Escolar Documentos

Profissional Documentos

Cultura Documentos

Bir Form 1701

Enviado por

miles1280Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Bir Form 1701

Enviado por

miles1280Direitos autorais:

Formatos disponíveis

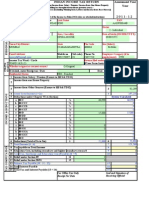

For BIR Use Only

BCS/ Item Republika ng Pilipinas Kagawaran ng Pananalapi Kawanihan ng Rentas Internas

Annual Income Tax Return

For Self-Employed Individuals, Estates and Trusts

Enter all required information in CAPITAL LETTERS using BLACK ink. Mark applicable boxes with an X. Two copies MUST be filed with the BIR and one held by the Tax Filer. 2 Amended Return?

170106/13ENCSP1 BIR Form No.

1701

June 2013 (ENCS) Page 1

1 For the Year (MM/20YY) 4 Alphanumeric Tax Code (ATC)

/20

Yes

No

3 Short Period Return?

Yes

No

II 011 Compensation Income

II 012 Business Income / Income from Profession

II 013 Mixed Income

Part I Background Information on TAXPAYER/FILER

5 Taxpayer Identification Number (TIN) - 0 0 0 0 6 RDO Code 7 Tax Filer Type Single Proprietor Professional Estate Trust 8 Tax Filers Name (Last Name, First Name, Middle Name for Individual) / ESTATE of (First Name, Middle Name, Last Name) / TRUST FAO:(First Name, Middle Name, Last Name) 9 Trade Name

10 Registered Address (Indicate complete registered address)

11 Date of Birth (MM/DD/YYYY)

12 Email Address 14 Civil Status Single Married

With No Income

/

13 Contact Number

/

Legally Separated

16 Filing Status Joint Filing

Widow/er

Separate Filing

15 If Married, indicate whether spouse has income 17 Main Line of Business

With Income

18 PSIC

19 PSOC

20 Method of Deduction

Itemized Deduction

[Sec. 34 (A-J), NIRC]

Optional Standard Deduction (OSD) 40% of Gross Sales/

Receipts/Revenues/Fees [Sec. 34(L), NIRC, as amended by R.A. 9504]

21 Method of Accounting Cash 22 Income Exempt from Income Tax? 24 Claiming Additional Exemptions? 26 27 28 29 30 31

Accrual

Yes Yes No No

Others (Specify)

23 Income subject to Special/Preferential Rate?

(Enter information about Children on Part VIIA of Page 4)

Yes

No

If Yes, fill up also Mandatory Attachments PER ACTIVITY (Part X).

If Yes, fill up also Mandatory Attachments PER ACTIVITY (Part X)

25 If YES, enter number of Qualified Dependent Children (Do NOT enter Centavos)

Part II Total Tax Payable Total Income Tax Due (Overpayment) for Tax Filer and Spouse (Sum of Items 72A & 72B) Less: Total Tax Credits / Payments (Sum of Items 76A & 76B) Net Tax Payable (Overpayment) (Item 26 Less Item 27)

Less: Portion of Tax Payable Allowed for 2nd Installment to be paid on or before July 15 (Not More Than 50% of

Item 26)

Total Tax Payable (Item 28 Less Item 29) Add: Total Penalties( From Item 84)

If Overpayment, mark one box only (Once the choice is made, the same is irrevocable) To be refunded To be issued a Tax Credit Certificate (TCC) To be carried over as a tax credit for next year/quarter

32 TOTAL AMOUNT PAYABLE Upon Filing (Overpayment) (Sum of Items 30 & 31)

I declare under the penalties of perjury, that this annual return has been made in good faith, verified by me, and to the best of my knowledge and belief, is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof. (If Authorized Representative, attach authorization letter and indicate TIN)

33 Number of pages filed Signature over printed name of Tax Filer

34 Community Tax Certificate (CTC) No./Govt. Issued ID

Signature over printed name of Authorized Representative 35 Date of Issue (MM/DD/YYYY)

/

Amount

36 Place of Issue

37 Amount, if CTC

Part III - Details of

Payment 38 Cash/Bank Debit Memo 39 Check 40 Others (Specify below)

Drawee Bank/ Agency

Number

Date (MM/DD/YYYY)

/ / /

/ / /

Stamp of Receiving Office/AAB and Date of Receipt

Machine Validation / Revenue Official Receipt Details (if not filed with an Authorized Agent Bank)

(ROs Signature/Bank Tellers Initial)

Annual Income Tax Return

For Self-Employed Individuals, Estates and Trusts Subject to REGULAR Income Tax Only

BIR Form No.

1701

June 2013 (ENCS)

170106/13ENCSP2

Page 2

TIN 0 0 0 0

Tax Filers Last Name A) Taxpayer/Filer B) Spouse

Part IV Computation of Income Tax- REGULAR RATE 41 Gross Compensation Income (From Schedule1 Item 5A1 / 5B1 ) 42 Less: Non-Taxable / Exempt Compensation 43 Gross Taxable Compensation Income (Item 41 Less Item 42) Less: Deductions 44 Premium on Health and/or Hospitalization Insurance (Not to Exceed P 2,400 / year) 45 Personal Exemption/Exemption for Estate and Trust 46 Additional Exemption 47 Total Deductions (Sum of Items 44 to 46) 48 Net Taxable Compensation Income (Item 43 Less Item 47)

OR

49 Excess of Deductions (Item 47 Less Item 43) 50 Net Sales/Revenues/Receipt/Fees (From Schedule 2 Item 5A / 5B) 51 Add: Other Taxable Income from Operations not Subject to Final Tax

(From Schedule 3 Item 3A / 3B)

52 Total Sales/Revenues/Receipts/Fees (Sum of Items 50 & 51) 53 Less: Cost of Sales/Services

(Not allowed for Tax Filer who opted for OSD) (From Schedule 4 Item 27A / 27B)

