Escolar Documentos

Profissional Documentos

Cultura Documentos

GE Sees The Light

Enviado por

adjie130 notas0% acharam este documento útil (0 voto)

29 visualizações5 páginasGE article

Título original

GE Sees the Light

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoGE article

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

29 visualizações5 páginasGE Sees The Light

Enviado por

adjie13GE article

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 5

I

N A LOBBY AT THE GENERAL ELECTRIC COMPLEX

known as the House of Magic sits a desk that belonged

to GE founder Thomas Edison. There, under glass, are

copies of his notebook papers with sketches of his great-

est achievement: the lightbulb. Two floors below, GE re-

searcher Anil Duggal is working in a cramped, darkened

lab on a replacement for that iconic invention. Duggal

holds a flat, glowing 6-inch square that illuminates his face.

The light is created by a thin layer of organic light-emitting

diodes (OLEDs) sandwiched between two glass plates. Duggal

hopes they will eventually be printed on plastic so that flexible

lighting surfaces can be incorporated into wallpaper or furniture.

Just as the OLEDs convert electricity into light, they can also do

the reverse, and thus could someday become the basis for in-

expensive plastic solar panels. They could be produced much

like newspapersand newspapers are so cheap, we throw

them away, Duggal says. Think of the possibilities, adds his

colleague Sanjay Correa. What if your rooftop

were made of a cheap material that creates elec-

tricity, and then inside, your ceiling could take

By learning to manage innovation, Jeffrey Immelt

is remaking Americas flagship industrial corporation into

a technology and marketing powerhouse.

B Y E R I C K S C H O N F E L D

P H O T O G R A P H S B Y D A R R Y L E S T R I N E

WHERE BUSINESS IS GOING WWW. BUSINESS2.COM J ULY 2004

that electricity and turn it into light,hemus-

es, a broad smile spreading across his face.

The work in this basement lab stands as

a neon-bright metaphor for the transfor-

mation quietly under way at GE. Three

years into chief executive Jeffrey Immelts

tenure, its becoming clear that hes at-

tempting a radical and risky reinvention of

the 126-year-old flagship of American in-

dustry. Immelt, 48, is de-emphasizing some

of the tenets that his famous predecessor

Jack Welch used to build one of the most

formidable records ever compiled by a

CEO. Instead, Immelt has staked GEs fu-

ture growth on the force that guided the

company at its birth and for much of its

history: breathtaking, mind-blowing, world-

rattling technological innovation.

In a sense, Immelt has concluded that to

power his $134billion goliath forward, his

managers must view GE not so much as a

collection of huge, multibillion-dollar busi-

nesses but as a vast network of entrepre-

neurial, Silicon Valley-styleor better still,

Edison-styletech startups. Hehas ordered

them to grab the scientific lead on the far

technological frontiers of markets from clean

energy to medical diagnostics to nanotech

to security to jet-propulsion systems. And

he wants to harness that revved-up innova-

tion metabolism to a morehighly developed

and systematic marketing effort than GE

has marshaled in many years, if ever.

The result, Immelt believes, will be a GE

that looks like an entirely different compa-

nymore entrepreneurial, more science-

based, and generating much more growth

from its own internal operations than by

simply acquiring other companies. Con-

stant reinvention,Immelt says, is thecen-

tral necessity at GE.

And necessity is the mother of this re-

invention. GE has been going through one

of its rare troughs: Its stock is down 50per-

cent from its mid-2000peak, and in 2001it

broke a long streak of double-digit revenue

and profit growth, benchmarks that have

come to be seen as minimums for GE. In

2003the companys revenue grew just 1.5

percent; profit was up only 6percent. GE

has been hurt by the fallout from 9/11 and

the global recession, and its recent per-

formance has led some critics to question

whether Immelts plan can revive the com-

panys days of growth and glory. Mean-

while, cost pressures in many old-line GE

businesses, from appliances to plastics, are

fierce and worsening. Immelt himself sees

the threat clearly. Were all just a moment

away from commodity hell,he says.

