Escolar Documentos

Profissional Documentos

Cultura Documentos

Ratio

Enviado por

Selva KumarDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Ratio

Enviado por

Selva KumarDireitos autorais:

Formatos disponíveis

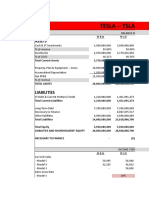

A) CURRENT RATIO

Current ratio may be defined as the relationship between current assets and current

liabilities. This ratio is also known as working capital ratio. It is a measure of general liquidity

and is most widely used to make the analysis for short term financial position or liquidity of a

firm. It is calculated by dividing the total of the current assets by total of the current liabilities.

Current Ratio Total current assets ! Total current liabilities

B) ACID TEST OR QUICK RATIO

"iquid ratio is also termed as "iquidity Ratio# $cid Test Ratio or %uick Ratio. The

term &quick assets' refers to current assets which can be

converted into cash immediately. It comprises all current assets e(pect stock

and prepaid e(penses. $n $cid Test Ratio of )*) is considered satisfactory as a firm can easily

meet all its current liabilities. It is the ratio of liquid assets to current liabilities. The true liquidity

refers to the ability of a firm to pay its short term obligations as and when they become due.

%uick Ratio %uick $ssets ! Current "iabilities

C) ABSOLUTE LIQUID RATIO

$bsolute liquidity is represented by cash and near cash items. It is a ratio of absolute

liquid assets to current liabilities. In the computation of this ratio only the absolute liquid assets

are compared with the liquid liabilities. The absolute liquid assets are cash# bank and marketable

securities. It is to be observed that receivables +debtors!accounts receivables and bills

receivables, are eliminated from the list of liquid assets in order to obtain absolute for liquid

assets since there may be some doubt in their liquidity.

$bsolute "iquid Ratio $bsolute "iquid $ssets ! Current "iabilities

This ratio gains much significance only when it is used in con-unction with the current

and liquid ratios. $ standard of ../*) absolute liquidity ratio

is considered an acceptable norm. That is# from the point of view of absolute liquidity# fifty cents

worth of absolute liquid assets are considered sufficient for one dollar worth of absolute liquid

liabilities. 0owever# this ratio is not in much use.

I. LEVERAGE RATIOS

These ratios are also called efficiency ratios. These ratios measure the owner's

stake in the business vis121vis that of outsiders. The long term solvency of the business can be

e(amined by using leverage ratios. "everage ratios may be calculated from the balance sheet

items to determine the proportion of debt in total financing. 3any variations of these ratios e(ist4

but all these ratios indicate the same thing1 the e(tent to which the

firm has relied on debt in financing assets. "everage ratios are also computed from the profit and

loss items by determining the e(tent to which operating profits are sufficient to cover the fi(ed

charges. The following are the important leverage ratios.

A. DEBT-EQUITY RATIO

The relationship between borrowed funds and owner's capital is a popular

measure of the long term financial solvency of a firm. This relationship is shown by the debt1

equity ratio. The term &debt' refers to the total outside liabilities. It includes all current liabilities

and other outside liabilities like loan# debentures etc the term &equity' refers to net worth or

shareholders fund. $n acceptable norm for this ratio is considered to 5*). $ high ratio shows

that the claims of creditors are greater than those of owners. $ low debt1equity ratio implies a

greater claim of owners than creditors.

6ebt 7quity Ratio 8utsiders 9unds ! :hareholders 9unds

B. PROPRIETORY RATIO OR EQUITY RATIO

This is a variant of the debt1to1equity ratio. It is also known as equity ratio or net

worth to total assets ratio. This ratio relates the shareholder's funds to total assets. Total assets

include all assets including goodwill +e(cluding fictitious assets,. The acceptable norm of the

ratio is )*;. It is calculated by dividing shareholder's funds by the total assets. <roprietary !

7quity ratio indicates the long1term or future solvency position of the business.

