Escolar Documentos

Profissional Documentos

Cultura Documentos

Shipping Research

Enviado por

bharathkrishnaimu0 notas0% acharam este documento útil (0 voto)

160 visualizações14 páginasshipping research

Título original

shipping research

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoshipping research

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

160 visualizações14 páginasShipping Research

Enviado por

bharathkrishnaimushipping research

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 14

Statistical Publications

Institute of Shipping Economics and Logistics

Shipping Statistics

and Market Review

Market Review

Analytical Focus

Volume 56 No 1/2 - 2012

World Merchant Fleet

World Bulk Carrier Market

World Tanker Market

World Container and General Cargo Shipping

World Merchant Fleet by Ownership Patterns

World Passenger and Cruise Shipping/

ISL Cruise Fleet Register

World Shipbuilding and Shipbuilders

Major Shipping Nations

World Seaborne Trade and World Port Traffc

ISL Institute of Shipping Economics and Logistics, Bremen, 2012

All rights reserved. No parts of this publication may be reproduced or transmitted, in any form or by

any means, electronic, mechanical, photocopying, recording or any information storage or retrieval

system without permission in writing from the editors. The editors do not guarantee the accuracy of

the information contained in ISL Shipping Statistics and Market Review (SSMR) nor do they accept

responsibility for errors or omissions of their consequences.

ISL Shipping Statistics and Market Review (SSMR)

Volume 56 - 2012

Published and distributed by:

ISL Institute of Shipping Economics and Logistics

Universitaetsallee 11-13

28359 Bremen, Germany

Orders and subscription:

Phone: +49/4 21/2 20 96-0

Fax: +49/4 21/2 20 96-55

eMail: subscription@isl.org

Web: www.isl.org/shop

Subscription prices (Net price):

ISL Shipping Statistics and Market Review (SSMR) Vol. 56 2012

Print copy 490.-

Online version 430.-

ISL Shipping Statistics Yearbook (SSYB) 2011

Print copy 330.-

Print copy + digital version (on disk) 360.-

Online version 300.-

ISL SSMR Vol. 56 2012 & ISL SSYB 2011 - Package

Print copy 680.-

Print copy + digital version (SSYB on disk) 700.-

Online version 605.-

ISL SSMR Vol. 56 2012 - Single issues online version

No. 1/2 World Merchant Fleet 120.-

No. 3 World Tanker Market 90.-

No. 4 World Bulk Carrier Market 90.-

No. 5/6 World Container and General Cargo Shipping 150.-

No. 7 World Merchant Fleet by Ownership Patterns 90.-

No. 8 World Passenger and Cruise Shipping 120.-

No. 9/10 World Shipbuilding and Shipbuilders 90.-

No. 11 Major Shipping Nations 90.-

No. 12 World Seaborne Trade and World Port Traffc 150.-

All prices plus packing and postage. In case of inland sales plus VAT (MwSt). Cancellation 3 months before end

of calendar year.

Comment - World merchant fleet

SSMR January/February 2012

www.isl.org

This short comment is an excerpt from the Analytical Comment published in the

ISL Shipping Statistics and Market Review (SSMR) No 1/2 2012.

The SSMR includes detailed statistical information concerning the analytical focus

and provides approx. 30 monthly/quarterly market indicators (Market Review).

For more information compare attached contents

If you are interested in the complete publication covering all

details (tables & figures), please contact our subscription

department subscription@isl.org or you can order it via our

webshop www.isl.org/shop

All rights reserved. No part of this publication may be reproduced, stored in

a retrieval system, or transmitted, in any form or by any means, electronic,

photocopying, recording or otherwise, without prior permission of the

editors.

ISL does not guarantee the accuracy of the information contained in "ISL

Shipping Statistics and Market Review (SSMR)" (this is also true for the Short

Comment) nor does it accept responsibility for errors or omissions or their

consequences.

Shipping Statistics

and Market Review

Institute of Shipping Economics and Logistics

World Merchant Fleet

ISL Comment ...........................................................

ISL InfoLine Special .................................................

ISL Statistical Tables ................................................

Market Review

Economic Indicators .................................................

World Merchant Fleet ..................................................

Freight and Charter Market .......................................

Shipping Prices and Costs .........................................

World Shipbuilding ...................................................

World Port Traffic .....................................................

9

13

18

51

54

57

69

70

72

Volume 56 (2012)

ISSN 0947 - 0220

published 9 times per year

Analytical Focus

(double issues Jan./Feb., May/ June.

and Sept./ Oct.)

No 1/2 - 2012

Abbreviations/Symbols www.isl.org

SSMR January/February 2012

Abbreviations

ARA Antwerp/Rotterdam/Amsterdam range

AWES Association of West European Shipbuilders

b/d Barrels per day

BHP Brake horsepower

cgt Compensated gross tonnage

cif Cost, insurance, freight

CIS Commonwealth of Independent States

COD Country of Domicile

CPE Centrally-planned Economies

CPI Consumer price index

cST Centi Stokes

cu.m Cubic metres (also m3)

DB Double bottom

DC Developing Countries

DH Double hull

DIS Danish International Ship Register

DME Developed market economies

DS Double sides

dwt Deadweight tons

d/y Day/year

ECB European Central Bank

EMEs Emerging Market Economies

EU European Union

FY Fiscal year

FAO Food and Agriculture Organization

of the United Nations

fio Free in and out

fob Free on board

FT Freight tons

ft Foot

GATT General Agreement on Tariffs and Trade

gt Gross tonnage

HP Horsepower

HT Harbour ton

ibf Intermediate bunker fuel

IEA International Energy Agency

IMF International Monetary Fund

IMO International Maritime Organization

in. Inch

ITF International Transport Workers Federation

km Kilometre

loa Length overall

lbs Pounds

LDT Light displacement tons

LDC Less Developed Countries

LNG Liquefied Natural Gas

LPG Liquefied Petroleum Gas

LT Long ton

m Metre

mbd Million barrel per day

mdo Marine diesel oil

MED Mediterranean

MfA Marine fishing area

mill Million

M/T Motor tanker

MT Metric tons

mtd per ton fob delivered

mth Month

mtw Per ton ex wharf

n.a. Not available

NDRF National Defence Reserve Fleet

n.e.c. Not elsewhere classified

neg. Negligible

NIS Norwegian International Ship Register

no Number

NODC Non-oil Producing Developing Countries

nrt Net register tonnage

nt Net tonnage

NWE,NW Northwest Europe

o.a. Over all

OBO Ore/bulk/oil carrier

OECD Organization for Economic

Cooperation and Development

O/O Ore/oil carrier

OPEC Organization of Petroleum

Exporting Countries

OR Ordinary Register

P/C Products carrier

Pr/OBO Product/ore-bulk-oil carrier

r Revised

Ro/ro Roll-on/roll-off

RT Revenue ton

SAR Special administration region

SBT Ship segregated ballast tanks

SDR Special drawing rights

SSMR ISL Shipping Statistics and Market Review

ST Short ton

t Ton/tonne

TB Tug/barge

TEU Twenty feet equivalent unit

TKB Tanker barge

T/S Tanker/steam

T/T Tanker/turbine

ULCC Ultra large crude carrier

USAC United States Atlantic Coast

USD US Dollar

VLCC Very large crude carrier

WS Worldscale

WTO World Trade Organization

YR, YRS Year, Years

Symbols

... Data not available

- Nil

0/0.0 Less than half of unit employed

1995-2004 From 1995 to 2004 inclusive

2002/03 Crop year, fiscal year etc., beginning

in 2002 and terminating in 2003

Billions means a thousand million

Detailed items in tables do not necessarily add to totals

because of rounding

For further explanation (e.g. Glossary)

please visit: www.isl.org/infoline

Contents Comment and Statistical Tables www.isl.org

SSMR January/February 2012 3

Page

ISL Comment World merchant fleet

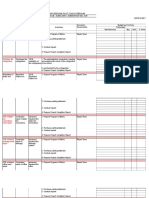

(1) WORLD TONNAGE SUPPLY

1.1 Ship Type Profile of the World Merchant Fleet ............................................................ 5

1.2 Age and Size Profile of the World Merchant Fleet ........................................................ 6

1.3 Ownership Patterns of the World Merchant Fleet ......................................................... 7

(2) MARKET FUNDAMENTALS

2.1 World Seaborne Trade ............................................................................................ 8

2.2 Rates and Prices .................................................................................................... 9

