Escolar Documentos

Profissional Documentos

Cultura Documentos

Online Service Online Service Quality and Customers' Satisfaction A Case Study of The Selected Commercial Banks in Riyadh (Saudi Arabia) Quality and Customers'

Enviado por

AFTAB KHANTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Online Service Online Service Quality and Customers' Satisfaction A Case Study of The Selected Commercial Banks in Riyadh (Saudi Arabia) Quality and Customers'

Enviado por

AFTAB KHANDireitos autorais:

Formatos disponíveis

Pensee Journal Vol 75, No.

12;Dec 2013

188 office@penseejournal.com

Online Service Quality and Customers Satisfaction: A Case Study of

the selected Commercial Banks in Riyadh (Saudi Arabia)

Dr.Mohammad Almotairi

e!artment of "arketin# Colle#e of Business Administration

$in# Saud %niversity Riyadh Saudi Arabia

Soad A. Al-Meshal1

e!artment of "arketin# Colle#e of Business Administration

$in# Saud %niversity Riyadh Saudi Arabia

Aftab Alam

Corres!ondence& e!artment of "arketin#& Colle#e of Business Administration&

$in# Saud %niversity& '( O( Bo) *+++,& Riyadh ++,-*&

$in#dom of Saudi Arabia

"obile: . /00 ,1 20 1* 31+

4mail: aftabalam++56#mail(com

Abstract

Online bankin# is one of the key features of todays 7orld modern bankin# system( 8his system enhances the

!erformance of the bankin# industry and hel!s their customers in reducin# their transaction costs( 8his study

aims to investi#ate the relationshi! bet7een online bankin# services !rovided by different banks in Riyadh (Saudi

Arabia) namely9 Al: Ra;hi bank& <ational commercial bank and Riyadh bank: Riyadh(8he different dimensions such

as tan#ibles& reliability& res!onsiveness& and em!athy have been taken as determinants of customer satisfaction( 8hese

dimensions are based on the S4R=Q%A> model !ro!osed by ?an and Beak (5331)( 8he reliability and validity

of the dimensions have been investi#ated by Cronbachs Al!ha test( 8he observed value of this test is 3(*1 7hich

re!resents a #ood scale of internal consistency( escri!tive statistics and dichotomous lo#istic re#ression model are used

to investi#ate the relationshi! bet7een each individual dimension and customer satisfaction( 8he sam!le si@e of the

res!ondents is +33 customers( 'ur!osive sam!lin# techniAue 7as used to collect information from only those clients of

the corres!ondin# banks 7ho are familiar 7ith online bankin# services& the selected customers are the students of the

selected universities of the $in#dom of Saudi Arabia located in Riyadh( 8hese universities are namely: $in# Saud

%niversity& Bmam "uhammad Bin Saud Bslamic %niversity and 'rince Sultan %niversity( 8he study reveals that all

the selected dimensions9 tan#ibles& reliability& res!onsiveness and em!athy are the si#nificant determinants of overall

satisfaction of the customer but 7ith diverse si#nificance levels( 8he study further reveals that tan#ibles and reliability

are most influential dimensions to enhance customers overall !robability of satisfaction as com!ared to the rest of

dimensions !ro!osed in this study(

Pensee Journal Vol 75, No. 12;Dec 2013

189 office@penseejournal.com

Keyword: Online bankin#& Customer satisfaction& Bslamic banks

JEL classification codes: M3! "3#

1. $ntrod%ction

Ceb:oriented services have brou#ht novel chan#es in all sectors of a modern economy !articularly& in the

bankin# sector( 'erha!s the bankin# industry is more com!etitive& innovative and customer oriented than any

other industry in the services sector( Online bankin# services are becomin# an attractive alternative to visit

service outlets or !honin# call centers for increasin# the number of customers ($enova '& 5330)( 4: service

technolo#y facilitate both9 stakeholders and clients in different 7ays and channels( Bnternet bankin# hel!s banks to

build and maintain close relationshi!s 7ith their customers& reduces o!eratin# and fi)ed costs and achieves more

efficient and enhanced financial !erformance (Rod "& 533-)( On the other hand& the customers also benefit from

this technolo#y havin# easy access to financial services and reduction in transaction cost (Dan#& 5331)( 8he

