declared winner of 6th CSR National Excellence Awards-2011 by Help International Welfare Trust, Karachi. March 28 Received CSR Business Excellence Award 2011 in a competition arranged by National Forum of Environment & Health, Lahore. March 31 March 31 Pillars Values & Business Conduct Workshop held at Conrwala Plant. Earth Hour was observed at Rakh Canal, Cornwala and Mehran Plants from 08:30 pm to 09:30 pm. April 10 Awarded 28th Corporate Excellence Award in the Food Producers Sector arranged by Management Association of Pakistan. April 27 First Prize Winner of 7th EFP Award in the category of Food, FMCG and Pharmaceutical sector by Employers Federation of Pakistan. May 02 May 17 May 22 Hajj Draw for 16 employees held at Rakh Canal Plant. Maize Buying Agents Meeting at Rakh Canal Plant. Received frist truck at Mehran Plant carrying 33 tons corn grain from Hyderabad elds under Contract Farming Program with yield of 2.5 tons corn per acre. June 05 June 21 June 26 July 10 July 12 Maize Agronomists Meeting held at Rakh Canal Plant. Pillars Values & Business Conduct Workshop at Cornwala Plant. Safety & Environment Training Program for Employees and Contractors at Cornwala Plant. Global Food Safety Award 2012 from Board of Investment and Pakistan Food Association. 9th Annual Environment Excellence Award 2012 from National Forum for Environment and Health, Karachi. August 08 August 08 September 01 September 06 September 08 September 22 October 01 October 08 Election for Collective Bargaining Agent at Rakh Canal Plant. SAP Certicate Distribution at Rakh Canal Plant. Dengue Awareness Session at Rakh Canal Plant. Meeting with South Region dealers at Karachi. Dengue Awareness Session held at Cornwala Plant. Pillars Values & Business Conduct Workshop held at Cornwala Plant. Start-up of Mehran Plant. Best Corporate & Sustainability Report Awards-2011 from Institute of Chartered Accountants of Pakistan and Institute of Cost and Management Accountants of Pakistan.

for the year ended December 31, 2012

Annual Report

21

Rafhan Calendar of Major Events - 2012

October 17 3rd Global HR Excellence Award 2012 by Global Media Links and Better Forum Pakistan at Karachi. October 23 October 24 November 2012 November 05 November 09 Safety & Environment Training Program for Employees & Contractors at Cornwala Plant. Plantation Ceremony at Government Girls Primary School, Madina Town, Faisalabad. November 2012 was observed as Safety Month at all locations. Meeting with Maize Agents at Rakh Canal Plant. Corporate Excellence Award from Institute of Cost and Management Accountants of Pakistan at Lahore. November 21 Arranged Free Eye Camp at Government Public Girls High School, Dhudiwala, Faisalabad - a CSR Project - Saving Sight of Kids. November 27 November 28 November 28-30 December 06 December 11 December 14 December 18 Lean Six Sigma Training Session at Rakh Canal Plant. Mock Exercise - Evacuation & Fire Fighting Drill by Safety Department at Rakh Canal Plant. Indoor Games Tournament amongst the teams of Rakh Canal and Cornwala Plants. Safety & Environment Training Program for Employees and Contractors at Mehran Plant. RCP & CWP: ISO 22000:2005 FSMS Surveillance-1 Audit, 2012 by BVC Lean Six Sigma Leadership Champions Training at Rakh Canal Plant. Special Merit Export Award from the Federation of Pakistan Chamber of Commerce & Industry on Export of Corn (Maize) derived products. December 21 December 23 December 29 December 29-31 Agreement with CBA concluded. Ofcers/Staff Picnic at Kallar Kahar/Khewra. Pillars Values & Business Conduct Workshop held at Cornwala Plant. Cricket Tournament amongst the teams of Rakh Canal and Cornwala Plants.

