Escolar Documentos

Profissional Documentos

Cultura Documentos

Chap 019

Enviado por

Neetu RajaramanDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Chap 019

Enviado por

Neetu RajaramanDireitos autorais:

Formatos disponíveis

Chapter 19 - Standard Costs, Variable Costing Systems, Quality Costs, and Joint Costs

CHAPTER 19

STANDARD COSTS, VARIABLE COSTING SYSTEMS,

QUALITY COSTS, AND JOINT COSTS

Changes from Twelfth Edition

All changes to Chapter 19 were minor.

Approach

ne o! the ad"antages o! standard costs is that a standard cost system re#uires less record$eeping than

does an actual cost system. Students ha"e di!!iculty in accepting this !act. %o learn about standard costs

re#uires an additional intellectual e!!ort on their part, and they e#uate this e!!ort with the physical e!!ort

o! operating a standard cost system. %he te&t e&plains why the sa"ing in record$eeping occurs, but the

e&planation may well re#uire rein!orcement by the instructor.

'e ha"e omitted a discussion o! waste and spoilage on the grounds that it is inappropriate !or a !irst

course. %his is an important, but di!!icult, topic in practice. Some instructors may wish to add a treatment

o! it on their own initiati"e.

%he (lac$ )eter Company description pro"ides a use!ul "ehicle !or understanding a standard cost

system* and it may be desirable to discuss it in considerable detail. %he description in the te&t does not

co"er e"ery number, but it should be ade#uate so that the students can deduce !or themsel"es where each

number on the e&hibits comes !rom, and in particular, how one e&hibit relates to others.

'e are sometimes critici+ed !or not being ad"ocates o! "ariable costing systems, as some authors seem to

be. Aside !rom the !act that we don,t "iew our role as being ad"ocates o! particular techni#ues, we !eel

that "ariable costing !inds !ar more !a"or in te&tboo$s than in practice. %he techni#ue appeared in the

literature o"er -. years ago, yet relati"ely !ew companies use it today. 'e interpret this !act not as a

matter o! company ignorance or inertia, but rather that companies do not !ind the system use!ul enough to

/usti!y the costs o! implementing it, which are nontri"ial costs. Any company ha"ing a !le&ible budget !or

o"erhead costs can combine the "ariable portion o! the o"erhead rate with direct labor and material costs

to get an ade#uate appro&imation o! short-term costs !or certain short-term decisions, without

implementing a !ormal "ariable costing system. %he increased use o! in"estment centers also leads

companies to want to "alue in"entories at !ull costs 0in some companies, !ull replacement costs1 !or

management reporting purposes. 'e ha"e tried to maintain a balanced presentation on this topic, so that

our students upon graduation don,t assume that their new employer is ignorant or in the 2ar$ Ages when

they !ind no "ariable costing system in that particular organi+ation.

%he 3cost o! #uality4 is an e"ol"ing topic. Students should be aware o! the concepts and related

terminology, but there are no speci!ic techni#ues to describe as yet. Similarly, students should ha"e

awareness o! the issues in /oint and by-product costing e"en i! the alternati"e costing procedures are not

pursued.

19-1

Chapter 19 - Standard Costs, Variable Costing Systems, Quality Costs, and Joint Costs

Cases

Bennett Body Company e&amines the nature and ad"antages o! a standard cost system in a simple

en"ironment. 5t also rein!orces the /ob-order "s. process costing distinction.

Black Meter Company as$s #uestions about the illustration in the te&t !or instructors who wish to discuss

this illustration thoroughly.

Brisson Company pro"ides !urther practice in setting up accounts !or a standard cost system and

preparing !inancial statements.

Landau Company contrasts "ariable costing and !ull absorption costing.

Lynchs Chicken Ranch is a /oint cost case. 5t emphasi+es conceptual understanding more than numerical

analysis 0this case is new in the %wel!th edition.1

Problem

Problem 19-1: Veronica Company

a. "erhead rate 6

hours labor direct 7stimated

o"erhead 7stimated

6

hours 8.,...

91:.,...

6 99 per direct labor hour

b. Jobs

; <

2irect material...................................................................................................................................................................................... 91.,... 91.,...

2irect labor.......................................................................................................................................................................................... 8:,... =8,...

"erhead.............................................................................................................................................................................................. 81,-..> 8?,8..@

%otal production costs.......................................................................................................................................................................... 9?9,-.. 9-A,8..

>8,B.. hours C 99 6 981,-..

@8,:.. hours C 99 6 98?,8..

c. Job ; Job <

Droduction cost..................................................................................................................................................................................... 9 ?9,-.. 9 -A,8..

Selling price 01:.E1............................................................................................................................................................................ 91.A,8:. 918.,9-.

Problem 19-2: Vermont !gar Enterprises

a. Selling price o! sugarF1,... C 98................................................................................................................................................... 98,......

%raceable costs 0a!ter split-o!!1............................................................................................................................................................ 8:....

;ross margin........................................................................................................................................................................................ 91,A8....

%otal syrup costG

Drocess costs 0918,8:. @ 91..,...1................................................................................................................................................. 9118,8:.

Hess sugar gross margin................................................................................................................................................................... 1,A8.

Cost allocated to syrup..................................................................................................................................................................... 911.,?-.

19-8

Chapter 19 - Standard Costs, Variable Costing Systems, Quality Costs, and Joint Costs

b. Joint product costsG

Syrup Sugar

Sales "alue........................................................................................................................................................................................... 9=..,... 98,...

Hess costs a!ter split-o!!....................................................................................................................................................................... 18,... 8:.

Ad/usted sales "alue............................................................................................................................................................................. 98::,... 91,A8.

Cost allocationG

SyrupG 8::,...I8:9,A8. & 1..,... 6 9 99,B.-

999,B.- @ 918,... 6 9111,B.-

SugarG 1,A8.I8:9,A8. & 1..,... 6 9?9B

?9B @ 8:. 6 9:AB

Problem 19-": #onrad Corporation

2H <ours

Allocation

JateI<our>

Allocated

7&penses

Cost o! goods sold................................................................................................................................................................................ =.,... 91B 9B8.,...

5n"entory.............................................................................................................................................................................................. =,... 1B B8,...

==,... B-8,...

>9B-8,... K ==,... 2H hours 6 91BI2irect labor hour

a. dr. Linished ;oods 5n"entory............................................................................................................................................................... B8,...

