Escolar Documentos

Profissional Documentos

Cultura Documentos

Hong Fok Corporation Limited: Revenue (Note 1)

Enviado por

Theng Roger0 notas0% acharam este documento útil (0 voto)

8 visualizações8 páginasThis document provides the full year financial statement and dividend announcement for Hong Fok Corporation Limited for the year ended December 31, 2005. It includes:

1) An income statement showing a net loss of $9.038 million for 2005 compared to a net profit of $1.316 million in 2004, with revenue declining 3% and expenses declining 7%.

2) A balance sheet as of December 31, 2005 showing total assets of $1.1 billion and total equity and liabilities also of $1.1 billion for the group.

3) Details of the group's borrowings including $128.499 million repayable within one year and $367.572 million repay

Descrição original:

Year 2005

Título original

HongFok

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoThis document provides the full year financial statement and dividend announcement for Hong Fok Corporation Limited for the year ended December 31, 2005. It includes:

1) An income statement showing a net loss of $9.038 million for 2005 compared to a net profit of $1.316 million in 2004, with revenue declining 3% and expenses declining 7%.

2) A balance sheet as of December 31, 2005 showing total assets of $1.1 billion and total equity and liabilities also of $1.1 billion for the group.

3) Details of the group's borrowings including $128.499 million repayable within one year and $367.572 million repay

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

8 visualizações8 páginasHong Fok Corporation Limited: Revenue (Note 1)

Enviado por

Theng RogerThis document provides the full year financial statement and dividend announcement for Hong Fok Corporation Limited for the year ended December 31, 2005. It includes:

1) An income statement showing a net loss of $9.038 million for 2005 compared to a net profit of $1.316 million in 2004, with revenue declining 3% and expenses declining 7%.

2) A balance sheet as of December 31, 2005 showing total assets of $1.1 billion and total equity and liabilities also of $1.1 billion for the group.

3) Details of the group's borrowings including $128.499 million repayable within one year and $367.572 million repay

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 8

HONG FOK CORPORATION LIMITED

(Co. Reg. No. 196700468N)

Full Year Financial Statement And Dividend Announcement for the Year Ended 31 December 2005

PART I INFORMATION REQUIRED FOR ANNOUNCEMENTS OF QUARTERLY (Q1, Q2 & Q3), HALF-YEAR AND FULL YEAR

RESULTS

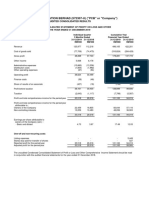

1(a) An income statement (for the group), together with a comparati ve statement for the corresponding period of the

immediately preceding financial year.

Full year financial statement on consolidated results for the year ended 31 December 2005.

These figures have not been audited.

%

Increase/

2005 2004 (Decrease)

Revenue (Note 1) 38,729 39,979 (3)

Other income (Note 2) 327 419 (22)

39,056 40,398 (3)

Allowance for diminution in value and foreseeable losses on - (400) NM

development properties

Impairment losses on other investments and remeasurement of (926) (865) 7

trading securities, net

Allowance for doubtful receivables and bad debts written off, net (333) (122) 173

Amortisation of negative goodwill - 93 NM

Cost of sales of development property - (434) NM

Depreciation of fixed assets (428) (346) 24

Exchange gain/(loss), net 399 (734) NM

Other operating expenses (23,679) (23,981) (1)

Total expenses (24,967) (26,789) (7)

Profi t from operations (Note 3) 14,089 13,609 4

Finance costs (18,782) (14,796) 27

Loss before share of resul ts of associ ated compani es (4,693) (1,187) 295

Share of results of associated companies (4,383) 2,087 NM

(Loss)/Profit from ordinary acti viti es before taxation (9,076) 900 NM

Income tax - current year (96) (206) (53)

Income tax - overprovision in prior years 305 1,440 (79)

Deferred taxation (171) (818) (79)

Net (Loss)/Profit for the year (9,038) 1,316 NM

$'000

The Group

Notes :

(1) Included in Revenue is investment income of approximately $312,000 (2004 : $89,000).

(2) Included in Other income is gain on disposals of fixed assets, net of approximately $97,000 (2004 : $64,000).

(3) Included in Profit from operations is profit on sale of development property of approximately $Nil (2004 : $716,000).

(4) NM Not Meaningful.

(5) NA Not Applicable.

Page 1

1 (b)(i) A balance sheet (for the issuer and group), together with a comparative statement as at the end of the immediately

preceding financial year.