Still, seeking salvation through capturing

the elusive, lightning-in-a-bottle instances

of innovation is tough for any company. It

becomes a monumental management chal-

lenge at a sprawling industrial empire with

11different major business lines, tens of

thousands of products, and 315,000em-

ployees in more than 100nations. Pushing

more of the entrepreneurial startup stuff

will probably result in morefailures at GE,

says Noel Tichy, a professor at the Univer-

High Hurdles

Immelts plan to turbocharge

GE through the marriage

of innovation and marketing

is ambitious to say the least.

sity of Michigan Business

School who ran GEs executive

education institute in the 1980s.

Spitting out a stream of entre-

preneurial ideas that mostly flop

in search of theonebig scoreis

an unnatural act for many GE

managers,he says.

Moreover, consider the sheer

scale of what Immelt is attempting: He has

set growth targets that would require GE

to generatemorethan $9billion in new rev-

enue annually from internal operations

alone. Thats likeadding thecombined busi-

nesses of eBay, JetBlue, MGM, and Star-

bucks. Few companies in history have been

able to consistently generate those kinds of

dollars without acquisitions.

The challenges of getting there by ignit-

ing innovation at a colossus likeGE arewrit

large, but in many ways they arent so dif-

ferent from the issues all companies face in

trying to unleash their latent entrepreneurial

power. How Immelt is going about it con-

tains broad lessons for managers everywhere.

And lets be clear about whats at stake for

GE. If Immelts reinvention doesnt work,

Tichy says, the almost unimaginable could

happen: GE could become just a tired, av-

eragecompany.Another probableresult of

failureis less difficult to envision. Immelt,

Tichy says, would be toast.

E

VERY CHIEF EXECUTIVE OF

GEand there have been only

10is expected to put his own

stamp on the company, even to

radically remakeit if necessary. Indeed, when

Immelt took over, Welch reportedly gave

him thesameadvicethat a previous GE boss

had given Welch: Blow it up.

Themarriageof technical innovation and

marketing is Immelts detonator, and hehas

been painstakingly wiring it up since he got

the top job. For one thing, he quickly be-

gan edging away from someof Welchs lega-

cy. Welch, of course, was a master innova-

tor himself, but mainly in the field of

financial management. He was to a large

degreea growth-by-acquisition man, buying

new businesses, many in high finance, and

mercilessly culling out underperformers. In

thelate90s,Immelt says, webecamebusi-

ness traders and not business growers. Today

organic growth is absolutely thebiggest task

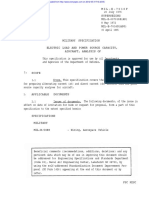

Immelts Laws of Reinvention

1 CHASE BIG CHANGE

GE is targeting markets undergoing a

transformationenergy, health care,

transportation, securityfor potential

billion-dollar scores.

$

134B

1.5%

>10%

7%

$

9.4B

*

$

9.1B

GEs 2003

revenue

Revenue

growth, 2003

Annual revenue

growth target

Annual internal

growth target

(excluding acquisitions)

Annual internal

growth target

(excluding acquisitions)

Combined

2003revenue of

eBay, JetBlue,

MGM, Starbucks

*

Based on 2003 revenue. Source: Company filings

sors that can communicate with one an-

other. During the presentation, one veter-

an engineer familiar with how oil refineries

operatehad a lightbulb moment: Refineries

might have a use for such wireless sensors

even beforetheyrefingernail-size. Thegroup

then figured out that infrared sensors used

in microwaveovens could becombined with

wireless technology designed for security

systems to offer petrochemical plants a way

to remotely monitor trouble spots in their

electrical equipment and machinery. That

job was often done by a person walking

around with a thermal camera. The prod-

uct, called GearTrak, hit themarket in May.

