Escolar Documentos

Profissional Documentos

Cultura Documentos

Define Partnership Liquidation and Identify Its Causes

Enviado por

Ron MagnoDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Define Partnership Liquidation and Identify Its Causes

Enviado por

Ron MagnoDireitos autorais:

Formatos disponíveis

CHAPTER 6- liquidation

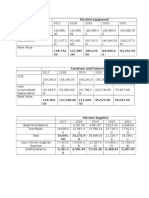

1. Define partnership liquidation and identify its causes. Partnership liquidation is the winding up of the business affairs of a partnership; hence the business operation is completely terminated or ended. Partnership liquidation may be caused by any of the following: (1) accomplishment of the purpose of the partnership (2) termination of the term/ period covered by the partnership contract (3) bankruptcy of the partnership (4) mutual agreement among the partners to close the business. 2. Discuss the various problems encountered in partnership liquidation. The liquidation of a partnership will give rise to the ff. problems (1) determining the partnership profit or loss from the beginning of the accounting period to the date of the liquidation and distributing such profit or loss to the partners (2) closing the partnership books (3) correcting accounting errors in prior periods (4) liquidating the business.

3. Identify and differentiate the two types of partnership liquidation. The two types of partnership liquidation are lump- sum liquidation (liquidation by totals) and instalment liquidation (piece-meal liquidation). Under lump- sum liquidation, distribution of cash to the partners is done only after the realization and payment of partnership liabilities. Under instalment liquidation, asset realization is on a piece-meal basis and cash is distributed to partners as it becomes available even if there are still unrealized non- cash assets. 4. Discuss and understand the accounting procedures under lump sum liquidation, Lump sum liquidation requires the following procedures: (1) realization of non-cash assets (sale of non-cash assets for cash) (2) distribution of gain or loss on realization to the partners according to their liquidation ratio, if there is any, or according to their residual profit and loss ratio; (3)payment of liabilities to outside creditors (4) distribution of cash to partners

Glossary of Accounting Terminologies

Capital deficiency- the excess of a partners share of losses over his capital credit balance Deficient partner- a partner with a debit balance in his capital account after receiving his share on the loss on realization Insolvent partner- a partner whose personal assets are less than his personal liabilities Free interest- a partners capital interest that is available for cash payment. Liquidation- the winding up of the business affairs of a partnership Realization- the process of converting non cash assets into cash Restricted Interest- a portion a partners capital account balance that is restricted for possible losses on liquidation. It is not, therefore, available for cash payment. Right of offset- the legal right to apply all or part of partners loan to the partnership against capital deficiency Solvent Partner- a partner whose personal assets are more than his personal liabilities

Você também pode gostar

- Chapter 6 Lumpsum LiquidationDocumento24 páginasChapter 6 Lumpsum LiquidationJenny BernardinoAinda não há avaliações

- ADVANCED ACCOUNTING Chapter 6Documento90 páginasADVANCED ACCOUNTING Chapter 6Stork EscobidoAinda não há avaliações

- Partnership LiquidationDocumento3 páginasPartnership LiquidationMarco de Padua100% (1)

- Partnership LiquidationDocumento5 páginasPartnership LiquidationChristian PaulAinda não há avaliações

- Chapter 2 - Partnership Liquidation-PROFE01Documento4 páginasChapter 2 - Partnership Liquidation-PROFE01Steffany RoqueAinda não há avaliações

- Partnership OperationDocumento3 páginasPartnership OperationShane NayahAinda não há avaliações

- Lesson 2 Formation of PartnershipDocumento27 páginasLesson 2 Formation of PartnershipheyheyAinda não há avaliações

- Chapter 16 Test Bank Dissolution and Liquidation of A PartnershipDocumento23 páginasChapter 16 Test Bank Dissolution and Liquidation of A Partnershipjosh lunarAinda não há avaliações