22

Horizontal Analysis of Prot and Loss Account

Sales Cost of sales Gross prot Distribution cost Administrative expenses Operating prot Other operating income Finance cost Other operating expenses Prot before taxation Taxation Prot after taxation 2012 2011 2010 2009 2008 2007 7% 31% 22% 6% 42% 24% 8% 36% 18% 12% 46% 20% 5% 15% 35% -11% 31% 34% 152% 11% 13% -27% -16% 79% 19% 20% 13% 13% 8% 7% -3% 15% 39% -12% 38% 33% -5% 28% 5% -13% 45% 41% -3% 83% -35% 35% 206% -42% -3% 12% 38% -12% 37% 35% -3% 15% 39% -12% 37% 34% -8% 23% 35% -11% 36% 34% 0% 11% 42% -13% 37% 35%

Horizontal Analysis of Balance Sheet

2012 2011 2010 2009 2008 2007 NON CURRENT ASSETS Property, plant and equipment 64% 5% 23% 14% 3% 12% Intangible assets -11% -20% - - - Capital work-in-progress -28% 86% -2% 96% 466% -67% EMPLOYEES RETIREMENT BENEFITS 16% -33% 311% -78% -25% 190% LONG TERM LOANS 88% -27% -18% 351% -46% -42% CURRENT ASSETS Stores and spares 20% 18% 12% -1% 28% 25% Stock in trade 3% -4% 168% -52% 77% 17% Trade debts 38% 43% 20% -8% 5% 23% Loans and advances 260% -43% 955% -52% 43% 97% Trade deposits and prepayments 104% 155% 15% -15% 23% -16% Other receivables 86% -30% 91% 19% 35% 4% Cash and bank balances 704% 59% -94% 4805% -96% 29% TOTAL ASSETS 25% 14% 38% 0% 33% 12% CURRENT LIABILITIES Trade and other payables 92% 22% 51% -4% 30% 7% Mark up accrued on short term running nances -2% 38% -4% 1% 13870% -97% Short term running nances - secured -100% -37% - -100% - Provision for taxation 10% 28% -14% 60% 88% 43% NON CURRENT LIABILITIES Deferred taxation 50% 6% 35% 11% -7% 33% SHARE CAPITAL AND RESERVES Share capital 0% 0% 0% 0% 0% 0% Reserves 17% 19% 24% 12% 19% 11% TOTAL LIABILITIES 25% 14% 38% 0% 33% 12% Note: No percentage has been worked out where there were no gures in current or corresponding year.

for the year ended December 31, 2012

Annual Report

23

Vertical Analysis of Prot and Loss Account

Sales Cost of sales Gross prot Distribution cost Administrative expenses Operating prot Other operating income Finance cost Other operating expenses Prot before taxation Taxation Prot after taxation 2012 2011 2010 2009 2008 2007 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 79.7% 79.2% 76.3% 78.7% 74.5% 72.3% 20.3% 20.8% 23.7% 21.3% 25.5% 27.7% 1.9% 0.8% 0.9% 1.0% 1.5% 2.5% 1.5% 1.4% 1.5% 1.6% 1.5% 2.0% 16.9% 18.6% 21.2% 18.6% 22.5% 23.2% 0.5% 0.6% 0.6% 0.7% 0.8% 0.8% 0.3% 0.3% 0.2% 0.4% 0.3% 0.2% 1.2% 1.3% 1.5% 1.3% 1.6% 1.6% 16.0% 17.6% 20.1% 17.6% 21.4% 22.2% 5.5% 6.5% 6.9% 6.3% 7.5% 7.8% 10.4% 11.1% 13.2% 11.3% 13.9% 14.4%

Vertical Analysis of Balance Sheet

NON CURRENT ASSETS Property, plant and equipment Intangible assets Capital work-in-progress EMPLOYEES RETIREMENT BENEFITS LONG TERM LOANS CURRENT ASSETS Stores and spares Stock in trade Trade debts Loans and advances Trade deposits and prepayments Other receivables Cash and bank balances TOTAL ASSETS 2012 2011 2010 2009 2008 2007

36.3% 0.2% 12.7%

27.6% 0.3% 21.9%

29.9% 0.4% 13.4%

33.7% 18.8%

29.7% 9.6%

38.1% 2.3%

0.5% 0.5% 0.9% 0.3% 1.4% 2.4% 0.0% 0.0% 0.0% 0.1% 0.0% 0.0%

4.2% 4.4% 4.3% 5.3% 5.4% 5.5% 30.0% 36.3% 43.1% 22.2% 46.0% 34.5% 7.2% 6.5% 5.2% 6.0% 6.6% 8.3% 2.5% 0.9% 1.7% 0.2% 0.5% 0.4% 1.3% 0.8% 0.4% 0.4% 0.5% 0.5% 0.2% 0.1% 0.2% 0.1% 0.1% 0.1% 4.9% 0.8% 0.5% 12.8% 0.3% 7.7% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0%