Cost o! ;oods Sold......................................................................................................................................................................... B8.,...

cr. Mon"ariable Droduction Costs................................................................................................................................................... B-8,...

b. As the abo"e entry shows, !ull costing 3capitali+es4 9B8,... o! the non"ariable costs in

in"entory, rather than treating the entire 9B-8,... as an e&pense* hence, in this particular year,

!ull costing will result in 9B8,... higher preta& income than will "ariable costing.

c. Linished goods in"entory 0!ull costs1 6 9A?,... @ B8,... 6 911A,...

Problem 19-$: %emad Company

Approach

%his problem raises an issue not discussed in the te&tG building normal materials waste and wor$er idle

time into standard costs. %he case is not di!!icult enough to /usti!y spending an entire class session on it. 5

use it in the same session as the Amurath Company case.

5 discuss materials !irst. %he rele"ant materials !igures are theseG

1. 7ach assembly re#uires eight le"ers.

8. %o get eight good le"ers, : I 9.E 6 : :I9 le"ers must be produced.

=. %he current price is 9.B? per le"er or 9B... per assembly.

B. 5n!lation is e&pected to raise this by B percent during the year, or to a year-end total o! 9B.1-. 5!

in!lation is at an e"en rate, the a"erage materials price per assembly during the year will be 9B..:.

19-=

Chapter 19 - Standard Costs, Variable Costing Systems, Quality Costs, and Joint Costs

?.

%his last amount would be the appropriate standard cost i! the standard is to be le!t unchanged !or the

year. %his means, o! course, that the company should e&pect !a"orable materials price "ariances !or the

!irst hal! o! the year, un!a"orable ones !or the second hal!, and +ero !or the year. 0%his would not

necessarily be true i! the case did not state that production is le"el throughout the year1.

%urning to direct labor, the rele"ant !acts are theseG

1. %he standard wor$wee$ is B. hours.

8. 2aily brea$s reduce this by 8.? hours per wee$, to =A.? hours. 0Apparently a lunch brea$ is not part o!

the standard :-hour day.1

=. nly :? percent o! the nominal producti"e hours are in !act producti"e, because o! necessary waiting

or interruptionsG =A.? > :?E 6 =1.:A? hours.

B. %he time-studied operation time is 18 minutes. )anagement belie"es this represents only 9. percent

o! practical e!!iciency* i.e., i! not being watched, the wor$ers could per!orm the operation 1.I9 times

in 18 minutes, or one time in 1..: minutes.

?. =1.:A? hrsIw$ > -. minIhr I 1..: minIunit 6 1AA..: unitsIwee$. 05! a student applied the 1? percent

waiting time to B. hours rather than =A.?, this will be 1::.9 unitsIwee$.1

-. 'ee$ly pay a"erages B. > 1: 6 9A8.* so standard labor per operation 6 9A8. I 1AA..: 6 9B..A 0or

9=.:1 !or the alternati"e interpretation o! waiting time1.

C!e

Case 19-1: Bennett Body Company

%oteG This case is unchanged from the Twelfth Edition. Please see the printed Instructors Resource

uide for the !ar"ard Teaching #otes$

Case 19-2: Black Meter Company

%oteG This case is unchanged from the Twelfth Edition.

Approach

%he (lac$ )eter Company description pro"ides a use!ul "ehicle !or understanding a standard cost

system, and it may be desirable to discuss it in considerable detail. %he description in the te&t does not

co"er e"ery number, but it should be ade#uate so that the students can deduce !or themsel"es where each

number on the e&hibits comes !rom, and in particular, how one e&hibit relates to others. Questions 1

through B are designed to !acilitate and build on this detailed analysis and should be assigned only i! the

instructor intends to spend considerable time 0a large !raction o! one class meeting1 on the (lac$ )eter

case. Question ? as$s !or a 3consultant,s appraisal4 o! the system, and raises the discussion to a more

managerial le"el. 'ith all !i"e #uestions, a !ull class period is de!initely re#uired.

19-B

Chapter 19 - Standard Costs, Variable Costing Systems, Quality Costs, and Joint Costs

%uestion &

%his #uestion 0and #uestions 8 through B1 should be used only i! the instructor wants to go into the (lac$

)eter Company description in detail. Students can answer it based on in!ormation in the te&t and tracing

the numbers !rom one illustration to the ne&t.

%uestion '

5n a standard cost system, the calculations in 5llustrations 19-- through 19-: are made once a year, or

whene"er standard costs are changed. %he resulting cost, 9?,.=?.89 !or 1.. meters 05llustration 19-:1 is

used without change !or carrying these meters in in"entory and !or calculating cost o! goods sold.

Similarly, the cost o! each component is deri"ed !rom this calculation and used !or carrying these

components in in"entory. 5! an actual cost system were used, records similar to those in 5llustrations 19--

through 19-: would ha"e to be maintained !or each meter order and each part production order, with

actual costs being collected on such records. %his would probably re#uire much more record$eeping than

the standard cost system re#uires. An actual cost system would pro"ide one piece o! in!ormation that the

standard cost system does not pro"ide, namely the actual cost o! speci!ic production orders. %his might be

use!ul to management i!, !or e&le, it showed that actual costs were tending to dri!t upward throughout

the year. <owe"er, there are other ways o! identi!ying possible ine!!iciencies, such as the di!!erence

between actual and standard direct labor cost, as indicated in 5llustration 19-9.

%uestion (

%his #uestion is more di!!icult than it may appear, as it entails de"eloping the !lowchart shown in 7&hibit

A on page ?-. %he greatest subtlety in 7&hibit A is the accounting !or )aterials 5n"entory. %his account

is debited based on actual #uantities at standard prices but is credited based on standard #uantities at

standard prices. 5! you as$ students to assume a month where purchased #uantities and standard #uantities

issued are e#ual, they should see that any material usage "ariance will be 3buried4 in this account. Nou

can then e&plain 0or get them to reali+e1 that when a physical count is ta$en and costed at standard, then

the di!!erence between this amount and the boo$ "alue o! materials in"entory includes material usage

"ariance. 05t will also include accounting errors and pil!erage.1 %his in"entory ad/ustment restores this

account,s beginning balance !or the ne&t period to actual #uantity at standard prices, and the debit or

credit which ma$es this ad/ustment has its counterpart in an entry to Cost o! Sales. 'e $now !rom the

te&t that this in"entory is ta$en semiannually, and !rom 5llustration 19-11 that this 3usage4 "ariance is

closed to the income statement. %his is a di!!icult concept, which can be re"iewed in the C.L. Church case

in Chapter 8..