2005 2004 2005 2004

Non-current Assets

Fixed assets 732 832 - -

Subsidiaries - - 186,746 187,207

Associates 176,412 157,281 4,456 4,403

Investment properties 867,453 829,720 - -

Other investments 375 918 - -

Deferred tax assets 51 221 - -

1,045,023 988,972 191,202 191,610

Current Assets

Trading securities 1,084 2,192 - -

Development properties 50,038 40,357 - -

Trade and other receivables 2,785 4,729 3 3

Derivative assets 241 - - -

Cash and cash equivalents 967 392 51 40

55,115 47,670 54 43

Total Assets 1,100,138 1,036,642 191,256 191,653

Equity Attributable to Equity Holders of the Parent

Share capital 149,899 149,899 149,899 149,899

Reserves 438,347 387,896 40,901 41,305

Total Equity 588,246 537,795 190,800 191,204

Non-current Liabilities

Obligations under finance leases 215 303 - -

Interest-bearing loans and borrowings 367,357 481,280 - -

Deferred tax liability 498 498 - -

368,070 482,081 - -

Current Liabilities

Bank overdraft (secured) 123 709 - -

Trade and other payables 15,091 14,433 456 449

Obligations under finance leases 145 134 - -

Interest-bearing loans and borrowings 128,231 1,000 - -

Tax payable 232 490 - -

143,822 16,766 456 449

Total Liabilities 511,892 498,847 456 449

Total Equity and Liabilities 1,100,138 1,036,642 191,256 191,653

The Group The Company

$'000 $'000

1(b)(ii) Aggregate amount of groups borrowings and debt securities.

Amount repayable in one year or less, or on demand

Secured Unsecured Secured Unsecured

$128,499,000 - $1,843,000 -

As at 31.12.2004 As at 31.12.2005

Amount repayable after one year

Secured Unsecured Secured Unsecured

$367,572,000 - $481,583,000 -

As at 31.12.2004 As at 31.12.2005

Page 2

Details of any collateral

Included in the amount repayable in one year or less, or on demand (secured) of $128,499,000 is a principal amount of

$110,000,000 bonds due J uly 2006 but was repaid in J anuary 2006 through refinancing of $70,000,000 Fixed Rate Notes

due 2011 and $40,000,000 Floating Rate Notes due 2011. Included in the carrying value of the interest-bearing loans and

borrowings is an amount of approximately $241,000 relating to the change in fair value of these bonds in line with the

adoption of FRS 39.

The borrowings by the subsidiaries are generally secured by the Groups investment and development properties and are

guaranteed by the Company.

1(c) A cash flow statement (for the group), together with a comparati ve statement for the corresponding period of the

immediately preceding financial year.

2005 2004

Operating Acti viti es :

(Loss)/Profit from ordinary activities before taxation (9,076) 900

Adjustments for :

Share of results of associated companies 4,383 (2,087)

Depreciation of fixed assets 428 346

Amortisation of negative goodwill - (93)

Gain on disposal of development property - (716)

Gain on disposals of fixed assets, net (97) (64)

Gain on disposals of trading securities (225) (20)

Impairment losses on other investments and remeasurement of 926 865

trading securities, net

Interest income (252) (89)

Interest expenses 18,782 14,796

Operating profit before working capital changes 14,869 13,838

Changes in working capital :

Development properties (8,738) (353)

Trade and other receivables 547 (1,864)

Trade and other payables 516 (283)

Cash generated from operations 7,194 11,338

Income tax paid (107) (502)

Interest received 72 89

Income tax refund 58 77

Cash Flows from Operati ng Activi ti es 7,217 11,002

Investing Activiti es :

Decrease in investment properties 50 152

Increase in trading securities (426) (2,288)

Purchase of fixed assets (270) (105)

Proceeds from disposal of development property - 1,150

Proceeds from disposals of fixed assets 97 67

Proceeds from disposals of trading securities 1,381 931

(Increase)/Decrease in interests in associated companies (400) 729

Cash Flows from Investi ng Activi ti es 432 636

Fi nancing Activiti es :

Interest paid (19,583) (14,679)

Dividend paid (1,199) (1,199)

Repayment of interest bearing loans and borrowings (1,000) -

Payment of finance lease rentals (136) (126)

Proceeds from interest bearing loans and borrowings 15,429 4,500

Cash Flows from Fi nanci ng Activi ties (6,489) (11,504)

Net Increase i n Cash and Cash Equi val ents 1,160 134

Cash and cash equivalents at 1 J anuary (317) (445)

Effect of exchange rate changes on balances held in foreign currencies 1 (6)

Cash and Cash Equi val ents at 31 December 844 (317)

Cash and Cash Equi val ents at 31 December is represented by :

Cash at banks and in hand 967 392

Bank overdraft (secured) (123) (709)

844 (317)

The Group

$'000

Page 3

1(d)(i) A statement (for the issuer and group) showing either (i) all changes in equity or (ii) changes in equity other than

those arising from capitalisation issues and distributions to shareholders, together with a comparati ve statement for

the corresponding period of the immediately preceding financial year.