54 Gross Income from Business/Profession (Item 52 Less Item 53) 55 Add: Non-Operating Income (From Schedule 5 Item 6A / 6B) 56 Total Gross Income (Sum of Items 54 & 55) Less: Allowable Deductions 57 Ordinary Allowable Itemized Deductions (From Schedule 6 Item 40A / 40B) 58 Special Allowable Itemized Deductions (From Schedule 7 Item 5A/5B) 59 Allowance for Net Operating Loss Carry Over (NOLCO)

(From Schedule 8A1 Item 8D / Schedule 8B1 Item 8D)

60 Total Allowable Itemized Deductions (Sum of Items 57 to 59)

OR

61 Optional Standard Deductions (OSD) (40% of Item 52-Total Sales/Receipts/Revenues/Fees)

(NOTE: If all income is subject ONLY to Regular Income Tax Regime)

62 Taxable Income from Business/Profession(Item 56 Less Item 60 OR 61) 63 Add: Net Taxable Compensation Income(From Item 48A/48B) 64 Net Taxable Income (Sum of Items 62 & 63)

65 Less: Excess Deductions, if any (From Item 49) OR the Total Deductions, if there is no compensation income (From Item 47)

66 TOTAL TAXABLE INCOME (Item 64 Less Item 65) 67 TAX DUE-REGULAR [Refer to Tax Table (Graduated Income Tax Rates) below]

Tax Table

If Taxable Income is: Not over P 10,000 Over P 10,000 but not over P 30,000 Over P 30,000 but not over P 70,000 Over P 70,000 but not over P 140,000 Tax Due is: 5% P 500 + 10% of the excess over P 10,000 P 2,500 + 15% of the excess over P 30,000 P 8,500 + 20% of the excess over P 70,000 Over P 140,000 but not over P 250,000 Over P 250,000 but not over P 500,000 Over P 500,000 P 22,500 + 25% of the excess over P 140,000 P 50,000 + 30% of the excess over P 250,000 P 125,000 + 32% of the excess over P 500,000 If Taxable Income is: Tax Due is:

Annual Income Tax Return

For Self-Employed Individuals, Estates and Trusts Subject to REGULAR Income Tax Only

BIR Form No.

1701

June 2013 (ENCS)

170106/13ENCSP3

Page 3 TIN 0 0 0 0

Tax Filers Last Name

Description

Part V - Summary of Income Tax Due A) Taxpayer/Filer

B) Spouse

68 Regular Rate - Income Tax Due (From Item 67A/67B) 69 Special Rate - Income Tax Due (From Part IX Item 18B/18F) 70 Less: Share of Other Government Agency, if remitted directly 71 Net Special Income Tax Due

(Sum of Items 68 &71) (Share of National Govt.) (Item 69 Less Item 70)

72 TOTAL INCOME TAX DUE (Overpayment)

(To Item 26)

Less: Tax Credits/Payments

73 Regular (From Schedule 9 Item 10A/10B) 74 Special (From Part IX Item 19B/19F) 75 Exempt (From Part IX Item 19C/19G) 76 Total Tax Credit/Payments (Sum of Items 73 to 75)

(To Item 27)

77 Net Tax Payable/(Overpayment) (Item72 Less Item 76) 78 NET TAX PAYABLE (OVERPAYMENT) FOR TAX FILER and SPOUSE (Sum of Items 77A & 77B) 79 Less: Portion of Tax Payable Allowed for 2nd Installment to be paid on or before July 15

(Not More Than 50% of the Sum of Items 72A & 72B) (To Item 29)

80 NET AMOUNT OF TAX PAYABLE (OVERPAYMENT) (Item 78 Less Item 79) Add: Penalties 81 Surcharge 82 Interest 83 Compromise 84 Total Penalties (Sum of Items 81 to 83)

(To Item 31) (To Item 32)

85 TOTAL AMOUNT PAYABLE UPON FILING (OVERPAYMENT) (Sum of Items 80 & 84) Part VI - Tax Relief Availment Description

86 Regular Income Tax Otherwise Due

(Sum of Items 66 & 58 X applicable Tax Rate per Tax Table )

A) Taxpayer/Filer

B) Spouse

87 Less: Tax Due Regular (From Item 67) 88 Tax Relief Availment Before Special Tax Credits (Items 86 Less Item 87) 89 Add: Special Tax Credits(From Schedule 9 Item 8A/8B) 90 Regular Tax Relief Availment (Sum of Items 88 & 89) 91 Special Tax Relief Availment( From Part IX Item 21B/21F) 92 Exempt Tax Relief Availment (From Part IX Item 21C/21G) 93 Total Tax Relief Availment (Sum of Items 90, 91 & 92) 94 Total Tax Relief Availment of Tax Filer & Spouse (Sum of Items 93A & 93B)

Annual Income Tax Return

For Self-Employed Individuals, Estates and Trusts Subject to REGULAR Income Tax Only

BIR Form No.

1701

June 2013 (ENCS)

170106/13ENCSP4

Page 4 TIN 0 0 0 0

Tax Filers Last Name Part VII - Other Relevant Information - SPOUSE

95 Spouses TIN

96 RDO Code

97 Spouses Name (Last Name, First Name and Middle Initial) 98 Trade Name 99 Date of Birth(MM/DD/YYYY) / / 101 Contact Number 104 Line of Business 105 Method of Deduction 106 Method of Accounting Cash 107 Income Exempt from Income Tax? 109 Alphanumeric Tax Code (ATC) Itemized Deductions

[Sec. 34 (A-J), NIRC]

100 Email Address 102 PSIC 103 PSOC

Optional Standard Deduction (OSD) 40% of Gross

Sales/Receipts/Revenues/Fees [Sec. 34(L), NIRC, as amended by R.A. 9504]

Accrual

Yes No

Others (Specify)

108 Income subject to Special/Preferential Rate?

Yes

No

If Yes, fill up also Mandatory Attachments PER ACTIVITY (Part X) .

