Escolar Documentos

Profissional Documentos

Cultura Documentos

10 Facts Every American Should Know About Pelosi Health Care Bill

Enviado por

apackof20 notas0% acharam este documento útil (0 voto)

164 visualizações2 páginas10 Facts Every American Should Know About Speaker Pelosi’s 1,990-Page Gov’t Takeover of Health Care

Direitos autorais

© Attribution Non-Commercial (BY-NC)

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documento10 Facts Every American Should Know About Speaker Pelosi’s 1,990-Page Gov’t Takeover of Health Care

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

164 visualizações2 páginas10 Facts Every American Should Know About Pelosi Health Care Bill

Enviado por

apackof210 Facts Every American Should Know About Speaker Pelosi’s 1,990-Page Gov’t Takeover of Health Care

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 2

10 Facts Every American Should Know About Speaker

Pelosi’s 1,990-Page Gov’t Takeover of Health Care

Members of Congress and the American people are just beginning to look at Speaker

Nancy Pelosi’s (D-CA) 1,990-page government takeover of health care, but it’s already

becoming clear just how costly and unsustainable this proposal is. From higher taxes on

middle-class families to job-killing mandates on small businesses to cuts in Medicare

benefits for seniors, here are 10 facts every American should know about Speaker

Pelosi’s 1,990-page government takeover of health care:

1. RAISES TAXES ON MIDDLE CLASS FAMILIES. Speaker Pelosi’s health care

bill imposes a range of tax increases on families with income below $250,000, breaking a

promise made by President Obama. Tax increases on middle class families include: an

individual mandate tax of up to 2.5 percent of income for taxpayers earning as little as

$9,350; repeal of a tax break on medicine purchased with funds from an HSA (health

savings account); limits to tax relief through FSAs (flexible spending accounts); taxes on

medical devices that will inevitably be passed on to consumers; and a new tax on all

insurance policies.

2. MASSIVE CUTS TO MEDICARE BENEFITS FOR SENIORS. Despite grave

warnings from CBO, FactCheck.org, and the independent Lewin Group that cuts to

Medicare of the magnitude included in Speaker Pelosi’s bill would have a negative

impact on seniors’ benefits and choices, Speaker Pelosi’s health care bill stays the course

and cuts Medicare by hundreds of billions of dollars.

3. NO PROTECTIONS FOR SMALL BUSINESSES. Speaker Pelosi’s health care bill

claims to exempt small businesses from the steep eight percent ‘pay or play’ employer

mandate. The facts tell a different story. Using Census data compiled by the Small

Business Administration, this so-called ‘exemption’ hammers small employers with only,

on average, 17 or more employees to new taxes and mandates. The outfits affected

employ 70 percent of all small business employees, or 42.3 million workers. Adding to

the assault on small businesses, the bill does not index the small business “exemption”

amounts, meaning more and more small businesses will be ensnared by this job-killing

employer mandate each year.

4. INCREASES THE COST OF HEALTH INSURANCE. Imposing a new $2 billion

tax on insurance policies will be passed on to patients in the form of higher premiums.

Changes to the Medicare Part D prescription drug benefit will, according to estimates by

CBO, will raise Medicare Part B premiums by $25 billion and Part D premiums by 20

percent. And imposing an unfunded mandate on the states to pay for the bill’s Medicaid

expansion will shift the burden of this expansion on state taxpayers who may experience

tax increases to cover the cost.

5. USES GIMMICKS TO HIDE BUDGET-BUSTING COST, PILES UP DEBT ON

FUTURE GENERATIONS. Speaker Pelosi’s health care bill claims to be deficit

neutral, but uses budget gimmickry to hide its massive total cost. Working families across

America know they cannot simply decide that a bill they get in the mail doesn’t exist, but

that’s exactly what congressional Democrats are doing. In order to meet the President’s

‘target’ spending total of $900 billion, Democrats have simply swept costly provisions

under the rug, including the $245 billion ‘doc fix.’