CURRENT LIABILITIES Trade and other payables 25.2% 16.4% 15.3% 14.0% 14.6% 14.8% Mark up accrued on short term running nances 0.1% 0.1% 0.1% 0.2% 0.2% 0.0% Short term running nances - secured 0.0% 4.8% 8.7% 0.0% 9.4% 0.0% Provision for taxation 2.8% 3.1% 2.8% 4.5% 2.8% 2.0% NON CURRENT LIABILITIES Deferred taxation 5.4% 4.5% 4.8% 5.0% 4.5% 6.4% SHARE CAPITAL AND RESERVES Share capital 0.9% 1.1% 1.3% 1.8% 1.8% 2.3% Reserves 65.6% 69.9% 67.0% 74.6% 66.7% 74.4% TOTAL LIABILITIES 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% Note: No percentage has been worked out where there were no gures in current or corresponding year.

24

Directors Report

The Directors of your Company feel pleasure in presenting the annual audited accounts along with auditors report thereon for the year ended December 31, 2012.

Financial Results

Prot and Appropriations

Year ended December 31

Prot after taxation Actuarial gains/(losses) of employees retirement benets Un-appropriated prot brought forward Appropriations Final Dividend 2011 @650% (2010: @550%) (2011: @350%) (2011: @250%)

2012 2011 (Rupees in Thousands) 2,039,930 4,527 5,751,132 7,795,589 600,367 230,911 230,911 1,062,189 6,733,400 220.86 2,033,828 (43,934) 4,823,427 6,813,321 508,003 323,275 230,911 1,062,189 5,751,132 220.20

1st Interim Dividend 2012 @250%

2nd Interim Dividend 2012 @250%

Un-appropriated Prot Earnings per Share (Rupees)

Chief Executives Review

The Directors of the Company endorse the contents of the Chief Executives Review which covers your Companys business review, salient activities in different fields of operations, outlook, investment plans for strategic growth and disclosures under corporate social responsibilities.

Distribution of Sales

(Percentage)

Corporate Governance

Your Company is committed to congregate the improved standards of corporate governance without any exception. The Directors are pleased to state that your Company is compliant with the provisions of the Code of Corporate Governance 2012 as required by SECP and formed as part of stock exchanges listing regulations. The statement of compliance with Code of Corporate Governance is annexed.

Material & Services Taxation Dividend & Retention Employee Cost Finance Cost Society Welfare

77.79% 6.70% 10.44% 4.76% 0.29% 0.01%

for the year ended December 31, 2012

Annual Report

25

Sales

2012 2011 2010 2009 2008 2007

0

(Rs. in million)

19,531 18,271 13,913 11,428 10,747 7,578 5,000 10,000 15,000 20,000

Profit after Tax

(Rs. in million) 2012 2011 2010 2009 2008 2007

0 500 1,089 1,000 1,500 2,000 2,500 1,297 1,492 1,838 2,040 2,034

Disclosures under Code of Corporate Governance Corporate and Financial Reporting Framework

(a) The nancial statements, prepared by the management of the listed company, present its state of affairs fairly, the result of its operations, cash ows and changes in equity. (b) Proper books of accounts of the listed company have been maintained. (c) Appropriate accounting policies have been consistently applied in preparation of nancial statements and accounting estimates are based on reasonable and prudent judgment. (d) International Financial Reporting Standards, as applicable in Pakistan, have been followed in preparation of nancial statements and any departure there from has been adequately disclosed and explained. (e) The system of internal control is sound in design and has been effectively implemented and monitored; and (f) There are no signicant doubts upon the listed Companys ability to continue as a going concern.