(3) FUTURE TONNAGE SUPPLY

3.1 Tankers ............................................................................................................... 10

3.2 Bulk Carriers ......................................................................................................... 10

3.3 General Cargo and Container Ships ......................................................................... 10

(4) WORLD SHIPBUILDING -

FUTURE TONNAGE SUPPLY

4.1 Total Order Book by Ship Type ................................................................................ 11

4.2 Outlook impact of the crisis .................................................................................. 12

SUMMARY TABLES - COMMENT

Tab. 1 World Merchant Fleets Reductions by Major Ship Types 2008 - 2011 ............................ 5

Tab. 2 World Merchant Fleet's Newbuilding Additions by Major Ship Types 2008 - 2011 ............. 5

Tab. 3 World Merchant Fleet by Ship Type 2007 and 2011 ..................................................... 6

Tab. 4 Largest Ships by Ship type per Ship Type Category 2011 ............................................. 7

Tab. 5 World Merchant Fleet by Ship Type and National and Foreign Flag 2008, 2011 and 2012 ... 7

Tab. 6 Development of Major Open Registry Flags 2008-2012 ................................................ 7

Tab. 7 Newbuilding Additions of the Top 5 Countries of Domicile by National and Foreign Flag 2011 8

Tab. 8 Total World Merchant Fleet (Registered and Controlled) by Region 2012 ........................ 8

Tab. 9 Ship Type Contribution for Selected OECD Countries (Controlled Fleet) 2012 .................. 8

Tab. 10 Controlled Fleets of Major Shipping Nations 2008-2012 ............................................... 9

Tab. 11 End-year Rate Level for Benchmark Tanker Trades 12/2009-12/2011 ............................ 10

Tab. 12 Total Order Book - Delivery Schedule by Country of Build 2012 .................................... 11

Tab. 13 New Orders by Major Ship Types during 2007 2011 ................................................. 11

Tab. 14 Total Order Book by Major Ship Types 2008-2012 ...................................................... 12

Tab. 15 Major Shipbuilding Countries Order Book and cgt per Cent-Shares of Total Order Book ..... 12

FIGURES - COMMENT

Fig. 1 World Merchant Fleet Annual Tonnage Changes 20002012 ...................................... 5

Fig. 2 World Tonnage Additions and Reductions 2000-2012 .................................................. 5

Fig. 3 World Merchant Fleet Age Structure by Major Ship Types 2012 .................................. 6

Fig. 4 World Merchant Fleet Ship Size Development of Selected Ship Types 1991-2012 .......... 6

Fig. 5 Total World Merchant Fleet by National and Foreign Registries 20008-2012 .................... 7

Fig. 6 Country Groups Fleets Share on Ship Types of the World Merchant Fleet 2012 ............... 8

Fig. 7 Controlled Fleet Development of Major Shipping Nations 2008-2012 .............................. 8

Fig. 8 Monthly Development of Baltic Indices 2008-2011 ...................................................... 9

Fig. 9 Monthly HARPEX Container Charter Rate Index up to December 20010 .......................... 9

Fig. 10 Share of the Ordered Tonnage on the Existing Merchant Fleets by Type 2000-2012 ......... 10

Fig. 11 Tanker Fleet - Development of New Orders and Broken-up Tonnage 2006-2011 ................. 10

Fig. 12 Bulk fleet - New Orders and Broken-up Tonnage 2006-2011 ........................................ 10

Fig. 13 General Cargo Fleet New Orders and Broken-up Tonnage, 2006-2011, quarterly ............. 10

Fig. 14 Container Ships - New Orders and Broken-up Tonnage 2006-2011, quarterly ................. 11

Fig. 15 World Order Book Quarterly Development by Major Ship Types 2006-2011 .................... 11

Fig. 16 Order book market shares of leading shipbuilding countries as of January 1

st

, 2012 ............ 12

ISL InfoLine Special World merchant fleet

ISL Statistical Tables World merchant fleet

(1) WORLD MERCHANT FLEET

1.1 Keyfigures as of January 1

st

, 2012 ............................................................................ 16

1.2 Ranking by Flag as of January 1

st

, 2011 and 2012 ...................................................... 17

1.3 By Major Flags and Ship Type as of January 1

st

, 2012 .............................................. 20

1.4 By Registered Flag and Country of Domicile According to Regions and Ship Type 2012 ..... 22

1.5 By Registered Flag and Country of Domicile According to Country Groups/Ship Type 2012 23

1.6 Fleet Development by Ship Type 2008, 2010-2012 ..................................................... 24

1.7 By Division of Age and Ship Type as of January 1

st

, 2012 ............................................. 27

1.8 By Size Class and Ship Type as of January 1

st

, 2012 ................................................... 28

1.9 By Summer Draught and Ship Type as of January 1

st

, 2012 No of Ships ...................... 30

1.10 By Country of Domicile as of January 1

st

, 2012 ........................................................... 31

1.11 Top Ten Countries of Domicile by Major Ship Types as of January 1

st

, 2008, 2011 and 2012 32

13

18-43

5-16

4 SSMR January/February 2012

ISL Statistical Tables World merchant fleet (continued)

(2) BROKEN-UP MERCHANT SHIPS

(YEARLY ANALYSIS)

2.1 Broken-up Ships by Type 2001 - 2011 ...................................................................... 33

2.2 Average Age of Broken-up Ships by Type 2001-2011 .................................................. 33

2.3 Broken-up Ships by Major Flags and Type January December 2011 ......................... 34

2.4 Broken-up ships by Country Groups of Registration and Type January December 2011 .. 34

2.5 Broken-up ships by Year of Build and Ship Type January December 2011 .................... 35

2.6 Broken-up ships by Size Class and Type January December 2011 ............................... 35

(3) DEVELOPMENT OF

WORLD SEABORNE TRADE

3.1 Seaborne Trade Volume in Tonnes 1990-2011 ........................................................... 36

(4) WORLD ORDER BOOK -

FUTURE TONNAGE SUPPLY

4.1 Ships on Order by Type as of January 1st, 2011 and 2012 ........................................... 37

4.2 Ships on Order by Major Types and Country of Build as of January 1st, 2011 and 2012 .... 37

4.3 Ships on Order by Type and Major Shipyards as of January 1st, 2012 ............................ 38

4.4 Ships on Order by Ship Type and Delivery Schedule as of January 1st, 2012 .................. 38

4.5 Ships on Order by Country of Build and Delivery Schedule as of January 1st, 2012 .......... 39

4.6 Ships on Order by Type and DWT-Size Class as of January 1

st

, 2012 ............................. 39

4.7 Additions to Order Book by Ship Type and Major Countries of Build 20082011 ............... 40

FIGURES STATISTICAL TABLES

Fig. 1 Tankers and Dry Cargo Ships Broken-up 1990 - 2011 ................................................. 33

Fig. 2 Cargo Carried by World Fleet 1990 - 2011 ................................................................. 37

Fig. 4 Total World Order Book by Major ship types 2001-2012 .............................................. 38

New ISL Publication ISL Shipping Statistics Yearbook 2011

The shipping industry needs various information to

evaluate market dynamics. The conceptual

approach of the ISL SHIPPING STATISTICS

YEARBOOK which goes back to the year 1986 is

designed to inform on developments in shipping,

world trade, seaborne trade, commodity markets,

ocean freight and charter rates, individual profiles

of shipping and shipbuilding countries, as well as on

world port developments. ISL provides the

yearbook for many years as a source for market

analysis.

