Escolar Documentos

Profissional Documentos

Cultura Documentos

AACE Cash Flow

Enviado por

Francois-0 notas0% acharam este documento útil (0 voto)

158 visualizações17 páginasConstruction cash flows

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoConstruction cash flows

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

158 visualizações17 páginasAACE Cash Flow

Enviado por

Francois-Construction cash flows

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 17

1

Construction Management, 3/E by Daniel W. Halpin

Copyright 2006 by J ohn Wiley & Sons, Inc. All rights reserved.

Project Cash Flow

By

Dr. Ibrahim Assakkaf

Construction Management, 3/E by Daniel W. Halpin

Copyright 2006 by J ohn Wiley & Sons, Inc. All rights reserved.

Scenario Testing

The Need

Cash flows can be estimated by attempting

to assess flows from

1. Project in progress.

2. Projects under contract but not yet begun.

3. Potential projects which will start during the

coming financial accounting period.

2

Construction Management, 3/E by Daniel W. Halpin

Copyright 2006 by J ohn Wiley & Sons, Inc. All rights reserved.

Scenario Testing

The Need (contd)

These sources of income can be viewed as:

1. Birds in the hand.

2. Birds in the bush, and

3. Birds flying the sky.

In other words, cash flows can be projected

from projects in progress and projects which

may, with some probability, start in the

coming period for which forecasts are being

made.

Construction Management, 3/E by Daniel W. Halpin

Copyright 2006 by J ohn Wiley & Sons, Inc. All rights reserved.

Scenario Testing

The Need (contd0

The advent of spreadsheet analysis and high

speed computers has led to scenario testing

of future cash flow expectations.

3

Construction Management, 3/E by Daniel W. Halpin

Copyright 2006 by J ohn Wiley & Sons, Inc. All rights reserved.

The Technology

Spreadsheet (can do probabilistic cash

flow projections)

More advanced analysis can also factor in

historical evidence of payment trends and

potential impact of macroeconomic

factors.

These techniques can go beyond the

typical best-, expected-, and worst-case

scenario modeling.

Construction Management, 3/E by Daniel W. Halpin

Copyright 2006 by J ohn Wiley & Sons, Inc. All rights reserved.

The Technology

These techniques may also rely on monte

Carlo simulation, Markov modeling, or the

use of fuzzydata sets to build up

statistically valid outcomes.

This level of analysis used to be in the

economists realm, but is now

commonplace in the future in the finance

and business development groups of

corporations.

4

Construction Management, 3/E by Daniel W. Halpin

Copyright 2006 by J ohn Wiley & Sons, Inc. All rights reserved.

Cash Flow Projections

Life of a project can be used to develop the

projection of income and expense during this

project life.

Complexity of the project obviously has an affect

on the method used.

In many contracts (e.g., public contracts such as

those used by state agencies), the owner

requires the contractor to provide an S-curve of

estimated progress and costs across the life of

the project.

Construction Management, 3/E by Daniel W. Halpin

Copyright 2006 by J ohn Wiley & Sons, Inc. All rights reserved.

Cash Flow Projections

The contractor develops this by

constructing a simple bar chart of the

project, assigning costs to the bars, and

smoothly connecting the projected

amounts of expenditures over time.

Consider the highly simplified project of

the next slide in which four major activities

are scheduled across a four-month time

span.

5

Construction Management, 3/E by Daniel W. Halpin

Copyright 2006 by J ohn Wiley & Sons, Inc. All rights reserved.

Figure 9.1 (p. 148)

Development of the S-Curve.

Construction Management, 3/E by Daniel W. Halpin

Copyright 2006 by J ohn Wiley & Sons, Inc. All rights reserved.

Cash Flow Projections

Bars representing the activities are

positioned along a time scale indicating

start and finish times.

The direct costs asociated with each

activity are shown above each bar in the

figure.

Its assumed that the monthly cost of

indirect charges (i.e., site office costs,

telephone, heat, light, which cannot be

charged directly to an activity) is $5,000.

6

Construction Management, 3/E by Daniel W. Halpin

Copyright 2006 by J ohn Wiley & Sons, Inc. All rights reserved.

