Escolar Documentos

Profissional Documentos

Cultura Documentos

Easure A T T A F C ' H P ?: Re Obacco Axes The Nswer To Unding Hildren S Ealth Rograms

Enviado por

reasonorgDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Easure A T T A F C ' H P ?: Re Obacco Axes The Nswer To Unding Hildren S Ealth Rograms

Enviado por

reasonorgDireitos autorais:

Formatos disponíveis

Policy Brief No.

65

Measure 50:

Are Tobacco Taxes the Answer to Funding

Children’s Health Programs?

by Skaidra Smith-Heisters

Executive Summary use prevention efforts. For the disproportionate number of

smokers at or near the federal poverty line, this tax would

M easure 50, a proposed constitutional amendment on

Oregon’s November 6, 2007 ballot, would increase the

state’s tobacco tax to create and expand health services, pri-

constitute the functional equivalent of increasing by 5 to 8

percent their annual state income tax. Approval of Measure

50 would mean that some people who can least afford it

marily for uninsured children. If Measure 50 were approved, would pay the bulk of a tax that expands health coverage

Oregon’s tobacco tax would be the third-highest in the for families with higher incomes. Consequently, tobacco

nation. Rather than being approved by the state legislature consumers would have fewer resources at hand to help them

and incorporated in to state statutes, the proposed tax would quit than they do now.

be inserted into Article IX of the Constitution of Oregon, At the same time, the new tax rate—roughly 2.5 times

setting a new precedent. Approval of the measure would the U.S. median cigarette tax rate—would create greater

also trigger the provisions of Senate Bill 3, which include incentives for Oregonians to purchase cigarettes else-

a reworking of the current formula for the distribution of where. While Oregon tobacco control officials currently

tobacco funds. estimate that tax evasion is small—approximately 4 percent

In promoting Measure 50, Gov. Ted Kulongoski has of smokers admitted to buying cigarettes from untaxed or

claimed that the present levels of cigarette and other out-of-state sources in the last year—if Oregon matches

tobacco taxes in Oregon “fail to reflect the costs to society Washington’s tax rate, more tobacco-tax evasion is likely to

from the use of tobacco products.” However, the governor’s ensue. Washington loses a staggering $223 million in tax

plans for spending most of the revenues generated by the revenue each year through the illegal sale of untaxed ciga-

new tax have nothing to do with tobacco. Under Measure rettes, nearly 28 percent of all cigarettes consumed annually

50, only an estimated 8 percent of new tobacco tax revenues in the state. Last year, the Oregon Department of Justice

would support Oregon’s chronically under-funded tobacco- reported that “with potential increases in tobacco taxes

Reason Foundation • reason.org

and corresponding profits for tax evaders, the market is at percent, from 92 to 54 packs per capita.3 The prevalence

serious risk for ongoing compromise by organized crime of tobacco use nationwide has decreased during the same

groups.” Increased black market sales should be a concern period, with Oregon somewhat ahead of the national trend.

not just because of the lost tax revenues, but because of At the same time, the number of children covered by

associated criminal activities, which may include increased health insurance in Oregon is also increasing. The majority

sales of tobacco products to minors. of children, 64 percent, currently are covered by employer-

Although Oregon has a very active Tobacco Tax Compli- sponsored or individual health insurance, and 25 percent

ance Task Force working to prosecute black market tobacco are insured by government programs. The remaining 11

sales in the state, legislators have shown less commitment percent of children in Oregon are uninsured, equal to the

to funding the state’s Tobacco Prevention and Education national average.4

Program. Programs designed to reduce tobacco use, initi- Measure 50 matches an exceptionally popular cause—

ated in 1996, receive only a small fraction of the tax rev- children’s health coverage—with a traditionally unpopular,

enues voters approved for this purpose. Instead, as Measure minority tax base—smokers. The only connection between

50 illustrates, tobacco tax revenues—and smokers’ pock- smokers and health care for children is contrived, namely,

ets—have proved an easy target for lawmakers simply trying the political convenience of compelling the disliked former

to grow the state budget. to pay for the latter.

Worst of all, Measure 50 might never generate the reve- Tobacco consumers are a relatively captive tax base

nues the governor and its other proponents have promised. from which politicians can draw funds for a variety of

While tobacco tax rates increase, tobacco sales decrease, programs without fear of meaningful political backlash.

and programs whose funding is predicated on taxing Ore- However, the tobacco tax increase proposed under Measure

gon’s tobacco consumers will be left stranded with budget- 50 will have far-reaching consequences that are not fully

ary needs far above the dedicated revenue stream. appreciated by voters.

There are better ways to address Oregon’s health needs.

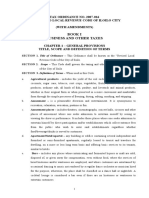

History of Cigarette Tax Rates in Oregon, ¢ Per Pack

Date Rate Change Tax Rate After

Increase

Introduction Measure 50 2007 (proposed) 84.5 202.5

If adopted, Measure 50 would make Oregon’s tobacco Measure 30 1/1/2004 -10.0 118.0

tax the third-highest in the nation, equal to the per-pack Measure 20 11/1/2002 60.0 128.0

cigarette tax levied in Washington State.1 Cigarette taxes in Measure 44 11/5/1996 30.0 68.0

Oregon were increased just five years ago, when the per-

pack excise tax was nearly doubled.