Capital

Share Share and Other Translation Revaluation

Capital Premium Reserves Reserves Reserves Total

The Group

At 1 J anuary 2004 149,899 814 10,297 (19,916) 277,370 75,807 494,271

Exchange differences on translation - - - (1,259) - - (1,259)

of financial statements of foreign

subsidiaries and associated companies

Exchange differences on translation - - (326) - (2,093) - (2,419)

of balances at beginning of the year

Net surplus on revaluation - - - - 932 - 932

Share of reserves of associated companies - - - - 46,153 - 46,153

Net profit for the year - - - - - 1,316 1,316

Dividend - - - - - (1,199) (1,199)

At 31 December 2004 149,899 814 9,971 (21,175) 322,362 75,924 537,795

At 31 December 2004, as previously reported 149,899 814 9,971 (21,175) 322,362 75,924 537,795

Effects of adopting :

FRS 21 - - - 70 - (79) (9)

FRS 103 - - (7,600) (317) - 13,983 6,066

At 1 J anuary 2005, as restated 149,899 814 2,371 (21,422) 322,362 89,828 543,852

Exchange differences on translation - - - 903 - - 903

of financial statements of foreign

subsidiaries and associated companies

Exchange differences on translation - - - - 2,035 - 2,035

of balances at beginning of the year

Net surplus on revaluation - - - - 37,783 - 37,783

Share of reserves of associated companies - - 772 - 13,324 (186) 13,910

Net loss for the year - - - - - (9,038) (9,038)

Dividend - - - - - (1,199) (1,199)

At 31 December 2005 149,899 814 3,143 (20,519) 375,504 79,405 588,246

The Company

At 1 J anuary 2004 149,899 814 - - - 41,682 192,395

Net profit for the year - - - - - 8 8

Dividend - - - - - (1,199) (1,199)

At 31 December 2004 149,899 814 - - - 40,491 191,204

Net profit for the year - - - - - 795 795

Dividend - - - - - (1,199) (1,199)

At 31 December 2005 149,899 814 - - - 40,087 190,800

$'000

Retained

Profit

1(d)(ii) Details of any changes in the companys share capital arising from rights issue, bonus issue, share buy-backs,

exercise of share options or warrants, conversion of other issues of equity securities, issue of shares for cash or as

consideration for acquisition or for any other purpose since the end of the previous period reported on. State also

the number of shares that may be issued on conversion of all the outstanding convertibles as at the end of the

current financial period reported on and as at the end of the corresponding period of the immediately preceding

financial year.

Nil.

Page 4

2. Whether the figures have been audited or reviewed, and in accordance with which auditing standard or practice.

The figures have not been audited nor reviewed by the Companys auditors.

3. Where the figures have been audited or reviewed, the auditors report (including any qualifications or emphasis of a

matter).

NA.

4. Whether the same accounting policies and methods of computation as in the issuers most recently audited annual

financial statements have been applied.

Except as disclosed in paragraph 5 below, the Group has applied the same accounting policies and methods of computation

in the financial statements for the current reporting year compared with the Groups audited financial statements for the year

ended 31 December 2004.

5. If there are any changes in the accounting policies and methods of computation, including any required by an

accounting standard, what has changed, as well as the reasons for, and the effect of, the change.

The Group adopted various new or revised Financial Reporting Standards (FRS) which became effective for the financial

year beginning 1 J anuary 2005. The FRS that have a material financial impact on the Group are disclosed below :

FRS 21 The Effects of Changes in Foreign Exchange Rates

With the adoption of the revised FRS 21, the measurement currency of one of the subsidiaries was changed from S$ to US$.

Consequently, comparatives were restated and opening retained profit was adjusted.

FRS 39 Financial Instruments : Recognition and Measurement

The adoption of FRS 39 resulted in the Group classifying certain of its financial assets as trading securities. It also requires

derivatives to be recognised at fair value and sets out certain conditions in which hedge accounting can be applied. The

Group has entered into an interest rate swap to manage the impact of interest rate risk of fixed rate bonds and the changes in

the fair value of the fixed rate bonds and interest rate swap are dealt with in the profit and loss account.

