Escolar Documentos

Profissional Documentos

Cultura Documentos

RMC No 16-2013

Enviado por

Eric Dykimching0 notas0% acharam este documento útil (0 voto)

475 visualizações3 páginasRMC 16-2013

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoRMC 16-2013

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

475 visualizações3 páginasRMC No 16-2013

Enviado por

Eric DykimchingRMC 16-2013

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 3

1

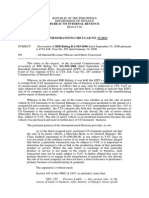

REPUBLIC OF THE PHILIPPINES

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

February 8, 2013

REVENUE MEMORANDUM CIRCULAR NO. 16-2013

SUBJECT : Clarifying the Tax Implications and Recording of Deposits/Advances

for Expenses Received by Taxpayers not covered by Revenue

Memorandum Circular No. 89-2012

TO : All Internal Revenue Officers and Others Concerned

___________________________________________________________________

This Circular is being issued to provide guidelines to be observed in accounting and

recording of deposits/advances for the payment of the pertinent expenses received

by taxpayers other than General Professional Partnerships (GPP) covered by

Revenue Memorandum Circular (RMC) No. 89-2012 dated December 28, 2012.

I. Policies and Guidelines

Deposits/Advances Part of Gross Receipts

When cash deposits or advances are received by taxpayers other than GPP covered

by RMC 89-2012 from the Client/Customer, a corresponding Official Receipt shall be

issued. The amount received shall be booked as Income and shall form part of the

Gross Receipts and subject to Value-added Tax (VAT) or Percentage Tax (Gross

Receipt Tax), if applicable, and shall in turn be deductible as expense by the

Client/Customer provided that it is duly substantiated by Official Receipts pursuant to

Section 34 (A) (1) of the Tax Code.

Claim for Deduction of Expenses

Receipts incurred, paid for and issued in the name of the taxpayer shall be recorded

as its own expenses for income tax purposes. These expenses shall be claimed as

deductions from gross income provided these are duly substantiated by Official

Receipts/Invoices issued by third-party establishments.

2

Income Payments are subject to appropriate Withholding Taxes

All Client/Customer shall, upon payment of deposits/advances, withhold tax at the

rate prescribed in Revenue Regulations No. (RR) 2-98, as amended, which shall be

remitted/paid on or before the 10

th

day of the following month using the Monthly

Remittance Return of Creditable Income Taxes Withheld (Expanded) [BIR Form No.

1601E] except for taxes withheld for the month of December of each year, which

shall be filed on or before January 15 of the following year pursuant to RR 2-98, as

amended. For those filing using the Electronic Filing and Payment System (EFPS),

the regulations pertaining to EFPS filers shall apply.

Issuing Official Receipts for the Deposit and Advances

An Official Receipt shall be issued for every deposit and advances pursuant to

Section 113 of the Tax Code. The Official Receipt shall cover the entire amount

which the Client/Customer pays.

For VAT Taxpayers, the VAT Official Receipt will constitute the Output Tax for

taxpayers other than GPP and in turn, the input tax of its client/customer.

II. PRO-FORMA ENTRIES

Upon receipt of the deposit/advances, the same shall be treated and recorded as

outright Income.

Accounting entries in the Books of the Taxpayer other than GPP

a. For VAT Taxpayers

Dr. Cr.

Cash xxx

Prepaid Income Tax (Creditable) xxx

Income xxx

Output VAT xxx

b. For Non-VAT Taxpayers

Dr. Cr.

Cash xxx

Prepaid Income Tax (Creditable) xxx

Income xxx

3

In turn, upon making deposit/advances for the necessary expenses, the

Client/Customer shall treat such deposit/advances as an outright expense.

Accounting entries in the Books of the Client/Customer

a. For VAT Taxpayers

Dr. Cr.

Expense xxx

Input VAT xxx

Cash xxx

Withholding Tax Payable xxx

b. For Non-VAT Taxpayers

Dr. Cr.

Expense xxx

Cash xxx

Withholding Tax Payable xxx

All revenue officials and employees are enjoined to give this Revenue

Memorandum Circular as wide a publicity as possible.

This Circular shall take effect immediately.