26

Directors Report

Key operating and nancial data of last six years are as follows:

Net Sales Cost of Sales Gross Prot Operating Prot Prot Before Tax Prot After Tax Earnings per Share Dividend Amount Capital Expenditure Rs. Million Rs. Million Rs. Million Rs. Million Rs. Million Rs. Million Rupees Rs. Million Rs. Million 2012 19,531 15,557 3,975 20 3,304 17 3,123 2,040 220.86 1,062 1,150 1,185 2011 2010 2009 2008 2007 18,271 14,471 3,800 21 3,400 19 3,216 2,034 220.20 1,062 1,150 1,122 13,913 10,615 3,298 24 2,955 21 2,800 1,838 198.99 924 1,000 582 11,428 8,993 2,435 21 2,131 19 2,012 1,297 140.43 831 900 848 10,747 8,006 2,741 26 2,415 22 2,299 1,492 161.57 924 1,000 606 7,578 5,480 2,098 28 1,755 23 1,681 1,089 117.92 831 900 114

% of Sales % of Sales

Dividend Percentage

Ten Years Performance showing key indicators has been given on the inside cover sheet of this report.

Earnings per Share

(Rupees) 2012 2011 2010 2009 2008 2007

0 50 100 117.92 150 200 250 140.43 161.57 198.99 220.86 220.20

Capital Expenditure

(Rs. in Million) 2012 2011 2010 2009 2008 2007

0 114 200 400 600 800 1,000 1,200 606 582 848 1,122 1,185

for the year ended December 31, 2012

Annual Report

27

Value of investments of employees retirement funds:

2012 Rs. Million 2011

Provident Fund Gratuity Fund Superannuation Fund

as at June 30 as at December 31 as at December 31

737.537 610.088 414.664

694.684 569.684 355.787

Board of Directors

The Board consists of eleven members which includes nine non-executive and two executive directors. Out of nine non-executive directors, one is independent non-executive director and three directors represent minority shareholders. The current members of the Board of Directors have been listed in the Company Information. During the year under review, one casual vacancy occurred on the Board which was lled up within 30 days thereof. Election of directors was held in September, 2012 after completion of its tenure of three years. The number of Directors for new term has been increased from ten to eleven. During the year, two Directors have obtained certication under The Board Development Series program offered by Pakistan Institute of Corporate Governance.

Total certied Directors now become three.

Attendance at Board Meetings

During the year ended December 31, 2012, ve meetings of the Board of Directors were held and attended as follows:

Name of Director Meetings attended in person Meetings attended by Alternate Director

Jorgen Kokke Rashid Ali Ansar Yahya James P. Zallie Cheryl K. Beebe Mary A. Hynes Zulfikar Mannoo Mian M. Adil Mannoo Wisal A. Mannoo Anis A. Khan* Dr. Abid Ali Sh. Gulzar Hussain*

2 5 5 1 2 2 5 4 5 1 4 2

2 2 2

*Mr. Anis A. Khan was replaced by Dr. Abid Ali in April, 2012. Sh. Gulzar Hussain joined the Board in September as eleventh member of the Board.

Transactions in Companys Shares

CEO, Directors, CFO, Company Secretary and their spouses and minor children have made no transactions in the Companys shares during the year.

Parent Company

Ingredion Incorporated (formerly Corn Products International, Inc.), USA is holding majority shares of the Company. During the year, name of the parent company was changed from Corn Products International to Ingredion Incorporated.

28

Directors Report

Human Resource & Remuneration Committee

The Board of Directors has established a Human Resource & Remuneration Committee comprising following four Board members: Jorgen Kokke Cheryl K. Beebe Rashid Ali Ansar Yahya Chairman Member Member Member Non Executive Director Non Executive Director Non Executive Director Executive Director

The Committee is responsible for i) recommending human resource management policies to the board ii) recommending to the board the selection, evaluation, compensation (including retirement benets) and succession planning of the CEO iii) recommending to the board the selection, evaluation, compensation (including retirement benets) of CFO, Company Secretary and Head of Internal Audit; and iv) consideration and approval on recommendations of CEO on such matters for key management positions who report directly to CEO.

Auditors

The retiring auditors, Messrs KPMG Taseer Hadi & Co., Chartered Accountants, being eligible, offer themselves for re-appointment. The Board of Directors, on recommendations of Audit Committee, has proposed appointment of Messrs KPMG Taseer Hadi & Co., Chartered Accountants for the year 2013.