The various development indicators are presented

within three main sections:

The Shipping Market

Shipbuilding

Ports and Sea Canals

Moreover the Yearbook comprises an indepth

analytical comment.

The ISL Yearbook is a unique, worldwide distributed

statistical source and designed to particularly meet

the requirements of shipowners,

shipbuilders/repairers, port authorities, brokers,

banks, transportation consultants, universities and

research institutes.

The ISL Shipping Statistics Yearbook 2011

(ISSN 0721-3220; 442 pages) is available from our webshop:

http://www.isl.org/shop/

Printed Edition 330.00

Printed Edition plus CD-Rom 360.00

Online Edition 300.00

Plus packing and postage.

In case of inland sales plus VAT(MwSt).

18-43

Comment - World merchant fleet

SSMR January/February 2012

www.isl.org

5

1 FLEET DEVELOPMENT 2011

Global shipping experienced a turbulent year due to a

combination of falling freight rates, ship oversupply and

tighter bank lending.

As regards charter and freight rates, the year 2011 was

rather mixed. It started well for ship owners with freight

rates similar to those at the end of 2010. In container

shipping, rates even increased during the first half, but

almost all markets were on a downward trend towards the

end of 2011.

The year also brought a lot of change to the world

merchant fleet. Never in the past had so much capacity

been added to the fleet within one year. At the same time,

ship breakers were busier than during the crisis year 2009.

Fleet

The world merchant fleet continues to expand rapidly.

After 146 million dwt of new capacity added in 2010, at

least 2,775 newbuildings with a combined tonnage of 164

million dwt were delivered in 2011, resulting in an 8.4 per

cent growth of the world merchant fleet. The capacity of

ships delivered in 2011 was 12.2 per cent higher than in

the already exceptional year 2010. Bulk carriers

contributed nearly two thirds to the tonnage delivered in

2011.

At the beginning of 2012, the total world merchant fleet

comprised 48,197 ships with 1.46 billion dwt and 15.3

million TEU. With a plus of 14.7 per cent, the dry bulk

sector again witnessed the largest year-on-year increase

(after 17 per cent one year earlier). The fully cellular

container fleet grew by 8.7 per cent (TEU). Both fleets

have almost doubled since 2005.

Newbuildings

About 110 million dwt were reported as new orders

during 2011. The volume of orders placed has been falling

since 2007. With a volume of 344 million dwt at the start

of 2012, the world order book was 42% smaller than in

2008.

During 2011 more than 700 merchant vessel orders were

cancelled, i.e. removed from the order book. Though the

order book has shrunk in all segments, all sectors will see

large volumes of new tonnage in the short term. At the

beginning of 2012, the total order book still represents

around 24 per cent of existing fleet capacity. Especially in

the bulk carrier segment we see an oversized order book

(32 per cent of the existing fleet). With view to other ship

types, these shares stood at 26 per cent for container

ships, 15 per cent for tankers and 13 per cent for general

cargo vessels.

In 2011, Chinese, Korean and Japanese yards accounted

for close to 95% of world deliveries, Chinese shipbuilders

delivering over 1,000 vessels for the second year in a row

the largest ever by one nation in a single year.

Demolition market

Since the beginning of the economic crisis, ship breaking

experienced a revival. After 33 million dwt in 2009 and 29

million dwt in 2010, the volume of the reported broken-up

tonnage reached a peak with nearly 41 million dwt in 2011.

It was the third highest demolition level ever (1,516

merchant vessels). Compared to 2010, bulk carrier

Fig. 1: World merchant fleet Annual tonnage changes 1999

2012 (dwt- per cent)

Fig. 2: World tonnage additions and reductions 1998-2011 (in dwt)

Fig. 3: World merchant fleet Age structure by major ship types

as of January 1

st

, 2012 (No. of ships per-cent share)

Tab. 1: World merchant fleet by ship type as of January 1

st

, 2008

and 2012

Sources

If not otherwise mentioned, the source for tables and figures

concerning the world merchant fleet, special ship type features and

order book information is ISL based on HIS Fairplay, please quote

accordingly. If not indicated otherwise, merchant fleet data refer to

ships of 300 gt and over.

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

8.0

9.0

10.0

1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

1.0

1.5

2.2

2.7

2.1

2.9

5.7

6.4

6.9 6.9

6.8

7.1

9.3

8.4

d

w

t

%

-

c

h

a

n

g

e

0

20

40

60

80

100

120

140

160

180

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

m

i

l

l

d

w

t

Additions Reductions

0

10

20

30

40

50

60

Tankers Bulk

carriers

Container

ships

General

cargo

Passenger

ships

%

-

s

h

a

r

e

(

N

o

.

o

f

s

h

i

p

s

)

up to 1991 1992- 2001 2002-2006 2007-2011

No of

2012 2008 2012 ships dwt TEU 2008 2012

Tankers 547.4 40.7 37.4 3.2 5.7 ... 16.7 14.5

- Oil tankers 496.7 37.1 34.0 4.1 5.6 ... 16.5 14.0

- Chemical tankers 6.3 1.0 0.4 -4.0 -9.4 ... 19.2 20.0

- Liquid gas tankers 44.5 2.7 3.0 4.4 10.2 ... 15.8 14.2

Bulk/OBO carriers 605.8 36.0 41.4 7.1 11.9 -5.3 16.0 12.4

- Bulk carriers 601.9 35.4 41.2 7.2 12.0 -4.5 15.9 12.3

- OBO carriers 3.9 0.6 0.3 -6.1 -2.5 ... 21.8 23.7

Container ships 196.9 12.7 13.5 4.1 8.0 9.2 10.6 10.4

General cargo ships 105.3 9.9 7.2 -1.2 0.6 1.4 22.4 21.2

- Single-deck ships 60.6 4.8 4.1 0.6 4.2 6.4 20.9 19.6

- Multi-deck ships 15.7 2.5 1.1 -7.9 -10.2 -7.5 28.8 30.0

- Reefer ships 5.7 0.7 0.4 -3.5 -3.9 0.0 22.8 24.7

- Special ships 17.1 1.3 1.2 1.8 5.2 1.9 19.0 16.3

- RoRo cargo ships 6.1 0.7 0.4 0.9 -2.0 -5.0 19.4 18.0

6.4 0.6 0.4 -0.4 0.8 -5.5 23.0 22.9

- Pure passenger ships 2.1 0.2 0.1 -3.0 0.1 -45.4 21.3 21.5

- Other passenger ships 4.3 0.4 0.3 1.4 1.2 -3.9 23.9 23.8

Total 1461.8 100.0 100.0 2.0 7.9 7.9 18.9 16.7

Average

age (years)

Passenger ships

Ship type

dwt-%

share of

total

Av. yearly growth

2008-2012 (%)

mill

dwt

Comment - World merchant fleet

SSMR January/February 2012

6

www.isl.org

demolition has increased fourfold to 24.4 million dwt. Bulk

carriers represented 60 per cent of the total broken-up

tonnage in 2011.

