Escolar Documentos

Profissional Documentos

Cultura Documentos

Merger in Banking Sector: ICICI Bank and Bank of Madura

Enviado por

Moaaz Ahmed0 notas0% acharam este documento útil (0 voto)

25 visualizações16 páginasThe document discusses two potential mergers:

1) ICICI Bank and Bank of Madura. ICICI Bank saw synergies from merging including a larger branch network, customer base, and technological capabilities. The swap ratio for the merger was proposed as 1:2.

2) Grasim and L&T Cement in the cement sector. No details were provided about this potential merger.

The document also discusses a case study of a successful merger between GlaxoSmithKline Pharmaceuticals Limited in India and another example of a failed merger between TATA and TETLEY.

Descrição original:

M&A

Título original

49_m&a

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoThe document discusses two potential mergers:

1) ICICI Bank and Bank of Madura. ICICI Bank saw synergies from merging including a larger branch network, customer base, and technological capabilities. The swap ratio for the merger was proposed as 1:2.

2) Grasim and L&T Cement in the cement sector. No details were provided about this potential merger.

The document also discusses a case study of a successful merger between GlaxoSmithKline Pharmaceuticals Limited in India and another example of a failed merger between TATA and TETLEY.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

25 visualizações16 páginasMerger in Banking Sector: ICICI Bank and Bank of Madura

Enviado por

Moaaz AhmedThe document discusses two potential mergers:

1) ICICI Bank and Bank of Madura. ICICI Bank saw synergies from merging including a larger branch network, customer base, and technological capabilities. The swap ratio for the merger was proposed as 1:2.

2) Grasim and L&T Cement in the cement sector. No details were provided about this potential merger.

The document also discusses a case study of a successful merger between GlaxoSmithKline Pharmaceuticals Limited in India and another example of a failed merger between TATA and TETLEY.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 16

- 47 -

Merger in Banking Sector

ICICI Bank and Bank of Madura

Chapter

10

- 48 -

The board of Directors at ICICI has contemplated the following

synergies emerging from the merger:

Financial Capability

Branch network

Customer base

Technological edge

- 49 -

Focus on Priority Sector

swap ratio 1:2

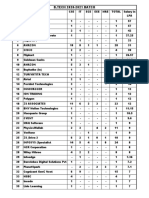

TABLE 1:- Comparative Study of Financial Strength of ICICI Bank & BOM

Financial Standings of ICICI Bank and Bank of Madura

Parameters ICICI Bank Bank of Madura

1999-2000 1998-99 1999-2000 1998-99

- 50 -

The Generation Gap

old

generation bank new generation bank

Managing rural branches

- 51 -

Managing Software

Managing Human resources

- 52 -

TABLE 2:- Crucial Parameters

CRUCIAL PARAMETERS

Name of

the Bank

Bank of

Madura

ICICI

Bank

Managing Client base

CONCLUSION

- 53 -

- 54 -

Merger in Cement Sector

CEMENTING THE FUTURE

GRASIM- L&T Cement

THE TIMELINE

Chapter

11

- 55 -

- 56 -

THE RESULT

(i)

(ii)

(iii)

(iv)

- 57 -

(v)

(vi)

- 58 -

Cases on Success and Failure of Merger

CASE STUDY 1

GlaxoSmithKline Pharmaceuticals Limited, India (Merger Success).

GlaxoSmithKline Pharmaceuticals

Limited )

, The two companies that have merged to become

GlaxoSmithKline in India have a great heritage a fact that gets reflected in their

products with strong brand equity. He added, The two companies have a long

history of commitment to India and enjoy a very good reputation with doctors,

patients, regulatory authorities and trade bodies. At GSK it would be our endeavor to

leverage these strengths to further consolidate our market leadership.

GlaxoSmithKline, India

Chapter

12

- 59 -

GlaxoSmithKline, Worldwide

GlaxoSmithKline plc

- 60 -

CASE STUDY 2

TATA TETLEY (Merger Failure).