!rovision of online Auality services to the bankin# customers !lays a vital role to maintain or enhance customer

satisfaction( 8he facility of internet bankin# to the customers is considered as a com!etitive necessity( 8he banks

assure Auality online services to their customers in order to enable them to en;oy the latest 7ide ran#e of financial

facilities 7ith minimum transaction cost (Rod " A( <(& 533-)( 8he success or failure of any business entity includin#

the bankin# sector de!ends on their corres!ondin# customersE satisfaction( Bncreasin# customer satisfaction 7ill yield

material benefits such as hi#her market shares& more !rofit and non:material benefits such as #ood re!utation&

confidence of the customers& #ood 7ill etc(

8he study aims to investi#ate the relationshi! bet7een online bankin# services !rovided by different banks in

Riyadh (Saudi Arabia) namely9 Al: Ra;hi bank& <ational commercial bank and Riyadh bank: Riyadh to #au#e ho7

efficiently these banks !rovide online bankin# facilities to their corres!ondin# clientsF ifferent dimensions

such as9 tan#ibles& reliability& res!onsiveness& and em!athy have been taken as determinants of customer satisfaction(

8hese dimensions are based on the S4R=Q%A> model !ro!osed by (?an San#& 5331)(

8here is no !rinci!al difference bet7een conventional and internet bankin# e)ce!t accessin# and makin#

Pensee Journal Vol 75, No. 12;Dec 2013

190 office@penseejournal.com

transactions of financial matters throu#h your com!uter rather than !a!er com!leted transactions( Bnternet

bankin# facilitates you in !erformin# multi!le financial tasks such as checkin# your balance& !ayment of utility

bills& money transfers& online !urchasin# and investment etc( 8his ease has attracted many customers and has

enhanced customer satisfaction across the 7orld(

#. Material and Methods

Bn order to investi#ate the relationshi! bet7een online service Auality and customer satisfaction& the theoretical

frame7ork has desi#ned in the conte)t of the S4R=Q%A> model ori#inally develo!ed and modified by

(Geithaml& +//3)( Ce have used the modified version of the S4R=Q%A> model refined by (?an San#& 5331)(

8his model su##ests four im!ortant dimensions of service Auality( 8hese are namely9 8an#ibles& reliability&

res!onsiveness& and em!athy( 8he follo7in# table #ives a detail descri!tion of these dimensions(

&able 1: Modified dimensions of SE'()*AL model and their descri+tion

SE'()*AL Dimensions Descri+tion of dimension

8an#ibles 8he online bank has u!:to:date eAui!ment( 4asiness and

availability of information on the bank 7ebsite(

Reliability Bnvolves the correct technical functionin# of the site and the

accuracy of service !romises (deliverin# 7hen !romised) and

!roduct information

Res!onsiveness Quick res!onse and the ability to #et hel! if there is a !roblem or

Auestion

4m!athy 'rovision of carin# and individuali@ed attention to customers

!rovided by call centers or 7eb administrators(

Source: (?an San#& 5331)

#.1 ,at%re of Data and its Descri+tion

8he study uses a !ur!osive sam!lin# techniAue because the data is collected from all those clients 7ho

are familiar 7ith the online bankin# system( 8herefore& this study takes into consideration only online bankin#

customers 7hile the rest of the customers are lyin# outside the sco!e of the study(

8he selected customers are the students of the selected universities of the $in#dom of Saudi Arabia

located in Riyadh( 8hese universities are namely: $in# Saud %niversity& Bmam "uhammad Bin Saud Bslamic

%niversity and 'rince Sultan %niversity( 8he data collected from the students throu#h a detailed Auestionnaire

Pensee Journal Vol 75, No. 12;Dec 2013

191 office@penseejournal.com

develo!ed by (?an San#& 5331) to investi#ate online bankin# services and customer satisfaction

1

(

8he Auestionnaire covers four dimensions of online bankin# services9 8an#ibles& Reliability& Res!onsiveness and

4m!athy( Hour to five Auestions& related to each dimension& 7ere asked from the res!ondents( 8he measurement

scale of the Auestions 7as ordinal scale and thus the res!onses of the res!ondents 7ere ordered from +:,