Cash Flow Projections

Assuming that the direct costs are evenly

distributed across the duration of the

activity, the monthly direct costs can be

readily calculated and shown below the

time line in the figure.

The direct charges in the second month,

for example, derive from activities A, B,

and C, all of which have a portion in the

period.

Construction Management, 3/E by Daniel W. Halpin

Copyright 2006 by J ohn Wiley & Sons, Inc. All rights reserved.

Cash Flow Projections

The direct charge is

simply calculated

based on portion of

the activity scheduled

in the second month

as:

$65,000

$20,000 000 , 60

3

1

: C Activity

$20,000 000 , 40

2

1

: B Activity

$25,000 000 , 50

2

1

: A Activity

=

=

=

7

Construction Management, 3/E by Daniel W. Halpin

Copyright 2006 by J ohn Wiley & Sons, Inc. All rights reserved.

Cash Flow Projections

The figure shows the total monthly and

cumulative monthly expenditures across

the life of the project.

The S-curve is nothing more than a

graphical presentation of the cumulative

expenditures over time.

A curve is plotted below the time-scaled

bars through the points of cumulative

expenditures.

Construction Management, 3/E by Daniel W. Halpin

Copyright 2006 by J ohn Wiley & Sons, Inc. All rights reserved.

Cash Flow Projections

As activities come on-line, the level of

expenditures increases and the curve has

a steeper middle section.

Toward the end of a project, activities are

winding down and expenditures flatten

again.

8

Construction Management, 3/E by Daniel W. Halpin

Copyright 2006 by J ohn Wiley & Sons, Inc. All rights reserved.

Cash Flow to the Contractor

The flow of money from the owner to the

contractor is in the form of progress payments.

As already noted, estimates of work cmpleted

are made by the contractor periodically (usually

monthly) and verified by the owners

representative.

Depending on the type of contract (e.g., lump

sum, unit price, etc.), the estimates are based on

evaluations of the percentage of total contract

completion or actual field measurements of

quantities placed.

Construction Management, 3/E by Daniel W. Halpin

Copyright 2006 by J ohn Wiley & Sons, Inc. All rights reserved.

Cash Flow to the Contractor

This process is best demonstrated by further

consideration of the four-activity example just

described.

Assume that the, contractor originally included a

profit or markup in his bid of $50,000 (i.e., 25%)

so that the total bid price was $250,000.

The owner retains 10% of all validated progress

payment claims until one-half of the contract

value (i.e., $125,000) has been built and

approved as an incentive for the contractor to

complete the contract.

9

Construction Management, 3/E by Daniel W. Halpin

Copyright 2006 by J ohn Wiley & Sons, Inc. All rights reserved.

Cash Flow to the Contractor

The retainage will be deducted from the

progress payments on the first $125,000

and eventually paid to the contractor on

satisfactory completion of the contract.

The progress payment will be billed at the

end of the month, and the owner will

transfer the billed amount minus any

retainage to the contractors acount 30

days later.

Construction Management, 3/E by Daniel W. Halpin

Copyright 2006 by J ohn Wiley & Sons, Inc. All rights reserved.

Cash Flow to the Contractor

The amount of each

progress payment

can be calculated as:

( ) [ ] expense) direct expense indirect 1.25 0.10 -

expense) direct expense (indirect 1.25 Pay

+ =

+ =

10

Construction Management, 3/E by Daniel W. Halpin

Copyright 2006 by J ohn Wiley & Sons, Inc. All rights reserved.

Cash Flow to the Contractor

The minus term for retainage drops out of

the equation when 50% of the contract has

been completed.

Because of the delay in payment of billings

by the owner and retainage withheld, the

revenue profile lags behind the expense

S-curve as shown in the following figure of

the next slide.

Construction Management, 3/E by Daniel W. Halpin

Copyright 2006 by J ohn Wiley & Sons, Inc. All rights reserved.

Figure 9.2 (p. 149)

Expenses and income profiles.

11

Construction Management, 3/E by Daniel W. Halpin

Copyright 2006 by J ohn Wiley & Sons, Inc. All rights reserved.

Cash Flow to the Contractor

The revenue profile has a stair-step appearance

since the progress payments are transferred in

discrete amounts based on the preceding

equation.

