Escolar Documentos

Profissional Documentos

Cultura Documentos

CGA AU1 Sept'12 Practice Exam

Enviado por

umgilkinTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

CGA AU1 Sept'12 Practice Exam

Enviado por

umgilkinDireitos autorais:

Formatos disponíveis

EAU1S12 CGA-Canada, 2012 Page 1 of 6

CGA-CANADA

EXTERNAL AUDITING [AU1] EXAMINATION

September 2012

Marks Time: 3 Hours

30 Question 1

Select the best answer for each of the following unrelated items. Answer each of these items in your

examination booklet by giving the number of your choice. For example, if the best answer for item (a)

is (1), write (a)(1) in your examination booklet. If more than one answer is given for an item, that item will

not be marked. Incorrect answers will be marked as zero. Marks will not be awarded for explanations.

Note:

2 marks each

a. What is the appropriate audit opinion when the auditor is unable to obtain sufficient appropriate audit

evidence, and the auditor concludes that the possible effects on the financial statements of undetected

misstatements, if any, could be material but not pervasive?

1) Unqualified opinion

2) Qualified opinion

3) Adverse opinion

4) Disclaimer of opinion

b. On March 26, 2012, a CGA firm completed the audit of GHI Ltd.s 2011 financial statements

(December 31 fiscal year end). GHI is a public company listed on the Toronto stock exchange. On

April 3, 2012, GHI made its yearly payment on a bank loan (a 10-year loan, with annual payments due

on April 3 each year from 2011 to 2020). On April 7, 2012, GHIs board of directors approved the

financial statements. On April 30, 2012, the financial statements were mailed to the shareholders.

What is the appropriate date for the independent auditors report in these circumstances?

1) March 26, 2012

2) April 3, 2012

3) April 7, 2012

4) April 30, 2012

c. What is the appropriate audit opinion when the auditor finds that the financial statements contain a

misstatement that is material and pervasive?

1) Unqualified opinion

2) Qualified opinion

3) Adverse opinion

4) Disclaimer of opinion

d. WWW.CA Inc. is a public corporation listed on the Toronto stock exchange. As a publicly

accountable enterprise, what accounting standard is the company required to use in the preparation of

its financial statements for the fiscal period ended December 31, 2011?

1) GAAP for either the United States or Canada

2) International Financial Reporting Standards (IFRS)

3) Canadian Accounting Standards for Private Enterprises (ASPE)

4) Differential accounting rules

Continued...

EAU1S12 CGA-Canada, 2012 Page 2 of 6

e. Lees audit firm has accepted the contract to audit TTT Inc.s financial statements for 2011. Lee

worked at TTT when he was a student in the CGA program, before joining the audit firm. What is the

likely ethical issue for Lee?

1) An advocacy threat

2) A self-review threat

3) A self-interest threat

4) An intimidation threat

f. During the audit of DeepWell Mining Inc., the auditor discovered that the company had bribed a

member of the government in order to obtain the rights to explore a piece of property containing gold

deposits. The bribe was illegal but the auditor was also aware that the Code of Ethical Principles and

Rules of Conduct (CEPROC) has a rule concerning maintaining confidentiality of a clients affairs.

The bribe was recorded in the clients board of directors minutes, and the client explained this was a

normal business practice, and that most of its competitors also paid bribes. How should the auditor

handle this situation?

1) Do nothing because the auditor must maintain the confidentiality of the clients information

2) Withdraw from the engagement (without an audit fee) without advising anyone of the issue

3) Obtain legal advice regarding this issue

4) Insist that the bribe be disclosed in the audit report if the client wants an unqualified audit opinion

g. When the auditor for XYZ Diamonds Ltd. discussed hiring an expert to provide a valuation of the

companys inventory, the client threatened to withhold the audit fee and to sue the auditor for

negligence for failing to maintain the confidentiality of the clients information. Which of the

following is true?

1) The auditor must obtain an agreement from the expert to maintain the clients confidentiality.

2) The auditor may not hire an outside party to perform a valuation.

3) The auditor can hire the outside party without restriction, since the auditor has already guaranteed

the confidentiality of the clients records.

4) The auditor can hire the outside party only if the expert is also a CGA subject to CEPROC.

h. Cleona is a partner in a CGA firm that has been asked to conduct an audit of GTE Inc.s financial

statements. Which of the following is true?

1) If Cleonas firm audited the client last year, this would likely create the appearance of bias and

she would not be seen to be independent by the general public.

2) It would not affect her independence if a family member owned shares in GTE as long as Cleona

does not own any shares in the company.

3) Cleona must consider whether there are any threats to her independence before accepting the audit

engagement.

4) Cleona should assume that she has independence of GTE unless a threat to her independence

arises.

i. Which of the following would provide the most assurance for an auditor seeking to verify the balance

of the accounts receivable in the general ledger control account?

1) Confirmation from the purchaser

2) Sales invoice prepared by the sales department

3) Shipping memo prepared by the shipping department

4) Payment recorded in the clients sub-ledger account for that customer

Continued...

EAU1S12 CGA-Canada, 2012 Page 3 of 6

j. How should confirmations of accounts receivable be handled in an audit?

1) Confirmation letters should be printed on the audit firms letterhead.

2) Confirmations should be controlled by the audit firm.

3) Responses should be sent directly to the client, for confidentiality reasons.

4) Responses should be requested to be handled by the management of the company that they are

being sent to.

k. How is the audit procedure of vouching sales conducted?

1) An auditor selects a recorded sales invoice and works backward in the system to find the related

source documentation, such as the shipping documents and customer purchase order.

2) An auditor reviews the recorded sales entries to look for anything that appears unusual, and then

investigates the unusual entry further.

3) An auditor selects the sales shipping documents and works forward in the system to find the final

recorded sale in the general ledger.