FRS 102 Share-based Payment

In compliance with FRS 102, share options granted by an associated company to certain of its directors and employees are

measured at fair value at the date of grant and recognised as an expense in the profit and loss account at the vesting date

which is the same as the grant date.

FRS 103 Business Combinations

The adoption of FRS 103 resulted in the Group derecognising negative goodwill at 1 J anuary 2005 with a corresponding

adjustment to the opening retained profit.

6. Earnings per ordinary share of the group for the current financial period reported on and the corresponding period

of the immediately preceding financial year, after deducting any provision for preference dividends.

2005 2004

(Loss)/Profit per ordinary share of the Group after deducting any provision for

preference dividends :

(a) Based on the average number of ordinary shares on issue; and (1.51) cts 0.22 cts

(b) On a fully diluted basis (detailing any adjustments made to the earnings) (1.51) cts NA

The Group

The (loss)/profit per ordinary share was calculated based on the loss for the year of approximately $9,038,000

(2004 : profit of $1,316,000) and the number of ordinary shares in issue of 599,595,180 (2004 : 599,595,180).

There is no dilutive potential ordinary shares in existence as at 31 December 2005.

Page 5

7. Net asset value (for the issuer and group) per ordinary share based on issued share capital of the issuer at the end

of the :

(a) current financial period reported on; and

(b) immediately preceding financial year.

2005 2004 2005 2004

Net asset value per ordinary share based on 98 cts 90 cts 32 cts 32 cts

issued share capital

The Group The Company

8. A review of the performance of the group, to the extent necessary for a reasonable understanding of the groups

business. It must include a discussion of the following :

(a) any significant factors that affected the turnover, costs, and earnings of the group for the current financial

period reported on, including (where applicable) seasonal or cyclical factors; and

(b) any material factors that affected the cash flow, working capital, assets or liabilities of the group during the

current financial period reported on.

The Groups revenue for 2005 decreased from approximately $40.0 million to $38.7 million. This was principally due to

an absence in sale of development property in Singapore and the lower contribution of rental income from its investment

properties although there was an increase in investment income from its trading securities.

The Groups other income for 2005 decreased mainly due to lower compensation income from the tenants of its

investment properties.

The Groups expenses for 2005 decreased from approximately $26.8 million to $25.0 million due mainly to the absence

of allowance for diminution in value and foreseeable losses on development properties, the absence of cost of sales of

the development property and the recording of an exchange gain in 2005 as against an exchange loss in 2004.

However, in spite of a slight increase in profit from operations, the Groups loss before share of results of associated

companies increased from approximately $1.2 million for 2004 to $4.7 million for 2005. This was attributed to increase

in finance costs from higher interest rates and increase in bank borrowings.

In addition, the Groups share of loss from associated companies was approximately $4.4 million for 2005. This was

principally due to the Groups share of impairment loss on property held for future development being higher than the

Groups share of the profit from the completion of the sale of a property in Hong Kong.

Hence, the Group made a loss of approximately $9.0 million for 2005 as compared to a profit of approximately $1.3

million for 2004.

The increase in net tangible assets was principally due to an increase in reserves resulting from the net surplus arising

from the revaluation of the Groups investment properties as of December 2005.

9. Where a forecast, or a prospect statement, has been previously disclosed to shareholders, any variance between it

and the actual results.

NA.

10. A commentary at the date of the announcement of the significant trends and competitive conditions of the industry

in which the group operates and any known factors or events that may affect the group in the next reporting period

and the next 12 months.

The Group expects its operating environment to remain challenging and competitive, especially in light of the rising interest

rates.

Page 6

11. Dividend

(a) Current Financial Period Reported On

Any dividend declared for the current financial period reported on ? None

(b) Corresponding Period of the Immediately Preceding Financial Year

Any dividend declared for the corresponding period of the immediately preceding financial year ? Yes

Name of Dividend

Dividend Type

Dividend Amount per Share (in cents)

Optional : Dividend Rate (in %)

Par value of shares

Tax Rate

$0.25

20%

First & Final

Cash

1% per ordinary share

0.25 cents per ordinary share (less tax)

(c) Date payable

NA.

(d) Books closure date

NA.

12. If no dividend has been declared/recommended, a statement to that effect.

No dividend has been declared nor recommended for the full year ended 31 December 2005.