If Yes, fill up also Mandatory Attachments PER ACTIVITY (Part X)

II 011 Compensation Income

II 012 Business Income/Income from Profession

II 013 Mixed Income

110 Claiming Additional Exemptions?

Yes

No

111 If YES, enter number of Qualified Dependent Children (Enter information about Children on Part VIIA)

Part VIIA - Qualified Dependent Children (If wife is claiming for additional exemption, please attach waiver of the husband) Last Name First Name and Middle Initial Date of Birth (MM / DD / YYYY)

Mark if Mentally/ Physically Incapacitated

Part VIIB - Current Address (Accomplish if current address is different from registered address)

Unit/Room Number/Floor Lot Number Block Number Phase Number House Number Subdivision/Village Municipality/City Province Building Name Street Name Barangay

Zip Code

Part VIII - Information - External Auditor/Accredited Tax Agent

112 Name of External Auditor/Accredited Tax Agent

113 TIN 114 Name of Signing Partner (If External Auditor is a Partnership)

115 TIN 116 BIR Accreditation No. 117 Issue Date (MM/DD/YYYY) 118 Expiry Date (MM/DD/YYYY)

Annual Income Tax Return

Page 5 - Schedules 1 to 4A

TIN 0 0 0 0

BIR Form No.

1701

June 2013 (ENCS)

170106/13ENCSP5

Tax Filers Last Name

SCHEDULES-REGULAR RATE

Schedule 1 - Gross Compensation Income and Tax Withheld (Attach additional sheet/s, if necessary)

Gross Compensation Income and Tax Withheld (On Items 1, 2 & 3, enter the required information for each of your employers and mark (X) whether the information is for the Taxpayer or the Spouse. Attach additional Sheets if necessary. On Item 5A, enter the Total Gross Compensation and Total Tax Withheld for the Taxpayer and on Line 5B, enter the appropriate information for the Spouse. DO NOT enter Centavos; 49 Centavos or Less drop down; 50 or more round up)

1 Name of Employer

Taxpayer Spouse

2 Name of Employer

Employers TIN

Compensation Income

Tax Withheld

Taxpayer Spouse

3 Name of Employer

Employers TIN

Compensation Income

Tax Withheld

Taxpayer Spouse

4 Name of Employer

Employers TIN

Compensation Income

Tax Withheld

Taxpayer Spouse

Employers TIN

Compensation Income

Tax Withheld 2. Total Tax Withheld 2. Total Tax Withheld

5A Total Gross Compensation Income and Total Tax Withheld from the above 1. Total Compensation Income

entries and any additional sheets attached for Taxpayer (To Part IV Item 41A)

5B Total Gross Compensation Income and Total Tax Withheld from the above 1. Total Compensation Income

entries and any additional sheets attached for Spouse (To Part IV Item 41B)

Schedule 2 - Sales/Revenues/Receipts/Fees from Business/Profession, including amount received from General Professional Partnership (GPP) Description 1 Total Sales/Revenues/Receipts/Fees 2 Add: Gross Sales/Revenues/Receipts/Fees not subject to Withholding Tax 3 Total Sales/Revenues/Receipts/Fees (Sum of Items 1 & 2 ) 4 Less: Sales Returns, Allowances and Discounts 5 Net Sales/Revenues/Receipts/Fees (Item 3 Less Item 4) (To Item 50) Schedule 3 - Other Taxable Income from Operations not Subject to Final Tax (Attach additional sheet/s, if necessary) Description A) Taxpayer/Filer B) Spouse 1 2 3 Total Other Taxable Income (Sum of Items 1 & 2) (To Item 51) Schedule 4 Cost of Sales/Services (Attach additional sheet/s, if necessary) Schedule 4A - Cost of Sales (For those engaged in Trading) Description A) Taxpayer/Filer 1 Merchandise Inventory, Beginning 2 Add: Purchases of Merchandise 3 Total Goods Available for Sale (Sum of Items 1 & 2) 4 Less: Merchandise Inventory, Ending 5 Cost of Sales (Item 3 Less Item 4) (To Schedule 4 Item 27) A) Taxpayer/Filer B) Spouse

B) Spouse

Annual Income Tax Return

Page 6 - Schedules 4B to 6

TIN 0 0 0 0

BIR Form No.

1701

June 2013 (ENCS) 170106/13ENCSP6

Tax Filers Last Name

Schedule 4B - Cost of Sales (For those engaged in Manufacturing) Description A) Taxpayer/Filer 6 Direct Materials, Beginning 7 Add: Purchases of Direct Materials 8 Material Available for Use (Sum of Items 6 & 7) 9 Less: Direct Materials, Ending 10 Raw Materials Used (Item 8 Less Item 9) 11 Direct Labor 12 Manufacturing Overhead 13 Total Manufacturing Cost (Sum of Items 10 to 12) 14 Add: Work in Process, Beginning 15 Less: Work in Process, Ending 16 Cost of Goods Manufactured (Sum of Items 13 & 14 Less Item 15) 17 Add: Finished Goods, Beginning 18 Less: Finished Goods, Ending 19 Cost of Goods Manufactured & Sold

(Sum of Items 16 & 17 Less Item 18) (To Schedule 4 Item 27)

B) Spouse

Schedule 4C - Cost of Services (For those engaged in Services, indicate only those directly incurred or related to the gross

revenue from rendition of services)

Description 20 Direct Charges Salaries, Wages and Benefits 21 Direct Charges Materials, Supplies and Facilities 22 Direct Charges Depreciation 23 Direct Charges Rental 24 Direct Charges Outside Services 25 Direct Charges Others 26 Total Cost of Services (Sum of Items 20 to 25) (To Schedule 4 Item 27)

27 Total Cost of Sales/Services (Sum of Items 5, 19 & 26, if applicable) (To Part IV Item 53)

A) Taxpayer/Filer

B) Spouse

Schedule 5 - Non-Operating Income Nature of Income 1 2 3 4 5 6

(Attach additional sheet/s, if necessary) A)

Taxpayer/Filer

B) Spouse

Total Non-Operating Income (Sum Items 1 to 5) (To Item 55)

(Attach additional sheet/s, if necessary)

Schedule 6 - Ordinary Allowable Itemized Deductions Description 1 Advertising and Promotions Amortizations (Specify on Items 2, 3 & 4) 2 3 4

A) Taxpayer/Filer

B) Spouse

Annual Income Tax Return

Page 7 - Schedule 6

TIN 0 0 0 0

BIR Form No.