(+Istron#ly disa#ree& ,Istron#ly a#ree)(

#.# Analytical &echni-%es

A set of analytical techniAues has been used to investi#ate the relationshi! bet7een online bankin#

services available to customers and customers satisfaction in Saudi Arabia(

.irstly! the reliability and validity of the dimensions have been investi#ated by Cronbachs Al!ha test(

Bnternal reliability can be tested by usin# al!ha (Cornbach)( Bt measures the e)tent to 7hich the res!onses are

collected for a #iven item correlate hi#hly 7ith each other ($enova '& 53309 Sidat& 533-)

CronbachEs is defined as9

(+)

7here is the number of com!onents (K-items or testlets)& the variance of the observed total test scores&

and the variance of com!onent i for the current sam!le of !ersons(

Secondly! As the data is collected on the ordinal scale therefore "edian and "ode are the best measures of calculatin#

central tendency of the data(

&hirdly! 7e have used the binary lo#istic model to sho7 that ho7 the !robability of overall satisfaction chan#es

#iven that a chan#e in the selected dimensions occurs( 8he overall satisfaction has been !ro)ied by median score(

1 For detail of questionnaire please see appendix-I

Pensee Journal Vol 75, No. 12;Dec 2013

192 office@penseejournal.com

Bf a res!ondent scores four or more in at least t7o dimensions then this situation is considered as overall

satisfaction and vice versa(

>o#istic model is thus s!ecified as:

((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((J (5)

Chere9 are odd ratios in favor of an increase in individual res!ondents overall satisfaction to the !robability that an

individual overall satisfaction has not increased(

K

+

I A#e of the customers

K

5

I "edian tan#ible score of the customers(

K

2

I "edian reliability score of the customers(

K

1

I "edian res!onsive score of the customers(

K

,

I "edian em!athy score of the customers(

3. Analysis and Disc%ssion

8he CronbachEs result is re!orted here to sho7 the reliability of different dimensions 7e !ro!osed for

investi#atin# the relationshi! bet7een online bankin# services and customer satisfaction(

&able-1: 'eliability Statistics

CronbachEs Al!ha

CronbachEs Al!ha Based on

Standardi@ed Btems <o( of Btems

3(*1+ 3(*12 +-

Source: Authors o7n calculation (S'SS +/ version estimation)

Chronbachs Al!ha value is 3(*1+ 7hich re!resents a #ood level of internal consistency of the scale for all

ei#hteen numbers of Auestions( Bdeally& the Cronbach al!ha coefficient of a scale should be 3(*3 and above ('allent&

533*)(

Pensee Journal Vol 75, No. 12;Dec 2013

193 office@penseejournal.com

&able-#: $tem-&otal Statistics

2

Dimension

)%estions

Scale Mean

if $tem

Deleted

Scale (ariance

if $tem Deleted

/orrected

$tem-&otal

/orrelation

S-%ared

M%lti+le

/orrelation

/ronbach0s

Al+ha if $tem

Deleted

Q+ 0*(*5,3 1+(,-/ (2+1 (,32 (*23

Q5 0*(,333 15(53, (13/ (053 (*5,

&an1ibility Q2 0*(-,33 15(,/5 (5,1 (153 (*21

Q1 0*(-,33 1+(101 (2,3 (,5/ (*5*

Q, 0-(3333 13(0+, (2*, (1/- (*51

Q0 0*(/,33 1+(*1+ (5/* (0,* (*2+

'eliability Q* 0*(0*,3 15(55, (5-- (,+/ (*25

Q- 0*(*5,3 1+(/// (23* (151 (*23

Q/ 0*(*5,3 1+(-/* (5,/ (020 (*2,

Q+3 0*(*,33 15(,,+ (523 (,/* (*2*

Q++ 0*(0,33 13(+2+ (1+2 (,,/ (*5+

'es+onsi2e

ness

Q+5 0*(*5,3 1+(222 (255 (2/3 (*5/

Q+2 0*(*,33 13(/+3 (22- (0// (*5-

Q+1 0*(/,33 13(1,/ (2+* (1*0 (*23

Q+, 0-(3333 15(1+3 (513 (250 (*20

Em+athy Q+0 0*(*333 15(3+3 (220 (1+3 (*5-

Q+* 0-(55,3 2-(-10 (131 (2*- (*5+

Q+- 0*(-,33 1+(00/ (5-1 (1-+ (*25

Source: Authors o7n calculation (S'SS +/ version estimation)

