Escolar Documentos

Profissional Documentos

Cultura Documentos

Marykayfinal

Enviado por

api-253948487Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Marykayfinal

Enviado por

api-253948487Direitos autorais:

Formatos disponíveis

Mary

Kay

J ason J ones

To increase consideration for product purchase and for the Mary Kay business

opportunity among female consumers ages 18 25.

The beauty and personal care industry is a continuously growing market

reaching more than $63.1 billion dollars in sales. With such a large market, Mary Kay

has the unique opportunity to capture a larger share of market. In order to do so,

Mary Kay needs to focus its efforts into enhancing three components of the

purchasing process. These three components include convenience, technology, and

experience.

Consumers today are more inclined to take the most convenient route to

purchase a product rather than the most benecial. Consumers feel that the ability to

enter a store and purchase a product on their own time is a matter of importance.

Technology is ever changing allowing people to interact and communicate much

more quickly and efciently than ever before. Consumers are nding new ways to use

this new communication to help better their purchasing decisions.

Consumers look for ways to experience the product before it is purchased. This

allows them to understand the product and how it will perform after its purchase.

Experience has become more important especially in the beauty world as many stores

allow their customers to try before they buy.

Marketing

Objectives

Situational

Analysis

Competitive

Analysis

SWOT

Analysis

To increase awareness among female consumers ages 18 25.

To increase positive perception among female consumers ages 18 25.

The competition in the beauty industry can be categorized in

many different ways. The competition we chose to focus on was

determined by their digital presence and their share of market.

The competition we will be focusing on is Neutrogena, Maybelline,

Avon, Clinique, and Estee Lauder.

Neutrogena

Positioned as great skin care product

for a reasonable price

#1 Dermatologist Recommended.

Top market share for the skin category

with 7.3%

Maybelline

Maybelline New York

Top market share of color with 9.8%

A high reach to Generation Y using

Instagram, Youtube, and Pinterest

Perceived as convenient with its

availability in brick and mortar stores

Avon

The company for women

High brand awareness

Perceived as an older brand

Strong digital presence

Clinique

Allergy Tested. 100% Fragrance Free.

Top 5 market share in both skin and color

Positioned as a high quality make up that

is safe to use on sensitive skin

Estee Lauder

Dening Beauty

Mary Kays closest competitor in market

share in all three categories

Perceived as an older brand

Strengths

Strong brand of more than 50 years with an established

image and following

Customers can try the product before buying it

In top ten make-up brands in America

Has solid digital presence in Youtube, Pinterest and

Facebook

Weaknesses

Perceived as abrand for older women

Perceived inconvenient purchasing process

Lacking full potential in all digital realms

Perception of sales pressure at Mary Kay parties

Opportunities

Can revamp all forms of digital communication including

social mediaand website

Can create apersonalized and unique experience for

each purchase

Can emphasize the ability to try out the product before

purchase

Can re-brand image of the Mary Kay party

Treats

Avon, the closest competition in the direct selling

market, has astrong presence in social media

Companies with brick and mortar stores hold 80% of

the beauty care sales in America

Companies such as Clinique and Estee Lauder hold a

higher percentage of the market in two or more

of the categories of skin, color, or fragrance.

Supporting

Research

Overview

In order to gain insight into the lives of women in Gen. Y, their views on make-up and Mary Kay, and the inner

workings of Mary Kay itself, we conducted thorough primary research using focus groups, personal IBC interviews,

surveys, target audience observation, and secret shopping.

We became aware of the target audiences priority of convenience followed by price and quality, their need for

make-up as a condence booster, as well as their overall lack of brand awareness to Mary Kay. We also found areas of

improvement in all digital areas including social media and the website.

Focus Groups

Method: Our six different focus groups allowed us to get to know the target audience in a personal and

qualitative level. Creating a relaxed and safe environment for them to explain their feelings and attitudes

allowed for deep and meaningful insight into their lives.

Findings: Through generalized questions to help eliminate bias, we learned what these women are

looking for in their make-up, skin care, and fragrances. We found that convenience in their purchases reign

supreme with price and quality coming in at close second. They also feel the need to learn through directions

and tutorials how to properly apply their product using it to the best of their ability.