1701

June 2013 (ENCS)

170106/13ENCSP7

Tax Filers Last Name

Schedule 6 (Continued) Ordinary Allowable Itemized Deductions Description A) Taxpayer/Filer 5 Bad Debts 6 Charitable Contributions 7 Commissions 8 Communication, Light and Water 9 Depletion 10 Depreciation 11 Director's Fees 12 Fringe Benefits 13 Fuel and Oil 14 Insurance 15 Interest 16 Janitorial and Messengerial Services 17 Losses 18 Management and Consultancy Fee 19 Miscellaneous 20 Office Supplies 21 Other Services 22 Professional Fees 23 Rental 24 Repairs and Maintenance - Labor or Labor & Materials 25 Repairs and Maintenance - Materials/Supplies 26 Representation and Entertainment 27 Research and Development 28 Royalties 29 Salaries and Allowances 30 Security Services 31 SSS, GSIS, Philhealth, HDMF and Other Contributions 32 Taxes and Licenses 33 Tolling Fees 34 Training and Seminars 35 Transportation and Travel Others (Specify below; Add additional sheet(s), if necessary) 36 37 38 39 40 Total Ordinary Allowable Itemized Deduction

(Sum of Items 1 to 39) (To Item 57)

B) Spouse

Annual Income Tax Return

Page 8 - Schedules 7 to 8B.1

TIN 0 0 0 0

BIR Form No.

1701

June 2013 (ENCS)

170106/13ENCSP8

Tax Filers Last Name

Schedule 7 - Special Allowable Itemized Deductions(Attach additional sheet/s, if necessary) Description Legal Basis A) Taxpayer/Filer 1 2 3 4 5 Total Special Allowable Itemized Deductions

(Sum of Items1 to 4) (To Item 58)

B) Spouse

Schedule 8 Computation of Net Operating Loss Carry Over (NOLCO)

Schedule 8A Taxpayer/Filers Computation of Net Operating Loss Carry Over (NOLCO) 1 Gross Income 2 Less: Total Deductions Exclusive of NOLCO & Deduction Under Special Law 3 Net Operating Loss (Item 1 Less Item 2)

(To Schedule 8A.1)

Schedule 8A.1 - Taxpayer/Filers Detailed Computation of Available Net Operating Loss Carry Over (NOLCO) Net Operating Loss B) NOLCO Applied Previous Year Year Incurred A) Amount 4 5 6 7 C) NOLCO Expired 4 5 6 7 8 Total NOLCO (Sum of Items 4D to 7D)

(To Item 59A)

D) NOLCO Applied Current Year

E) Net Operating Loss (Unapplied)

Schedule 8B Spouses Computation of Net Operating Loss Carry Over (NOLCO) 1 Gross Income 2 Less: Total Deductions Exclusive of NOLCO & Deduction Under Special Law 3 Net Operating Loss (Item 1 Less Item 2)

(To Schedule 8B.1)

Schedule 8B.1 Spouses Detailed Computation of Available Net Operating Loss Carry Over (NOLCO) Net Operating Loss B) NOLCO Applied Previous Year Year Incurred A) Amount 4 5 6 7 C) NOLCO Expired 4 5 6 7 8 Total NOLCO (Sum of Items 4D to 7D)

(To Item 59B)

D) NOLCO Applied Current Year

E) Net Operating Loss (Unapplied)

Annual Income Tax Return

Page 9 - Schedules 9 to 10

TIN 0 0 0 0

BIR Form No.

1701

June 2013 (ENCS)

170106/13ENCSP9

Tax Filers Last Name

Schedule 9 Tax Credits/Payments (Attach proof) Description 1 Prior Year's Excess Credits 2 Tax Payments for the First Three Quarters 3 Creditable Tax Withheld for the First Three Quarters 4 Creditable Tax Withheld for the 4th Quarter 5 Creditable Tax Withheld per BIR Form No. 2316 (From Schedule 1 Item 5A2 /5B2) 6 Tax Paid in Return previously filed, if this is an Amended Return 7 Foreign Tax Credits, if applicable 8 Special Tax Credits, if applicable 9 Other Payments / Credits, specify __________________________ 10 Total Tax Credits / Payments (Sum Items 1 to 9) (To Item73) Schedule 10 - BALANCE SHEET Assets Description 1 Current Assets 2 Long-Term Investments 3 Property, Plant and Equipment - Net 4 Long Term Receivables 5 Intangible Assets 6 Other Assets 7 Total Assets (Sum Items 1 to 6) Liabilities 8 Current Liabilities 9 Long Term Liabilities 10 Deferred Credits 11 Other Liabilities 12 Total Liabilities (Sum of Items 8 to 11) Capital 13 Capital, Beginning 14 Add: Net Income for the Year 15 Less: Drawings 16 Capital, Ending (Sum of Items 13 & 14 Less Item 15) 17 Total Liabilities and Capital (Sum of Items 12 & 16)

A) Taxpayer/Filer

B) Spouse

A) Taxpayer/Filer

B) Spouse

Annual Income Tax Return

Page 10 Schedules 11A to 11B

TIN 0 0 0 0

BIR Form No.

1701

June 2013 (ENCS)

170106/13ENCSP10

Tax Filers Last Name

Schedule 11 - Reconciliation of Net Income per Books Against Taxable Income (Attach additional sheet/s, if necessary) Schedule 11A TAX FILERS Reconciliation of Net Income per Books Against Taxable Income 1 Net Income (Loss) per books Add: Non-deductible Expenses/Taxable Other Income 2 3 4 Total (Sum of Items 1 to 3) Less: A) Non-taxable Income and Income Subjected to Final Tax 5 6 B) Special Deductions 7 8 9 Total (Sum of Items 5 to 8) 10 Net Taxable Income (Loss) - Tax Filer (Item 4 Less Item 9) Schedule 11B SPOUSES Reconciliation of Net Income per Books Against Taxable Income 1 Net Income (Loss) per books Add: Non-deductible Expenses/Taxable Other Income 2 3 4 Total (Sum of Items 1 to 3) Less: A) Non-taxable Income and Income Subjected to Final Tax 5 6 B) Special Deductions 7 8 9 Total (Sum of Items 5 to 8) 10 Net Taxable Income (Loss) Spouse (Item 4 Less Item 9)

Annual Income Tax Return

Page 11 Schedules 12A to 12B

TIN 0 0 0 0

BIR Form No.