4) An auditor compares the recorded sales for the current year to the recorded sales for the prior year

to find significant differences between the two amounts.

l. When the auditors risk assessment includes an expectation that controls at a service organization used

by the auditee are operating effectively, how should the auditor obtain audit evidence about the

operating effectiveness of those controls?

1) Obtain a type 1 report

2) Ask the service organizations auditor to perform appropriate tests of controls

3) Use another auditor to perform tests of controls at the service organization on your behalf

4) Issue an unqualified audit report (assuming no material misstatements are found in the auditees

records), since you have no indication of any problem

m. When a company changes audit firms, who owns the audit files from the previous years audit?

1) The previous auditor owns the audit files, until a new auditor is appointed, then ownership passes

to the new audit firm.

2) The auditee always owns the audit files, since they contain confidential information.

3) Ownership is shared between the previous firm and any future firm as long as the previous years

audited information is included in the financial statements (as past years data).

4) The previous audit firm owns the files even though it is no longer auditing the company.

n. What is the risk of incorrect acceptance if IR =0.20, CR =0.60, AR =0.05, and the analytical

procedures risk =0.80?

1) 0.006

2) 0.096

3) 0.521

4) 1.920

o. Which of the following is true concerning dollar-unit sampling?

1) It can only be used for sampling for tests of details of balances.

2) When testing accounts payable, each separate account payable would be a population unit.

3) It is an attribute sampling method.

4) All accounts have an equal chance of being selected in the sample, regardless of their balance.

Continued...

EAU1S12 CGA-Canada, 2012 Page 4 of 6

9 Question 2

J J J Movers Ltd. is owned by J acques. The company used to be profitable but several new small companies

have started to compete with J J J , offering very low prices that J J J cannot match. J acques thinks he can

make his company profitable again if he eliminates his competitors, which will allow him to raise prices.

He therefore decided to purchase one of his competitors each year for the next 4 years. The first company

he bought was a proprietorship called J errys Trucking. Jacques has hired your CGA firm to review the

accounting system and controls at J errys Trucking to see what changes are needed before he can integrate

it into J J J Movers. J acques hopes there are not many problems.

You interviewed the owner of J errys Trucking and the companys bank manager and learned the

following information:

The company has customers in both Canada and in the United States, and the owner was not very

knowledgeable about customs fees that must be paid and regulations that have to be followed when

transporting goods across the borders. Also, the owner, J erry, often simply took any cash that the business

earned and spent it on personal items, instead of claiming a wage from the business. There is only one

office staff besides J erry: J errys cousin, who does all of the bookkeeping. His cousin is not an accountant

but has taken some accounting courses. J erry explained that control at J errys Trucking is strong because:

He can trust his cousin completely (having honest employees is important for effective control).

J erry personally checks all of the bookkeeping entries, making any corrections he feels are necessary.

At the year end, J erry takes the bookkeeping records to a tax preparer who prepares his tax return.

Required

Discuss the inherent risk at J errys Trucking based on the above information. Include six observations in

your answer.

9 Question 3

LKL Inc. has been audited by the same CGA firm for the past 2 years, with unqualified audit reports

issued both years. This year, some of the audit staff has changed at the CGA firm. Steve is a CGA and is

responsible for the inventory account and the cost of goods sold calculation. Steve was satisfied with the

inventory count procedures, including pre-numbered count sheets and experienced staff, and was confident

that the staff followed the procedures. He now has the inventory count sheets and wants to reconcile the

value of the count results to the trial balance. Steve looked at last years working papers for guidance and

to make sure he did not miss anything. The working papers had the following notes:

Objectives for inventory count:

Verify count sheets are complete

Look for fictitious adjustments to inventory account

Find out about obsolete items

Check cut-off

Check assignment of inventory

Required

7

1

/2 a. Design one audit procedure for each of the objectives in the working paper. Do not use analytical

procedures.

1

1

/2 b. Design one additional audit procedure that should be performed to determine the accuracy of the

inventory records.

Continued...

EAU1S12 CGA-Canada, 2012 Page 5 of 6

10 Question 4

W-Air Ltd.s 2010 net income before audit adjustments was $2,100,000. Its income would have been

$2,600,000, but the company had recorded a special development expense of $500,000. During the audit,

however, the auditor discovered that the $500,000 was actually a fine for illegal activities. The treasurer

had paid a $400,000 bribe to a government official to obtain confidential information about a new aircraft

design. The $400,000 was hidden in several expense accounts, whose balances had been inflated to hide

the payment. The auditor found one other misstatement, which was collusion between the treasurer and his

assistant to record $2,500 in personal expenses for a vacation taken by the treasurer as business travel

expenses. The $2,500 had been incorrectly recorded as a debit to business travel expenses.

Required

8 a. Calculate the amount that you would consider to be appropriate for materiality for the company for

2010. Explain each factor in your calculation.

2 b. Explain how the vacation expense misstatement would be treated by the auditor in terms of

materiality.

12 Question 5

Small-M Stores Inc. operates department stores in smaller communities. The companys strategy is to

locate stores in communities that are not within a 1 hour drive to larger cities. There are 21 stores in the

chain and all accounting is handled in the companys head office. All purchases are handled by 3 buyers,

who report to the purchasing manager, who authorizes all purchases. Stores place their orders through one

of the buyers, and then the buyer submits a purchase order (PO) to the purchasing manager for approval.

When a purchase is approved, the purchasing manager releases the PO by computer to the accounting

system for recording. An accounting clerk checks the PO for authorization and then authorizes the system

to enter the PO to the purchase journal.