Shares Transfer Committee

The Board of Directors has established a Shares Transfer Committee comprising three Board members. Ten meetings of the Shares Transfer Committee were held and attended during the year as under

Audit Committee

The Board of Directors has established an Audit Committee in compliance with the Code of Corporate Governance comprising four Board members. Four meetings of the Audit Committee were held during the year and attended as under: No. of Meetings Attended Sh. Gulzar Hussanin Cheryl K. Beebe Rashid Ali Zulfikar Mannoo Chairman Member Member Member Indepedent Director Non Executive Director Non Executive Director Non Executive Director 1 4 4

No. of Meetings Attended

Rashid Ali Chairman 7 Ansar Yahya Member 10 Anis A. Khan* Member 2 Dr. Abid Ali Member 7 The Committee met from time to time to consider and approve valid transfers and transmissions of shares or any business related thereto. *Mr. Anis A. Khan was replaced by Dr. Abid Ali in April, 2012.

Pattern of Shareholding

Pattern of Shareholding as on December 31, 2012 according to requirements of Code of Corporate Governance and a statement reecting distribution of shareholding appears at the end of this report.

The Audit Committee reviewed the quarterly, half yearly and annual nancial statements before submission to the Board and their publication. CFO, Head of Internal Audit and a representative of external auditors attended all the meetings where issues relating to accounts and audit were discussed. The Audit Committee also reviewed internal audit ndings and held separate meetings with internal and external auditors as required under the Code of Corporate Governance. The Audit Committee also discussed with the external auditors their letter to the management. Related Parties Transactions were also placed before the Audit Committee. The Audit Committee has fully adopted the terms of reference as specied in Code of Corporate Governance 2012.

Contribution to National Exchequer

Your Company has contributed Rs.2,267 million (2011: Rs.2,518 million) during the year 2012 to the national exchequer on payments towards sales tax, income tax, import duties and statutory levies. An amount of Rs.290 million (2011: Rs.200 million) was also paid as withholding income tax deducted by the Company from shareholders, employees, suppliers and contractors.

for the year ended December 31, 2012

Annual Report

29

Corporate Social Responsibility & Sustainability

Your Company has a strong belief in and endeavors to be a responsible corporate citizen in the community without any political afliation. The management is well aware of its social obligations and has used a proactive approach to achieve the goodwill and respect for the Company within the areas of its operations. The Company focuses on community development through sustained investment in education, health, environment, infrastructural development and disaster relief initiatives. Our major contribution towards community activities include but are not limited to: Donations amounting to Rs.2.5 million were made to the following organizations / institutions to support the noble causes under Corporate Social Responsibility Policy of the Company: > The Kidney Center Karachi through the American Business Council of Pakistan. > SOS Children Village, Faisalabad in our neighborhood to provide family based care and education to abandoned, destitute and orphaned children. > Sindh Institute of Urology and Transplantation (SIUT), Karachi, a welfare organization to provide free of cost medicines. > Liver Foundation Trust, Faisalabad for the treatment of patients suffering from Hepatitis. > Allied Hospital Patient Welfare Society to provide beds in the ICU Ward. > District Anti Tuberculosis (T.B.) Association treatment of needy and poor patients. for

32 students of different professional institutions were provided internship training in different departments of the Company. Extended 77 Scholarships to talented students for the facilitation and promotion of higher education. Contributed towards the uplift of economy by providing free agricultural advisory services to the farmers of various provinces. The Company celebrates with great fervor various internationally commemorative days like Earth Day, World Health Day and Earth Hour, World No Tobacco Day, World Environment Day and World Heart Day for creating awareness among employees. Apprenticeship training is provided to the young aspiring students for 2-3 years. Employees participation in community welfare and development activities is encouraged. Two Days Eye Camp was sponsored for the students of Govt. Public Girls High School, Faisalabad. 1700 students were examined by the Eye Specialist doctor out of whom 500 students were given treatment. 279 students have been prescribed eye glasses to be sponsored by the Company.

Dividend

The Company has already paid two interim dividends of 250% each. The Directors now propose a nal dividend of 750% making the total 1250% for the year. On behalf of the Board

> Fatima Jinnah Degree College for Women, Faisalabad to meet the Educational expenses of needy students. > For establishing a Playground adjacent to Cornwala Plant. Your Company is recognized as an equal opportunity employer with reasonable compensation, benets and working conditions. Your Company is financing and facilitating a public primary school and a post ofce built at its premises for the benet of surrounding community. A fully equipped dispensary is also available to meet emergency and general health care of the employees and their dependents.