1.1 Size development

The average size of bulk carriers, container ships, cruise

vessels and to a lesser extent tankers has been

increasing steadily during the last few years (see Figure 4).

A total of 105 VLCC tankers on order range in the size

class above 300,000 dwt. About one third of all tankers on

order are in size classes above 80,000 dwt against 19 per

cent in the current fleet.

The focus of the order activity in the bulk carrier segment

has been on Capesize vessels (>85.000 dwt). The current

order book includes 516 bulk carriers of 85,000 dwt and

above, the average size of all bulk carriers on order is

82,000 dwt against 64,000 dwt in the active fleet.

The average size of container ships has more than

doubled in 20 years. The average size increased from

1,250 TEU (1990) to 3,064 TEU at the beginning of 2012.

In the current order book, cellular container ships have an

average size of 6,900 TEU. At the start of 2012, 111

container ships in service had capacities of 10,000 TEU

and above against 165 container ships on order in this size

class. Meanwhile, Maersk Line has ordered 20 container

ships in a new size class, each able to transport 18,000

TEU.

Cruise vessels also tend to larger sizes. The average size

for cruise vessels on order is 100,000 gt. There are now 47

ships in the world cruise fleet larger than 100,000 gt with

an average capacity of 3,700 berths.

1.2 Ownership patterns of the world merchant fleet

World merchant fleet by flag

The flag-related ownership analysis shows the increasing

concentration on open registry flags. At the beginning of

2012, 940 million dwt equal to 70 per cent of the total

merchant fleet tonnage were registered under foreign flags

mainly open registry flags.

Tonnage registered under the top ten open registry flags

totalled 809 million dwt. The leading open registry flag is

Panama with 320 million dwt (21.9 per cent of the world

tonnage), followed by Liberia with 183 million dwt (12.5

per cent) and the Marshall Islands with 116 million dwt

(7.9 per cent).

World merchant fleet by country of domicile of owner

The country-by-country analysis underlines that the world

shipping scene is controlled by a few shipping countries.

At the beginning of 2012, about 70 per cent of the total

deadweight tonnage of the world merchant fleet was

controlled by only ten countries (excl. tonnage for ships of

which the parent company is unknown).

Greece is still the leading shipping nation in terms of

deadweight tonnage with a controlled tonnage of 217

million dwt (16.4 per cent) followed by Japan with 210

million dwt (15.8 per cent) and Germany with 125 million

dwt (9.5 per cent). Greek ship owners increased their

tonnage on average by 5.4 per cent per year in the period

2008-2012. Within the top shipping nations, the highest

Fig. 4: World merchant fleet Ship size development of selected

ship types as of January 1

st

, 1990 2012 (average dwt)

Fig. 5: Total world merchant fleet by national and foreign registries

as of January 1

st

, 1995 2012 (dwt index 1995 = 100)

Fig. 6: Country groups controlled fleets share on ship types of the

world merchant fleet as of January 1

st

, 2012 (dwt-%-share)

Fig. 7: Controlled fleet development of major shipping nations as

of January 1

st

, 2008-2012

Additions/reductions:

Additions (newbuildings) and reductions (broken-up) tonnage refer to

the fleet data of the respective year.

Single shipping markets:

In-depth analyses will be presented in the next SSMR issues, namely in

No 2 (Tanker fleet), No 3 (Bulk fleet), No 5/6 (General cargo and

container shipping) and No 7 (Passenger/Cruise fleet)

Explanatory note

Country of domicile indicating where the controlling interest of the

fleet is located in terms of the parent company. This information is only

available for merchant ships of 1,000 gt and over. As of January 1

st

,

2012, the country of domicile information was attributable to 33,373

merchant ships with a total tonnage of 1.33 billion dwt, whereas for

5,751 ships with 126.0 mill dwt this information was unknown.

20000

25000

30000

35000

40000

45000

50000

55000

60000

65000

70000

1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012

s

h

i

p

s

i

z

e

(

a

v

.

d

w

t

)

Oil tankers Bulk carriers Container ships

75

100

125

150

175

200

225

250

275

300

1995 1997 1999 2001 2003 2005 2007 2009 2011

National flag Foreign flag

217.1

209.8

125.5

115.6

54.5

0.0

50.0

100.0

150.0

200.0

250.0

0.0 2.5 5.0 7.5 10.0 12.5

m

i

l

l

d

w

t

average annual dwt growth in %

Germany

China, PR of

Korea, Rep.of

Japan Greece

Comment - World merchant fleet

SSMR January/February 2012

7

www.isl.org

tonnage growth in this period was reached by Korea (10.4

per cent), the UK (11.3 per cent) and China (8.6 per cent).

2 MARKET FUNDAMENTALS IN 2010/2011

2.1 World seaborne trade

From a total of 8.8 billion tonnes of seaborne trade in 2011,

about 35.0 per cent are attributable to liquid bulks. Due to

the low growth of global oil trade compared with other

commodities and due to increasing pipeline transport

volumes, this share decreased from 40 per cent in 1990 to

the current value. As the growing supply of dry bulk

tonnage suggests, the share of major dry bulk volumes still

increases. In 2011, 28.0 per cent of the total seaborne trade

were attributable to iron ore, coal and grain. According to

Clarkson Research, containerised cargo had a share of 17

per cent in total seaborne trade in 2011.

During the course of 2011, especially the increase of

container trade (+9.7 per cent), Bauxite (+8.9 per cent) and

the group of minor bulks (+ 4.9 per cent), which includes

the so-called noble earths, reveal the economic recovery.

Crude oil and products shipments increased by 2.4 per cent,

and 3.0 per cent respectively between 2010 and 2011.

During the same period, LNG-transport by sea increased by

only 1.3 per cent (see also table 3.1 Seaborne Trade on page

36).

2.2 Rates and prices

Ship owners nowadays have to pay the price for the vast

ordering activities of the past five years. Deliveries to the

active fleet with a combined capacity of 165 million dwt

have set rates under an enormous pressure (see table 1.1 on

page 16). As a consequence, ship builders will probably not

be able to sustain the relatively stable prices they were

earning so far.

In this regard the tendency to order bigger vessels widens

the gap between supply and demand not only in the bulk

and container market, but also in the tanker market (see

Table 4 above).

Tanker market

Compared to bulk and container markets, the tanker sector

was particularly struck by the ongoing conflicts in Northern

Africa in 2011. Moreover, rates weakened significantly

primarily due to an oversupply of vessels relative to

demand. Additionally, the release of some 60 million barrels

of crude oil from several governmental stockpiles and some

oilfield outages impeded the tanker demand during the last

twelve month.

All in all, it can be stated that the bigger the tanker, the

sharper the dip of the charter rates. Since the ridge of the

rate levels in early 2010, tanker spot World Scales (WS) on

the Arabian Gulf to Europe trade, for example, are nearly

20 per cent lower on average than in 2010. The Average WS

for VLCC tankers was around 38 versus WS 49.2 in 2010,

with peaks during winter times. Consequently, the main

market for oil shipments is still weak.