Cross-fertilization also plays a role in a

broader effort to modify the digital X-ray,

ultrasound, and CT scanning gear GE

sells to hospitals, so that it can be used to

monitor a variety of industrial systems

from aircraft parts assembly plants to gas

pipelines. These so-called nondestructive

testing businesses, launched since 2001,

brought in $400million last year and could

hit $1billion by 2006just the kind of in-

ternal growth Immelt is after.

Some of the software used in GEs

medical-imaging devices is also inspiring

GEs security division, whose mainstay

products are alarm systems. Like many

companies, GE sees security as a potential-

ly huge growth area in the post-9/11world.

And as it turns out, the sophisticated sys-

tems that can identify a tumor in a lung are

similar to the software needed to detect an

intruder amid hundreds of hours of digi-

tal surveillance video. In a cluttered room

called the Visualization Lab, scientist Greg

Chambers eyes a screen showing people

moving around a parking lot. Theyre be-

ing tracked by software that puts a big yel-

low rectangle around each person. But

Chambers and his team dont merely want

to track and record movements. We want

to calculate human intent,Chambers says.

on a plane, or soundproofing homes along

a particular flight path to allow the use of

bigger, noisier jet engines.

Bolsinger boiled the ideas down to five

and then presented them to I mmelt. He

approved all five, including one that GE

finds particularly promising: making a new

class of small, superefficient jet engines for

a coming generation of air taxis. The

breakthrough piece here is not just that we

can serve the air taxi market, Bolsinger

explains, but I think that wecan help build

the air taxi market.She concedes that its

not clear air taxis will catch on, but adds

that if the market does develop, theres

not a company in the world that could de-

sign, build, or support it better than GE.

This isnt total pie in the sky: GE already

has a joint venture with Honda thats de-

veloping a compact, technologically so-

phisticated jet engine. By the end of the

year, Bolsinger expects one major aircraft

manufacturer to select that engine for a

new class of business jets. Certification of

the plane by the FAA will take at least an-

other two years. But if all goes well, she

says, the business of making small jet en-

gines could eventually bring in as much as

$500million a year.

Of the 50imagination breakthroughs

presented to Immelt, 35 were green-lighted,

including such novel ideas as mobile ultra-

sound machines and emergency water pu-

rification systems mounted on truck trailers.

Many of them will amount to nothing, of

course, but so what? Just those 35projects

have the potential for $5billion in revenue

by 2006, he says. Besides, Immelt has or-

dered his teams to come up with another

50. This summer.

T

HE HEAT FROM IMMELT FOR

fresh ideas has led manyGE man-

agers to scour their operations for

promising but sidetracked tech-

nologies, and to dream up ways to refash-

ion existing technologies for totally differ-

ent markets. I call it the J unkyard Wars

approach to innovation, says Joe Krisci-

unas, global technology manager at GEs

sensor business. What can you find in

your arsenal to meet new needs?

Last year Krisciunas led a brainstorming

session on industrial applications for an idea

dubbed smart dust, fingernail-size sen-

of every one of our companies. To make

that clear, Immelt has tied compensation to

internal growth. If wedont hit our organic

revenue targets, he says, people are not

going to get paid.

He has also brought in more big brains

to dream up innovations. GE has added

5,000engineers since 2001, and there are

now 21engineers among thecompanys top

175 officersup from only seven when Im-

melt took over. He has cut the acquisitions

team by two-thirds. To drive home the re-

newed focus on marketing, he appointed

Beth Comstock, a 15-year GE veteran, as

chief marketing officer. The position had

been eliminated under Welch. Immelt also

assigned a marketing leader to each of GEs

major business lines, another first. And he

has hired 5,000new salespeople.