February 12, 2013

Ansar Yahya Chief Executive & Managing Director

30

Forward Looking Statements

This Annual Report contains or may contain forward-looking statements. The Company intends these forward-looking statements to be covered by the safe harbor provisions for such statements. These statements include, among other things, any predictions regarding the Companys prospects or future nancial condition, earnings, revenues, tax rates, capital expenditures, expenses or other nancial items, any statements concerning the Companys prospects or future operations, including managements plans or strategies and objectives therefor and any assumptions, expectations or beliefs underlying the foregoing. These statements can sometimes be identied by the use of forward looking words such as may, will, should, anticipate, believe, plan, project, estimate, expect, intend, continue, pro forma, forecast or other similar expressions or the negative thereof. All statements other than statements of historical facts in this report or referred to in or incorporated by reference into this report are forward-looking statements. These statements are based on current expectations, but are subject to certain inherent risks and uncertainties, many of which are difcult to predict and are beyond our control. Although we believe our expectations reected in these forward-looking statements are based on reasonable assumptions, stockholders are cautioned that no assurance can be given that our expectations will prove correct. Actual results and developments may differ materially from the expectations expressed in or implied by these statements, based on various factors, including energy availability and costs; the effects of global economic conditions and their impact on our sales volumes and pricing of our products, our ability to collect our receivables from customers and our ability to raise funds at reasonable rates; uctuations in worldwide markets for corn and other commodities, and the associated risks of hedging against such uctuations; uctuations in the markets and prices for our co-products, particularly corn oil; uctuations in aggregate industry supply and market demand; the behavior of nancial markets, including foreign currency uctuations and uctuations in interest and exchange rates; continued volatility and turmoil in the capital markets; the commercial and consumer credit environment; general political, economic, business, market and weather conditions in the countries in which we sell our products; future nancial performance of major industries which we serve, including, without limitation, the textile, food and beverage, pharmaceuticals, paper, corrugated and brewing industries; freight and shipping costs, and changes in regulatory controls regarding quotas, tariffs, duties, taxes and income tax rates; operating difculties; boiler reliability; labor disputes; genetic and biotechnology issues; changing consumption preferences and trends; increased competitive and/or customer pressure in the corn-rening industry; and the outbreak or continuation of serious communicable disease or hostilities including acts of terrorism. Our forward-looking statements speak only as of the date on which they are made and we do not undertake any obligation to update any forward-looking statement to reect events or circumstances after the date of the statement as a result of new information or future events or developments. If we do update or correct one or more of these statements, investors and others should not conclude that we will make additional updates or corrections.

for the year ended December 31, 2012

Annual Report

31

32

Stakeholders Information

Performance Indicators for Six Years

Prot and Loss Account Net turnover Rs. Million 19,531.40 18,270.99 13,912.77 11,428.10 10,746.83 7,578.34 Gross prot Rs. Million 3,974.51 3,799.82 3,297.74 2,435.36 2,741.25 2,098.17 Operating prot Rs. Million 3,304.12 3,399.87 2,954.88 2,130.94 2,415.17 1,754.64 Prot before tax Rs. Million 3,122.80 3,216.19 2,799.99 2,011.86 2,299.07 1,681.10 Prot after tax Rs. Million 2,039.93 2,033.83 1,837.94 1,297.08 1,492.37 1,089.18 Earnings before interest, taxes, depreciation Rs. Million and amortization (EBITDA) 3,398.56 3,453.23 2,989.07 2,211.54 2,475.27 1,829.73 Balance Sheet Share capital Reserves Shareholders funds Property, plant and equipment Net current assets / (liabilities) Long term / deferred liabilities Total assets Rs. Million Rs. Million Rs. Million Rs. Million Rs. Million Rs. Million Rs. Million 92.36 6,771.49 6,863.86 3,749.57 2,289.13 562.06 10,320.26 92.36 5,789.23 5,881.59 2,283.49 2,091.54 373.68 8,280.18 92.36 4,861.52 4,953.89 2,174.15 2,061.37 351.75 7,259.95 92.36 3,915.37 4,007.73 1,765.37 1,495.49 260.32 5,245.91 92.36 3,486.08 3,578.44 1,553.16 1,684.25 235.27 5,228.76 92.36 2,933.33 3,025.70 1,501.74 1,589.41 252.34 3,945.61