The shaded area of the previous figure between

the revenue and expense profiles indicates the

need on the part of the contractor to finance part

of the construction until such time as he is

reimbursed by the owner.

Construction Management, 3/E by Daniel W. Halpin

Copyright 2006 by J ohn Wiley & Sons, Inc. All rights reserved.

Figure 9.3 (p. 150)

Influence of front, or mobilization, payment on expense or income profiles.

12

Construction Management, 3/E by Daniel W. Halpin

Copyright 2006 by J ohn Wiley & Sons, Inc. All rights reserved.

Table 9.1 (p. 151)

Overdraft calcuations.

Construction Management, 3/E by Daniel W. Halpin

Copyright 2006 by J ohn Wiley & Sons, Inc. All rights reserved.

Figure 9.4 (p. 152)

Plot of maximum overdraft.

13

Construction Management, 3/E by Daniel W. Halpin

Copyright 2006 by J ohn Wiley & Sons, Inc. All rights reserved.

Figure 9.5 (p. 153)

Composite overdraft profiles.

Construction Management, 3/E by Daniel W. Halpin

Copyright 2006 by J ohn Wiley & Sons, Inc. All rights reserved.

Figure 9.6 (p. 153)

ROR for small bar chart problem.

14

Construction Management, 3/E by Daniel W. Halpin

Copyright 2006 by J ohn Wiley & Sons, Inc. All rights reserved.

Table 9.2 (p. 154)

ROR Calculations for Small Project.

Construction Management, 3/E by Daniel W. Halpin

Copyright 2006 by J ohn Wiley & Sons, Inc. All rights reserved.

Figure 9.7 (p. 154)

ROR for small bar chart problem with mobilization payment.

15

Construction Management, 3/E by Daniel W. Halpin

Copyright 2006 by J ohn Wiley & Sons, Inc. All rights reserved.

Table 9.3 (p. 155)

Overdraft Calculation with Mobilization Payment

Construction Management, 3/E by Daniel W. Halpin

Copyright 2006 by J ohn Wiley & Sons, Inc. All rights reserved.

Table 9.4 (p. 156)

ROR Calculations to Include Mobilization Payment

16

Construction Management, 3/E by Daniel W. Halpin

Copyright 2006 by J ohn Wiley & Sons, Inc. All rights reserved.

Problem 9.1 (p. 156)

Construction Management, 3/E by Daniel W. Halpin

Copyright 2006 by J ohn Wiley & Sons, Inc. All rights reserved.

Problem 9.2 (p. 157)

17

Construction Management, 3/E by Daniel W. Halpin

Copyright 2006 by J ohn Wiley & Sons, Inc. All rights reserved.

Problem 9.3 (p. 157)

Construction Management, 3/E by Daniel W. Halpin

Copyright 2006 by J ohn Wiley & Sons, Inc. All rights reserved.

Problem 9.4 (p. 157)

Você também pode gostar

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Samtech 200 Epoxy Grout: Three Component Rapid Cure High Strength Epoxy GroutDocumento3 páginasSamtech 200 Epoxy Grout: Three Component Rapid Cure High Strength Epoxy GroutFrancois-Ainda não há avaliações

- FlowcableDocumento4 páginasFlowcableFrancois-Ainda não há avaliações

- Ferroflow 939: Iron Fortified Shrinkage Compensated GroutDocumento2 páginasFerroflow 939: Iron Fortified Shrinkage Compensated GroutFrancois-Ainda não há avaliações

- MEYCO MP320 Questions & Answers PDFDocumento12 páginasMEYCO MP320 Questions & Answers PDFFrancois-Ainda não há avaliações

- Ferromortar 707: Iron Fortified Non-Shrink Grout For Dry-Pack To Pourable InstallationDocumento2 páginasFerromortar 707: Iron Fortified Non-Shrink Grout For Dry-Pack To Pourable InstallationFrancois-Ainda não há avaliações

- Standard Grout PDFDocumento3 páginasStandard Grout PDFFrancois-Ainda não há avaliações

- Masterflow 410 PCDocumento3 páginasMasterflow 410 PCFrancois-Ainda não há avaliações