By last year, however, it had becomefrus-

tratingly clear to Immelt that the message

was not taking hold fast enough. In Sep-

tember 2003hesummoned all themarketing

directors to a company conference room

and for hours hammered at the importance

of new innovations. Wehaveto put growth

on steroids,he told them. He ordered each

of them to come back with five ideas for

new growth businessesimagination

breakthroughs, he christened them. The

ideas could be for things totally new to GE,

or they could leverage existing assets to cre-

ate new products or business lines. But each

idea should generate at least$100million in

new revenuewithin threeyears. I want game

changers, Immelt told them. Take a big

swing.He gave them two months.

Some in the room were stunned. There

was a collective gulp across the organiza-

tion,Comstock recalls. Peoplewerethink-

ing, Is this real?

For LorraineBolsinger, a former engineer

who was named last year to head up mar-

keting at GEs huge aircraft engine division

($10.7 billion in 2003revenue), reality sank

in quickly. Within days of themeeting, Bol-

singer arranged the first of 20 brainstorm-

ing sessions that brought together engineers,

finance people, marketers, sales staff, and

research scientists. She barred herself from

the first round of meetings so people

wouldnt be afraid to sound silly in front of

the boss. Within six weeks, the group came

up with 354ideas, including somethat were

silly indeed: putting a million micro-engines

2 REPURPOSE EVERYTHING

GE managers have been ordered to find

new markets for existing products; modi-

fying medical-imaging technology to

monitor industrial systems, for instance,

is expected to bring in $1 billion in 2006.

Thecoders aretrying to develop software

that will sense minute deviations from nor-

mal patternsat a shopping mall, in an air-

port, at a sporting eventand sound an

alert when something seems out of order.

For instance, if things arent usually taken

off a warehouse shelf at midnight on Sun-

day, and suddenly they are, the software

could detect the abnormality and summon

security. To work, the software will always

have to stay one step ahead of crooks and

terrorists. There will be an arms race be-

tween us and them,Chambers says. Were

putting the pedal to the metal.

S

OME OF THESE INITIATIVES

could add hundreds of millions

or even billions of dollars to GEs

revenue in coming years. And as

Scott Donnelly, head of GEs global re-

search and development efforts, points out,

a whole bunch of $1billion things adds

up after a while. But they stem mostly

from adaptations of existing businesses or

technologies; they arent the jaw-dropping

breakthroughs that can create entirely new

businesses with gargantuan payoffs. Thats

the holy grail of Immelts reinvention cam-

paign, and its being hunted diligently in

the House of Magic.

More formally known as the Global

Research Center, the House of Magic has

a storied past. Originally set up in 1900

in a barn in Schenectady, N.Y., as a refuge

for brilliant minds, it is now situated on

525secluded acres nearby. Over the years

it has hosted big thinkers like Albert Ein-

stein and employed such celebrated sci-

entists as Nobel Prize-winning chemist

I rving Langmuir. Among the many in-

ventions it has pumped out are the X-ray

tube, synthetic diamonds, the high-fre-

quency alternator that enabled the first

radio broadcasts, and the plastic used in

CDs. But in recent decades, the place be-

came less central

to GEs opera-

tions, particularly

as the company fo-

cused more on fi-

nancial services

under Welch. One

of I mmelts first

moves was to

pump new life into

tors pinpoint plaque buildups long before

any current technology can.

GE scientists are also pouring resources

into the quest for clean energy. Immelt has

made a long-term bet that fossil fuels will

have to be supplemented because of dwin-

dling supplies and geopolitical and envi-

ronmental constraints. GE has a team of

80 scientists dedicated to working on

hydrogen-related projects, and theyre try-

ing everything. In one lab theyve rigged

up a lawn mower with canisters they want

to fill with a metallic powder that could

absorb and release hydrogen.

