Escolar Documentos

Profissional Documentos

Cultura Documentos

Co Operative Society

Enviado por

Raghu CkDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Co Operative Society

Enviado por

Raghu CkDireitos autorais:

Formatos disponíveis

ONE FOR ALL, ALL FOR ONE

SYNOPSIS

INTRODUCTION TO THE PROJECT REPORT

CO-OPERATIVE MOVEMENT IN INDIA

CO-OPERATIVE ORGANISATION

SIR M. VISHWESHVARIAH CO-OPERATIVE SOCIETY

LTD., SHIVAMOGGA A PROFILE

CREDIT FACILITIES IN SIR M. VISHWESHVARAIAH

CO-OPERATIVE SOCIETY LTD., SHIVAMOGGA

RECOVERY OF LOANS IN SIR M. VISHWESHVARAIAH

CO-OPERATIVE SOCIETY LTD., SHIVAMOGGA

ANALYSIS OF RESONSE

SUGGESTIONS AND CONCLUSIONS

ANNEXURES

SAHYADRI ARTS & COMMERCE COLLEGE

ONE FOR ALL, ALL FOR ONE

Chapter-I

INTRODUCTION

INTRODUCTION TO PROJECT REPORT

AIMS AND OBJECTIVES

METHODOLOGY

IMPORTANCE AND LIMITATION OF THE

STUDY

SAHYADRI ARTS & COMMERCE COLLEGE

ONE FOR ALL, ALL FOR ONE

PREAMBLE

In the beginning of human existence, needs were simple and every

individual produced all that was necessary to sustain life, he provided his

own food of animal flesh and vegetables; prepared his own clothing and

found his own shelter.

After this stage, Barter system came into existence. Barter System

means trade with exchange of goods, with the absence of money. At this

stage the concept of dependency demanded co- operation that is how cooperation was born.

In course of time, people settled down in different occupations,

and with specialization, exchange of goods became wider. And the

money was introduced in trading, which was widely accepted for

payment. As money started getting importance Co-operation was going

hand in hand with it.

So, co-operation is an important thing which plays an important

role in all for goods and services and in settlement of debts. Money is

given and received without reference to the standing of the person who

offers it in payment.

According to D.H. Robertson money is any thing which is

widely accepted in payment for goods or in discharge of other kinds of

business obligations.

This is the way how money got extends into the co-operation.

SAHYADRI ARTS & COMMERCE COLLEGE

ONE FOR ALL, ALL FOR ONE

OBJECTIVES

Following are the some of the major objectives of the project

report.

To know about the co-operative societies.

To study the establishment of the sir. M. vishweshvaraiah cooperative society Ltd.

To know the performance of sir .M. Vishweshvaraiah co-operative

society Ltd.

To make a detail study of credit facilities and recovery of debts of

sir .M. Vishweshvaraiah co-operative society Ltd.

To express out own opinion about the societys development and

services.

AREA OF STUDY

Sir .M. Vishweshvaraiah co-operative society Ltd, Shivamogga

which is located in Shivappa Naika Complex, Nehru Toad is selected for

the study. This study involve in the detailed report of the Sir .M.

Vishweshvaraiah co-operative society Ltd. About its Credit facilities and

recoveries of debts since the year of its establishment.

This society was established in the year 1983, since, from its

establishment, it is working or providing services for the up liftman of its

members.

SAHYADRI ARTS & COMMERCE COLLEGE

ONE FOR ALL, ALL FOR ONE

METHODOLOGY:

Primary and secondary data re collected for the preparation

of the project report.

Primary data has been collected through survey. Survey was

conducted, questionnaire was prepared and the respondents were

selected on random sampling bases to avoid bias in collection and

analysis of data, which reveals.

Secondary data has been collected from the secretary and staff of

the society personally interviewed and from the bye-law, annual report

and other documents of the society to study the various aspects of cooperation service and finance.

IMPORTANCE OF THE STUDY

Following are the some major importance of the study;

1. It provides information about the co-operative principles, its

origin and importance in Indian society.

2. It helps to know the structure, organization and performance of

the SMV Cooperative Society Ltd.

3. The report helps to know the procedure principle and policies and

functions, of the society.

4. We can get clear picture about the credit facilities and recoveries

of debts of the SMV Co-operative Society Ltd.

SAHYADRI ARTS & COMMERCE COLLEGE

ONE FOR ALL, ALL FOR ONE

LIMITATIONS OF THE STUDY

There are certain limitations are found in doing the project report.

They are:

1. Members were selected on random basis. Hence they may hot

represent the population.

2. Some members were hesitant to give out their opinion about the

society services. Hence, the information my be biased.

3. The survey entitled the limitation of time factor. Due to this

limitation of the project lacks in detailed information.

4. As the recent information regarding 5 years plans were not

available its not been included in the project.

SAHYADRI ARTS & COMMERCE COLLEGE

ONE FOR ALL, ALL FOR ONE

Chapter-II

CO-OPERATIVE MOVEMENT

INTRODUCTION

MEANING

DEFINITION

CO-OPERATIVE MOVEMENT IN INDIA

STAGES IN CO-OPERATIVE MOVEMENT IN INDIA

BENEFITS OF CO-OPERATIVE MOVEMENT IN

INDIA

CO-OPERATIVE IN FIVE YEAR PLANS

SAHYADRI ARTS & COMMERCE COLLEGE

ONE FOR ALL, ALL FOR ONE

INTRODUCTION

Co-operative means working together. The principle of cooperation is as old as human society. It is truly the basis of domestic and

social life. What is known as co-operative effort is ultimately the group

instinct in man, which enables him to work together and help each other

in times of stress and strain. Unconsciously the principle has always

penetrated the life of human race. The history of co-operation, for

without it social and economic progress would have been impossible.

MEANING AND DEFINITION

Modern biologists believe that the co-operative forces are

biologist more important and vital.

According to Emerson co-operation has a more evolutionary in

the development of man than has the better competitive struggle for

existence.

According to Montague science points out the way to survival

and happiness for all mankind through love and co-operation.

SAHYADRI ARTS & COMMERCE COLLEGE

ONE FOR ALL, ALL FOR ONE

CO-OPERATIVE MOVEMENT IN INDIA

India is a country with a rural setting having 5, 75,936 inhabited

villages studded with towns and villages. Which serve a center of trade,

commerce, industries, education and administration? 70% of working

force still depends upon agriculture.

Towards the end of the last century, the peasantry or agriculturist

was in the grip of Sahukar and the rural debt was daily mounting the

condition of the agriculturists was readily deplorable. As a result of

increase in population and the absence of rapid industrialization, more

and more people depended upon agriculture resulting in too much on

land farmers. Who were once prosperous become petty peasants with

tiny holdings of a few acres and were finally reduced to the status of

land less laborers. They are in the clutches of the moneylenders. Rural

debt was decreasing and this increased the burden on the farmer. The

farmer did not have the incentive or the ability to improve the condition.

The government fell that the farmer could help through some type of a

co-operative effort.

The credit of taking right action in this matter goes to the

government of Madras (Chennai). In 1882 they deputed Sri Frederick

Nicholson to probe into the possibility of introducing land and

agriculture banks in that provinces. In the basis of recommendations, it

was passed into law in 1904, as the co-operative Credit Society Act.

SAHYADRI ARTS & COMMERCE COLLEGE

ONE FOR ALL, ALL FOR ONE

Following are the stages of Co-operative Movement in India;

Ist STAGE OF THE MOVEMENT (1904 11)

The introduction of the Co-operative Credit Society Act in 1904

marked in the beginning of the co-operative movement in India.

The essential features of this act were s follows:

1. A society could be formed by any ten persons living in the same

village or town.

2. The co-operative societies were classified as rural and urban.

3. The Act provided only for the formation of credit societies.

4. The societies could advance loans to members only on personal or

real security.

5. No member could hold shares for more than Rs. 1,000.

IInd STAGE (1912 18)

The defects of the 1904 Act were remained in 1912 when another

Co-operative Societies Act was enacted. With the passing of this Act, the

movement entered on the second stage of this progress.