Similarly students should see that the direct labor "ariance account combines e!!iciency and rate

"ariances. %hese components o! total labor "ariance are not mentioned in the te&t, but 5 ha"e !ound that

better students can 3in"ent4 them prior to their !ormal presentation in Chapter 8.. (y the same to$en,

some students can see intuiti"ely that the o"erhead "ariance combines spending and "olume e!!ects.

Comparing 7&hibit A with the te&t,s 5llustration 19-8, one sees the two !lowcharts are the same e&cept !or

materials usage "ariance. 5n 5llustration 19-8, this "ariance 3!alls out4 e&plicitly, since )aterials

5n"entory is credited at actual #uantity issued costed at standard prices whereas 'or$ in Drocess is

debited at standard #uantity at standard prices. (oth methods are seen in practice* the te&t,s method seems

superior to (lac$ )eter,s, in that usage "ariance is identi!ied in a more timely !ashion and is not

3muddied4 by pil!erage and accounting errors.

19-?

Chapter 19 - Standard Costs, Variable Costing Systems, Quality Costs, and Joint Costs

%uestion )

%his #uestion illustrates the wor$ in"ol"ed in changing standard costs, and is also help!ul in tracing

amounts !rom one illustration to another.

5n 5llustration 19--, the cost o! chamber rings would be increased by 1.A- hours > 91 6 91.A-. %he cost

there!ore becomes 98B9.8B @ 91.A- 6 98?1. %his increase carries through to 5llustration 19-A, ma$ing the

cost 9:-1.=B @ 91.A- 6 9:-=.1.. Linally, it carries through to 5llustration 19-:.

5n addition, 5llustration 19-: is increased by the 91 per hour increase in labor !or 2epartment 1=1. Since

there are 1..8 hours o! labor, the increase is 91..8.. %he total cost !or 1.. meters in 5llustration 19-:

there!ore becomesG

As gi"en............................................................................................................................................................................................... 9?,.=?.89

Add !rom 18.A.................................................................................................................................................................................... 1.A-

Add !rom 1=1....................................................................................................................................................................................... 1..8.

Ad/usted costs...................................................................................................................................................................................... 9?,.BA.8?

19--

Chapter 19 - Standard Costs, Variable Costing Systems, Quality Costs, and Joint Costs

E&hibit A

'lowchart for (lac) #eter Company

Accounts Dayable )aterials 5n"entory

Act. Qty. C

Act. Drice

Act. Qty. Std.

Drice

Std. Qty. C

Std. Drice

)aterial Drice Variance 5n"entory

Ad/ustment

(alance to Cost o! Sales 7"ery - mos. a physical in"entory is ta$en and

costed at standard. Any di!!erence between this

amount and the 3boo$4 balance is an in"entory

ad/ustment which is closed to Cost o! Sales

'or$ in Drocess 5n"entory>

)aterial

0C Std.1

Sales

C Std.

'ages Dayable

Act. <rs. C

Act. Jate

Habor

0Std. <rs. C

Std. Jate1

2irect Habor Variance

"erhead (alance to Cost o! Sales "erhead 0C

Std.1

Cost o! Sales

Actual Std. <rs. &

"erhead Jate

Sales

C Std.

%o Je"enue

and 7&pense

Summary

"erhead Variance VariancesG

-)aterial price

-)aterials in"entory

ad/ustments 03usage41

-2irect Habor

-"erhead

Any month-end balance in this

account closed to "erhead

Variance (alance to Cost o! Sales

>Lor meter parts, costs !low at standard !rom 'or$ in Drocess to Linished ;oods, and then to Cost o! Sales. %he diagram

here is descripti"e o! complete meters, which are made to order and hence are not in"entoried prior to shipment to the

customer.

19-A

Chapter 19 - Standard Costs, Variable Costing Systems, Quality Costs, and Joint Costs

%uestion *

%his or any other system cannot be e"aluated without identi!ying the purposes the system is supposed to

!ul!ill. Although not e&plicitly stated, 5 thin$ it is reasonable to impute the !ollowing purposesG 011 to

pro"ide monthly operating statements* 081 to control costs* and 0=1 to help on a "ariety o! necessary

3chores4 that ha"e to be done, such as paying employees what is due them, $eeping trac$ o! orders and

material, paying suppliers, and billing customers. Since these /obs ha"e to be done anyway, we may be

able to get !igures that will help accomplish the !irst two purposes as an ine&pensi"e by-product o! doing

them.

#onthly *perating tatements

5! we hew strictly to the de!inition that net pro!it is the di!!erence between sales and the cost o! ma$ing

and selling the same goods that are in the sales !igure, this system does not pro"ide net pro!it becauseG

a. %he purchase price "ariance is related to material purchased in the month.

b. %he labor and o"erhead "ariances are related to the products wor$ed on in the month.

c. Various discrepancies creep in that are unco"ered by a physical in"entory only e"ery si& months

5!, howe"er, we as$G 3<ow could you get the actual pro!it i! you wanted toO4 we !ind the answer is

di!!icult, i! not impossible. Suppose an actual cost system were used. %hen, !or each production order o!

each item there would ha"e to be a set o! calculations similar to those in 5llustrations 19-- to 19-:,

whereas under the standard cost system, these calculations are made only once a year. 0Students usually

!ind it hard to belie"e that a standard cost system is much simpler than an actual cost system and re#uires

much less paperwor$ in a situation o! the $ind described.1

5! we try to !ind actual pro!it by the direct determination o! in"entories, we could throw out the cost

accounting system entirely but would ha"e to ta$e a physical in"entory e"ery month* the /ob o! costing

the wor$ in process would be signi!icant.

Lurthermore, e"en i! the 3pro!it4 resulting !rom this system di!!ers somewhat !rom the strict de!inition

abo"e, the income statement may, ne"ertheless, be a use!ul de"ice, since it reports the "ariances that

occurred during the month 0e&cept material usage1. %his is earlier than they would be reported according

to the strict de!inition, and o! course, these "ariances would not show up at all i! a standard cost system

were not used.

