Escolar Documentos

Profissional Documentos

Cultura Documentos

SAP Payroll Canada: Payroll Infotypes

Enviado por

hellosri2001Descrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

SAP Payroll Canada: Payroll Infotypes

Enviado por

hellosri2001Direitos autorais:

Formatos disponíveis

CanadianPayrollInfotypes

InCanadianPayroll,wehaveThreePrimeinfotypes,whichgovernthePayrolltaxcalculationforthe FederalandProvincialtax.ThosethereareInfotype461,462and463. Letscheckabouttheseinterestinginfotypes. 461TaxAssignmentCA

Province of Employment: This defines the provincial or territorial rules and rates used for income tax withholding purposes. Employment Jurisdiction : Here you enter the province having jurisdiction to pass labour-related laws governing this employee. If no entry is made, the system recognizes the province of employment as the province of employment . Province of residence : The place of residence of the EE. Province of Health Tax: The Province on which health tax is calculated.

http://saphrxperts.wordpress.com/

462ProvincialTaxCA

Total credits: Employee's total for all personal tax credit amounts. Total non-indexed: This amount is the total personal tax credit amount that is not subject to an annual cost of living adjustment. Other deductions : other annual deductions ( line 22 of form TP-1015.3). Additional tax : The additional tax as requested by the Employee. Estimated net commissions : Income from Estimated net commission income for the year. Letters of waiver Deductions : Any other deductions authorized by Revenue QC, such as deductions granted to employees working outside of Canada. Letters of waiver Credits: any other non-refundable tax credits for the year as approved by Revenue QC . E.g charitable donations.

http://saphrxperts.wordpress.com/

463FederalTaxCA

TotalCredits:employee's total for all personal tax credit amounts Totalnonindexed:This amount is the total personal tax credit amount that is not subject to an annual cost of

living adjustment. Additional tax : The additional tax as requested by the Employee. Designated Area :Employee's annual deduction for living in a designated area (Yukon Territory or Northwest Territories, for example), as indicated on form TD1.

http://saphrxperts.wordpress.com/

Estimated remuneration: Estimated total remuneration for the year, as reported by the employee on line 4 of form TD1X. Estimated expenses : Estimated total expenses deduction for the year as reported by the employee on line 10 of form TD1X. Labour-sponsored funds : The amount of approved shares of the capital stock of a prescribed laboursponsored venture capital corporation acquired by an employee in the year. Letters of waiver Deductions : This field contains Annual Authorized federal deduction. Such as child care expenses, alimony, maintenance payments, etc. authorized by a Tax Services Office or Tax Centre for the employee. Letters of waiver Credits: Other federal tax credits, such as medical expenses and charitable donations, requested by an employee and authorized by a Tax Services Office or Tax Centre.

http://saphrxperts.wordpress.com/

Você também pode gostar

- Overview of Canadian PayrollDocumento25 páginasOverview of Canadian Payrollvishal chandra100% (3)

- Payroll Check ExplainedDocumento3 páginasPayroll Check Explainedfriendresh1708Ainda não há avaliações

- SAP US Payroll Tax - Well ExplainedDocumento45 páginasSAP US Payroll Tax - Well ExplainedSuren Reddy67% (15)

- 941 2008-1Documento47 páginas941 2008-1lionkingae100% (1)

- IFRS in Your Pocket 2016 PDFDocumento120 páginasIFRS in Your Pocket 2016 PDFPiyush Shah100% (2)

- PCL Chap 4 en CaDocumento70 páginasPCL Chap 4 en CaRenso Ramirez100% (1)

- Claims in US PayrollDocumento24 páginasClaims in US Payrollsrikanthyh1979100% (2)

- Payroll Configuration inDocumento77 páginasPayroll Configuration inJoseph Hall100% (1)

- 0: Valuation Basis /1: Cumulation Wage Type /2: Averages /3,/4,/6: Taxation /5: Retroactive Handling or Net /8: Factoring Wage Types /a,/x Outflow Wage Types /559 Stands For Bank PaymentDocumento5 páginas0: Valuation Basis /1: Cumulation Wage Type /2: Averages /3,/4,/6: Taxation /5: Retroactive Handling or Net /8: Factoring Wage Types /a,/x Outflow Wage Types /559 Stands For Bank PaymentLokesh DerashriAinda não há avaliações