When goods are received, a receiving clerk checks the goods for quantity and updates the online inventory

record. The goods are then moved to the inventory area of the warehouse, under the control of the

warehouse supervisor. Each quarter, the inventory clerks count the inventory on hand and send this

information to the accounting manager for reconciliation with the recorded inventory. Any adjustments to

inventory above $1,500 per quarter are authorized by the controller.

Required

Identify the four kinds of segregation of responsibilities for the purchasing function at Small-M Stores.

Using the case facts, include one example for each kind in your answer.

8 Question 6

XWA Chemicals Inc. appointed its auditors late in the year. The auditors were able to attend the year-end

inventory count but could not test the controls during the year. To keep the audit costs down, they decided

to use the test data approach for payroll to test samples of transactions for the year. You are a partner at the

audit firm and have been asked to provide advice to the auditors designing the test data.

Required

Explain what advice you would provide to the auditors regarding the test data approach. Include at least

four points in your answer.

Continued...

EAU1S12 CGA-Canada, 2012 Page 6 of 6

10 Question 7

DEF Inc. sells motors and parts to boat retailers and repair shops. DEF ships to many different areas

in 3 Canadian provinces. A typical entry to record a sale for DEF is:

Accounts receivable .................................................................................................... 976

Sales ..................................................................................................................... 976

To record sales in sales journal

DEFs sales journal records all sales details, including the sales date and the shipping date, and there is an

automatic adjustment to the appropriate receivables sub-ledger account for whichever customer the sale

was made to. Last year the company had more than 30,000 sales entries, of which only 150 exceeded

$1,600. Most sales were under $1,000 (200 were under $600). Last year the auditor was curious about the

increase in sales to smaller repair shops in northern Ontario, therefore she used a CAAT to identify all

customers in that particular geographic area.

Required

Identify four other examples of how CAATs could be used in the audit of sales at DEF, using the above

information. State briefly why the results of each CAAT you design would be relevant for the audit of

sales or receivables.

12 Question 8

Easy Oil Inc. started as a proprietorship owned by Chen. When she found a large oil deposit in Argentina,

South America, Chen incorporated, but she holds 60% of the issued and outstanding shares (the other 40%

are held by various hedge funds). Chen acted as guarantor of the companys bank loan and the companys

bank holds 50% of Chens shares as collateral (the loan is the largest liability on the companys balance

sheet). Easys long-term plan is to develop the oil field and ship oil to the refineries off the coast of Texas.

On the companys December 31, 2010, balance sheet, the South American oil field was valued at

C$70 million and total assets were C$80 million. The company is audited by Hen Hao CGAs. The audit

firm has two partners, Jing and Wan. The auditors in this case reported to J ing. Wan was not involved in

the audit and has never met Chen.

The audit firm completed the field work on the audit of the 2010 financial statements on February 28, 2011,

and found no material misstatements. However, on March 1, 2011, the government of Argentina made a

surprising announcement that it was nationalizing the oil field and taking ownership of the property. Chens

company will be paid C$6 million. Chen was very surprised at this as she had always involved the local

government in her plans and was expecting to receive favourable tax treatment in Argentina by creating at

least 200 jobs locally.

Required

3 a. Indicate whether the nationalization is a Type I or Type II subsequent event. Briefly explain your

answer.

6 b. Assuming that the government nationalized the oil field on March 8, 2011 (1 week after the

announcement), explain in two points how this announcement should be handled by the auditor.

3 c. Indicate who should perform the independent review when the audit is completed. Explain your

answer.

END OF EXAMINATION

100

EXTERNAL AUDITING [AU1]

EXAMINATION

AU1

Before starting to write the examination, make sure that it is complete and that there are no

printing defects. This examination consists of 6 pages. There are 8 questions for a total of

100 marks.

READ THE QUESTIONS CAREFULLY AND ANSWER WHAT IS ASKED.

To assist you in answering the examination questions, CGA-Canada includes the following glossary of terms.

Glossary of Assessment Terms

Adapted from David Palmer, Study Guide: Developing Effective Study Methods (Vancouver: CGA-Canada, 1996).

Copyright David Palmer.

Calculate Mathematically determine the amount

or number, showing formulas used and

steps taken. (Also Compute).

Compare Examine qualities or characteristics that

resemble each other. Emphasize

similarities, although differences may

be mentioned.

Contrast Compare by observing differences.

Stress the dissimilarities of qualities or

characteristics. (Also Distinguish

between)

Criticize Express your own judgment concerning

the topic or viewpoint in question.

Discuss both pros and cons.

Define Clearly state the meaning of the word or

term. Relate the meaning specifically to

the way it is used in the subject area

under discussion. Perhaps also show

how the item defined differs from items

in other classes.

Describe Provide detail on the relevant

characteristics, qualities, or events.

Design Create an outcome (e.g., a plan or

program) that incorporates the relevant

issues and information.

Determine Calculate or formulate a response that

considers the relevant qualitative and

quantitative factors.

Diagram Give a drawing, chart, plan or graphic

answer. Usually you should label a

diagram. In some cases, add a brief

explanation or description. (Also Draw)

Discuss This calls for the most complete and

detailed answer. Examine and analyze

carefully and present both pros and

cons. To discuss briefly requires you to

state in a few sentences the critical

factors.

Evaluate This requires making an informed

judgment. Your judgment must be

shown to be based on knowledge and

information about the subject. (Just

stating your own ideas is not sufficient.)

Cite authorities. Cite advantages and

limitations.

Explain In explanatory answers you must clarify

the cause(s), or reasons(s). State the

how and why of the subject. Give

reasons for differences of opinions or of

results. To explain briefly requires you

to state the reasons simply, in a few

words.

Identify Distinguish and specify the important

issues, factors, or items, usually based on

an evaluation or analysis of a scenario.

Illustrate Make clear by giving an example, e.g., a

figure, diagram or concrete example.

