Escolar Documentos

Profissional Documentos

Cultura Documentos

Purchase Agreement 07312013

Enviado por

Gat Magiliw BatiDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Purchase Agreement 07312013

Enviado por

Gat Magiliw BatiDireitos autorais:

Formatos disponíveis

PURCHASE AGREEMENT

BANK OF THE PHILIPPINE ISLANDS

Employee Number

Card Type

Amount Collected By

Processing Fee Collected By

Signature Verified By

Encoded By

Name (as it appears on ID)

Valid ID Presented / ID Number

Card Received By

Date

Branch Name

Authorized By

Branch Code

BPI Prepaid Card Number

THIS PORTION TO BE FILLED OUT BY THE BANK REPRESENTATIVE

*Email Address

*Telephone Number

*Address

*Civil Status

*Gender

*Date of Birth (DD/MM/YYYY)

*Mothers Maiden Name

I prefer not to enroll my BPI Prepaid Card in Bills Payment and Express Mobile.

Signature of Purchaser / Cardholder

I agree to the Terms and Conditions printed at the back of this Purchase Agreement Form.

I understand that my BPI Prepaid Card will be automatically enrolled in Bills Payment and Express Mobile given that I

have a BPI Current / Savings Account. My account number is

(Kindly fill out and sign in front of a Bank Personnel at a BPI Branch)

TERMS AND CONDITIONS AGREEMENT

*Mobile Number

( ) Single ( ) Married

( ) Male ( ) Female

Name to Appear on Card (maximum of 21 characters including spaces and should be supported by a valid ID.

Refrain from using nicknames and abbreviations)

Fill out only if applied for someone else.

ABOUT THE CARD USER (Kindly fill out all fields)

( ) More Fun prepaid Visa

Card

( ) BPI Express Gift Mastercard

( ) My ePrepaid Mastercard

Gallery

Tangerine Champagne

Azure

Upload

Celeste Crystal

Indigo

CARD TYPE

TELEPHONE NUMBER

DATE OF BIRTH (DD/MM/YYYY)

MOTHERS MAIDEN NAME

ADDRESS

NAME (First Name, Middle Name, Last Name)

E-MAIL ADDRESS

MOBILE NUMBER

ABOUT ME

IMPORTANT: Address, date of birth, and other details must be those of the Cardholder and the Purchaser. Please read this Purchase Agreement carefully.

THE CARD - Shall refer to BPI Prepaid Cards such as Express Cash, Express Money Order, Express Cash Gift Cards, Express Cash Photo Gift Cards, My ePrepaid which

are affiliated with MasterCard, More Fun Prepaid Card which is affiliated with Visa or a local proprietary Card, or such other Cards to be issued by BPI, which can be

purchased for personal use or as a gift to a third party, or for whatever legal reason it may serve.

CARDHOLDER/ BEARER/PURCHASER - The term Cardholder/Bearer shall refer to (i) a person who purchases or avails of a Card for his/her own use or (ii) the

person for whom or for whose use a Card is purchased. The term Purchaser shall refer to the person who purchases or avails of a Card for his/her own use or for

the use of another.

For generic/nameless Cards, the Purchaser agrees to be solely and exclusively bound by the

Purchase Agreement for the issuance of the Prepaid Card for the use of another.

All Cards should be signed by the relevant Cardholder and are non-transferable.

RESPONSIBILITY OF THE CARDHOLDER - The Cardholder agrees to (i) sign the Card immediately upon receiving it and (ii) safeguard the Card as if it were cash.

BPI may, at its option, assign a system-generated personal identification number (PIN) to a Card (except for BPI Express Cash Gift Card, BPI Express Cash Photo Gift

Card, My ePrepaid, and More Fun Prepaid Card) to enable the Cardholder to withdraw cash or do balance inquiries via the ATM. It is also advised that the Cardholder

immediately change this initial PIN and nominate his own PIN.