8his table re!resents the statistics for relationshi!s bet7een individual items and the 7hole scale(

Colum 2 and , are the most im!ortant calculations for the establishment of a relationshi! bet7een variables(

Corrected item:total correlations are the correlations bet7een scores on each item and the total scale scores( Bf

the scale is internally consistent& you 7ould e)!ect these correlations to be reasonably stron#( 8he final column

re!resents that 7hat CronbachEs al!ha 7ould be if 7e deleted an item and re:calculated it on the basis of the

remainin# items( Ce can observe that removal of any Auestion 7ould result in a lo7er CronbachEs al!ha(

2 Questions related to different dimesions have been assigned differet colors.

Pensee Journal Vol 75, No. 12;Dec 2013

194 office@penseejournal.com

8herefore& 7e 7ould not 7ant to remove any of these Auestions( CronbachEs al!ha sim!ly !rovides you 7ith an

overall reliability coefficient for a set of variables& e(#( Auestions(

<e)t& 7e calculate descri!tive statistics of the !ro!osed dimensions to investi#ate the avera#e behavior

of the res!ondents re#ardin# their overall satisfaction to7ards the online bankin# facilities in Riyadh (Saudi

Arabia)( As the data is collected on the ordinal scale therefore "edian and "ode is the best measures of central

tendency& the ran#e and Bnter Quartile Ran#e (BQR) are the best measures of dis!ersion(

8akin# median and mode for each dimension to reveal the res!ondents satisfaction about the online bankin#

facility in Riyadh (Saudi Arabia)& 8able:2 reveals that overall median for each dimension is 1( 8his reveals that

res!ondents are satisfied 7ith the online bankin# facilities !rovided by the commercial banks in Riyadh( 8hese results

!rovide an insi#ht into the u!dated facilities& use of modern technolo#y& the efficiency of the bankin# industry in Riyadh

in !articular and Saudi Arabia in #eneral( 8able:2 sho7s descri!tive statistics of res!ondents res!onses(

&an1i

bility

'eliab

ility

'es+o

nsi2en

ess

Em+athy

Q+ Q5 Q2 Q1 Q, Q0 Q* Q- Q/ Q+3 Q++ Q+5 Q+2

Mean 3.4 3.3 3.4 3. 3.4 3. 3.1 3.1 3.1 3. 3.1 3.4 3.4

Stand

ard

Error

4.1 4.1 4.1 4.1 4.1 4.1 4.1 4.1 4.1 4.1 4.1 4.1 4.1

Media

n

3.4 3.4 3.4 3.4 3.4 3.4 3.4 3.4 3.4 3.4 3.4 3.4 3.4

Mode 3.4 3.4 5.4 3.4 5.4 3.4 3.4 3.4 5.4 3.4 5.4 5.4 3.4

Stand

ard

De2iat

ion

4.6 4.7 4.6 4.6 4. 4.6 4.6 4.6 4. 4. 4.6 4.6 4.7

Sam+l

e

(aria

nce

4.8 4.3 4.8 4.8 4.6 4.8 4.7 4.7 4.6 4.8 4.8 4.8 4.3

K%rto

sis

-1.3 1.7 -1.5 -1.5 -1.3 -

1.3

-1.3 -4.6 -1.# -1.3 -1.4 -1.7 1.4

S9ew

ness

4.4 -4.7 -4.1 4.# -4.# 4.4 -4.1 -4.3 -4.3 4.1 -4.3 4.4 -4.3

'an1e 3.4 3.4 #.4 #.4 3.4 3.4 #.4 3.4 3.4 3.4 3.4 #.4 3.4

Mini

m%m

#.4 #.4 3.4 3.4 #.4 #.4 3.4 #.4 #.4 #.4 #.4 3.4 #.4

Pensee Journal Vol 75, No. 12;Dec 2013

195 office@penseejournal.com

Ma:i

m%m

5.4 5.4 5.4 5.4 5.4 5.4 5.4 5.4 5.4 5.4 5.4 5.4 5.4

S%m 3# 338.4 344.4 368.4 38.4 3

1.4

343.4 347.4 341.4 366.