PART II ADDITIONAL INFORMATION REQUIRED FOR FULL YEAR ANNOUNCEMENT

(This part is not applicable to Q1, Q2, Q3 or Half Year Results)

13. Segmented revenue and results for business or geographical segments (of the group) in the form presented in the

issuers most recently audited annual financial statements, with comparati ve information for the immediatel y

preceding year.

Property Property Property Other

Business Segments Investment Development Management Operations Total

2005

Total revenue 37,122 399 896 312 38,729

Segment results 14,250 286 65 (512) 14,089

Finance costs (17,689) (629) - (464) (18,782)

(4,693)

Share of results of associated companies (4,383)

Taxation 38

Net loss for the year (9,038)

2004

Total revenue 37,470 1,532 888 89 39,979

Segment results 14,789 393 86 (1,659) 13,609

Finance costs (14,194) (405) - (197) (14,796)

(1,187)

Share of results of associated companies 2,087

Taxation 416

Net profit for the year 1,316

$'000

The Group

Page 7

14. In the review of performance, the factors leading to any material changes in contributions to turnover and earnings

by the business or geographical segments.

Please refer to paragraph 8 above.

15. A breakdown of sales.

%

Increase/

2005 2004 (Decrease)

(a) Sales reported for first half year 19,616 19,191 2

(b) Operating profit/(loss) after tax before deducting minority 175 (817) NM

interests reported for first half year

(c) Sales reported for second half year 19,113 20,788 (8)

(d) Operating (loss)/profit after tax before deducting minority (9,213) 2,133 NM

interests reported for second half year

The Group

$'000

16. A breakdown of the total annual dividend (in dollar value) for the issuers latest full year and its previous full year.

Total Annual Dividend (Refer to Para 16 of Appendix 7.2 for the required details)

Latest Full Year ('000) Previous Full Year ('000)

Ordinary - 1,199

Preference - -

Total : - 1,199

BY ORDER OF THE BOARD

Koh Chay Tiang

Quek Sok Cher

Company Secretaries

28 February 2006

Page 8

Você também pode gostar

- SBA Loan InformationDocumento2 páginasSBA Loan InformationNews 5 WCYBAinda não há avaliações

- Negotiable Instruments Law ReviewerDocumento10 páginasNegotiable Instruments Law ReviewerEdwin VillaAinda não há avaliações

- Strategy Guide-Best Practices For Affordable Housing RehabDocumento74 páginasStrategy Guide-Best Practices For Affordable Housing RehabCP TewAinda não há avaliações

- Kansas City Property Management AgreementDocumento23 páginasKansas City Property Management AgreementJustin ScerboAinda não há avaliações

- Geas 1Documento84 páginasGeas 1Mariz-Elaine Noceja Rodriguez100% (7)

- Victoria v. Pidlaoan, 791 SCRA 16 (Digest)Documento3 páginasVictoria v. Pidlaoan, 791 SCRA 16 (Digest)Homer SimpsonAinda não há avaliações

- Agency, Trust & Partnership Reviewer - 1810-1836 (Cambri Notes)Documento6 páginasAgency, Trust & Partnership Reviewer - 1810-1836 (Cambri Notes)Arvin Figueroa100% (1)

- Timeline: The Failure of The Royal Bank of ScotlandDocumento7 páginasTimeline: The Failure of The Royal Bank of ScotlandFailure of Royal Bank of Scotland (RBS) Risk Management100% (1)

- St. Raphael V Bpi DigestDocumento2 páginasSt. Raphael V Bpi DigestKirsten Rose Boque Concon0% (1)

- NDC vs. Phil. Veterans BankDocumento2 páginasNDC vs. Phil. Veterans BankAnneAinda não há avaliações

- Abella Vs Abella DigestDocumento2 páginasAbella Vs Abella DigestJasielle Leigh UlangkayaAinda não há avaliações

- Hong Fok Corporation Limited: Revenue (Note 1)Documento10 páginasHong Fok Corporation Limited: Revenue (Note 1)Theng RogerAinda não há avaliações

- RFL Bond Report q1 Fy 2015Documento6 páginasRFL Bond Report q1 Fy 2015husnuozyegiinAinda não há avaliações

- Dell Financial Data Mid Course Quiz 1668627324062Documento10 páginasDell Financial Data Mid Course Quiz 1668627324062rohit goyalAinda não há avaliações

- 4.3 Financial Analysis 4.3.1 Financial Statements For The Year Ended December 31, 2014Documento8 páginas4.3 Financial Analysis 4.3.1 Financial Statements For The Year Ended December 31, 2014mustiAinda não há avaliações