Existing tobacco revenues in Oregon already partially Overview of Measure 50

fund the Oregon Health Plan, as well as going to the Gen-

The tobacco tax hike currently proposed under Measure

eral Fund, local cities, counties and transit districts. In

50 would increase the cigarette tax from $1.18 to $2.025 per

addition, Oregon was awarded approximately $150 million

pack starting January 1, 2008. Further, it would increase

per biennium through the year 2025 in the Master Settle-

the tax on other tobacco products from 65 percent of the

ment Agreement resulting from the combined lawsuits of

wholesale price to 95 percent. Oregon’s Legislative Revenue

individual states against the tobacco industry. Tobacco

Office estimates that Measure 50 would generate $152.8

consumers nationwide pay for a share of the cost of the

million in net new revenue in 2007–09 and $233.2 million

Master Settlement Agreement—in effect an indirect tobacco

in 2009–2011 (though it should be noted that net gains

tax—and such consumers also pay a federal excise tax of 39

from this type of tax are notoriously difficult to predict).5

cents per pack.

The explanatory statement for Measure 50 prepared by

In 2004 only an estimated 20 percent of Oregon adults

the Oregon Secretary of State states in its entirety:6

smoked, a decrease of 15 percent since 1996.2 During this

same period, annual per capita cigarette sales dropped 41 This measure would amend the Oregon Constitu-

tion to provide dedicated funding for children’s

Measure 50: Oregon’s Tobacco Tax

2 Reason Foundation

health care and other health programs through an cent would be allocated to tobacco prevention.

increase in the tobacco tax.

If this measure fails, the Healthy Kids Program

The measure would raise the cigarette tax by 84.5 and other health care expansions in Senate Bill 3

cents per pack to equalize it with the cigarette tax will not become law.

in the State of Washington. The measure would

Measure 50 would add a new section to Article IX of the

also raise the tax on cigars and other tobacco

Constitution of Oregon.7 Approval of the measure would

products.

also trigger the provisions of Senate Bill 3, which includes

The new revenue generated by this measure would a reworking of the current formula for the distribution of

be dedicated to the following purposes: tobacco funds, with current and the proposed new revenue

to be allocated as follows:

1. Providing health care to children.

Tobacco Tax Fund Allocations Pending Approval of

2. Providing health care to low-income adults.

Measure 50

$ New Starting 1-1-08 2008-09 2007-09 2009-11

3. Providing health care to other medically Revenue 2007-08 Biennium Biennium

underserved Oregonians. Health Plan $ 7,312,952 26,802,832 34,115,784 50,704,975

(OHP)

4. Preventing tobacco use. TURA $ 6,106,296 13,401,480 19,507,776 38,964,178

Rural Health $ 458,878 1,681,843 2,140,722 3,181,672

If the measure passes, it will be implemented by Kids Safety $ 1,198,518 4,392,709 5,591,227 8,310,025

Senate Bill 3, which the legislature passed earlier Net

this year. That legislation: Healthy Kids $ 28,531,970 104,573,034 133,105,004 197,828,841

Program

1. Creates the Healthy Kids Program, which Total $43,608,614 $150,851,898 $194,460,512 $298,989,691

is designed to provide affordable health care to

uninsured children in Oregon. The Healthy Kids $ Old Starting 1-1-08 2008-09 2007-09 2009-11

Revenue 2007-08 Biennium Biennium

Program expands eligibility for existing health

State General $ 37,760,703 63,116,462 100,877,165 127,423,832

insurance programs, streamlines and simplifies Fund

application procedures and creates a new chil- Health Plan $ 88,755,658 154,045,604 242,801,262 314,416,828

(OHP)

dren’s health care pool to lower health care costs.

Local Govern- $ 2,623,304 4,602,292 7,225,597 9,198,138

ment (Cities)

2. Provides affordable health care for 10,000

Local Govern- $ 2,623,304 4,602,292 7,225,597 9,198,138

low-income adults through the Oregon Health ment (Coun-

Plan. ties)

Local Govern- $ 2,623,304 4,602,292 7,225,597 9,198,138

ment (Transit)

3. Expands funding for rural health care and

Total $134,386,274 $230,968,943 $365,355,217 $469,435,073

safety net clinics.

From Oregon Legislative Revenue Office, Revenue Measures Passed

by the 74th Legislature 2007, pp. 76–77.

4. Expands funding of Oregon’s Tobacco Use

Reduction Account [TURA].

Higher taxes are expected to reduce taxed sales of

Under Senate Bill 3, approximately 70 percent of cigarettes and other tobacco products through a combina-

the new tobacco tax revenue through 2011 would tion of factors: reduced consumption of tobacco products,

be allocated to the Healthy Kids Program; approx- increased out-of-state purchases (Washington and Oregon

imately 18 percent would be allocated to health residents who currently take advantage of the substan-

care for low-income adults; approximately 4 tially lower Oregon cigarette prices will buy elsewhere)

percent would be allocated to rural health services and increased tobacco smuggling. (Additional reductions

and safety net clinics; and approximately 8 per- are anticipated as a result of expanding state-mandated

Reason Foundation 3 Measure 50: Oregon’s Tobacco Tax

smoking restrictions in businesses.) Because of these fac-

tors, carefully defined formulas are necessary to prevent

the proposed new tax from reducing revenue for programs

and services already funded by existing tobacco taxes. (The

actual allocation schedule is shown in the Appendix.)

Future allocation of the current and any new tobacco

tax revenue streams will need to account for further

decreasing revenues, both as a result of the above-cited

factors, and due to the long-term nationwide trend toward

lower per capita tobacco consumption.

Problems with Measure 50

Tobacco taxes are one of the most regressive sources of

Constitutional Means revenue available at either a state or federal level.