Closer to reality is GEs fuel cell, which

could be providing clean power to malls or

whole neighborhoods by the end of the

decade, and ultimately could transform the

way power is distributed. Long before you

burn hydrogen to make electricity in cars,

says Correa, head of GEs energy and pro-

pulsion research, you will have stationary

fuel cells. Correa says the companysfuel

cell will convert natural gas to electricity

more efficiently than any power system to-

day and produceless than 10 percent of the

nitrous oxide coughed out by GEs gas tur-

bines. Best of all, one of the by-products

is hydrogen. GE believes that the market

for clean power ultimately will be enor-

mousand isnt as far off as many people

think. We foresee a huge move to more

sustainable energy,Correa says.

I

MMELTS GOALIS TO GET GE BACK

on its double-digit growth path by ulti-

mately generating up to 7percent in

added annual revenue from internal

growth, making up the rest through acqui-

sitions. Though he intends to de-emphasize

buying growth, he hasnt turned his back

on thepractice, havingthis year madetwo of

GEs largest purchases evera $10billion

deal for British biomedical company Amer-

sham and a$14 billion purchase of Viven-

di Universal Entertainment.

But do the math: Immelts targets mean

that hes demanding that a $134billion be-

hemoth innovate its way to annual internal

growth of as much as $9.4billionand that

number will grow, year after year. Its stag-

geringly ambitious, which is why his plan

invites skepticism. Besides facing the law of

large numbers, GE also risks becoming dis-

tracted by having too many irons in thefire.

GEs pure research effort. He has upped

its budget 14 percent to $359 million,

spent $100million on a new laboratory

wing in Schenectady, and invested an-

other $100million to open research cen-

ters in Munich and Shanghai. He also

started requiring top managers and mar-

keters to regularly cycle through the

House of Magic to keep in touch with

the latest advances.

Though they do have plenty of room to

roam, GE hasnt given the science wizards

free rein. To manage the kind of innova-

tion werelooking for,Donnelly says, first

you have to have a strategy of where you

want your company to be, where you can

be a big player, and where technology can

make a difference.One of Donnellys first

moves after being named R&D chief short-

ly before I mmelt took over was to slash

the number of projects at the research cen-

ter from more than 1,000to just 100high-

ly focused ones.

Margaret Blohms nanotechnology work

is one of them. In her House of Magic lab,

she sets up a simple experiment to show the

novel properties of very small things. She

inserts a magnet into a test tube suspended

over a rust-colored solution of iron nanopar-

ticles. The solution flows upwardseem-

ingly defying gravityand collects around

thetest tube, forming a spiked ball of brown

liquid. Blohm believes that thebizarreprop-

erties of nanoparticles could eventually lead

to any number of profitable uses for GE:

lighter metals, less brittle ceramics, sensors

that can detect a single molecule of a given

gas (such as sarin), plastics that conduct elec-

tricity. For us, nano is the ultimate materi-

als science,she says.

In a nearby lab, Nadeem Ishaque is al-

ready working on one use for Blohms tiny

particles. Ishaque, head of GEs advanced

molecular imaging program, wants to pack

1,000 of them inside a biocompatible

polymer shell and

then attach an anti-

body that seeks out

early signs of arteri-

al plaque. Once in-

side the body, the

iron nanoparticles

would be picked up

by an MRI scan,

and thus help doc-

3 SELL LIKE CRAZY

Immelt created the post of chief

marketing officer, named marketing

execs for each of GEs 11 major

divisions, and added 5,000new

salespeople.

Generating all that internal revenue

growth is going to be tough,says analyst

Tony Boase of A.G. Edwards. On the oth-

er hand, GE has been generally masterful

at managing hundreds of different busi-

nesses at once. Even Tichy thinks Immelt

has a good shot. Jeff still has a lot more

levers to pull,he says.

Immelt points to what he sees as major

signs of progress: By next year he expects

what he has labeled GEs seven growth

businesseseverything but plastics, ap-

pliances, equipment leasing, and insur-

anceto account for 85percent of rev-

enue, up from 68percent in 2000. Last

year six smaller GE units, all relatively

new and encompassing things like water

purification, health-care IT, and wind

turbines (see Growing in the Wind,

page 85), generated combined revenue

of $9billion, up 50percent from a year

earlier. And Immelt strongly believes that

continued supercharging of the compa-

nys marketing machinewill go a long way

toward keeping thosetrends moving in the

right direction.