19-:

Chapter 19 - Standard Costs, Variable Costing Systems, Quality Costs, and Joint Costs

Control

Mo system controls costs. At best, a system pro"ides in!ormation that responsible people can use in the

control process. Deople control.%he system pro"ides no summary !igure on material usage in a month

when no physical in"entory o! materials is ta$en, and the June and 2ecember income statements are

distorted by including usage "ariance !or the pre"ious si& months.%his situation could be impro"ed #uite

easily as !ollowsG i! material in e&cess o! standard is needed, a re#uisition should be !illed out !or this

e&cess. %he amounts o! such re#uisitions can be totaled monthly, with )aterials 5n"entory credited by

this amount, and 3true4 )aterials Psage Variance account debited. %hen the semiannual physical

in"entory will result in a "ariance including accounting errors and pil!erage, but not usage. %his should

largely eliminate the distortions in the monthly income statements

19-9

Chapter 19 - Standard Costs, Variable Costing Systems, Quality Costs, and Joint Costs

which are created by the current procedure. Alternati"ely, )aterials 5n"entory could be credited at actual

#uantity times standard price, and 'or$ in Drocess debited at standard #uantity times standard price 0as in

5llustration 19-81.

%he system pro"ides a total !igure on the direct labor "ariance. Although there is no routine report that

brea$s this "ariance down, it would be possible to reclassi!y with little di!!iculty. Habor rate and

e!!iciency "ariances could also be bro$en down !rom timecards by department, by /ob, or e"en by

operation, but management apparently !eels that this is not worth the e!!ort

(ecause the o"erhead costs are allocated and because e&pected costs will not "ary proportionately with

production "olume, the o"erhead "ariance is not o! much use !or control purposes. %his is characteristic

o! o"erhead costs in a standard !ull cost system, and some students may see the need !or special de"ices

0"ariable budgets and collection o! costs by responsible department1 to handle this situation. At this stage,

howe"er, we can only touch on this matter.

%he $ey control is collecting actual costs by responsibility center, not by product. 5 illustrate this with a

matri&, both in this case and (ennett (ody Company. (oth (lac$ )eter and Conley can determine

"ariances by responsibility center, whereas it is not clear that (ennett can. Similarly, (ennett needs actual

product costs !or !re#uent pricing decisions, whereas (lac$ )eter and Conley do not.

Case 19-3: Brisson Company

%ote: This case is unchanged from the Twelfth Edition.

Approach

%his problem ta$es the student through a complete cycle o! transactions in a standard cost system in a

simple setting. 5t shows how such a system wor$s, including the de"elopment o! "ariances, and ties cost

accounting to the accounting cycle the student learned in Dart 1 o! the boo$. 0(risson,s system is the same

as the one depicted in 5llustration 19-8.1 %his seems to be a "aluable e&ercise, especially in helping to

minimi+e the omnipresent problems students ha"e with production cost "ariance analysis in the ne&t

chapter. 5! not assigned !or class, this ma$es a good e&am case. 0Lor ease in grading, 5 suggest you

prepare !orms with all needed % accounts preprinted on them.1

%uestion &

)aterials 5n"entory 'or$ in Drocess 5n"entory

(al. ?.,8?. 0B1 11:,:1. (al. A?,-.. 091 8-A,-:B

081 1.B,9:. =-,B8. 0B1 11-,-9-

(al. =-,B8. 0?a,:1 A9,8..

0:1 99,... 1.8,:18

Linished ;oods 5n"entory (al. 1.8,:18

(al. 1??,B.. 01.b1 8=8,-.8

091 8-A,-:B 19.,B:8

(al. 19.,B:8

19-1.

Chapter 19 - Standard Costs, Variable Costing Systems, Quality Costs, and Joint Costs

Accounts Dayable All ther Assets

0=a1 1.8,=.. (al. 1.B,A.. (al. =8?,?.. 0=a1 1.8,=..

081 1.=,?=? 0=b1 198,... 0=b1 198,...

1B=,B=? 0-1 =A,?.. 01.a1 =A?,1?. 0?b1 11-,A..

(al. 1B=,B=? 0-1 1:,=..

0A1 A:,A?.

All ther Hiabilities =:B,-..

(al. BA,8?. (al. =:B,-..

"erhead 'ages Dayable

0?a1 B.,?.. 0:1 99,... 0?b1 11-,A.. (al. -,1?.

0-1 ??,:.. 8,8?. 0?a1 118,:..

0111 8,A.. (al. 8,8?.

"erhead Variance Shareholders, 7#uity

01B1 8,A.. 0111 8,A.. (al. BB:,-?.

?81,=A9 0191 A8,A89

(al. ?81,=A9

Habor Variance )aterial Drice Variance

01-1 -,9.. 0?a,:1 -,9.. 01?1 1,BB? 081 1,BB?

Sales )aterial Psage Variance

0181 =A?,1?. 01.a1 =A?,1?. 0B1 8,11B 01A1 8,11B

Selling and Admin. 7&pense 5ncome Summary

0A1 A:,A?. 01:1 A:,A?. 01=1 8=8,-.8 0181 =A?,1?.

01A1 8,11B 01B1 8,A..

01:1 A:,A?. 01?1 1,BB?

Cost o! Sales 0191 A8,A89 01-1 -,9..

01.b1 8=8,-.8 01=1 8=8,-.8

Motes on entries 0numbered to correspond to the case transactions1G

081 8,?.. C 989.:. @ 1,... C 9=..B: 6 91.B,9:. C std.

91.B,9:. - 91.=,?=? 6 91,BB? credit 0!a"orable1 price "ariance. La"orable price "ariances o!ten

arise in the !irst hal! o! the year* the standard is set to represent the annual a"erage, and with

in!lation, prices will tend to be below this a"erage !or the !irst - months and abo"e it in the latter

hal! o! the year.

0=b1 %he debit re!lects an increase in Cash* the credit represents the decrease in Accounts Jecei"able.

19-11

Chapter 19 - Standard Costs, Variable Costing Systems, Quality Costs, and Joint Costs

0=1 =,8.. C 989.:. @ A.. C 9=..B: 6 911-,-9- !or original issues* plus e&tra 0replacement1 issues as

!ollowsG 1.. C 918.=A @ 8. C 911.8? @ B? C 91..:. @ 8. C 9-.-= @ B C 9:.B= 6 98,11B 0an

19-18

Chapter 19 - Standard Costs, Variable Costing Systems, Quality Costs, and Joint Costs

0B1 un!a"orable usage "ariance1* gi"ing total issues o! 911:,:1.. 0MoteG Some students may claim that

the 98,11B in e&tra materials issues were to replace materials that were de!ecti"e, as opposed to

replacing good items that were spoiled in the production places. Such students may treat this 98,11B

as an o"erhead cost* i! so, they will ha"e 9. material usage "ariance and 9?:- !a"orable o"erhead

"ariance.1

0?a1 %his entry stumps many students, at least temporarily. Some will cle"erly set up a labor clearing

account analogous to the o"erhead clearing account, and then charge the standard labor to this

account at entry 0:1 the balance in this labor clearing account will be 9-,9.. dr., which is closed

to Habor Variance. ther students will do what 5,"e done hereFread ahead to entry 0:1, and

deduce the labor "ariance as part o! the entry.