The essential features of this Act are the following:

1. Under this Act, any society, credit or otherwise may be registered

which has its object that the promotion of the economic interests of

its members in accordance with the co-operative principles.

2. A federal society like the Central Bank could be registered.

3. No member can more than 1/5th of the total share capital.

4. 1/4th of the net profit of a society must be carried to its reserve fund.

SAHYADRI ARTS & COMMERCE COLLEGE

10

ONE FOR ALL, ALL FOR ONE

III rd STAGE 91919 29)

During this period, the movement continued to make a rapid

progress. The number of membership of agricultural credit societies

increased three times, while their working capital moved up four folds.

In spite of this rapid expansion the proportion of the rural families

brought with in the co-operative fold was very small.

IV th AND V th STAGE (1929 -39)

A significant highlight of this period was, the establishment of the

Reserve Bank of India in 1935, and its Agricultural Credit

Department which was charged with the duty of studying various

problems relating to agricultural credit.

CO-OPERATIVE MOVEMENT AFTER INDEPENDENCE

After independence the co-operative movement has been making

rapid progress in various directions. The government has established

various committees like The Co-operative Planning Committee (1946),

The All India Rural Credit Committee ( 1954), The Vaikunth Lal Mehta

Committee (1960) etc. Further the co-operating has been assigned as

important role in the country plans.

Rural Credit Survey Committee:The most important landmark in the history of the co-operative

movement in India after independence was the publication of the report

of All India Rural Credit Survey Committee. The report contains the

survey conducted by the committee in villages.

SAHYADRI ARTS & COMMERCE COLLEGE

11

ONE FOR ALL, ALL FOR ONE

THE Ist FIVE YEAR PLAN (1951 - 56)

The 1st five year plan, which was launched in 1950 -51, described the

co- operative movement as an indispensable instrument of planned

action in the country.

The main features of the 1st plan with reference to co-operative are

the following:

1. Co-operative agencies in the village should have the closest possible

relationship with panchayat.

2. The target set by the Co-operative Planning Committee is to cover

50% of Indias villages.

3. An attempt should be made to have a co-operative organization in

each village, which will cater to the multiple needs of its members.

4. The state should encourage the information of co-operative firms.

The committee recommended on Integrated Schemes Rural Credit

based on the following principles.

i. State Partnership.

ii. Long term Operations Fund.

iii. Loans against Anticipated Crops.

iv. Large sized Societies.

v. Special Funds.

SAHYADRI ARTS & COMMERCE COLLEGE

12

ONE FOR ALL, ALL FOR ONE

THE IInd FIVE YEAR PLAN (1955-56)

During the IInd plan period in 1958 the National Development

Council considered the role of co-operative movement in intensifying

agricultural production and building the rural economy. Economy

development at the village level should be placed fully on the village cooperatives and the village panchayat. The main recommendations of the

NDC was to ensure every family is represented in the village cooperatives and the co-operatives should make permanent arrangements

in the village for producing the seeds and organic and green manures,

needed, arrange for the supply of these in kind to persons who cannot

pay for them in advance, recoveries being made after harvest. During

this period a lot of attention was given to rural development and success

is also achieved.

Consumers Co-operative Movement made phenomenal progress

during the IIIrd plan on account of government patronage and assistance

under the centrally sponsored schemes.

THE IIIrd FIVE YEAR PLAN (1961 66)

During the IIIrd plan, the co-operative movement was accorded a

special role in implementing the schemes of economic development with

special reference to rural areas. The agricultural credit movement should

cover all the villages and 60% of the agricultural population by the end

of the IIIrd plan.

SAHYADRI ARTS & COMMERCE COLLEGE

13

ONE FOR ALL, ALL FOR ONE

Progress during the III rd plan

As against 100% coverage aimed at in the IIIrd plan 80% of village

were covered. Paddy being one of the important crops, which needs

processing before it reaches the consumer. Co-operative was assisted to

setup Rice Mills in the IIIrd plan.

At the end of the IIIrd plan there were 78 co-operative sugar

factories, 155 cotton ginning pressing societies, 329 paddy husking

societies and mills, 298 oil-crushing societies and 22 fruit and vegetable

societies were present.

ANNUAL PLANS (1966 69)

After the IIIrd five year plan, co-operative movement made

headway under the annual plans. In 1966-67, Rs. 33.5 Crores; in 196768, Rs 36.3 Crores and in 1968 -69, Rs34 Crores were spend in this

field.

IVth FIVE YEAR PLAN (1969 74)

In the IVth plan, one of the main endeavors was to orient the

policies and procedures of credit co-operative and land development

banks in favor of small cultivators.

All India Rural Credit Review Committee:All India Rural Credit Review Committee was appointed by the

Governor of the Reserve Bank for reviewing the supply of the credit in

the context of the IVth plan in general and the intensive agricultural

programmed in particular. The recommendation made by this committee

SAHYADRI ARTS & COMMERCE COLLEGE

14

ONE FOR ALL, ALL FOR ONE

are; the re-organization of rural credit in RBI; involving the

establishment of an

Agricultural Credit Board; the setting up of a small farmers development

agency in each of a number of selected throughout the country.

The important recommendations made by the committee are listed

below;

1. Need for viable primary co-operatives.

2. Lending policies and procedures. Small farmers development

agency.

3. Term credit.

4. Rural Electrification Corporation.

5. Role of the RBI.

Progress during the IVth plan

The performance of the co-operative movement during the IVth

plan period presents a mixed picture. in respect of one item namely, cooperative marketing as agricultural produce, the IVth plan targets were

exceed.

Another significant development in the course of the IVthe plan

has been the establishment of a consultancy and promotional all with in

the national co-operative consumer federation for providing expert

guidance to consumer co-operatives.

SAHYADRI ARTS & COMMERCE COLLEGE

15

ONE FOR ALL, ALL FOR ONE

Vth FIVE YEAR PLAN (1974 79)

Three specific objectives have been stated for co-operative

development during the V th plan.

1. To strengthen the network of agricultural co-operatives.

2. To build up a viable consumer co-operative movement to enable it to

function as an important element in a consumer oriented distribution

system.

3. to make efforts towards the correction of regional imbalances in the

level of the co-operative development particularly in the sphere of

agricultural credit.

VIth FIVE YEAR PLAN (1980 85) &

VIIth FIVE YEAR PLANK (1985 90)

At the end of the VIth plan the short term loans and the medium

term loans, advanced amounted to Rs. 2,500 Crores and Rs.250 Crores

respectively. A major development in the field of credit during the VI th

Plan was the setting up of National Bank for Agriculture and Rural

Development in July 1982. NABARD has emerged as an apex

national institution accredited with all materials concerning policy

planning and operations in the field of credit for agriculture and other

economic activities in the rural areas.

The major twist during the VIIth Plan to ensure adequate flow of

credit to the weaker sections of the population and to the rural areas.

SAHYADRI ARTS & COMMERCE COLLEGE

16

ONE FOR ALL, ALL FOR ONE

CO-OPERATION PROSTECTS

The co-operative movement has been in existence in the country

for more the 90 years. The movement was introduced with high hopes

and lofty expectations. It was expected to provide lasting solution to the

problems of our rural economy.

The co-operative movement is now a mammoth organization

covering about 95% of villages and 44% of our rural population. In a

single village, which is not covered by a village co-operative society.

ACHIEVEMENTS

The various achievements of the co-operative movement in

India can be summarized under the following heads.

1)

Economic Benefits

The co-operative movement has been rendering invaluable

services for the economic betterment and well being of the rural

population. Some of the economic benefits provided by the co-operative

movement can be stated as under:

Cheap credit

Rescuing the peasantry from the clutches of money lender

Better use of credit

Popularizing modern inputs

Better prices to farmers

SAHYADRI ARTS & COMMERCE COLLEGE

17

ONE FOR ALL, ALL FOR ONE

Rural entrepreneur

Developing banking habits

2)

Social and Moral Benefits

The co-operative movement has also brought about a number of

special and moral benefits to the people they are:

it is reaching people to live harmoniously on a community

basis.

It fosters a sense of responsibility integrity and diligence.

