Escolar Documentos

Profissional Documentos

Cultura Documentos

Pharmaceutical Sector - Saudi Arabia: Outlook and Current Trends

Enviado por

AliMirza0 notas0% acharam este documento útil (0 voto)

145 visualizações3 páginasOverview of Pharma sector in Saudi Arabia

Título original

Sanofi in Saudi Arabia

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

DOCX, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoOverview of Pharma sector in Saudi Arabia

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

145 visualizações3 páginasPharmaceutical Sector - Saudi Arabia: Outlook and Current Trends

Enviado por

AliMirzaOverview of Pharma sector in Saudi Arabia

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

Você está na página 1de 3

Pharmaceutical sector - Saudi Arabia

Outlook and current trends:

Increased consumer sophistication & proactive treatment:

Saudi Arabia is a market that is experiencing rapid population growth. We are also witnessing a more proactive

approach on part of consumers towards healthcare.

We have also witnessed a shift in attitude of the general population towards health and wellness. People are

becoming more aware of issues pertaining to being overweight, smoking and also certain lifestyle diseases like

diabetes.

They are becoming more sophisticated regarding symptoms, causes and treatment. Hence there is an increased

willingness to self-medicate, boosting the utilization of OTC drugs.

Some consumers are now willing to stave off potential future ailments by opting for calcium or vitamin

supplements.

Hajj:

For the local populace, Hajj (Annual pilgrimage for Muslims) is also a season where people fear the influx of disease

from various countries. There have been a few inoculation campaigns targeting Saudis and expat residents for

certain diseases near Hajj. There is no formidable data to back up such concerns but it remains a genuine concern

for locals especially for people residing in the Western province of Saudi Arabia.

Distribution mix:

Chemists/ Pharmacists remain on top among distribution channels; however, post 2010 with increased awareness

on fitness and alternative medicine consumers are opting for health-food shops which have demonstrated strong

performance in weight management and allergy care. Internet retail is yet to kick off in KSA and based on data

from 2010 represents only 0.1 % contribution to the distribution mix.

Government initiatives and Economic growth:

The Saudi Government through the Ministry of Health runs many initiatives for a number of diseases on an yearly

or bi-annual basis. Nowadays, there is special emphasis on healthcare awareness and prevention of various

diseases like STDs & Hepatitis etc.

The ministry also regularly organizes seminars for local practitioners and invests a substantial amount in training

doctors and nurses as well as pharmacists.

It is quite evident that government spending in healthcare is on a constant rise with high investments in medical

education and infrastructure.

For example, development of public healthcare facilities is on the rise which is in line with the Governments plans

to establish 5 entirely new cities in previously under-developed areas. Such cities will also be provided with

neighborhood clinics, hospitals and medical universities.

The Saudi government also runs a scholarship program where students who obtain admission in reputable foreign

universities are fully funded by the government to pursue their academic requirements which includes a fixed

monthly stipend as well.

Overall, in terms of Pharmaceutical sector growth, we predict stronger sales as economic growth and population

figures of KSA are on the rise compounded by the emergence of five new cities in the long term.

Pharmaceutical industry overview:

Market Share:

Consumers are constantly opting for leading brands and at the moment Novartis (11.3 %) and Saudi

Pharmaceutical Industries and Medical Appliances Co. (10.8 %) rank on top in terms of Retail value RSP and are the

only companies with a share in double digits in the Kingdom for the year 2011. They are followed by GSK (9.1%),

Reckitt-Benckiser (7.3 %), Tabuk Pharmaceutical Manufacturing Co. (3.7 %) and Merck & Co. (3.4 %).

Sanofis market share has remained relevantly marginal at around 0.9% over the period 2006-2011.