4

345.4 37.4 3.4

/o%nt .4 .4 .4 .4 .4 .

4

.4 .4 .4 .4 .4 .4 .4

&able-3 Descri+ti2e statistics of res+ondents; res+onses

3

Source: Authors o7n calculation (4)cel sheet 53+3)

3 Questions related to different dimesions have been assigned differet colors.

Pensee Journal Vol 75, No. 12;Dec 2013

196 office@penseejournal.com

> 'o#istic re#ressions estimates are re!orted alon# 7ith other statistics are re!orted in table:1(

&able-3: Lo1istic 'e1ression Estimates

<i S.E =ald-test df Si1. E:+><?

A#e :3(*+ (+01 (+-0 + (000 3(1/25

8an#ibles 5(10* (/-0 0(5,* + (3+5 ++(*-5

Reliability 5(225 (-13 *(0// + (330 +3(5/*

Res!onsiveness +(5,+ (*-+ 5(,0* + (+3/ 2(1/,

4m!athy (/*, (,-1 5(*/+ + (3/, 5(0,5

Constant :55(/+* -(203 *(,+, + (330 (333

Source: Authors o7n calculation (S'SS +/ version estimation)

8he binary lo#istic re#ression estimates reveal an overall !ositive relationshi! bet7een online facilities

!rovided by the bankin# industry in Saudi Arabia and customers satisfaction( All slo!e coefficients are !ositive e)ce!t

a#e of the customers( Bn order to inter!ret the lo#istic estimates& it is oftenly !referred by the econometrisions to take a

anti:lo# of the estimates for meanin#ful inter!retation of the results( 8he effect of a#e on overall satisfaction of

customers is ne#li#ible (3(1/25)( 8an#ibles dimensions are the most im!ortant determinants of customer overall

satisfaction( Bf the median tan#ible dimensions increase by one unit then the !robability of customers overall satisfaction

increases by ++(*- times( Similarly& reliability dimensions are the 5

nd

im!ortant determinants of customers overall

satisfaction( Bf the median reliability dimensions increase by one unit then the !robability of overall customer satisfaction

increases by +3(5/ times( Bn the similar 7ay& median reliability and res!onsiveness increases by one unit the !robability

in favor of overall satisfaction increase by 2(1, and 5(0,5 res!ectively( All dimensions are statistically si#nificant at //

!ercent confidence level e)ce!t reliability and res!onsiveness(

3. /oncl%sion and .indin1s

8he study aims to investi#ate the relationshi! bet7een online bankin# services !rovided by different banks in Riyadh

(Saudi Arabia) namely9 Al: Ra;hi bank& <ational commercial bank and Riyadh bank: Riyadh( 8he study uses three

em!irical investi#ation techniAues e:#& Chronbachs Al!ha statistics for internal scale of consistency of various

dimensions !ro!osed& escri!tive statistics es!ecially& median and mode to reveal the avera#e satisfaction of the

customers and finally& the binary lo#istic re#ression model to !redict chan#es in overall level of satisfaction #iven that a

Pensee Journal Vol 75, No. 12;Dec 2013

197 office@penseejournal.com

median chan#e in any dimension( 8he results of the study favor the !revious im!ortant studies such as9 (Dan#& 53319

Dan# G( L(& 53319 "obarek& 533*9 <u!ur& 53+3)(

8he study reveals the follo7in# im!ortant findin#s:

+( 8he Chronbachs Al!ha statistics for internal scale of consistency 7as used( 8he value of this test is

re!orted as 3(*1+ 7hich re!resents a #ood scale of internal consistency and relevancy of all Auestions related to the

overall level of satisfaction(

5( 8he overall median score& for all customers& is 1 7hich re!resent an overall level of satisfaction of customers

re#ardin# the various online facilities !rovided by the selected banks in Riyadh(

2( 8he em!irical results of lo#istic re#ression reveal that a#e of the customers does not si#nificantly influence

their corres!ondin# overall level of satisfaction( 8he results further reveal that all the selected dimensions9

tan#ibles& reliability& res!onsiveness and em!athy are the si#nificant determinants of overall satisfaction of the

customer but 7ith diverse si#nificance levels(

1( 8he study further reveals that tan#ibles and reliability are most influential dimensions to enhance

customers overall !robability of satisfaction as com!ared to the rest of dimensions !ro!osed in this study(