2012 2011 2010 2009 2008 2007

Protability Ratios Gross prot ratio Percentage 20.35 20.80 23.70 21.31 25.51 27.69 Net prot to sales Percentage 10.44 11.13 13.21 11.35 13.89 14.37 EBITDA margin to sales Percentage 17.40 18.90 21.48 19.35 23.03 24.14 Operating leverage Percentage (0.41) 0.48 1.78 (1.86) 0.90 1.39 Return on equity Percentage 32.01 37.54 41.02 34.20 45.20 37.87 Return on capital employed Percentage 27.47 32.51 34.64 30.39 39.13 33.23 Liquidity Ratios Current ratio Times 1.79 2.03 2.05 2.53 2.19 3.38 Quick/ Acid test ratio Times 0.57 0.37 0.30 1.05 0.29 1.01 Cash to current liabilities Times 0.17 0.03 0.02 0.69 0.01 0.46 Cash ow from operations to sales Times 0.16 0.13 0.02 0.25 0.07 0.13 Activity / Turnover Ratios Inventory turnover ratio Times 4.41 4.29 3.09 6.23 2.98 3.47 No. of days in inventory Days 82.77 85.08 118.12 58.59 122.48 105.19 Debtors turnover ratio Times 26.31 33.97 36.91 36.24 31.28 23.08 No. of days in receivables Days 13.87 10.74 9.89 10.07 11.67 15.81 Creditors turnover ratio Times 5.99 10.68 9.58 12.25 10.45 9.30 No. of days in payables Days 60.93 34.18 38.10 29.80 34.93 39.25 Total assets turnover ratio Times 1.89 2.21 1.92 2.18 2.06 1.92 Fixed assets turnover ratio Times 5.21 8.00 6.40 6.47 6.92 5.05 Operating cycle Days 46.57 63.92 61.31 63.89 77.78 73.43 Investment / Market Ratios Earnings per share Rupees 220.86 220.20 198.99 140.43 161.57 117.92 Price earning ratio Times 18.10 11.41 10.60 10.57 14.74 19.12 Dividend yield ratio Percentage 3.00 5.00 5.00 6.00 4.00 4.00 Dividend payout ratio Percentage 52.07 52.23 50.25 64.09 61.89 76.32 Dividend cover ratio Times 1.92 1.91 1.99 1.56 1.62 1.31 Cash dividend per share Rupees 115.00 115.00 100.00 90.00 100.00 90.00 Stock Dividend (Bonus) per share Percentage - - - - - Market value per share at the end of the year Rupees 3,998.38 2,513.28 2,109.87 1,485.00 2,381.42 2,255.00 Market value per share during the year (High) Rupees 4,625.00 3,016.00 2,298.00 2,262.35 2,940.00 2,415.00 Market value per share during the year (Low) Rupees 2,405.00 2,010.00 1,100.00 1,286.87 2,300.00 945.00 Break-up value per share - Refer note below - Without surplus on revaluation of xed assets Rupees 743.13 636.78 536.34 433.91 387.43 327.58 - Including the effect of surplus on revaluation of xed assets Rupees 743.13 636.78 536.34 433.91 387.43 327.58 Capital Structure Ratios Financial leverage ratio Times - 0.07 0.13 Weighted average cost of debt Percentage 11.87 13.88 13.35 Debt : Equity ratio Times - - - Interest cover Times 56.67 56.70 89.75 Note: The Company has not carried out any revaluation, hence there is no surplus on revaluation of xed assets. - 13.73 - 42.26 0.14 12.66 - 64.65 8.91 143.38

for the year ended December 31, 2012

Annual Report

33

Summary of Cash Flow Statement

2012 2011 2010 2009 2008 2007

(Rupees in Thousands)

Cash ow from operating activities Cash ow from investing activities Cash ow from nancing activities Opening cash and cash equivalents Effect of exchange rate uctuations Closing cash and cash equivalents

3,088,555

2,440,132

232,457 2,830,047 (577,499) (846,392)

741,549 1,011,781 (604,368) (111,239) (429,291) (831,423) (292,110) 305,420 420 13,730 69,119 236,295 6 305,420