If we look at brands by various firms, GSKs Panadol is on top with a 7.1% share of Retail Value Rsp. Dettol 3.9%

(Reckitt-Benckiser), Voltaren 2.8% (Ciba-Geigy), Otrivin 2.2% (Novartis), Rofenac 2.0 % (SPIMACO) round off the

top five in particular order. (Based on data for Year 2010)

(For a more detailed look at media spends within the Pharmaceutical industry, please refer to attached document titled Consumer Health Market shares.xls)

Media Spends:

Based on estimates of aggregate media spends within KSA for the period 2010-2011, Riyadh Pharma was the

highest spender. Pfizer, SPIMACO, Al Haya were at par with significantly lower but yet substantial investment in

media. Sanofi is also close-by in terms of magnitude of investment in advertising their products.

(For a more detailed look at media spends within the Pharmaceutical industry, please refer to attached document Consumer Health Media Spends estimates.xls)

Local Regulations:

The Saudi ministry of Health divides pharmaceuticals into three groups:

Medicines and Pharmaceuticals

o Rx (Require Prescriptions)

o OTC

Herbal Medicines

Cosmeceuticals

Pricing is also regulated by the Ministry of Health with an aim to ensure lowest prices possible. For imports the

ministry assesses the prices in several countries and selects the lowest available price.

Advertising of Pharmaceutical and medicinal products is prohibited on non-medical media, including TV and radio.

Hence, firms invest in promotion via seminars, medical magazines and also target healthcare workers.

Pharma firms also utilize sales pushes to chemists/pharmacists like bulk-buy bonuses as they cannot target

consumers with price promotions. Sales reps also visit doctors and pharmacists on a regular basis offering free

samples, leaflets and gifts as well.

Exceptions: Some Pharma firms have obtained permission from the Ministry of Health to advertise their brands

locally. For example: Panadol (GSK), Sedergine (UPSA), Fevadol (SPIMACO) etc. Such brands are mostly analgesics,

cough, cold and allergy remedies. Drapolene (by Wellcome for diaper rashes) and Gaviscon (Antacid by GSK)

Você também pode gostar

- NHS FPX6004 BorovacSarah Assessment3 1Documento7 páginasNHS FPX6004 BorovacSarah Assessment3 1sara walterAinda não há avaliações

- SanofiDocumento17 páginasSanofiyishun44Ainda não há avaliações

- TRA IoT Regulatory Procedure UAEDocumento8 páginasTRA IoT Regulatory Procedure UAEAKAinda não há avaliações

- CH 08Documento12 páginasCH 08Dafina Doci100% (1)

- AssignmentDocumento1 páginaAssignmentSheryar NaeemAinda não há avaliações

- FIN526 Financial Statement Analysis Template JeffDocumento5 páginasFIN526 Financial Statement Analysis Template Jeffjeffff woodsAinda não há avaliações

- Case Study Question 1Documento2 páginasCase Study Question 1Bandit BanAinda não há avaliações

- Macsg11: Money Demand and Equilibrium Interest RateDocumento23 páginasMacsg11: Money Demand and Equilibrium Interest RateJudithAinda não há avaliações

- Porter Five Forces and CompetitorsDocumento5 páginasPorter Five Forces and CompetitorsCarmen Alexandra IamandiiAinda não há avaliações

- Case Study: Sanofi: Dispensing The Drug LordDocumento8 páginasCase Study: Sanofi: Dispensing The Drug Lordpersephone hadesAinda não há avaliações

- Sanofi Aventis Vaccines Supply Chain ProcessDocumento21 páginasSanofi Aventis Vaccines Supply Chain ProcessarnaqviAinda não há avaliações

- Pharma 2020 PWC ReportDocumento32 páginasPharma 2020 PWC ReportBrand SynapseAinda não há avaliações

- Saudi Arabia Pharmaceutical Market Development AnalysisDocumento4 páginasSaudi Arabia Pharmaceutical Market Development AnalysisNeeraj ChawlaAinda não há avaliações

- Ethics in Pharmaceutical Industry PDFDocumento2 páginasEthics in Pharmaceutical Industry PDFMichelle0% (1)

