Escolar Documentos

Profissional Documentos

Cultura Documentos

Variables

Enviado por

Nguyễn Minh Thông0 notas0% acharam este documento útil (0 voto)

17 visualizações2 páginasCapital structure indicators will be regressed against the debt level of SMEs as dependent variable. SMEs normally prefer to use short-term financing over long-term financing as it is less likely for them to go bankrupt. The dependent variable is capital structure. The proxy is financial leverage.

Descrição original:

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

DOCX, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoCapital structure indicators will be regressed against the debt level of SMEs as dependent variable. SMEs normally prefer to use short-term financing over long-term financing as it is less likely for them to go bankrupt. The dependent variable is capital structure. The proxy is financial leverage.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

17 visualizações2 páginasVariables

Enviado por

Nguyễn Minh ThôngCapital structure indicators will be regressed against the debt level of SMEs as dependent variable. SMEs normally prefer to use short-term financing over long-term financing as it is less likely for them to go bankrupt. The dependent variable is capital structure. The proxy is financial leverage.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

Você está na página 1de 2

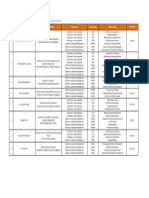

Variables

As mentioned before, the purpose of this Dependent variables

paper is to investigate the effects of determinants of capital structure on Iran SMEs borrowing

behavior. In order to reach this purpose, the capital structure indicators will be regressed against

the debt level of SMEs as dependent variable. Moreover, according to Michaelas et al. (1999), the

financing attitude of SMEs usually varies against of the long-run and short-run finance. For

example, SMEs asset structure is more volatile in compared with their larger counterparts.

However, SMEs normally prefer to use short-term financing over long-term financing as it is less

likely for them to go bankrupt.

The dependent variable is capital structure. The proxy is financial leverage. Two measures of

financial leverage are book financial leverage and market leverage which differ in whether equity

is book value or market value. Market value is future-oriented while book value focuses on

historical performance of a firm (Loof, 2004). Loof (2004) chooses market value of leverage due to

a future perspective required when he analyses firms growth opportunities. Frank & Goyal, (2009)

prefer book value over market value of leverage since they believe market value is not reliable for

financing policies.

In my thesis, I choose book financial leverage ratio to test the hypotheses. Market value financial

leverage ratio is used to perform robustness tests. Reviewed amounts of articles regarding capital

structure, the proxies of capital structure are short term debt ratio, longterm debt ratio and

total debt ratio (Vilasuso & Minkler, 2001; Ahmad et al., 2012; Abor, 2005; Halov & Heider,

2011). Choosing an approach to interpret leverage takes advantage of paper written by Rajan and

Zingales (1995). Six different leverage measurements were analysed which are total liability/ total

assets, total debt/ total assets, total debt/ net assets, total debt/ capital, EBIT/ interest expense,

EBITDA/ interest expense. The first four measurements are related to financial leverage. The ratio

of total liability to total assets may overstate leverage due to accounts payable and untaxed

reserves included in total liability. Total debt/ total assets can be affected by level of trade credit.

Total debt/ net assets can be affected by assets held against pension liabilities that is nothing to do

with financing. The ratio of total debt to capital where capital is calculated as total debt plus

total equity was considered to be the best representation of past financial decisions (Rajan &

Zingales, 1995). Since R&D is a long term investment and the effort of R&D cant be seen in a short

term, the financial leverage is measured as long term debt over capital.

Accordingly, the proxies of dependent variable, capital structure, are book value of long term debt

ratio and market value of long term debt ratio. Book long term debt ratio is measured as the ratio

of long term debt to the sum of total debt and book value of equity.Market value of long term

debt ratio is measured as the ratio of long term debt to the sum of total debt and market value of

equity.