USES AND LIMITATIONS OF THE CARD - The Cardholder can use BPI Prepaid Cards to pay for purchases and services availed. All BPI Prepaid Cards are not deposit

accounts, and the value stored is not insured by the Philippine Deposit Insurance Corporation (PDIC). Enumerated below are the specific uses for the Cards:

For BPI Express Cash and BPI Express Money Order, the Card can be used to pay for purchases and services availed at any MasterCard-affiliated establishment

nationwide. It can also be used for balance inquiry, cash withdrawal, prepaid mobile phone reload and fund transfer to another BPI Prepaid Card via BPI ATMs

nationwide. The withdrawal is limited to a maximum of Twenty Thousand Pesos (P20.000.00) per day. The Card cannot be used for Over-the-Counter withdrawals

at any BPI/BPI Family Savings Bank branch.

For BPI Express Cash Gift Card and Express Cash Photo Gift Card, the Card can be used to pay for purchases and services availed at any MasterCard-affiliated

establishment nationwide.

BPI My ePrepaid can be used for payments of any purchases made online at any MasterCard-affiliated website and payments of purchases and services at any

MasterCard-affiliated establishment worldwide.

The More Fun Prepaid Card can be used for payments of any purchases made online at any Visa-affiliated website and payments of purchases and services at any

Visa-affiliated establishment worldwide.

For My ePrepaid and More Fun Prepaid Card payment transactions made abroad will be converted at the exchange rate on the date the transaction is posted.

In cases of return of goods, tickets, and other services obtained through the use of the Card where the merchant permits such return, the Cardholder agrees to

absorb any loss or gain in relation to the exchange rate which may be charged to the Card. Payment transactions made online and/or abroad using the Card are

subject to the regulations, controls, or limitations imposed by the merchant, institution and/or country.

BPI Express Cash Gift Card, Express Cash Photo Gift Card, My ePrepaid and More Fun Prepaid Card cannot be used for cash withdrawals at BPI ATMs or at BPI or BPI

Family Savings Bank branches.

ACCREDITED ESTABLISHMENTS - BPI has agreed with MasterCard International that Cards bearing the MasterCard or MasterCard Electronic logo shall be honored at

all MasterCard-affiliated merchants with electronic terminals. Cards with Internet shopping functionality can also be used in MasterCard-affiliated shopping sites

through an online payment facility. However, BPI shall not be responsible/liable to the Cardholder if for any reason, the Card is not accepted.

BPI has also agreed with Visa that Cards bearing the Visa logo shall be honored at all Visa-affiliated merchants with electronic terminals. Cards with Internet

shopping functionality can also be used in Visa-affiliated shopping sites through an online payment facility. However, BPI shall not be responsible/liable to the

Cardholder if for any reason, the Card is not accepted.

CARD VALUE - The value of the Card is determined by the Cardholder or Purchaser by simply loading value in the Card. The maximum amount that can be loaded

is Twenty Thousand Pesos (P20,000.00) for BPI Express Cash, BPI Express Money Order, BPI Express Cash Gift Card and Express Cash Photo Gift Card while the

maximum amount that can be loaded to BPI My ePrepaid and More Fun Prepaid Card is One Hundred Thousand Pesos (P100,000.00). The aggregate load limit per

client per month is subject to BSP Circular 649 (Guidelines Governing the Issuance of Electronic Money). Only cash and its equivalent (e.g. fund transfer from a

deposit account) shall be accepted for loading value into the Card. The Bank reserves the right to, without notice and without liability, deactivate Cards exceeding

the load and balance limit. No checks shall be accepted for loading value into the Card. The Cardholder may check the balance of the Card by inquiring via: (i)

Express Phone (89-100); (ii) any Express Teller ATM nationwide (if Card has a valid 4-digit Personal Identification Number (PIN); (iii) Express Online, provided the

Card has been enrolled in the Purchaser's/Cardholder's Express Online account, or (iv) by texting using a mobile phone. Key in BALEC <16 digit BPI Prepaid Card

number> and send to 2274 for Globe and Touch Mobile and 3274 for SMART & Talk n Text.