1701

June 2013 (ENCS)

170106/13ENCSP11

Tax Filers Last Name Schedule 12 Supplemental Information

Schedule 12A - Gross Income/ Receipts Subjected to Final Withholding I) Description 1 Interests 2 Royalties 3 Dividends 4 Prizes and Winnings 5 Fringe Benefits 6 Compensation Subject to 15% Preferential Rate II) Sale/Exchange of Real Properties 7 Description of Property (e.g., land, improvement, etc.) 8 OCT/TCT/CCT/Tax Declaration No. 9 Certificate Authorizing Registration (CAR) No. 10 Actual Amount/Fair Market Value/Net Capital Gains 11 Final Tax Withheld/Paid III) Sale/Exchange of Shares of Stock 12 Kind (PS/CS) / Stock Certificate Series No. 13 Certificate Authorizing Registration (CAR) No. 14 Number of Shares 15 Date of Issue (MM/DD/YYYY) 16 Actual Amount/Fair Market Value/Net Capital Gains 17 Final Tax Withheld/Paid IV) Other Income (Specify) 18 Other Income Subject to Final Tax Under Sections

57(A)/127/others of the Tax Code, as amended (Specify)

Exempt

A) Actual Amount/Fair Market Value/Net Capital Gains

B) Final Tax Withheld/Paid

A) Sale/Exchange #1

B) Sale/Exchange #2

A) Sale/Exchange #1

B) Sale/Exchange #2

A) Other Income #1

B) Other Income #2

19 Actual Amount/Fair Market Value/Net Capital Gains 20 Final Tax Withheld/Paid 21 Total Final Tax Withheld/Paid (Sum of Items 1B to 6B, 11A, 11B,17A, 17B, 20A & 20B) Schedule 12B - Gross Income/Receipts Exempt from Income Tax (Actual Amount/Fair Market Value) 1 Proceeds of Life Insurance Policy 2 Return of Premium 3 Retirement Benefits, Pensions, Gratuities, etc. I) Personal/Real Properties Received thru Gifts, A) Personal/Real Properties #1 B) Personal/Real Properties #2 Bequests, and Devises 4 Description of Property (e.g., land, improvement, etc.) 5 Mode of Transfer (e.g. Donation) 6 Certificate Authorizing Registration (CAR) No. 7 Actual Amount/Fair Market Value II) Other Exempt Income/Receipts 8 Other Exempt Income/Receipts Under Section 32(B) of the

Tax Code, as amended (Specify)

A) Personal/Real Properties #1

B) Personal/Real Properties #2

9 Actual Amount/Fair Market Value/Net Capital Gains 10 Total Income/Receipts Exempt from Income Tax (Sum of Items 1 to 3, 7A, 7B, 9A & 9B)

Annual Income Tax Return

Consolidation of ALL Activities per Tax Regime

(Accomplish only if with MULTIPLE Tax Regimes)

From Part X Mandatory Attachments for Exempt / Special Tax Regime PER ACTIVITY and Part IV for REGULAR

BIR Form No.

1701

June 2013 (ENCS) Page 12

170106/13ENCSP12

TIN

Tax Filers Last Name

0 0 0 0

Part IX - CONSOLIDATED COMPUTATION BY TAX REGIME (Consolidate amounts from Part X Mandatory Attachments for Exempt / Special Tax Regime PER ACTIVITY and Part IV for REGULAR)

TAXPAYER/FILER

A) Regular B) Total Special C) Total Exempt D) TOTAL (D= A + B + C) E) Regular F) Total Special

SPOUSE

G) Total Exempt H) TOTAL (H=E+F+G)

1 Net Sales/Revenues/Receipt/Fees

(From Part IV Item 50A/50B-Regular) (From Schedule B Item 1A/1B-Special/Exempt)

2 Add: Other Taxable Income from Operations not subject to Final Tax

(From Part IV Item 51A/51B-Regular) (From Schedule B Item 2A/2B-Special/Exempt)

3 Total Sales/Revenues/Receipts/Fee (Sum of Items 1 & 2) 4 Less: Cost of Sales/Service

(From Part IV Item 53A/53B-Regular) (From Schedule B Item 4A/4B-Special/Exempt)

5 Gross Income from Business/Profession (Item 3 Less Item 4) 6 Add: Non-Operating Income

(From Part IV Item 55A/55B-Regular) (From Schedule B Item 6A/6B-Special/Exempt)

7 TOTAL GROSS INCOME (Sum of Items 5 & 6)

Less: Allowable Deductions

8 Ordinary Allowable Itemized Deductions

(From Part IV Item 57A/57B-Regular) (From Schedule B Item 8A/8B-Special/Exempt)

9 Special Allowable Itemized Deductions

(From Part IV Item 58A/58B-Regular) (From Schedule B Item 9A/9B-Special/Exempt)

10 Allowance for Net Operating Loss Carry Over (NOLCO)

(From Part IV Item 59A/59B)

11 Total Allowable Itemized Deductions (Sum of Items 8 to 10)

OR

12 Optional Standard Deductions (OSD) (40% of Item 3 Total Sales/ Receipts / Revenues / Fees)

(Note: Option to use OSD is not applicable on those with Multiple Tax Regimes)

13 Taxable Income from Business/Profession

(Item 7 Less Item 11)