Interpret Translate, give examples of, solve, or

comment on a subject, usually making a

judgment on it.

Justify Prove or give reasons for decisions or

conclusions.

List Present an itemized series or tabulation.

Be concise. Point form is often

acceptable.

Outline This is an organized description. Give a

general overview, stating main and

supporting ideas. Use headings and

sub-headings, usually in point form.

Omit minor details.

Prove Establish that something is true by citing

evidence or giving clear logical reasons.

Recommend Propose an appropriate solution or course

of action based on an evaluation or

analysis of a scenario.

Relate Show how things are connected with

each other or how one causes another,

correlates with another, or is like

another.

Review Examine a subject critically, analyzing

and commenting on the important

statements to be made about it.

State Clearly provide a position based on an

evaluation, e.g., Agree/Disagree,

Correct/Incorrect, Yes/No. (Also

Indicate)

Summarize Give the main points or facts in

condensed form, like the summary of a

chapter, omitting details and illustrations.

Trace In narrative form, describe progress,

development, or historical events from

some point of origin.

SAU1S12 CGA-Canada, 2012 Page 1 of 4

CGA-CANADA

EXTERNAL AUDITING [AU1] EXAMINATION

September 2012

SUGGESTED SOLUTIONS

Marks Time: 3 Hours

30 Question 1

Note:

2 marks each

Sources/Calculations:

a. 2) Topic 1.9 (Level 1)

b. 3) Topic 1.8 (Level 1)

c. 3) Topic 1.9 (Level 1)

d. 2) Topic 1.8 (Level 1)

e. 2) Topic 2.4 (Level 1)

f. 3) Topic 2.3 (Level 1)

g. 1) Topic 2.3 (Level 1)

h. 3) Topic 2.4 (Level 1)

i. 1) Topic 3.3 (Level 1)

j. 2) Topic 3.4 (Level 1)

k. 1) Topic 3.4 (Level 1)

l. 3) Topic 3.4 (Level 1)

m. 4) Topic 3.6 (Level 1)

n. 3) Topic 6.7 (Level 2)

RIA =

.

...

= 0.521

o. 3) Topic 6.11 (Level 2)

Continued...

SAU1S12 CGA-Canada, 2012 Page 2 of 4

9 Question 2

Source: Topic 4.6 (Level 1)

The inherent risk at Jerrys Trucking is high.

Integrity of management is doubtful, since Jerry simply takes cash and does not appear to report this in

the company income.

The company has never been audited before.

The accounting is done by one person, who is not a trained accountant.

Jerry checks all of the bookkeeping entries, making any corrections he feels are necessary, but he is not

a trained accountant.

Management is not knowledgeable about customs fees and regulations; therefore, mistakes will likely

occur.

The company has transactions in Canada and the United States; therefore, there are foreign currency

complexities to deal with.

Note:

1

1

/2 marks per bullet to a maximum of 9 marks

9 Question 3

Source: Topic 9.2 (Level 2)

7

1

/2 a. Verify count sheets are complete

Select a random sample of the count sheets and test them by a re-count

Verify that all pre-numbered count sheets are included in the inventory reconciliation

Look for fictitious adjustments to inventory account

Scan the inventory entries in the ledger for unusual entries and amounts, and trace back to

supporting documents

Find out about obsolete items

Enquire with management about the policy for identifying and writing down obsolete items

Scan the inventory records for slow-moving items

Review samples of inventory and look for damaged or shop-worn items

Check cut-off

Obtain the serial numbers of the last shipping and last receiving documents for the year

Trace the last receiving document into the inventory account for the year

Trace the goods from the last shipping document to ensure they were removed from the inventory

account for the year

Trace subsequent shipping and receiving documents to ensure they were removed from or added to

next years inventory

Check assignment of inventory

Review bank confirmations for indications of assignment

Review board of directors minutes for authorization of assignment

Review debt agreements for pledge of inventory

Note:

1

1

/2 marks per bullet to a maximum of 7

1

/2 marks

Continued...

SAU1S12 CGA-Canada, 2012 Page 3 of 4

1

1

/2 b. Select a sample of inventory items and vouch unit prices to supporting invoices

Select a sample of entries to inventory records and recalculate purchase invoice amounts

Recalculate the journal extensions and footings for accuracy

Note:

1

1

/2 marks for any reasonable procedure

10 Question 4

Source: Topic 4.4 (Level 1)

8 a. Use 5% to 10% of normalized income from continuing operations (if income is used as a base, it

should be adjusted for extraordinary or abnormal items)

$2,100,000 + $500,000 (the bribe is not a normal business item)

$2,600,000 + $400,000 = $3,000,000 (the $400,000 is fraudulent)

Therefore 5% to 10% = $150,000 to $300,000

The auditor would choose an amount in the above range, based on professional judgment.

Note:

2 marks per bullet to a maximum of 8 marks

2 b. The vacation expense misstatement was fraudulent, therefore qualitatively material, even though much

less than the quantitative amount calculated by the auditor for materiality.

12 Question 5

Source: Topic 5.3 (Level 1)

Segregation of responsibilities category:

Authorization of transactions

Example: The purchase manager can authorize transactions, but cannot enter them to the general ledger

(G/L).

Recording of transactions

Example: The accounting department enters the PO to the G/L but cannot authorize a PO.

Custody of goods

Example: It is not clear how custody of inventory is maintained, but is stated to be under the control of

the warehouse supervisor, therefore separate from the other functions.

Periodic reconciliation

Example: There is a reconciliation done each quarter and any adjustments to the G/L account above

$1,500 are authorized by a separate person.

Note:

1 mark each for the segregation of responsibilities plus 2 marks for each example to a maximum of 12 marks

Continued...