CARD RELOAD - The Card can be reloaded by the Cardholder, the Purchaser, or by a third party with additional value any time as long as it has not yet expired, and

the total value in the Card at any time does not exceed Twenty Thousand Pesos (P20,000.00) for BPI Express Cash, BPI Express Money Order, BPI Express Cash Gift

Card and Express Cash Photo Gift Card and One Hundred Thousand Pesos (P100,000.00) for BPI My ePrepaid and More Fun Prepaid Card. Funds transfer from an

existing deposit account to the Card can also be done thru: (i) Express Phone (89-100) (ii) Express Online (www.bpiexpressonline.com) (iii) all Express Teller ATMs

nationwide (iv) Express Mobile, and (v) all Express Deposit Machines. The actual time of crediting the load will depend on what channel was used to reload. Some

channels may also require pre-enrollment or encoding of passwords, security numbers, or codes before reloading can be done.

EXPIRY AND RENEWAL OF THE CARD - Unless earlier terminated by BPI, voluntarily cancelled, or returned by the Cardholder, the Card shall be valid from the day of

issuance or renewal up to the last day of the month indicated on the face of the Card. Only the Cardholder may request for the renewal of the Card, which should

be accomplished within One Hundred Twenty (120) days from Card expiry date thru: (i) Express Phone (89-100), subject to Positive Identification (PID) or (ii) any

BPI or BPI Family Savings Bank branch. The Cardholder must accomplish all requirements set by BPI at the time of request. BPI has the right whether to approve

or deny the renewal request. The Cardholder agrees that if no request for renewal is submitted/called in to BPI, a monthly maintenance fee* shall be charged to

the Card beginning on the One Hundred Twenty First (121st) day from Card's expiry date. In case the request for renewal is denied for whatever reason, a Managers

Check in the name of the Cardholder with the amount equivalent to the remaining load at the time of expiry will be issued within Ninety (90) days.

More Fun Prepaid Card is not for renewal. Cardholder may apply for a new card online.

CARD INACTIVITY AND EXPIRY FEES - A Card not used for One Hundred Twenty (120) continuous days shall be automatically placed in inactive status. BPI may, at its

option, impose a reasonable inactivity fee* for any Card that has been in inactive status at the end of each month. Once the value of the inactive Card becomes

zero, it shall be automatically closed. Similarly, a Card with value not claimed One Hundred Twenty (120) days after its expiry date shall be assessed a monthly

maintenance fee* to be computed starting on the One Hundred Twenty First day (121st) after the expiry date. It shall be automatically deducted from the Card

balance. Redemption of balances from expired Cards shall be net of these fees. Should the Card balance become zero as a result of the fees deducted, the Card

shall likewise be closed. BPI reserves the right to impose additional fees as may be necessary in providing this service.

Kung ang Card ay hindi nagamit sa loob ng Isang Daan at Dalawampung (120) sunod-sunod na araw mula sa pagka-issue o huling transaksyong gamit ito, ang

Card ay agad-agad malalagay sa inactive status. Maaaring maningil ang BPI ng inactivity fee* sa katapusan ng bawat buwan. Sa oras na maubos ang balanse ng

Card, ito ay kaagarang isasara. Anumang Card na may nalalabing balanse matapos ang Isang Daan at Dalawampung (120) araw pagkaraan ng expiry date ay

maaaring mapatawan ng maintenance fee* kada buwan na sisingilin mula sa unang araw matapos ang Isang Daan at Dalawampung (120) araw. Ito ay agarang

mababawas sa balanse ng Card. Anumang balanse na matitira matapos mabawasan ng service maintenance fee* ay ang halagang maaaring makuha ng

Cardholder. Sa oras na maubos ang balanse ng Card ng service maintenance fee*, ang Card ay kaagarang isasara. Ang BPI ay may karapatan magpataw ng

anumang fees para sa serbisyong ito.

LOSS OF THE CARD - A lost Card is like lost cash. BPI shall block the Card and load value on the Card remaining at the time a lost/stolen Card is reported. Cardholder

should immediately call 89-100 or if abroad, BPI toll-free numbers listed on BPI Express Online. Reimbursement of unused load value in the Card can be claimed

after Ninety (90) days from report of loss. This will be either in the form of a Managers Check made payable to the Cardholder or a replacement Card, both of which

shall be subject to service fees*. Losses due to the use of a lost/stolen Card before the loss or theft has been reported shall be for the account of the Cardholder.