<roprietary or 7quity Ratio :hareholders 9unds ! Total $ssets

C. FIXED ASSETS TO PROPRIETORS FUND RATIO

9i(ed assets to proprietor's fund ratio establish the relationship between fi(ed

assets and shareholder's funds. The purpose of this ratio is to indicate the percentage of the

owner's funds invested in fi(ed assets. If the ratio is greater than one# it means that creditors

have been used to acquire a part of the fi(ed assets.

9i(ed $seets to <roprietors 9und 9i(ed $ssets ! :hareholders 9und

II. ACTIVITY RATIOS

9unds of creditors and owners are invested in various assets to generate sales and profits.

The better the management of assets# the larger the amount of sales. $ctivity ratios are employed

to evaluate the efficiency with which the firm manages and utili=es its assets. These ratios are

also called turnover ratios because they indicate the speed with which assets are being converted

or turned over into sales. $ctivity ratios# thus# involve a relationship between sales and assets. $

proper balance between sales and assets generally reflects that assets are managed well. :everal

activity ratios can be calculated to -udge the effectiveness of asset utili=ation.

A. INVENTORY TURNOVER RATIO OR STOCK TURNOVER RATIO (ITR)

7very firm has to maintain a certain level of inventory of finished goods so as to

be able to meet the requirements of the business. >ut the level of inventory should neither be too

high nor too low. $ too high inventory means higher carrying costs and higher risk of stocks

becoming obsolete whereas too low inventory may mean the loss of business opportunities. It is

very essential to keep sufficient stock in business. :tock turnover ratio and inventory turnover

ratio are the same. This ratio is a relationship between the costs of goods sold during a particular

period of time and the cost of average inventory during a particular period. It is e(pressed in

number of times. :tock inventory ratio ! inventory turnover ratio indicates the number of time the

stock has been turned over during the period and evaluates the efficiency with which a firm is

able to manage its

inventory. This ratio indicates whether investment in stock is within proper limit or not.

Inventory Turnover Ratio Cost of ?oods :old ! $verage Inventory at Cost

B. FIXED ASSETS TURNOVER RATIO

9i(ed assets turnover ratio is also known as sales to fi(ed assets ratio. This measures the

efficiency and profit earning capacity of the concern. 0igher the ratio# greater is the intensive

utili=ation of fi(ed assets. "ower ratio means under1utili=ation of fi(ed assets. The ratio is

calculated by using following formula*

9i(ed $ssets Turnover Ratio @et :ales ! @et 9i(ed $ssets

C. WORKING CAPITAL TURNOVER RATIO

Aorking capital turnover ratio indicates the velocity of the utili=ation of net

working capital. This ratio indicates the number of times the working capital is turned over in

the course of a year. This ratio measures the efficiency with which the working capital is

being used by a firm.

D. DEBTORS TURNOVER RATIO $

concern may sell goods on cash as well as on credit. Credit is one of the important elements of

sales promotion. The volume of sales can be increased by following a liberal credit policy. The

effect of a liberal credit policy may result in tying up substantial funds of a firm in the form of

trade debtors +or receivables,. Trade debtors are e(pected to be converted into cash within a short

period of time and are included in current assets. 0ence# the liquidity position of concern to pay

its short term obligations in time depends upon the quality of its trade debtors. 6ebtor's turnover

ratio or accounts receivable turnover ratio indicates the velocity of debt collection of a firm. In

simple words it indicates the number of times average debtors +receivable, are turned over during

a year.

Cost of ?oods :old

Aorking Capital Turnover Ratio 11111111111111111111111111111111111

@et Aorking Capital

6ebtors Turnover Ratio @et Credit :ales ! $verage Trade 6ebtors

E. AVERAGE COLLECTION PERIOD RATIO

The 6ebtors ! Receivable Turnover Ratio when calculated in terms of days is known as

$verage Collection <eriod or 6ebtors Collection <eriod Ratio. The average collection period

ratio represents the average number of days for which a firm has to wait before its debtors are

converted into cash.