091 =,... C 9A..=. @ :.. C 9A..9: 6 98-A,-:B

01.b1 8,B.. C 9A..=. @ 9.. C 9A..9: 6 98=8,-.8 cost o! sales

0111 %his closes the o"erhead clearing account.

0181-0191 %hese entries close the temporary accounts and income summary.

%uestion '

(+,*% C*#PA%-

,ncome tatement #onth of April

Sales re"enue........................................................................................................................................................................................ 9=A?,1?.

Cost o! sales C standard...................................................................................................................................................................... 8=8,-.8

Standard gross margin.......................................................................................................................................................................... 1B8,?B:

Droduction cost "ariances>................................................................................................................................................................... :,9=1

Actual gross margin............................................................................................................................................................................. 1?1,BA9

Selling and administrati"e e&pense...................................................................................................................................................... A:,A?.

5ncome 9 A8,A89

>Droduction cost "ariancesG

)artial price...................................................................................................................................................................................................................................... 91,BB?L

)aterial usage................................................................................................................................................................................................................................... 8,11BP

Habor................................................................................................................................................................................................................................................. -,9..L

"erhead........................................................................................................................................................................................................................................... 8,A..L

9:,9=1L

Question =

19-1=

Chapter 19 - Standard Costs, Variable Costing Systems, Quality Costs, and Joint Costs

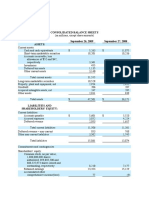

(+,*% C*#PA%-

(alance heet

As of April ".

Assets Hiabilities and Shareholders, 7#uity

)aterials in"entory.............................................................................................................................................................................. 9 =-,B8. Accounts payable................................................................................................................................................................................. 91B=,B=?

'or$ in process in"entory................................................................................................................................................................... 1.8,:18 'ages payable..................................................................................................................................................................................... 8,8?.

Linished goods in"entory..................................................................................................................................................................... 19.,B:8 All other liabilities................................................................................................................................................................................ BA,8?.

All other asses...................................................................................................................................................................................... =:B,-.. Shareholders, e#uity............................................................................................................................................................................. ?81,=A9

9A1B,=1B 9A1B,=1B

Case 19-4: Landau Company

*

%ote: This case is unchanged from the Twelfth Edition$ The commentary to the Cotter Company case

+case ',-(. e/plains how Cotter and Landau can 0e used as a two-case se1uence.

Approach

5 spend about the !irst hal! o! class wor$ing through the comprehensi"e e&les shown below. %his 9-

column table co"ers e"ery possible relationship among sales "olume, production "olume, and normal

"olume. 7"en i! students ha"e not been !ormally e&posed to o"erhead "olume "ariance, they #uic$ly pic$

it up. (e!ore class 5 put on the blac$board the headings o! the nine columns and the !irst two lines o! data

0sales and production1, as well as the assumptions. 05! the instructor has limited board space, this can be

prepared as a handout, and !illed out by each student as you do so on a transparency.1

'!ll /s0 12irect3 4Variable5 Costing ,ll!stration

AssumeG Pnit price 9?... M 6 Mormal "olume

Pnit "ariable costs 6 9=... 6 1.. units

Li&ed costs 6 91.....

Lull cost per unit 6 9=... @

units 1..

91..

6 9B... 0Assume no spending "ariances1

*

%his teaching note was written by James S. Jeece. Copyright Q by James S. Jeece.

19-1B

Chapter 19 - Standard Costs, Variable Costing Systems, Quality Costs, and Joint Costs

S 6 D S R D S S D

Sales 0S1

Ddn. 0D1 T

units

1..

1..

:.

:.

11.

11.

11?

1..

9.

:.

18?

11.

9.

1..

A?

:.

1..

11.

Je"enue............................................................................................................................................................................................... 9?.. 9B.. 9??. 9?A? 9B?. 9-8? 9B?. 9=A? 9?..

2ull Costing

Cost o! ;oods Sold..............................................................................................................................................................................

;ross )argin........................................................................................................................................................................................

Volume Variance.................................................................................................................................................................................

Dro!it....................................................................................................................................................................................................

B..

1..

--

91..

=8.

:.

08.1

9 -.

BB.

11.

1.

918.

B-.

11?

--

911?

=-.

9.

08.1

9 A.

?..

18?

1.

91=?

=-.

9.

--

9 9.

=..

A?

08.1

9 ??

B..

1..

1.

911.

3aria0le Costing

Cost o! ;oods Sold..............................................................................................................................................................................

Contribution.........................................................................................................................................................................................

Li&ed Costs...........................................................................................................................................................................................

Dro!it....................................................................................................................................................................................................

=..

8..

1..

91..

8B.

1-.

1..

9-.

==.

88.

1..

918.

=B?

8=.

1..

91=.

8A.

1:.

1..

9:.

=A?

8?.

1..

91?.

8A.

1:.

1..

9 :.

88?

1?.

1..

9?.

=..

8..

1..

91..

C C C C C C

bser"eG S 6 D, no di!!erence* S R D, greater pro!it with "ariable costing* S S D, greater pro!it with !ull

costing. Compare columns C and * same sales, but di!!erent pro!its with !ull costing* same pro!it with

19-1?

Chapter 19 - Standard Costs, Variable Costing Systems, Quality Costs, and Joint Costs

"ariable costingFditto !or C and C.

5 then complete column 5 !or !ull costs only, then ha"e students do the remaining eight. Me&t, 5 raise this

board and e&tend the nine columns !or "ariable costing, again doing the !irst column mysel! and ha"ing

students try the others. 'hen all nine columns are completed, 5 thin$ e"en the wea$est students

understand the di!!erent mechanics o! the two systems.

Me&t, 5 as$ them to generali+e about which system shows the greater pro!it i! S6D, i! S R D, and i! S S D

0shown as 3bser"e4 in the table1. 5 also ha"e them compare columns 1 and 9, and then ? and A. 5n both

instances sales were e#ual* but !ull costing showed di!!erent pro!its, whereas "ariable costing showed

e#ual pro!its. 5 then proceed to discuss the Handau case.

