Escolar Documentos

Profissional Documentos

Cultura Documentos

Rangkuman UTS

Enviado por

scorpion1820 notas0% acharam este documento útil (0 voto)

270 visualizações7 páginas1. This document provides examples of calculating bid-ask spreads for different currency pairs. It also defines direct and indirect currency quotations.

2. It gives an example of calculating the expected cash flows in US dollars for a company expecting cash inflows in multiple currencies at the end of the year using current exchange rates.

3. It provides two examples of currency speculation - one where the currency appreciates and one where it depreciates - to calculate the potential dollar profit from borrowing and investing in the foreign currency over a short period.

Descrição original:

rangkuman uts finance

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

DOCX, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documento1. This document provides examples of calculating bid-ask spreads for different currency pairs. It also defines direct and indirect currency quotations.

2. It gives an example of calculating the expected cash flows in US dollars for a company expecting cash inflows in multiple currencies at the end of the year using current exchange rates.

3. It provides two examples of currency speculation - one where the currency appreciates and one where it depreciates - to calculate the potential dollar profit from borrowing and investing in the foreign currency over a short period.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

270 visualizações7 páginasRangkuman UTS

Enviado por

scorpion1821. This document provides examples of calculating bid-ask spreads for different currency pairs. It also defines direct and indirect currency quotations.

2. It gives an example of calculating the expected cash flows in US dollars for a company expecting cash inflows in multiple currencies at the end of the year using current exchange rates.

3. It provides two examples of currency speculation - one where the currency appreciates and one where it depreciates - to calculate the potential dollar profit from borrowing and investing in the foreign currency over a short period.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

Você está na página 1de 7

1.

Computation of the Bid Ask Spread

Bid/Ask Spread = (Ask Rate Bid Rate) / Ask Rate

Currency Bid Rate Ask Rate (Ask Rate

Bid Rate) /

Ask Rate

= Bid/Ask Per

Spread

GBP $ 1.52 $ 1.60 ($ 1.60 - $

1.52) / $ 1.60

= 0.05 or 5%

JPY $ 0.0070 $ 0.0074 ($ 0.0074 $

0.0070) / $

0.0074

= 0.054 or 5.4 %

Notes : Lebih kecil lebih liquid

2. Direct quotation, represents the value of a foreign currency in dollars, ex: $ 1.40 per Euro.

3. Indirect quotation, represents the number of units of a foreign currency per dollar, ex: 0.7143 per

dollar

Indirect quotation = 1 / Direct quotation

4. Cross exchange rate, ex:

Value of peso = $0.07

Value of Canadian dollar = $0.70

Value of peso in C$ = Value of peso in $/Value of C$ in $

= $0.07/$0.70

= C$ 0.10

5. Percent in foreign currency value = S-St-1/St-1, ex :

Value of C$ Monthly % change

in C$

Value of Euro Monthly % change

in Euro

Jan 1 $ .70 o $1.18 o

Feb 1 $ .71 +1.43% $1.16 -1.69%

6. Assume that Live Co. has expected cash flows of $100,000 from domestic operations, SF100,000 from

Swiss operations, and 75,000 euros from Italian operations at the end of the year. The Swiss franc's

value and euro's value are expected to be $0.83 and $1.29 respectively, at the end this year. What are

the expected dollar cash flows of Live Co?

= $ 100,000 + $ (100,000 * 0.83) + $ (75,000 * 1.29)

= $ 100,000 + $ 83,000 + $ 96,750

= $ 279.750

7. Baylor Bank believes the New Zealand dollar will appreciate over the next five days from $.48 to $.50.

The following annual interest rates apply: (APPRECIATE)

Currency Lending Rate Borrowing Rate

Dollars 7.10% 7.50%

New Zealand dollar (NZ$) 6.80% 7.25%

Baylor Bank has the capacity to borrow either NZ$10 million or $5 million. If Baylor Bank's forecast is

correct, what will its dollar profit be from speculation over the five-day period (assuming it does not use

any of its existing consumer deposits to capitalize on its expectations)?

o Borrow $5 million.

o Convert to NZ$: $5,000,000/$0.48 = NZ$10,416,667.

o Invest the NZ$ at an annualized rate of 6.80% over five days.