- 61 -

- 62 -

Você também pode gostar

- Your AccountDocumento6 páginasYour AccountJean FurtadoAinda não há avaliações

- Vol.3 (CH22-Part1 - FMCS)Documento501 páginasVol.3 (CH22-Part1 - FMCS)versine100% (1)

- Financial Systems & Risk Managements: Hkcareers - Achieve With UsDocumento117 páginasFinancial Systems & Risk Managements: Hkcareers - Achieve With UsArissa ISSAinda não há avaliações

- MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionDocumento14 páginasMULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionSoweirdAinda não há avaliações

- The GE Way Fieldbook: Jack Welch's Battle Plan for Corporate RevolutionNo EverandThe GE Way Fieldbook: Jack Welch's Battle Plan for Corporate RevolutionAinda não há avaliações

- The Product Manager's Field Guide: Practical Tools, Exercises, and Resources for Improved Product ManagementNo EverandThe Product Manager's Field Guide: Practical Tools, Exercises, and Resources for Improved Product ManagementNota: 4.5 de 5 estrelas4.5/5 (2)

- Strategic Management Theory Cases An Integrated Approach 13th Edition Ebook PDFDocumento42 páginasStrategic Management Theory Cases An Integrated Approach 13th Edition Ebook PDFnicole.jenkins42998% (42)

- Analysis of Demand, Supply & Elasticity of Coca ColaDocumento8 páginasAnalysis of Demand, Supply & Elasticity of Coca ColaLavanya KawaleAinda não há avaliações

- SABIC-Annual-Report-2017 - English - tcm1010-12625 PDFDocumento44 páginasSABIC-Annual-Report-2017 - English - tcm1010-12625 PDFAzizol WahabAinda não há avaliações

- IIT BHU - CasebookDocumento187 páginasIIT BHU - CasebookArnaov JaiminiAinda não há avaliações

- Original PDF Contemporary Financial Management 14th Edition PDFDocumento41 páginasOriginal PDF Contemporary Financial Management 14th Edition PDFpaul.shropshire768100% (38)

- Icon Iimb Casebook 12 (B)Documento182 páginasIcon Iimb Casebook 12 (B)Vasu SharmaAinda não há avaliações

- Liebherr Crane Liccon Service TrainingDocumento20 páginasLiebherr Crane Liccon Service Trainingcalvin100% (53)

- ICON Casebook 2023-24 - Volume 13 (B)Documento193 páginasICON Casebook 2023-24 - Volume 13 (B)ShubhamAinda não há avaliações

- Instructions: Business Startup Cash Flow TemplateDocumento8 páginasInstructions: Business Startup Cash Flow TemplateMoaaz AhmedAinda não há avaliações

- Maste Storytelling Mark-J.-Carpenter - Darrell-DDocumento182 páginasMaste Storytelling Mark-J.-Carpenter - Darrell-DmauriAinda não há avaliações

- Newzen Mba Finance 2023Documento11 páginasNewzen Mba Finance 2023New Zen InfotechAinda não há avaliações

- Reoprt On "Portfolio Management Services" by Sharekhan Stock Broking LimitedDocumento111 páginasReoprt On "Portfolio Management Services" by Sharekhan Stock Broking LimitedAshutosh Rathod91% (22)

- Gemba Kaizen: A Commonsense, Low-Cost Approach to ManagementNo EverandGemba Kaizen: A Commonsense, Low-Cost Approach to ManagementAinda não há avaliações

- MBA Finance ProjectsDocumento87 páginasMBA Finance ProjectsSANJAY THAPA100% (3)

- Global Luxury 2023 DatagraphicDocumento1 páginaGlobal Luxury 2023 DatagraphicSenda SurauAinda não há avaliações

- RBI Financial Stability Report 2023Documento179 páginasRBI Financial Stability Report 2023pankajatwork01Ainda não há avaliações