Bulk carrier market

It is obvious that the bulk sector still has difficulties to

absorb the armada of new ships ordered in the pre-crisis

era. This sets the rate development under high pressure.

Fig. 8: Share of selected commodity groups on world seaborne

trade in 2011 and 1990 (% of total volume)

Fig. 9: Monthly development of Baltic indices 2007-2012

ISL Bremen 2012; based on Baltic Exchange

Fig. 10: Time charter rates for tankers 2007 - 2012

ISL Bremen 2012; based on Fearnleys Weekly

Fig. 11: Monthly HARPEX Container charter rate index up to

December 2012

ISL Bremen 2012; based on Harper Petersen & Co., Hamburg

Fig. 12: Share of the ordered tonnage on the existing merchant fleets

by type as of January 1

st

, 2007-2012 (dwt-%)

Major dry

bulks

28%

Minor

bulks

11%

Container

17%

Liquid

bulk

35%

Others

9%

2011

Major dry

bulks

23%

Minor

bulks

16%

Container

6%

Liquid

bulk

40%

Others

15%

1990

0

4000

8000

12000

16000

20000

2007 2008 2009 2010 2011 2012

Baltic Dry Index

Baltic Panmax Index

Baltic Capesize Index

10

20

30

40

50

60

70

80

90

2007 2008 2009 2010 2011 2012

1

0

0

0

U

S

$

/

d

a

y

VLCC (modern)

SUEZMAX (modern)

0

250

500

750

1000

1250

1500

Jan. 07 Jul Jan. 08 Jul Jan. 09 Jul Jan. 10 Jul Jan. 11 Jul Jan. 12

H

A

R

P

E

X

I

n

d

e

x

0.0

20.0

40.0

60.0

80.0

100.0

Tanker Bulk carrier Container General Cargo

40.4

24.7

42.1

12.5

28.9

60.4

32.8

19.3

15.2

32.3

26.0

13.0

d

w

t

-

%

s

h

a

r

e

o

f

o

r

d

e

r

b

o

o

k

o

n

f

l

e

e

t

Comment - World merchant fleet

SSMR January/February 2012

8

www.isl.org

Consequently, the Baltic Dry Index (BDI), during 2010 on

the way up, fell to ranges of around 1400, not far away from

the low point at the end of 2008, but picked up 40 per cent

up to 1900 points at the turn of the year. This upswing was

mostly limited to the Capesize class while the Panamax

sector stagnated.

On the demand side, heavy rain and floods in Australia

severely disrupted coal and iron ore trade in early 2011.

Weather conditions are again expected to hit the dry bulk

trades in 2012. As a result of La Nina, the US Gulf is

expected to experience significant drought in first quarter

2012, affecting grain exports.

Container charter rates

Until mid-2011, the charter rates have benefited from the

market recovery. In the second half the rates have fallen

back to the level of mid-2009. The large number of

additions to the fleet in the upper size segment has

accelerated the cascade effect, creating pressure on rates in

all size segments and crowding out smaller units. At the

same time, the slowdown of growth in many industrialised

countries led to a deceleration of demand for capacity.

At the end of 2011, the downward trend in charter rates of

recent months continued. An annual comparison shows

that the low rates now varied between one and two thirds of

the previous years figures. Howe Robinson published a

level of around 476 points for the weighted container index

(HRCI) at the end of December 2011, a decrease of 30.7

per cent compared to December 2010.

Demolition and newbuilding prices

As stated above, it is not unlikely that newbuilding prices

may weaken as yards have to fill their order books in

times of observant markets. At the turn of the year, the

values for all ship types move marginally down. Bulk

carrier newbuilding prices, especially for larger vessels,

were around 2 per cent lower than at the end of 2010, of

course a reaction of the high amount of newbuildings.

Correspondingly the level of newbuilding prices was

relatively low. According to industry sources, namely

Fearnleys and Platou, the second hand values for tankers

were relatively low in the crude sector and more or less

stable regarding the products tankers.

3 FUTURE TONNAGE SUPPLY

The economic recovery since 2010 also revives global

shipbuilding. At least 2,042 merchant vessels with nearly

39 million cgt were reported as new orders during 2011.

However due to many deliveries and removals the

order book for merchant ships has decreased in all

segments. The global order book at the start of 2012

comprised 5,301 ships with 108 million cgt, 16.9 per cent

less than a year ago and 41.3 per cent less than five years

ago.

3.1 Tankers

During 2011 tanker deliveries consisted of 640 units with

44.4 million dwt, thereof 531 oil tankers and 74 liquid gas

tankers. In the same period 433 new orders with 18.1

million dwt were placed, 220 units were removed from the

order book, and 249 units with 9.0 million dwt were

reported to be broken up. At the beginning of 2012, 1,138

Fig. 13: Tanker fleet - quarterly development of new orders and

broken-up tonnage 2005 2011 (in dwt)

Fig. 14: Bulk fleet - quarterly development of new orders and broken-

up tonnage 2005 2011 (in dwt)

Fig. 15: General cargo fleet quarterly development of new orders

and broken-up tonnage, 2005 2011 (mill dwt)

Fig. 16: Container ships - quarterly development of new orders and

broken-up tonnage 2005 2011 (mill dwt)

5.0

0.0

5.0

10.0

15.0

20.0

25.0

30.0

05/I 05/III 06/I 06/III 07/I 07/III 08/I 08/III 09/I 09/III 10/I 10/III 11/I 11/III

m

i

l

l

d

w

t

Broken-up

New orders

20.0

10.0

0.0

10.0

20.0

30.0

40.0

50.0

60.0

05/I 05/III 06/I 06/III 07/I 07/III 08/I 08/III 09/I 09/III 10/I 10/III 11/I 11/III

m

i

l

l

d

w

t

Broken-up

New orders

3.0

2.0

1.0

0.0

1.0

2.0

3.0

4.0

05/IV 06/II 06/IV 07/II 07/IV 08/II 08/IV 09/II 09/IV 10/II 10/IV 11/II 11/IV

m

i

l

l

d

w

t

Broken-up

New orders

3.0

0.0

3.0

6.0

9.0

12.0

15.0

18.0

05/IV 06/II 06/IV 07/II 07/IV 08/II 08/IV 09/II 09/IV 10/II 10/IV 11/II 11/IV

m

i

l

l

d

w

t

Broken-up

New orders

Comment - World merchant fleet

SSMR January/February 2012

9

www.isl.org

tankers with 25.2 million cgt (83 million dwt) were on

order. The total tanker order book corresponded to 15 per

cent of the total tanker fleet, compared with 24 per cent

one year earlier. More than half of this tonnage volume is

scheduled until end of 2012.

3.2 Bulk carriers

At the start of 2012, we still see a huge oversupply of

vessels in the bulk carrier segment. The future

supply/demand balance in the bulk market is determined

by a surprisingly high contracting of newbuildings: 941

new orders totalling 16.9 million cgt (68 million dwt) were

ordered. At the same time, 431 bulk carriers with 24

million dwt were reported as demolitions and more than

320 vessels were removed from the order book during

2011.

At the beginning of 2012, the order book for bulk carriers

comprised 2,397 carriers with 45.6 million cgt (195 million

dwt). This would increase the bulk carrier fleet by almost

one third in the years to come.