- Moderna CEO Stephane Bancel Says Coronavirus Vaccine Price Will Be LowDocumento3 páginasModerna CEO Stephane Bancel Says Coronavirus Vaccine Price Will Be Lowtp4oyk fdtaz4100% (1)

- IntuitDocumento3 páginasIntuitDarleen Joy UdtujanAinda não há avaliações

- Medicalchain Whitepaper enDocumento42 páginasMedicalchain Whitepaper enehtishamAinda não há avaliações

- Dells Just in Time Inventory Management SystemDocumento19 páginasDells Just in Time Inventory Management SystemThu HươngAinda não há avaliações

- John Keells Holdings PLC AR 2021 22 CSEDocumento332 páginasJohn Keells Holdings PLC AR 2021 22 CSEDINESH INDURUWAGEAinda não há avaliações

- Offensive - Objectionable Marketing and Ethics - Group6Documento27 páginasOffensive - Objectionable Marketing and Ethics - Group6Ashwath Singh RainaAinda não há avaliações

- Socially Responsible and Ethical Marketing Decisions To Sell Tobacco To Third World CountriesDocumento2 páginasSocially Responsible and Ethical Marketing Decisions To Sell Tobacco To Third World Countrieshussainalishah0% (1)

- Milo MaterialsDocumento17 páginasMilo MaterialsNwabuisi PamelaAinda não há avaliações

- Cepton Strategic Outsourcing Across The Pharmaceuticals Value ChainDocumento9 páginasCepton Strategic Outsourcing Across The Pharmaceuticals Value ChainFrenzy FrenesisAinda não há avaliações

- Ethical Issues in Providing Pharmaceutical CareDocumento7 páginasEthical Issues in Providing Pharmaceutical CareXee JayAinda não há avaliações

- Module 3 - BMC 1Documento30 páginasModule 3 - BMC 1MARJORIE SEDROMEAinda não há avaliações

- Developing The International Manager WalMarts Cross Cultural Management in GermanyDocumento22 páginasDeveloping The International Manager WalMarts Cross Cultural Management in GermanyTâm NhưAinda não há avaliações

- Vijaya Diagnostic Centre LimitedDocumento7 páginasVijaya Diagnostic Centre LimitedRavi KAinda não há avaliações

- IoT Based Smart City Security Issues and Tokenization, Pseudonymization, Tunneling Techniques Used For Data ProtectionDocumento4 páginasIoT Based Smart City Security Issues and Tokenization, Pseudonymization, Tunneling Techniques Used For Data ProtectionEditor IJTSRDAinda não há avaliações

- Baker McKenzie Workshop On Green Bonds For Fiji RBF - 2017Documento19 páginasBaker McKenzie Workshop On Green Bonds For Fiji RBF - 2017Seni NabouAinda não há avaliações

- Telehealth: Review and Perspectives For SingaporeDocumento33 páginasTelehealth: Review and Perspectives For Singaporesuhangmydoc100% (1)

- Advertising, Marketing and The Truth - Ethics and Social Responsibility PDFDocumento11 páginasAdvertising, Marketing and The Truth - Ethics and Social Responsibility PDFSagar KattimaniAinda não há avaliações

- VodafoneDocumento28 páginasVodafoneNavaneet Yadav100% (1)

- For AssignmentDocumento19 páginasFor AssignmentsadiiAinda não há avaliações

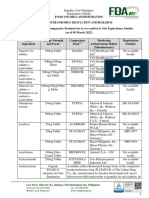

- MS Word Project Team GagnantsDocumento11 páginasMS Word Project Team Gagnantsvijay chatterjeeAinda não há avaliações

- Strategic AlliancesDocumento15 páginasStrategic AlliancesAli AhmadAinda não há avaliações

- ImcDocumento13 páginasImcAnubhov JobairAinda não há avaliações

- Anglo American PLC in South AfricaDocumento11 páginasAnglo American PLC in South AfricaAvaneesh Srivastava80% (5)