- Practical Sap Us PayrollDocumento37 páginasPractical Sap Us PayrollBharathk Kld100% (2)

- Tax HandbookDocumento37 páginasTax HandbookChouchir SohelAinda não há avaliações

- Payroll USA ConfigurationDocumento33 páginasPayroll USA Configurationsanthi100% (1)

- SAP US Payroll Tax ClassDocumento45 páginasSAP US Payroll Tax Classmastersaphr100% (2)

- HR Payroll US PracticeDocumento37 páginasHR Payroll US PracticeHau LeAinda não há avaliações

- PC - KSA HCM Localization-MainDocument-20110619Documento101 páginasPC - KSA HCM Localization-MainDocument-20110619Tofi Al-s100% (2)

- Payroll Schemas and Personnel Calculation RulesDocumento23 páginasPayroll Schemas and Personnel Calculation Rulesananth-jAinda não há avaliações

- Wage Type CharacteristicsDocumento29 páginasWage Type Characteristicsananth-jAinda não há avaliações

- Berlin, Two Concepts of LibertyDocumento11 páginasBerlin, Two Concepts of Libertyana loresAinda não há avaliações

- Stages of Civil Suit ByAbdullah ZahidDocumento11 páginasStages of Civil Suit ByAbdullah ZahidAbdullah Zahid100% (1)

- SAP US Payroll Taxation PDFDocumento45 páginasSAP US Payroll Taxation PDFPhani MunnaAinda não há avaliações

- Indirect Valuation - SAP HCMDocumento9 páginasIndirect Valuation - SAP HCMkarishma0110100% (1)

- Go4itCreditCardTermsConditions PDFDocumento29 páginasGo4itCreditCardTermsConditions PDFJismin JosephAinda não há avaliações

- Payroll - Configuration - V0 01Documento38 páginasPayroll - Configuration - V0 01Abdul WahabAinda não há avaliações

- SAP Payroll Year End Step by Step White Paper PDFDocumento8 páginasSAP Payroll Year End Step by Step White Paper PDFAlessandro LincolnAinda não há avaliações

- Payroll 3Documento48 páginasPayroll 3eurofighter100% (3)

- SAP HR Common Error MessagesDocumento16 páginasSAP HR Common Error MessagesSaraswathi Nimmagadda100% (2)

- SAP Payroll Schema. Functions, Rules and Operations - An OverviewDocumento21 páginasSAP Payroll Schema. Functions, Rules and Operations - An OverviewUday KiranAinda não há avaliações

- Processing Classes (SAP HCM)Documento5 páginasProcessing Classes (SAP HCM)chinnipappu1Ainda não há avaliações

- SAP HR and Payroll Wage TypesDocumento3 páginasSAP HR and Payroll Wage TypesBharathk Kld0% (1)

- How To Audit Payroll in SAP & Matchcode WDocumento5 páginasHow To Audit Payroll in SAP & Matchcode WManepali TejAinda não há avaliações

- SAP Payroll BasicsDocumento19 páginasSAP Payroll Basicsprdeshpande100% (3)

- Manarang Auto Repair Shop Journal by The Month of January 2019Documento9 páginasManarang Auto Repair Shop Journal by The Month of January 2019Renz MoralesAinda não há avaliações

- Payroll Schemas and Personnel Calculation Rules (PCR)Documento14 páginasPayroll Schemas and Personnel Calculation Rules (PCR)ruchityaAinda não há avaliações

- Indian Payroll SAPDocumento73 páginasIndian Payroll SAPSuneeti Akanksha0% (1)

- U000 SchemaDocumento4 páginasU000 SchemaclaokerAinda não há avaliações

- Venue of Action and Criminal JurisdictionDocumento5 páginasVenue of Action and Criminal JurisdictionjustineAinda não há avaliações

- SAP Payroll Training DocumentsDocumento15 páginasSAP Payroll Training Documentskb200933% (3)

- SAP HR Payroll Schemas and Personnel Calculation RulesDocumento17 páginasSAP HR Payroll Schemas and Personnel Calculation RulesRoberto Martínez83% (6)

- SAP HCM - Creating Custom Payroll FunctionDocumento8 páginasSAP HCM - Creating Custom Payroll Functionsainath89100% (2)