The Constitution of Oregon, drafted 150 years ago this tobacco taxes in Oregon “fail to reflect the costs to society

fall, is an enduring document that has changed surprisingly from the use of tobacco products.”8 However, the gover-

little through the state’s history. The constitution charts the nor’s plans for spending most of the revenues generated by

progress of the state, containing both anachronisms—such the new tax have nothing to do with tobacco.

as penalties for any person who gives or accepts “a chal- Oregon’s Measure 44 tobacco tax increase created the

lenge to fight a duel” (Article II, §9)—while also recording state’s Tobacco Prevention and Education Program just

some of our noblest values: “We declare that all men, when ten years ago. When Governor Kulongoski assumed office

they form a social compact are equal in right: that all power in 2003, tobacco prevention was the only program funded

is inherent in the people, and all free governments are by Measure 44 tobacco taxes to be entirely cut in order to

founded on their authority, and instituted for their peace, address the state’s budget deficit. In the Tobacco Preven-

safety, and happiness” (Article I, §1). tion and Education Program’s Oregon Statewide Tobacco

The constitution certainly addresses issues of taxation, Control Plan 2005–2010, the report’s authors celebrate

but generally only to limit and define expenditures. For “tremendous strides” in the state’s tobacco control efforts,

example, the tax rebate “kicker” law, approved in 2000, but notably observe that, “[u]nfortunately, funding cuts

was a constitutional amendment. The proposed new tax on threaten progress. At present, Oregon’s budgets for tobacco

tobacco would be the first time that a specific product tax control comprise only a small fraction of what the Centers

was inserted into the state’s constitution. for Disease Control and Prevention considers minimum

Most relevant to Measure 50 is Article IV, §25(2) of the funding for effective tobacco prevention programs.”9

Oregon Constitution, which requires that three-fifths of all According to the report, in the 2003–05 biennium Oregon

members of the state legislature must approve new taxes. received $668 million from tobacco taxes and payments

This provision is intended to, and does, protect taxpayers. from tobacco companies under the Master Settlement

Measure 50 would circumvent it by amending the Oregon Agreement, but allocated only $6.9 million of that on actual

Constitution itself. The implications of this unprecedented tobacco prevention, far short of the $42 million minimum

constitutional tinkering for future tax decisions would be recommended by the Centers for Disease Control and

serious. Prevention (CDCP), and only half of what voters approved

through the 1996 tobacco tax, Measure 44.10

Unfair Ends Under Measure 50, only an estimated 8 percent of new

Tobacco taxes are often represented as a “user fee” tobacco tax revenues would fund tobacco-use prevention

levied to pay for the social costs, or externalities, of smoking efforts—fully 92 percent of the revenues would support

on society. In promoting Measure 50, Gov. Ted Kulongoski statewide programs with little direct relationship to tobacco

has claimed that the present levels of cigarette and other use.11 Consequently, tobacco consumers would have fewer

Measure 50: Oregon’s Tobacco Tax

4 Reason Foundation

resources at hand to help them quit than they do now. The It is a farce, then, to claim that Measure 50 would

state’s spending on tobacco control would still fall short of benefit smokers or address the social costs of smoking. The

the minimum recommended by the CDCP, and if the mea- real purpose of Measure 50 is to create the Healthy Kids

sure passes, there would be no guarantee that in a few years Program, a new, un-funded program intended to benefit all

legislators wouldn’t further reduce the revenues dedicated Oregonians.

to actual tobacco control efforts, as they have done with

Unintended Consequences

voter-mandated tobacco tax allocations as recently as four

years ago. Oregon’s lower cigarette prices and less restrictive

Despite Governor Kulongoski’s representation of the smoking laws have long brought out-of-state consum-

purpose driving the tobacco tax increase, no independent ers (mostly from Clark County) into the state for tobacco

state-level effort has been made to calculate and mitigate purchases. By matching tobacco tax rates to Washington’s,

the social costs of smoking. National data suggest that most a significant amount of this cross-border commerce would

of the costs of smoking—ranging from cleaning fees on real end. At the same time, the new tax rate—roughly 2.5 times

property to insured medical expenses—are paid for privately. the U.S. median cigarette tax rate—would create greater

Recently, Duke University researchers, in a comprehensive incentives for Oregonians to purchase cigarettes elsewhere.

tabulation of net externalized costs of smoking, estimated Current state law exempts out-of-state purchases of less

that, averaged over the smoker’s lifetime, per-pack costs than one carton (10 packs) from Oregon tobacco tax. If

borne by society amount to $1.44.12 Smokers in Oregon Measure 50 passes, a personal purchase of 9 packs of ciga-

already pay more than that, and Measure 50 would go rettes in Idaho would save an Oregon smoker $13 in tobacco

even further, bringing the tobacco excise tax imposed on taxes. The gap between the Oregon tax rate and the lowest

Oregon smokers to $2.42 per pack—well beyond the Duke rate in the nation, South Carolina’s, would amount to $20

researchers’ postulated cost of smokers to society. Moreover, per carton—enough to cover shipping and handling with

smokers would still subsidize state programs indirectly via change left over.

cigarette prices as a consequence of the Master Settlement Large-scale tobacco-tax evasion and smuggling is

Agreement funds, an additional 39 cents per pack.13 already an industry in Oregon. The state Department of

Justice reports that criminal cigarette tax evasion is being

The two goals of Measure 50—reducing tobacco use and facilitated not just by out-of-state and Internet retailers,

funding health programs—are completely incompatible.