Sumasang-ayon ang Cardholder na kinakailangang tumawag agad sa 89-100, at kung nasa abroad, tumawag sa mga toll-free numbers ng BPI na nakatala sa BPI

Express Online upang ipaalam ang pagkawala o pagkanakaw ng kanyang Card. Oras na matanggap ng BPI ang tawag, agarang iba-block ang anumang transaksyon

para sa Card na ito. Kung sakaling nagamit ang Card bago ito naitawag na nawawala o nanakaw, ang anumang pagkawala o pagkabawas ng pera ay para sa

account ng Cardholder. Sumasang-ayon rin ang Cardholder na maaari lamang makuha ang anumang nalalabing balanse sa Card makalipas ang Siyamnapung (90)

araw matapos itawag ang pagkakawala ng Card sa pamamagitan ng Managers Check na nakapangalan sa Cardholder o kayay pagpapalit ng bagong Card na may

karampatang service fees*.

REPLACEMENT OF DAMAGED CARDS - BPI shall replace a damaged Card for free if it still has its full ORIGINAL load value and HAS NOT BEEN USED for any transaction.

In the event the damaged Card has less than its original value and/or has already been used by the Cardholder for any transaction, BPI shall issue a replacement

Card with value equal to the remaining balance of the damaged Card, subject to Cardholder's payment of service fees*. The replacement Card can be claimed Five

(5) banking days for nominated GMMA branches and Seven (7) banking days for nominated non-GMMA branches including Visayas and Mindanao after BPI receives

the replacement request.

SETTLEMENT OF FINANCIAL LOSSES - Financial losses of the Cardholder arising from security breaches, system failures, or errors committed by BPI or any BPI

personnel shall be settled by automatic credit to the Card. If the Cardholder wishes to discontinue using the Card, BPI shall issue a Managers Check made payable

to the Cardholder equivalent to the unused load. Settlement of losses shall only be done after investigations conducted by BPI and/or its affiliates.

Ang financial losses ng Cardholder o pagkabawas ng balanse ng Card na dulot ng security breaches, system failures, o anumang errors ng BPI o empleyado ng BPI

ay pagbabayaran sa pamamagitan ng pag-credit sa Card. Kung gusto naman ng Cardholder na itigil na ang paggamit ng Card, magbibigay ng Managers Check ang

BPI na nakapangalan sa Cardholder na naglalaman ng katumbas na balanse ng Card. Ang pag-aayos nito ay gagawin lamang pagkatapos maimbistigahan ng BPI

o ng mga affiliates nito ang kaso.

SERVICE CHARGE AND OTHER FEES - The Cardholder and the Purchaser recognize the right of BPI to impose charges such as service fees*, loading fees*, and other

fees* on any or all of its products, services, and facilities. The Cardholder and/or Purchaser agree to pay such service charges and fees presently imposed or may

in the future be imposed by BPI at its option. As necessary, the amount of said service charges and fees may also be revised by BPI from time to time. The

Cardholder and/or Purchaser may be notified of new or revised charges or fees thru any of the following: (i) BPI ATMs; (ii) www.bpiexpressonline.com; (iii) BPI and

BPI Family Savings Bank branches; or (iv) other communication channels available to BPI.

Kinikilala ng Cardholder at ng Purchaser ang karapatan ng BPI na maningil para sa mga produkto, serbisyo, at mga pasilidad na ibinibigay nito. Sumasang-ayon

ang Cardholder at/o Purchaser na magbayad ng anumang pangkasalukuyang charges tulad ng service fees*, loading fees* o anumang fees* sa BPI sa hinaharap.

Ang BPI ay maaaring magdagdag ng service fees* o magsagawa ng pagbabago sa halaga ng nasabing service fees* anumang oras. Ito ay maaaring ipagbigay alam

sa pamamagitan ng anunsyo sa: (i) BPI ATMs; (ii) www.bpiexpressonline.com; (iii) mga sangay ng BPI o BPI Family Savings Bank; o (iv) iba pang communication

channels ng BPI.