Você também pode gostar

- Vietnam Quarterly Knowledge Report: Accelerating SuccessDocumento32 páginasVietnam Quarterly Knowledge Report: Accelerating SuccessNguyễn Minh ThôngAinda não há avaliações

- Assignment 2Documento2 páginasAssignment 2Nguyễn Minh ThôngAinda não há avaliações

- CA"H #$%& E"T'MAT'%( CHAPTE A(D !!'") A(ADocumento77 páginasCA"H #$%& E"T'MAT'%( CHAPTE A(D !!'") A(ANguyễn Minh ThôngAinda não há avaliações

- Group 1Documento10 páginasGroup 1Nguyễn Minh ThôngAinda não há avaliações

- 2013 Global Internship Program Application - EnglishDocumento6 páginas2013 Global Internship Program Application - EnglishNguyễn Minh ThôngAinda não há avaliações

- Ch1sol FINS3641 UNSWDocumento1 páginaCh1sol FINS3641 UNSWLeo KaligisAinda não há avaliações

- RM3Documento24 páginasRM3Nguyễn Minh ThôngAinda não há avaliações

- 6-Pecking Order TheoryDocumento1 página6-Pecking Order TheoryNguyễn Minh ThôngAinda não há avaliações

- Documents: Distribution Is Prohibited Without PermissionDocumento23 páginasDocuments: Distribution Is Prohibited Without PermissionNguyễn Minh ThôngAinda não há avaliações

- CA"H #$%& E"T'MAT'%( CHAPTE A(D !!'") A(ADocumento77 páginasCA"H #$%& E"T'MAT'%( CHAPTE A(D !!'") A(ANguyễn Minh ThôngAinda não há avaliações

- Ch1sol FINS3641 UNSWDocumento1 páginaCh1sol FINS3641 UNSWLeo KaligisAinda não há avaliações

- Quiz 3Documento6 páginasQuiz 3Nguyễn Minh ThôngAinda não há avaliações

- CH 4Documento4 páginasCH 4Nguyễn Minh ThôngAinda não há avaliações

- SEO-Vietnam 2014 IntroductionDocumento1 páginaSEO-Vietnam 2014 IntroductionNguyễn Minh ThôngAinda não há avaliações

- Teaching StaffDocumento1 páginaTeaching StaffNguyễn Minh ThôngAinda não há avaliações

- Sally SampleDocumento1 páginaSally SampleNguyễn Minh ThôngAinda não há avaliações

- Some Economic Indicators and Customers' InsightsDocumento6 páginasSome Economic Indicators and Customers' InsightsNguyễn Minh ThôngAinda não há avaliações

- Sally SampleDocumento1 páginaSally SampleNguyễn Minh ThôngAinda não há avaliações

- Bento Chan Group FinalDocumento18 páginasBento Chan Group FinalNguyễn Minh ThôngAinda não há avaliações

- Bento Chan Group FinalDocumento18 páginasBento Chan Group FinalNguyễn Minh ThôngAinda não há avaliações

- FromDocumento1 páginaFromNguyễn Minh ThôngAinda não há avaliações

- Higher Algebra - Hall & KnightDocumento593 páginasHigher Algebra - Hall & KnightRam Gollamudi100% (2)

- Higher Algebra - Hall & KnightDocumento593 páginasHigher Algebra - Hall & KnightRam Gollamudi100% (2)

- Higher Algebra - Hall & KnightDocumento593 páginasHigher Algebra - Hall & KnightRam Gollamudi100% (2)

- SPEAKINGDocumento1 páginaSPEAKINGNguyễn Minh ThôngAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Circular Flow of Process 4 Stages Powerpoint Slides TemplatesDocumento9 páginasCircular Flow of Process 4 Stages Powerpoint Slides TemplatesAryan JainAinda não há avaliações

- GMWIN SoftwareDocumento1 páginaGMWIN SoftwareĐào Đình NamAinda não há avaliações

- Ujian Madrasah Kelas VIDocumento6 páginasUjian Madrasah Kelas VIrahniez faurizkaAinda não há avaliações

- 2-Port Antenna Frequency Range Dual Polarization HPBW Adjust. Electr. DTDocumento5 páginas2-Port Antenna Frequency Range Dual Polarization HPBW Adjust. Electr. DTIbrahim JaberAinda não há avaliações