- Partnership Dissolution Withdrawal Retirement Death and IncapacityDocumento25 páginasPartnership Dissolution Withdrawal Retirement Death and IncapacityGale KnowsAinda não há avaliações

- Qualifying Exam (Basic & ParCor)Documento7 páginasQualifying Exam (Basic & ParCor)Rommel CruzAinda não há avaliações

- Elite AISDocumento70 páginasElite AISDiana Rose OrlinaAinda não há avaliações

- 1 Lecture Notes DissolutionDocumento17 páginas1 Lecture Notes DissolutionMaybelle Espenido0% (2)

- Cfas ReviewerDocumento7 páginasCfas ReviewerDarlene Angela IcasiamAinda não há avaliações

- PFRS of SME and SE - Concept MapDocumento1 páginaPFRS of SME and SE - Concept MapRey OñateAinda não há avaliações

- Paid and Not Currently Matched With EarningsDocumento46 páginasPaid and Not Currently Matched With EarningsBruce SolanoAinda não há avaliações

- Partnership Dissolution TheoriesDocumento4 páginasPartnership Dissolution TheoriesShiela Mae BautistaAinda não há avaliações

- 7 Cost Formulas and LCNRVDocumento6 páginas7 Cost Formulas and LCNRVJorufel PapasinAinda não há avaliações

- Problem 6 1Documento2 páginasProblem 6 1SerdenRoseAinda não há avaliações

- True or FalseDocumento7 páginasTrue or FalseColline ZoletaAinda não há avaliações

- Ea - Module 1 Partnership FormationDocumento7 páginasEa - Module 1 Partnership FormationJoana Trinidad100% (1)

- Tom-Sawyer - Company CompleteDocumento45 páginasTom-Sawyer - Company CompleteCresenciano MalabuyocAinda não há avaliações

- Partnership DissolutionDocumento3 páginasPartnership DissolutionRoselyn Balik100% (1)

- PAS 10 Events After The Reporting PeriodDocumento2 páginasPAS 10 Events After The Reporting Periodpanda 1Ainda não há avaliações

- C. Mortgage Markets and Derivatives 1. Describe What Are Mortgages and Mortgage Market?Documento3 páginasC. Mortgage Markets and Derivatives 1. Describe What Are Mortgages and Mortgage Market?Aldrin GerenteAinda não há avaliações

- AlagangWency - Partnersip Dissolution Short QuizDocumento1 páginaAlagangWency - Partnersip Dissolution Short QuizKristian Paolo De LunaAinda não há avaliações

- Partnership OperationDocumento21 páginasPartnership OperationDonise Ronadel SantosAinda não há avaliações

- True or False. Partnership FormationDocumento1 páginaTrue or False. Partnership Formation촏교새벼Ainda não há avaliações

- Exercise 1: Required: Classify The Reports in Part A-E Into One of The Three Major Purposes of Accounting Systems OnDocumento2 páginasExercise 1: Required: Classify The Reports in Part A-E Into One of The Three Major Purposes of Accounting Systems OnMyunimintAinda não há avaliações

- Lumpsum LiquidationDocumento28 páginasLumpsum LiquidationCAMILLE100% (1)

- Financial Ac Counting An D Reporting: Prof. Justiniano L. Santo S, Cpa, MbaDocumento41 páginasFinancial Ac Counting An D Reporting: Prof. Justiniano L. Santo S, Cpa, MbaEthan Manuel Del ValleAinda não há avaliações

- Partnership Liquidation Exam AnswersDocumento7 páginasPartnership Liquidation Exam AnswersAlexandriteAinda não há avaliações

- Partnership OperationDocumento71 páginasPartnership Operationglenn langcuyanAinda não há avaliações

- Chap 1 Part 4 - Installment Liquidation ProblemsDocumento3 páginasChap 1 Part 4 - Installment Liquidation ProblemsLarpii Moname100% (1)

- MODULE 2 - Partnership AccountingDocumento14 páginasMODULE 2 - Partnership AccountingEdison Salgado CastigadorAinda não há avaliações