- MEYCO MP 364 Flex PDFDocumento2 páginasMEYCO MP 364 Flex PDFFrancois-Ainda não há avaliações

- Masterflow 400: High Strength, Free Flowing Epoxy GroutDocumento2 páginasMasterflow 400: High Strength, Free Flowing Epoxy GroutFrancois-Ainda não há avaliações

- Meyco MP 357 GS PDFDocumento2 páginasMeyco MP 357 GS PDFFrancois-Ainda não há avaliações

- Meyco Fix Lube 1 PDFDocumento2 páginasMeyco Fix Lube 1 PDFFrancois-Ainda não há avaliações

- Meyco MP302 PDFDocumento3 páginasMeyco MP302 PDFFrancois-Ainda não há avaliações

- Meyco MP308 PDFDocumento3 páginasMeyco MP308 PDFFrancois-Ainda não há avaliações

- MEYCO MP 367 Foam PDFDocumento2 páginasMEYCO MP 367 Foam PDFFrancois-Ainda não há avaliações

- Meyco FIB 600 PDFDocumento2 páginasMeyco FIB 600 PDFFrancois-Ainda não há avaliações

- Rheocrete 222+: Organic Corrosion Inhibiting AdmixtureDocumento3 páginasRheocrete 222+: Organic Corrosion Inhibiting AdmixtureFrancois-Ainda não há avaliações

- Primer SC PDFDocumento3 páginasPrimer SC PDFFrancois-Ainda não há avaliações

- Meyco MP 301 PDFDocumento2 páginasMeyco MP 301 PDFFrancois-Ainda não há avaliações

- Pozzolith 555: Non-Chloride Accelerating AdmixtureDocumento3 páginasPozzolith 555: Non-Chloride Accelerating AdmixtureFrancois-Ainda não há avaliações

- Meyco FIB 500 PDFDocumento2 páginasMeyco FIB 500 PDFFrancois-Ainda não há avaliações

- Protectosil CIT PDFDocumento3 páginasProtectosil CIT PDFFrancois-Ainda não há avaliações

- Method Statement - Masterseal 345 REV D PDFDocumento17 páginasMethod Statement - Masterseal 345 REV D PDFFrancois-Ainda não há avaliações

- Rheofinish 303: High Performance Chemical and Physical Mould Release Agents DescriptionDocumento1 páginaRheofinish 303: High Performance Chemical and Physical Mould Release Agents DescriptionFrancois-Ainda não há avaliações

- Pozzolith LD20: Water-Reducing, Plasticiser / Retarder For ConcreteDocumento2 páginasPozzolith LD20: Water-Reducing, Plasticiser / Retarder For ConcreteFrancois-Ainda não há avaliações

- Pozzolith CRP4+: High Performance Retarding Plasticiser For ConcreteDocumento2 páginasPozzolith CRP4+: High Performance Retarding Plasticiser For ConcreteFrancois-Ainda não há avaliações

- Primer TC PDFDocumento3 páginasPrimer TC PDFFrancois-Ainda não há avaliações

- RheoFIT 761 PDFDocumento2 páginasRheoFIT 761 PDFFrancois-Ainda não há avaliações

- Meyco MP355 1K - TDS - 07 - PDFDocumento2 páginasMeyco MP355 1K - TDS - 07 - PDFFrancois-Ainda não há avaliações

- Pozzolith 600R PDFDocumento2 páginasPozzolith 600R PDFFrancois-Ainda não há avaliações

- Pozzolith 390N PDFDocumento2 páginasPozzolith 390N PDFFrancois-Ainda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Assignment 3Documento6 páginasAssignment 3salebanAinda não há avaliações

- Ass Intacc 3 - GonzagaDocumento12 páginasAss Intacc 3 - GonzagaLalaine Keendra GonzagaAinda não há avaliações

- 601b9f7c3988930021ce6845-1612423290-CHAPTER 2 - BUILDING CUSTOMER LOYALTY THROUGH CUSTOMER SERVICEDocumento5 páginas601b9f7c3988930021ce6845-1612423290-CHAPTER 2 - BUILDING CUSTOMER LOYALTY THROUGH CUSTOMER SERVICEDomingo VillanuevaAinda não há avaliações