NZ$10,416,667 x [1 + 6.80% (5/360)]

= NZ$10,426,505

o Convert the NZ$ back to dollars:

NZ$10,426,505 x $.50 = $5,213,252

o Repay the dollars borrowed. The repayment amount is:

$5,000,000 x [1 + 7.5% (5/360)]

= $5,000,000 x [1.00104]

= $5,005,208

o After repaying the loan, the remaining dollar profit is:

$5,213,252 - $5,005,208 = $208,044

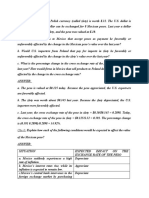

8. Assume the following information regarding U.S. and European annualized interest rates:

(DEPRECIATE)

Currency Lending Rate Borrowing Rate

U.S. Dollar ($) 6.73% 7.20%

Euro () 6.80% 7.28%

Trensor Bank can borrow either $20 million or 20 million. The current spot rate of the euro is $1.13.

Furthermore, Trensor Bank expects the spot rate of the euro to be $1.10 in 90 days. What is Trensor

Bank's dollar profit from speculating if the spot rate of the euro is indeed $1.10 in 90 days?

Borrow 20 million.

Convert the 20 million to 20,000,000 x $1.13 = $22,600,000.

Invest the $22,600,000 at an annualized rate of 6.73% for 90 days.

$22,600,000 x [1 + 6.73% (90/360)]

= $22,980,245

Determine euros owed: 20,000,000 x [1 + 7.28% (90/360)] = 20,364,000.

Determine dollars needed to repay euro loan: 20,364,000 x $1.10 = $22,400,400.

The dollar profit is $22,980,245 - $22,400,400 = $579,845.

9. The one-year forward rate of the British pound is quoted at $1.62, and the spot rate of the British pound

is quoted at $1.65. The forward ____ is ____ percent.

(F/S) 1 = ($1.62/$1.65) 1 = 1.8 percent. (klo minus discount)

10. The 90-day forward rate for the euro is $1.05, while the current spot rate of the euro is $1.07. What is

the annualized forward premium or discount of the euro?

[(F/S) 1] x 360/90 = 7.5 percent.

11. The 180-day forward rate for the euro is $1.34, while the current spot rate of the euro is $1.29. What is

the annualized forward premium or discount of the euro?

[(F/S) 1] x 360/180 = [($1.34/$1.29) 1] x 360/180 = 7.75%

12. You purchase a call option on pounds for a premium of $0.04 per unit, with an exercise price of $1.64;

the option will not be exercised until the expiration date, if at all. If the spot rate on the expiration date is

$1.65, your net profit per unit is:

Net profit per unit = $1.65 $1.64 $0.04 = $0.03.

13. Your company will receive AUD600,000 in 90 days. The 90-day forward rate in the Australian dollar is

$0.75. If you use a forward hedge, you will:

AUD600,000 x $0.75 = $450,000

Assume the following information:

U.S. deposit rate for 1 year = 11%

U.S. borrowing rate for 1 year = 12%

Swiss deposit rate for 1 year = 8%

Swiss borrowing rate for 1 year = 10%

Swiss forward rate for 1 year = $0.40

Swiss franc spot rate = $0.39

Also assume that a U.S. exporter denominates its Swiss exports in Swiss francs and expects to receive

SF600,000 in 1 year.

Using the information above, what will be the approximate value of these exports in 1 year in U.S.

dollars given that the firm executes a forward hedge?

SF600,000 x $.40 = $240,000

14. Assume the following information:

U.S. deposit rate for 1 year = 11%

U.S. borrowing rate for 1 year = 12%

New Zealand deposit rate for 1 year = 8%

New Zealand borrowing rate for 1 year = 10%

New Zealand dollar forward rate for 1 year = $0.40

New Zealand dollar spot rate = $0.39

Also assume that a U.S. exporter denominates its New Zealand exports in NZ$ and expects to receive

NZ$600,000 in 1 year. You are a consultant for this firm.

Using the information above, what will be the approximate value of these exports in 1 year in U.S.

dollars given that the firm executes a money market hedge?

Borrow NZ$545,455 (NZ$600,000/1.1) = NZ$545,455.-> 1.1 dari 1+0.1 (10% borrow rate NZD)

Convert NZ$545,455 to $212,727 (at $.39 per NZ$).