3)

Educational Benefits

A good co-operative society is a continuous source of education

for the member of rural areas. It reaches the proper use of money, the

true value of goods and better methods or production.

Thus, the co-operative movement is playing a significant role in

the present economic setup, in acknowledged on all hands. It cannot

eliminate.

SAHYADRI ARTS & COMMERCE COLLEGE

18

ONE FOR ALL, ALL FOR ONE

Chapter-III

CO-OPERATIVE ORGANISATION

MEANING AND DEFINITION

FEATURES

TYPES OF CO-OPERATIVE SOCIETY

ROLE OF CO-OPERATIVE SOCIETY IN

SOCIAL CHANGES IN INDIA

SAHYADRI ARTS & COMMERCE COLLEGE

19

ONE FOR ALL, ALL FOR ONE

MEANING AND DEFINITION

Co-operative form of organization is different from other

organizations i.e., sole- trading concerns, partnership firms and joint

stock companies in one basic aspect that the Co-operative organization is

not set-up for rendering services to the voluntary bases for the

furtherance of her common economic interest (goal).The co-operative

organization may be defined as a voluntary association of persons

joining together in equal basis for the promotion of certain economic or

business interest of the society.

The International Labor Organization defined the co-operative

organization as an association of persons, usually of limited, means

who have voluntarily joined together to achieve a common economic

and through the formation of a democratically controlled business

organization making equitable contributions to the capital required and

accepting a fair share of risks and benefits of the undertakings.

Prof. Paul Lambert, a leading authority on co-operations states:

A co-operative society is an enterprise formed and directed by an

association of users, applying within it the sales of democracy and

directly intended to serve both its own members and the community as

whole.

SAHYADRI ARTS & COMMERCE COLLEGE

20

ONE FOR ALL, ALL FOR ONE

Features of Co-Operative Organization

1. voluntary association:

A co-operative society is a voluntary association of persons and

not of capital any persons irrespective of sex, creed casts etc. any person

can join the society of his wish and he can leave it at any time after

giving the notice

to society. While leaving he has to withdraw his amount and he is not

suppose to transfer the amount on other persons.

2. Source of finance:

The capital of co-operative society is raised from the members by

way of share capital. Since co-operatives are organized by relatively

weaker section of society, the share capital will be limited. However, it

is a part of government policy to assist and encourage co-operative

societies and therefore, a co-operative society can usually arrange its

resources by loans from the State and Central Co-operative Banks.

3. Control and management:

Democracy is the keynote of the management of the co-operative

society since most of these societies operate on a local scale, the

meetings of the members select the managing committee and lay down

the policy which it must flow to promote their common interest each

member, whatever may be the state in the society, has one vote and by

proxy. Besides the organization and control of a co-operative society,

has one vote and by proxy. Besides the organization and control of a coSAHYADRI ARTS & COMMERCE COLLEGE

21

ONE FOR ALL, ALL FOR ONE

operative society may be carried on by two or more members working in

different capacities and outsides may be employed only when the society

grows too large.

4. Service Notice:

A co-operative society is organized primarily with the object of

rendering maximum service to its members in certain field. It does not

aim at the cast of its members for it is formed basically for providing

certain essential facilities to members. This does not mean that a cooperative society will have work for profit. It is quite used for societies

to earn profits by extending their services to maximum members.

5. Disposal of surplus:

It is usual for commercial concerns to distribute profits among the

owner in the ration of their capital contribution or in agreed ration. A cooperative society differs from trading company in their respect. Under

the co-operative form of ownership and organization. The surplus arising

of a years working is given to the members not directly or divided on

shares held by each of them. But in the form of a bonus which need not

be proportionate to their respective capital contribution.

6. Fixed return on capitals:

The fixed or limited return on capital subscribed to the society

must be paid out of the surplus to the members making the payment of

fixed interest or paid up capital definitely a first charge on the trading

surplus of all those who joined the society a solid reason for leaving their

saving in deposits with it.

SAHYADRI ARTS & COMMERCE COLLEGE

22

ONE FOR ALL, ALL FOR ONE

7. State control and co-operative status:

Although voluntary in their basic chapter the co-operative

societies are subject to considerable state control and supervision.

Although, the co-operative societies are voluntary in their basic

feature but, they are subject to some considerable state control and

supervision.

The features of the co-operative organization outlined above were

the basic principles on which the co-operative movement was based in

the beginning. With the passage of time, some of them have been

modified in view of the peculiar needs and difficulties of certain types of

societies.

While a co-operative society is essentially a business unit

established primarily for organizing and providing some services to the

members and the committee. It is a movement aiming at the end of

exploitation by private business and the development of self help among

various sections of the society in voluntary basis. It is a socio-economic

movement inspired by the idea of organizing and uplifting the weaker

section of the society through collective action.

SAHYADRI ARTS & COMMERCE COLLEGE

23

ONE FOR ALL, ALL FOR ONE

TYPES OF CO-OOPERATIVE SOCIETY

Co-operatives may be formed practically in any work of life.

Some of them concern themselves with the moral and social uplift of a

weaker section of the society. And, some of them combine some

business activity with service to their members. Since co-operative are

being consider here as a force of business organization, only those

societies which are concern with some business purpose need an

introduction here. The principal types of business co-operatives are as

enumerated below:

1) Consumers Co-operative Societies

2) Producers Co-operative Societies

3) Marketing Co-operative Societies

4) Housing Co-operative Societies

5) Co-operative Credit Societies

6) Co-operative Forming Societies

1. consumers Co-operative Societies:

These societies are formed by the ordinary or general people for

obtaining their day-to day requirements of goods at cheaper prices.

These societies make their purchase in bulk from wholesalers at

wholesale rates and sell to members at market prices. The difference is

represented by the surplus. Which is distributed among the purchasing

members in the form of bonus on purchases?

SAHYADRI ARTS & COMMERCE COLLEGE

24

ONE FOR ALL, ALL FOR ONE

This is the oldest form of co-operative organization. In India,

consumers co-operative societies have received impetus (impulses)

from the government attempt to check rise in prices of consumers goods

and essential commodities.

2. Producers Co-operative Societies:

It is also called as industrial co-operatives these societies are

voluntary association of small producers formed with the object of

eliminating the capitalist from the system of industrial production. Some

times consumers societies may join hands with this association.

3. marketing Co-operative Societies:

The marketing co-operative society or the sales co-operative

societies are voluntary association of independent producers organized

for the purpose of arranging for the sale of their output. As the central

sales agency for a member of producers, a marketing co-operative

society quite often performs some important functions of marketing.

Such as, processing and grading of the product delivered by the

individual producers. Societies of this kind are particularly useful for

agriculturists, small producers and artisans.

4. Housing Co-operative Societies:

Housing co-operatives are the association of persons who are

interested either in securing dealership of a house or obtaining

accommodation at fair and reasonable rent. Such societies join together

to form co-operatives of this kind. Through, these societies they can

SAHYADRI ARTS & COMMERCE COLLEGE

25

ONE FOR ALL, ALL FOR ONE

secure not merely financial assistance, but also the economics of

purchase of building materials in bulk. The membership of such a

society is open to all those who are interested in securing house

accommodation as well as to those who are ready to deposit money in

the society for interest. Each member has to buy at least one share and

the liability is generally limited to his contribution.

5. Credit Co-operative Societies:

The credit co-operative societies are voluntary association of the

people with moderate means formed with the object of extending shortterm financial accommodation to them and developing the habit of thrift

among them, the funds of these societies consists of share capital

contributed by the members, the liabilities of the members are in

generally unlimited. This helps the society in raising funds from

outsiders and ensures that every member shows keen interest in the

working of the society in granting loans, the society may show

concession for the poor people who apply for smaller loans. Besides,

loans may generally be granted only for productive purpose. The society

may or may not as for security of immovable property while making

loans; the rate of interest charged on the borrowings is kept as low as

possible

Credit co-operative societies may be divided into two types they

are,

i. Agriculture Credit Society

ii. Non- agriculture Credit Society

SAHYADRI ARTS & COMMERCE COLLEGE

26

ONE FOR ALL, ALL FOR ONE

6. Farming Co-operative Societies :

These co-operative societies are generally agriculture cooperatives framed with t3eh object of achieving the benefits of large

scale farming and maximizing agricultural output, such societies are

advanced for those agricultural countries like India, which suffer from

excessive fragmentation or sub-division of agricultural land holding by

farmer. This membership is generally confined to farmers including

those doing land and those who till the land.