5. 'ecommendations and @olicy $m+lications

Based on the findin#s of the study& the study summari@es the recommendation of the study as9

+( iverse online bankin# facilities are the im!ortant determinants of overall customers satisfaction

therefore customers oriented banks should make note this !henomenon to increase their customers circle by

!rovidin# more reliable& innovative online facilities to their customers(

5( imensions such as tan#ibles and reliability amon# others are the most im!ortant determinants of

customers overall level of satisfaction( 8his !henomenon can be used by the bankin# industry in Riyadh to accelerate

the #ro7th of their customer satisfaction by focusin# on all other dimensions 7ith a !articular focus on tan#ibles and

reliability dimensions of customer satisfaction(

Pensee Journal Vol 75, No. 12;Dec 2013

198 office@penseejournal.com

7. Limitation of this st%dy

8he findin#s and recommendations of this study are based on the res!ondents !erce!tion( 8he information

about the online service Auality and customer satisfaction& re#ardin# the commercial banks in Riyadh is collected from

+33 students( 8he sam!le is considerably lo7 and thus the result cant be #enerali@ed for the entire commercial banks

o!eratin# across the Saudi Arabia(

Ac9nowled1ment

Cith the s!ecial thanks for scientific research council e!artment of marketin#& Colle#e of Business Administration

$in# Saud %niversity Riyadh kin#dom of Saudi Arabia for the !re!arin# and fundin# for this research manuscri!t

<iblio1ra+hy

?an San#& B( S( (5331)( Antecedents and ConseAuences of Service Quality in Online Bankin#: An A!!lication of

the S4R=Q%A> Bnstrument( Advance in Consumer Research, 31& 53-:5+1(

$enova '& =( L( (5330)( Quality Online Banking Service Lonko!in# university(

"obarek& A( (533*)( !-BA"K#"$ %RAC&#C!S A"' C(S&O)!R SA&#S*AC&#O"- A CAS! S&('+ #"

BO&S,A"A e!t( of Accountin# and Hinance& %niversity of Bots7ana(

<u!ur& L( "( (53+3)( 4:Bankin# and Customers Satisfaction in Ban#ladesh:An Analysis( #nternational Revie- o.

Business Research %a/ers, 0& +1,:+,0(

'allent& L( (533*)( S%SS Survival )anual1 A Ste/ 2y Ste/ $uide to 'ata Analysis using S%SS .or ,indo-s

"cMra7 4n#land(

Rod "& A( <( (533-)( An e)amination of the relationshi! bet7een service Auality dimensions& overall internet

bankin# service Auality and customer satisfaction: A <e7 Gealand study( )arketing #ntelligence 3

%lanning, 45(+)(

Rod "& A( <( (533-)( An e)amination of the relationshi! bet7een service Auality dimensions& overall internet

bankin# service Auality and customer satisfaction: A <e7 Gealand study( )arketing #ntelligence 3

%lanning, 45(+)(

Sidat& S( (533-)( )easuring Service Quality using S!,R6Q(A7 )odel1 A Case Study o. !-Retiling in #ran

%niversity 8echnolo#y "alaysia(

Dan#& H( (5331)( Online service Auality dimensions and their relationshi!s 7ith satisfaction: A content analysis of

customer revie7s of securities brokera#e services( #nternational 8ournal o. Service #ndustry

)anagement, 19(2)& 235:250(

Dan#& G( L( (5331)( "easurin# customer !erceived online service Auality Scale develo!ment and mana#erial

im!lications( #nternational 8ournal o. O/erations 3 %roduction )anagement, 4:(++)& ++1/:++*1(

Pensee Journal Vol 75, No. 12;Dec 2013

199 office@penseejournal.com

Geithaml& '( &( (+//3)( 'elivering Quality Service; Balancing Customer %erce/tions and !</ectations Hree