Invest $212,727 to accumulate $236,127 ($212,727 x 1.11) = $236,127. -> 1.11 dari 1+0.11

(11% deposit rate USD)

Klo AR put, klo AP call

Klo AR cari pilihan yang return paling besar

Klo AP cari pilihan yang return paling kecil

Você também pode gostar

- Inside the Currency Market: Mechanics, Valuation and StrategiesNo EverandInside the Currency Market: Mechanics, Valuation and StrategiesAinda não há avaliações

- MF 6Documento29 páginasMF 6Hueg HsienAinda não há avaliações

- 683sol04 PDFDocumento46 páginas683sol04 PDFJonah MoyoAinda não há avaliações

- MF Tutorial 6Documento29 páginasMF Tutorial 6Hueg Hsien0% (1)

- International Corporate FinanceDocumento8 páginasInternational Corporate FinanceAnirudh DewadaAinda não há avaliações

- Practice Questions - International FinanceDocumento18 páginasPractice Questions - International Financekyle7377Ainda não há avaliações

- Shrikhande International Finance Fall 2010 Problem Set 1: NswerDocumento7 páginasShrikhande International Finance Fall 2010 Problem Set 1: NswerHwa Tee HaiAinda não há avaliações

- Chapter 014Documento12 páginasChapter 014Shinju Sama100% (1)

- ch06 IMDocumento7 páginasch06 IMlokkk333Ainda não há avaliações

- Total Points: 20, Time: 20 Min: 2. Define Interlocking Directorates. How Are They Perceived in The SWM and inDocumento5 páginasTotal Points: 20, Time: 20 Min: 2. Define Interlocking Directorates. How Are They Perceived in The SWM and inFolk BluesAinda não há avaliações

- Currency Derivatives C (Chapter 5)Documento10 páginasCurrency Derivatives C (Chapter 5)Evelina WiszniewskaAinda não há avaliações

- Shapiro Chapter 07 SolutionsDocumento12 páginasShapiro Chapter 07 SolutionsRuiting Chen100% (1)

- Fix 336Documento6 páginasFix 336Bánh BaoAinda não há avaliações

- TCQT - Revision - Problem - For - Final - Exam 2023 Part 2Documento2 páginasTCQT - Revision - Problem - For - Final - Exam 2023 Part 220070095Ainda não há avaliações

- Topic 3 For Students International ParityDocumento71 páginasTopic 3 For Students International Paritywanimtiaz9150Ainda não há avaliações

- Practice Question of International ArbitrageDocumento5 páginasPractice Question of International ArbitrageHania DollAinda não há avaliações

- PS7 Primera ParteDocumento5 páginasPS7 Primera PartethomasAinda não há avaliações

- BUS3026W Objective Test 8 SolutionsDocumento5 páginasBUS3026W Objective Test 8 Solutionsapi-3708231100% (1)

- Exchange Rate Determination: SOLUTION: ($0.73 - $0.69) /$0.69 5.80%Documento11 páginasExchange Rate Determination: SOLUTION: ($0.73 - $0.69) /$0.69 5.80%Trần Thị Bảo TrinhAinda não há avaliações

- Microsoft Word - Module 1Documento4 páginasMicrosoft Word - Module 1sshreyasAinda não há avaliações

- International Finance IF4 - FX MarketsDocumento37 páginasInternational Finance IF4 - FX MarketsMariem StylesAinda não há avaliações

- HW2 Assignment - CH 4,5 - FIN465 Fall 2015Documento3 páginasHW2 Assignment - CH 4,5 - FIN465 Fall 2015Le Quang AnhAinda não há avaliações

- Lecture 3 PracticeDocumento9 páginasLecture 3 PracticeMithona855Ainda não há avaliações

- Chapter 5 6 - Solutions For Recommended End-Of-Chapter ProblemsDocumento5 páginasChapter 5 6 - Solutions For Recommended End-Of-Chapter Problemsminh vận đỗAinda não há avaliações

- WE - 12 - Exchange Rates and FX MarketsDocumento23 páginasWE - 12 - Exchange Rates and FX MarketsKholoud KhaledAinda não há avaliações

- Problem Set 4Documento7 páginasProblem Set 4WristWork Entertainment100% (1)

- Chapter Fourteen Foreign Exchange RiskDocumento14 páginasChapter Fourteen Foreign Exchange Risknmurar01Ainda não há avaliações

- FOREX QuestionsDocumento16 páginasFOREX QuestionsParvesh AghiAinda não há avaliações