When questions were asked specically about Mary Kay, the consensus was less of a negative

attitude towards Mary Kay and rather a lack of awareness of the brand as a whole. The minority who were

aware of the brand related it merely to pink Cadillacs, older women, and our competition, Avon. They feel

that Mary Kay is not readily available and are less likely to attend parties due to the perceived sales pressure.

On the topic of the digital realm, the members of the target audience revealed themselves to

be heavy users of social media sites and websites used for communication and reviews. Many of the target

audience follows make-up brands on social media but feel that Mary Kay is not present enough to make an

impact in their daily life.

Observations

Method: The four observations we conducted helped us to witness the target audience in a typical

make-up purchasing situation. We observed potential customers in stores such as Sephora, Ulta, Belk, and

department stores.

Findings: We found that the younger generation is attracted by sales and lower prices. They also

appreciate the help of sales people but rely more heavily on the input of their friends or family.

Personal Interviews

Method: In order to gain insight into the important world of the Independent Beauty Consultant, we conducted seven personal

interviews. These were all conducted face to face with pre-determined questions to ask the IBC. This is an area that is of the utmost

importance, as the client does not deal with Mary Kay directly rather the IBC who is an extension of the company.

Findings: The typical age of an IBCs clientele, whether part time or full time, is found to be in the thirties and forties. Many IBCs

use samples and gift-giving as ways to promote their products, as well as promoting Mary Kays return policy.

The typical IBC and the target audience seem to have contradictory views on certain aspects of the company. IBCs

view their product as competitive in pricing to competitors where the target audience perceives it as out of their price range. IBCs

also feel that the product sells itself where the target audience feels that the IBC is pushy and puts pressure on them to buy.

The relationship that IBCs have with Mary Kay is usually positive and that the company is supportive of their needs.

Some concerns that were expressed include the IBC paying for too many things out of pocket, the website not being user friendly,

and the advertising provided by them from the company is outdated and not effective.

Secret Shoppers

Method: To gain the insight of a potential customer of Mary Kay,

we went undercover to a Mary Kay party.

Findings: Unlike the perception of the target audience, the party

had no sense of sales pressure and provided a large array of samples

to try on and admire. This reveals that merely the perception of the

parties needs to be changed to attract the target audience and not

the parties themselves.

Marketing Solutions

Attractive Availability

One of the top priorities of the

target audience is convenience. They

are much more willing to run down to

Walgreens to select a mascara than to

order through an IBC.

We need to make Mary Kay seem

more readily available to the target

audience. Buying through Mary Kay is

currently perceived as a process and

leaning more towards a hassle. With the

new look of availability; Mary Kay will

become a top of mind awareness brand

instead of a link to pink Cadillacs and

older women.

Digital Diagnosis

Generation Y is constantly

searching, communicating, and shopping

using the digital world. Mary Kay needs

to have an effective presence in order to

stay current and important.

With the proper use of social

media sites, Mary Kay can effectively

reach their target audience in as much a

personal way as their product demands.

The revitalization and ease of a new

website will help to encourage trafc with

potential customers, as well as provide

a consistent and easy foundation for the

IBC to work from.

Party Perception

The execution and experience of a

Mary Kay party is the most successful tool an

IBC has to sell her product, but its the image

of the party that is the problem. The image

of the party needs to be changed in order to

attract the target audience to attend.

Re-branding and encouraging the

idea of a try before you buy experience,

such as is given in brick and mortar stores, as

opposed to the current approach, will help

bring in the target audience and allow the

product to sell itself.

Target

Audience

Advertising

Objectives

Women ages 18 to 25 are a relatively small percentage of the overall population (9%) of the United States, which

creates the obstacle of how to affectively reach them without too much waste.

These women are in a very crucial and inuential time in their lives as they face many different obstacles and

opportunities, including college, a career, marriage and children. They value their money and are not willing to give up their

convenience for quality. They are less likely to have any loyalties to certain make up brands as long as they get a value.