(Original Signed)

KIM S. JACINTO-HENARES

Commissioner of Internal Revenue

Você também pode gostar

- Revenue Memorandum Circular No. 016-13: February 8, 2013 February 8, 2013Documento2 páginasRevenue Memorandum Circular No. 016-13: February 8, 2013 February 8, 2013Ravenclaws91Ainda não há avaliações

- Tax-Free Exchanges That Are Not Subject To Income Tax, Capital Gains Tax, Documentary Stamp Tax And/or Value-Added Tax, As The Case May BeDocumento7 páginasTax-Free Exchanges That Are Not Subject To Income Tax, Capital Gains Tax, Documentary Stamp Tax And/or Value-Added Tax, As The Case May BeJouhara ObeñitaAinda não há avaliações

- By Rowena Altura: Volume 9 No.12Documento6 páginasBy Rowena Altura: Volume 9 No.12arnelmapzAinda não há avaliações

- Understanding VAT on Professional ServicesDocumento2 páginasUnderstanding VAT on Professional Servicesadian09Ainda não há avaliações

- Module 2 Tax Accounting and BenefitsDocumento12 páginasModule 2 Tax Accounting and BenefitsMon RamAinda não há avaliações

- Presentation On Taxation To The Construction Industry Federation of Zimbabwe (Cifoz)Documento44 páginasPresentation On Taxation To The Construction Industry Federation of Zimbabwe (Cifoz)Franco DurantAinda não há avaliações

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeNo Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeNota: 1 de 5 estrelas1/5 (1)

- PWC Newsletter - Value Added Tax Regulations, 2015 - Updated VersionDocumento5 páginasPWC Newsletter - Value Added Tax Regulations, 2015 - Updated VersionAnonymous FnM14a0Ainda não há avaliações

- SEMINAR ON NGAsDocumento63 páginasSEMINAR ON NGAsHelen Joy Grijaldo JueleAinda não há avaliações

- Tax Ruling on VAT Invoice RequirementsDocumento8 páginasTax Ruling on VAT Invoice RequirementsturtlesareawesomexxAinda não há avaliações

- TDS AND TCS PROVISIONSDocumento55 páginasTDS AND TCS PROVISIONSBeing HumaneAinda não há avaliações

- BIR FormsDocumento30 páginasBIR FormsRoma Sabrina GenoguinAinda não há avaliações

- Taxation of Salaried EmployeesDocumento39 páginasTaxation of Salaried Employeessailolla30Ainda não há avaliações

- List of Bir FormsDocumento26 páginasList of Bir FormsAviaAinda não há avaliações

- TAXATION SCHEMES EXPLAINEDDocumento7 páginasTAXATION SCHEMES EXPLAINEDLeonard CañamoAinda não há avaliações

- Fate of "Unjust Enrichment" Principle Under GSTDocumento2 páginasFate of "Unjust Enrichment" Principle Under GSTRajula Gurva ReddyAinda não há avaliações

- TMAP Tax Updates for November 2017Documento13 páginasTMAP Tax Updates for November 2017Mark Lord Morales BumagatAinda não há avaliações

- OVERVIEW 2020 Printed Edition (iBOOK Version)Documento21 páginasOVERVIEW 2020 Printed Edition (iBOOK Version)Quinciano MorilloAinda não há avaliações

- Reply On PANDocumento6 páginasReply On PANPaul Casaje88% (17)

- Tanzania Revenue Authority - VAT RefundDocumento1 páginaTanzania Revenue Authority - VAT RefundMICHAEL MBILINYIAinda não há avaliações

- Income tax credit for April 15 deadlineDocumento2 páginasIncome tax credit for April 15 deadlinebrainAinda não há avaliações

- Section 2.57.4 of RR No. 2-98Documento2 páginasSection 2.57.4 of RR No. 2-98fatmaaleahAinda não há avaliações

- RR No. 02-2006Documento10 páginasRR No. 02-2006odessaAinda não há avaliações

- Taxation of Salaried EmployeesDocumento41 páginasTaxation of Salaried EmployeesAbhiroop BoseAinda não há avaliações

- Manual Book 1770 PDFDocumento46 páginasManual Book 1770 PDFHafiedz SAinda não há avaliações

- Withholding Taxes: Carlo P. Divedor 19 October 2017Documento20 páginasWithholding Taxes: Carlo P. Divedor 19 October 2017Melanie Grace Ulgasan LuceroAinda não há avaliações