but by Mexican nationals and organized crime groups from

Tobacco taxes are one of the most regressive sources of republics in the former Soviet Union.16 In 2004, Oregon

revenue available at either a state or federal level.14 Accord- State Police apprehended drivers en route through the state

ing to the Tobacco Prevention and Education Program, the in a truck loaded with $94,000-worth of untaxed tobacco

poorest people in Oregon are the most likely to smoke—27 products. The Tobacco Tax Compliance Task Force pros-

percent of current smokers in Oregon meet the Oregon defi- ecuted the drivers on felony smuggling charges.17 In 2005,

nition for economically disadvantaged, compared to only 18 the Task Force assisted in the prosecution of an Oregon

percent of the general population.15 If Measure 50 succeeds couple suspected of importing and reselling tobacco prod-

in raising the revenues predicted by the Legislative Revenue ucts from Washington and New York worth an estimated

Office, it would amount to approximately $768 per smoker $1.2 million dollars in unpaid taxes.18 In June of this year,

per year. For the disproportionate number of smokers at or a Portland-area man was sentenced to 16 months in prison

near the federal poverty line, this tax would constitute the and required to pay more than $800,000 to the Oregon

functional equivalent of increasing by 5 to 8 percent their Department of Revenue for redistributing untaxed ciga-

state income tax. The effects of such a regressive tax are far- rettes purchased at a Yakima, Washington Indian reserva-

reaching. Consider, for example, that approval of Measure tion.19 Many similar cases have been prosecuted.20

50 would mean that some people who can least afford it In addition to dozens of investigations by the state Task

would pay the bulk of a tax that expands health coverage for Force, the federal Bureau of Alcohol, Tobacco, Firearms and

families with higher incomes, including those with incomes Explosives last reported 452 active tobacco investigations at

up to 300 percent of the federal poverty line. the national level, including multi-million dollar trafficking

Reason Foundation 5 Measure 50: Oregon’s Tobacco Tax

schemes where groups organize cigarette shipments from Increased black market sales should be a concern not just

low-tax states to high-tax states.21 because of the lost tax revenues, but because of associated

While Oregon tobacco control officials currently esti- criminal activities, which may include increased sales of

mate that tax evasion is small—approximately 4 percent tobacco products to minors.

of smokers admitted to buying cigarettes from untaxed or

Measure 50 will increase incentives for tax evasion and

out-of-state sources in the last year—if Oregon matches

the costs associated with black market tobacco sales.

Washington’s tax rate, more tobacco-tax evasion is likely to

ensue.22 The Washington State Liquor Control Board, the

Unsustainable Funding

agency responsible for tobacco tax enforcement in Washing-

ton, estimates that their state loses more than $223 million In the end, Measure 50 might never generate the rev-

in tax revenue each year through the illegal sale of untaxed enues the governor and its other proponents have prom-

cigarettes, nearly 28 percent of all cigarettes consumed ised. Accurate revenue projections from state tobacco taxes

annually in the state.23 In Maine, where the per pack ciga- are complicated not just by legitimate decrease in demand

rette tax is $2.00, tobacco tax revenues for this year have and tax evasion, but also by the fact that the federal govern-

been $800,000 lower per month than projected, leaving a ment may change the cost of cigarettes at any time, either

budget gap of several million dollars, due at least in part to through raising the federal per pack excise tax, or through

tax evasion.24 increased regulation of the tobacco industry. That’s bad

The enforcement costs required to eliminate tobacco- news for programs that currently depend on tobacco taxes.

tax evasion would be astounding, and partial enforcement Tobacco tax funding doesn’t bode well for the future

of these laws unfortunately means that the most honest of new state obligations, either. Measure 50 expands state

retailers—those obeying state law—generally suffer the services and creates an entirely new program, Healthy Kids,

greatest disadvantage in the marketplace. completely dependent on a shrinking, minority tax base. If

Last year, the Oregon Department of Justice reported the measure passes, families with incomes up to 300 per-

that “with potential increases in tobacco taxes and cor- cent of the federal poverty level would qualify for taxpayer-

responding profits for tax evaders, the market is at serious funded or partially subsidized children’s health coverage.

risk for ongoing compromise by organized crime groups.”25 While tobacco tax rates increase, tobacco sales decrease,

Comparison of tax rates in neighboring states and U.S. median, ¢ per pack

250

200

202.5

150

100

87 80 80

50

57

0

California Idaho Nevada Washington U.S. median

(Jan. 1, 2007)

From Federation of Tax Administrators, State Excise Tax Rates on Cigarettes, www.taxadmin.org/fta/rate/cigarett.html, January 1, 2007. These

rates only represent state tobacco excise taxes, not including federal tobacco excise taxes or applicable state and local sales taxes.

Measure 50: Oregon’s Tobacco Tax

6 Reason Foundation

and programs whose funding is predicated on taxing aimed at lessening barriers to quitting faced by low-income

Oregon’s tobacco consumers will be left stranded with bud- smokers should be emphasized.”27

getary needs far above the dedicated revenue stream. It is Although Oregon has a very active Tobacco Tax Compli-

fiscally irresponsible to create long-term programs without ance Task Force working to prosecute black market tobacco

a long-term revenue source. sales in the state, legislators have shown less commitment to

funding the state’s Tobacco Prevention and Education Pro-

gram. Programs designed to reduce tobacco use, initiated in

Better Approaches to 1996, receive only a small fraction of the tax revenues voters

Tobacco and Health Issues approved for this purpose. Instead, as Measure 50 illus-

trates, tobacco tax revenues—and smokers’ pockets—have

Increasing cigarette prices alone is not an effective strat- proved an easy target for lawmakers simply trying to grow

egy to reduce smoking. Teenagers are thought to be the most the state budget.

price-sensitive cohort, but teen smoking is higher in western There are better ways to address Oregon’s health needs.