- PreweekSol (Advacc)Documento91 páginasPreweekSol (Advacc)Rommel Cruz100% (2)

- Basic Concepts of PartnershipDocumento7 páginasBasic Concepts of PartnershipKhim CortezAinda não há avaliações

- Partnership Liquidation (Installment Method)Documento24 páginasPartnership Liquidation (Installment Method)Jesseca TuboAinda não há avaliações

- Chapter 5 PartnershipDocumento3 páginasChapter 5 PartnershipRose Ayson0% (1)

- CHAPTER 16 - DIVIDENDS - Problem 3 - Computations - Page 597-599Documento9 páginasCHAPTER 16 - DIVIDENDS - Problem 3 - Computations - Page 597-599Penelope PalconAinda não há avaliações

- AFAR - Partnership OperationsDocumento3 páginasAFAR - Partnership OperationsCleofe Mae Piñero AseñasAinda não há avaliações

- 01 Long QuizDocumento6 páginas01 Long Quizgiana riveraAinda não há avaliações

- Liquidation 2Documento3 páginasLiquidation 2Kenneth CuencaAinda não há avaliações

- Illustration: Formation of Partnership Valuation of Capital A BDocumento2 páginasIllustration: Formation of Partnership Valuation of Capital A BArian AmuraoAinda não há avaliações

- Chapter 11 Partnership FormationDocumento10 páginasChapter 11 Partnership FormationJo Faula BelleAinda não há avaliações

- ACCOUNTING FOR CORPORATIONS-Basic ConsiderationsDocumento41 páginasACCOUNTING FOR CORPORATIONS-Basic ConsiderationsMarriel Fate Cullano100% (2)

- Chapter 2&3 Par - CorDocumento31 páginasChapter 2&3 Par - CorJUARE MaxineAinda não há avaliações

- Partnership Accounting Liquidation - InstallmentDocumento4 páginasPartnership Accounting Liquidation - InstallmentMerielyn MetilloAinda não há avaliações

- PartnershipDocumento3 páginasPartnershipMark Edgar De Guzman0% (1)

- Incorrect: Discussion 7Documento3 páginasIncorrect: Discussion 7Jasmine ActaAinda não há avaliações

- 33Documento2 páginas33yes yesnoAinda não há avaliações

- Partnership OperationsDocumento12 páginasPartnership OperationsAmber JasmineAinda não há avaliações

- PAS 27 Separate Financial StatementsDocumento16 páginasPAS 27 Separate Financial Statementsrena chavez100% (1)

- Corporation Accounting TheoriesDocumento20 páginasCorporation Accounting TheoriesClient Carl AcostaAinda não há avaliações

- Partnership Q1Documento3 páginasPartnership Q1Lorraine Mae RobridoAinda não há avaliações

- Chapter 21 Ia2Documento15 páginasChapter 21 Ia2JM Valonda Villena, CPA, MBAAinda não há avaliações

- FAR 2 REVIEWER Other SourceDocumento120 páginasFAR 2 REVIEWER Other SourceAirish GeronimoAinda não há avaliações

- Acctba2 Lecture - Lump Sum LiquidationDocumento10 páginasAcctba2 Lecture - Lump Sum Liquidationmia_catapangAinda não há avaliações

- Partnership Liquidation: Accounting For Special TransactionsDocumento20 páginasPartnership Liquidation: Accounting For Special TransactionsjaneAinda não há avaliações

- Lesson 5 Accounting For Partnership Liquidation - Lump SumDocumento13 páginasLesson 5 Accounting For Partnership Liquidation - Lump SumKenneth NinalgaAinda não há avaliações

- Part V: Accounting For Partnership LiquidationDocumento6 páginasPart V: Accounting For Partnership LiquidationFirezer AgegnehuAinda não há avaliações

- Chapter 4 ProfileDocumento9 páginasChapter 4 ProfileRon Magno100% (1)