UNCLAIMED CARDS Upon application, card can be claimed within Five to Seven (5-7) banking days for nominated Branches in GMMA and Seven to Ten (7-10)

banking days for nominated Branches in non-GMMA including Visayas and Mindanao. Any Card unclaimed after Thirty (30) days from the time of delivery to the

nominated Branch shall be perforated for security reasons. Any Cardholder who fails to claim his Card within such prescribed period shall be required to purchase

a new one.

COMPLIANCE WITH EXISTING LAWS - The Cardholder and Purchaser hereby warrant that the use of the Card, including but not limited to the transfer and/or receipt

of funds using the Card and the available channels for the Card, do not and will not violate the Anti-Money Laundering Law, as amended as well as other applicable

laws, rules, or regulations. By signing this Agreement or using the Card, the Cardholder and Purchaser hereby agree to render BPI, its officers, employees, and

representatives, free and harmless and to indemnify BPI from any liabilities, damages, suits, or causes of action whatsoever which may arise from any violation

of said laws, rules, or regulations. Moreover, BPI, upon reasonable suspicion of fraud, irregularity, or anomaly involving the Card may automatically block the use

thereof and initiate investigation.

AMENDMENTS - BPI may, at anytime and for whatever reason it may deem proper, amend, revise, or modify this Agreement. Any such amendment shall bind the

Cardholder and Purchaser upon date of effectivity as specified on the notice, whichever is earlier. The Cardholder or Purchaser may have his Card terminated within

Fifteen (15) days from notice if he refuses to be bound by the amendment. Failure to notify BPI of Cardholder's or Purchaser's intention to terminate his Card shall

be construed as acceptance by the Cardholder of the amendments to this Agreement.

LIMITATION OF LIABILITY - BPI shall not be liable to the Cardholder or Purchaser for any loss, damage, claim, cost, or other liability arising from the Agreement or

the use or misuse of the Card unless solely and directly caused by the gross negligence or willful misconduct of BPI or its officers, employees, or representatives.

BPI's liability arising out of or in connection herewith shall be limited to 50% of card balance or the actual and proven amount lost, whichever is lower.

AGREEMENT TO THESE TERMS AND CONDITIONS - The Cardholder's or Purchaser's signature herein, or by Cardholder's use of the Card, or the Cardholder's receipt of

the Card from the Purchaser, if Cardholder is not the Purchaser, constitutes Cardholder's agreement to and acceptance of these terms and conditions and the Terms

and Conditions of the Bank of the Philippine Islands governing PRODUCTS, SERVICES, FACILITIES, AND CHANNELS. The Cardholder and Purchaser fully understand the

corresponding risk entailed in availing of such products, facilities, services, and channels. The Cardholder and Purchaser agree to any and all supplement(s),

modification(s), or amendment(s) of such terms and conditions, notices of which shall be posted in the Banks premises, website, or any other channel where

available.

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

*The applicable fees and charges shall be published in the Bank's website at Client Updates portion from time to time and made an integral part hereof.

(PRINTED NAME AND SIGNATURE)

PURCHASER/CARDHOLDER

DATE

Você também pode gostar

- BPI Express OnlineDocumento7 páginasBPI Express OnlineJacqueline Gregorio RamosAinda não há avaliações

- Cash Card Terms and Conditions PDFDocumento4 páginasCash Card Terms and Conditions PDFJoann BasirgoAinda não há avaliações

- Z3 800 PDFDocumento3 páginasZ3 800 PDFEmma MagalsoAinda não há avaliações

- APPLY VISA PREPAID CARDDocumento2 páginasAPPLY VISA PREPAID CARDShiela HuniAinda não há avaliações

- Bdo TCSDocumento7 páginasBdo TCSJohn PitaoAinda não há avaliações

- Including The Long Form Fee Disclosure ("List of All Fees.")Documento9 páginasIncluding The Long Form Fee Disclosure ("List of All Fees.")Shamara LoganAinda não há avaliações

- Cards Dbscardsflash TNCDocumento2 páginasCards Dbscardsflash TNCkicofAinda não há avaliações

- AT&T Cardholder Agreement ReviewDocumento22 páginasAT&T Cardholder Agreement ReviewChrisAinda não há avaliações