Europe than in the United States, despite generally higher n Recognize that expanding services requires growing

tobacco prices there, and in June the United States Congres- revenue sources. If Oregonians want to expand health

sional Research Service reported that “recent studies raise coverage and other statewide services, the state legisla-

some questions about the effectiveness of tax increases on ture should seek revenue sources that are balanced and

teenage smoking.” Overall, tobacco prices were found to have sustainable.

a weak or insignificant affect on teen smoking, and the report

n Increase opportunities for private health coverage. It is

concluded that “stricter regulations on sales to teenagers,

possible to increase health coverage without expanding

counseling, education, and assistance with smoking cessa-

state services. Health Savings Accounts (HSAs) are an

tion might be more effective.”26 Minors in Oregon already

option that would do just that. Simply defined, HSAs

purchase their tobacco products illegally, and as discussed

incorporate a tax-free savings account with a high-

earlier, there’s good reason to believe that unregulated black

deductible health insurance plan.

market sales will increase under the proposed tax.

n Make health services and insurance coverage more

Rising tobacco taxes are increasingly ineffective at curbing affordable. A major goal of HSAs is to give enrollees

adult tobacco use. incentives use their health dollars wisely and force

Rising tobacco taxes are increasingly ineffective at health service providers to compete for those dollars.

curbing adult tobacco use as well. Nationwide, people in the The current situation—including employer mandates,

lowest income brackets smoke at the highest rates—despite ever-expanding government subsidies and the limited

regressive taxes such as the one proposed for Oregon. This number of insurance providers—does just the opposite,

fall, researchers at the University of California at Davis by reducing competition. It also fails to ensure that

reported that national data on cigarette prices and smoking smokers don’t pass the costs of their habits on to others.

rates indicate that the minority of adults who continue to Those who are concerned about the effects of pooling

smoke are effectively insensitive to price increases, possi- smokers’ and non-smokers’ health care costs in pro-

bly because of addiction, and they do not respond to higher grams such as Medicaid and group life insurance should

cigarette taxes with a lower prevalence of smoking. Even examine the regulatory changes needed to end any

after taking into consideration the statistical bias created hidden subsidies.

by cigarette tax evasion and avoidance behaviors—such as n Support smokers who want to quit. Oregonians who

switching from brand-name to generic cigarettes, purchas- smoke pay enough in tobacco taxes to provide state-

ing cigarettes in low-tax states, on American Indian res- of-the-art tobacco cessation services to everyone who

ervations, from the Internet, or on the black market—the wants to quit, but unfortunately most of that tax money

researchers concluded that the recent dramatic drop in price is spent on unrelated services. Tobacco taxes should be

responsiveness suggests that “tobacco control measures directly connected to tobacco prevention, education and

other than increases in cigarette taxes, such as programs control programs.

Reason Foundation 7 Measure 50: Oregon’s Tobacco Tax

n Minimize incentives for black market sales of cigarettes.

About the Author

A sudden, large price increase and huge disparities

between Oregon’s tax rate and surrounding states will Skaidra Smith-Heisters is a policy analyst at Reason

only exacerbate existing problems with black market Foundation, a nonprofit think tank advancing free minds

tobacco sales. By moderating Oregon’s tobacco tax rate, and free markets.

sales of tobacco won’t be forced into an unregulated Her research is part of Reason’s New Environmentalism

underground. program, launched by Lynn Scarlett, which develops inno-

n

vative solutions to environmental problems and emphasizes

Protect the Oregon Constitution. The constitution is

the benefits of local decisions over Washington’s command-

meant to guard the rights of Oregon citizens. State

and-control regulations.

legislators and interest groups should follow the provi-

Smith-Heisters is a graduate of the University of Cali-

sions of the current constitution whenever they seek to

fornia at Davis program in Nature and Culture. Prior to

approve new taxes.

joining Reason, she worked in environmental science and

Measure 50 takes the unprecedented step of inserting a natural resources planning with the California State Parks

new tax into the Constitution of Oregon. system.

Conclusion

Appendix: Allocation Schedule

Measure 50 aims to create revenue for a wide variety of

health programs through heavy taxation of a small minor-

for Oregon Tobacco Taxes

ity. Further, the measure takes the unprecedented step of under Measure 50

inserting a new tax into the Constitution of Oregon—cir-

cumventing the constitutional provision that requires a Constitutional Tax increase 84.5 cents dedicated to:

three-fifths vote of the state legislature to author new taxes. n Healthy Kids (72.34% for 07–09) (68.47% for 09–11).

This dramatic tax increase would likely still be incorpo- n Kids Safety Net (3.04% for 07–09) (2.88% for 09–11).

rated into the Oregon Constitution long after the revenue n Rural Health (1.16% for 07–09) (1.10% for 09–11).

it generates is no longer sufficient to sustain the new and n TURA (4.918% for 07–09) (10% for 09–11).

expanded programs the measure is intended to fund. n Heath Plan (OHP) (18.54% for 07–09) (17.55% for 09–11).

