Escolar Documentos

Profissional Documentos

Cultura Documentos

ABC Practice QueActivity Based Costing Samples

Enviado por

pramodh kumarTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

ABC Practice QueActivity Based Costing Samples

Enviado por

pramodh kumarDireitos autorais:

Formatos disponíveis

The following data is for the mixing centre of Acacia Paints for the year Mixing Centre Costs

and Resource Drivers

Wages $ energy $ Depreciation $ Other $ Total Labour and overhead $

Cost 100,000 80,000 20,000 10,000 210,000

Resource Driver Head Count Kilowatt Hours Machine hours Head Count

Amount of Resources driver consumed by the Centre 5 people 10,000 KwH 5,000 machine hours 5 people

Required 1. Complete the following table to calculate the cost of the activity 'Load Mixer' for the current year. This activity is performed in the mixing centre Acacia Paints Ltd Activity: Load Mixer Amount of Resource Driver used to load mixer 5% of total labour time 500 KwH 100 machine hours 5% of total labour time

Cost Category Wages energy Depreciation Other Total Cost

Mixing Ctr Cost $ 100,000 $ 80,000 $ 20,000 $ 10,000 $ 210,000

Cost of Activity 'Load Mixer' $ 5,000 $ 4,000 $ 400 $ 500 $ 9,900

2. Why would Acacia Paints use an activity-based costing system that assigns labour as well as overhead costs to activities? 3. How would the management accountant obtain details of the activities performed and the quantity of resource drivers used by activities in the Mixing Centre?

Cost per activity measure $ $ 8 4

The following data is for the mixing centre of Acacia Paints for the year Mixing Centre Costs and Resource Drivers

Wages energy Depreciation Other Total Labour and overhead

$ $ $ $ $

Cost 100,000 80,000 20,000 10,000 210,000

Resource Driver Head Count Kilowatt Hours Machine hours Head Count

Amount of Resources driver consumed by the Centre 5 people 10,000 KwH 5,000 machine hours 5 people

Required 1. Complete the following table to calculate the cost of the activity 'Load Mixer' for the current year. This activity is performed in the mixing centre Acacia Paints Ltd Activity: Load Mixer Amount of Resource Driver used to load mixer 5% of total labour time 500 KwH 100 machine hours 5% of total labour time

Cost Category Wages energy Depreciation Other Total Cost

Mixing Ctr Cost $ 100,000 $ 80,000 $ 20,000 $ 10,000 $ 210,000

Cost of Activity 'Load Mixer' $ 5,000.00 $ 4,000 $ 400 $ 500.00 $ 9,900.00

2. Why would Acacia Paints use an activity-based costing system that assigns labour as well as overhead costs to activities? Labour is almost 50% of the cost in the mixing centre, so it is important to consider this cost and allocate it as accurately as possible.

3. How would the management accountant obtain details of the activities performed and the quantity of resource drivers used by activities in the Mixing Centre? Wages and other: obtain cost from timesheets, wages records and % of labour to perform the activity from supervisor or mixing centre manager Energy: obtain cost from electricity bills and amount of electricity to perform activity from engineer Depreciation: obtain cost and depreciation rate from fixed assets register/ financial reports and amount of machin from production records

s and amount of machine hours

Calculating cost per unit of activity driver Campbells make a variety of different Soups The following is a list of activities, costs and quantities of activity drivers for the Mixing Centre for the current year Campbells Mixing Centre Activities and Costs Activity Activity cost Activity Driver Weigh ingredients $ 8,000 No of batches Load mixing machine $ 11,000 No of batches Operate mixing machine $ 70,000 No of machine hours Unload mixing machine $ 8,000 No of batches Heat Soup $ 25,000 No of cans Move soup to canning $ 12,000 No of loads Total Cost $ 134,000 Qty of Activity Driver 500 batches 500 batches 3,200 machine hours 500 batches 500,000 cans 2,000 loads

Required 1. Calculate the cost per unit of activity driver for each activity in the Campbells Mixing Centre 2. Explain how these costs are used to calculate the cost of the different soups produced 3. Campbells makes a vegetable soup. The annual production details are as follows:Cost per Activity driver Mixing Centre Cost 80 batches $ 54 $ 4,320 1,000 machine hours $ 21.88 $ 21,875 150,000 cans $ 0.05 $ 7,500 400 loads $ 6 $ 2,400 $ 36,095 Use activity based costing to calculate the Mixing Centre costs for vegetable soup