ROLE OF CO-OPERATIVE SOCIETY IN SOCIAL

CHANGES IN INDIA

Co-operative societies are playing a very important role in modern

society. In olden days there were no co-operative society, people were

not aware of the concept itself, but the theory of co-operation or concept

of co-operation is as old as human civilization. They used this, to make

their group for the purpose of living, hunting and working together. He

did know the importance of co-operative society in society in social life,

when one of other person exploited a common man.

In olden days people were exploited by their own masters. The

laborers of the peasant classes of people were ill-treated. The people of

low class and low caste were neglected from the society not getting due

respects. These low class people suffered lot and they were exploited by

the upper class and they were also kept out from the education.

SAHYADRI ARTS & COMMERCE COLLEGE

27

ONE FOR ALL, ALL FOR ONE

After the introduction of the co-operative movement in India in

1904, the people who exploited and who needed a change got a ray of

hope. They started to educate themselves. They give birth to a feeling of

oneness among them and they started to working not only for the people

of themselves but also for welfare of others. However, by making their

co-operatives they enjoyed very much. Their standard of living was

raised. When the government realizes that the groupism is started, then

to stop that groupism, the government took steps in establishing cooperative societies like Financial Co-operatives, Industrial Co-operative

etc., and the government made some resolution to these Co-operative by

passing their Act.

The co-operative system reduced many problems relating to

finance and industry. The people who were borrowing money from lords

were now able to get money or financial assistance by the co-operative

societies. A man by making himself a member can get an amount as loan

and with in the prescribed limit rate of interest. In the earning of profits

of the societies he was given his share of profit in the form of dividend

according to his capital in the society. This reduced the burden of paying

high interest and in turn he gets cash profits from the co-operative

society. By getting all these benefits the life style and standard of living

of common people have increased and totally it is bringing change in

society.

Thus, co-operative societies have made lot of changes in the

Indian society. No one can be exploited by any one due to the coSAHYADRI ARTS & COMMERCE COLLEGE

28

ONE FOR ALL, ALL FOR ONE

operative societies and a common man is safe in the hands of cooperative societies.

BENEFITS OR MERITS OF CO-OPERATIVE SOCIETIES:

Co-operative societies in India have provided many benefits they

are:

1. The most important service of co-operative societies in India is the

provision of agricultural credit. The co-operative credit societies

have provided c heap credit facilities to farmers. These societies,

today, meet about 43%of the credit. Requirements of the farmers,

and thereby, minimize the dependence of the farmers on money

lenders.

2. By supplying credit, better seeds, fertilizers, pesticides and

insecticides, irrigation facilities etc., co-operative societies have

raised the agricultural productivity and production in the country,

and thereby, contributed to the agricultural development of the

country. In fact, co-operative societies are partly responsible for

the Green Revolution that has taken place in some parts of the

country, such as Punjab, Maharastra, and Andhra Pradesh etc.

3. The co-operative marketing societies have been instrumental in

securing remunerative prices for the formers for their produce.

SAHYADRI ARTS & COMMERCE COLLEGE

29

ONE FOR ALL, ALL FOR ONE

4. The co-operative marketing societies in urban areas have provided

cheap credit facilities to artisans, craftsmen, small traders and

industrial workers and employees.

5. The producers co-operative societies or the industrial cooperative s

6. Have provided a source of livelihood to artisans and craftsmen.

7. The consumers co-operative societies have opened a chain of

stores and supplied good quality goods at fair prices to buyers in

both urban and rural areas. In fact, consumers co-operative stores

have helped the equitable distribution of essential commodities at

fair prices and helped the Government to hold the price line to a

certain extent.

8. The dairy co-operatives like the Amul have ensured regular

supply of good quality milk and milk products at reasonable prices

to the consumers in towns and cities and better prices for the

producers of milk. The dairy co-operatives are making efforts to

achieve White Revolution in the country.

9. The fisheries co-operatives have contributed to large-scale

production and sale of fishes. They are partly responsible for the

Blue Revolution that is taking place in the country.

10.The co-operative societies have helped in pooling the resources of

the weaker sections of the society for productive purposes.

11.The primary credit societies in rural areas have checked the

wasteful expenditure of the tenants and encouraged the habit of

thrift and saving among the people.

SAHYADRI ARTS & COMMERCE COLLEGE

30

ONE FOR ALL, ALL FOR ONE

12.The co-operative societies in rural areas have improved the moral

behavior of the rural people. The made the villagers give up vices,

such as gambling drinking, litigation etc.

SAHYADRI ARTS & COMMERCE COLLEGE

31

ONE FOR ALL, ALL FOR ONE

DEFECTS OF THE CO-OPERATIVE MOVEMENT IN INDIA OR

CAUSES FOR THE SLOW GROWTH OF CO-OPERATIVE

MOVEMENT IN INDIA:

The co-operative movement in India suffers from certain

drawbacks. That is why; its growth has been rather slow. The main

defects of the co-operative movement in the country are:

1. The co-operative movement in India has not come from the

people. It is only the Government. Which has taken the initiative

in starting the co-operative societies? So, it has become a

movement of the government and not of the people.

2. The masses of India are illiterate. They are not able to understand

the objectives and the importance of co-operation.

3. The financial resources of the co-operative societies are meager.

So, they are not able to meet the growing needs of the members.

4. Generally, the management of the co-operative societies is not

efficient. Further, in many cases, the management of the societies

has fallen into the hands of dishonest and unscrupulous persons.

5. The recovery of loans from the borrowers is not efficient. Overdues are increasing at an alerting rate.

6. Loans are given without proper enquiry. A number of loans are

given in fictitious names. In many cases, loans are given to the

friends and relatives of the members of the managing committee.

7. There is political intervention in the working of the co-operative

societies.

SAHYADRI ARTS & COMMERCE COLLEGE

32

ONE FOR ALL, ALL FOR ONE

8. The co-operative credit societies have failed to mobilize deposits.

They are just acting as agents for the distribution of funds

provided by the Government.

9. There has been too much of emphasis on co-operative credit

societies. Other types of co-operative societies have not been

given much importance.

EVOLUTION OF COOPERATIVES IN INDIA

The cooperative movement in India owes its origin to agriculture

and allied sectors. Towards the end of the 19 th century, the problems of

rural indebted ness and the consequent conditions of farmers created an

environment for the chit funds and cooperative societies. The farmers

generally found the cooperative movement an attractive mechanism for

pooling their meager resources for solving common problems relating to

credit, supplies of inputs and marketing of agricultural produce. The

experience gained in the working of cooperatives led to the enactment of

cooperative

credit

societies

act,

1904.

Subsequently,

more

comprehensive legislation called the cooperative societies act was

enacted. This act, inter alias, provided for the creation of they post of

registrar of cooperative societies and registration of cooperative societies

for various purposes and audit. Under the Montague. Chelmsford

Reforms of 1919, cooperation became a provincial subject and the

provinces were authorized to make their own cooperative laws. Under

the Government of India Act, 1935, cooperatives were treated as a

provincial subject. The item Cooperative Societies is a State Subject

under entry No.32 of the State List of the Constitution of India.

SAHYADRI ARTS & COMMERCE COLLEGE

33

ONE FOR ALL, ALL FOR ONE

In order to cover Cooperative Societies with membership from

more than one province, the Government of India enacted the Multi-Unit

Cooperative Societies Act, 1942. This Act was an enabling legislative

instrument dealing with incorporation and winding up of cooperative

societies having jurisdiction in more than one province. With the

emergence of national federations of cooperative societies in various

functional areas and to obviate the plethora of different laws governing

the same types of societies, a need was felt for a comprehensive Central

legislation to consolidate the laws governing such cooperative societies.

Therefore, the Multi-State Cooperative Societies Act, 1984 was enacted

by parliament under Entry No.44 of the Union List of the Constitution of

India.

