Escolar Documentos

Profissional Documentos

Cultura Documentos

Financial Accounting 1 - Cash and Cash Equivalents Part 2

Enviado por

Ryan Jay BanaoDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Financial Accounting 1 - Cash and Cash Equivalents Part 2

Enviado por

Ryan Jay BanaoDireitos autorais:

Formatos disponíveis

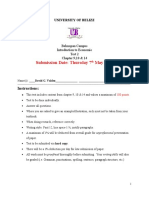

Practice Set: Financial Accounting - Cash and Cash Equivalents Part 2 Problem #1: LLP Co.

s accounting staff prepared the bank reconciliation for their Metrobank account number xxx2050 for the year ended December 31, 2013. Below is a copy of the bank reconciliation prepared by the staff: Books P = 600,000 (1,500) 5,000 8,000 27,500 P = 674,000 Banks P = 900,000 99,000 (325,000) P = 674,000

Unadjusted balance Reconciling items Bank charges Deposit in transit Outstanding checks Interest income from bank deposits Errors: Cash sales Receivable collection Adjusted balance How much is the cash to be presented in the Trial Balance? Prepare entries to reflect the adjustments in the LLP Co.s books. <<<<<<<<<< - >>>>>>>>>>

Problem #2: The chief accountant of xXx, Inc. is reviewing the bank reconciliation prepared by the accounting staff when he noted the following: a. A check amounting to P = 60,000 was prepared. However, this was not yet recorded in the Companys books though was released as of year-end. The check is dated week before year end and is outstanding as of year-end. b. A collection amounting to P = 88,000 was in the form of post-dated check. No entry was made upon collection. c. An error was committed by the accounting staff in recording bank charges. Instead of a debit to expense, cash was debited and the partner credit is interest income. Bank charges amounted to P = 1,300. d. Cash collection amounting to P = 69,696 was recorded as P = 96,969. e. The bank erroneously credited the Companys account for P = 700,000. This was supposed to be for another bank customer. f. The Company was advised by the Bank that a loan amounting to P = 700,000 was granted and credited to the Companys account. The accounting staff recorded this before year -end. g. The cash and cash equivalent amounted to P = 650,000. What is the unadjusted book balance? What is the unadjusted bank balance? Prepare entry to record the adjustments <<<<<<<<<< - >>>>>>>>>> Problem #3: The composition of cash and cash equivalents of Balot Co. is as follows: Coins and currencies P = 6,000 IOUs 19,000 Money markets; issued December 1, 2013; 120 days; purchased December 10, 2013 200,000 Cash in bank 500,000 Treasury shares 20,000 Cash in sinking fund 90,000 Demand deposit 20,000 What is the adjusted cash and cash equivalents of Balot Co. if its year end is December 31, 2013? What is the adjusted cash and cash equivalents of Balot Co. if its year end is March 31, 2014?

1|Page

It does not matter how slowly you go as long as you do not stop. - Confucius

Você também pode gostar

- CashDocumento7 páginasCashhellohello100% (1)

- Intaudp - Mem02Documento2 páginasIntaudp - Mem02Cal PedreroAinda não há avaliações

- Preparing a bank reconciliation and journal entries (20鈥�25 min) P7 ...Documento5 páginasPreparing a bank reconciliation and journal entries (20鈥�25 min) P7 ...ehab_ghazallaAinda não há avaliações

- Ap CceDocumento209 páginasAp CceTrisha RafalloAinda não há avaliações

- Quiz 2 - Audit Cash - 5ae63b1cb41c4b23e6070f657ddaDocumento8 páginasQuiz 2 - Audit Cash - 5ae63b1cb41c4b23e6070f657ddaAlexAinda não há avaliações

- AUD02 - 05 Audit of Cash and Cash EquivalentsDocumento3 páginasAUD02 - 05 Audit of Cash and Cash EquivalentsMark BajacanAinda não há avaliações

- Bank ReconcilationDocumento9 páginasBank ReconcilationJohnpaul FloranzaAinda não há avaliações

- Module in LawDocumento4 páginasModule in LawBSIT 1A Yancy CaliganAinda não há avaliações

- Financial Accounting Case StudiesDocumento2 páginasFinancial Accounting Case StudiesRodlyn LajonAinda não há avaliações

- Semi Final Exam (Accounting)Documento4 páginasSemi Final Exam (Accounting)MyyMyy JerezAinda não há avaliações

- Bank Reconciliation (IA)Documento7 páginasBank Reconciliation (IA)rufamaegarcia07Ainda não há avaliações

- Exam Questionaire in IntermediateDocumento5 páginasExam Questionaire in IntermediateJester IlaganAinda não há avaliações