3.3 Container ships and General cargo vessels

In 2011, a total of 253 container ships with a combined

capacity of 1.8 million TEU were ordered worldwide, up

from 0.7 million TEU one year earlier. At the beginning of

2012 the order book for container ships comprised 631

ships with 23.3 million cgt (4.4 mill TEU). The container

ship order book at the beginning of 2012 represented a

TEU ratio of 28.5 per cent in relation to the existing

container fleet.

Based on the current order book the container fleet

capacity will increase by 10.2 per cent in 2012 and about 9

per cent in 2013 if ships are delivered as planned.

A noticeable 165 container ships on order had capacities

of 10,000 TEU and above, of which 134 ships with more

than 12,000 TEU.

New orders for general cargo ships (incl. various ship

types such as ro-ro cargo ships, car carriers or heavy-lift

vessels) amounted to 345 vessels with 2.7 million cgt (3.4

million dwt) in 2011, a decrease of 26.5 per cent

compared with 2010. The order book as of January 1

st

,

2012 comprised 1,004 general cargo ships with 10.2

million cgt and 13.7 million dwt, respectively. The general

cargo ship order book at the beginning of 2012

represented a dwt ratio of 13.0 per cent in relation to the

existing general cargo fleet.

3.4 Passenger and passenger/ro-ro cargo vessels

During 2011, 105 passenger and ro-ro cargo/passenger

ships (1.3 million cgt) left the order book after completion,

while 70 new orders with 1.0 million cgt were reported.

As of January 1

st

, 2012, the total order book was composed

of 24 cruise vessels with 2.7 million cgt, 36 passenger ships

(0.02 mill cgt) and 71 passenger/ro-ro cargo ships with 0.7

million cgt. It includes 16 cruise vessels with capacities of

100,000 gt and over. Total passenger tonnage under

construction now represents 9.2 per cent of the fleet in

service (cgt), down from 10.2 per cent one year earlier.

Fig. 17: World order book - quarterly development by major ship

types 2007 - 2012 (mill cgt)

Tab. 2: Total order book by major ship types as of

January 1

st

, 2008, 2011 and 2012

Fig. 18: Order book market shares of leading shipbuilding countries

as of January 1

st

, 2012 (cgt - %)

Guide to relevant market information:

Shipping & Shipbuilding Market

Platou: Platou Monthly, Platou Report: www.platou.com

Barry Rogliano Salles: BRS online market information:

www.brs-paris.com

Simpson Spence & Young: SSY World Oil-Tanker Trend:

www.ssyonline.com

Clarkson: Container Intelligence Monthly, Oil & Tanker Trades Outlook:

www.clarksons.co.uk

Statistical details World Shipbuilding

Ships on order by type p. 45

By major types and country of build p. 45

By type and major shipyards p. 46

By country of build and delivery schedule p. 47

By ship type and delivery schedule p. 47

Explanatory note

The compensated gross tons (cgt) concept was first devised by

shipbuilder associations, and adopted by the OECD Council Working

Party on Shipbuilding (WP6), in the 1970s to provide a more accurate

measure of shipyard activity than could be achieved by the usual gross

ton (gt) and deadweight ton (dwt) measures. The compensated gross

tons (cgt) is calculated by multiplying the tonnage of a ship by a

coefficient, which is determined according to type and size for a

particular ship. Cgt is used as an indicator of the volume of work that is

necessary to build a given ship.

0

10

20

30

40

50

60

70

Tanker Bulk carrier Container Others

07/I 07/I 07/I 07/I 12/1 12/1 12/1 12/1

m

i

l

l

c

g

t

cgt-%

No of mill No of mill No of mill change

ships cgt ships cgt ships cgt '11/'12

Tankers 2935 63.7 1543 33.1 1138 25.2 -23.6

Bulk carriers 2790 54.0 2944 57.6 2397 45.6 -20.8

Container ships 1518 41.5 606 21.1 631 23.3 10.7

General cargo ships 1421 17.5 1295 14.4 1004 10.3 -29.0

Passenger ships 223 7.4 137 3.9 131 3.6 -6.8

Total 8887 184.0 6525 130.0 5301 108.0 -16.9

Ship type

2008 2012 2011

CESA

4.1%

China, PR of

38.2%

Kora, Rep. of

32.5%

Japan

15.5%

Others

9.8%

ISL InfoLine - Publications & Databases

ISL Institute of Shipping Economics and Logistics

Legal Form

Founded in

Capacity

Directorate

Board of Trustees

Scientifc Advisory Board

Sponsoring Body

Independent, private non-proft foundation

1954

55 permanent staff members

Prof Dr Hans-Dietrich Haasis, Prof Dr Burkhard Lemper, Prof Dr

Frank Arendt

Decision-makers from trade, industry, science and politics

Experts from trade, industry and science

Companies and individual members from the maritime industry

During the past 50 years the Institute of Shipping Economics and Logistics (ISL) has become one

of Europe's leading research and consulting organisations in the maritime sector. More than 50 high

qualifed employees, equipped with state of the art technology and compatible instruments, work in trans-

disciplinary teams on applied research and development projects in the departments Logistic Systems,

Maritime Economics and Transport as well as Information Logistics. Due to its professional capability,

superb reputation and exhaustive connections to politics and industry, ISL will continuously contribute to

the advancement of added value as well as to the maritime and logistics industry as to science in future.

www.isl.org info@isl.org

The ISL InfoLine is your resource of up-to-date market information and completes ISL's service spectrum

with numerous proprietary publications, which are available in the online portal. The key publications are

the ISL Shipping Statistics and Market Review (SSMR), the ISL Shipping Statistics Yearbook (SSYB) and

the ISL Monthly Container Port Monitor (MCPM).

Furthermore, the portal of the ISL InfoLine offers various databases used for market analyses, statistical

publications, information services and customers' enquiries. The focus here is on the ISL Port Database and

the ISL Fleet Database.

www.infoline.isl.org infoline@isl.org

ISL Information Centre - Library & Seabase

The ISL Information Centre is the leading institution in Europe for information and documentation in

maritime economics and logistics. Beside the literature database ISL SEABASE and the reference library

in Bremen, the Information Centre offers professional services about industries, markets and companies

within the knowledge areas of shipping, shipbuilding and ports, transport and logistics as well as economic

and trade.

The literature database ISL SEABASE represents more than 105,000 bibliographic records and is an

important knowledge source for industry and commerce, research and education. All new entries of

the ISL library are bibliographical recorded and made available as regards content. Besides reference

books also market studies, research and conference reports, economy statistics as well as business

and annual reports are included. Contributions from about 230 national and international professional

journals are evaluated selectively after relevance. The ISL SEABASE research is available online and

offers a systematic access to current maritime and logistic knowledge.