14 Add: Net Taxable Compensation Income (From Part IV Item 63A/63B) 15 Net Taxable Income (Sum of Items 13 & 14) 16 Less: Excess Deductions, if any OR the Total Deductions, if there is no

compensation income (From Part IV Item 65A/65B)

17 TOTAL TAXABLE INCOME (Item 15 Less Item 16) 18 TOTAL INCOME TAX DUE - REGULAR (From Part V Item 68A/68B);

- SPECIAL (Item 17B/17F X applicable Special Tax Rate) - EXEMPT (Item 7C/7G X 0%)

19 Less: Total Tax Credits / Payments

(From Sched. 9 Item 10A/10B-Regular) (From Sched. J Item 10A/10B-Special/Exempt)

20 NET TAX PAYABLE (OVERPAYMENT) (Item 18 Less Item 19) 21 Total Tax Relief Availment - REGULAR (From Part VI Item 90A/90B)

-SPECIAL (From Schedule C1 Item 8A/8B) (To Part VI Item 91A/91B) -EXEMPT (From Schedule C2 Item 11A/11B) (To Part VI Item 92A/92B)

Você também pode gostar

- Worksheet 1 PrelimDocumento8 páginasWorksheet 1 PrelimGetteric obafial90% (20)

- Civ Pro (Riano) PDFDocumento110 páginasCiv Pro (Riano) PDFJude-lo Aranaydo100% (3)

- Bir 1701Documento2 páginasBir 1701RAYNAN MARCELO100% (1)

- 1701 Bir FormDocumento12 páginas1701 Bir Formbertlaxina0% (1)

- New Income Tax Return BIR Form 1701 - November 2011 RevisedDocumento6 páginasNew Income Tax Return BIR Form 1701 - November 2011 RevisedBusinessTips.Ph100% (4)

- New Form 2550 M - Monthly VAT Return P 1-2Documento3 páginasNew Form 2550 M - Monthly VAT Return P 1-2Pearl Reyes64% (14)

- 1902 - BirDocumento2 páginas1902 - BirLilian Laurel Cariquitan50% (2)

- Form 137Documento63 páginasForm 137Wilma VillanuevaAinda não há avaliações

- Philippines New Annual Income Tax Return Form 01 IAF JUNE 2013Documento12 páginasPhilippines New Annual Income Tax Return Form 01 IAF JUNE 2013Danilla Navarro VelasquezAinda não há avaliações

- 2550MDocumento9 páginas2550MAngel AlfaroAinda não há avaliações

- Business Plan Bolt & Nuts - Financial AspectsDocumento14 páginasBusiness Plan Bolt & Nuts - Financial AspectsgboobalanAinda não há avaliações

- CMA Exam Questions by Surgent CMA and I Pass The CMA ExamDocumento13 páginasCMA Exam Questions by Surgent CMA and I Pass The CMA ExamMai JaberAinda não há avaliações

- NSRP FormDocumento2 páginasNSRP FormMa rosario Jaictin100% (1)

- Business Permit 2011Documento1 páginaBusiness Permit 2011Patrick Henry LopezAinda não há avaliações

- Government Secondary School Profile (Beginning of The Sy Data, As of July 31)Documento5 páginasGovernment Secondary School Profile (Beginning of The Sy Data, As of July 31)ILubo Ak100% (2)

- Certificate of EnrollmentDocumento16 páginasCertificate of EnrollmentIrrie VillaverdeAinda não há avaliações

- Phil GEPSDocumento1 páginaPhil GEPSDon SumiogAinda não há avaliações

- Bir Form 1902Documento2 páginasBir Form 1902Jayson Garcia100% (1)

- Certification For Loyalty Pay For 10 Year ClaimDocumento1 páginaCertification For Loyalty Pay For 10 Year ClaimMa Elena Claro100% (1)

- Form137 BlankDocumento5 páginasForm137 BlankDMIA REGISTRARAinda não há avaliações

- CertificationDocumento1 páginaCertificationJairolla Obay100% (1)

- 1701 Annual Income Tax Return: (From Part VI Item 5) (From Part VII Item 10)Documento5 páginas1701 Annual Income Tax Return: (From Part VI Item 5) (From Part VII Item 10)Jennylyn TagubaAinda não há avaliações

- Certification: Catubig Valley National High SchoolDocumento1 páginaCertification: Catubig Valley National High SchoolDerickAinda não há avaliações

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocumento1 página1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trustsjoel razAinda não há avaliações

- DIPLOMADocumento2 páginasDIPLOMAJ-anne Paula Dacusin100% (2)

- NSRP Form 1Documento2 páginasNSRP Form 1ima100% (1)

- Revised Cash Disbursement RegisterDocumento8 páginasRevised Cash Disbursement RegisterPatrice GonzalesAinda não há avaliações

- Certificate of Recognition TNHSDocumento1 páginaCertificate of Recognition TNHSlbaldomar1969502Ainda não há avaliações

- Form For Ingress and EgressDocumento4 páginasForm For Ingress and Egressrhizza basilioAinda não há avaliações

- Schools Division Office of Isabela: 201 File ChecklistDocumento3 páginasSchools Division Office of Isabela: 201 File ChecklistRichardSanchezPicazaAinda não há avaliações

- Certificate KinderDocumento1 páginaCertificate KinderLadybrown Taurus100% (1)

- Bir Form 0605Documento2 páginasBir Form 0605alona_245883% (6)

- Diploma Grade 12 IctDocumento42 páginasDiploma Grade 12 IctMAE ANN TOLENTINOAinda não há avaliações

- Application For Permit To Study: Gusa National High School - Cugman AnnexDocumento1 páginaApplication For Permit To Study: Gusa National High School - Cugman AnnexMiri Mor TimAinda não há avaliações

- Cav Fillable Form 9 - 13Documento1 páginaCav Fillable Form 9 - 13K-Cube MorongAinda não há avaliações

- MDR PDFDocumento1 páginaMDR PDFbenjey24Ainda não há avaliações

- Application For Permit To Study: Division of Cagayan de Oro CityDocumento1 páginaApplication For Permit To Study: Division of Cagayan de Oro Cityenelra08100% (1)