$verage Collection <eriod Ratio +Trade 6ebtors B @o. of Aorking 6ays, ! @et

Credit :ales

F. CREDITORS TURNOVER RATIO (OR) ACCOUNTS PAYABLE TURNOVER

RATIO

$ccounts payable are the short term credits that the company has to pay within a set

period of time# usually within less than one year# but more often than not this period is a few

months. This ratio determines the financial stability of the company with a good accuracy.

Creditors Turnover Ratio Credit <urchase ! $verage Trade Creditors

G. AVERAGE PAYMENT PERIOD RATIO

The creditors ! payable turnover ratio when calculated in terms of days is known as

$verage <ayment <eriod or creditors payment period ratio. The average payment period ratio

represents the average number of days for which a firm has to wait before its creditors are

converted into cash.

$verage 6ebt <ayment <eriod +in month, +Trade Creditors B )5, ! @et Credit

<urchase

III. PROFITABILITY RATIOS

$ company should earn profits to survive and grow over a long period of time. <rofits are

essential# but it would be wrong to assume that every action initiated by management of a

company should be aimed at ma(imi=ing profits# irrespective of concerns for customers#

employees# suppliers or social consequences. It is unfortunate that the word &profit' is looked

upon as a term of abuse since some firms always want to ma(imi=e profits at the cost of

employees# customers and society. 7(cept such infrequent cases# it is a fact that sufficient profits

must be earned to sustain the operations of the business to be able to obtain funds from investors

for e(pansion and growth and to contribute towards the social overheads for the welfare of the

society. <rofit is the difference between revenues and e(penses over a period of time +usually

one year,. <rofit is the ultimate &output' of a company# and it will have no future if it fails to

make sufficient profits. Therefore# the financial manager should continuously evaluate the

efficiency of the company in term of profits. The profitability ratios are calculated to measure the

operating efficiency of the company. >esides management of the company# creditors and owners

are also interested in the profitability of the firm. Creditors want to get interest and repayment of

principal regularly. 8wners want to get a required rate of return on their investment. This is

possible only when the company earns enough profits. The following are the important

profitability ratios.

A. GROSS PROFIT RATIO (GP RATIO)

?ross profit ratio is the ratio of gross profit to net sales e(pressed as a

percentage. It e(presses the relationship between gross profit and sales. The gross profit should

be adequate to cover fi(ed e(penses# dividends and building up of reserves. $n important

factor which will affect the ratio of gross profit to sales is that of the practice of increasing or

reducing the sale price of goods sold by mark1ups and mark1downs .

?ross <rofit Ratio +?ross <rofit ! @et :ales, B )..

B. NET PROFIT RATIO

@et profit ratio is used to measure the overall profitability and hence it is

very useful to proprietors. This ratio e(plains per rupee profit generating capacity of sales.

This ratio is very useful to the proprietors and prospective investors because it reveals the

overall profitability of the concern. It is e(pressed as percentage. This is the ratio of net profit

after ta(es to net sales and is calculated below*

@et <rofit Ratio @et <rofit ! @et :ales B )..

C. OPERATING RATIO

8perating ratio is the ratio of cost of goods sold plus operating e(penses to net

sales. It is generally e(pressed in percentage. 8perating ratio measures the cost of operations per

dollar of sales. This is closely related to the ratio of operating profit to net sales.

8perating Ratio 8perating Cost ! @et :ales B )..

8perating Cost cost of goods sold C operating e(penses

D. RETURN ON TOTAL ASSET RATIO

<rofitability can be measured in terms of relationship between net profit and total

assets. This ratio is also known as return on gross capital employed. It measures the profitability

can be known by applying this ratio. The term @et profit stands for @et profit before interest

and ta( and dividend.

Return on Total $sset Ratio @et <rofit ! Total $ssets B )..

E. RETURN ON NET CAPITAL EMPLOYED

This ratio is also known as return on investment +R8I,. The primary ob-ective of

making investment in any business is to obtain satisfactory return on capital invested. It indicates

the return on capital employed in the business and it can be used to show the efficiency of the

business as a whole. The term net capital employed refers to long term funds supplied by the

creditors and owners of the firm.