- 100000000000000000000000000002e FsberfDocumento1 página100000000000000000000000000002e FsberfRon MagnoAinda não há avaliações

- Depreciation SchedulesDocumento2 páginasDepreciation SchedulesRon MagnoAinda não há avaliações

- National Capital Region Seat of Government Region Culture Economy Education GovernmentDocumento2 páginasNational Capital Region Seat of Government Region Culture Economy Education GovernmentRon MagnoAinda não há avaliações

- 100000000000000000000000000002e Fsberf Yibujnle FSVRFSG DrnyDocumento1 página100000000000000000000000000002e Fsberf Yibujnle FSVRFSG DrnyRon MagnoAinda não há avaliações

- Portfolio in Math 9: Passed By: Micaella May Magno Passed To: Tchr. Grace EspinosaDocumento9 páginasPortfolio in Math 9: Passed By: Micaella May Magno Passed To: Tchr. Grace EspinosaRon MagnoAinda não há avaliações

- 5.2 Financial StudyDocumento5 páginas5.2 Financial StudyRon MagnoAinda não há avaliações

- CtviyhbkjDocumento4 páginasCtviyhbkjRon MagnoAinda não há avaliações

- Reaction Paper: Gr-9 Job Micaella May MagnoDocumento1 páginaReaction Paper: Gr-9 Job Micaella May MagnoRon MagnoAinda não há avaliações

- IpaDocumento2 páginasIpaRon MagnoAinda não há avaliações

- VHKBJDocumento1 páginaVHKBJRon MagnoAinda não há avaliações

- VBJKNLDocumento1 páginaVBJKNLRon MagnoAinda não há avaliações

- EuthanasiaDocumento3 páginasEuthanasiaRon MagnoAinda não há avaliações

- Save Our Planet Earth: ReduceDocumento1 páginaSave Our Planet Earth: ReduceRon MagnoAinda não há avaliações

- Ch05 SDLCDocumento19 páginasCh05 SDLCab_alsol100% (3)

- TB 18Documento24 páginasTB 18Marc Raphael Ong100% (1)

- TBCH01Documento6 páginasTBCH01Arnyl ReyesAinda não há avaliações

- GHUCOQDocumento1 páginaGHUCOQRon MagnoAinda não há avaliações

- 2008 Annual Review Business ProfileDocumento2 páginas2008 Annual Review Business ProfileArnab DebAinda não há avaliações

- Hbo Web FormDocumento1 páginaHbo Web FormRon MagnoAinda não há avaliações

- Upcat Reviewer Practice Test 1Documento12 páginasUpcat Reviewer Practice Test 1Gneth Cabral33% (3)

- Cpa Review School of The Philippines ManilaDocumento2 páginasCpa Review School of The Philippines ManilaAljur Salameda50% (2)

- Certificate Programme: Unit 2: Legal Requirements in Setting Up Ngos: India &south Asia 1Documento48 páginasCertificate Programme: Unit 2: Legal Requirements in Setting Up Ngos: India &south Asia 1Deepak Gupta100% (1)

- UK (Lloyds Bank - Print Friendly Statement1)Documento2 páginasUK (Lloyds Bank - Print Friendly Statement1)shahid2opuAinda não há avaliações

- Blankcontract of LeaseDocumento4 páginasBlankcontract of LeaseJennyAuroAinda não há avaliações

- Article On Female Foeticide-Need To Change The MindsetDocumento4 páginasArticle On Female Foeticide-Need To Change The MindsetigdrAinda não há avaliações

- CA CHP555 Manual 2 2003 ch1-13Documento236 páginasCA CHP555 Manual 2 2003 ch1-13Lucas OjedaAinda não há avaliações

- Nyandarua BursaryAPPLICATION FORMDocumento5 páginasNyandarua BursaryAPPLICATION FORMK Kamau100% (1)