- Authorization LetterDocumento1 páginaAuthorization Letterromelio salumbidesAinda não há avaliações

- Service Record: (To Be Accomplished by The Employee)Documento1 páginaService Record: (To Be Accomplished by The Employee)Gerald RojasAinda não há avaliações

- Bir Form 2306Documento2 páginasBir Form 2306Ralp LiboonAinda não há avaliações

- Bir Forms PDFDocumento4 páginasBir Forms PDFgaryAinda não há avaliações

- 82255BIR Form 1701Documento12 páginas82255BIR Form 1701Leowell John G. RapaconAinda não há avaliações

- New Income Tax Return BIR Form 1700 - November 2011 RevisedDocumento4 páginasNew Income Tax Return BIR Form 1700 - November 2011 RevisedBusinessTips.Ph100% (2)

- Bir Form 1702-RtDocumento8 páginasBir Form 1702-RtShiela PilarAinda não há avaliações

- 82202BIR Form 1702-MXDocumento9 páginas82202BIR Form 1702-MXJp AlvarezAinda não há avaliações

- 1702-EX June 2013 Pages 1 To 2 PDFDocumento2 páginas1702-EX June 2013 Pages 1 To 2 PDFJulio Gabriel AseronAinda não há avaliações

- 82202BIR Form 1702-MXDocumento9 páginas82202BIR Form 1702-MXRen A EleponioAinda não há avaliações

- Income TaxDocumento6 páginasIncome TaxKuldeep HoodaAinda não há avaliações

- NNNDocumento4 páginasNNNJemely BagangAinda não há avaliações

- BIR FormDocumento4 páginasBIR FormfyeahAinda não há avaliações

- IT Return 2011 2012Documento3 páginasIT Return 2011 2012swapnil6121986Ainda não há avaliações

- 1702 June 2011Documento18 páginas1702 June 2011fatmaaleahAinda não há avaliações

- 1701qjuly2008 (ENCS)Documento5 páginas1701qjuly2008 (ENCS)Mary Rose AnilloAinda não há avaliações

- 2012 Itr1 Pr21Documento5 páginas2012 Itr1 Pr21MRLogan123Ainda não há avaliações

- Bir Form 1702-ExDocumento7 páginasBir Form 1702-ExdignaAinda não há avaliações

- Quarterly Income Tax Return: (YYYY) 1st 2nd 3rd Yes NoDocumento1 páginaQuarterly Income Tax Return: (YYYY) 1st 2nd 3rd Yes NoAlexis TrinidadAinda não há avaliações

- Monthly Value-Added Tax DeclarationDocumento17 páginasMonthly Value-Added Tax DeclarationMIRAHNELAinda não há avaliações

- ITR-4S: Assessment Year (Presumptive Business Income Tax Return) Indian Income Tax Return SugamDocumento11 páginasITR-4S: Assessment Year (Presumptive Business Income Tax Return) Indian Income Tax Return SugamcachandhiranAinda não há avaliações

- 2550Mv 2Documento7 páginas2550Mv 2nelsonAinda não há avaliações

- Gross Total Income (1+2c) 4: System CalculatedDocumento3 páginasGross Total Income (1+2c) 4: System CalculatedDHARAMSONIAinda não há avaliações

- Bir Form Percentage TaxDocumento3 páginasBir Form Percentage TaxEc MendozaAinda não há avaliações

- Monthly Value-Added Tax Declaration: Kawanihan NG Rentas InternasDocumento9 páginasMonthly Value-Added Tax Declaration: Kawanihan NG Rentas InternasAdriel Torreda NaturalAinda não há avaliações

- BIR Form 2551MDocumento4 páginasBIR Form 2551MJun Casono100% (2)

- Form 16, Tax Deduction at Source... Income Tax of IndiaDocumento2 páginasForm 16, Tax Deduction at Source... Income Tax of IndiaDrAnilkesar GohilAinda não há avaliações

- Alex Tiongco Vbs. People Mar. 11, 2015Documento5 páginasAlex Tiongco Vbs. People Mar. 11, 2015miles1280Ainda não há avaliações

- Raza Vs DaikokuDocumento1 páginaRaza Vs Daikokumiles1280100% (1)

- My Prayer To GodDocumento1 páginaMy Prayer To Godmiles1280Ainda não há avaliações

- Beralde Vs LapandayDocumento4 páginasBeralde Vs Lapandaymiles1280Ainda não há avaliações

- Civil Law Cases 2010-2011 (Uribe)Documento988 páginasCivil Law Cases 2010-2011 (Uribe)miles1280Ainda não há avaliações

- Carpio Morales Cases 2003Documento39 páginasCarpio Morales Cases 2003miles1280Ainda não há avaliações

- Manuel Portugez vs. People Jan. 14, 2015Documento7 páginasManuel Portugez vs. People Jan. 14, 2015miles1280Ainda não há avaliações

- The Prime Glossary - Sieve of Eratosthenes PDFDocumento3 páginasThe Prime Glossary - Sieve of Eratosthenes PDFmiles1280Ainda não há avaliações

- A.M. No. 12-12-11-SC (Financial Rehabilitation Rules of Procedure)Documento66 páginasA.M. No. 12-12-11-SC (Financial Rehabilitation Rules of Procedure)rocket_blue100% (5)

- Jollibee Financial AnalysisDocumento4 páginasJollibee Financial Analysismiles1280Ainda não há avaliações

- LRA Circular No. 11-2002 - Schedule of Fess of The LRADocumento16 páginasLRA Circular No. 11-2002 - Schedule of Fess of The LRAMelvin BanzonAinda não há avaliações

- Administrative Law ReviewerDocumento73 páginasAdministrative Law ReviewerShiena Angela Aquino100% (9)

- Show RoomDocumento1 páginaShow Roommiles1280Ainda não há avaliações

- Barnotes 2011 BorDocumento15 páginasBarnotes 2011 Bormiles1280Ainda não há avaliações