(1,180,865) (1,116,204) (1,459,253) (1,298,041) 448,437 63,026 (4,943) 506,520 25,887 39,741 (2,602) 63,026

(288,480) (1,324,451) (633,522) 673,409 (146) 39,741 659,204 13,730 475 673,409

Cash Flow Statement - Direct Method

Cash ows from operating activities Cash received from customers Cash paid to suppliers and employees Finance cost paid Interest income received Taxes paid Net cash ows from operating activities Cash ows from investing activities Property, plant and equipment Sale proceeds of property, plant and equipment Disbursement of long term loans Repayment from long term loans Net cash ows from investing activities Cash ows from nancing activities Dividend paid Increase / (Decrease) in short term running nances Net cash ows from nancing activities Net increase / (Decrease) in cash and cash equivalents Cash and cash equivalents at the beginning of the year Effect of exchange rate uctuations Cash and cash equivalents at the end of the year 448,437 63,026 (4,943) 506,520 25,887 39,741 (2,602) 63,026 (633,522) 673,409 (146) 39,741 659,204 13,730 475 673,409 (292,110) 305,420 420 13,730 69,119 236,295 6 305,420 (1,061,351) (1,061,483) (922,940) (830,742) (923,000) (831,423) (397,902) (1,459,253) (236,558) (1,298,041) 634,460 (288,480) (493,709) (1,324,451) 493,709 (429,291) 0 (831,423) (1,184,502) 6,186 (4,746) 2,197 (1,180,865) (1,122,352) 5,411 (2,943) 3,680 (1,116,204) (581,897) 3,587 (1,500) 2,311 (577,499) (847,507) 4,822 (4,826) 1,119 (846,392) (606,325) 707 (230) 1,480 (604,368) (114,255) 1,402 (948) 2,562 (111,239) 19,326,826 18,110,107 13,851,211 11,456,343 10,731,611 (15,236,202) (14,484,335) (12,653,053) 2,083 (870,388) 3,088,555 3,614 (1,095,675) 2,440,132 6,685 (919,784) 232,457 7,516,737 (7,964,546) (9,231,427) (5,983,517) 4,303 (581,908) 2,830,047 25,420 (746,430) 741,549 22,005 (528,402) 1,011,781 2012 2011 2010 2009 2008 2007 (Rupees in thousands)

(133,764) (93,579) (52,602) (84,145) (37,625) (15,042)

34

Comments on Analysis Results

Protability Ratios Despite increase in fuel prices and usage of costly alternate energy, the company succeeded in maintaining 2011 Gross Prot and After Tax Net Income Ratios. However EBITDA Margin to Sales slightly decreased (1.50%) mainly due to increase in certain incremental manufacturing overheads. Operating Leverage Ratio, Return on equity ratio and Return on Capital Employed are on the decrease owing to heavy investment in new Greeneld plant at Kotri, Sindh. Liquidity Ratios The company is maintaining good Current Ratio (1.79 times) with slight improvement in Quick / Acid Test Ratio over the last year. Companys cash to current liabilities ratio increased by 0.14 Times in 2012 over last year because of the increase in Cash ow from operations (by 0.03 Times) during the year under review thus depicting efciencies of the operations. Activity / Turnover Ratios The company has very healthy Inventory Turnover Ratio (4.41 times) with days cover of approximately 83. During 2012, the company secured supply order from Kenya on 60 day deferred payment terms which slightly decreased trade debts turnover ratio, however, decrease in creditor turnover ratio has compensated enough to maintain optimum level of working capital. Investment in new Green eld plant not only led to decrease xed assets turnover ratio but also Total Asset turnover Ratio. Investment / Market Ratios EPS of the company has been slightly improved over last year and posted healthy increase (58%) in P/E ratio over 2011. Market price of share has sharply increased during past one year which resulted in decrease in Dividend Yield Ratio (reduced to 2%) whereas Cash Dividend Per Share, Dividend Payout Ratio and Dividend Cover Ratio of the company are consistent with the last year. Capital Structure Ratios The company is fully operating on equity capital, no long term debt hence Debt to Equity ratio is Zero.

Statement of Value Added and its Distribution

2012 2011 (Rupees in thousands) VALUE ADDED Net sales Material and services Other income