Cost per Activity driver $ 16 per batch $ 22 per batch $ 21.88 per mach hour $ 16 per batch $ 0.05 per can $ 6 per load

Campbells Mixing Centre

Calculating cost per unit of activity driver Campbells make a variety of different soups The following is a list of activities, costs and quantities of activity drivers for the Mixing Centre for the current year Campbells Mixing Centre Activities and Costs Activity Weigh ingredients Load mixing machine Operate mixing machine Unload mixing machine Heat Soup Move soup to canning Total Cost Activity cost $ 8,000 $ 11,000 $ 70,000 $ 8,000 $ 25,000 $ 12,000 $ 134,000 Activity Driver No of batches No of batches No of machine hours No of batches No of cans No of loads Qty of Activity Driver 500 batches 500 batches 3,200 machine hours 500 batches 500,000 cans 2,000 loads

Required 1. Calculate the cost per unit of activity driver for each activity in the Campbells Mixing Centre Mixing Ctr Qty of Activity Activity Cost Activity Driver Driver Weigh ingredients $ 8,000 No of batches 500 Load mixing machine $ 11,000 No of batches 500 Operate mixing machine $ 70,000 No of machine hours 3,200 Unload mixing machine $ 8,000 No of batches 500 Heat Soup $ 25,000 No of biscuits 500,000 Move soup to canning $ 12,000 No of loads 2,000 Total Cost $ 134,000

2. Explain how these costs are used to calculate the cost of the different soups produced 3. Campbells makes a vegetable soup. The annual production details are as follows 80 batches 1,000 machine hours 150,000 biscuits 400 loads Use activity based costing to calculate the Mixing Centre costs for vegetable soup Vegetable soup Mixing Centre Costs Activity Driver No of batches

Activity Weigh ingredients

Qty of Activity Driver Cost per Activity 80 $ 16.00

Load mixing machine Operate mixing machine Unload mixing machine Heat Soup Move soup to canning Total Cost

No of batches No of machine hours No of batches No of biscuits No of loads

80 1000 80 150000 80

$ $ $ $ $

22.00 21.88 16.00 0.05 6.00

ctivity Driver

chine hours

ells Mixing Centre Cost per Activity $ 16.00 $ 22.00 $ 21.88 $ 16.00 $ 0.05 $ 6.00

per batch per batch per machine hour per batch per biscuit per load

ps produced

Cost $ 1,280.00

$ $ $ $ $ $

1,760.00 21,875.00 1,280.00 7,500.00 480.00 34,175.00

ABC vs volume based cost driver The Telescope company makes mirrors and lenses for large telescopes The company is preparing its annual budget The management accountant estimates the amount of overhead to allocate to each of the product lines based on the following:Lenses Units Produced 25 Mirrors 15 Total

Traditional Costing Predetermined overhead rate (pla Based on total ohead $$/Total bud

ABC Costing Based on activity rate and no of ac

Material handling (number of moves) per product line 5 15 20 Direct labour hours per unit 200 200 Total direct labour hours 5,000 3,000 8,000 The total budgeted material handling cost is $50,000 Material Handling ohd 31,250 18,750 Material handling cost per lens 1,250 1,250 Required 1. Calculate the material handling costs allocated to one lens under a costing system that allocates cost based on Direct labour hours 2. Calculate the material handling costs allocated to one mirror under a costing system that allocates cost based on Direct labour hours 3. Calculate the material handling costs allocated to one lens under activity based costing. The activity driver for material handling activity is the number of material moves 4. Calculate the material handling costs allocated to one mirror under activity based costing.

1.Calc total direct labour hours in 2. Calc predetermined oh rate 3. Use predetermined oh rate and and lenses to calculate oh allocate

Predetermined ohd rate for mater

Material Handling Cost 50,000

Traditional Costing Predetermined overhead rate (plant-wide) Based on total ohead $$/Total budgeted Direct labour hours

Based on activity rate and no of activity

1.Calc total direct labour hours in Factory for the year 2. Calc predetermined oh rate 3. Use predetermined oh rate and direct labour hours for mirrors and lenses to calculate oh allocated to each

Predetermined ohd rate for material handling =50,000/8000 $ 6.25 Material Handling Cost Activity cost driver Cost per activity driver no of moves 20 2,500 per move Lens 5 moves 12,500 Mirror 15 moves 37,500 per lens $ 500 per mirror $ 2,500