- GP AnalysisDocumento25 páginasGP Analysismiles1280Ainda não há avaliações

- 24 Effective Closing Tech - Brian TracyDocumento30 páginas24 Effective Closing Tech - Brian Tracyadi_vijAinda não há avaliações

- The Obligations of Airlines and The Rights of PassengersDocumento6 páginasThe Obligations of Airlines and The Rights of Passengersmiles1280Ainda não há avaliações

- Legal Environment of Philiippine Business & Management ADM 220Documento1 páginaLegal Environment of Philiippine Business & Management ADM 220miles1280Ainda não há avaliações

- Sources of VariationDocumento12 páginasSources of Variationmiles1280Ainda não há avaliações

- A.M. No. 12-12-11-SC (Financial Rehabilitation Rules of Procedure)Documento66 páginasA.M. No. 12-12-11-SC (Financial Rehabilitation Rules of Procedure)rocket_blue100% (5)

- I. Administrative Laws: Scope of Power of Administrative AgenciesDocumento8 páginasI. Administrative Laws: Scope of Power of Administrative Agenciesmiles1280Ainda não há avaliações

- Lecture 2 (Banking)Documento108 páginasLecture 2 (Banking)miles1280100% (1)

- Barnotes 2011 PilDocumento44 páginasBarnotes 2011 Pilmiles1280Ainda não há avaliações

- How To File Your Income Tax Return in The Philippines-COMPENSATIONDocumento10 páginasHow To File Your Income Tax Return in The Philippines-COMPENSATIONmiles1280Ainda não há avaliações

- UP Bar Reviewer 2013 - TaxationDocumento210 páginasUP Bar Reviewer 2013 - TaxationPJGalera89% (28)

- How To Fill Up The New Philippine Bir Itr For CorpDocumento6 páginasHow To Fill Up The New Philippine Bir Itr For Corpmiles1280Ainda não há avaliações

- Mortimer vs. GoDocumento3 páginasMortimer vs. Gomiles1280Ainda não há avaliações

- How To File Your Income Tax Return in The Philippines-COMPENSATIONDocumento10 páginasHow To File Your Income Tax Return in The Philippines-COMPENSATIONmiles1280Ainda não há avaliações

- Concurrence& Preference of Credit & PartnershipDocumento5 páginasConcurrence& Preference of Credit & Partnershipmiles1280Ainda não há avaliações

- BSBFIM601 Hints For Task 2Documento32 páginasBSBFIM601 Hints For Task 2Marwan Issa71% (7)

- Wealth Investment Management PresentationDocumento23 páginasWealth Investment Management Presentationratnesh singhAinda não há avaliações

- (Notes) FAR Summary (NICE)Documento48 páginas(Notes) FAR Summary (NICE)Anne Echavez PascoAinda não há avaliações

- Analyzing Operating ActivitiesDocumento38 páginasAnalyzing Operating ActivitiesindahmuliasariAinda não há avaliações

- Closing Entries and The Post-Closing Trial Balance: Teacher VersionDocumento21 páginasClosing Entries and The Post-Closing Trial Balance: Teacher VersionMary Joyce GarciaAinda não há avaliações

- New Annual Report ERC Form DU AO1 1Documento97 páginasNew Annual Report ERC Form DU AO1 1Jopan SJAinda não há avaliações

- Company Analysis Report (Raymond)Documento33 páginasCompany Analysis Report (Raymond)balaji bysani100% (2)

- 1Documento13 páginas1gamalbedAinda não há avaliações

- F ProjectDocumento172 páginasF ProjectManish JaiswalAinda não há avaliações

- QuestionDocumento2 páginasQuestionyaniAinda não há avaliações

- PolestarDocumento3 páginasPolestarKian TuckAinda não há avaliações

- CIR vs. St. Lukes Medical Center Inc. G.R. No. 195909Documento7 páginasCIR vs. St. Lukes Medical Center Inc. G.R. No. 195909ZeusKimAinda não há avaliações

- Financial Management For Decision Makers Canadian 2nd Edition Atrill Solutions ManualDocumento35 páginasFinancial Management For Decision Makers Canadian 2nd Edition Atrill Solutions Manualalmiraelysia3n4y8100% (26)

- Philamlife V. Cta DoctrineDocumento1 páginaPhilamlife V. Cta DoctrineChiiAinda não há avaliações

- Accounting Concepts & ConventionsDocumento2 páginasAccounting Concepts & ConventionsKartik KAinda não há avaliações

- 10 CIR V CitytrustDocumento1 página10 CIR V CitytrustAnn QuebecAinda não há avaliações

- Accounts FinalDocumento28 páginasAccounts FinalSatyam SinghAinda não há avaliações

- Chapter 4 SolutionsDocumento85 páginasChapter 4 SolutionssevtenAinda não há avaliações

- FABM 1 - Module 1 - Introduction of AccountingDocumento11 páginasFABM 1 - Module 1 - Introduction of AccountingKatrina MorillaAinda não há avaliações

- International Finance - TCS Case StudyDocumento22 páginasInternational Finance - TCS Case StudyPrateek SinglaAinda não há avaliações

- Statement of Profit or Loss For The Year Ended 31 March 2009Documento1 páginaStatement of Profit or Loss For The Year Ended 31 March 2009Plawan GhimireAinda não há avaliações

- Adjusting Entries Notes CompressDocumento7 páginasAdjusting Entries Notes CompressJason YulinaAinda não há avaliações

- Understanding and Analysis and Interpretation of Financial StatementsDocumento18 páginasUnderstanding and Analysis and Interpretation of Financial StatementsLara FloresAinda não há avaliações

- HikalDocumento22 páginasHikalADAinda não há avaliações

- Fy2024 Budget Book Final Proposed 3.7.23 3Documento78 páginasFy2024 Budget Book Final Proposed 3.7.23 3Dave BondyAinda não há avaliações

- Principles of AccountingDocumento10 páginasPrinciples of AccountingSohail Liaqat AliAinda não há avaliações

- E-Mechanic Business PlanDocumento40 páginasE-Mechanic Business PlanSana Jameel100% (1)