SAU1S12 CGA-Canada, 2012 Page 4 of 4

8 Question 6

Source: Topic 7.11 (Level 1)

When using the test data approach:

The computer system being tested must be the same one the client used to process data for the entire

period under review.

None of the test data can contaminate the clients records and files.

The auditor must include both valid and invalid transaction data in order to test controls for invalid data.

Examining only the output may miss offsetting errors in the computer processing.

Without examining the internal processing logic of the computer systems, the auditor can only prove

that the computer system works correctly with the test data used.

Note:

2 marks per bullet to a maximum of 8 marks

10 Question 7

Source: Topic 8.2 (Level 1)

Stratify sales by customer, or by amount (possible high-risk accounts)

Scan the 30,000 sales for unusually large amounts, or for round numbers (possible fraud or error)

Verify the numerical accuracy of sales to the general ledger sales account (accuracy)

Scan for entries without shipping dates (fictitious sales)

Scan for duplicated sales (validity of sales)

Scan for shipping dates after year end (possible cut-off errors)

Note:

1

1

/2 marks for CAAT plus 1 mark for reason (2

1

/2 marks per bullet) to a total of 10 marks

12 Question 8

3 a. Source: Topic 10.9 (Level 2)

This is a Type II event, because the cause and manifestation both occurred after year end.

6 b. Source: Topic 10.9 (Level 2)

The auditor will have to ensure proper and full disclosure, but there will not be any adjustment to

the companys accounts and financial statements.

The amount is highly material, because the company is losing at least C$64 million and is also

losing its largest asset. The value of the collateral held by the bank is now drastically reduced and

the bank may call its loan.

The auditor should consider the risk of going concern.

Note:

3 marks per bullet to a maximum of 6 marks

3 c. Source: Topic 10.11 (Level 2)

The independent review should be performed by Wan.

She is from the same audit firm.

She has had no experience on the engagement.

She has not been biased by the ongoing relationship with the client.

Note:

1 mark per bullet to a maximum of 3 marks

END OF SOLUTIONS

100

AU1S12 CGA-Canada, 2012

CGA-CANADA

EXTERNAL AUDITING [AU1] EXAMINATION

September 2012

EXAMINERS COMMENTS

General Comments

Overall performance on this examination was good. Students answers demonstrated a good awareness of

the tested issues involved in internal control, inherent risk, materiality, inventory, audit risk, ethics, and

reporting. The performance on the multiple-choice questions was good.

However, it appears that some students may be focusing their study on past examinations rather than the

course material. For example, some students had very little awareness of the test data approach, even

though the module notes provide most of the material for the answers. These examinations do not repeat

questions from old examinations, and all course material is examinable as indicated (Level 1, Level 2, or

Level 3). There is also a blueprint provided to help guide students.

Another problem was that some answers did not address the required; they cannot obtain a satisfactory

mark.

AU1 examinations are reviewed and designed to address the learning objectives of the course, with

appropriate emphasis on Levels 1 and 2. Students should be sure to study the course materials for topics

and the depth of detail. It is recommended that students underline the task in the required part of the

question, to ensure that their answer addresses each point. When answering questions dealing with audit

procedures, students should ensure that the procedure identifies what records or items will be selected and

what actions will be taken. It is also helpful to think of what audit evidence is being sought and how this

would be obtained.

Specific Comments

Question 1 Multiple choice (Levels 1 and 2)

This question was answered well. Parts (e), (l), and (o) were not answered satisfactorily.

e. Auditors independence Evaluate situations that may threaten independence (Level 1)

This question was not answered satisfactorily. An advocacy threat occurs when an auditor is

promoting a clients position or opinion; a self-interest threat occurs when an auditor stands to benefit

from an association or interest in a client; and an intimidation threat occurs when an auditor is deterred

from acting objectively, by actual or perceived threats from a client. None of these situations is

suggested by the fact that the auditor previously worked for the client as a student, therefore

options 1), 3), and 4) are not reasonable. Option 2), however, is possible since the auditor may be

reviewing his or her own work. Therefore option 2) is the best choice.

l. Evidence-gathering audit procedures (Level 1)

This question was not answered satisfactorily. CAS 402, Audit Considerations Relating to an Entity

Using a Service Organization, which is a Level 1 required reading for Topic 3.4, discusses this topic.

A Type 1 report is a report prepared by the service auditor on the description and design of the

controls, but the given information states that the external auditor has already made a risk assessment

and expects that controls are operating effectively. Therefore option 1) is not a reasonable choice. The

auditor needs to obtain evidence concerning the operating effectiveness of the controls at the service

organization, therefore the recommended procedure is to have another auditor (that is, independent) to

perform tests of controls at the service organization on behalf of the external auditor. Therefore

option 2) is not the best choice. Option 4) cannot be reasonable since the auditor still needs evidence.

Option 3) is the best choice.

Continued...

AU1S12 CGA-Canada, 2012

o. Dollar-unit sampling (Level 2)

This question was not answered satisfactorily. The module notes point out that dollar-unit sampling

(DUS) is an attribute sampling method that can be used for sampling for tests of controls and for

sampling for tests of details of balances, and that the population in DUS is a pool of dollars not a

pool of transactions, nor a pool of individual accounts. Therefore options 1), 2), and 4) are all

incorrect, and option 3) is correct.

No particular problems were noted with the remaining multiple-choice questions.

Question 2 Inherent risk (Level 1)

Overall performance on this question was excellent. Students who had difficulty with this question tended

to discuss internal controls and control risk, when inherent risk is the risk that exists without considering

the entitys internal controls. Most students obtained full marks or almost full marks.