- Int Finance Practice - SolDocumento7 páginasInt Finance Practice - SolAlexisAinda não há avaliações

- ch6 328Documento5 páginasch6 328Jeremiah KhongAinda não há avaliações

- FRA and SWAPSDocumento49 páginasFRA and SWAPSBluesinhaAinda não há avaliações

- Lecture04 Derivatives StudentDocumento22 páginasLecture04 Derivatives StudentMit DaveAinda não há avaliações

- Lecture 1 Question RiskDocumento2 páginasLecture 1 Question RiskJody BuiAinda não há avaliações

- IlliquidDocumento3 páginasIlliquidyến lêAinda não há avaliações

- FINA3020 Assignment3Documento5 páginasFINA3020 Assignment3younes.louafiiizAinda não há avaliações

- Multinational Financial Management 9th Edition Shapiro Solutions ManualDocumento12 páginasMultinational Financial Management 9th Edition Shapiro Solutions Manualdecardbudgerowhln100% (35)

- Multinational Financial Management 9Th Edition Shapiro Solutions Manual Full Chapter PDFDocumento33 páginasMultinational Financial Management 9Th Edition Shapiro Solutions Manual Full Chapter PDFheadmostzooenule.s8hta6100% (8)

- EOC13Documento28 páginasEOC13jl123123Ainda não há avaliações

- Speculating On Anticipated Exchange RateDocumento9 páginasSpeculating On Anticipated Exchange RatefaisalharaAinda não há avaliações

- End of Chapter Exercises - Answers: Chapter 18: Spot and Forward MarketsDocumento4 páginasEnd of Chapter Exercises - Answers: Chapter 18: Spot and Forward MarketsYvonneAinda não há avaliações

- Unit III International ArbitrageDocumento14 páginasUnit III International ArbitrageanshuldceAinda não há avaliações

- HW2 QDocumento6 páginasHW2 Qtranthithanhhuong25110211Ainda não há avaliações

- Chapter 9Documento6 páginasChapter 9smileseptemberAinda não há avaliações

- Foreign Exchange Rates: September 2016Documento9 páginasForeign Exchange Rates: September 2016hayama317Ainda não há avaliações

- Chapter 15 HW SolutionDocumento5 páginasChapter 15 HW SolutionZarifah FasihahAinda não há avaliações

- Chapter 4Documento14 páginasChapter 4Selena JungAinda não há avaliações

- Sample QuestionDocumento9 páginasSample QuestionYussone Sir'YussAinda não há avaliações

- International Financial ManagementDocumento23 páginasInternational Financial Managementmartins faithAinda não há avaliações

- Homework Connect 6ptsDocumento5 páginasHomework Connect 6ptsAndrés GuecháAinda não há avaliações

- Suggested Solutions To Chapter 7 Problems: NswerDocumento4 páginasSuggested Solutions To Chapter 7 Problems: NswerDINI RAHMADIANTI100% (1)

- FM 04 Lecture 10Documento18 páginasFM 04 Lecture 10Aniket PuriAinda não há avaliações

- 6 International Parity Relationships and Forecasting Foreign Exchange RatesDocumento57 páginas6 International Parity Relationships and Forecasting Foreign Exchange Ratesreena2412Ainda não há avaliações

- APP1 Montesde Oca ADocumento6 páginasAPP1 Montesde Oca AAF MontoscaAinda não há avaliações

- Chapter 4-Exchange Rate DeterminationDocumento21 páginasChapter 4-Exchange Rate DeterminationMelva CynthiaAinda não há avaliações

- Foreign Exchange Arithmetic Worksheet (With Answers)Documento4 páginasForeign Exchange Arithmetic Worksheet (With Answers)Viresh YadavAinda não há avaliações

- USM1 FIN 614 Week02 WorkProblemsWorksheetDocumento13 páginasUSM1 FIN 614 Week02 WorkProblemsWorksheetwaszenvAinda não há avaliações

- Solutions: SAMPLE 1: EXAM 4: FINA 4500Documento3 páginasSolutions: SAMPLE 1: EXAM 4: FINA 4500Kamran AliAinda não há avaliações

- Beat Housing Inflation with Dividends: Financial Freedom, #231No EverandBeat Housing Inflation with Dividends: Financial Freedom, #231Ainda não há avaliações