- RMC No 23-2012 - Withholding of TaxesDocumento7 páginasRMC No 23-2012 - Withholding of TaxesJOHAYNIEAinda não há avaliações

- Withholding Taxes 2Documento20 páginasWithholding Taxes 2hildaAinda não há avaliações

- Contex Corporation vs. Commissioner of Internal RevenueDocumento13 páginasContex Corporation vs. Commissioner of Internal Revenuenoonalaw0% (1)

- Amnisty For Tax and Custom DutiesDocumento12 páginasAmnisty For Tax and Custom DutieserishysiAinda não há avaliações

- TaxationDocumento38 páginasTaxationEphraim LopezAinda não há avaliações

- Importance of Withholding Tax SystemDocumento7 páginasImportance of Withholding Tax SystemALAJID, KIM EMMANUELAinda não há avaliações

- W3 Module 3 - Tax Administration Part IIDocumento14 páginasW3 Module 3 - Tax Administration Part IIElmeerajh JudavarAinda não há avaliações

- RMC No. 73-2018Documento3 páginasRMC No. 73-2018Madi KomoaAinda não há avaliações

- Value-Added Tax Description: BIR Form 2550MDocumento15 páginasValue-Added Tax Description: BIR Form 2550MJAYAR MENDZAinda não há avaliações

- VAT ReturnsDocumento39 páginasVAT ReturnsTaha AhmedAinda não há avaliações

- Value Added TaxDocumento19 páginasValue Added TaxRenalyn GardeAinda não há avaliações

- Overview of TDS: Who Shall Deduct Tax at Source?Documento37 páginasOverview of TDS: Who Shall Deduct Tax at Source?pradeep_ravi_7Ainda não há avaliações

- Vat On BanksDocumento4 páginasVat On BanksRolando VasquezAinda não há avaliações

- BASICS OF TAXATION (Income Tax Ordinance, 1984) Updated Till Finance Act. 2013 by Prof. Mahbubur RahmanDocumento14 páginasBASICS OF TAXATION (Income Tax Ordinance, 1984) Updated Till Finance Act. 2013 by Prof. Mahbubur RahmansaadmansheedyAinda não há avaliações

- Post Activity ReportDocumento7 páginasPost Activity ReportIrene Mae DairoAinda não há avaliações

- 7tax Administration LectureDocumento48 páginas7tax Administration LectureHawa MudalaAinda não há avaliações

- RR 22-2020 (Notice of Discrepancy) PDFDocumento3 páginasRR 22-2020 (Notice of Discrepancy) PDFilovelawschoolAinda não há avaliações

- Value Added Taxes Part 2Documento15 páginasValue Added Taxes Part 2Deo CoronaAinda não há avaliações

- Draft RR Registration EOPT - For Public ConsultationDocumento18 páginasDraft RR Registration EOPT - For Public ConsultationGennelyn OdulioAinda não há avaliações

- SubjectDocumento2 páginasSubjectapi-247793055Ainda não há avaliações

- ANDALAS UNIVERSITY MID TERM EXAMDocumento6 páginasANDALAS UNIVERSITY MID TERM EXAMMuhammad AlfarrabieAinda não há avaliações

- VAT Compliance RequirementsDocumento44 páginasVAT Compliance RequirementsAcademe100% (2)

- TAX 2 Group 1 Handout PDFDocumento6 páginasTAX 2 Group 1 Handout PDFMi-young SunAinda não há avaliações

- Basic TaxationDocumento25 páginasBasic Taxationmggaylan77Ainda não há avaliações

- BIR - Invoicing RequirementsDocumento17 páginasBIR - Invoicing RequirementsCkey ArAinda não há avaliações

- Withholding Tax SystemDocumento8 páginasWithholding Tax Systemjeric aquipelAinda não há avaliações

- BIR clarifies audit program and tax agent responsibilitiesDocumento2 páginasBIR clarifies audit program and tax agent responsibilitiesCkey ArAinda não há avaliações

- TAX PAYER GUIDE: BIR Compliance for BusinessesDocumento7 páginasTAX PAYER GUIDE: BIR Compliance for BusinessesLevi Lazareno EugenioAinda não há avaliações