These women are very knowledgeable in social media and are present on many different sites including Twitter,

Facebook, Pinterest, and Youtube. They use these sites to connect and interact with their fellow colleagues but do not

appreciate interference in their social life. They rely heavily on these sites as well as review sites in making their purchase

decisions.

We decided to focus our advertising efforts to 15 DMAs and ten universities in the US. The DMAs were chosen based on

population of the target audience and the universities were chosen based on population of the target audience and the

DMAs

Phoenix-Mesa-Scottsdale, Arizona

Tucson, Arizona

Tuscaloosa, Alabama

Flagstaff, Arizona

Fayetteville, North Carolina

Little Rock-North Little Rock-Conway,

Arkansas

Yuma, Arizona

J onesboro, Arkansas

Pensacola-Ferry Prass-Brent, Florida

Mobile, Alabama

Birmingham-Hoover, Alabama

Montgomery, Alabama

Florence, South Carolina

Troy, Alabama

Peoria, Illinois

Universities

Arizona State University

Miami-Dade College

Liberty University

University of Central Florida

Ohio State University, Main Campus

University of Minnesota, Twin Cities

University of Texas at Austin

University of Florida

Texas A&M University

Michigan State University

Scholars

Vals- Experiencer, Striver, Achiever

Prizm- Striving Singles, Midtown Mix

These women tend to be on the younger side of the age spectrum and are typically more

adventurous and care free. They are in a new world trying to nd their identity while making and

keeping connections with their friends. They are usually on a strict budget and look for convenience

in their busy schedule. These women are not willing to put in the time or effort to sell Mary Kay, and

would only be willing to attend parties with people they know to avoid the sales pressure.

Up and Comer

Valz- Achiever, Experiencer

Prizm- Young Achievers, Midtown Mix, City Startup

These women are looking to create a more professional appearance and identity for themselves

as they become part of the work force. They have a larger amount of money ow but still seem in

the mindset of budget and convenience over quality. They would only be willing to sell Mary Kay

on the side for extra money but are not likely to do so.

To increase awareness of the brand among the target audience.

To create a sense of availability for the product to the target audience.

To position Mary Kay as a young, trendy brand that is benecial to the target audiences self-image.

To position Mary Kay as up to date on the latest technology and forms of social media.

Target Audience: To expand to a new market of women ages 18 to 25 years old with an integrated campaign

of traditional and nontraditional media.

Media Mix: To implement a media mix that includes national magazine, spot guerilla marketing, and a

heavy use of digital and social media.

Reach and Frequency: To have an average reach between 85 and90 percent with an average frequency of 4.

Scheduling and Timing: To impose a pulsing media plan that will be scheduled from February 2015 to February

2016.

Media Budget: To implement a media schedule with a budget of $10 million.

Geography: To have an integrated media plan that includes a national strategy and a heavy-up in 15

DMAs and 10 colleges and universities with the highest population of the target audience.

Media

Objectives

Strategies

Plan

Start with a heavy up in February 2015 and end with a heavy up in J anuary 2016.

Have a continuous base in national womens magazines.

Flight a national campaign of digital and social media.

Implement a heavy-up in 20 DMAs using direct mail and a heavy-up on 15 colleges and universities using guerilla

marketing using pop-up events.

National Continuous

Magazine: $2,610,800

Mary Kays target audience uses magazines as a way to learn about the newest styles and

trends in the world around them. Each magazine buy will be a full page, four color ads that

will run continuously.

Cosmopolitan

Womens Health Magazine

Magazines

Mobile: $262,900

Mary Kay has already developed many apps to help keep its customers connected and up to date with the

latest technology. In order to keep up with current trends, the current app will be upgraded and revamped

capitalizing on current GPS technology being able to inform customers on local parties and events. We will

also maintain presence on social media sights while expanding and creating sponsored communications on

sites such as twitter and instagram.

National Flighted

Internet: $6,858,500

Mary Kays target audience is heavy internet users as they use this resource for information and entertainment. We will

have a ighted national plan using banner ads, 30 second radio spots, and 60 second comercials on many different forms

of websites that are frequently visited by the target audience along with sponsored searches on popular search engines.