6. IMPOSES JOB-KILLING EMPLOYER MANDATES. Additional taxes on

employers and new government mandates that dictate acceptable insurance will place

new and crushing burdens on employers. These are burdens that will ultimately fall

squarely on the backs of workers in the form of reduced wages, fewer hours or lost

employment. CBO agrees that "[e]mployees largely bear the cost of... play-or-pay fees in

the form of lower wages." According to the National Federation of Independent Business

(NFIB), the nation’s largest small business association, an employer mandate of this

magnitude will disproportionately impact small businesses, triggering up to 1.6 million

lost jobs. Two-thirds of those jobs would be shed by small businesses.

7. TILTS THE PLAYING FIELD IN FAVOR OF THE GOVERNMENT-RUN

INSURANCE COMPANY. Speaker Pelosi’s health care bill promises not to give the

government-run plan advantages over private insurers in the market, but the opposite is

true. The bill provides billions in start-up funding for the government-run plan, and while

it requires the plan to repay the money over time it does not require the plan to pay

interest on this “loan.” This interest-free, taxpayer-subsidized loan is potentially worth

millions of dollars and tilts the playing field in favor of the government-run plan.

8. THREATENS CASH-STRAPPED STATES WITH UNFUNDED MANDATES.

Speaker Pelosi’s health care bill swells the number of Americans on the government rolls

by expanding Medicaid eligibility. Medicaid is financed through a federal-state

partnership, but the bill dumps nearly ten percent of the mandated expansion included in

the bill onto the states. States, already struggling with fiscal constraints, would be left on

the hook for billions of dollars due to this unfunded mandate.

9. CREATES A NEW MONSTROSITY IN THE TAX CODE. Starting in 2011,

Speaker Pelosi’s health care bill imposes a 5.4 percent tax on adjusted gross income

above $500,000 for individuals and $1 million for married couples. Yet, the dollar

amounts for which the tax kicks in are not indexed for inflation. We’ve seen this horror

film before: the Alternative Minimum Tax, another Frankenstein’s monster of the tax

code, also wasn’t indexed for inflation and now affects millions of middle class families

with incomes below the Democrat’s surtax.

10. MISSES AN OPPORTUNITY TO CURTAIL JUNK LAWSUITS. Speaker

Pelosi’s health care bill misses a critical opportunity to rein in junk lawsuits and costly

defensive medicine. The bill includes only a voluntary grant program to deal with the

medical liability crisis instead of including real reform, which would produce tens of

billions of dollars in savings, improve efficiency in our health care system and reduce

costs for patients and providers.

http://republicanleader.house.gov/News/DocumentSingle.aspx?DocumentID=152063

Você também pode gostar

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Effective Leadership Skills in The 21ST CenturyDocumento67 páginasEffective Leadership Skills in The 21ST CenturySam ONi100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Yellow King - Black Star MagicDocumento186 páginasYellow King - Black Star Magicwijeesf797100% (1)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Bilderberg GroupDocumento35 páginasThe Bilderberg GroupTimothy100% (2)

- Ebook Service Desk vs. Help Desk. What Is The Difference 1Documento18 páginasEbook Service Desk vs. Help Desk. What Is The Difference 1victor molinaAinda não há avaliações

- Foucault Truth and Power InterviewDocumento7 páginasFoucault Truth and Power IntervieweastbayseiAinda não há avaliações

- Forex Risk ManagementDocumento114 páginasForex Risk ManagementManish Mandola100% (1)

- Bajaj - Project Report - Nitesh Kumar Intern-Bajaj Finserv Mumbai - Niilm-Cms Greater NoidaDocumento61 páginasBajaj - Project Report - Nitesh Kumar Intern-Bajaj Finserv Mumbai - Niilm-Cms Greater NoidaNitesh Kumar75% (20)

- The Works of Samuel Johnson, Volume 04 The Adventurer The Idler by Johnson, Samuel, 1709-1784Documento297 páginasThe Works of Samuel Johnson, Volume 04 The Adventurer The Idler by Johnson, Samuel, 1709-1784Gutenberg.orgAinda não há avaliações

- Brochure Trifold - Responsible Citizens For Public Safety (RC4PS)Documento2 páginasBrochure Trifold - Responsible Citizens For Public Safety (RC4PS)apackof2Ainda não há avaliações