- KSA - GOSI Enhancements Overview + SettingsDocumento6 páginasKSA - GOSI Enhancements Overview + SettingssriAinda não há avaliações

- Off Cycle PayrollDocumento5 páginasOff Cycle PayrollHemant ShettyAinda não há avaliações

- Indus Motor Company: PayrollDocumento26 páginasIndus Motor Company: PayrollYousuf Admani100% (1)

- 6 PayrollDocumento52 páginas6 PayrollNguyen HoaAinda não há avaliações

- PCL Chap 4 en CaDocumento69 páginasPCL Chap 4 en CaMitchieAinda não há avaliações

- SAP Income TaxDocumento5 páginasSAP Income TaxBullet BairagiAinda não há avaliações

- Indirect Evaluation (INVAL) and 40ECS Feature: PurposeDocumento6 páginasIndirect Evaluation (INVAL) and 40ECS Feature: PurposeTejaswi ReddyAinda não há avaliações

- Payroll ConfiDocumento50 páginasPayroll ConfiLokesh Derashri100% (1)

- Sap Payroll Taxes ScribdDocumento41 páginasSap Payroll Taxes ScribdChakrapani Dusetti100% (3)

- SAP Payroll Processing AdministrationDocumento64 páginasSAP Payroll Processing Administrationlovely_s_guy100% (5)

- Complete Payroll PCR SchemaDocumento98 páginasComplete Payroll PCR Schemaraja100% (2)

- Sap HR Schema and PCR With ExampleDocumento7 páginasSap HR Schema and PCR With ExampleSoo Raj100% (1)

- Income Tax Calculation (SAP Library - Payroll India (PY-IN) )Documento6 páginasIncome Tax Calculation (SAP Library - Payroll India (PY-IN) )Pradeep KumarAinda não há avaliações

- Indian Payroll Help-SAPDocumento238 páginasIndian Payroll Help-SAPJitendra Kumar50% (4)

- SAP HR Payroll Implemantation StudyDocumento19 páginasSAP HR Payroll Implemantation StudyAvi Nandy100% (1)

- Processing ClassDocumento6 páginasProcessing ClassVishalAinda não há avaliações

- Payroll Troubleshooting Reference GuideDocumento75 páginasPayroll Troubleshooting Reference Guidesenthilmask80Ainda não há avaliações

- An SAP Consultant - SAP HR Benefits BADIs and Enhancement SpotsDocumento1 páginaAn SAP Consultant - SAP HR Benefits BADIs and Enhancement SpotsarunAinda não há avaliações

- SAP Time Management - Questions With AnswersDocumento33 páginasSAP Time Management - Questions With AnswersPradeep KumarAinda não há avaliações

- Tax Reporter Configuration OSS Note 0000544849Documento11 páginasTax Reporter Configuration OSS Note 0000544849Pavan DonepudiAinda não há avaliações

- Payroll Control Centre - Overview and Implementation OutlineDocumento5 páginasPayroll Control Centre - Overview and Implementation OutlineArun Varshney (MULAYAM)Ainda não há avaliações

- Sap HR PCR Time MGTDocumento14 páginasSap HR PCR Time MGTHarris CHAinda não há avaliações

- Madhupayroll - Sap HR - HCM Indian Payroll Schemas and PCRDocumento7 páginasMadhupayroll - Sap HR - HCM Indian Payroll Schemas and PCRMurali MohanAinda não há avaliações

- Payslip ConfigurationDocumento70 páginasPayslip ConfigurationAarohiSoodAinda não há avaliações

- Retroactive Accounting PDFDocumento16 páginasRetroactive Accounting PDFMohamed ShanabAinda não há avaliações

- 2023 PCL Chapter 4 Income TaxDocumento67 páginas2023 PCL Chapter 4 Income TaxSkyAinda não há avaliações

- Payroll Glosary InglesDocumento7 páginasPayroll Glosary InglesAlejoTiradoAinda não há avaliações

- New Boa Syllabus - Financial Accounting & ReportingDocumento3 páginasNew Boa Syllabus - Financial Accounting & ReportingVoltairePeraltaAinda não há avaliações