The ISL reference library, which exists since 1954, is one of the biggest libraries in the area of maritime

economics and logistics with a total stock of about 125,000 books (September 2011), of which are

30,000 monographs and 29,000 annual publications. Furthermore 750 professional journals and series

are kept regularly.The ISL Library is open to the public and the use is free of charge.

www.library.isl.org library@isl.org

www.isl.org

Você também pode gostar

- Tanker Chartering (TKC) PDFDocumento3 páginasTanker Chartering (TKC) PDFagus pramana100% (1)

- Financing Greek ShippingDocumento49 páginasFinancing Greek ShippingDaplet Chris100% (1)

- Shipping PracticeDocumento11 páginasShipping PracticeMr. BuffyAinda não há avaliações

- Marsoft Valuation Methodology Case StudyDocumento8 páginasMarsoft Valuation Methodology Case StudymekulaAinda não há avaliações

- The New Leader's 100-Day Action PlanDocumento15 páginasThe New Leader's 100-Day Action Planramjet1Ainda não há avaliações

- Shipping Practice - With a Consideration of the Law Relating TheretoNo EverandShipping Practice - With a Consideration of the Law Relating TheretoAinda não há avaliações

- Shipping Cycle 2017Documento6 páginasShipping Cycle 2017Yvonne Taratsa100% (1)

- Basics of Chartering: Negotiation - Compatibility - Decision MakingNo EverandBasics of Chartering: Negotiation - Compatibility - Decision MakingAinda não há avaliações

- Important Banking abbreviations and their full formsDocumento10 páginasImportant Banking abbreviations and their full formsSivaChand DuggiralaAinda não há avaliações

- Container Shipping Outlook Feb 2016Documento8 páginasContainer Shipping Outlook Feb 2016LiknusLiknusAinda não há avaliações

- Ssy WorldscaleDocumento24 páginasSsy WorldscaleFnu JoefrizalAinda não há avaliações

- Concise Australian Commercial Law by Clive Trone Turner John Gamble Roger - NewDocumento659 páginasConcise Australian Commercial Law by Clive Trone Turner John Gamble Roger - NewPhương TạAinda não há avaliações

- Shipping Industry: Submitted byDocumento32 páginasShipping Industry: Submitted byAkhsam PaleriAinda não há avaliações

- Study Guide Public BookletDocumento16 páginasStudy Guide Public Bookletअमोल नितनवरे0% (1)

- 60MT TraderDocumento71 páginas60MT TradersriAinda não há avaliações

- Economics of Sea Transport and International TradeDocumento6 páginasEconomics of Sea Transport and International TradediablolcAinda não há avaliações

- Port Management Case Studies-UnctadDocumento52 páginasPort Management Case Studies-Unctadbharathkrishnaimu100% (2)

- Port Management Case Studies-UnctadDocumento52 páginasPort Management Case Studies-Unctadbharathkrishnaimu100% (2)

- Far East Bank & Trust Co. v. Gold Palace Jewelry Co DIGESTDocumento3 páginasFar East Bank & Trust Co. v. Gold Palace Jewelry Co DIGESTAprilAinda não há avaliações

- What Causes Small Businesses To FailDocumento11 páginasWhat Causes Small Businesses To Failmounirs719883Ainda não há avaliações

- Consequences of Maritime Critical Infrastructure Accidents: Environmental Impacts: Modeling-Identification-Prediction-Optimization-MitigationNo EverandConsequences of Maritime Critical Infrastructure Accidents: Environmental Impacts: Modeling-Identification-Prediction-Optimization-MitigationAinda não há avaliações

- Brief History of IncotermsDocumento2 páginasBrief History of IncotermsWinact12100% (1)

- PPG Chartering TermsDocumento70 páginasPPG Chartering TermskhabiranAinda não há avaliações

- IMO and The Environment 2011Documento12 páginasIMO and The Environment 2011RihardsAinda não há avaliações

- Cargo Insurance Policy PDFDocumento14 páginasCargo Insurance Policy PDFdiacu dianaAinda não há avaliações

- 28 - Maritime Economics - Stopford-Halaman-410-441 PDFDocumento32 páginas28 - Maritime Economics - Stopford-Halaman-410-441 PDFSidratul NugrahaAinda não há avaliações

- Shipping Market OrganisationDocumento5 páginasShipping Market Organisationyesuplus2Ainda não há avaliações

- Maritime Economics: Yalqa Rizqi Azka 04211841000033Documento15 páginasMaritime Economics: Yalqa Rizqi Azka 04211841000033Yalqa RizqiAinda não há avaliações

- Ship Sale and Purchase - SlidesDocumento47 páginasShip Sale and Purchase - Slidesbharathkrishnaimu0% (1)

- Maersk Annual Report 2013Documento197 páginasMaersk Annual Report 2013bharathkrishnaimuAinda não há avaliações

- UNCTAD Review of Maritime Transport 2017 2017 10Documento130 páginasUNCTAD Review of Maritime Transport 2017 2017 10Mehmet AliAinda não há avaliações

- Contrat of AffreightmentDocumento29 páginasContrat of AffreightmentAnalisa Casanes PacunlaAinda não há avaliações

- Difference Between Arbitration Conciliation Negotiation and MediationDocumento23 páginasDifference Between Arbitration Conciliation Negotiation and MediationPranav Khanna79% (29)

- Shipping Economics and FinanaceDocumento13 páginasShipping Economics and FinanaceRavikiranAinda não há avaliações

- Pollution by Ships Presentation)Documento16 páginasPollution by Ships Presentation)mylife10Ainda não há avaliações

- Master's HandbookDocumento119 páginasMaster's HandbookFernando Igor AlvarezAinda não há avaliações

- Working Capital Managment ProjectDocumento48 páginasWorking Capital Managment ProjectArun BhardwajAinda não há avaliações

- Competetion in Harbour TowageDocumento16 páginasCompetetion in Harbour TowageDeanna BarrettAinda não há avaliações

- Determinants of Maritime Transport CostsDocumento28 páginasDeterminants of Maritime Transport CostsKristiaan SturmAinda não há avaliações

- Automotive Marketing Feasibility StudyDocumento13 páginasAutomotive Marketing Feasibility Studyaneraz2719100% (1)

- Topic 4 - Bulk and Liner Service - Abril23Documento58 páginasTopic 4 - Bulk and Liner Service - Abril23Kawtar El Mouden DahbiAinda não há avaliações

- Ports and Port Services 1 1Documento5 páginasPorts and Port Services 1 1Marion KonesAinda não há avaliações

- Port of Tallinn Handbook: CargoDocumento15 páginasPort of Tallinn Handbook: CargoPort of TallinnAinda não há avaliações

- Bot ContractDocumento18 páginasBot ContractideyAinda não há avaliações

- Dry BulkDocumento28 páginasDry BulkyousfinacerAinda não há avaliações

- Sea Transport - NotesDocumento88 páginasSea Transport - Notesjmathew11Ainda não há avaliações

- DRY CARGO CHARTERING CAPITAL MARKETS DAYDocumento23 páginasDRY CARGO CHARTERING CAPITAL MARKETS DAYestotalAinda não há avaliações

- Fortis Bank Maritime FinanceDocumento43 páginasFortis Bank Maritime FinancebluepperAinda não há avaliações

- Port Community SystemsDocumento33 páginasPort Community SystemsModrisan CristianAinda não há avaliações

- Shipping Solutions:: Technological and Operational Methods Available To Reduce CoDocumento28 páginasShipping Solutions:: Technological and Operational Methods Available To Reduce CoCvitaCvitić100% (1)

- Shipping Courses PDFDocumento2 páginasShipping Courses PDFNico GoussetisAinda não há avaliações

- 2012 BIMCO ISF Manpower StudyDocumento6 páginas2012 BIMCO ISF Manpower StudycashelleAinda não há avaliações

- Guided By: Prof. Seema Vyas: Presented By: Divya AgarwalDocumento39 páginasGuided By: Prof. Seema Vyas: Presented By: Divya AgarwalDivya AgarwalAinda não há avaliações