- Auditing and Assurance Principles Pre-Test ReviewDocumento9 páginasAuditing and Assurance Principles Pre-Test ReviewKryzzel Anne JonAinda não há avaliações

- Bank ReconcilaitionDocumento2 páginasBank ReconcilaitionLUCELLE ESCANOAinda não há avaliações

- IFA Chapter 3Documento97 páginasIFA Chapter 3kqk07829Ainda não há avaliações

- Audit of Cash and Cash Equivalent Problem 1 (Adapted)Documento6 páginasAudit of Cash and Cash Equivalent Problem 1 (Adapted)Robelyn Asuna LegaraAinda não há avaliações

- ACCOUNTING PROCESSDocumento20 páginasACCOUNTING PROCESSAkemi83% (6)

- 4 5805514475188521062Documento3 páginas4 5805514475188521062eferem100% (5)

- Homework QuestionsDocumento17 páginasHomework QuestionsAAinda não há avaliações

- Composition of Cash and Cash EquivalentDocumento20 páginasComposition of Cash and Cash EquivalentYenelyn Apistar CambarijanAinda não há avaliações

- 07 - Petty Cash Fund and Bank ReconciliationDocumento2 páginas07 - Petty Cash Fund and Bank ReconciliationCy Miolata100% (2)

- Chapter 5Documento5 páginasChapter 5Abrha636Ainda não há avaliações

- AP - Audit of CashDocumento4 páginasAP - Audit of CashRose CastilloAinda não há avaliações

- Long Quiz 1 Acc 205Documento6 páginasLong Quiz 1 Acc 205Philip LarozaAinda não há avaliações

- A) B) C) D) E) A) B) C) D) E) A) B) C) D) E) A) B) C) D) E)Documento3 páginasA) B) C) D) E) A) B) C) D) E) A) B) C) D) E) A) B) C) D) E)Mharvie LorayaAinda não há avaliações

- Midterm Examination Suggested AnswersDocumento9 páginasMidterm Examination Suggested AnswersJoshua CaraldeAinda não há avaliações

- Business Cup Level 1 Quiz BeeDocumento28 páginasBusiness Cup Level 1 Quiz BeeRowellPaneloSalapareAinda não há avaliações

- Business Cup Level 1 Quiz BeeDocumento28 páginasBusiness Cup Level 1 Quiz BeeRowellPaneloSalapareAinda não há avaliações

- Intermidate AssignmentDocumento6 páginasIntermidate AssignmentTahir DestaAinda não há avaliações

- Self-Test 1Documento8 páginasSelf-Test 1Dymphna Ann CalumpianoAinda não há avaliações

- Unit 2. Audit of Cash and Cash Transactions Handout Final t31516Documento8 páginasUnit 2. Audit of Cash and Cash Transactions Handout Final t31516mimi96100% (1)

- Reconciling bank and book cash balancesDocumento4 páginasReconciling bank and book cash balancesRon MagnoAinda não há avaliações

- Accounting Cash Internal ControlsDocumento14 páginasAccounting Cash Internal ControlsDave A ValcarcelAinda não há avaliações

- Audit of Cash and Cash EquivalentsDocumento9 páginasAudit of Cash and Cash Equivalentspatricia100% (1)

- ExtAud 3 Midterm Exam W AnswersDocumento12 páginasExtAud 3 Midterm Exam W AnswersJANET ILLESESAinda não há avaliações

- Week 2 Leap FabmDocumento7 páginasWeek 2 Leap FabmDanna Marie EscalaAinda não há avaliações

- Cash and Cash Equivalents - MidtermDocumento9 páginasCash and Cash Equivalents - MidtermDan RyanAinda não há avaliações

- CH 07Documento8 páginasCH 07Antonios FahedAinda não há avaliações

- Cash and ReceivablesDocumento30 páginasCash and ReceivablesAira Mae Hernandez CabaAinda não há avaliações

- Assignment On Chapter 5 Cash Ad ReceivablesDocumento3 páginasAssignment On Chapter 5 Cash Ad Receivablesdameregasa08Ainda não há avaliações

- Audit Cash and EquivalentsDocumento19 páginasAudit Cash and EquivalentsAiden PatsAinda não há avaliações

- ICARE Preweek APDocumento15 páginasICARE Preweek APjohn paulAinda não há avaliações

- Cash - CRDocumento14 páginasCash - CRpingu patwhoAinda não há avaliações

- P1-01 Cash and Cash EquivalentsDocumento5 páginasP1-01 Cash and Cash EquivalentsRachel LeachonAinda não há avaliações

- Cash and Cash Equivalents Sample ProblemsDocumento7 páginasCash and Cash Equivalents Sample ProblemsCamille Donaire LimAinda não há avaliações