Banners Sponsored Searches 30 Second Radio Spots Commercial

net-a-porter.com

style.com

womenshealthmag.com

Google Pandora Hulu

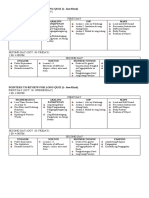

Medium Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan

Magazines-Womens 25 25 25 20 20 20 20 20 25 25 25 25 GRPS: 275

$(000) 237.3 237.3 237.3 189.9 189.9 189.9 189.9 189.9 237.3 237.3 237.3 237.3 COST: 2610.8

Internet-Keyword/Search 20 25 20 25 20 20 GRPS: 130

$(000) 473.0 591.3 473.0 591.3 473.0 473.0 COST: 3074.5

Internet-Trgtd Sites 20 20 20 20 20 GRPS: 100

$(000) 473.0 473.0 473.0 473.0 473.0 COST: 2365.0

Internet-Sponsorship 20 20 20 GRPS: 60

$(000) 473.0 473.0 473.0 COST: 1419.0

Direct Mail 10 10 10 GRPS: 30

$(000) 56.0 56.0 56.0 COST: 167.8

National Only Area

GRPS 64 69 44 39 39 44 39 39 44 44 44 44 GRPS: 564

$(000) 1183.3 1301.6 710.4 662.9 662.9 781.1 662.9 662.9 710.4 710.4 710.4 710.4 Cost: 9469.4

Reach 43.6 45.3 33.9 30.8 30.8 32.9 30.8 30.8 33.9 33.9 33.9 33.9

Avg. Freq. 1.5 1.5 1.3 1.3 1.3 1.4 1.3 1.3 1.3 1.3 1.3 1.3

Spot Only Area

GRPS 10 10 10 10 GRPS: 40

$(000) 56 56 56 Cost: 167.8

Reach 10 10 10 10

Avg. Freq. 1.0 1.0 1.0 1.0

Spot + National

GRPS 74 69 44 39 39 44 49 49 44 44 44 54 GRPS: 604

$(000) 1239.3 1301.6 710.4 662.9 662.9 781.1 718.8 662.9 710.4 710.4 710.4 766.3 Cost: 9637.2

Reach 49 45.3 33.9 30.8 30.8 32.9 37.5 37.5 33.9 33.9 33.9 40.3

Avg. Freq. 1.5 1.5 1.3 1.3 1.3 1.4 1.3 1.3 1.3 1.3 1.3 1.4

Mary Kay Media Plan

Target Demo: All Women ages 18-24

Total Across

Spot Flighted

Pop-up event: $100,000

In order to reach the target audience on a personal level, we will be holding pop-up events in 10 colleges and universities

with the highest population of the target audience. IBCs will be present to host parties throughout the day on the campus

to help promote the product and their local business. These will be held once in August for the start of the new school year

and then once the following J anuary to end the campaign.

Direct Mail: $167,800

We will send out a direct mailer to the target audience in the top 15 DMAs for their population. The direct mailer will have

information on the products, IBCs in their local area, along with free samples for the target audience to experience.

Internet: 68.5%

Magazine: 26.1%

Mobile: 2.6%

Direct Mail: 1.7%

Pop-up Event: 1%

Você também pode gostar

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- English 3 - EJE 2 - Week 4Documento4 páginasEnglish 3 - EJE 2 - Week 4Nelson Granados GranadosAinda não há avaliações

- WhittardsDocumento7 páginasWhittardsAaron ShermanAinda não há avaliações

- Investing in Indian Stock Markets - The 5 Minute WrapUp - EquitymasterDocumento18 páginasInvesting in Indian Stock Markets - The 5 Minute WrapUp - EquitymasterAtanu PaulAinda não há avaliações

- 2.-A-Journal & Ledger - QuestionsDocumento3 páginas2.-A-Journal & Ledger - QuestionsLibrarian 19750% (1)

- Bernini, and The Urban SettingDocumento21 páginasBernini, and The Urban Settingweareyoung5833Ainda não há avaliações

- People v. JaranillaDocumento2 páginasPeople v. JaranillaReinerr NuestroAinda não há avaliações