%he central issue is the desirability o! "ariable costing !rom the point o! 011 the users o! balance sheet and

income statement in!ormation 0management, stoc$holders, creditors, etc.1, 081 as an aid in pricing, and

0=1 as an aid in control.

,ncome tatements. 5t is instructi"e to reconcile the di!!erence in preta& income under the methods !or at

least one o! the two months. 5 begin by noting that the di!!erence between the two systems is in how

budgeted !i&ed o"erhead costs 3!ind their way to the income statement.4 'ith "ariable costing, budgeted

!i&ed costs 0and actual, !or that matter1 !or a gi"en month are charged to that month,s income statement*

this is simple, but clearly a "iolation o! both the cost concept !or asset 0in"entory1 "aluation and the

matching concept. 'ith !ull costing, budgeted !i&ed costs are charged to income in two piecesG the

standard !i&ed costs in cost o! sales 0consistent with the matching concept1 and the o"er- or

underabsorbed budgeted !i&ed costs in that month,s o"erhead "olume "ariance 0not consistent with the

matching concept i! closed to the monthly DUH, which is the usual practice1. %hus, to reconcile the

di!!erence in reported income, we need to identi!y the amount o! budgeted !i&ed costs in the month,s

income statement !or each method. Lor June and July, the reconciliation isG

4une 4uly

Lull standard cost o! sales.................................................................................................................................................................... 9B:B,-B. 9?81,A?:

Variable standard cost o! sales............................................................................................................................................................. ==A,?1A =-=,=-A

(udgeted !i&ed costs in cost o! sales.................................................................................................................................................... 1BA,18= 1?:,=91

"erhead "olume "ariance................................................................................................................................................................... 01,A=.1 -=,AA9

(udgeted !i&ed costs charged to income with absorption costing........................................................................................................ 1B?,=9= 888,1A.

(udgeted !i&ed costs charged to income with "ariable costing............................................................................................................ 198,::= 198,::=

2i!!erence............................................................................................................................................................................................ 09 BA,B9.1 9 89,8:A

Chec$G

Dreta& income, "ariable costing....................................................................................................................................................... 9 ==,?=9 9-?,.99

Dreta& income, absorption costing................................................................................................................................................... :1,.89 =?,:18

2i!!erence................................................................................................................................................................................... 9 0BA,B9.1 989,8:A

! course, the abo"e calculations can be per!ormed using actual !i&ed costs charged to the income

statement rather than budgeted. (ut since both costing approaches treat the o"erhead spending "ariance

the same way, the di!!erence in pro!it must be a !unction o! the treatment o! budgeted !i&ed costs. Also,

some students will as$ how we $now that the 9198,::= is a budget !igure rather than actual. %here are

two reasonsG 011 it seems too great a coincidence !or the actual amount to be e&actly the same in both

months* and 081, more important, it wouldn,t ma$e sense to show an o"erhead spending "ariance i! the

amount shown !or o"erhead were an actual amount.

19-1-

Chapter 19 - Standard Costs, Variable Costing Systems, Quality Costs, and Joint Costs

Students should also be prepared to e&plain to Sil"er why the sum o! the two months, absorption costing

net incomes is 9-.,A?A, whereas !or "ariable costing it is 9?1,891. As stated in the te&t 0and pro"en in

Appendi& (1, !or any period in which production "olume e&ceeds sales "olume, !ull costing reports

higher income than "ariable costing. %hus, !or the combined June-July period, Handau,s production

"olume must ha"e e&ceeded its sales "olume. 0%his was also true !or June, but not !or July.1 "er the

course o! an entire year, i! 0but only i!1 the annual sales and production "olumes are e#ual the month-to-

month income di!!erences will wash outi.e., annual income will be the same under either method.

Comments on 6!estions

%uestion &

5n the order o! their being mentioned in the case, the "arious stated pros and cons o! "ariable costing,

together with my reactions to them, are as !ollowsG

1. DroG %erry Sil"er doesn,t understand income changes in absorption costing attributable solely to

production "olume changes. %o me, this is an important reason to consider seriously the introduction

o! "ariable costing !or monthly management reports.

8. DroG 5t eliminates time-consuming and argumentati"e !i&ed o"erhead allocations. %his is only a partial

truth. Absorption costing statements would need to be prepared at least annually, and perhaps

#uarterly, !or shareholder reporting and income ta& calculations. <owe"er, this restatement could be

done using a plant-wide, a!ter-the-!act o"erhead rate. 2epartmental predetermined o"erhead rates

would not need to be de"eloped as part o! the process o! preparing the standard cost sheet !or each

product.

=. DroG Cost control will be impro"ed. 5 don,t !eel this is necessarily the case. Certainly a clear

segregation o! !i&ed and "ariable costs aids in cost control, because "ariable costs are controlled

essentially on a unit-o!-product basis 0e.g., did we spend more or less than 91A.-= per unit !or raw

materialsO1, whereas !i&ed costs are controlled on an amount-per-time-period basis 0e.g., was our July

!actory super"ision cost abo"e or below budgetO1 <owe"er, absorption costing does not preclude this

sort o! cost analysis in any way. %he chie! ad"antage o! "ariable costing is that it eliminates the o!ten-

con!using o"erhead "olume "ariance.

B. DroG Contribution margin data are better signals o! product pro!itability than are gross margin data.

Sil"er,s contention here is only a partial truth. 5n the e&le gi"en, it is true that i! a customer were

indi!!erent between buying 91,... worth o! 189 or 91,... worth o! 8B= then Handau would be 9:B

better o!! selling 91,... worth o! 189. <owe"er, i! the allocations o! !i&ed costs are reasonably

e#uitable, then 189 is causing more !i&ed costs to be incurred per dollar o! sales V098.?B - 91.=:1 I

9B.=B 6 8-.AEW than is 8B= V09=..? - 98.=A1 I 9?.:9 6 11.?EW. 7"en though these !i&ed costs may be

sun$ costs in the short run, in the longer run they are not. %hus, which o! the two products is more

pro!itable is a matter o! the time hori+on being considered.

Students can understand this better i! you use an e&aggerated e&le. Suppose that products X and

N are substitutes in the eyes o! the customer, and that they ha"e the same selling price per unit, 91..