After India attained independence in August, 1947, cooperatives

assumed a great significance in poverty removal and faster socioeconomic growth. With the advent of the planning process, cooperatives

became an integrate part of the Five Year Plans. As a result, they

emerged as a distinct segment in our national economy, in the First Five

Year plan, it was specifically stated that the success of the Plan would be

judged, among other things, by the extent it was implemented through

cooperative organizations.

The All-India Rural Credit Survey Committee Report, 1954

recommended an integrated approach to cooperative credit and

emphasized the need for viable credit cooperative societies by expanding

their area of operation, encouraging rural savings and diversifying

SAHYADRI ARTS & COMMERCE COLLEGE

34

ONE FOR ALL, ALL FOR ONE

business.

The

Committee

also

recommended

for

Government

participation in the share capital of the cooperatives.

In view of these recommendations, different States drew up

various schemes for the cooperative movement for organizing large size

societies and provision of State partnership and assistance. During

1960s, further efforts were made to consolidate the cooperative societies

by their re-organization. Consequently, the number of primary

agricultural cooperative credit societies was reduced from around two

lakh to 92,000.

EVOLUTION

In 1958 the National Development Council (NDC) had

recommended a national policy on cooperatives. Jawaharlal Nehru had a

strong faith in the cooperative movement. While opening an

international seminar on cooperative leadership in South East Asia he

had said But my outlook at present is not the outlook of spreading the

cooperative movement gradually, progressively, as it has done. My

outlook is to convulse India with the

Cooperative Movement or rather with cooperation to make it, broadly

speaking the basic activity of India, in every village as well as

elsewhere; and finally, indeed, to make the cooperative approach the

common thinking of India.therefore, the whole future of India really

depends on the success of this approach of ours to these vast numbers,

hundreds of millions of people.

SAHYADRI ARTS & COMMERCE COLLEGE

35

ONE FOR ALL, ALL FOR ONE

The cooperative sector has been playing a distinct and significant

role in the countrys process of socio-economic development. There has

been a substantial growth of this sector in diverse areas of the economy

during the past few decades. The number all types of cooperatives

increased from 1.81

lakh in 1950-51 to 4.53 lakh in 1996-97. The total membership of

Cooperative societies increased from 1.55 crore to 20.45 crore during the

same period. The cooperatives have been operating in various areas of

the economy such as credit, production, processing, marketing, input

distribution, housing, dairying and textiles. In some of the areas of their

activities like dairying, urban banking and housing, sugar and

handlooms, the cooperatives have achieved success to an extent by there

are larger areas where they have not been so successful. The failure of

cooperatives has achieved successful. The failure of cooperatives in the

country is mainly attributable to: dormant membership and lack of active

participation of members in the management of co-operatives. Mounting

overdue in cooperative credit institution, lack of mobilization of internal

resources and over-dependence on Government assistance, lack of

professional management. Bureaucratic control and inter reference in

the management, political interference and over- pulsation have proved

harmful to their growth. Predominance of vested interests resulting in

non-percolation of benefits to a common member, particularly to the

class of persons for whom such cooperatives were basically formed, has

also retarded the development of cooperatives. These are the areas which

need to be attended to by evolving suitable legislative and policy

support.

SAHYADRI ARTS & COMMERCE COLLEGE

36

ONE FOR ALL, ALL FOR ONE

Chapter-IV

SIR M. VISHWESHVARAIAH CO-OPERATIVE SOCIETY LTD.,

SHIVAMOGGA A PROFILE

HISTORY

FEATURES

DEPOSITS

SHARE CAPITAL

NET PROFITS

MANAGEMENT

MEMBERS

SAHYADRI ARTS & COMMERCE COLLEGE

37

ONE FOR ALL, ALL FOR ONE

SMV CO - OPERATIVE SOCIETY LTD.,

SHIVAMOGGA

HISTORY:

Sir M. Vishweshvaraiah Co-operative Society was established

on 4th April 1983. The scope of serv8ices of the society is limited to

Brahmins community only. The area of operation of this society limited

to Shivamogga city only.

Before 1983 in Shivamogga city, the number of co-operative

societies was very less and these societies failed to meet the credit needs

of Brahmins community. At that time, a few leaders of community

decided to establish a xo-operative society.

The first president of this society was Venkataramana Shastri

and the first secretary of this society was B. N. Krishna Murthy whose

services are ever to be remembered. The society was established mainly

with a view to provide credit facilities to its members at a reasonable rate

of interest.

Features of the society

Following are the main features of the SMV co-operative society:

1. According to the byelaw of the society board of directors are not

entitled for taking loans from the society.

2. Society has not taken any loans from government or any other

financial institutions.

SAHYADRI ARTS & COMMERCE COLLEGE

38

ONE FOR ALL, ALL FOR ONE

3. Members are avail to the surety loan up to Rs. 20000. Till date

loan of Rs.85 lakhs has been disbursed under this scheme.

4. Members are avail to the Property loan up to Rs.3 lakhs and Rs.

1.15 crores already granted to the members.

5. For the purchase of two wheeler vehicles the members can take

Rs. 25,000 as Vehicle loan.

6. Loan facilities to the extent of Rs. 50,000 are granted on the

security of NSC, KVP and Gold.

7. The society is granting loan for businessmen up to Rs. 25000.

DEPOSITS:

The deposits of the society increase since from earliest years of its

working, as the confidence of the members increases. The society

receives deposits from the members through the following accounts.

1. savings deposits Account

2. Pigmy Deposits Account

3. Fixed Deposits Account

4. Recurring Deposits Account

SAHYADRI ARTS & COMMERCE COLLEGE

39

ONE FOR ALL, ALL FOR ONE

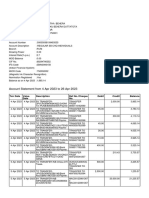

Following is the table shown the total deposits deposited by the

members during the year 2004-05 to 2008-09.

Sl. No

Years

1

2

3

4

5

2004-05

2005-06

2006-07

2007-08

2008-09

Total

Deposits

1,15,25,941

1,56,44,749

1,83,77,001

2,23,84,028

2,99,96,674

9,79,28,393

According to the Banking Regulation Act, 1966, the society has

been also keeping Rs. 5,00,000 as cash reserve laid down under Sec.

18.

SHARE CAPITAL:

The share capital of the society consists A class shares at Rs1,

000 each. In the year1983-84 the share capital of the society was

Rs.1,79,800 and members of the society was 813 and as confidence

of the members increases the share capital and members (i.e. share

holders) are also increases to 45,59,800 and 5694 respectively.

The following is the table showing the share capital and share

holders of the society during the year 2004-05 to 2008-09

SAHYADRI ARTS & COMMERCE COLLEGE

40

ONE FOR ALL, ALL FOR ONE

Sl. No.

1

2

3

4

5

Years

2004-05

2005-06

2006-07

2007-08

2008-09

Share Holders

4,513

4,538

4,525

4,545

5,694

23,815

Total

Share Capital

23,66,400

26,08,700

27,36,300

29,96,900

45,59,800

1,52,68,100

NET PROFITS:

In the first annual meeting profits came to Rs. 3, 8425. During the

year 2004-05 to 2008-09 the net profits of the society was as under.

Sl.No

1

2

3

4

5

Years

2004-05

2005-06

2006-07

2007-08

2008-09

Total

SAHYADRI ARTS & COMMERCE COLLEGE

41

Net Profits

4,61,034

3,83,129

7,40,521

7,61,999

14,55,047

38,01,730

ONE FOR ALL, ALL FOR ONE

MANAGEMENT:

The management of the society rest in the board consisting

of 12 directors elected annually at the general meeting. The president,

the vice-president (the treasures are elected from among the

directors). From the beginning the society has been lucky in getting

competent and self sacrificing directors as well as office bearers.

No sitting or other fees is paid any of the directors. With the

increases in the number of members and depositor and the

consequent increase in staff, efficient management has necessitated

greater systematization of work.

MEMBERS:

It cannot be ignored that the building up of this institution

and its growth to its present size are primarily the result of the fact

that a very great majority of the members. The society not only

provides services to its members but also expand the banking

business among the members of the society.