- Tri-City Times: New Manager Ready To Embrace ChallengesDocumento20 páginasTri-City Times: New Manager Ready To Embrace ChallengesWoodsAinda não há avaliações

- Crusades-Worksheet 2014Documento2 páginasCrusades-Worksheet 2014api-263356428Ainda não há avaliações

- SAP Project System - A Ready Reference (Part 1) - SAP BlogsDocumento17 páginasSAP Project System - A Ready Reference (Part 1) - SAP BlogsSUNIL palAinda não há avaliações

- Family Budget': PSP 3301 Household Financial Management Assignment 4Documento2 páginasFamily Budget': PSP 3301 Household Financial Management Assignment 4DenzNishhKaizerAinda não há avaliações

- 09-01-13 Samaan V Zernik (SC087400) "Non Party" Bank of America Moldawsky Extortionist Notice of Non Opposition SDocumento14 páginas09-01-13 Samaan V Zernik (SC087400) "Non Party" Bank of America Moldawsky Extortionist Notice of Non Opposition SHuman Rights Alert - NGO (RA)Ainda não há avaliações

- Cibse Lighting LevelsDocumento3 páginasCibse Lighting LevelsmdeenkAinda não há avaliações

- Cameron, Et Al v. Apple - Proposed SettlementDocumento37 páginasCameron, Et Al v. Apple - Proposed SettlementMikey CampbellAinda não há avaliações

- 5.opulencia vs. CADocumento13 páginas5.opulencia vs. CARozaiineAinda não há avaliações

- PAGCOR - Application Form For Gaming SiteDocumento4 páginasPAGCOR - Application Form For Gaming SiteJovy JorgioAinda não há avaliações

- Tecno Spark Power 2 Misty Grey, 64 GB: Grand Total 9999.00Documento2 páginasTecno Spark Power 2 Misty Grey, 64 GB: Grand Total 9999.00Lucky KumarAinda não há avaliações

- Attendance 2022 2023Documento16 páginasAttendance 2022 2023Geralyn Corpuz MarianoAinda não há avaliações

- 5paisa Capital Limited: Account Opening FormDocumento11 páginas5paisa Capital Limited: Account Opening FormSuman KumarAinda não há avaliações

- Performance Bank Guarantee FormatDocumento1 páginaPerformance Bank Guarantee FormatSRIHARI REDDIAinda não há avaliações

- 2018.05.14 Letter To ATT On Their Payments To Trump Attorney Michael CohenDocumento4 páginas2018.05.14 Letter To ATT On Their Payments To Trump Attorney Michael CohenArnessa GarrettAinda não há avaliações

- Blue Ocean StrategyDocumento247 páginasBlue Ocean StrategyFadiAinda não há avaliações

- MOFCOM SCHOLARSHIP(2019 Enrollment Guide) - Scholarships - 留学中国Documento9 páginasMOFCOM SCHOLARSHIP(2019 Enrollment Guide) - Scholarships - 留学中国qweku jayAinda não há avaliações

- Dumo Vs RepublicDocumento12 páginasDumo Vs RepublicGladys BantilanAinda não há avaliações

- Aubrey Jaffer: Scheme Implementation Version 5f1Documento149 páginasAubrey Jaffer: Scheme Implementation Version 5f1kevinmcguireAinda não há avaliações

- Kashmir Problem and SolutionssDocumento7 páginasKashmir Problem and SolutionssmubeenAinda não há avaliações

- Position Paper in Purposive CommunicationDocumento2 páginasPosition Paper in Purposive CommunicationKhynjoan AlfilerAinda não há avaliações

- BeerVM11e PPT Ch11Documento92 páginasBeerVM11e PPT Ch11brayanAinda não há avaliações

- Cdi 4 Organized Crime 2020 Covid ADocumento66 páginasCdi 4 Organized Crime 2020 Covid AVj Lentejas IIIAinda não há avaliações

- Philippine Laws On WomenDocumento56 páginasPhilippine Laws On WomenElle BanigoosAinda não há avaliações