- What Is Global Strategy? and Why Is It Important?Documento12 páginasWhat Is Global Strategy? and Why Is It Important?Mohsin JuttAinda não há avaliações

- Pfizer PBC BookletDocumento7 páginasPfizer PBC BookletDon HeymannAinda não há avaliações

- Mid Assignment - ACT 202Documento4 páginasMid Assignment - ACT 202ramisa tasrimAinda não há avaliações

- GE Industry AnalysisDocumento8 páginasGE Industry AnalysisTanvi Singh50% (2)

- Marketing Mix On Betage Hilton Phrama ReportDocumento21 páginasMarketing Mix On Betage Hilton Phrama Reportmirza_2010Ainda não há avaliações

- Market AnalysisDocumento6 páginasMarket AnalysisMohamed AhmedAinda não há avaliações

- Apollo Gleneagles HospitalDocumento20 páginasApollo Gleneagles HospitalApoorv SinghalAinda não há avaliações

- 11 718 ProtectionismDocumento22 páginas11 718 ProtectionismJESUROBO COLLINSAinda não há avaliações

- On The Cutting Edge or The Chopping BlockDocumento33 páginasOn The Cutting Edge or The Chopping BlockLuizAinda não há avaliações

- Chapter - 02 Digital EconomyDocumento44 páginasChapter - 02 Digital EconomyMuntaha ArbabAinda não há avaliações

- Thailand Healthcare: The Rise of Asia'S Medical HubDocumento8 páginasThailand Healthcare: The Rise of Asia'S Medical HubBeau PhatruetaiAinda não há avaliações

- Implementation of QMSDocumento20 páginasImplementation of QMScrab849Ainda não há avaliações

- Path Lab 19-20 PDFDocumento202 páginasPath Lab 19-20 PDFPriyesh Bharad0% (1)

- Microeconomics AssignmentDocumento12 páginasMicroeconomics AssignmentChuin Han100% (1)

- Mergers & AcquisitonsDocumento11 páginasMergers & AcquisitonsSid BhambhaniAinda não há avaliações

- Urban Transportation Problem NoveloDocumento12 páginasUrban Transportation Problem NoveloCeyn LumabadAinda não há avaliações

- BPM When Outsourcing Goes AwryDocumento2 páginasBPM When Outsourcing Goes AwryAbhishek Minz100% (1)

- PF Italy Pestle SwotDocumento10 páginasPF Italy Pestle SwotSky walkingAinda não há avaliações

- The Thomas Cook France Strategy On French Market Marketing EssayDocumento19 páginasThe Thomas Cook France Strategy On French Market Marketing EssayHND Assignment HelpAinda não há avaliações

- How Pfizer Partner BioNTech Became A Leader in Coronavirus Vaccine Race - WSJDocumento5 páginasHow Pfizer Partner BioNTech Became A Leader in Coronavirus Vaccine Race - WSJFERNANDA IBÁÑEZAinda não há avaliações

- Literature ReviewDocumento2 páginasLiterature ReviewNajia SiddiquiAinda não há avaliações

- T NG Quan NgànhDocumento6 páginasT NG Quan Ngànhk60.2113340007Ainda não há avaliações

- Strategic Management Assignment (Est) : Regulatory FrameworksDocumento4 páginasStrategic Management Assignment (Est) : Regulatory FrameworksIshaan KumarAinda não há avaliações

- Monitor Pharma Prescription Launches in Emerging Markets 083112Documento28 páginasMonitor Pharma Prescription Launches in Emerging Markets 083112Siddharth SikariaAinda não há avaliações

- INSPolicyNotePharmaceutical PDFDocumento10 páginasINSPolicyNotePharmaceutical PDFAna AsmaraAinda não há avaliações

- Indonesia Healthcare MarketDocumento10 páginasIndonesia Healthcare MarketBenjaporn OngmongkolkulAinda não há avaliações