- Further Reading - Institute of Chartered ShipbrokersDocumento5 páginasFurther Reading - Institute of Chartered Shipbrokerscoimbra_1987Ainda não há avaliações

- Shipping ManagementDocumento9 páginasShipping ManagementHarun KınalıAinda não há avaliações

- Maritime Logistics A Guide To Contemporary Shipping and Port Management From Kogan PageDocumento11 páginasMaritime Logistics A Guide To Contemporary Shipping and Port Management From Kogan PageGAYATRI NAIDUAinda não há avaliações

- 7000 Acres in SaklaspurDocumento6 páginas7000 Acres in SaklaspurANIL100% (1)

- Significance of World Shipping and Sea-Borne TradeDocumento26 páginasSignificance of World Shipping and Sea-Borne TradeIqtiran KhanAinda não há avaliações

- Cargo Handling and Ship Registration Course at CHITECHMADocumento5 páginasCargo Handling and Ship Registration Course at CHITECHMATambe Chalomine Agbor100% (1)

- Review of Marine Time Transport 2015Documento122 páginasReview of Marine Time Transport 2015longpham67Ainda não há avaliações

- Weekly Shipping Intelligence ReportDocumento20 páginasWeekly Shipping Intelligence ReportleejingsongAinda não há avaliações

- 1 Maritime TransportDocumento413 páginas1 Maritime TransportWondwosen Tiruneh100% (1)

- Apm Terminals Corporate BrochureDocumento19 páginasApm Terminals Corporate BrochureSky MarshallAinda não há avaliações

- Maritime Econs & TransportationDocumento15 páginasMaritime Econs & TransportationTs-Radzif OmarAinda não há avaliações

- Shipping Cycles Are Difficult To PredictDocumento4 páginasShipping Cycles Are Difficult To PredictNikos NoulezasAinda não há avaliações

- Customs Role in Securing Global TradeDocumento34 páginasCustoms Role in Securing Global TradeTerique BrownAinda não há avaliações

- B L Types B L 48 68Documento21 páginasB L Types B L 48 68Abdel Nasser Al-sheikh YousefAinda não há avaliações

- Demurrage RulesDocumento2 páginasDemurrage RulesSantosh BaldawaAinda não há avaliações

- Entrepreneurial Mindset and Historical DevelopmentDocumento11 páginasEntrepreneurial Mindset and Historical DevelopmentCynthia AkothAinda não há avaliações

- STOWAWAYSDocumento10 páginasSTOWAWAYSSun Htoo Myint0% (1)

- Ports as Nodal Points in a Global Transport System: Proceedings of Pacem in Maribus XVIII August 1990No EverandPorts as Nodal Points in a Global Transport System: Proceedings of Pacem in Maribus XVIII August 1990A.J. DolmanAinda não há avaliações

- Guerrero Rodrigue 2012 Container WavesDocumento25 páginasGuerrero Rodrigue 2012 Container WavesProf C.S.PurushothamanAinda não há avaliações

- International Maritime Law: Codes-ResolutionDocumento101 páginasInternational Maritime Law: Codes-ResolutionbharathkrishnaimuAinda não há avaliações

- Logistics IndustryDocumento48 páginasLogistics IndustryTanu NigamAinda não há avaliações

- SCM of AmulDocumento26 páginasSCM of AmulbharathkrishnaimuAinda não há avaliações

- International Maritime Law: Codes-ResolutionDocumento101 páginasInternational Maritime Law: Codes-ResolutionbharathkrishnaimuAinda não há avaliações

- The Cultural Context: Chapter ObjectivesDocumento48 páginasThe Cultural Context: Chapter ObjectivesbharathkrishnaimuAinda não há avaliações

- Research MethodologyDocumento41 páginasResearch MethodologyRomit Machado83% (6)

- Concession Agreements and Market Entry in The Container Terminal IndustryDocumento7 páginasConcession Agreements and Market Entry in The Container Terminal IndustrybharathkrishnaimuAinda não há avaliações

- Value Stream Mapping Process - Supply Chain ManagementDocumento21 páginasValue Stream Mapping Process - Supply Chain ManagementMANTECH Publications100% (1)

- Case Review (Chwee Kin Keong & Statoil)Documento9 páginasCase Review (Chwee Kin Keong & Statoil)AFIQQIWA93Ainda não há avaliações

- MGT602 Finalterm Subjective-By KamranDocumento12 páginasMGT602 Finalterm Subjective-By KamranKifayat Ullah ToheediAinda não há avaliações

- Kwality WallsDocumento18 páginasKwality WallsKanak Gehlot0% (2)

- MM ZC441-L2Documento60 páginasMM ZC441-L2Jayashree MaheshAinda não há avaliações

- Master of Business Administration: The Report On Summer-Internship at Suguna Foods Limited in VaratharajapuramDocumento20 páginasMaster of Business Administration: The Report On Summer-Internship at Suguna Foods Limited in VaratharajapuramThilli KaniAinda não há avaliações

- Doing Research in Business ManagementDocumento20 páginasDoing Research in Business Managementravi_nyseAinda não há avaliações

- CH 02 Project Life Cycle and Organization: A Guide To The Project Management Body of Knowledge Third EditionDocumento15 páginasCH 02 Project Life Cycle and Organization: A Guide To The Project Management Body of Knowledge Third Editionapi-3699912Ainda não há avaliações

- The Science Behind The 4lifetm Pay PlanDocumento24 páginasThe Science Behind The 4lifetm Pay Planapi-282063528Ainda não há avaliações

- Hotels 2020 - Responding To Tomorrow's Customer and The Evolution of TechnologyDocumento12 páginasHotels 2020 - Responding To Tomorrow's Customer and The Evolution of TechnologyHetalMehtaAinda não há avaliações

- AIP WFP 2019 Final Drps RegularDocumento113 páginasAIP WFP 2019 Final Drps RegularJervilhanahtherese Canonigo Alferez-NamitAinda não há avaliações

- Optimize Supply Chains with Bonded WarehousingDocumento8 páginasOptimize Supply Chains with Bonded WarehousingJohannesRöderAinda não há avaliações

- Sarah Williams CVDocumento2 páginasSarah Williams CVsarahcwilliamsAinda não há avaliações

- Planning & Strategic ManagementDocumento135 páginasPlanning & Strategic ManagementSurajit GoswamiAinda não há avaliações

- MQP For MBA I Semester Students of SPPUDocumento2 páginasMQP For MBA I Semester Students of SPPUfxn fndAinda não há avaliações

- Top US Companies by RegionDocumento88 páginasTop US Companies by RegionLalith NeeleeAinda não há avaliações

- Muthoot FinanceDocumento58 páginasMuthoot FinanceNeha100% (2)

- What Is Cost ?Documento3 páginasWhat Is Cost ?amita_gade90Ainda não há avaliações

- 15 Golden Tips 2 Bluid ResumeDocumento3 páginas15 Golden Tips 2 Bluid ResumeDeepak KumarAinda não há avaliações

- Du Tran New Partner - Press ReleaseDocumento1 páginaDu Tran New Partner - Press ReleaseTranDuVanAinda não há avaliações

- Section What Is Entrepreneurship? Section Characteristics of An EntrepreneurDocumento12 páginasSection What Is Entrepreneurship? Section Characteristics of An EntrepreneurAashir RajputAinda não há avaliações

- Merchandise Planning: PGDM Iv-7Documento19 páginasMerchandise Planning: PGDM Iv-7Rajdeep JainAinda não há avaliações