In the mid- to long-term, the two goals of Measure

50—reducing tobacco use and funding health programs— Other Tobacco Products (OTP) increase (30% of wholesale

are completely incompatible. If the tax succeeded in reduc- price) dedicated to:

ing tobacco use, the funding for dependent health programs n TURA (55.4% for 07–09) (43.0% for 09–11).

would also be diminished. On the other hand, if Measure n Heath Plan (OHP) (44.6% for 07–09) (57% for 09–11).

50 did not substantially reduce tobacco use—because the

The current tax in two pieces 58 cents and 60 cents, com-

fraction of revenue dedicated to tobacco control, preven-

bined as $1.18 tax and distributed as:

tion, and cessation is too small, because consumers adjust

n First (hold harmless) General Fund (GF) 21.69%

their buying habits instead of their smoking habits, or other

n Cities 2.3 %

factors—additional health subsidies might be needed. At

the same time, Measure 50 will increase incentives for tax n Counties 2.3 %

evasion and the costs associated with black market tobacco n ODOT (Senior and Disabled Transportation) 2.3 %

sales. n What is left (after hold harmless) then goes to OHP (71.41%)

The good news is that Oregonians are smoking less and

OTP the original 65% of wholesale price to fill gaps:

health coverage is improving. There are plenty of sensible

n General Fund (78.7%)

options that don’t include re-writing the constitution to

n Oregon Heath Plan (21.3%)

make sure Oregon’s progress on these issues continues into

the future. (From Oregon Legislative Revenue Office, Revenue Measures

Passed by the 74th Legislature 2007, p. 77.)

Measure 50: Oregon’s Tobacco Tax

8 Reason Foundation

Endnotes 11. If taken as a percentage of total state tobacco rev-

enues, including estimated Master Settlement Agreement

1. Federation of Tax Administrators, State Excise Tax payments, the projected funding for the Tobacco Use Reduc-

Rates on Cigarettes, www.taxadmin.org/fta/rate/cigarett. tion Account (TURA) appears to be closer to 3 or 4 percent

html, January 1, 2007. of tobacco revenues.

2. Mike Dahlin and Stacey Schubert, Oregon Department 12. Frank A. Sloan et al., The Price of Smoking (Cam-

of Human Services, Health Services, Tobacco Prevention and bridge, MA: MIT Press, 2004). See also W. Kip Viscusi,

Education Program, Oregon Tobacco Facts, www.oregon. “Tobacco Taxes,” in The Encyclopedia of Taxation and Tax

gov/DHS/ph/tobacco/docs/facts05.pdf, June 2006, p. 8. Policy, ed. Joseph J. Cordes, Robert D. Ebel, and Jane G.

3. Mike Dahlin and Stacey Schubert, Oregon Tobacco Gravelle (Washington, D.C.: Urban Institute, 2005).

Facts, p. 2. 13. Jane G. Gravelle, U.S. Congressional Research Ser-

4. Urban Institute and Kaiser Commission on Medicaid vice, The Cigarette Tax Increase to Finance SCHIP (Wash-

and the Uninsured, Oregon: Health Insurance Coverage ington D.C., June 19, 2007), p. 2.

of Children 0-18, states (2004-2005), U.S. (2005), www. 14. For a more in-depth discussion of this, see Tax Foun-

statehealthfacts.org/profileind.jsp?ind=127&cat=3&rgn=39. dation, “Options for Funding SCHIP Expansion: Cigarette

Most of those who are currently uninsured already qualify Taxes Least Defensible Alternative,” Fiscal Facts, www.tax-

for existing programs according to the Healthy Kids Plan, foundation.org/publications/show/22476.html, July 13, 2007.

governor.oregon.gov/Gov/sos2006/kids.pdf 15. Oregon Department of Human Services, Health

5. Oregon Legislative Revenue Office, Revenue Mea- Services, Tobacco Prevention and Education Program, Eco-

sures Passed by the 74th Legislature 2007 (Salem, OR, nomically disadvantaged Fact Sheet–2007, www.oregon.

September 2007), pp. 75–77. gov/DHS/ph/tobacco/2007_Pop_Fact_Sheets/Economi-

6. Oregon Secretary of State, Elections Division, callyDisadvantaged.pdf, p. 1.

November 6, 2007, Special Election, Measure 50; Explana- 16. Oregon Department of Justice, Criminal Justice

tory Statement, www.sos.state.or.us/elections/nov62007/ Division, Organized Crime in Oregon (Salem OR, August

military_vp/m50_es.pdf, July 12, 2007. 2006), pp. 21, 28.

7. Oregon Secretary of State, Elections Division, 74th 17. Stephanie Soden, Oregon Department of Justice,

Oregon Legislative Assembly–2007 Regular Session, “Oregon Tobacco Tax Compliance Task Force Secures 2 Con-

Senate Joint Resolution 4, www.sos.state.or.us/elections/ victions,” www.doj.state.or.us/releases/2006/rel103006.

nov62007/military_vp/m50_text.pdf. shtml, October 27, 2006.

8. Governor Ted Kulongoski, The Governor’s Hope and 18. Kevin Neely, Oregon Department of Justice,

Opportunity Budget 2007–2009 (Salem, OR ), p. 4. “Tobacco Task Force Arrest Owners of Sunrise Whole-

9. Oregon Department of Human Services, Health Ser- sale For Tobacco Tax Evasion,” www.oregon.gov/OSP/

vices, Tobacco Prevention and Education Program, Oregon NEWSRL/news/05_05_2005_sunrisewholesale.shtml, May

Statewide Tobacco Control Plan 2005–2010, www.oregon. 5, 2005.

gov/DHS/ph/tobacco/docs/stateplan05-10.pdf, p. 5. 19. Stephanie Soden, Oregon Department of Justice,

10. Oregon Department of Human Services, Health Ser- “Tobacco Tax Violator Sentenced to Prison,” www.doj.state.

vices, Tobacco Prevention and Education Program, 2003– or.us/releases/2007/rel062907c.shtml, June 29, 2007.