- Coalition Government - 1 Coalition 60Documento35 páginasCoalition Government - 1 Coalition 60Anonymous qjccOiLn100% (2)

- India Strategy - Decade of India! - 220104Documento66 páginasIndia Strategy - Decade of India! - 220104Krishna Raj KAinda não há avaliações

- B.tech 2020-2021 BatchDocumento3 páginasB.tech 2020-2021 BatchKushank GuptaAinda não há avaliações

- Anjali Kumari Keshri PGDBMDocumento2 páginasAnjali Kumari Keshri PGDBMAnjali KeshriAinda não há avaliações

- Implementation of Supply Chain I2 Solution AT Escorts INDIA LTDDocumento10 páginasImplementation of Supply Chain I2 Solution AT Escorts INDIA LTD2036n1366Ainda não há avaliações

- Internship Report of M.Shahzad PDFDocumento64 páginasInternship Report of M.Shahzad PDFinzamamalam515Ainda não há avaliações

- Template For Content Gap AnalysisDocumento48 páginasTemplate For Content Gap AnalysisPratima SinghAinda não há avaliações

- Newzen Mba HR 2023Documento9 páginasNewzen Mba HR 2023New Zen InfotechAinda não há avaliações

- 2023 Training ScheduleDocumento1 página2023 Training Scheduleadindra magaliAinda não há avaliações

- Venezuela TalentDocumento1 páginaVenezuela TalentlysludwikAinda não há avaliações

- Combine Quality and Speed To MarketDocumento6 páginasCombine Quality and Speed To MarketdtkraeutAinda não há avaliações

- 2017 - Preuveneers - The Intelligent Industry of The Future, A Survey On Emerging Trends PDFDocumento12 páginas2017 - Preuveneers - The Intelligent Industry of The Future, A Survey On Emerging Trends PDFchrisalexoAinda não há avaliações

- Business PlanDocumento46 páginasBusiness PlanShan Alay-ayAinda não há avaliações

- Etextbook 978 1305664791 OmDocumento61 páginasEtextbook 978 1305664791 Omebony.blanchard211100% (45)

- CSAT 2019 - Begg - Henry PDFDocumento28 páginasCSAT 2019 - Begg - Henry PDFdocturboAinda não há avaliações

- 10.1016@j.jtumed.2020.04.008 3Documento7 páginas10.1016@j.jtumed.2020.04.008 3Laura ImreAinda não há avaliações

- 50 Business Frameworks, Tools & ConceptsDocumento81 páginas50 Business Frameworks, Tools & Conceptssuchanshetty1Ainda não há avaliações

- Annual Review 2018-1 PDFDocumento33 páginasAnnual Review 2018-1 PDFMirang ShahAinda não há avaliações

- Annual Review 2018 PDFDocumento33 páginasAnnual Review 2018 PDFSleek StyleAinda não há avaliações

- Mitsubishi 2022Documento72 páginasMitsubishi 2022AntwanAinda não há avaliações

- VB Recruitment Ad FinalDocumento5 páginasVB Recruitment Ad FinalbaraiipranavAinda não há avaliações

- Open Merit Bachelors Admissions-2019: Closing Percentages by Category and EligibilityDocumento1 páginaOpen Merit Bachelors Admissions-2019: Closing Percentages by Category and EligibilitymahmadwasiAinda não há avaliações

- MihirDocumento66 páginasMihirPRERANA JADHAVAinda não há avaliações

- Far 610 Group Project 1: InstructionsDocumento6 páginasFar 610 Group Project 1: InstructionsSiti Rafidah DaudAinda não há avaliações

- MAC4862 2023 TL 102 0 B UpdateDocumento120 páginasMAC4862 2023 TL 102 0 B UpdateLubabalo MapipaAinda não há avaliações

- Courses List - PGPEX VLM 2012-13Documento1 páginaCourses List - PGPEX VLM 2012-13harshagarwal5Ainda não há avaliações