ABC vs volume based cost driver The Telescope company makes mirrors and lenses for large telescopes The company is preparing its annual budget The management accountant estimates the amount of overhead to allocate to each of the product lines based on the following:Lenses Units Produced Material handling (number of moves) per product line Direct labour hours per unit 25 Mirrors 15 Labour hrs/unit Traditional Costing Lenses 200

5 200

15 200

The total budgeted material handling cost is $50,000 Required 1. Calculate the material handling costs allocated to one lens under a costing system that allocates cost based on Direct labour hours 2. Calculate the material handling costs allocated to one mirror

Direct Lab hrs/year =200*25 5000 Material Handling =(5000/8000)*50000 31250

Material Handling Activity no of moves

under a costing system that allocates cost based on Direct labour hours 3. Calculate the material handling costs allocated to one lens under activity based costing. The activity driver for material handling activity is the number of material moves 4. Calculate the material handling costs allocated to one mirror under activity based costing.

Traditional Costing Mirrors 200

Total

=200*15 3000 =(5000/8000)*50000 18750

8000

ABC Lenses

Mirrors

5 15 =(5/20)*50000 =(15/20)*50000 12500 37500

Você também pode gostar

- Costing Tool 2014Documento149 páginasCosting Tool 2014Jason NoneyabizAinda não há avaliações

- Logistics Operation PlanningDocumento24 páginasLogistics Operation PlanningDani Leonidas S100% (1)

- HR Manual On 31jan2008Documento32 páginasHR Manual On 31jan2008miftahul ulumAinda não há avaliações

- Baskin Horror Decision TreeDocumento9 páginasBaskin Horror Decision Treespectrum_480% (2)

- Kunci Kuis EPSDocumento3 páginasKunci Kuis EPSYahyaSupriatnaAinda não há avaliações

- Materi AKMENDocumento102 páginasMateri AKMENSagita Rajagukguk100% (1)

- Entrepreneur ProjectDocumento276 páginasEntrepreneur ProjectUsmanAinda não há avaliações

- WHO - HMN HIS Tools To Support GFR10 - Template For Costing The HIS GapDocumento202 páginasWHO - HMN HIS Tools To Support GFR10 - Template For Costing The HIS GapHarumAinda não há avaliações

- Name of Company: Salary List For The Month of January - 2011Documento1 páginaName of Company: Salary List For The Month of January - 2011Revati C. DeshpandeAinda não há avaliações

- Cogs & Cogm: Finance For Non-Financials SeriesDocumento8 páginasCogs & Cogm: Finance For Non-Financials SeriesAhmed HassanAinda não há avaliações

- Quality Control OCT. 2017.Documento473 páginasQuality Control OCT. 2017.mohamed hamedAinda não há avaliações

- Chapter 5 Activity Based CostingDocumento48 páginasChapter 5 Activity Based CostingAtif SaeedAinda não há avaliações

- Latihan Soal Cash FlowDocumento2 páginasLatihan Soal Cash FlowRuth AngeliaAinda não há avaliações

- PLTM GeneralDocumento132 páginasPLTM GeneralBronoz GrypenAinda não há avaliações

- Analisa CostingDocumento32 páginasAnalisa CostingpicalnitaAinda não há avaliações

- Activity Based Costing ExampleDocumento3 páginasActivity Based Costing ExampleImperoCo LLCAinda não há avaliações

- Economic and Financial TermsDocumento10 páginasEconomic and Financial Termsvica3_100% (4)

- Financial Model EE ProjectDocumento24 páginasFinancial Model EE ProjectRetno PamungkasAinda não há avaliações

- Costing Calculations:: Date: 12/5/2016 Revision: R0 Costing 336Documento9 páginasCosting Calculations:: Date: 12/5/2016 Revision: R0 Costing 336Rakesh SharmaAinda não há avaliações

- Nebula SalaryDocumento20 páginasNebula Salarydeby aprilAinda não há avaliações

- Job Order Costing ExampleDocumento3 páginasJob Order Costing ExampleImperoCo LLCAinda não há avaliações

- Prime Cost of Daywork Rates 2014-15Documento1 páginaPrime Cost of Daywork Rates 2014-15Peter Jean-jacquesAinda não há avaliações

- EBITDA Margin Financial Data Revenue Ebitda Company Name: Average MedianDocumento2 páginasEBITDA Margin Financial Data Revenue Ebitda Company Name: Average MedianGolamMostafaAinda não há avaliações