- Terms and Conditions For Barodatravel Easy CardsDocumento12 páginasTerms and Conditions For Barodatravel Easy CardsMohit DeshpandeAinda não há avaliações

- BDO Debit Card T&CsDocumento6 páginasBDO Debit Card T&CsEjay ReyesAinda não há avaliações

- Frequently Asked Questions For DCB Prepaid CardsDocumento4 páginasFrequently Asked Questions For DCB Prepaid Cardsbhadrichandu961Ainda não há avaliações

- June 1 - 30, 2020Documento4 páginasJune 1 - 30, 2020MaraAinda não há avaliações

- Rewarding Excellence Visa Prepaid Card FaqsDocumento4 páginasRewarding Excellence Visa Prepaid Card FaqsjudahAinda não há avaliações

- Customer Information Form CIF Rev 02-12-17 2014Documento2 páginasCustomer Information Form CIF Rev 02-12-17 2014Zoryel MontanoAinda não há avaliações

- BDO Credit Card Terms and ConditionsDocumento7 páginasBDO Credit Card Terms and ConditionsHolly WestAinda não há avaliações

- Dos Lifestyledebit 07122018 PDFDocumento38 páginasDos Lifestyledebit 07122018 PDFSarra AmyleaAinda não há avaliações

- "Registering Your Card" and "Personal Identification Number"Documento11 páginas"Registering Your Card" and "Personal Identification Number"Ivan MilosavljevicAinda não há avaliações

- Hav Card T&CDocumento1 páginaHav Card T&CVishal AyeerAinda não há avaliações

- FreeGiftWithCitiPromo TCsDocumento4 páginasFreeGiftWithCitiPromo TCsmelpintucanAinda não há avaliações

- Visa-Debit FaqDocumento3 páginasVisa-Debit FaqraishtAinda não há avaliações

- AchieveCard Prepaid MasterCard Cardholder AgreementDocumento18 páginasAchieveCard Prepaid MasterCard Cardholder AgreementAchieve CardAinda não há avaliações

- Yazz Frequently Asked Questions: What Is A YAZZ Card?Documento5 páginasYazz Frequently Asked Questions: What Is A YAZZ Card?John Ladice Severino TumbagahonAinda não há avaliações

- Terms and Conditions - Debit Card Issuance & OperationsDocumento4 páginasTerms and Conditions - Debit Card Issuance & OperationshemnathAinda não há avaliações

- 170323-Annex D FAQ English Website 2023Documento9 páginas170323-Annex D FAQ English Website 2023Abhijith AnandAinda não há avaliações

- Hook UpDocumento3 páginasHook UpBoluwatife OluwafemiAinda não há avaliações

- SingSaver Rewards Campaign Terms and Conditions 22062022Documento7 páginasSingSaver Rewards Campaign Terms and Conditions 22062022kicofAinda não há avaliações

- State of Washington Payroll Card Program FAQsDocumento7 páginasState of Washington Payroll Card Program FAQsFoyez AhammadAinda não há avaliações

- Key BenefitsDocumento2 páginasKey Benefitsumana.rafiqAinda não há avaliações

- Ds 10Documento5 páginasDs 10Tan Dq100% (1)

- Cardholder Agreement Visa 637621Documento8 páginasCardholder Agreement Visa 637621chrisAinda não há avaliações

- Yazz Frequently Asked Questions: What Is A YAZZ Card?Documento6 páginasYazz Frequently Asked Questions: What Is A YAZZ Card?Krizna VargasAinda não há avaliações

- MasterCard Prepaid TandCDocumento9 páginasMasterCard Prepaid TandCmikeAinda não há avaliações

- GE Capital Retail Bank Walmart MoneyCard Cardholder Agreement SummaryDocumento7 páginasGE Capital Retail Bank Walmart MoneyCard Cardholder Agreement SummaryAngie MottoAinda não há avaliações

- Faq Credit Card Jun 2015Documento4 páginasFaq Credit Card Jun 2015Darshan HMAinda não há avaliações

- Digital Card FAQs TCs Digital OnboardingDocumento5 páginasDigital Card FAQs TCs Digital OnboardingSHARATHAinda não há avaliações