'ress(

Pensee Journal Vol 75, No. 12;Dec 2013

200 office@penseejournal.com

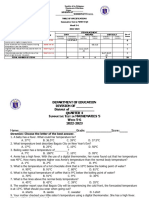

A++endi:-1: )%estionnaire

Dimensions )%estions

&an1ibles

Q+) KDG online bank has u!:to:date eAui!ment N technolo#y(

Q5) 8he 7ebsite of the KDG online bank is visually a!!ealin#(

Q2) 8he 7ebsite of the KDG online bank makes you find information easily(

Q1) 8he 7ebsite of the KDG online bank !rovides you 7ith valuable information(

Q,) 8he 7ebsite of the KDG online bank is easy to use and navi#ate(

'eliability

Q0) Chen KDG online bank !romises to do somethin# by a certain time& it does so(

Q*) Chen there is a !roblem9 KDG online bank sho7s a sincere interest in solvin#

it(

Q-) KDG online bank !erforms the service ri#ht first time(

Q/) KDG online bank !rovides its services at the time it !romises to do so(

Q+3) KDG online bank insists on error:free records(

'es+onsi2eness

Q++) Administrators of KDG online bank tell you e)actly 7hen the service 7ill be

!erformed

Q+5) Administrators of KDG online bank #ive you !rom!t service(

Q+2) Administrators of KDG online bank are al7ays 7illin# to hel! you(

Q+1) Administrators of KDG online bank are never too busy to res!ond to your

Auestions(

Em+athy

Q+,) KDG online bank #ives you individual attention(

Q+0) ?el!desks or call centers of KDG online banks have o!eratin# hours

convenient for all its customers(

Q+0) ?el! desks& call centers& and 7eb administrators of KDG online bank #ive

your !ersonal attention(

Q+*) ?el! desks& call centers& and 7eb administrators of KDG online bank have

your best interests at heart(

Q+-) ?el! desks& call centers& and 7eb administrators of KDG online bank

understand your s!ecific needs

Você também pode gostar

- Impact of FDI and Electricity On The Economic Growth of Pakistan: A Long Run Cointegration and Causality AnalysisDocumento16 páginasImpact of FDI and Electricity On The Economic Growth of Pakistan: A Long Run Cointegration and Causality AnalysisAFTAB KHANAinda não há avaliações

- Mobile Applications To Fight Against COVID-19 Pandemic: The Case of Saudi ArabiaDocumento9 páginasMobile Applications To Fight Against COVID-19 Pandemic: The Case of Saudi ArabiaAFTAB KHANAinda não há avaliações

- The Effect of Stressand Work Overload On Employee's Performance: A CaseStudy of Public Sector Universities of Khyber PakhtunkhwaDocumento6 páginasThe Effect of Stressand Work Overload On Employee's Performance: A CaseStudy of Public Sector Universities of Khyber PakhtunkhwaAFTAB KHANAinda não há avaliações

- Council For Innovative ResearchDocumento9 páginasCouncil For Innovative ResearchAFTAB KHANAinda não há avaliações

- Psychological Empowerment As A Mediator Between Leadership Styles and Employee CreativityDocumento12 páginasPsychological Empowerment As A Mediator Between Leadership Styles and Employee CreativityAFTAB KHANAinda não há avaliações

- Importance of Culture in Success of International MarketingDocumento15 páginasImportance of Culture in Success of International MarketingAFTAB KHAN100% (2)

- A Case Study "Challenges and Threats For InternationalDocumento6 páginasA Case Study "Challenges and Threats For InternationalAFTAB KHANAinda não há avaliações

- FAST FOOD RESTAURANT: An Example of Small and Medium EnterpriseDocumento18 páginasFAST FOOD RESTAURANT: An Example of Small and Medium EnterpriseAFTAB KHAN77% (13)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Improve Your Communication Skills: Ghulam Mustafa KhattiDocumento21 páginasImprove Your Communication Skills: Ghulam Mustafa KhattiGhulam MustafaAinda não há avaliações

- Mathematical Excursions 4th Edition Aufmann Test Bank 1Documento12 páginasMathematical Excursions 4th Edition Aufmann Test Bank 1malissa100% (50)

- Constructivism and Instructional DesignDocumento12 páginasConstructivism and Instructional DesignKim Bureau DinsmoreAinda não há avaliações

- Exposure and Response PreventionDocumento6 páginasExposure and Response PreventionshobaAinda não há avaliações