- Tax Deduction at Source on SalariesDocumento112 páginasTax Deduction at Source on SalariesArnav MendirattaAinda não há avaliações

- Large Taxpayers Regulations on Filing & Payment DatesDocumento3 páginasLarge Taxpayers Regulations on Filing & Payment DatesLady Ann CayananAinda não há avaliações

- Obligations: 1. RegistrationDocumento5 páginasObligations: 1. RegistrationPhilip AlamboAinda não há avaliações

- Income Tax in GeneralDocumento6 páginasIncome Tax in GeneralMatt Marqueses PanganibanAinda não há avaliações

- GPPB Resolution No. 20-2013Documento7 páginasGPPB Resolution No. 20-2013Eric DykimchingAinda não há avaliações

- Agan vs. PiatcoDocumento44 páginasAgan vs. PiatcoEric DykimchingAinda não há avaliações

- GPPB NPM 011-2010Documento4 páginasGPPB NPM 011-2010Eric DykimchingAinda não há avaliações

- Republic of The Philippines Securities and Exchange CommissionDocumento4 páginasRepublic of The Philippines Securities and Exchange CommissionEric DykimchingAinda não há avaliações

- Revised PSE Listing RulesDocumento68 páginasRevised PSE Listing RulesEric Dykimching100% (1)

- Revokes Ruling on VAT for Car SalesDocumento3 páginasRevokes Ruling on VAT for Car SalesEric DykimchingAinda não há avaliações

- PH Competition Commission MC 16-001Documento3 páginasPH Competition Commission MC 16-001Eric DykimchingAinda não há avaliações

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocumento8 páginasBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledEric DykimchingAinda não há avaliações

- Anti-Money Laundering Act of 2001Documento20 páginasAnti-Money Laundering Act of 2001Eric DykimchingAinda não há avaliações

- Sec Memo No. 6, s2014Documento2 páginasSec Memo No. 6, s2014Eric DykimchingAinda não há avaliações

- Chattel Mortgage LawDocumento5 páginasChattel Mortgage LawEric DykimchingAinda não há avaliações

- SEC - MC#9 - Series - 2014 - Amendment To The Revised Code of Corporate GovernanceDocumento2 páginasSEC - MC#9 - Series - 2014 - Amendment To The Revised Code of Corporate GovernanceEric DykimchingAinda não há avaliações

- RR 12-2013 Withheld or Your Expenses Will Be DisallowedDocumento1 páginaRR 12-2013 Withheld or Your Expenses Will Be DisallowedMarita Ragus Victorino CabreraAinda não há avaliações

- TMAP Tax Updates April 2012Documento6 páginasTMAP Tax Updates April 2012Eric DykimchingAinda não há avaliações

- ADB Employees RMC No 31-2013Documento24 páginasADB Employees RMC No 31-2013Eric DykimchingAinda não há avaliações

- RR 02-01Documento4 páginasRR 02-01saintkarriAinda não há avaliações

- Summary of Chart of AccountsDocumento6 páginasSummary of Chart of AccountsBaneLoverAinda não há avaliações

- RMC 35-2011Documento3 páginasRMC 35-2011Alyssa NuquiAinda não há avaliações

- Amla Revised Implementing Rules and RegulationsDocumento45 páginasAmla Revised Implementing Rules and RegulationsEric DykimchingAinda não há avaliações

- Tax Brief - March 2013 v.02Documento8 páginasTax Brief - March 2013 v.02Eric DykimchingAinda não há avaliações

- Ra 9337Documento41 páginasRa 9337Eric DykimchingAinda não há avaliações

- Sri S T Kalairaj, Chairman: Income Tax TaxesDocumento3 páginasSri S T Kalairaj, Chairman: Income Tax TaxesvikramkkAinda não há avaliações

- 1.each of The Solids Shown in The Diagram Has The Same MassDocumento12 páginas1.each of The Solids Shown in The Diagram Has The Same MassrehanAinda não há avaliações

- ServiceDocumento47 páginasServiceMarko KoširAinda não há avaliações

- BPL Millipacs 2mm Hardmetrics RarDocumento3 páginasBPL Millipacs 2mm Hardmetrics RarGunter BragaAinda não há avaliações