- Profitability Analysis Vs Profit Center Vs Business AreaDocumento2 páginasProfitability Analysis Vs Profit Center Vs Business Areaspetr1Ainda não há avaliações

- 4 AIQS APC Q A Workshop Ramesh PDFDocumento16 páginas4 AIQS APC Q A Workshop Ramesh PDFRajkumar ChinniahAinda não há avaliações

- Utb Programmes 2021-2022Documento3 páginasUtb Programmes 2021-2022labid.mccAinda não há avaliações

- Data of Logistics Companies of UAEDocumento93 páginasData of Logistics Companies of UAEAli Altaf100% (2)

- Paper No. 503Documento71 páginasPaper No. 503NITESH ROHADAAinda não há avaliações

- NCSP Value and BehavioursDocumento55 páginasNCSP Value and Behavioursberry MikeAinda não há avaliações

- Implementation of Artificial Intelligence and Its Impact On Human Auditors - Finance International ProgramDocumento7 páginasImplementation of Artificial Intelligence and Its Impact On Human Auditors - Finance International ProgramPanashe GuzhaAinda não há avaliações

- IS Definitions v2Documento13 páginasIS Definitions v2Ajith VAinda não há avaliações

- Leida Kristin GardeDocumento4 páginasLeida Kristin Garderealjosh21Ainda não há avaliações

- 5ATDocumento3 páginas5ATPaula Mae DacanayAinda não há avaliações

- Audthe02 Activity 1Documento4 páginasAudthe02 Activity 1Christian Arnel Jumpay LopezAinda não há avaliações

- BWU Notice 2024 Pass Out Batch Hero FinCorp Limited MBADocumento4 páginasBWU Notice 2024 Pass Out Batch Hero FinCorp Limited MBAAditya Prakash ChaudharyAinda não há avaliações

- Motion Court 10 10 2019Documento5 páginasMotion Court 10 10 2019denis blackAinda não há avaliações

- Apple AnalysisDocumento8 páginasApple AnalysisExpertAinda não há avaliações

- The Audit Process: Principles, Practice and Cases Seventh EditionDocumento28 páginasThe Audit Process: Principles, Practice and Cases Seventh EditionSyifa FebrianiAinda não há avaliações

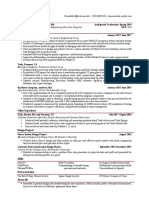

- Stacey Rosenfeld Resume 2018Documento1 páginaStacey Rosenfeld Resume 2018api-333865833Ainda não há avaliações

- Running Head: YUVA: (Name) (Institute) (Date)Documento29 páginasRunning Head: YUVA: (Name) (Institute) (Date)Liam GreenAinda não há avaliações

- AFAR 04 Business CombinationDocumento9 páginasAFAR 04 Business CombinationPym-Kaytitinga St. Joseph ParishAinda não há avaliações

- Grade 8-Melc & Budget of WorkDocumento5 páginasGrade 8-Melc & Budget of WorkMarilou Eroles MontonAinda não há avaliações

- Chapter 3 Fundamentals of Organization StructureDocumento21 páginasChapter 3 Fundamentals of Organization StructureKaye Adriana GoAinda não há avaliações

- Group 2 - Schumpeter - The Creative Response in Economic HistoryDocumento2 páginasGroup 2 - Schumpeter - The Creative Response in Economic Historymkmen100% (2)

- Final Exam BUS 4005 PJT MGTDocumento3 páginasFinal Exam BUS 4005 PJT MGTMarc SchafradAinda não há avaliações

- Strategic Manage Men 1Documento46 páginasStrategic Manage Men 1Ahtesham AnsariAinda não há avaliações

- Maturity Organization Level ISO 9004Documento7 páginasMaturity Organization Level ISO 9004abimanyubawonoAinda não há avaliações

- One-Pager OptaveDocumento1 páginaOne-Pager OptavedancsargentinaAinda não há avaliações

- UCSP Module 7 SummaryDocumento11 páginasUCSP Module 7 SummaryJudy May BaroaAinda não há avaliações

- Business CommunicationDocumento214 páginasBusiness Communicationrajeshpavan92% (13)