Question 3 Audit procedures for inventory (Level 1)

a. Overall performance on this question was excellent, but some students were unable to provide actual

audit procedures or assumed consignment instead of assignment of inventory. Particularly, answers

dealing with cut-off tended to be vague, such as test the last few purchases to make sure they are

recorded in the right period Such an answer is more of an objective than an audit procedure; it does

not indicate how these purchases would be tested or how the auditor would determine that they were

or were not recorded in the right period. Audit procedures are a major topic in the course, so students

should expect this topic to be worth significant marks when tested.

b. Overall performance on this question was satisfactory. The question is not difficult and there are

several procedures one could use to determine accuracy. Relying on ratio analysis to compare results

either to budgets or to prior years would not provide very good evidence for accuracy. The question

asked students to determine the accuracy, not to see if the inventory numbers seemed reasonable or as

expected; therefore ratio analysis would not be a satisfactory procedure in this case.

Question 4 Materiality (Level 1)

a. Overall performance on this question was excellent, but some students confused materiality with

material misstatement and calculated which of the misstatements they would consider to be material.

This problem results from not reading the required carefully. Students are reminded that their answer,

even if it contains true statements, cannot be awarded full marks if it does not answer the question

asked. Part (a) dealt with the quantitative aspect of materiality. There were marks for each factor

considered in the answer, and most students obtained at least part marks.

b. Overall performance on this question was satisfactory. Most students identified the fraudulent nature

of the misstatement and its implications. Some students, however, simply stated that the error would

be added to unadjusted errors to be considered at the end of the audit. While the amount itself was

immaterial, misstatements involving fraud are always considered material. Again, the required part of

the question has to be addressed. The question was not how would the auditor handle this

misstatement for the audit, but how would it be treated in terms of materiality.

Question 5 Internal controls (Level 1)

Overall performance on this question was excellent. Most students achieved full or almost full marks.

Students who had difficulty with this question tended to answer in terms of how to improve the internal

control at the company, which may be an answer from a past examination. This question simply required

analysis of the existing segregation of responsibilities. Some students were unaware of the four kinds of

responsibilities that should be segregated for effective internal control. A few answers simply repeated the

given information in the question with no indication of segregation of responsibilities.

Continued...

AU1S12 CGA-Canada, 2012

Question 6 Test data approach (Level 1)

This question was not answered satisfactorily. Answers that did not address the test data approach could

not obtain any marks. Although the topic is fully discussed in the module notes, many students appear to

have very little knowledge of this topic. A typical answer simply offered one point that there could be

offsetting errors but little more, or else explained general sampling issues, such as select a random

sample, or suggested audit steps for the payroll account, such as check the time cards or verify the pay

scale rate. These may be helpful to an auditor in a general sense, but are not related to the test data

approach.

Question 7 Computer assisted audit techniques (Level 1)

This question was answered satisfactorily, but some students lost marks by providing examples that were

not related to auditing, such as select all sales to a particular product so that the company can determine

which products are in high demand. This may be a useful strategy for the business itself, but is not related

to auditing. These types of answers were awarded part marks for the use of the computer software to select

files or transactions or accounts, but could not obtain full marks as they were not shown to be related to

auditing of sales at the company. Answers that simply repeated the example in the given information about

identifying customers in a particular geographic area were not awarded any marks as the question asked

for four other examples.

Question 8 Subsequent events (Level 2)

a. Part (a) was answered satisfactorily, but some students confused subsequent events with contingent

liabilities and answered based on the probability of the event and the materiality. However most

students obtained at least high part marks for this question.

b. Part (b) was answered satisfactorily, with no problems noted other than a lack of detail in some

answers. The event was very significant and as such the disclosure should have been extensive. There

were no other problems noted.

c. Part (c) was not answered satisfactorily. Many students answers suggested a lack of awareness of the

independent review at the end of the audit. Some students suggested that another audit firm be hired,

or that the auditor partner, Jing, who was in charge of the audit do it. There are important reasons for

the independent review, which should have suggested that the other partner, Wan, was the appropriate

choice.

Você também pode gostar

- Audit Risk Alert: General Accounting and Auditing Developments 2018/19No EverandAudit Risk Alert: General Accounting and Auditing Developments 2018/19Ainda não há avaliações

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)No EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Nota: 5 de 5 estrelas5/5 (1)

- CGA AU1 June'12 Practice ExamDocumento14 páginasCGA AU1 June'12 Practice ExamumgilkinAinda não há avaliações

- March'12 Audit 1Documento14 páginasMarch'12 Audit 1umgilkinAinda não há avaliações

- Cga-Canada External Auditing (Au1) Examination June 2011 Marks Time: 3 HoursDocumento14 páginasCga-Canada External Auditing (Au1) Examination June 2011 Marks Time: 3 Hoursyinghan2203031Ainda não há avaliações

- Auditing Theory Par4Documento8 páginasAuditing Theory Par4Taehyungiiee KimAinda não há avaliações

- Ca Exm Au2 2005-03-2Documento17 páginasCa Exm Au2 2005-03-2melsun007Ainda não há avaliações

- Chap 123 AAADocumento10 páginasChap 123 AAAHà Phương TrầnAinda não há avaliações

- Tutorial 4 QuestionsDocumento3 páginasTutorial 4 QuestionsShivneel NaiduAinda não há avaliações

- BT - Photo SV - Hoan ThienDocumento12 páginasBT - Photo SV - Hoan Thienthanhcong832003Ainda não há avaliações

- HHHHDocumento6 páginasHHHHLester Jude Del RosarioAinda não há avaliações

- Tutorial 6 Q & ADocumento4 páginasTutorial 6 Q & Achunlun87Ainda não há avaliações

- Assignment For Audit AssistantDocumento3 páginasAssignment For Audit AssistantDipali PatilAinda não há avaliações

- MTP 12 21 Questions 1696771411Documento8 páginasMTP 12 21 Questions 1696771411harshallahotAinda não há avaliações