- Financial MStatements Ceres MGardening MCompanyDocumento11 páginasFinancial MStatements Ceres MGardening MCompanyRodnix MablungAinda não há avaliações

- Dec09 Inv Presentation GAAPDocumento23 páginasDec09 Inv Presentation GAAPOladipupo Mayowa PaulAinda não há avaliações

- Comparative FSDocumento4 páginasComparative FSSuper GenerationAinda não há avaliações

- 4019 XLS EngDocumento13 páginas4019 XLS EngAnonymous 1997Ainda não há avaliações

- Starbucks DataDocumento32 páginasStarbucks DatabrainsphereAinda não há avaliações

- Aspen Colombiana Sas (Colombia) : SourceDocumento5 páginasAspen Colombiana Sas (Colombia) : SourceCatalina Echeverry AldanaAinda não há avaliações

- Enterprise Group PLC: Unaudited Financial Statements For The Year Ended 31 December 2021Documento8 páginasEnterprise Group PLC: Unaudited Financial Statements For The Year Ended 31 December 2021Fuaad DodooAinda não há avaliações

- RHB Group Soci SofpDocumento3 páginasRHB Group Soci SofpAnis SuhailaAinda não há avaliações

- Ford 18Documento6 páginasFord 18Bhavdeep singh sidhuAinda não há avaliações

- Yongnam Holdings Limited: Financial Statements Announcement For The Year Ended 31 December 2019Documento8 páginasYongnam Holdings Limited: Financial Statements Announcement For The Year Ended 31 December 2019Batu GajahAinda não há avaliações

- Consolidated Statement of Cash Flows: For The Financial Year Ended 31 December 2017Documento3 páginasConsolidated Statement of Cash Flows: For The Financial Year Ended 31 December 2017Vijay KumarAinda não há avaliações

- NIVS. 2009 SAIC Filing TranslatedDocumento3 páginasNIVS. 2009 SAIC Filing Translatedwensley2001Ainda não há avaliações

- Income Statements: Group Company 2009 2008 2009 2008 Note RM'000 RM'000 RM'000 RM'000Documento6 páginasIncome Statements: Group Company 2009 2008 2009 2008 Note RM'000 RM'000 RM'000 RM'000Praveen PintoAinda não há avaliações

- Fact-Sheet SyngeneDocumento4 páginasFact-Sheet SyngeneRahul SharmaAinda não há avaliações

- HE 4 Questions - Updated-1Documento13 páginasHE 4 Questions - Updated-1halelz69Ainda não há avaliações

- Beng Kuang Marine Limited: Page 1 of 10Documento10 páginasBeng Kuang Marine Limited: Page 1 of 10pathanfor786Ainda não há avaliações

- Acct 401 Tutorial Set FiveDocumento13 páginasAcct 401 Tutorial Set FiveStudy GirlAinda não há avaliações

- The Boeing Company and Subsidiaries Consolidated Statements of Cash FlowsDocumento1 páginaThe Boeing Company and Subsidiaries Consolidated Statements of Cash Flowsdivineyang05Ainda não há avaliações

- Earnings Quality Score 90: Nike Inc - Balance Sheet 25-Mar-2022 19:25Documento12 páginasEarnings Quality Score 90: Nike Inc - Balance Sheet 25-Mar-2022 19:25Yamilet Maria InquillaAinda não há avaliações

- ABC Cement FM (Final)Documento24 páginasABC Cement FM (Final)Muhammad Ismail (Father Name:Abdul Rahman)Ainda não há avaliações

- GB20003: International Financial Statement Analysis Individual Case Study (30%)Documento7 páginasGB20003: International Financial Statement Analysis Individual Case Study (30%)Priyah RathakrishnahAinda não há avaliações

- United Bank Limited and Its Subsidiary CompaniesDocumento15 páginasUnited Bank Limited and Its Subsidiary Companieszaighum sultanAinda não há avaliações

- 31-Mar-20 31-Mar-19: Non-Current AssetsDocumento6 páginas31-Mar-20 31-Mar-19: Non-Current AssetsKunalAinda não há avaliações

- Quarterly Report 20191231Documento21 páginasQuarterly Report 20191231Ang SHAinda não há avaliações

- Enterprise GroupDocumento8 páginasEnterprise GroupFuaad DodooAinda não há avaliações

- HBL FSAnnouncement 3Q2016Documento9 páginasHBL FSAnnouncement 3Q2016Ryan Hock Keong TanAinda não há avaliações