- Flashwire US Monthly September-16 PDFDocumento6 páginasFlashwire US Monthly September-16 PDFRishabh BansalAinda não há avaliações

- Penggunaan Rasio Keuangan Untuk Mengukur Kinerja Keuangan Perusahaan (Studi Pada PT. Astra Otoparts, TBK Dan PT. Goodyer Indonesia, TBK YangDocumento10 páginasPenggunaan Rasio Keuangan Untuk Mengukur Kinerja Keuangan Perusahaan (Studi Pada PT. Astra Otoparts, TBK Dan PT. Goodyer Indonesia, TBK YangAris SetiawanAinda não há avaliações

- Liza MazaDocumento1 páginaLiza MazaVERA FilesAinda não há avaliações

- The Danger of Joining A Gang GroupDocumento22 páginasThe Danger of Joining A Gang GroupMona Duterte LegitimasAinda não há avaliações

- Shyam Babu Ticket PDFDocumento1 páginaShyam Babu Ticket PDFRanjeet KushwahaAinda não há avaliações

- Fallacy of DiversionDocumento12 páginasFallacy of DiversionMaria Consolacion CatapAinda não há avaliações

- University of San Carlos Vs Court of AppealsDocumento4 páginasUniversity of San Carlos Vs Court of AppealsmwaikeAinda não há avaliações

- 17-0977 Joint Motion To Dismiss With Certificate of Service (01257069xB608A)Documento10 páginas17-0977 Joint Motion To Dismiss With Certificate of Service (01257069xB608A)John AllisonAinda não há avaliações

- Crim - ConcurrenceDocumento2 páginasCrim - ConcurrenceFarhan TyeballyAinda não há avaliações

- H.17A Syl sp12 1230Documento11 páginasH.17A Syl sp12 1230Josh KnobleAinda não há avaliações

- Ashwin Murthy TortsDocumento28 páginasAshwin Murthy Tortssaurabh kapurAinda não há avaliações

- Your Vodafone Bill: Amount DueDocumento2 páginasYour Vodafone Bill: Amount DueRahul PrakashAinda não há avaliações

- Magna Carta of WomenDocumento4 páginasMagna Carta of WomenNevej ThomasAinda não há avaliações

- Ricoh - d062 - d063 - d065 - MP 8001Documento1.347 páginasRicoh - d062 - d063 - d065 - MP 8001Valfredo SOUSAAinda não há avaliações

- The Conduct of The Earl of CaithnessDocumento15 páginasThe Conduct of The Earl of CaithnessBren-RAinda não há avaliações

- 特 定 技 能 外 国 人 の 履 歴 書 Curriculum Vitae Of The Specified Skilled WorkerDocumento25 páginas特 定 技 能 外 国 人 の 履 歴 書 Curriculum Vitae Of The Specified Skilled WorkerAoi BaraAinda não há avaliações

- 07 Government Vs Cabangis G.R. No. L 28379 Mar. 27 1929Documento4 páginas07 Government Vs Cabangis G.R. No. L 28379 Mar. 27 1929Awe SomontinaAinda não há avaliações

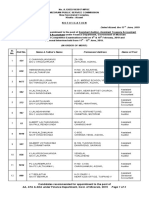

- Final Result of Aa Ada Ata Under Finance Department 2019Documento3 páginasFinal Result of Aa Ada Ata Under Finance Department 2019Ab KhawlhringAinda não há avaliações

- Financial Management757 8NpfYQinoODocumento3 páginasFinancial Management757 8NpfYQinoOHarshhaa ZanjageAinda não há avaliações

- United States v. Murphy, C.A.A.F. (2015)Documento26 páginasUnited States v. Murphy, C.A.A.F. (2015)Scribd Government DocsAinda não há avaliações

- Gloria Macapagal Arroyo vs. People of The Philippines and The Sandiganbayan G.R. NO. 220598 APRIL 18, 2017Documento4 páginasGloria Macapagal Arroyo vs. People of The Philippines and The Sandiganbayan G.R. NO. 220598 APRIL 18, 2017Jenalin FloranoAinda não há avaliações

- Mughal Emperor AurangzebDocumento3 páginasMughal Emperor Aurangzebgulrukk65Ainda não há avaliações

- MCQ PDFDocumento7 páginasMCQ PDFshaan76Ainda não há avaliações