- Crux Casebook 2024Documento381 páginasCrux Casebook 2024Harshit SharmaAinda não há avaliações

- RONAKDocumento1 páginaRONAKHR TWINKLEAinda não há avaliações

- Waltad Slsuu Univarsik: Des Ks 39104 Noina NeuaenationalDocumento2 páginasWaltad Slsuu Univarsik: Des Ks 39104 Noina NeuaenationalSimnikiwe Biki MniraAinda não há avaliações

- ExecutiveSummary Saudi Arabia Petrochemicals Report 639769Documento5 páginasExecutiveSummary Saudi Arabia Petrochemicals Report 639769Mohammed Al-barrakAinda não há avaliações

- Electronic BankingDocumento57 páginasElectronic BankingsureshkumarAinda não há avaliações

- EdumentorDocumento20 páginasEdumentorSamrathSinghSieraAinda não há avaliações

- Support de Cours Theme 2Documento61 páginasSupport de Cours Theme 2Abdelaziz MoustaidAinda não há avaliações

- Cians Investment Banking Sample PackDocumento79 páginasCians Investment Banking Sample PackBisht DeepaakAinda não há avaliações

- How To Download Transportation A Global Supply Chain Perspective 9Th Edition Ebook PDF Version Ebook PDF Docx Kindle Full ChapterDocumento36 páginasHow To Download Transportation A Global Supply Chain Perspective 9Th Edition Ebook PDF Version Ebook PDF Docx Kindle Full Chapterstacy.merlette128100% (27)

- ComTech Sourcebook 2020Documento127 páginasComTech Sourcebook 2020Meet PanchalAinda não há avaliações

- Business PlanDocumento131 páginasBusiness PlanMikha BorcesAinda não há avaliações

- Chapter 09Documento23 páginasChapter 09PUTRI AVERINAAinda não há avaliações

- Raymond Brochure 2019Documento41 páginasRaymond Brochure 2019SaurabhAinda não há avaliações

- FAQs of Batch 2021Documento92 páginasFAQs of Batch 2021PRABAL BHATAinda não há avaliações

- Sarbanes-Oxley Guide for Finance and Information Technology ProfessionalsNo EverandSarbanes-Oxley Guide for Finance and Information Technology ProfessionalsAinda não há avaliações

- Braced for Impact: Reforming Kazakhstan's National Financial Holding for Development Effectiveness and Market CreationNo EverandBraced for Impact: Reforming Kazakhstan's National Financial Holding for Development Effectiveness and Market CreationAinda não há avaliações

- Conducting Anticorruption Due Diligence in M&A DealsDocumento4 páginasConducting Anticorruption Due Diligence in M&A DealsMoaaz AhmedAinda não há avaliações

- M&A Regulations in IndiaDocumento4 páginasM&A Regulations in IndiaMoaaz AhmedAinda não há avaliações

- 6 EquitiesDocumento1 página6 EquitiesMoaaz AhmedAinda não há avaliações

- 4Q2012 MA Financial Advisory ReviewDocumento24 páginas4Q2012 MA Financial Advisory ReviewMoaaz AhmedAinda não há avaliações

- Tue Jun 18, 2013 1:16pm IST: ST THDocumento3 páginasTue Jun 18, 2013 1:16pm IST: ST THMoaaz AhmedAinda não há avaliações

- Case StudiesDocumento2 páginasCase StudiesMoaaz AhmedAinda não há avaliações

- Annual Report 2012-2013 Federal BankDocumento192 páginasAnnual Report 2012-2013 Federal BankMoaaz AhmedAinda não há avaliações

- Capital Structure TheoriesDocumento13 páginasCapital Structure TheoriesMoaaz AhmedAinda não há avaliações

- Legal & Regulatory AspectsDocumento23 páginasLegal & Regulatory AspectsMoaaz Ahmed100% (1)