SAHYADRI ARTS & COMMERCE COLLEGE

42

ONE FOR ALL, ALL FOR ONE

The structure of management of Sir M. Vishweshvaraiah Co

operative Society Ltd., Shivamogga can be shown in a chart as

follows:

SHAREHOLDERS

PRESIDENT

VICE PRESIDENT

DIRECTORS

SECRETARY

ACCOUNTANT

CLERKS Cum CASHIERS

SERVANTS

SAHYADRI ARTS & COMMERCE COLLEGE

43

ONE FOR ALL, ALL FOR ONE

Chapter-V

CREDIT FACILITIES IN SMV CO-OPERATIVE

SOCIETY LTD.

INTRODUCTION TO CREDIT

MEANING AND DEFINITION OF CREDIT

TYPES OF CREDIT

CREDIT FACILITIES IN SMV CO-OPERATIVE

SOCIETY LTD.

TYPES OF LOANS GIVEN BY THE SMV COOPERATIVE SOCIETY LTD.

SAHYADRI ARTS & COMMERCE COLLEGE

44

ONE FOR ALL, ALL FOR ONE

MEANING OF CREDIT

Credit means good opinion founded on the belief in a persons

veracity, integrity, ability and virtue. Credit refers to the confidence

in a persons willingness and ability to pay. A persons credit depends on

three Cs Character, Capacity and Capital. It is a combination of all

these qualities which go to make a mans credit. He must be honest and

fair in his dealings with others; he must also have capacity for making

his business a success; and he must be a man of substance. Credit is thus

an attribute of the borrower.

DEFINITION:

The word Credit has been derived from the Latin word Credo,

meaning I believe. Credo however is a combination of the Sanskrit

word, meaning trust and the Latin word do, meaning I place.

According to Wing field Stratford, credit is nothing more or

less than faith and faith no less on the stock exchange than

before the alter, is the substance of things hoped for, the

evidence of things not seen.

According to William Stanley jevons, credit is noting but the

deferring of payment.

According to Cole, credit is purchasing power not derived

from income, but created by financial institutions either as an

offset to idle incomes held by depositors in the banks, or as a

net addition to the total amount of purchasing power.

SAHYADRI ARTS & COMMERCE COLLEGE

45

ONE FOR ALL, ALL FOR ONE

KINDS OF CREDIT

In modern times credit is required for many purposes and is

employed by almost every sector of the economy. Some of the main

types of credit are studies under.

1. Classified on the basis of Use

a. Productive Credit

b. Consumer Credit

Productive Credit:

Producers undertake production on a large scale by depending

upon the banks to finance the purchases of raw materials, wages

payments by seeking overdraft and cash credit facilities from the banks.

The loan facilities given for the purpose is called productive Credit.

Consumer Credit:

In the developed countries of the world the purchases of most

consumer durables such as cars, refrigerators, T.V. sets and the like are

all financed by banks and other financial intermediaries. The loan

provided for this purpose is called Consumer Credit.

2. classified on the basis of period of credit given :

On this basis credit is classified into 3 types. They are

i. Long-term credit

ii. Medium-term credit

iii. Short-term credit

SAHYADRI ARTS & COMMERCE COLLEGE

46

ONE FOR ALL, ALL FOR ONE

Long-term credit:

This type of credit is given for a period between 5to25 years. This

type of loan is used to purchase buildings, machineries or any other fixed

assets and to construct house or re-modification of the machineries etc.

Medium-term credit:

Medium-term credit is granted for a period below 5 years and

above one year. So, medium-term credit stands midway between the

long-term and short-term credit. Formers to setting up of pump sets and

other machineries use this type of loan.

Short-term credit:

Short- term credit is an credit or loan advanced by the banks or

other financial institutions for a period of few days or a few months.

This loan is granted for a period of few days or a few months. This loan

is granted for the purpose of purchasing raw-materials, wage payments

etc.

3. Classified on the basis of Security

a. Secured loan

b. Un-secured loan

SAHYADRI ARTS & COMMERCE COLLEGE

47

ONE FOR ALL, ALL FOR ONE

Secured loan:

Loans are generally granted by the banks and other financial

agencies against the security of tangible assets pledged by the borrower

in favor of the lender is called secured loans.

Unsecured loan:

Loans may, however, be granted without requiring the borrower to

furnish any security of tangible assets are called Unsecured loans.

Functions of credit

Credit performs many useful functions for the economic

prosperity of country thus:

1. Credit economies the use of metallic currency. Credit instruments

serve in place of coins and thus save much unnecessary expense.

2. It helps in the financing of the industry by making possible huge

loans to businessman.

3. It increases the productivity of capital. Idle money, through the

agency of banks, is made available to people, who can use it

productivity.

4. By means of credit, large sums can be lent by banks against small

cash reserves.

5. Credit instruments, especially bill of exchange, greatly facilitate

payments in international trade. Payments can be made without

movement of treasure to any large degree.

SAHYADRI ARTS & COMMERCE COLLEGE

48

ONE FOR ALL, ALL FOR ONE

SIR M. VISHWESHARAIAH CO-OPERATIVE SOCIETY LTD.

Credit facility or loan to members;

SMV Co-operative Society Ltd. Not only accepting deposits from

the members but also providing loans to smaller traders, businessmen

etc. at the reasonable rate of interest. The society lends loans only for

members of the society.

The society knows that all the depositors do not withdraw all their

money at the same time, more over as and when there are withdrawals

the societies get depositors. Again, Secretary makes a proper judgment

while employing the funds a small portion of funds is kept in cash as

CRR.

The balance of funds is employed by way of loans, overdrafts,

cash credit etc. each more of these advances are repayable as dividend.

The loans granted for fixed capital required for purchase or construction

of fixed assets like building, machinery etc repayable within the period

of 3-4 years. The secretary stipulates periodical repayment of

installments towards liquidation of these advances. Thus, by a proper

employment of funds the secretary is able to keep the funds liquid or

repayable at short notice.

SAHYADRI ARTS & COMMERCE COLLEGE

49

ONE FOR ALL, ALL FOR ONE

TYPES OF LOANS PROVIDED BY THE SOCIETY

Following are the types of loans provided by the society to its

members:

1. surety Loan

2. Property Loan

3. Gold Loan

4. Pigmy Loan

5. fixed Deposit Loan

6. Recurring Deposit loan

7. N.S.C Loan

8. K.V.P Loan

9. vehicle Loan

10.business Loan

11.House Construction Loan.

SAHYADRI ARTS & COMMERCE COLLEGE

50

ONE FOR ALL, ALL FOR ONE

Following is the table showing the credit facilities given by the

society to the members during the year 1996-97 to 2000-01.

1.

SURETY LOAN :

This loan is given by society for its members on the security of other

member. It provides this loan up to Rs.20, 000 for each member. The

rate of interest on this loan is 15% P.A.

The table showing surety loan granted by the society during

the years 2004-05to 2008-09.

Sl.No.

1

2

3

4

5

Years

2004-05

2005-06

2006-07

2007-08

2008-09

Surety Loans granted

58,20,000

50,42,000

46,18,100

60,15,000

84,45,500

2,99,40,600

Total

Bar diagram showing the Surety Loan granted by the society during the

year 2004-05to 2008-09. (in lakhs)

100

80

60

Surety loan

40

20

0

2.

PROPERTY LOAN

SAHYADRI ARTS & COMMERCE COLLEGE

51

ONE FOR ALL, ALL FOR ONE

This loan is given by the society for its members against fixed

assets. It provides property loan up to Rs.3, 00,000 for each

member. The rate of interest charged on property loan is 15% P.A.

Table showing the property loan granted by the society

during the years 2004-05to 2008-09

Sl.No

1

2

3

4

5

Years

2004-05

2005-06

2006-07

2007-08

2008-09

Total

Property loans granted

24,54,000

32,60,000

27,24,000

52,50,000

51,50,000

1,88,38,000

Bar diagram showing the Property Loan granted by the

society during the year 2004-05to 2008-09. (In lakhs)

60

50

40

30

Property loan

20

10

0

3.