- Financial PlanDocumento25 páginasFinancial PlanAyesha KanwalAinda não há avaliações

- 247806Documento51 páginas247806Jack ToutAinda não há avaliações

- XLS EngDocumento5 páginasXLS EngBharat KoiralaAinda não há avaliações

- Lady Case Exhibit SBR 1Documento7 páginasLady Case Exhibit SBR 1Kanchan GuptaAinda não há avaliações

- A3 6Documento3 páginasA3 6David Rolando García OpazoAinda não há avaliações

- Consolidated Statements of Operations - USD ($) Shares in Millions, $ in MillionsDocumento20 páginasConsolidated Statements of Operations - USD ($) Shares in Millions, $ in MillionsLuka KhmaladzeAinda não há avaliações

- XLS EngDocumento10 páginasXLS EngLIMAAinda não há avaliações

- Hartalega Holdings Berhad (Malaysia) : Source: - WVB - Financial Standard For Industrial CompaniesDocumento6 páginasHartalega Holdings Berhad (Malaysia) : Source: - WVB - Financial Standard For Industrial CompaniesJUWAIRIA BINTI SADIKAinda não há avaliações

- Hand Protection PLCDocumento8 páginasHand Protection PLCasankaAinda não há avaliações

- NRSP-MFBL-Q3-Financials-Sept 2022 - V1Documento15 páginasNRSP-MFBL-Q3-Financials-Sept 2022 - V1shahzadnazir77Ainda não há avaliações

- Lotus 2017Documento14 páginasLotus 2017teingnidetioAinda não há avaliações

- Rastriya Banijya Bank Limited: Interim Financial StatementsDocumento30 páginasRastriya Banijya Bank Limited: Interim Financial StatementsNepal LoveAinda não há avaliações

- Financial Statements 2022 CACEIS GroupDocumento18 páginasFinancial Statements 2022 CACEIS GroupElio AseroAinda não há avaliações

- Financial Statement 2020Documento3 páginasFinancial Statement 2020Fuaad DodooAinda não há avaliações

- Emis Soriana IndicesDocumento11 páginasEmis Soriana IndicesRamiro Gallo Diaz GonzalezAinda não há avaliações

- Rak Properties 1Documento9 páginasRak Properties 1Govind Kumar VermaAinda não há avaliações

- 2011 MAS Annual 2Documento9 páginas2011 MAS Annual 2Thaw ZinAinda não há avaliações

- Colgate Cash FlowsDocumento2 páginasColgate Cash FlowsChetan DhuriAinda não há avaliações

- 105 10 Amazon Financial StatementsDocumento5 páginas105 10 Amazon Financial StatementsCharles Vladimir SolvaskyAinda não há avaliações

- Acc319 - Take-Home Act - Financial ModelDocumento24 páginasAcc319 - Take-Home Act - Financial Modeljpalisoc204Ainda não há avaliações

- Realestate Annual Handbook 2018Documento65 páginasRealestate Annual Handbook 2018Sayed DanishAinda não há avaliações

- Ceres Gardening Company - Spreadsheet For StudentsDocumento1 páginaCeres Gardening Company - Spreadsheet For Studentsandres felipe restrepo arango0% (1)

- Statement of Financial Position Statement of Profit or Loss: As at 30 June 2019 For The Year Ended 30 June 2019Documento3 páginasStatement of Financial Position Statement of Profit or Loss: As at 30 June 2019 For The Year Ended 30 June 2019Saljook AslamAinda não há avaliações

- Nigeria German Chemicals Final Results 2012Documento4 páginasNigeria German Chemicals Final Results 2012vatimetro2012Ainda não há avaliações

- Adani Ports & Special Economic Zone Ltd. (India) : SourceDocumento9 páginasAdani Ports & Special Economic Zone Ltd. (India) : SourceDivyagarapatiAinda não há avaliações

- AstraZeneca AR 2021 Financial StatementsDocumento77 páginasAstraZeneca AR 2021 Financial StatementsZoe SPAinda não há avaliações

- Adb Fin Statement - Dec 2020 - Final 2Documento2 páginasAdb Fin Statement - Dec 2020 - Final 2Fuaad DodooAinda não há avaliações

- HSC Báo Cáo Tài ChínhDocumento8 páginasHSC Báo Cáo Tài ChínhNgọc Dương Thị BảoAinda não há avaliações