- Indian Oil Corporation Limited: Bhubaneswar Divisional OfficeDocumento3 páginasIndian Oil Corporation Limited: Bhubaneswar Divisional OfficeBinay Sahoo100% (1)

- Employee of The Month SheetDocumento7 páginasEmployee of The Month SheetVhing ResurreccionAinda não há avaliações

- Mason Isolation MountsDocumento1 páginaMason Isolation MountsarunjacobnAinda não há avaliações

- Motor's Bearing DetailsDocumento9 páginasMotor's Bearing DetailsValipireddy NagarjunAinda não há avaliações

- Preparation & Practice General & C7Documento1 páginaPreparation & Practice General & C7JáskáránAinda não há avaliações

- Lesson 4 Development of Business Plan NOTESDocumento5 páginasLesson 4 Development of Business Plan NOTESShunuan HuangAinda não há avaliações

- HEJCL23Documento10 páginasHEJCL23idilsagal2021Ainda não há avaliações

- MJ'S Collect ION: Acknowledgement ReceiptDocumento2 páginasMJ'S Collect ION: Acknowledgement ReceiptMichael JAvonilloAinda não há avaliações

- Economies and DiseconomiesDocumento11 páginasEconomies and DiseconomiesChitra GangwaniAinda não há avaliações

- Field Performance of BlueCoil Including Performance of Mechanically Damaged CTDocumento15 páginasField Performance of BlueCoil Including Performance of Mechanically Damaged CTbehrooz rajabshehniAinda não há avaliações

- As95234 Reverse Bayonet Connector Catalog PDFDocumento42 páginasAs95234 Reverse Bayonet Connector Catalog PDFdatcuflorinAinda não há avaliações

- BUCKET - DQ Type Elevator SANWEIDocumento3 páginasBUCKET - DQ Type Elevator SANWEIPurchasing Central TechnicAinda não há avaliações

- YouCan Invoice Mesk Shop Aug 2021Documento22 páginasYouCan Invoice Mesk Shop Aug 2021AdnaneAdNàNeAinda não há avaliações

- Global View - Investing in Emerging Markets: Visit The - C 2008 Praxis Language LTDDocumento4 páginasGlobal View - Investing in Emerging Markets: Visit The - C 2008 Praxis Language LTDIrmão Alex SandroAinda não há avaliações

- Examen Final Semana 8 INGLES 1 1 INTENTODocumento13 páginasExamen Final Semana 8 INGLES 1 1 INTENTOClaudia100% (1)

- VLÄTKRIG InstructionsDocumento2 páginasVLÄTKRIG InstructionsEscargotAinda não há avaliações

- Aboitiz Subcontractor's Profile FormDocumento6 páginasAboitiz Subcontractor's Profile FormRizza Jane ArriesgadoAinda não há avaliações

- DSC1520 Notes and Past PapersDocumento168 páginasDSC1520 Notes and Past PapersMaks MahlatsiAinda não há avaliações

- Mba 3 Sem Supply Chain and Logistics Management Kmbnom01 2022Documento1 páginaMba 3 Sem Supply Chain and Logistics Management Kmbnom01 2022kapa123Ainda não há avaliações

- (Williamson) Washington Consensus 14 PG InglésDocumento14 páginas(Williamson) Washington Consensus 14 PG InglésGabriela Montiel FuentesAinda não há avaliações

- FailureEnvelopesNEW 11Documento41 páginasFailureEnvelopesNEW 11Osama AshourAinda não há avaliações

- Homework Chap 25Documento2 páginasHomework Chap 25An leeAinda não há avaliações

- Channel FUSDocumento1 páginaChannel FUSArunKumar RajendranAinda não há avaliações

- Vessel 2023 09 07Documento3 páginasVessel 2023 09 07bill duanAinda não há avaliações

- Bergerac D3D3D3Systems: The Challenge of Backward IntegrationDocumento4 páginasBergerac D3D3D3Systems: The Challenge of Backward IntegrationZee ShanAinda não há avaliações