(oth ha"e the same material costs, but X is made with a manual process whereas N is made by highly

automated e#uipment. %hus X has a much smaller contribution margin per unit than does N. Can we

say that N is more pro!itableO

19-1A

Chapter 19 - Standard Costs, Variable Costing Systems, Quality Costs, and Joint Costs

?. ConG )ar$eting will underprice products i! only the "ariable cost per unit is emphasi+ed. 5 can,t agree

with the treasurer,s condescending attitude about mar$eting managers, understanding o! the business

as a whole. 5n mar$eting, as in other areas o! the company, "ariable cost data are use!ul !or some

decisions, whereas !ull cost data are use!ul !or others. 5! top management belie"es that mar$eters 0or

any other decision ma$ers1 will misuse "ariable cost data, this argues !or educating the decision

ma$ers, not suppressing the data.

-. ConG Hac$ o! control o"er long-run costs can ban$rupt a company. %his is true, but really has nothing

to do with the "ariable costing proposal. 5t is e#ually true that i! short-run costs get out o! control, the

company won,t ha"e a long run to worry about. 5! in this company the introduction o! "ariable

costing will introduce !or the !irst time the routine separation o! !i&ed and "ariable costs, then it is

#uite possible that control o"er all costs will be enhanced, as the controller is asserting.

A. ConG Hower pro!its will be worrisome to shareholders and ban$ers 0e"en though lower pro!its are

desirable !or union negotiations and income ta&es1. %his is a totally !allacious argument. Variable

costing is not permitted under either ;AAD or income ta& regulations. )oreo"er, the president

doesn,t understand that, i! !or the year, the sales and production "olumes are e#ual, then both

methods report the same income.

%o me, the $ey point is that this is not an 3either-or4 issue. Companies should consider designing

their account structure so that "ariable costs are segregated !rom !i&ed costs. %hese cost data represent

a data base, the elements o! which can be put together in di!!erent ways !or di!!erent purposes. As

stressed in Chapter 1A, !ull cost data are use!ul !or certain purposes* and as stressed in Chapters 8-

and 8A, they are not use!ul !or other purposes. %hat is the o"erall point 5 try to ma$e with the Handau

case.

%uestion '

Co"ered in abo"e comments.

5dditional %uestion

5! using the case 0as 5 do1 with Chapter 8. a!ter the Cotter case, 5 assign this additional #uestionG 3<ow

busy 0relati"e to normal "olume1 was Handau,s !actory in June and JulyO4

As demonstrated to students in the Cotter Case, we $now thatG

costs !i&ed (udgeted

costs !i&ed Absorbed

normal o! E as "olume Actual =

'e also $now that the o"erhead "olume "ariance e#uation is e#ui"alent toG

Absorbed !i&ed costs 6 (udgeted !i&ed cost @ Volume "ariance

%hus !or Handau we ha"eG

mal nor o! 1...9E

198,::=

1,A=. 198,:==

Volume G June =

+

=

19-1:

Chapter 19 - Standard Costs, Variable Costing Systems, Quality Costs, and Joint Costs

mal nor o! --.9E

198,::=

1 AA9 , -= 0 198,:==

Volume G June =

+

=

Case 19-5: Lynchs Chicken !anch

%ote: This case is unchanged from the Twelfth Edition.

2isc!ssion

%his case raises two cost-related issuesG /oint- 0or by-1 product costing and trans!er pricing. %he issues are

salient in the case because the accounting treatments a!!ect di"ision pro!its and, conse#uently, the

di"ision managers, bonuses.

5t is use!ul to start the class by clari!ying the interdependencies among the di"isions. %hey are illustrated

in Ligure %M-1 below.

%he issue that pro"o$ed the discussion is the cost o! !eed, which has risen by 8.E recently. %his rise has

caused the 7gg 2i"ision to become unpro!itable. ;ary 2awson, the 7gg 2i"ision manager, points out in

the case that while the mar$et prices o! corn !eed ha"e increased, due to a drought in corn-growing

regions, Jon Johnson,s Leed di"ision was not a!!ected by the drought. <ence, the cost o! corn !eed

produced by Hynch,s Chic$en Janch ha"e not increased, and ;ary does not want to ha"e to absorb !eed

cost increases.

5n his search to stem his losses, ;ary is attempting to boost his bottom-line by capturing some o! the

gains !rom the sale o! !ertili+er stemming !rom reprocessing o! chic$en droppings. 7gg 2i"ision

employees collect the waste and deli"er it to the Lertili+er 2i"ision, which uses automated 3digesters4 to

con"ert the waste into a mar$etable product.

%he current trans!er price o! the waste is +ero. ;ary 2awson argues that the waste ob"iously has "alue,

and that "alue stems !rom his chic$ens, ine!!icient digesti"e processes. Lorty percent o! the nutrients the

chic$ens eat is e&creted in the waste. <ence, he wants the Lertili+er 2i"ision to pay !or B.E o! the cost o!

!eeding the chic$ens. Judy replies that ;ary is already getting a large bene!it !rom her con"erting the

waste to !ertili+er. <e !ormerly had to pay 98..,...-8?.,... to ha"e the droppings remo"ed.

Figure TN-1

Division Interdependencies

"ee# D$%$$o&

Ron Johnson

E'' D$%$$o&

Gary Dawson

"er($l$)er D$%$$o&

Judy Smith

Feed !orn"

soy#eans

!orn

mu$ch !hic%en droppings

19-19

Chapter 19 - Standard Costs, Variable Costing Systems, Quality Costs, and Joint Costs

5n this e&le, the chic$en droppings can be seen as a by-product o! producing the eggs, or eggs and

!ertili+er can be seen as /oint products.

'hile it is generally desirable to use mar$et-based trans!er pricing in situations li$e this, where products

are undi!!erentiated and mar$ets are competiti"e 0see Chapter 881, in this case the use o! mar$et-based

trans!er prices allow Jon Johnson,s Leed 2i"ision to reap wind!all gains. ;ary is re#uesting a reduction

in the prices his di"ision has to pay !or !eed. Jon Johnson says that he can sell the !eed outside at the

mar$et price, so he should not be !orced to trans!er it internally at an arti!icially reduced price.

Jon,s logic is correct. %he opportunity cost !or Hynch,s Chic$en Janch is the current mar$et price.