2005 Tobacco Prevention & Education Program Report, 20. See, for example, Oregon Department of Justice,

www.oregon.gov/DHS/ph/tobacco/ar03-05.shtml, February “Farzad Larki Convicted of Tobacco Tax Law Violations,”

2005. Measure 44 promised to allocate 10 percent of taxes May 8, 2007; “Tobacco Tax Evader Nguyen Convicted,”

generated, or $8 million per year, for programs designed to April 23, 2007; “13 Indicted for Smuggling & Distribution

reduce cigarette and tobacco use, but the Tobacco Preven- of Untaxed Tobacco Products,” March 1, 2007; “Ex-Mayor

tion and Education Program received only $3.45 million per of Mill City Bill Downer Convicted of Violations of State

year in the 2003–05 biennium. Tobacco Tax Laws,” July 15, 2005.

Reason Foundation 9 Measure 50: Oregon’s Tobacco Tax

21. U.S. Bureau of Alcohol, Tobacco, Firearms and

Explosives, 2005 Annual Report, www.atf.gov/pub/gen_ REASON FOUNDATION’s mis-

pub/2005annual_report.pdf, p. 32. sion is to advance a free society by

22. Oregon Department of Human Services, Center for developing, applying, and promot-

Health Statistics, 2006 Behavioral Risk Factor Surveillance ing libertarian principles, including

System Survey: Tobacco Use, www.dhs.state.or.us/dhs/ph/ individual liberty, free markets, and

chs/brfs/06/tobacco.pdf, pp. 26–28. the rule of law. We use journalism and

23. Washington State Liquor Control Board, “Tobacco public policy research to influence the

Tax Enforcement in Washington State,” www.liq.wa.gov/ frameworks and actions of policymak-

tobacco/tobacco.asp. The Web site states, “[l]oss of revenue ers, journalists, and opinion leaders.

occurs through illegal purchases of tobacco. Sixty percent

of revenue loss is believed to be from Indian smoke shops. For more information on Reason Foundation and our

Twenty percent of the revenue loss is from military sales related research, please contact the appropriate Reason

and another 20% percent from casual smugglers who bring staff member:

in cigarettes from out of state.” Annual questionnaires by

the Washington State Department of Health as part of the Government Officials

Behavioral Risk Factor Surveillance System corroborate

these figures, with a quarter of smokers commonly report- Mike Flynn

ing having purchased non-taxed tobacco products within Director of Government Affairs

the last 30 days. See also Stephen D. Smith and Van Huynh, (202) 427-2127

Washington State Department of Revenue, Washington Mike.Flynn@Reason.org

State Cigarette Consumption Revisited, dor.wa.gov/docs/

reports/CigStudyJan11_2007.pdf, January 2007. Media

24. Victoria Wallack, “Cigarette taxes lag, sending

Chris Mitchell

revenues up in smoke,” The Times Record, September 19,

Director of Communications

2007. Additionally, in the Behavioral Risk Factor Surveil-

(310) 367-6109

lance System (BRFSS) survey for 2006, 17 percent of respon-

Chris.Mitchell@Reason.org

dents admitted to having bought cigarettes out of state, on a

military base or Indian reservation in the past month. Data

Policy

for Internet purchases was not available. Kip Neale, Maine

BRFSS Coordinator, Augusta, Maine, personal communica-

Skaidra Smith-Heisters

tion, September 21, 2007.

Policy Analyst

25. Oregon Department of Justice, Organized Crime in (707) 321-1249

Oregon, p. 28. skaidra@Reason.org

26. Jane G. Gravelle, U.S. Congressional Research Ser-

vice, p. 5. At the same time, the Campaign for Tobacco-Free Reason’s research and commentary is available online at

Kids reports that Oregon ranks 33rd in the nation in spend- www.reason.org/.

ing on tobacco prevention, spending only 1.1 percent of state

tobacco revenue on tobacco prevention programs (Campaign

for Tobacco-Free Kids, State Tobacco-Prevention Spending

vs. State Tobacco Revenues, tobaccofreekids.org/reports/

settlements/2007/spendingrevenues.pdf, December 2006.)

27. Peter Franks et al., “Cigarette Prices, Smoking, and

the Poor: Implications of Recent Trends,” American Journal

of Public Health, vol. 97, no. 10 (October 2007), pp. 1–5.

Measure 50: Oregon’s Tobacco Tax

10 Reason Foundation

Você também pode gostar

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Distinguishing Fact From OpinionDocumento12 páginasDistinguishing Fact From OpinionParlindungan Pardede100% (2)

- Science-9 q1 w2 Mod2 AdmDocumento36 páginasScience-9 q1 w2 Mod2 AdmMA MERCEDES POSADAS100% (3)

- SWOT Analysis of Pakistan Tobbaco Company (PTC)Documento3 páginasSWOT Analysis of Pakistan Tobbaco Company (PTC)Jawad Ahmed57% (7)

- ManuscriptDocumento36 páginasManuscriptJasmine AgustinAinda não há avaliações

- Convenience Stores AnalysisDocumento8 páginasConvenience Stores AnalysisPedro ViegasAinda não há avaliações