GOLD LOAN :

The society provides loans against gold and jewelers for the

members. The members are avail to taken for this loan up to Rs.50, 000

and the rate of interest is 15% P.A

SAHYADRI ARTS & COMMERCE COLLEGE

52

ONE FOR ALL, ALL FOR ONE

Table showing the Gold loan granted by the society during the

year 2004-05to 2008-09

(In terms of Rs.)

Sl. No.

1

2

3

4

5

Years

2004-05

2005-06

2006-07

2007-08

2008-09

Total

Gold Loans granted

656.64,650

5,11,650

4,88,400

4,66,150

4,86,800

26,17,650

Bar diagram showing the Gold Loan granted by the society during

the year 2004-05to 2008-09 (in lakhs)

8

6

4

Gold loan

2

0

4.

PIGMY LOAN :

The society provides loans to its members on the basis of

amount deposited in Pigmy Deposit Account. The society

charges interest on the above loan is 2% higher the interest

given on the deposit amount.

SAHYADRI ARTS & COMMERCE COLLEGE

53

ONE FOR ALL, ALL FOR ONE

Table showing the pigmy loan granted by the society

during the year 2004-05to 2008-09

(in terms of Rs.)

Sl. No.

1

2

3

4

5

Years

2004-05

2005-06

2006-07

2007-08

2008-09

Total

Pigmy Loans granted

3,69,425

3,49,450

5,06,800

3,38,700

4,43,450

20,07,825

Bar diagram showing the pigmy loan granted by the society during

the year 2004-05to 2008-09 (in lakhs)

6

5

4

3

Pigm y loan

2

1

0

SAHYADRI ARTS & COMMERCE COLLEGE

54

ONE FOR ALL, ALL FOR ONE

5.

FIXED DEPOSIT LOAN :

The society also provides loans to its members on the basis of deposit

made by them to fixed deposit account.

Table showing fixed deposit loan granted during the year 200405to 2008-09

(in terms of Rs.)

Sl. No.

1

2

3

4

5

Years

2004-05

2005-06

2006-07

2007-08

2008-09

Total

Fixed Loans granted

5,73,150

8,40,175

7,32,900

12,10,000

16,39,650

49,95,875

Bar diagram showing the fixed deposit loan granted by the society

during the year 2004-05to 2008-09 (in lakhs)

20

15

10

Fixed Deposit

5

0

6.

RECURRING DEPOSIT LOAN

SAHYADRI ARTS & COMMERCE COLLEGE

55

ONE FOR ALL, ALL FOR ONE

The recurring deposit loan is given to the members by the society on

the basis of deposits made by them to recurring deposits account.

Table showing recurring deposit loan granted by the society

during the year 2004-05 to 2008-09

(In terms of Rs.)

Sl. No.

1

2

3

4

5

Years

2004-05

2005-06

2006-07

2007-08

2008-09

Total

Recurring Deposit Loans granted

15,575

33,250

58,750

30,150

96,800

2,34,525

Bar diagram showing the Recurring deposit loan granted by the

society during the year 2004-05 to 2008-09 (in lakhs)

100

80

60

Recurring deposit loans

40

20

0

SAHYADRI ARTS & COMMERCE COLLEGE

56

ONE FOR ALL, ALL FOR ONE

7.

N.S.C LOAN :

The society provides N.S.C loan to its members on the security of

National Saving Certificate. The society grants this loan to the extent of

75% of the face value of the certificate if it is above 2 years.

Table showing the N.S.C loan granted by the society during

the years 2004-05to 2008-09

(In terms of Rs.)

Sl. No.

1

2

3

4

5

Years

N>S>C Loans

2004-05

2005-06

2006-07

2007-08

2008-09

granted

2,79,500

1,42,450

92,860

84,425

1,34,000

7,33,235

Total

Bar diagram showing the N.S.C loan granted by the society during

the year 2004-05to 2008-09 (in lakhs)

300

250

200

150

N.S.C Loan

100

50

0

8.

K.V.P LOAN :

SAHYADRI ARTS & COMMERCE COLLEGE

57

ONE FOR ALL, ALL FOR ONE

By pledging Kisan Vikas Patra Certificates the members are avail to

taken for loan up to Rs.25, 000

Table showing the K.V.P loan granted by the society during the

years 2004-05to 2008-09.

(In terms of Rs.)

Sl. No.

1

2

3

4

5

Years

2004-05

2005-06

2006-07

2007-08

2008-09

Total

Gold Loans granted

91,500

93,250

1,11,750

36,200

1,29,800

4,62,500

Bar diagram showing the K.V.P loan granted by the society during

the year 2004-05to 2008-09 (in lakhs)

140

120

100

80

K.V.P Loan

60

40

20

0

SAHYADRI ARTS & COMMERCE COLLEGE

58

ONE FOR ALL, ALL FOR ONE

Chapter-VI

RECOVERY OF LOANS IN CO-OPERATIVE

SOCIETY LTD.

INTRODUCTION

RECOVERY OF LOANS IN SMV CO-OPERATIVE

SOCIETY LTD.

SAHYADRI ARTS & COMMERCE COLLEGE

59

ONE FOR ALL, ALL FOR ONE

RECOVERY OF LOANS

The circle of funds will be completed only when the issued

amounts are recovered and re-issued. Therefore, in other words recovery

means the collection of dues or repayment of loans amounts.

Loan amount cannot be recovered unless the loans are

persuading properly owning to their personal problems and other

reasons. Some times loans are unable to repay the loan amount in time.

In such cases they should contact personally and they will be granted

further period to repay their loans. This time extended to them is called

Extension of loans. A special provision as made in the loans by

institution to extend extension of times.

After the expiry of the original period the loans were

charged with additional interest. It is called Penal interest. Generally,

penal interest will be changed at 2% interest above the original rate of

interest.

SIR.M.VISHWESHARAIAH CO-OPERATIVE SOCIETY LTD.

From one year to another year the society has gained more and

more profit and has economic progress. The society has worked a lot for

the upliftment of the poorer class of people to come forward.

SAHYADRI ARTS & COMMERCE COLLEGE

60

ONE FOR ALL, ALL FOR ONE

Different types of loans issued by this society and amount

recovered and its performance would be glanced from the table given

below:

1.

SURETY LOAN :

Table showing surety loans advanced and recovered by the society

during the year 2004-05to 2008-09.

(In terms of Rs.)

Sl. No.

1

2

3

4

5

Years

2004-05

2005-06

2006-07

2007-08

2008-09

Total

Surety Loans

Surety loan

Advanced

58,20,000

50,42,000

46,18,100

60,15,000

84,45,500

2,99,40,600

Recovered

46,54,715

46,49,986

50,45,722

58,70,580,

59,13,191,

2,61,34,194

The above table reveals the performance of the society during the

period of 2004-05to 2008-09. it shows the total amount of surety loan

sanctioned Rs.2,99,40,6000 and total amount of surety loan recovered

Rs.2,61,34,194 by the society.

SAHYADRI ARTS & COMMERCE COLLEGE

61

ONE FOR ALL, ALL FOR ONE

Bar diagram showing the surety loans advanced and recovered by

the society during the year 2004-05to 2008-09. (In lakhs)

90

80

70

60

50

Advanced

Recovered

40

30

20

10

0

SAHYADRI ARTS & COMMERCE COLLEGE

62

ONE FOR ALL, ALL FOR ONE

2.

PROPERTY LOAN:

Table showing property loan advanced and recovered by the

society during the year 2004-05to 2008-09.

Sl.

Years

property Loans

Property loans

No.

1

2004-

Advanced

24,54,000

Recovered

9,17,581

05

2005-

32,60,000

12,67,804

06

2006-

27,24,000

19,70,486

07

2007-

52,50,000

27,82,135

08

2008-

51,50,000

33,02,254

1,88,38,000

1,02,40,200

09

Total

The above table reveals the performance of the society during the

period of 2004-05to 2008-09. It shows the total amount of Property loan

sanctioned Rs.1, 88, 38,000 and total amount of Property loan recovered

Rs.1, 02, 40,200.