Return on @et 7mployed @et <rofit >efore Interest and Ta( ! @et Capital

7mployed B )..

F. RETURN ON SHAREHOLDERS INVESTMENT OR NET WORTH RATIO

It is the ratio of net profit to shareholder's investment. It is the relationship

between net profit +after interest and ta(, and shareholder's ! proprietor's fund. This ratio

establishes the profitability from the shareholder's point of view. The ratio is generally

calculated in percentage.

Return on :hareholders Investment @et <rofit +after interest and ta(,!

:hareholders 9und B )..

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Davis Dynasty: Focus Take-AwaysDocumento5 páginasThe Davis Dynasty: Focus Take-Awaysgreyistari100% (1)

- FGate Vinamilk VNM ModelDocumento94 páginasFGate Vinamilk VNM Modelnvanhuu98Ainda não há avaliações

- GRC PWC IntegritydrivenperformanceDocumento52 páginasGRC PWC IntegritydrivenperformanceDeepak YakkundiAinda não há avaliações

- Final DocumentationDocumento39 páginasFinal DocumentationSelva KumarAinda não há avaliações

- Project Profile For Establishment of 48 Automatic Loom: 1.0 Scope of The Project in The Area of OperationDocumento2 páginasProject Profile For Establishment of 48 Automatic Loom: 1.0 Scope of The Project in The Area of OperationSelva KumarAinda não há avaliações

- A Study On Cunsumers Preference and Attitude Towards Purchase of Gold (With Special Reference To Pollachi Talluk)Documento5 páginasA Study On Cunsumers Preference and Attitude Towards Purchase of Gold (With Special Reference To Pollachi Talluk)Selva KumarAinda não há avaliações

- Chapter 2Documento36 páginasChapter 2Selva KumarAinda não há avaliações

- Create and Display The List of Ledger Accounts in The Books of Star LTD On 31 MarchDocumento1 páginaCreate and Display The List of Ledger Accounts in The Books of Star LTD On 31 MarchSelva KumarAinda não há avaliações

- UTR: P17010306821520: Beneficiary DetailsDocumento1 páginaUTR: P17010306821520: Beneficiary DetailsSelva KumarAinda não há avaliações

- DFT Study On Dihydrogen Bond Interactions by Substitution in XH Si .NCH and NCH .HM (X H, F, CL, BR M Li, Na, Beh, MGH) ComplexesDocumento24 páginasDFT Study On Dihydrogen Bond Interactions by Substitution in XH Si .NCH and NCH .HM (X H, F, CL, BR M Li, Na, Beh, MGH) ComplexesSelva KumarAinda não há avaliações

- A Study On Customer Satisfaction Towards Tvs MotorDocumento3 páginasA Study On Customer Satisfaction Towards Tvs MotorSelva KumarAinda não há avaliações

- Program For Form ValidationDocumento8 páginasProgram For Form ValidationSelva KumarAinda não há avaliações

- Program For User Defined Exception / Exp - HTMLDocumento2 páginasProgram For User Defined Exception / Exp - HTMLSelva KumarAinda não há avaliações

- Determination of GoalsDocumento1 páginaDetermination of GoalsSelva KumarAinda não há avaliações

- Program For Illustrate The Concept of Cookies / Cookies - PHPDocumento3 páginasProgram For Illustrate The Concept of Cookies / Cookies - PHPSelva KumarAinda não há avaliações

- Jfty) Mwpa (K) Chpik RL) LJ) JPD) FPH) MDG) G (DH)Documento2 páginasJfty) Mwpa (K) Chpik RL) LJ) JPD) FPH) MDG) G (DH)Selva KumarAinda não há avaliações

- Telephone Banking: FeaturesDocumento3 páginasTelephone Banking: FeaturesSelva KumarAinda não há avaliações

- Coir ProjectDocumento18 páginasCoir ProjectSelva KumarAinda não há avaliações

- Companies Act 2017Documento30 páginasCompanies Act 2017Muhammad AzeemAinda não há avaliações