- Visa International Application FormDocumento4 páginasVisa International Application FormJoel_10010Ainda não há avaliações

- Terms and Conditions - Debit CardsDocumento7 páginasTerms and Conditions - Debit CardsAshan SanAinda não há avaliações

- Everyday Spend FAQs English v2Documento4 páginasEveryday Spend FAQs English v2hubrAinda não há avaliações

- BpiDocumento35 páginasBpiChing CamposagradoAinda não há avaliações

- Pre Paid Cards TC enDocumento7 páginasPre Paid Cards TC enAbdulla SameehAinda não há avaliações

- Terms and ConditionsDocumento2 páginasTerms and ConditionsRaviteja YasarapuAinda não há avaliações

- DC Usage Guide TNC - 30.09.2022Documento5 páginasDC Usage Guide TNC - 30.09.2022SowjanyaAinda não há avaliações

- Welcome Gift For Citi PartnersDocumento4 páginasWelcome Gift For Citi PartnersChristian Earl OcbeñaAinda não há avaliações

- UBLWiz Application FormDocumento2 páginasUBLWiz Application Formsaif_khan1155Ainda não há avaliações

- Partnership Consolidated Terms ConditionsDocumento14 páginasPartnership Consolidated Terms ConditionsJedd jafferAinda não há avaliações

- HJSKDocumento24 páginasHJSKB. SinghAinda não há avaliações

- Citi Click Cash Sodexo Pass PromoDocumento2 páginasCiti Click Cash Sodexo Pass PromoRhod Bernaldez EstaAinda não há avaliações

- FAQs GiftCardDocumento4 páginasFAQs GiftCardYet_undecidedAinda não há avaliações

- FaqsDocumento4 páginasFaqsburke1983dAinda não há avaliações

- SingSaver Rewards Campaign Terms and Conditions 06122021Documento37 páginasSingSaver Rewards Campaign Terms and Conditions 06122021Lz CaiAinda não há avaliações

- CHA_51285705BDocumento6 páginasCHA_51285705BmarksolomonighoAinda não há avaliações

- Product Disclosure Sheet: Page 1 of 4 (PDS027/REV201115)Documento4 páginasProduct Disclosure Sheet: Page 1 of 4 (PDS027/REV201115)Lipsin LeeAinda não há avaliações

- NB Bancorp Cardholder AgreementDocumento9 páginasNB Bancorp Cardholder Agreementtcsqueenwife4evaAinda não há avaliações

- Singsaver CIMBDocumento7 páginasSingsaver CIMBkicofAinda não há avaliações

- Account Terms Cards Mastercard enDocumento12 páginasAccount Terms Cards Mastercard enHASSAN KocentiniAinda não há avaliações

- SBI - NoneDocumento2 páginasSBI - NoneSushil Kumar RaoAinda não há avaliações

- Bdo Credit Cards Cash Advance Terms and Conditions - Revised As of Oct 2022Documento2 páginasBdo Credit Cards Cash Advance Terms and Conditions - Revised As of Oct 2022mikechuasecoAinda não há avaliações

- Lowest Interest CorpBank Credit CardDocumento3 páginasLowest Interest CorpBank Credit CardKunal JainAinda não há avaliações

- GrabDocumento1 páginaGrabGat Magiliw BatiAinda não há avaliações

- Military Phonetic AlphabetDocumento1 páginaMilitary Phonetic AlphabetGat Magiliw BatiAinda não há avaliações

- Important reminders for DFA passport appointment on Tue, Apr 22Documento3 páginasImportant reminders for DFA passport appointment on Tue, Apr 22Gat Magiliw BatiAinda não há avaliações

- Military Phonetic AlphabetDocumento1 páginaMilitary Phonetic AlphabetGat Magiliw BatiAinda não há avaliações

- Answers: Section (2) CH 5: The Financial Statements of Banks and Their Principal CompetitorsDocumento7 páginasAnswers: Section (2) CH 5: The Financial Statements of Banks and Their Principal CompetitorsDina AlfawalAinda não há avaliações

- A Study of Non Performing Assets With Special Reference To Icici BankDocumento58 páginasA Study of Non Performing Assets With Special Reference To Icici BankrimcyAinda não há avaliações