But, as he says, marketing is bullshit

without stuff. Back in the House of

Magic, Tony Dean, head of GEs ad-

vanced propulsion program, is working

on stuff that may lead to the ultimate

growth engine: a kind of air-breathing

rocket that many peoplenot just in-

side GEbelieve could revolutionize

aviation. I n a test chamber at the re-

search center, this pulse detonation en-

gineis fired, rat-a-tat-tatting like a how-

itzer spitting out thousands of rounds.

I nstead of the rotating turbines of to-

days jet engines, this one creates thrust

by sparking controlled explosions in a

steel tube filled with gas fuel. I n theo-

ry, it could power small airliners that

could fly at supersonic speedsmore

than twice as fast as todays passenger

jets. And its expected to use 5 percent

less fuel than a standard jet engine.

Thats worth many billions of dollars a

year to the airline industry, Dean says.

It doesnt take an Edison to figure out

what ideas likethat could mean for Jeff Im-

melt and GE.

Growing in the Wind

O

ne answer to GEs growth

challenges is already in

the air. Among the com-

panys hottest business-

es is a two-year-old unit that sells

wind-power turbines. GE Wind Ener-

gys revenue more than doubled to

$1.2 billion last year, and the compa-

ny has rapidly become the worlds No.

2 maker of wind-power systems.

That remarkable growth has come

from a combination of buying into the

business and bringing to bear tech-

nologies and expertise from all across

the company. GE acquired Enrons

wind assets in 2002 for $285 million

and immediately faced a big prob-

lem: The erratic nature of the power

sourcewind gustsis taxing on tur-

bine components, especially the gear-

box vital to transforming the spinning

of the blades into electricity. GE

knows gearboxes: Its transportation

division makes huge, highly efficient

ones, including those used in 300-ton

mining trucks. That expertise helped

GE develop more reliable wind-tur-

bine gearboxes.

Meanwhile, GE jet-engine scien-

tists began working on fiber com-

posites to lighten the giant blades

each nearly as big as the wingspan

of a Boeing 747and expect to cut

the blades weight 25 percent by

next year. GE al so has teams of

Ph.D.s in India and China working

on computer simulations to test

components for new wind turbine

models (there are 23 now, each de-

signed for specific wind conditions).

We really understand the physics

of the machine, says Steve Zwolin-

ski, GE Winds CEO.

All the work is paying off in wind

turbines that are far more durable

and efficient than they were when

GE acquired the business. Manufac-

turing costs have also come down

30 percent. With wind power likely

to become an increasingly impor-

tant part of the global energy pic-

ture, GE believes its set to see bil-

lions of dollars of future growth

breezing its way.

4 UNLEASH THE MAD SCIENTISTS

Immelt reinvigorated GEs famed House

of Magic research center, hiring

hundreds of new scientists to dream

up groundbreaking innovations.

Produced exclusively by Business 2.0 Custom Reprints. 2004 Time Inc. All rights reserved.

Você também pode gostar

- The Threat of Geopolitics To International RelationsDocumento30 páginasThe Threat of Geopolitics To International Relationsadjie13Ainda não há avaliações

- Countering Terrorism Online With Ai Uncct Unicri Report WebDocumento50 páginasCountering Terrorism Online With Ai Uncct Unicri Report Webadjie13Ainda não há avaliações

- The Anatomy of Fraud and Corruption - W46P35962Documento295 páginasThe Anatomy of Fraud and Corruption - W46P35962adjie13Ainda não há avaliações

- CTI Security Intelligence Handbook Third EditionDocumento164 páginasCTI Security Intelligence Handbook Third EditionMJAinda não há avaliações