- Paper 3 - Audit - TP-8Documento6 páginasPaper 3 - Audit - TP-8Suprava MishraAinda não há avaliações

- Advanced Auditing Professional Ethics Full Test 1 May 2023 Scheduled Test Paper 1674103055Documento26 páginasAdvanced Auditing Professional Ethics Full Test 1 May 2023 Scheduled Test Paper 1674103055Kunal BhatnagarAinda não há avaliações

- Question and Answer - 3Documento31 páginasQuestion and Answer - 3acc-expertAinda não há avaliações

- TESTDocumento10 páginasTESTHà Phương TrầnAinda não há avaliações

- Rrpa 9Documento8 páginasRrpa 9mr rahulAinda não há avaliações

- Qia Practice QuestionDocumento0 páginaQia Practice QuestionZiaul HuqAinda não há avaliações

- ACCT5908 2015题目Documento21 páginasACCT5908 2015题目a45247788989Ainda não há avaliações

- Professional Codes of Ethics Multiple ChoicesDocumento5 páginasProfessional Codes of Ethics Multiple ChoicessesomokuleileAinda não há avaliações

- Summary of Audit & Assurance Application Level - Self Test With Immediate AnswerDocumento72 páginasSummary of Audit & Assurance Application Level - Self Test With Immediate AnswerIQBAL MAHMUDAinda não há avaliações

- Semester 1 - PAPER IDocumento7 páginasSemester 1 - PAPER IShilongo OliviaAinda não há avaliações

- AAA QuizzDocumento47 páginasAAA QuizzHà Phương TrầnAinda não há avaliações

- Audit Fraud MemoDocumento16 páginasAudit Fraud MemoManish AggarwalAinda não há avaliações

- Chapter "1" "The Demand For Audit & Other Assurance" 1) ) AuditingDocumento9 páginasChapter "1" "The Demand For Audit & Other Assurance" 1) ) AuditingamrmazzAinda não há avaliações

- Final Exam PDFDocumento14 páginasFinal Exam PDFJuris Renier Mendoza0% (1)

- Perceived Benefits of Vat and Its Impact To The Corporate Taxpayers in The Lone District of BinanDocumento10 páginasPerceived Benefits of Vat and Its Impact To The Corporate Taxpayers in The Lone District of BinanJohn Kayle BorjaAinda não há avaliações

- Short Quiz 1Documento11 páginasShort Quiz 1AMAinda não há avaliações

- Test Acc 5102Documento2 páginasTest Acc 5102michael choggaAinda não há avaliações

- Audit Mtp2 DoneDocumento11 páginasAudit Mtp2 Donegaurav gargAinda não há avaliações

- Question and Answer - 6Documento30 páginasQuestion and Answer - 6acc-expertAinda não há avaliações

- ACC311 Fundamental of Accounting Final Term Subjective Prepared by Brave Heart Innocent MishiiDocumento4 páginasACC311 Fundamental of Accounting Final Term Subjective Prepared by Brave Heart Innocent MishiiZeeAinda não há avaliações

- Mock Final Exam Autumn 2011 SolutionsDocumento15 páginasMock Final Exam Autumn 2011 SolutionsYasir MuyidAinda não há avaliações

- ReSA B42 AUD First PB Exam Questions Answers Solutions PDFDocumento24 páginasReSA B42 AUD First PB Exam Questions Answers Solutions PDFNamnam KimAinda não há avaliações

- Acct 555 Audit Week 4 MidtermDocumento6 páginasAcct 555 Audit Week 4 MidtermNatasha DeclanAinda não há avaliações

- CaseDocumento4 páginasCaseDavut AbdullahAinda não há avaliações

- MTP 19 52 Questions 1712750749Documento13 páginasMTP 19 52 Questions 1712750749shivamshttAinda não há avaliações

- The Risk That An 2auditorDocumento6 páginasThe Risk That An 2auditorvivianzou0412Ainda não há avaliações

- Acct 555 - Week 1 AssignmentDocumento8 páginasAcct 555 - Week 1 AssignmentJasmine Desiree WashingtonAinda não há avaliações

- Midterm Test 1Documento6 páginasMidterm Test 1hoangmyduyennguyen2004Ainda não há avaliações

- Acctg 16a - Midterm ExamDocumento6 páginasAcctg 16a - Midterm ExamChriestal SorianoAinda não há avaliações

- f8hkg 2011 Jun QuDocumento6 páginasf8hkg 2011 Jun Qudavidip1991Ainda não há avaliações

- ICAB-Q-audit Assurance Nov Dec 2016Documento4 páginasICAB-Q-audit Assurance Nov Dec 2016Md Joinal AbedinAinda não há avaliações

- Audit NotesDocumento16 páginasAudit NotesMohammad ChaudharyAinda não há avaliações

- Week 3 HomeworkDocumento11 páginasWeek 3 Homeworkchaitrasuhas100% (1)

- MTP1 May2022 - Paper 6 AuditingDocumento20 páginasMTP1 May2022 - Paper 6 AuditingYash YashwantAinda não há avaliações

- © The Institute of Chartered Accountants of IndiaDocumento8 páginas© The Institute of Chartered Accountants of IndiaShrwan SinghAinda não há avaliações

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocumento12 páginasAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestGJ ELASHREEVALLIAinda não há avaliações

- Exercises c3 4 5 PDFDocumento9 páginasExercises c3 4 5 PDFlazycat1703Ainda não há avaliações

- Audit 101Documento3 páginasAudit 101Jonard AlterAinda não há avaliações

- Audit MTP2 QP M24 @CAInterLegendsDocumento17 páginasAudit MTP2 QP M24 @CAInterLegendssharmaansshumanAinda não há avaliações