<ence, that is the price that the 7gg 2i"ision should pay !or the !eed. 5! that ma$es the 7gg 2i"ision loo$

unpro!itable, so be it. )aybe the price o! eggs should rise to o!!set the increase in the operating costs. (ut

what i! the competitors don,t !ollow the price increaseO

%here is no simple answer to the /oint-costing problem. %he pro!its on the !ertili+er produced !rom the

chic$en waste can be attributed solely to the Lertili+er 2i"ision or the 7gg 2i"ision, or the pro!its can be

shared. 5! the pro!its !rom this type o! !ertili+er become highly signi!icant to both di"isions, then it might

ma$e sense to combine the 7gg and Lertili+er 2i"isions into one. 5t would be a di"ision with two products

Feggs and !ertili+er. 5! these pro!its are relati"ely small, then !i&ing a trans!er pricing policy and setting

budgets accordingly should pro"ide a reasonably good solution to an intractable problem.

19-8.

Você também pode gostar

- Solution Manual For AccountingDocumento21 páginasSolution Manual For AccountingNeetu RajaramanAinda não há avaliações

- Chap 028Documento12 páginasChap 028Rand Al-akam100% (1)

- Lieberose Solar ParkDocumento23 páginasLieberose Solar ParkNeetu RajaramanAinda não há avaliações

- Lieberose Solar Park - Presentation-WorkedDocumento43 páginasLieberose Solar Park - Presentation-WorkedNeetu RajaramanAinda não há avaliações

- Chap 026Documento17 páginasChap 026Neetu Rajaraman100% (2)

- Chap 025Documento17 páginasChap 025Neetu Rajaraman100% (7)

- Chap 023Documento23 páginasChap 023Neetu RajaramanAinda não há avaliações

- Chap 024Documento22 páginasChap 024Neetu RajaramanAinda não há avaliações

- Chap 018Documento25 páginasChap 018Neetu RajaramanAinda não há avaliações

- Chap 021Documento19 páginasChap 021Neetu Rajaraman100% (1)

- Chap 012Documento11 páginasChap 012Neetu RajaramanAinda não há avaliações

- Chap 005Documento12 páginasChap 005SurajAluruAinda não há avaliações

- Chap 015Documento4 páginasChap 015Neetu RajaramanAinda não há avaliações

- Chap 006Documento15 páginasChap 006Neetu RajaramanAinda não há avaliações

- Chap 011Documento8 páginasChap 011Neetu RajaramanAinda não há avaliações

- Chap 001Documento17 páginasChap 001Neetu RajaramanAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Monnet Ispat: Performance HighlightsDocumento13 páginasMonnet Ispat: Performance HighlightsAngel BrokingAinda não há avaliações

- ICICI Bank LTD (ICICIBC IN) - StandardizedDocumento51 páginasICICI Bank LTD (ICICIBC IN) - StandardizedSasidharan RavikumarAinda não há avaliações

- Basic Acco FinalsDocumento10 páginasBasic Acco FinalsZek DannugAinda não há avaliações

- Application OF Function: Break Even Analysis Deals With Cost and Revenue Aspect of The BusinessDocumento24 páginasApplication OF Function: Break Even Analysis Deals With Cost and Revenue Aspect of The BusinessOmkar Reddy PunuruAinda não há avaliações

- Tibetan Grill: Jacob SheridanDocumento23 páginasTibetan Grill: Jacob SheridanJacob Sheridan100% (1)

- Fu Wang GroupDocumento49 páginasFu Wang GroupShowkatAinda não há avaliações

- Financial Statement Analysis: The Information MazeDocumento43 páginasFinancial Statement Analysis: The Information MazeJay DaveAinda não há avaliações

- E8-29 Segmented Income Statement: Conceptual ConnectionDocumento5 páginasE8-29 Segmented Income Statement: Conceptual ConnectionDhiva Rianitha Manurung100% (1)

- Real Estate Project Feasibility StudyDocumento13 páginasReal Estate Project Feasibility StudyRei Villanueva100% (2)

- Practical Problems On PV RatioDocumento7 páginasPractical Problems On PV Ratiohrmohan8667% (3)

- Project WorkDocumento83 páginasProject Worknagamohan22Ainda não há avaliações

- Application LevelDocumento45 páginasApplication LevelMinhajul Haque SajalAinda não há avaliações

- Slide ACC309 ACC309 Slide 04Documento10 páginasSlide ACC309 ACC309 Slide 04Sofyan AliAinda não há avaliações

- Salon de Elegance FinalDocumento35 páginasSalon de Elegance FinalRon Benlheo OpolintoAinda não há avaliações

- Other Comprehensive IncomeDocumento5 páginasOther Comprehensive Incometikki0219Ainda não há avaliações

- Presentation On Recycling of PlasticDocumento22 páginasPresentation On Recycling of PlasticTushar YadavAinda não há avaliações

- Correcting The Trial Balance 2022Documento3 páginasCorrecting The Trial Balance 2022Charlemagne Jared RobielosAinda não há avaliações

- Latihan Uts PPM Mme 59Documento3 páginasLatihan Uts PPM Mme 59VayraAinda não há avaliações

- Financial Forecasting, Planning, and BudgetingDocumento38 páginasFinancial Forecasting, Planning, and BudgetingjawadzaheerAinda não há avaliações

- Balance SheetDocumento25 páginasBalance SheetImran AhmedAinda não há avaliações

- Accounting For Airline FFPDocumento20 páginasAccounting For Airline FFParabianlightAinda não há avaliações

- IFA Chapter 4Documento15 páginasIFA Chapter 4Suleyman TesfayeAinda não há avaliações

- CACC031 Mock Test 1 SSDocumento11 páginasCACC031 Mock Test 1 SSMartia NongAinda não há avaliações

- Assignment 1: Problem #9: Airah Shane B. Diana BSAS1Documento4 páginasAssignment 1: Problem #9: Airah Shane B. Diana BSAS1airahAinda não há avaliações

- Pe2 Acc Nov05Documento19 páginasPe2 Acc Nov05api-3825774Ainda não há avaliações

- NFJPIA - Mockboard 2011 - AP PDFDocumento6 páginasNFJPIA - Mockboard 2011 - AP PDFSteven Mark MananguAinda não há avaliações

- Nubear FPDocumento4 páginasNubear FPgwynethanne.dimayuga.acctAinda não há avaliações

- Chapter 12 Test BankDocumento214 páginasChapter 12 Test BankAya Aragon100% (1)

- Learning Guide: Accounts and Budget ServiceDocumento28 páginasLearning Guide: Accounts and Budget ServiceMitiku BerhanuAinda não há avaliações

- Course Text Chapter 12Documento20 páginasCourse Text Chapter 12Amanda LapaAinda não há avaliações