- 13 Years Us Dog Bite Fatalities 2005 2017 DogsbiteDocumento9 páginas13 Years Us Dog Bite Fatalities 2005 2017 Dogsbiteapackof2Ainda não há avaliações

- Pit Bull Warning Flyer - Responsible Citizens For Public Safety (RC4PS)Documento1 páginaPit Bull Warning Flyer - Responsible Citizens For Public Safety (RC4PS)apackof2Ainda não há avaliações

- Michigan 2018-2019 Transportation Fund Revenues and DistributionsDocumento1 páginaMichigan 2018-2019 Transportation Fund Revenues and Distributionsapackof2100% (1)

- Michigan 2018-2019 Transportation Fund Revenues and DistributionsDocumento1 páginaMichigan 2018-2019 Transportation Fund Revenues and Distributionsapackof2100% (1)

- Fiscal Brief Allocation of Federal Aid To LRA Feb19-1Documento5 páginasFiscal Brief Allocation of Federal Aid To LRA Feb19-1apackof2Ainda não há avaliações

- Michigan 2018-2019 Transportation Fund Revenues and DistributionsDocumento1 páginaMichigan 2018-2019 Transportation Fund Revenues and Distributionsapackof2100% (1)

- My Grandfather Naturalization ApplicationDocumento1 páginaMy Grandfather Naturalization Applicationapackof2Ainda não há avaliações

- Credentials ChallengeDocumento5 páginasCredentials Challengeapackof2Ainda não há avaliações

- Gov. Snyder EXECUTIVE ORDER No. 2014-12Documento3 páginasGov. Snyder EXECUTIVE ORDER No. 2014-12apackof20% (1)

- Bill "Sanders" NowlingDocumento1 páginaBill "Sanders" Nowlingapackof2Ainda não há avaliações

- Calley VotesDocumento3 páginasCalley Votesapackof2Ainda não há avaliações

- A Summary of House Joint Resolution Uu, Senate Bill 847, and House Bills 4593, 5492, and 5493Documento4 páginasA Summary of House Joint Resolution Uu, Senate Bill 847, and House Bills 4593, 5492, and 5493apackof2Ainda não há avaliações

- Michigan Proposal 1 of 2015Documento1 páginaMichigan Proposal 1 of 2015Beverly TranAinda não há avaliações

- Ballot Language To Amend Constitution To Increase The Sales TaxDocumento1 páginaBallot Language To Amend Constitution To Increase The Sales Taxapackof2Ainda não há avaliações

- Michigan Same Sex Marriage JudgementDocumento31 páginasMichigan Same Sex Marriage JudgementpkampeAinda não há avaliações

- House Joint Resolution UU - Transportation Funding PackageDocumento4 páginasHouse Joint Resolution UU - Transportation Funding Packageapackof2Ainda não há avaliações

- Public Input On State Supt SearchDocumento1 páginaPublic Input On State Supt Searchapackof2Ainda não há avaliações

- 2013-2014 State CommitteeDocumento3 páginas2013-2014 State Committeeapackof2Ainda não há avaliações

- PROP 1 InformationDocumento5 páginasPROP 1 Informationapackof2Ainda não há avaliações

- John Hayhoe ExposedDocumento17 páginasJohn Hayhoe Exposedapackof2Ainda não há avaliações

- MIGOP 5th Congressional District Resolution Against Medicaid Expansion Part 8Documento1 páginaMIGOP 5th Congressional District Resolution Against Medicaid Expansion Part 8apackof2Ainda não há avaliações

- Sandra Kahn Questionnaire and QualificationsDocumento4 páginasSandra Kahn Questionnaire and Qualificationsapackof2Ainda não há avaliações

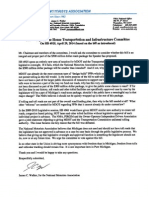

- Testimony by The National Motorist Association On HB 4925Documento1 páginaTestimony by The National Motorist Association On HB 4925apackof2Ainda não há avaliações

- Bobbi Schostack Endorments MIGOP ChairDocumento20 páginasBobbi Schostack Endorments MIGOP Chairapackof2Ainda não há avaliações