- Iob 2Documento104 páginasIob 2Krishna Kant PariharAinda não há avaliações

- Otc Trading ManualDocumento1 páginaOtc Trading ManualMohammed KamruzzamanAinda não há avaliações

- MT760 SBLC Interbank SWIFT Copies - 221201 - 093335Documento4 páginasMT760 SBLC Interbank SWIFT Copies - 221201 - 093335tamer abdelhadyAinda não há avaliações

- RCB TC 150922enDocumento9 páginasRCB TC 150922encsyik123junkAinda não há avaliações

- Multi-Purpose Loan (MPL) Application FormDocumento16 páginasMulti-Purpose Loan (MPL) Application FormPablito BeringAinda não há avaliações

- DiscussionDocumento5 páginasDiscussionKalaAinda não há avaliações

- CH04 Interest RatesDocumento30 páginasCH04 Interest RatesJessie DengAinda não há avaliações

- Negotiable Instruments PrelimsDocumento6 páginasNegotiable Instruments PrelimsCattleyaAinda não há avaliações

- Hospitals HYDERABADDocumento25 páginasHospitals HYDERABADPavan KumarAinda não há avaliações

- 103 400mDocumento2 páginas103 400mismail saltanAinda não há avaliações

- Uhht BG 0 P Il 6 MP 6 GMDocumento8 páginasUhht BG 0 P Il 6 MP 6 GMpaappaapAinda não há avaliações

- PDFDocumento4 páginasPDFAmit vohraAinda não há avaliações

- Jesse Hammen Credit ReportDocumento60 páginasJesse Hammen Credit ReportAshok PanditAinda não há avaliações

- Split Payment Cervantes, Edlene B. 01-04-11Documento1 páginaSplit Payment Cervantes, Edlene B. 01-04-11Ervin Joseph Bato CervantesAinda não há avaliações

- Loans and Advances at HDFC Bank PaperDocumento7 páginasLoans and Advances at HDFC Bank PaperSarah FatimaAinda não há avaliações

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocumento33 páginasDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceRahul RaoAinda não há avaliações

- Payment Confirmation Transaction DetailsDocumento1 páginaPayment Confirmation Transaction DetailsZees Design and BuildAinda não há avaliações

- SRS Document - Project ArrowDocumento4 páginasSRS Document - Project ArrowRanier RanierAinda não há avaliações

- Appraisal Memo Cash Credit LimitDocumento23 páginasAppraisal Memo Cash Credit LimitMuana LalthlaAinda não há avaliações

- Types of Banks in the Philippines: Universal, Commercial, Thrift, Rural & CooperativeDocumento11 páginasTypes of Banks in the Philippines: Universal, Commercial, Thrift, Rural & CooperativeAmir AuditorAinda não há avaliações

- JPMorgan Chase Mortgage Settlement DocumentsDocumento291 páginasJPMorgan Chase Mortgage Settlement DocumentsFindLaw100% (1)

- G.R. No. 172652 (Negotiable Instruments Law) Case DigestDocumento2 páginasG.R. No. 172652 (Negotiable Instruments Law) Case DigestMaestro LazaroAinda não há avaliações

- Meezan Bank Report FinalDocumento61 páginasMeezan Bank Report FinalMuhammad JamilAinda não há avaliações

- Formulario WolfsbergDocumento3 páginasFormulario WolfsbergAndrea VeitAinda não há avaliações

- Rebecca M. Palacios: Summary of QualificationsDocumento3 páginasRebecca M. Palacios: Summary of QualificationsRebecca Moya-PalaciosAinda não há avaliações

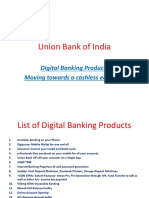

- Digital Banking Products From UBIDocumento18 páginasDigital Banking Products From UBISawan NathwaniAinda não há avaliações

- Grameen Bank PDFDocumento31 páginasGrameen Bank PDFDodon Yamin100% (2)

- Management of Non Performing Assets Public Sector BankDocumento76 páginasManagement of Non Performing Assets Public Sector BankShubham MuktiAinda não há avaliações