- Financial Statement Analysis Professor Julian Yeo: 1 You May Only Share These Materials With Current Term StudentsDocumento25 páginasFinancial Statement Analysis Professor Julian Yeo: 1 You May Only Share These Materials With Current Term StudentsHE HUAinda não há avaliações

- Limketkai Sons Milling, Inc., vs. Court of Appeals, Et. AlDocumento5 páginasLimketkai Sons Milling, Inc., vs. Court of Appeals, Et. AlKPPAinda não há avaliações

- Nietes Vs CADocumento11 páginasNietes Vs CAJay-ar TeodoroAinda não há avaliações

- Accounting Test Bank 2Documento73 páginasAccounting Test Bank 2likesAinda não há avaliações

- Share Based Compensation Cheat SheetDocumento2 páginasShare Based Compensation Cheat SheetJaneAinda não há avaliações

- Quiz Internal AccountingDocumento3 páginasQuiz Internal AccountingMili Dit100% (1)

- (Merrill Lynch, Youssfi) Convexity Adjustment For Volatility SwapsDocumento18 páginas(Merrill Lynch, Youssfi) Convexity Adjustment For Volatility Swapsm325075Ainda não há avaliações

- CH 19Documento26 páginasCH 19Samphors SengAinda não há avaliações

- Foreign Exchange Risk Management - International Financial Environment, International Business - EduRev NotesDocumento8 páginasForeign Exchange Risk Management - International Financial Environment, International Business - EduRev Notesswatisin93Ainda não há avaliações

- Focus Questions For Laura MartinDocumento10 páginasFocus Questions For Laura MartinEyiram Adanu100% (2)

- A Study On Derivatives and Risk ManagementDocumento77 páginasA Study On Derivatives and Risk ManagementShabeerAinda não há avaliações

- QUIZ FinanceDocumento39 páginasQUIZ FinanceAbhishek YadavAinda não há avaliações

- How To Record IFRS 16 LeaseDocumento24 páginasHow To Record IFRS 16 Leasehur hussainAinda não há avaliações

- Civil Law Reviewer: Law On SalesDocumento48 páginasCivil Law Reviewer: Law On Salesviktor samuel fontanilla88% (43)

- Câu 5: Assume That The Polish Currency (Called Zloty) Is Worth $.32. The U.S. Dollar IsDocumento4 páginasCâu 5: Assume That The Polish Currency (Called Zloty) Is Worth $.32. The U.S. Dollar IsQuốc HuyAinda não há avaliações

- Govt Emerson College, Multan: Name: Iqra KhalilDocumento21 páginasGovt Emerson College, Multan: Name: Iqra KhalilZain ShahidAinda não há avaliações

- Research of The StudyDocumento50 páginasResearch of The StudyRuchi KapoorAinda não há avaliações

- Active Soa TemplateDocumento38 páginasActive Soa TemplatejamesAinda não há avaliações

- Fin Mar Ce 910Documento29 páginasFin Mar Ce 910moriary artAinda não há avaliações

- Financial Management: Page 1 of 7Documento7 páginasFinancial Management: Page 1 of 7cima2k15Ainda não há avaliações

- ISB Consulting Casebook 2013 - FinalDocumento86 páginasISB Consulting Casebook 2013 - FinalAAinda não há avaliações

- Bloomberg ReferenceDocumento112 páginasBloomberg Referencephitoeng100% (1)

- 7 Derivatives and Risk ManagementDocumento8 páginas7 Derivatives and Risk ManagementIm NayeonAinda não há avaliações

- Limketkai Sons Milling v. CADocumento10 páginasLimketkai Sons Milling v. CAKPPAinda não há avaliações

- PS 2 SolutionDocumento3 páginasPS 2 Solutionwasp1028100% (1)

- Journal 13Documento168 páginasJournal 13forasepAinda não há avaliações

- Preview PDFDocumento6 páginasPreview PDFMATHANA SOORIA A/P ADEYAH MoeAinda não há avaliações

- 123Documento47 páginas123Romeo Romario GintingAinda não há avaliações

- Trend Follower - 2nd IssueDocumento6 páginasTrend Follower - 2nd IssuecrystalAinda não há avaliações

- Describe The Major Features of Valuing Futures, Forwards and SwapsDocumento25 páginasDescribe The Major Features of Valuing Futures, Forwards and SwapsflichuchaAinda não há avaliações