- Synthetic and Structured Assets: A Practical Guide to Investment and RiskNo EverandSynthetic and Structured Assets: A Practical Guide to Investment and RiskAinda não há avaliações

- Hedge Funds' Oil Shorts Reach Peak For The Year: David SheppardDocumento3 páginasHedge Funds' Oil Shorts Reach Peak For The Year: David SheppardTheng RogerAinda não há avaliações

- Growth Hormone Guidance: Editor'S Choice in Molecular BiologyDocumento2 páginasGrowth Hormone Guidance: Editor'S Choice in Molecular BiologyTheng RogerAinda não há avaliações

- The Dangers in Rising Bond YieldsDocumento2 páginasThe Dangers in Rising Bond YieldsTheng RogerAinda não há avaliações

- Danish Krone Stages Biggest Fall Vs Euro Since 2001Documento2 páginasDanish Krone Stages Biggest Fall Vs Euro Since 2001Theng RogerAinda não há avaliações

- Noble GroupDocumento5 páginasNoble GroupTheng Roger100% (1)

- Buy OpportunityDocumento1 páginaBuy OpportunityTheng RogerAinda não há avaliações

- Globalrisk: Friday, January 17, 2014 6:13 AmDocumento2 páginasGlobalrisk: Friday, January 17, 2014 6:13 AmTheng RogerAinda não há avaliações

- Sex Doesn't SellDocumento2 páginasSex Doesn't SellTheng RogerAinda não há avaliações

- Worst Shipping Over 2014Documento1 páginaWorst Shipping Over 2014Theng RogerAinda não há avaliações

- GDF Suez Unit Acquires Data Centre Firm: Regional ExpansionDocumento1 páginaGDF Suez Unit Acquires Data Centre Firm: Regional ExpansionTheng RogerAinda não há avaliações

- Training BookletDocumento143 páginasTraining BookletSurenderAinda não há avaliações

- BC NEIA Booklet English 01-08-2019Documento14 páginasBC NEIA Booklet English 01-08-2019abhiroopboseAinda não há avaliações

- Promissory NoteDocumento4 páginasPromissory NoteSatbir TalwarAinda não há avaliações

- Joseph Harry Walter Poole-Blunden, Petitioner, V. Union Bank OF THE PHILIPPINES, Respondent. Decision Leonen, J.Documento14 páginasJoseph Harry Walter Poole-Blunden, Petitioner, V. Union Bank OF THE PHILIPPINES, Respondent. Decision Leonen, J.tink echivereAinda não há avaliações

- April 4, 2013 Mount Ayr Record-NewsDocumento14 páginasApril 4, 2013 Mount Ayr Record-NewsMountAyrRecordNews0% (1)

- ApartmentDocumento4 páginasApartmentMohammad Kamruzzaman100% (2)

- Operation of GP Parsik Sahakari BankDocumento14 páginasOperation of GP Parsik Sahakari BankSONI GUPTAAinda não há avaliações

- DBP v. Prudential BankDocumento3 páginasDBP v. Prudential BankKevin HernandezAinda não há avaliações

- Role of LIC in Indian Insurance in IndiaDocumento3 páginasRole of LIC in Indian Insurance in IndiaKaran Gulati100% (1)

- Tutorial 2 - Mathematics of Finance PDFDocumento3 páginasTutorial 2 - Mathematics of Finance PDFИбрагим ИбрагимовAinda não há avaliações

- Short Term Sources of FinanceDocumento18 páginasShort Term Sources of FinanceJithin Krishnan100% (1)

- Stauffer-V-usbank Petition For Review 9-13Documento22 páginasStauffer-V-usbank Petition For Review 9-13A. Campbell100% (1)

- Supreme Court: InsolventDocumento14 páginasSupreme Court: InsolventpatrixiaAinda não há avaliações

- Actionable Claims: CknowledgementDocumento16 páginasActionable Claims: CknowledgementPee KachuAinda não há avaliações

- List of Holyoke Property Tax DelinquentsDocumento16 páginasList of Holyoke Property Tax DelinquentsMike PlaisanceAinda não há avaliações

- Credit Risk Management PDFDocumento85 páginasCredit Risk Management PDFSanket LakdeAinda não há avaliações

- FijiTimes - Nov 23 2012pdfDocumento48 páginasFijiTimes - Nov 23 2012pdffijitimescanadaAinda não há avaliações

- 9 Earnings Management.2Documento31 páginas9 Earnings Management.2Huong TranAinda não há avaliações

- Sample LoanDocumento1 páginaSample Loannikhil3831Ainda não há avaliações