- 9th BASIC ENGLISH TEST - 10-08-19 PDFDocumento3 páginas9th BASIC ENGLISH TEST - 10-08-19 PDFJIM GUIMACAinda não há avaliações

- Academic TextDocumento2 páginasAcademic TextCatherine ProndosoAinda não há avaliações

- PepsicoDocumento17 páginasPepsicoUsman GhaniAinda não há avaliações

- Lesson Plan - Contemporary Arts From The PhilippinesDocumento4 páginasLesson Plan - Contemporary Arts From The PhilippinesEljay Flores96% (25)

- Demo K-12 Math Using 4a's Diameter of CircleDocumento4 páginasDemo K-12 Math Using 4a's Diameter of CircleMichelle Alejo CortezAinda não há avaliações

- Grammar D - Types of Processes in Experiential Meaning (Part 1)Documento13 páginasGrammar D - Types of Processes in Experiential Meaning (Part 1)Dena BenAinda não há avaliações

- WMS - IV Flexible Approach Case Study 2: Psychiatric DisorderDocumento2 páginasWMS - IV Flexible Approach Case Study 2: Psychiatric DisorderAnaaaerobiosAinda não há avaliações

- Game Based Learning FoundationDocumento26 páginasGame Based Learning FoundationNessa BleuAinda não há avaliações

- MBA in Healthcare Management - Masters in Hospital AdministrationDocumento2 páginasMBA in Healthcare Management - Masters in Hospital AdministrationSandeep SonawneAinda não há avaliações

- BSBAUD501 Initiate A Quality Audit: Release: 1Documento5 páginasBSBAUD501 Initiate A Quality Audit: Release: 1Dwi Nur SafitriAinda não há avaliações

- My Favorite Meal EssayDocumento7 páginasMy Favorite Meal Essayb71g37ac100% (2)

- Schoolcity Math q2Documento2 páginasSchoolcity Math q2api-297797689Ainda não há avaliações

- q2 Lesson 9 Concept PaperDocumento4 páginasq2 Lesson 9 Concept PaperShiela May DelacruzAinda não há avaliações

- NRS110 Lecture 1 Care Plan WorkshopDocumento14 páginasNRS110 Lecture 1 Care Plan WorkshopsamehAinda não há avaliações

- Web Based Gamo Gofa AgricultureDocumento4 páginasWeb Based Gamo Gofa AgricultureAnonymous vNvtJIAinda não há avaliações

- DCS Seam 3Documento25 páginasDCS Seam 3tony ogbinarAinda não há avaliações

- Patient A (Click On The Link To "Complete Patient A's Karyotype")Documento2 páginasPatient A (Click On The Link To "Complete Patient A's Karyotype")ZzaiRraAinda não há avaliações

- Weekly Home Learning Plan in Homeroom Guidance Grade 8: San Carlos Elementary School Matalang DistrictDocumento2 páginasWeekly Home Learning Plan in Homeroom Guidance Grade 8: San Carlos Elementary School Matalang DistrictEdz Sevilla100% (2)

- Duncan Clancy ResumeDocumento1 páginaDuncan Clancy Resumeapi-402538280Ainda não há avaliações

- Resume Parser Analysis Using Machine Learning and Natural Language ProcessingDocumento7 páginasResume Parser Analysis Using Machine Learning and Natural Language ProcessingIJRASETPublicationsAinda não há avaliações

- Intermittent FastingDocumento5 páginasIntermittent FastingIrfan KaSSimAinda não há avaliações

- Professional Development Plan (Required)Documento4 páginasProfessional Development Plan (Required)api-314843306Ainda não há avaliações

- Support Vector Machines and Artificial Neural Networks: Dr.S.Veena, Associate Professor/CSEDocumento78 páginasSupport Vector Machines and Artificial Neural Networks: Dr.S.Veena, Associate Professor/CSEvdjohnAinda não há avaliações

- ChatGPT & How Writers Can Use ItDocumento15 páginasChatGPT & How Writers Can Use ItJateen Kumar Ojha100% (3)

- Communication Technology Definition PDFDocumento2 páginasCommunication Technology Definition PDFVictoriaAinda não há avaliações

- ST3 - Math 5 - Q4Documento3 páginasST3 - Math 5 - Q4Maria Angeline Delos SantosAinda não há avaliações