- North Korea Cyber Activity: Recorded Future Insikt GroupDocumento29 páginasNorth Korea Cyber Activity: Recorded Future Insikt GroupEsteban RamirezAinda não há avaliações

- Chinese State-Sponsored Group Reddelta' Targets The Vatican and Catholic OrganizationsDocumento21 páginasChinese State-Sponsored Group Reddelta' Targets The Vatican and Catholic Organizationsadjie13Ainda não há avaliações

- Threatintethandbook PDFDocumento140 páginasThreatintethandbook PDFMunwwarHussainSheliaAinda não há avaliações

- Block Chain PDFDocumento27 páginasBlock Chain PDFPalani SamyAinda não há avaliações

- Allow 21 of The Brightest Minds in Marketing To ExplainDocumento24 páginasAllow 21 of The Brightest Minds in Marketing To Explainadjie13Ainda não há avaliações

- Allow 21 of The Brightest Minds in Marketing To ExplainDocumento24 páginasAllow 21 of The Brightest Minds in Marketing To Explainadjie13Ainda não há avaliações

- PWC The Future of Software Pricing Excellence Saas PricingDocumento8 páginasPWC The Future of Software Pricing Excellence Saas Pricingadjie13Ainda não há avaliações

- 7insightsofindonesia 160222044137Documento41 páginas7insightsofindonesia 160222044137Pratiwi SusantiAinda não há avaliações

- Automationsurveyapril2018final 180430033835 PDFDocumento16 páginasAutomationsurveyapril2018final 180430033835 PDFadjie13Ainda não há avaliações

- Consumer Attitudes About Renewable Energy - Trends and Regional DifferencesDocumento28 páginasConsumer Attitudes About Renewable Energy - Trends and Regional Differencesadjie13Ainda não há avaliações

- Global Trends in Renewable Energy Investment 2011 - Analysis of Trends and Issues in The Financing of Renewable Energy (Datapack)Documento59 páginasGlobal Trends in Renewable Energy Investment 2011 - Analysis of Trends and Issues in The Financing of Renewable Energy (Datapack)adjie13Ainda não há avaliações

- Intrapreneurship - Conceptualizing Entrepreneurial Employee BehaviourDocumento47 páginasIntrapreneurship - Conceptualizing Entrepreneurial Employee Behaviouradjie13Ainda não há avaliações

- Delivering On Renewable Energy Around The World - How Do Key Countries Stack UpDocumento8 páginasDelivering On Renewable Energy Around The World - How Do Key Countries Stack Upadjie13Ainda não há avaliações

- CNG LNG Factsheet Final enDocumento2 páginasCNG LNG Factsheet Final enadjie13Ainda não há avaliações

- What Is LNGDocumento4 páginasWhat Is LNGsekarsanthanamAinda não há avaliações

- CEO LogicDocumento4 páginasCEO Logicadjie13100% (1)

- Art of Powerful QuestionsDocumento18 páginasArt of Powerful QuestionsDaisy100% (49)

- Steve Jobs PrincipleDocumento5 páginasSteve Jobs Principleadjie13Ainda não há avaliações

- Global Economic Forecast: September 13th 2011Documento12 páginasGlobal Economic Forecast: September 13th 2011adjie13Ainda não há avaliações

- Brand CSR IntegrationDocumento6 páginasBrand CSR IntegrationDarwin FloresAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Thermal Plasma TechDocumento4 páginasThermal Plasma TechjohnribarAinda não há avaliações

- Norphonic VoIP D10003Documento2 páginasNorphonic VoIP D10003Topcom Toki-VokiAinda não há avaliações

- Essay On The Traffic Conditions in Big CitiesDocumento3 páginasEssay On The Traffic Conditions in Big CitiesCeciliaAinda não há avaliações

- 9-4130 - Loose Stepper MotorDocumento2 páginas9-4130 - Loose Stepper MotorarasAinda não há avaliações