- CHAPTER - 5 - Exercise & ProblemsDocumento6 páginasCHAPTER - 5 - Exercise & ProblemsFahad Mushtaq20% (5)

- Ap 9401-1 SheDocumento4 páginasAp 9401-1 SheLuzviminda SaspaAinda não há avaliações

- Carpio, J.: Directors, and Thus in The Present Case Only To Common Shares, and Not To The TotalDocumento3 páginasCarpio, J.: Directors, and Thus in The Present Case Only To Common Shares, and Not To The Totalkimoymoy7Ainda não há avaliações

- Midterm II SampleDocumento4 páginasMidterm II SamplejamesAinda não há avaliações

- Technical Perspectives: Louise Yamada Technical Research Advisors, LLCDocumento8 páginasTechnical Perspectives: Louise Yamada Technical Research Advisors, LLCanalyst_anil14Ainda não há avaliações

- PS1Documento5 páginasPS1faiqsattarAinda não há avaliações

- Islamic Perspective of Maximizaing Shareholders' WealthDocumento56 páginasIslamic Perspective of Maximizaing Shareholders' WealthI'ffah NasirAinda não há avaliações

- Nestle: Final Task in Fundamentals of Accountancy, Business and ManagementDocumento43 páginasNestle: Final Task in Fundamentals of Accountancy, Business and ManagementApply Ako Work EhAinda não há avaliações

- FNDACT2 Corporations PDFDocumento11 páginasFNDACT2 Corporations PDFEl YangAinda não há avaliações

- Acct 4610Documento3 páginasAcct 4610Juliette YasuhiroAinda não há avaliações

- World Largest Gold and Copper Mine Reko Diq BalochistanDocumento6 páginasWorld Largest Gold and Copper Mine Reko Diq BalochistanJavaid Ali ShahAinda não há avaliações

- Strategic Management Full NotesDocumento133 páginasStrategic Management Full Notessahir_sameer1984100% (1)

- ALR 20180427172542 2017-Annual-Report PDFDocumento130 páginasALR 20180427172542 2017-Annual-Report PDFAnonimu256Ainda não há avaliações

- Mahusay Bsa 315 Module 3 Major OutputDocumento7 páginasMahusay Bsa 315 Module 3 Major OutputJeth MahusayAinda não há avaliações

- Tesla ForecastDocumento6 páginasTesla ForecastDanikaLiAinda não há avaliações

- Chart of Entity ComparisonDocumento4 páginasChart of Entity ComparisonDee BeldAinda não há avaliações

- BA Boeing Stock SummaryDocumento1 páginaBA Boeing Stock SummaryOld School ValueAinda não há avaliações

- Leverage and Capital StructureDocumento8 páginasLeverage and Capital StructureC H ♥ N T ZAinda não há avaliações

- Panlilio Vs Citi BankDocumento2 páginasPanlilio Vs Citi BankRed HoodAinda não há avaliações

- Government-Owned And/Or Controlled Corporations: (GOCC)Documento30 páginasGovernment-Owned And/Or Controlled Corporations: (GOCC)Angelica HonaAinda não há avaliações

- FTSE All-World High Dividend Yield IndexDocumento16 páginasFTSE All-World High Dividend Yield IndexLeonardo ToledoAinda não há avaliações

- Canslim TradingDocumento1 páginaCanslim TradingSudeesh Kumar Pabbathi100% (1)

- Test 8 Corporate GovernanceDocumento3 páginasTest 8 Corporate GovernanceMir Fida NadeemAinda não há avaliações

- Pocket Money Course Material-MarathiDocumento81 páginasPocket Money Course Material-MarathiAbhieshek P GodhaAinda não há avaliações

- KKR Investor UpdateDocumento8 páginasKKR Investor Updatepucci23Ainda não há avaliações

- The State of Social Enterprise in Indoensia British Council Web FinalDocumento101 páginasThe State of Social Enterprise in Indoensia British Council Web FinalAlinda PermatasariAinda não há avaliações