- Ronna Romney McDaniels Questionnaire and QualificationsDocumento4 páginasRonna Romney McDaniels Questionnaire and Qualificationsapackof2Ainda não há avaliações

- Mary Sears Questionnaire and QualificationsDocumento5 páginasMary Sears Questionnaire and Qualificationsapackof2Ainda não há avaliações

- MIGOP Saint Clair County Part Resolution Against Medicaid Expansion Part 8Documento1 páginaMIGOP Saint Clair County Part Resolution Against Medicaid Expansion Part 8apackof2Ainda não há avaliações

- Senate Passed Medicaid Expansion Sub For HB 4714Documento40 páginasSenate Passed Medicaid Expansion Sub For HB 4714apackof2Ainda não há avaliações

- The 14th Congressional District Republican Committee Resolution Opposing The Expansion of Medicaid and The Implementation of Health Care ExchangesDocumento1 páginaThe 14th Congressional District Republican Committee Resolution Opposing The Expansion of Medicaid and The Implementation of Health Care Exchangesapackof2Ainda não há avaliações

- Sharmaji by Anjana AppachanaDocumento2 páginasSharmaji by Anjana Appachanasj3Ainda não há avaliações

- 1Documento3 páginas1Ashok KumarAinda não há avaliações

- Aldovino vs. COMELECDocumento71 páginasAldovino vs. COMELECisaaabelrfAinda não há avaliações

- ___Documento2 páginas___kikuomahdi123Ainda não há avaliações

- Law 113 (Legal Techniques and Logic) : Atty. Annabelle B. Cañazares-Mindalano, RCH, RcheDocumento2 páginasLaw 113 (Legal Techniques and Logic) : Atty. Annabelle B. Cañazares-Mindalano, RCH, RcheJhoAinda não há avaliações

- The Crown - Episode 7Documento7 páginasThe Crown - Episode 7Grom GrimonAinda não há avaliações

- Web Design Wordpress - Hosting Services ListDocumento1 páginaWeb Design Wordpress - Hosting Services ListMotivatioNetAinda não há avaliações

- Accomplishment Report MTBDocumento9 páginasAccomplishment Report MTBRay Marcial Jamolin MacabutasAinda não há avaliações

- Rules For SopeDocumento21 páginasRules For Sopearif zamanAinda não há avaliações

- Ensuring Ethical Supply ChainsDocumento19 páginasEnsuring Ethical Supply ChainsAbhishekAinda não há avaliações

- Day1 S2 Gravity IntroDocumento21 páginasDay1 S2 Gravity IntroPedro Hortua SeguraAinda não há avaliações

- Bibliography of the Butterworth TrialDocumento3 páginasBibliography of the Butterworth TrialmercurymomAinda não há avaliações

- InterContinental Global Etiquette Compendium FO backTVDocumento12 páginasInterContinental Global Etiquette Compendium FO backTVGian SyailendraAinda não há avaliações

- Pho 2000 HistoryDocumento4 páginasPho 2000 Historybao phanAinda não há avaliações

- Muqam e Rabulalamin Aur Fitna Qadianiat by UbaidullahDocumento26 páginasMuqam e Rabulalamin Aur Fitna Qadianiat by UbaidullahIslamic Reserch Center (IRC)Ainda não há avaliações

- Literature ReviewDocumento6 páginasLiterature Reviewapi-549249112Ainda não há avaliações

- Astm d4921Documento2 páginasAstm d4921CeciliagorraAinda não há avaliações

- Classical Philosophies Guide Business Ethics DecisionsDocumento48 páginasClassical Philosophies Guide Business Ethics DecisionsDanielyn GestopaAinda não há avaliações

- Taste of IndiaDocumento8 páginasTaste of IndiaDiki RasaptaAinda não há avaliações

- International Portfolio TheoryDocumento27 páginasInternational Portfolio TheoryDaleesha SanyaAinda não há avaliações

- HCB 0207 Insurance Ad Risk ManagementDocumento2 páginasHCB 0207 Insurance Ad Risk Managementcollostero6Ainda não há avaliações

- Contemporary Management Education: Piet NaudéDocumento147 páginasContemporary Management Education: Piet Naudérolorot958Ainda não há avaliações