- Midterm Exam KeyDocumento5 páginasMidterm Exam KeyRiña Lizte AlteradoAinda não há avaliações

- Bank ReconciliationDocumento64 páginasBank ReconciliationmarkjohnmagcalengAinda não há avaliações

- ABM FABM2 Q2 Wk3 LAS3Documento11 páginasABM FABM2 Q2 Wk3 LAS3ayaAinda não há avaliações

- Cash and Cash Equivalents Basic ProblemsDocumento6 páginasCash and Cash Equivalents Basic ProblemshellokittysaranghaeAinda não há avaliações

- Accounting For Cash and ReceivableDocumento7 páginasAccounting For Cash and ReceivableAbrha GidayAinda não há avaliações

- Audit of Cash and Cash Equivalents 1Documento9 páginasAudit of Cash and Cash Equivalents 1nena cabañesAinda não há avaliações

- Ap9208 Cash 1Documento4 páginasAp9208 Cash 1Onids AbayaAinda não há avaliações

- Audit 2 (T) - Topic1B (Kerjakan Sendiri)Documento17 páginasAudit 2 (T) - Topic1B (Kerjakan Sendiri)kartika.mhrn2104Ainda não há avaliações

- Instruction. Encircle The Letter That Corresponds To Your Answer. Do Not Use Pencils. Avoid ErasuresDocumento6 páginasInstruction. Encircle The Letter That Corresponds To Your Answer. Do Not Use Pencils. Avoid ErasuresstillwinmsAinda não há avaliações

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionAinda não há avaliações

- Summary of Richard A. Lambert's Financial Literacy for ManagersNo EverandSummary of Richard A. Lambert's Financial Literacy for ManagersAinda não há avaliações

- Bookkeeping for Nonprofits: A Step-by-Step Guide to Nonprofit AccountingNo EverandBookkeeping for Nonprofits: A Step-by-Step Guide to Nonprofit AccountingNota: 4 de 5 estrelas4/5 (2)

- 21St Century Computer Solutions: A Manual Accounting SimulationNo Everand21St Century Computer Solutions: A Manual Accounting SimulationAinda não há avaliações

- Hall 5e TB Ch07Documento19 páginasHall 5e TB Ch07Zerjo CantalejoAinda não há avaliações

- Chapter 6 - Expenditure Cycle Part 2Documento17 páginasChapter 6 - Expenditure Cycle Part 2Ryan Jay BanaoAinda não há avaliações

- Hall 5e TB Ch01Documento14 páginasHall 5e TB Ch01J.C. S. Maala100% (2)

- Answer Key - RefresherDocumento6 páginasAnswer Key - RefresherRyan Jay BanaoAinda não há avaliações

- Chapter 5 - Expenditure Cycle Part 1Documento8 páginasChapter 5 - Expenditure Cycle Part 1Ryan Jay Banao100% (3)

- (Agamata Relevant Costing) Chap 9 - Short-Term Decision PDFDocumento66 páginas(Agamata Relevant Costing) Chap 9 - Short-Term Decision PDFMatthew Tiu80% (20)

- Hall 5e TB Ch04Documento14 páginasHall 5e TB Ch04ralphalonzo71% (14)

- Hall 5e TB Ch03Documento17 páginasHall 5e TB Ch03psbacloud94% (18)

- 1 STPPTDocumento41 páginas1 STPPTMaurine RamosAinda não há avaliações

- (Agamata Relevant Costing) Chap 9 - Short-Term Decision PDFDocumento66 páginas(Agamata Relevant Costing) Chap 9 - Short-Term Decision PDFMatthew Tiu80% (20)

- Management AccountingDocumento1 páginaManagement AccountingRyan Jay BanaoAinda não há avaliações

- (Agamata Relevant Costing) Chap 9 - Short-Term Decision PDFDocumento66 páginas(Agamata Relevant Costing) Chap 9 - Short-Term Decision PDFMatthew Tiu80% (20)

- Financial Accounting 1 - Cash and Cash Equivalents Part 1Documento2 páginasFinancial Accounting 1 - Cash and Cash Equivalents Part 1Ryan Jay Banao100% (1)

- New CPA Exam SyllabiDocumento32 páginasNew CPA Exam Syllabisweet_tweet101783100% (2)

- P&GDocumento2 páginasP&GRyan Jay BanaoAinda não há avaliações

- Cancer: Nio C. Noveno, RN, Man, MSNDocumento34 páginasCancer: Nio C. Noveno, RN, Man, MSNRyan Jay BanaoAinda não há avaliações

- Ap 2020exam Sample Questions MicroeconomicsDocumento4 páginasAp 2020exam Sample Questions MicroeconomicsKayAinda não há avaliações