- Format Laporan Keuangan JODocumento3 páginasFormat Laporan Keuangan JOAnastasia WidyaAinda não há avaliações

- FebmrpDocumento2.107 páginasFebmrpVijay VadgaonkarAinda não há avaliações

- Analisis Fundamental WikaDocumento5 páginasAnalisis Fundamental WikaAnonymous XoUqrqyuAinda não há avaliações

- EFM Classic Business Free TrialDocumento290 páginasEFM Classic Business Free TrialadildastiAinda não há avaliações

- DDocumento9 páginasDkinaAinda não há avaliações

- Opc - Least Unit CostDocumento12 páginasOpc - Least Unit CostRishabh JainAinda não há avaliações

- Buss Plan KPRDocumento521 páginasBuss Plan KPRApriadi YusufAinda não há avaliações

- 6400 Lecture SpreadsheetsDocumento351 páginas6400 Lecture SpreadsheetsPhuong HoAinda não há avaliações

- Accounting KpisDocumento6 páginasAccounting KpisHOCINIAinda não há avaliações

- 6.7 Control Schedule: Monitoring and ControllingDocumento6 páginas6.7 Control Schedule: Monitoring and ControllingAh GusAinda não há avaliações

- Budget 2021Documento5 páginasBudget 2021Jobeth DaculaAinda não há avaliações

- Kelompok 3-Anggaran Tenaga KerjaDocumento25 páginasKelompok 3-Anggaran Tenaga KerjaUSWATUNAinda não há avaliações

- Sample Travel Site Dashboard: $5,350 Let's Celebrate !!! 120 $31,200 Sales 40% Up From Previous Month 17%Documento3 páginasSample Travel Site Dashboard: $5,350 Let's Celebrate !!! 120 $31,200 Sales 40% Up From Previous Month 17%Eleazar BrionesAinda não há avaliações

- Tips Tricks EPCDocumento37 páginasTips Tricks EPCpthakur234Ainda não há avaliações

- Bulog 2017 PDFDocumento103 páginasBulog 2017 PDFAnju Theresia LubisAinda não há avaliações

- Advance Accounting I - New (Ibu Rumida)Documento83 páginasAdvance Accounting I - New (Ibu Rumida)Shinta RisandiAinda não há avaliações

- Hilton CH 14 Select SolutionsDocumento277 páginasHilton CH 14 Select SolutionsHabib EjazAinda não há avaliações

- Absorption & Direct CostingDocumento22 páginasAbsorption & Direct CostingMuhammad azeemAinda não há avaliações

- Spare PartsDocumento846 páginasSpare PartsDjar NdoethAinda não há avaliações

- Cash FlowDocumento71 páginasCash Flowpuput utomoAinda não há avaliações

- 2022 Materi PSC Taxation FEBUPDocumento39 páginas2022 Materi PSC Taxation FEBUPvalen martaAinda não há avaliações

- Coal Business-1Documento14 páginasCoal Business-1gdamodharreddyAinda não há avaliações

- Process FMECA Worksheet - PS MUPDocumento5 páginasProcess FMECA Worksheet - PS MUPSyed AliAinda não há avaliações

- PR-Akuntansi Manufaktur - RevisiDocumento4 páginasPR-Akuntansi Manufaktur - Revisisafira annisaAinda não há avaliações

- Earned Value ChartDocumento4 páginasEarned Value ChartRanda S JowaAinda não há avaliações

- Katalog KPIDocumento125 páginasKatalog KPIAlmasita AginshaAinda não há avaliações

- EPC-2018.10.29-Amendment in Standard RFP - AE BILLINGDocumento2 páginasEPC-2018.10.29-Amendment in Standard RFP - AE BILLINGPremAinda não há avaliações

- Financial Slide For ReportDocumento6 páginasFinancial Slide For ReportTuan Noridham Tuan LahAinda não há avaliações

- Exsum TPK (April)Documento280 páginasExsum TPK (April)lubangjarumAinda não há avaliações

- Standard Operating Procedure For Importing Used Automotive PartsDocumento14 páginasStandard Operating Procedure For Importing Used Automotive Partsxinn_goh0% (1)

- Hi-Tech ISTDocumento360 páginasHi-Tech ISTDharineeshAinda não há avaliações

- 09.05.13 Power Failure ReportDocumento17 páginas09.05.13 Power Failure Reportsuleman247Ainda não há avaliações

- 9.maveric PM Dashboard Template V 0.4Documento16 páginas9.maveric PM Dashboard Template V 0.4srik1011Ainda não há avaliações