- 20 Ua412s en 2.0 V1.16 EagDocumento122 páginas20 Ua412s en 2.0 V1.16 Eagxie samAinda não há avaliações

- Forensic Science From The Crime Scene To The Crime Lab 2nd Edition Richard Saferstein Test BankDocumento36 páginasForensic Science From The Crime Scene To The Crime Lab 2nd Edition Richard Saferstein Test Bankhilaryazariaqtoec4100% (25)

- SCA ALKO Case Study ReportDocumento4 páginasSCA ALKO Case Study ReportRavidas KRAinda não há avaliações

- Disaster Management Plan 2018Documento255 páginasDisaster Management Plan 2018sifoisbspAinda não há avaliações

- Fernandez ArmestoDocumento10 páginasFernandez Armestosrodriguezlorenzo3288Ainda não há avaliações

- Annamalai International Journal of Business Studies and Research AijbsrDocumento2 páginasAnnamalai International Journal of Business Studies and Research AijbsrNisha NishaAinda não há avaliações

- April 26, 2019 Strathmore TimesDocumento16 páginasApril 26, 2019 Strathmore TimesStrathmore Times100% (1)

- MODULE+4+ +Continuous+Probability+Distributions+2022+Documento41 páginasMODULE+4+ +Continuous+Probability+Distributions+2022+Hemis ResdAinda não há avaliações

- Zelev 1Documento2 páginasZelev 1evansparrowAinda não há avaliações

- Briana SmithDocumento3 páginasBriana SmithAbdul Rafay Ali KhanAinda não há avaliações

- PandPofCC (8th Edition)Documento629 páginasPandPofCC (8th Edition)Carlos Alberto CaicedoAinda não há avaliações

- Lifespan Development Canadian 6th Edition Boyd Test BankDocumento57 páginasLifespan Development Canadian 6th Edition Boyd Test Bankshamekascoles2528zAinda não há avaliações

- Panel Data Econometrics: Manuel ArellanoDocumento5 páginasPanel Data Econometrics: Manuel Arellanoeliasem2014Ainda não há avaliações

- 5054 w11 QP 11Documento20 páginas5054 w11 QP 11mstudy123456Ainda não há avaliações

- DLP in Health 4Documento15 páginasDLP in Health 4Nina Claire Bustamante100% (1)

- Electronics Ecommerce Website: 1) Background/ Problem StatementDocumento7 páginasElectronics Ecommerce Website: 1) Background/ Problem StatementdesalegnAinda não há avaliações

- Tech Data: Vultrex Production & Drilling CompoundsDocumento2 páginasTech Data: Vultrex Production & Drilling CompoundsJeremias UtreraAinda não há avaliações

- Built - in BeamsDocumento23 páginasBuilt - in BeamsMalingha SamuelAinda não há avaliações

- India: Kerala Sustainable Urban Development Project (KSUDP)Documento28 páginasIndia: Kerala Sustainable Urban Development Project (KSUDP)ADBGADAinda não há avaliações

- Audit Acq Pay Cycle & InventoryDocumento39 páginasAudit Acq Pay Cycle & InventoryVianney Claire RabeAinda não há avaliações

- Us Virgin Island WWWWDocumento166 páginasUs Virgin Island WWWWErickvannAinda não há avaliações

- Trading As A BusinessDocumento169 páginasTrading As A Businesspetefader100% (1)

- ASMOPS 2016 - International Invitation PHILIPPINEDocumento4 páginasASMOPS 2016 - International Invitation PHILIPPINEMl Phil0% (3)

- Rounded Scoodie Bobwilson123 PDFDocumento3 páginasRounded Scoodie Bobwilson123 PDFStefania MoldoveanuAinda não há avaliações

- Antenna VisualizationDocumento4 páginasAntenna Visualizationashok_patil_1Ainda não há avaliações

- S5-42 DatasheetDocumento2 páginasS5-42 Datasheetchillin_in_bots100% (1)