- ThiocolchicosideDocumento8 páginasThiocolchicosideSAAinda não há avaliações

- State Contracts DetailsDocumento635 páginasState Contracts DetailsDexter Davis100% (1)

- World Preview 2016-EvaluatepharmaDocumento34 páginasWorld Preview 2016-Evaluatepharmasunxiaodong11100% (1)

- Cfo India 201302Documento52 páginasCfo India 201302Sandeep ViswanathAinda não há avaliações

- HRM 370 2020 1 Spring Case 5 Aventis PharmaDocumento44 páginasHRM 370 2020 1 Spring Case 5 Aventis PharmaAhmed ShahriarAinda não há avaliações

- Sanofi 2015Documento109 páginasSanofi 2015Abdulwahab AfridiAinda não há avaliações

- Database Sector Wise NewDocumento38 páginasDatabase Sector Wise NewTanmay VashishthaAinda não há avaliações

- Brown Et Al. 2009 Obesity - Why Be ConcernedDocumento52 páginasBrown Et Al. 2009 Obesity - Why Be ConcernedManny RosengallegosAinda não há avaliações

- Sanofi PDFDocumento64 páginasSanofi PDFAngel Lopez GarciaAinda não há avaliações

- Pharmaceutical Specialty Sales Representative in Wilkes Barre Scranton PA Resume Scott Van EttenDocumento2 páginasPharmaceutical Specialty Sales Representative in Wilkes Barre Scranton PA Resume Scott Van EttenScott Van EttenAinda não há avaliações

- Case Study Emerson and Sanofi: Data Stewards Seek Data Conformi TYDocumento28 páginasCase Study Emerson and Sanofi: Data Stewards Seek Data Conformi TYTaimoorAdilAinda não há avaliações

- Differentiated ProductDocumento4 páginasDifferentiated Productshah777Ainda não há avaliações

- Report - : AnnualDocumento233 páginasReport - : AnnualMohammad SalmanAinda não há avaliações

- Sap Eh&sDocumento40 páginasSap Eh&ssmbeatty08100% (1)

- Bleeding in ACS SlideCASTDocumento83 páginasBleeding in ACS SlideCASTCarlos Del Carpio EnriquezAinda não há avaliações

- Case Study: The Global Pharmaceutical IndustryDocumento23 páginasCase Study: The Global Pharmaceutical IndustryRasool AsifAinda não há avaliações

- PH59 - Pagaduan (Assignment)Documento2 páginasPH59 - Pagaduan (Assignment)Princess Valerie PagaduanAinda não há avaliações

- Douglas Rochler Lawsuit ZantacDocumento51 páginasDouglas Rochler Lawsuit ZantacLaw&CrimeAinda não há avaliações

- World OTC Pharmaceutical Market 2013-2023Documento33 páginasWorld OTC Pharmaceutical Market 2013-2023VisiongainGlobal0% (1)

- WockhardtDocumento69 páginasWockhardtdiyaalkhazraji1290% (1)

- Lista MDocumento240 páginasLista MMaria MagicdAinda não há avaliações

- Wa0002.Documento4 páginasWa0002.nabi.rafiqueAinda não há avaliações

- Food and Drug Administration Center For Drug Regulation and R Food and Drug Administration Center For Drug Regulation and Research EsearchDocumento141 páginasFood and Drug Administration Center For Drug Regulation and R Food and Drug Administration Center For Drug Regulation and Research EsearchJha JhaAinda não há avaliações

- Orientation Reports-SanofiDocumento20 páginasOrientation Reports-Sanofioptimistic07Ainda não há avaliações

- PRODUCTDocumento38 páginasPRODUCTSaroj MishraAinda não há avaliações

- Finalll Project LorealDocumento48 páginasFinalll Project Lorealgaryart1110% (1)

- Assignment On I.T & Pharma IndustryDocumento11 páginasAssignment On I.T & Pharma IndustryGolu SinghAinda não há avaliações