- Cost ReportDocumento48 páginasCost ReportdptAinda não há avaliações

- Forex Currency Correlation Majors DATE OF DATA:2005-2020: Trader Name:Abdullahi Omar GutaleDocumento154 páginasForex Currency Correlation Majors DATE OF DATA:2005-2020: Trader Name:Abdullahi Omar GutaleAbdullahi omarrAinda não há avaliações

- AutoCount Bill of MaterialDocumento12 páginasAutoCount Bill of MaterialkhalidsnAinda não há avaliações

- Performance Drinks Case 2 QureshiDocumento9 páginasPerformance Drinks Case 2 QureshiRabia Qureshi100% (2)

- Management AccountingDocumento1 páginaManagement Accountingpramodh kumarAinda não há avaliações

- Week 2 - Practice QuestionsDocumento4 páginasWeek 2 - Practice Questionspramodh kumarAinda não há avaliações

- Finacial Statement and Investment Analysis Tutorial SolutionsDocumento4 páginasFinacial Statement and Investment Analysis Tutorial Solutionspramodh kumarAinda não há avaliações

- Tutorial Questions 140312Documento26 páginasTutorial Questions 140312pramodh kumarAinda não há avaliações

- Week 2 Sem 1 2014 Tutorial QuestionsDocumento2 páginasWeek 2 Sem 1 2014 Tutorial Questionspramodh kumarAinda não há avaliações

- What Is Reported As PropertyDocumento10 páginasWhat Is Reported As Propertypramodh kumarAinda não há avaliações

- Foreigh Direct InvestmentDocumento1 páginaForeigh Direct Investmentpramodh kumarAinda não há avaliações

- ERG TheoryDocumento2 páginasERG Theorypramodh kumarAinda não há avaliações

- Reflections: Termites, Group Behaviour, and The Loss of Innovation: Conformity Rules!Documento16 páginasReflections: Termites, Group Behaviour, and The Loss of Innovation: Conformity Rules!pramodh kumarAinda não há avaliações

- Effects of Organisational CitizenshipDocumento13 páginasEffects of Organisational Citizenshippramodh kumarAinda não há avaliações

- Equity TheoryDocumento3 páginasEquity Theorypramodh kumarAinda não há avaliações

- Corporate Social ResponsibilityDocumento8 páginasCorporate Social Responsibilitypramodh kumarAinda não há avaliações

- Absolute Poverty Basic Human Needs Water: HealthDocumento2 páginasAbsolute Poverty Basic Human Needs Water: Healthpramodh kumarAinda não há avaliações

- Models For Finance and AccountingDocumento56 páginasModels For Finance and Accountingpramodh kumarAinda não há avaliações

- Mother Teresa - A Biography PDFDocumento174 páginasMother Teresa - A Biography PDFkunjesh vermaAinda não há avaliações

- Foundations of Group BehaviourDocumento33 páginasFoundations of Group Behaviourpramodh kumarAinda não há avaliações

- Income Statement of BussinessDocumento3 páginasIncome Statement of Bussinesspramodh kumarAinda não há avaliações

- Personality Traits EmployeesDocumento3 páginasPersonality Traits Employeespramodh kumarAinda não há avaliações

- Interpersonal Dynamics 1156600Documento3 páginasInterpersonal Dynamics 1156600pramodh kumarAinda não há avaliações

- Week 6. Chapter 7 Introduction To Inferential StatisticsDocumento24 páginasWeek 6. Chapter 7 Introduction To Inferential Statisticspramodh kumarAinda não há avaliações

- Acc For Busi AssignmentDocumento12 páginasAcc For Busi Assignmentpramodh kumarAinda não há avaliações

- Network ProjectDocumento18 páginasNetwork Projectpramodh kumar0% (2)

- Quantative MethodsDocumento26 páginasQuantative Methodspramodh kumar100% (1)

- Organisation BehaviourDocumento80 páginasOrganisation Behaviourpramodh kumarAinda não há avaliações

- CCNA Study GuideDocumento14 páginasCCNA Study GuideWaqasMahmoodAinda não há avaliações

- CCNA2 M5 Managing Cisco IOS SoftwareDocumento17 páginasCCNA2 M5 Managing Cisco IOS SoftwarePankajSharma100% (1)

- Parking Management: Strategies, Evaluation and PlanningDocumento31 páginasParking Management: Strategies, Evaluation and PlanningTeros01Ainda não há avaliações