- Problem Set 1Documento2 páginasProblem Set 1edhuguetAinda não há avaliações

- 2059 s16 in 02 PDFDocumento4 páginas2059 s16 in 02 PDFAsif NazeerAinda não há avaliações

- Civil 20procedure 20final PalsDocumento185 páginasCivil 20procedure 20final PalsPaul EspinosaAinda não há avaliações

- John Zietlow, D.B.A., CTPDocumento11 páginasJohn Zietlow, D.B.A., CTParfankafAinda não há avaliações

- ENVI Biodiversity Conservation and ManagementDocumento38 páginasENVI Biodiversity Conservation and ManagementgowthamAinda não há avaliações

- Front Desk Staff-Giezel Bell Staff - Marc Client - Augustus Friend - AthenaDocumento4 páginasFront Desk Staff-Giezel Bell Staff - Marc Client - Augustus Friend - Athenagener magbalitaAinda não há avaliações

- Garment Manufacturing TechnologyDocumento3 páginasGarment Manufacturing TechnologyamethiaexportAinda não há avaliações

- 131.3 Visa Requirements General 2016 10 PDFDocumento2 páginas131.3 Visa Requirements General 2016 10 PDFDilek YILMAZAinda não há avaliações

- PG&E 2012 Greenbook ManualDocumento366 páginasPG&E 2012 Greenbook ManualVlade KljajinAinda não há avaliações

- Offshore banking_ financial secrecy, tax havens_ evasion, asset protection, tax efficient corporate structure, illegal reinvoicing, fraud concealment, black money _ Sanjeev Sabhlok's revolutionary blog.pdfDocumento23 páginasOffshore banking_ financial secrecy, tax havens_ evasion, asset protection, tax efficient corporate structure, illegal reinvoicing, fraud concealment, black money _ Sanjeev Sabhlok's revolutionary blog.pdfVaibhav BanjanAinda não há avaliações

- George Moses Federal ComplaintDocumento11 páginasGeorge Moses Federal ComplaintWXXI NewsAinda não há avaliações

- TOURISM AND HOSPITALITY ORGANIZATIONS Di Pa Tapooos 1 1Documento101 páginasTOURISM AND HOSPITALITY ORGANIZATIONS Di Pa Tapooos 1 1Dianne EvangelistaAinda não há avaliações

- Home / Publications / Questions and AnswersDocumento81 páginasHome / Publications / Questions and AnswersMahmoudAinda não há avaliações

- Pointers To Review For Long QuizDocumento1 páginaPointers To Review For Long QuizJoice Ann PolinarAinda não há avaliações

- Mordheim - Cities of Gold Slann Warband: Tommy PunkDocumento5 páginasMordheim - Cities of Gold Slann Warband: Tommy PunkArgel_Tal100% (1)

- Transcript of Jail Cell Interview With Robert PicktonDocumento175 páginasTranscript of Jail Cell Interview With Robert PicktonToronto Star100% (1)

- The Harm Principle and The Tyranny of THDocumento4 páginasThe Harm Principle and The Tyranny of THCally doc100% (1)

- In Organic We TrustDocumento5 páginasIn Organic We Trustapi-511313050Ainda não há avaliações

- Bajrang Lal Sharma SCCDocumento15 páginasBajrang Lal Sharma SCCdevanshi jainAinda não há avaliações

- Concrete Calculator Steel Calculator Brick Calculator: Atish Kumar EmailDocumento12 páginasConcrete Calculator Steel Calculator Brick Calculator: Atish Kumar EmailAnil sainiAinda não há avaliações

- Launch Your Organization With WebGISDocumento17 páginasLaunch Your Organization With WebGISkelembagaan telitiAinda não há avaliações

- Mohan ResearchDocumento6 páginasMohan ResearchRamadhan A AkiliAinda não há avaliações

- Delhi To AhmedabadDocumento2 páginasDelhi To Ahmedabad02 Raihan Ahmedi 2997Ainda não há avaliações

- The Role of Service in The Hospitality IndustryDocumento24 páginasThe Role of Service in The Hospitality IndustryhdanesanAinda não há avaliações