- David Kreps-Gramsci and Foucault - A Reassessment-Ashgate (2015)Documento210 páginasDavid Kreps-Gramsci and Foucault - A Reassessment-Ashgate (2015)Roc SolàAinda não há avaliações

- COOTER, R. - The Falcon's GyreDocumento106 páginasCOOTER, R. - The Falcon's GyreArthur SpinaAinda não há avaliações

- Managerial AssDocumento19 páginasManagerial AssbojaAinda não há avaliações

- Foreign ExchangeDocumento35 páginasForeign ExchangeHafiz Ahmed33% (3)

- Accounting Information System As The Source of Corporate Competitive AdvantageDocumento201 páginasAccounting Information System As The Source of Corporate Competitive AdvantageIlham Filardhi AnugrawanAinda não há avaliações

- Micro Ch17 LecnotesDocumento6 páginasMicro Ch17 LecnotesThiện ThảoAinda não há avaliações

- Pervan 2020 Efficiency of Large Firms OperatingDocumento9 páginasPervan 2020 Efficiency of Large Firms OperatingStiven Riveros GalindoAinda não há avaliações

- Class Test-I Intermediate Microeconomics-II Time: 1 Hour Maximum Marks: 25Documento2 páginasClass Test-I Intermediate Microeconomics-II Time: 1 Hour Maximum Marks: 25amrat meenaAinda não há avaliações

- Business Plan Report of Nari SringarDocumento31 páginasBusiness Plan Report of Nari SringarAakriti SapkotaAinda não há avaliações

- Globalization & The Multinational Firm: International Financial ManagementDocumento19 páginasGlobalization & The Multinational Firm: International Financial ManagementSahil PasrijaAinda não há avaliações

- MMPC 014Documento6 páginasMMPC 014Pawan ShokeenAinda não há avaliações

- Final Project LUSH Group 2Documento32 páginasFinal Project LUSH Group 2Pat Neenan60% (5)

- Upsc Syllabus (New) Prelims Syllabus:: Paper 1 (General Studies) Paper 2 (Civil Services Aptitude Test)Documento9 páginasUpsc Syllabus (New) Prelims Syllabus:: Paper 1 (General Studies) Paper 2 (Civil Services Aptitude Test)Anonymous Cduq54QlwvAinda não há avaliações

- Minutes of Product Inovation Meeting: Politeknik Negeri Semarang 2019Documento2 páginasMinutes of Product Inovation Meeting: Politeknik Negeri Semarang 2019PutAinda não há avaliações

- Inflation Chapter SummaryDocumento14 páginasInflation Chapter SummaryMuhammed Ali ÜlkerAinda não há avaliações

- Microeconomics Assignment 2Documento4 páginasMicroeconomics Assignment 2api-213064294100% (1)

- Folk Exam Janitorial Costs Shipping ExpensesDocumento3 páginasFolk Exam Janitorial Costs Shipping ExpensesabeeralkhawaldehAinda não há avaliações

- OSKDocumento7 páginasOSKRibka Susilowati SilabanAinda não há avaliações

- IIT Madras MBA Programme Curriculum (July 2018Documento93 páginasIIT Madras MBA Programme Curriculum (July 2018karanAinda não há avaliações

- Cost Volume Profit Analysis GuideDocumento34 páginasCost Volume Profit Analysis GuideBhup EshAinda não há avaliações

- Time Series Analysis ForecastingDocumento18 páginasTime Series Analysis ForecastingUttam BiswasAinda não há avaliações

- Introduction To Economic Test CHPT 9,10 &14.docx NEWDocumento8 páginasIntroduction To Economic Test CHPT 9,10 &14.docx NEWAmir ContrerasAinda não há avaliações

- Ba 206 LPC 03Documento13 páginasBa 206 LPC 03rachna357Ainda não há avaliações

- 2021 PHC General Report Vol 3E - Economic ActivityDocumento180 páginas2021 PHC General Report Vol 3E - Economic ActivityMartin AnsongAinda não há avaliações

- The Framework of Contemporary BusinessDocumento19 páginasThe Framework of Contemporary BusinessLivingstone CaesarAinda não há avaliações

- Chapter 4 CB Problems - FDocumento11 páginasChapter 4 CB Problems - FAkshat SinghAinda não há avaliações

- Decision Making and Relevant Information - ch11Documento49 páginasDecision Making and Relevant Information - ch11Umair UddinAinda não há avaliações

- Handout 2Documento2 páginasHandout 2altynkelimberdiyevaAinda não há avaliações

- Instruments of Moneytary PolicyDocumento3 páginasInstruments of Moneytary PolicyJaydeep Paul100% (1)