SAHYADRI ARTS & COMMERCE COLLEGE

63

ONE FOR ALL, ALL FOR ONE

Bar diagram showing the property loans advanced and recovered by

the society during the year 2004-05to 2008-09. (In lakhs)

60

50

40

Advanced

Recoved

30

20

10

0

SAHYADRI ARTS & COMMERCE COLLEGE

64

ONE FOR ALL, ALL FOR ONE

3.

GOLD LOAN :

Table showing Gold loans advanced and recovered by the society

during the year 2004-05to 2008-09.

Sl. No.

1

2

3

4

5

Years

2004-05

2005-06

2006-07

2007-08

2008-09

Total

Gold Loans

Gold loan

Advanced

6,64,650

5,11,650

4,88,400

4,66,150

4,86,800

26,17,650

Recovered

5,13,206

5,03,606

4,41,164

6,10,029

5,63,513

26,31,518

The above table reveals the performance of the society during the

period of 2004-05to 2008-09. it shows the total amount of Gold loan

sanctioned Rs.26,17,650 and total amount of Gold loan recovered Rs.

26,31,518 by the society.

SAHYADRI ARTS & COMMERCE COLLEGE

65

ONE FOR ALL, ALL FOR ONE

Bar diagram showing the Gold loans advanced and recovered by the

society during the year 2004-05to 2008-09. (in lakhs)

7

6

5

4

Advanced

Recovered

3

2

1

0

SAHYADRI ARTS & COMMERCE COLLEGE

66

ONE FOR ALL, ALL FOR ONE

4.

PIGMY LOAN :

Table showing pigmy loans advanced and recovered by the

society during the year 2004-05to 2008-09.

Sl. No.

1

2

3

4

5

Years

2004-05

2005-06

2006-07

2007-08

2008-09

Total

Pigmy Loans

Pigmy loan Recovered

Advanced

3,69,425

3,49,450

5,06,800

3,38,700

4,43,450

20,07,825

3,72,018

3,31,070

3,96,012

4,47,421

4,06,379

19,52,900

The above table revels the performance of the society during the

period of 2004-05to 2008-09. it shows the total amount of Pigmy loan

sanctioned Rs.20,07,825 and total amount of Pigmy loan recovered

Rs.19,52,900 by the society.

SAHYADRI ARTS & COMMERCE COLLEGE

67

ONE FOR ALL, ALL FOR ONE

Bar diagram showing the Pigmy loans advanced and recovered by

the society during the year 2004-05to 2008-09. (In lakhs)

6

5

4

3

2

1

0

Advanced

Recovered

SAHYADRI ARTS & COMMERCE COLLEGE

68

ONE FOR ALL, ALL FOR ONE

5.

FIXED DEPOSIT LOAN :

Table showing Fixed Deposit Loans advanced and recovered by the

society during the year 2004-05to 2008-09.

Sl. No.

1

2

3

4

5

Years

2004-05

2005-06

2006-07

2007-08

2008-09

Total

Fixed Deposit Loans

Fixed Deposit loan

Advanced

5,73,150

8,40,175

7,32,900

12,10,000

16,39,650

49,95,875

Recovered

5,99,955

8,13,032

5,86,818

10,87,280

16,78,022

47,65,107

The above table reveals the pe4rformance of the society during the

period of 2004-05to 2008-09. it shows the total amount of Fixed Deposit

Loan sanctioned Rs.49,95,675 and total amount of Fixed Deposit Loan

recovered Rs.47,65,107 by the society.

SAHYADRI ARTS & COMMERCE COLLEGE

69

ONE FOR ALL, ALL FOR ONE

Bar diagram showing the Fixed Deposit loans advanced and

recovered by the society during the year 2004-05to 2008-09. (In

lakhs)

18

16

14

12

10

8

6

4

2

0

Advanced

SAHYADRI ARTS & COMMERCE COLLEGE

70

Recovered

ONE FOR ALL, ALL FOR ONE

6.

RECURRING DEPOSIT LOAN :

Table showing Recurring Deposit loans advanced and recovered by

the society during the year 2004-05to 2008-09

Sl. No.

1

2

3

4

5

Years

2004-05

2005-06

2006-07

2007-08

2008-09

Total

Recurring Deposit

Recurring Deposit

Loans Advanced

15,575

33,250

58,750

30,150

96,800

2,34,525

loan Recovered

12,255

25,000

62,900

30,265

89,513

2,19,733

The above table revels the performance of the society during the

period of 2004-05to 2008-09. it shows the total amount of Recurring

Deposit loan sanctioned Rs. 2,34,525 and total amount of Recurring

Deposit loan recovered Rs. 2,19,733 by the society.

SAHYADRI ARTS & COMMERCE COLLEGE

71

ONE FOR ALL, ALL FOR ONE

Graph showing the recurring deposit Loan advanced and recovered

by the society during the year 2004-05to 2008-09. (In lakhs)

100

90

80

70

60

Advanced

Recovered

50

40

30

20

10

0

SAHYADRI ARTS & COMMERCE COLLEGE

72

ONE FOR ALL, ALL FOR ONE

7)

N.S.C LOAN :

Table showing N.S.C loans advanced and recovered by the society

during the year 2004-05to 2008-09.

Sl. No.

Years

1

2004-05

2

2005-06

3

2006-07

4

2007-08

5

2008-09

Total

N.S.C Loans Advanced

2,79,500

1,42,450

92,860

84,425

1,34,000

733,235

N.S.C loan Recovered

1,34,300

97,642

1,45,292

1,43,719

1,58,426

6,79,379

The above table revels the performance of the society during the

period of 2004-05to 2008-09. it shows the total amount of N.S.C

loan sanctioned Rs.7,33,235 and total amount of N.S.C loan

recovered Rs.6,79,379 by the society.

SAHYADRI ARTS & COMMERCE COLLEGE

73

ONE FOR ALL, ALL FOR ONE

Bar diagram showing the N.S.C loans advanced and recovered

by the society during the year 2004-05to 2008-09. (In Lakhs)

300

250

200

150

100

50

0

Advanced

Recovered

SAHYADRI ARTS & COMMERCE COLLEGE

74

ONE FOR ALL, ALL FOR ONE

1.

K.V.P LOAN :

Table showing K.V.P loans advanced and recovered by the society

during the year 2004-05to 2008-09.

Sl. No.

1

2

3

4

5

Years

2004-05

2005-06

2006-07

2007-08

2008-09

Total

K.V.P Loans Advanced

K.V.P loan

91,500

93,250

1,11,750

36,200

1,29,800

4,62,500

Recovered

49,65

94,890

62,495

71,589

54,479

3,33,418

The above table revels the performance of the society

during the period of 2004-05to 2008-09. It shows the total amount

of K.V.P loan sanctioned Rs.4,62,500 and total amount of K.V.P

loan recovered Rs.3,33,418 by the society.

SAHYADRI ARTS & COMMERCE COLLEGE

75

ONE FOR ALL, ALL FOR ONE

Bar diagram showing the K.V.P loans advanced and

recovered by the society during the year 2004-05to 2008-09.

(in lakhs)

140

120

100

80

Advanced

Recovered

60

40

20

0

SAHYADRI ARTS & COMMERCE COLLEGE

76

ONE FOR ALL, ALL FOR ONE

Chapter-VII

ANALYSIS OF RESPONSE

INTRODUCTION

ANALYSIS OF RESPONSE

MAJOR SUMMARY OF FINDINGS

SAHYADRI ARTS & COMMERCE COLLEGE

77

ONE FOR ALL, ALL FOR ONE

INTRODUCTION

Survey means going into the depth o the responses and collecting

inner expression for the purpose of knowing attitude of the respondents

about which the survey is conducted.

The purpose of conducting the survey is the in-depth study of the

attitude of the members and problems faced by the them while dealing

with Sit. M. Vishweshvaraiah Co-operative Society Ltd., Shivamogga.

For the purpose of survey questionnaire was prepared and was

given to 50 members. The entire area covered by the survey is classified

into different parts and the members are given the format of

questionnaire and are requested to fill it and return to us.

The survey has been successfully carried out and the respondents