- Important Instructions To Examiners:: Calculate The Number of Address Lines Required To Access 16 KB ROMDocumento17 páginasImportant Instructions To Examiners:: Calculate The Number of Address Lines Required To Access 16 KB ROMC052 Diksha PawarAinda não há avaliações

- Rishte ki baat SMS messages collectionDocumento108 páginasRishte ki baat SMS messages collectionTushar AggarwalAinda não há avaliações

- FINAL A-ENHANCED MODULES TO IMPROVE LEARNERS - EditedDocumento22 páginasFINAL A-ENHANCED MODULES TO IMPROVE LEARNERS - EditedMary Cielo PadilloAinda não há avaliações

- Report Emerging TechnologiesDocumento97 páginasReport Emerging Technologiesa10b11Ainda não há avaliações

- Borello-Bolted Steel Slip-Critical Connections With Fillers I. PerformanceDocumento10 páginasBorello-Bolted Steel Slip-Critical Connections With Fillers I. PerformanceaykutAinda não há avaliações

- FX15Documento32 páginasFX15Jeferson MarceloAinda não há avaliações

- The European Journal of Applied Economics - Vol. 16 #2Documento180 páginasThe European Journal of Applied Economics - Vol. 16 #2Aleksandar MihajlovićAinda não há avaliações

- Sharp Ar5731 BrochureDocumento4 páginasSharp Ar5731 Brochureanakraja11Ainda não há avaliações

- India: Kerala Sustainable Urban Development Project (KSUDP)Documento28 páginasIndia: Kerala Sustainable Urban Development Project (KSUDP)ADBGADAinda não há avaliações

- Game Rules PDFDocumento12 páginasGame Rules PDFEric WaddellAinda não há avaliações

- 5054 w11 QP 11Documento20 páginas5054 w11 QP 11mstudy123456Ainda não há avaliações

- Exercises2 SolutionsDocumento7 páginasExercises2 Solutionspedroagv08Ainda não há avaliações

- MBO, Management by Objectives, Pooja Godiyal, Assistant ProfessorDocumento20 páginasMBO, Management by Objectives, Pooja Godiyal, Assistant ProfessorPooja GodiyalAinda não há avaliações

- RUJUKANDocumento3 páginasRUJUKANMaryTibanAinda não há avaliações

- FS2004 - The Aircraft - CFG FileDocumento5 páginasFS2004 - The Aircraft - CFG FiletumbAinda não há avaliações

- Accomplishment Report 2021-2022Documento45 páginasAccomplishment Report 2021-2022Emmanuel Ivan GarganeraAinda não há avaliações

- Math5 Q4 Mod10 DescribingAndComparingPropertiesOfRegularAndIrregularPolygons v1Documento19 páginasMath5 Q4 Mod10 DescribingAndComparingPropertiesOfRegularAndIrregularPolygons v1ronaldAinda não há avaliações

- Progressive Myoclonic Epilepsies - Practical Neurology 2015. MalekDocumento8 páginasProgressive Myoclonic Epilepsies - Practical Neurology 2015. MalekchintanAinda não há avaliações

- Pom Final On Rice MillDocumento21 páginasPom Final On Rice MillKashif AliAinda não há avaliações

- Why Genentech Is 1Documento7 páginasWhy Genentech Is 1panmongolsAinda não há avaliações

- ESA Knowlage Sharing - Update (Autosaved)Documento20 páginasESA Knowlage Sharing - Update (Autosaved)yared BerhanuAinda não há avaliações

- SD8B 3 Part3Documento159 páginasSD8B 3 Part3dan1_sbAinda não há avaliações

- Pradhan Mantri Gramin Digital Saksharta Abhiyan (PMGDISHA) Digital Literacy Programme For Rural CitizensDocumento2 páginasPradhan Mantri Gramin Digital Saksharta Abhiyan (PMGDISHA) Digital Literacy Programme For Rural Citizenssairam namakkalAinda não há avaliações

- Difference Between Text and Discourse: The Agent FactorDocumento4 páginasDifference Between Text and Discourse: The Agent FactorBenjamin Paner100% (1)

- Final Thesis Report YacobDocumento114 páginasFinal Thesis Report YacobAddis GetahunAinda não há avaliações

- Tigo Pesa Account StatementDocumento7 páginasTigo Pesa Account StatementPeter Ngicur Carthemi100% (1)