- P501D808 (Idt8n)Documento56 páginasP501D808 (Idt8n)ariasroberthAinda não há avaliações

- Piston Head Analysis - AnsysDocumento5 páginasPiston Head Analysis - Ansyssamar kadamAinda não há avaliações

- Why Firefighters Die - 2011 September - City Limits MagazineDocumento33 páginasWhy Firefighters Die - 2011 September - City Limits MagazineCity Limits (New York)100% (1)

- Form 1 AWS D1.1Documento2 páginasForm 1 AWS D1.1Bui Chi TamAinda não há avaliações

- Cloud Point of Diesel Fuel: Application NoteDocumento2 páginasCloud Point of Diesel Fuel: Application Noteanilkumar995472Ainda não há avaliações

- Cooling by Underground Earth TubesDocumento4 páginasCooling by Underground Earth TubesNaava BasiaAinda não há avaliações

- LNGC BW Everett - IMO 9243148 - Cargo Operating ManualDocumento223 páginasLNGC BW Everett - IMO 9243148 - Cargo Operating Manualseawolf50Ainda não há avaliações

- SAPPHIRE® PLUS 70-BarDocumento2 páginasSAPPHIRE® PLUS 70-BarAyhan ÖZKALAinda não há avaliações

- Unit 8 Guided NotesDocumento12 páginasUnit 8 Guided NotesflyingmsAinda não há avaliações

- Test 8 ch8 Phy 9thDocumento1 páginaTest 8 ch8 Phy 9thMurtazaAinda não há avaliações

- Touareg Supplementary HeatingDocumento32 páginasTouareg Supplementary HeatingAnonymous t1FCvPRSaAinda não há avaliações

- 4-LET - General Education - SCIENCE 82-109Documento28 páginas4-LET - General Education - SCIENCE 82-109Rogen Hemodo67% (6)

- Flowmeter Measurement ApparatusDocumento29 páginasFlowmeter Measurement ApparatusSyafiq Izzuddin100% (2)

- Assignment#1Documento5 páginasAssignment#1Hennesey LouriceAinda não há avaliações

- 988B Diagrama ElectricoDocumento4 páginas988B Diagrama ElectricoMaquinaria Pesada ServisAinda não há avaliações

- Alkylation PDFDocumento7 páginasAlkylation PDFVasthadu Vasu Khanan DLAinda não há avaliações

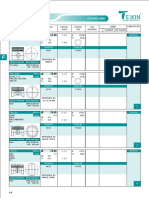

- Teikin Catalog Vol 18-Automotive FiatDocumento6 páginasTeikin Catalog Vol 18-Automotive FiatJuan Esteban Ordoñez BonillaAinda não há avaliações

- Iadc Dull Grading: Cutting StructureDocumento2 páginasIadc Dull Grading: Cutting StructuredayanaAinda não há avaliações

- Quadri PDFDocumento44 páginasQuadri PDFYanuar WidyarsaAinda não há avaliações

- Definition of Terms - Plumbing2Documento15 páginasDefinition of Terms - Plumbing2Gels GenovaAinda não há avaliações

- Pe Final Ex SS 2010-2011Documento8 páginasPe Final Ex SS 2010-2011Saif Uddin100% (1)

- NBC Gear Info.Documento8 páginasNBC Gear Info.GLOCK35Ainda não há avaliações

- Esr PDFDocumento2 páginasEsr PDFBhabeshSarangiAinda não há avaliações

- Detection of Power Grid Synchronization Failure On Sensing Frequency and Voltage Beyond Acceptable RangeDocumento6 páginasDetection of Power Grid Synchronization Failure On Sensing Frequency and Voltage Beyond Acceptable RangeHari PrasadAinda não há avaliações

- TLP 2355Documento16 páginasTLP 2355teomondoAinda não há avaliações

- Aquarea Split Systems Installation Handbook 2013 (A2W-SPX-130305-012)Documento80 páginasAquarea Split Systems Installation Handbook 2013 (A2W-SPX-130305-012)Anonymous ec2P0F5iKXAinda não há avaliações

- 2-Wire Ac or DC Inductive SensorsDocumento10 páginas2-Wire Ac or DC Inductive SensorsCsaba VargaAinda não há avaliações

- Heat Pump 1-1Documento9 páginasHeat Pump 1-1sdio06Ainda não há avaliações

- Iec 61330-2005Documento10 páginasIec 61330-2005pradyumnaukAinda não há avaliações