- Case 1.5 Lincoln Savings and Loan AssociationDocumento17 páginasCase 1.5 Lincoln Savings and Loan AssociationAlexa RodriguezAinda não há avaliações

- Assignment (1) : B) Identify Whether Each of The Following Statements Is (True) or (False)Documento5 páginasAssignment (1) : B) Identify Whether Each of The Following Statements Is (True) or (False)Shimaa MohamedAinda não há avaliações

- BAP41 - Lecture 2 - Tutorial QuestionsDocumento7 páginasBAP41 - Lecture 2 - Tutorial QuestionsFarzana zafriAinda não há avaliações

- Acctg 16a - Midterm Exam PDFDocumento5 páginasAcctg 16a - Midterm Exam PDFMary Grace Castillo AlmonedaAinda não há avaliações

- Lebanese Association of Certified Public Accountants - Audit February Exam 2020 Extra SessionDocumento8 páginasLebanese Association of Certified Public Accountants - Audit February Exam 2020 Extra Sessionjifri syamAinda não há avaliações

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsNo EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsNota: 5 de 5 estrelas5/5 (1)

- Summary of Gregory R. Caruso's The Art of Business ValuationNo EverandSummary of Gregory R. Caruso's The Art of Business ValuationAinda não há avaliações

- PoliciesDocumento44 páginasPoliciesGabriel Joseph AdanAinda não há avaliações

- Accounting: South Pacific Form Seven CertificateDocumento35 páginasAccounting: South Pacific Form Seven CertificateArun ThakurAinda não há avaliações

- Project On NJ India Invest PVT LTDDocumento68 páginasProject On NJ India Invest PVT LTDbabloo200650% (2)

- Cut Off Points Makerere University Under Private Sponsorship 2017/ 2018Documento6 páginasCut Off Points Makerere University Under Private Sponsorship 2017/ 2018The Campus Times100% (1)

- A Study On Students Perception of Choosing Their CareerDocumento11 páginasA Study On Students Perception of Choosing Their CareerMeganathAinda não há avaliações

- Chart of Account Argartile Revbaru Ke 2 SaryonoDocumento17 páginasChart of Account Argartile Revbaru Ke 2 SaryonoSaryonoAbdullahAinda não há avaliações

- Housing Loan AgreementDocumento5 páginasHousing Loan AgreementVADeleon100% (1)

- Case Study Analysis STMDocumento42 páginasCase Study Analysis STMThanveer Ma100% (1)

- PERMIAS Sponsorship Proposal 2022Documento21 páginasPERMIAS Sponsorship Proposal 2022Sarah JasmineAinda não há avaliações

- Doing Business in IndonesiaDocumento52 páginasDoing Business in IndonesiaDharmendra TripathiAinda não há avaliações

- GDR & ADRsDocumento4 páginasGDR & ADRsShub SidhuAinda não há avaliações

- Acceptance Letter - SBI Audit DT 21.03.2014 - FinalDocumento5 páginasAcceptance Letter - SBI Audit DT 21.03.2014 - FinalSanjay JeenaAinda não há avaliações

- Perenco - Oil and Gas - A Leading Independent Exploration and Production CompanyDocumento3 páginasPerenco - Oil and Gas - A Leading Independent Exploration and Production CompanyCHO ACHIRI HUMPHREYAinda não há avaliações

- Entrepreneurship Compensation CorporationDocumento16 páginasEntrepreneurship Compensation CorporationPankaj GuptaAinda não há avaliações

- A Case Study of Inventory Management Using Selective Control TechniqueDocumento12 páginasA Case Study of Inventory Management Using Selective Control TechniqueRadhika VashishtAinda não há avaliações

- Contact ListDocumento2 páginasContact ListcmgenrAinda não há avaliações

- O T Public - PleaDocumento2 páginasO T Public - PleaoldeproAinda não há avaliações

- Whitepaper Digital ShipyardDocumento8 páginasWhitepaper Digital ShipyardSuhas MayekarAinda não há avaliações

- Recognizing Public Value: Developing A Public Value Account and A Public Value ScorecardDocumento33 páginasRecognizing Public Value: Developing A Public Value Account and A Public Value ScorecardRicardo Luis Salgado AraujoAinda não há avaliações

- Title XDocumento9 páginasTitle XJana marieAinda não há avaliações

- Fjord Trends 2019Documento53 páginasFjord Trends 2019MartinAinda não há avaliações

- Notes Part 1 & 2 QuizDocumento2 páginasNotes Part 1 & 2 QuizElla Mae LayarAinda não há avaliações

- Udyam Registration CertificateDocumento4 páginasUdyam Registration CertificatePATEL SAHILKUMARAinda não há avaliações

- Working With Route SchedulesDocumento6 páginasWorking With Route ScheduleskrizvlAinda não há avaliações

- Certified Public AccountantDocumento3 páginasCertified Public AccountantDesiree IrraAinda não há avaliações

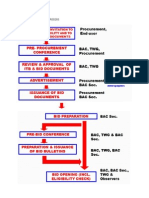

- Bidding Process For Procurement Process and DPWHPDFDocumento9 páginasBidding Process For Procurement Process and DPWHPDFGerardoAinda não há avaliações

- PMEX Registered Brokers With SECP: Member Code Name of Broker Status Reg. # Address Phone # As at November 15, 2019Documento2 páginasPMEX Registered Brokers With SECP: Member Code Name of Broker Status Reg. # Address Phone # As at November 15, 2019noname1Ainda não há avaliações

- Parole Evidence RuleDocumento78 páginasParole Evidence RuleJocelyn CoAinda não há avaliações

- Airline ReportDocumento9 páginasAirline ReportRaheel AhmedAinda não há avaliações

- Cdep Sample SlidesDocumento9 páginasCdep Sample SlidesKarla Kressel CerenoAinda não há avaliações