- Inter Rat Handover GSM UmtsDocumento4 páginasInter Rat Handover GSM UmtsadanakebapAinda não há avaliações

- Gitlab CICDDocumento15 páginasGitlab CICDdeepak bansal100% (1)

- Cybersecurity Essentials 1.0 Release Notes: PurposeDocumento5 páginasCybersecurity Essentials 1.0 Release Notes: PurposeRonny Kimer Fiestas VargasAinda não há avaliações

- Greenhouse Project Interim ReportDocumento26 páginasGreenhouse Project Interim ReportMuneek ShahAinda não há avaliações

- Company Work Execution Plan For A Long Form ContractDocumento4 páginasCompany Work Execution Plan For A Long Form Contractshojaee1063Ainda não há avaliações

- Svcet: Unit IV Traveling Waves On Transmission LineDocumento21 páginasSvcet: Unit IV Traveling Waves On Transmission LineDeepak CoolAinda não há avaliações

- Heidenhain MotorsDocumento44 páginasHeidenhain MotorsmarhiAinda não há avaliações

- Technics Su-7200 SMDocumento21 páginasTechnics Su-7200 SMF_E_TermanAinda não há avaliações

- A Seminar Report On Virtualization Techniques in Cloud - ComputingDocumento33 páginasA Seminar Report On Virtualization Techniques in Cloud - ComputingParth AgarwalAinda não há avaliações

- Kode Simbol Rate TVDocumento10 páginasKode Simbol Rate TVAndri PAinda não há avaliações

- An Introduction To Java Programming 3Documento179 páginasAn Introduction To Java Programming 3Aleksandar Dutina100% (2)

- QAV - 1.1. Report (Sup1)Documento2 páginasQAV - 1.1. Report (Sup1)Rohit SoniAinda não há avaliações

- IA-NT-PWR-2.4-Reference GuideDocumento110 páginasIA-NT-PWR-2.4-Reference GuideSamuel LeiteAinda não há avaliações

- Practice - Creating A Discount Modifier Using QualifiersDocumento37 páginasPractice - Creating A Discount Modifier Using Qualifiersmadhu12343Ainda não há avaliações

- Module-I Introduction To Instructional Technology PDFDocumento15 páginasModule-I Introduction To Instructional Technology PDFcharwinsAinda não há avaliações

- Mil e 7016FDocumento48 páginasMil e 7016Fgustavojorge12Ainda não há avaliações

- Domino's PizzaDocumento37 páginasDomino's PizzaAristianto Pradana0% (3)

- L11 ImageplacementDocumento2 páginasL11 ImageplacementJayram JavierAinda não há avaliações

- Savitha S. Panikar, PH.DDocumento4 páginasSavitha S. Panikar, PH.Diboorose7Ainda não há avaliações

- UNIC Jakarta Internship ApplicationDocumento4 páginasUNIC Jakarta Internship ApplicationMuhammad IkhsanAinda não há avaliações

- GNP-GAP Installation InstructionsDocumento10 páginasGNP-GAP Installation InstructionsLeonardo ValenciaAinda não há avaliações

- Humboldt Triaxial Equipment Guide-LR0417Documento21 páginasHumboldt Triaxial Equipment Guide-LR0417Dilson Loaiza CruzAinda não há avaliações

- Mechanics Guidelines 23 Div ST Fair ExhibitDocumento8 páginasMechanics Guidelines 23 Div ST Fair ExhibitMarilyn GarciaAinda não há avaliações

- PDH DFE1000 BrochureDocumento2 páginasPDH DFE1000 Brochuremajdi1985Ainda não há avaliações

- Upgrading A P - SupplyDocumento7 páginasUpgrading A P - SupplyDrift GeeAinda não há avaliações

- Dual Prime Source Datasheet 1Documento1 páginaDual Prime Source Datasheet 1EstebanAinda não há avaliações