- Iloilo City Tax OrdinanceDocumento168 páginasIloilo City Tax OrdinanceRichard Delos ReyesAinda não há avaliações

- How Smoking Affects Our Health Reading Comprehensi Reading Comprehension Exercises 80448Documento3 páginasHow Smoking Affects Our Health Reading Comprehensi Reading Comprehension Exercises 80448YusniAinda não há avaliações

- A Complete Course in 'Noesitherapy'Documento23 páginasA Complete Course in 'Noesitherapy'Alex William Smith100% (1)

- af5a2b0939b617d9604f31765df4f0bfDocumento23 páginasaf5a2b0939b617d9604f31765df4f0bfreasonorgAinda não há avaliações

- 87189798b5d1d8ce1be8fb811a21a3d0Documento38 páginas87189798b5d1d8ce1be8fb811a21a3d0reasonorgAinda não há avaliações

- 6196f532a4d75327fb15c8a9785edcebDocumento6 páginas6196f532a4d75327fb15c8a9785edcebreasonorgAinda não há avaliações

- d834fab5860d5cf4b3949fecf86d3328Documento49 páginasd834fab5860d5cf4b3949fecf86d3328reasonorgAinda não há avaliações

- 623f73ae14a6925cdaaedeb38c210404Documento8 páginas623f73ae14a6925cdaaedeb38c210404reasonorgAinda não há avaliações

- 16 A R P S H S (1984-2005) : TH Nnual Eport On The Erformance of Tate Ighway YstemsDocumento51 páginas16 A R P S H S (1984-2005) : TH Nnual Eport On The Erformance of Tate Ighway YstemsreasonorgAinda não há avaliações

- 7227d934ecfa04d5db576c126f0385a6Documento53 páginas7227d934ecfa04d5db576c126f0385a6reasonorgAinda não há avaliações

- D A: I T T: Ensity in Tlanta Mplications For Raffic and RansitDocumento6 páginasD A: I T T: Ensity in Tlanta Mplications For Raffic and RansitreasonorgAinda não há avaliações

- W M M P L: Hy Obility Atters To Ersonal IfeDocumento34 páginasW M M P L: Hy Obility Atters To Ersonal IfereasonorgAinda não há avaliações

- c1e3962b90998a26fe9e1cf3a939a264Documento8 páginasc1e3962b90998a26fe9e1cf3a939a264reasonorgAinda não há avaliações

- Leasing The Pennsylvania Turnpike: A Response To Critics of Gov. Rendell's PlanDocumento19 páginasLeasing The Pennsylvania Turnpike: A Response To Critics of Gov. Rendell's PlanreasonorgAinda não há avaliações

- f4b3060c451c35f004519f3971d05fb3Documento13 páginasf4b3060c451c35f004519f3971d05fb3reasonorgAinda não há avaliações

- M T T: P F S: Iami Oll Ruckway Reliminary Easibility TudyDocumento42 páginasM T T: P F S: Iami Oll Ruckway Reliminary Easibility TudyreasonorgAinda não há avaliações

- db38316bd23c0beef9d021a9fd7af1eaDocumento77 páginasdb38316bd23c0beef9d021a9fd7af1eareasonorgAinda não há avaliações

- O L: R S E A: Ccupational Icensing Anking The Tates and Xploring LternativesDocumento58 páginasO L: R S E A: Ccupational Icensing Anking The Tates and Xploring LternativesreasonorgAinda não há avaliações

- 5b1a53503729a50cbca6d5047efce846Documento10 páginas5b1a53503729a50cbca6d5047efce846reasonorgAinda não há avaliações

- Federal Interference in State Highway Public-Private Partnerships Is UnwarrantedDocumento2 páginasFederal Interference in State Highway Public-Private Partnerships Is UnwarrantedreasonorgAinda não há avaliações

- 59f2e045a676b9c69bb9139b2c217bf3Documento2 páginas59f2e045a676b9c69bb9139b2c217bf3reasonorgAinda não há avaliações

- 8a00bd89cb4421e0c9351b8be7e1b8cbDocumento4 páginas8a00bd89cb4421e0c9351b8be7e1b8cbreasonorgAinda não há avaliações

- T U N R Faa' A T C S: He Rgent Eed To Eform The S Ir Raffic Ontrol YstemDocumento38 páginasT U N R Faa' A T C S: He Rgent Eed To Eform The S Ir Raffic Ontrol YstemreasonorgAinda não há avaliações

- d40314fbefcf4e491538f1d6613103e5Documento11 páginasd40314fbefcf4e491538f1d6613103e5reasonorgAinda não há avaliações

- 07cd869c63c4e54c544786e1ec8935eeDocumento5 páginas07cd869c63c4e54c544786e1ec8935eereasonorgAinda não há avaliações

- e9f414aa6feb85192849cbfc177dcecdDocumento43 páginase9f414aa6feb85192849cbfc177dcecdreasonorgAinda não há avaliações

- E A P W: Vidence That Irport Ricing OrksDocumento9 páginasE A P W: Vidence That Irport Ricing OrksreasonorgAinda não há avaliações

- bec884a9b25a2e4c07228fec28eb1972Documento78 páginasbec884a9b25a2e4c07228fec28eb1972reasonorgAinda não há avaliações

- Other Protected Species: Federal Law and Regulation. BNA Books: Washington, D.CDocumento9 páginasOther Protected Species: Federal Law and Regulation. BNA Books: Washington, D.Creasonorg100% (1)

- U R A P: Sing The Evenues From Irport RicingDocumento12 páginasU R A P: Sing The Evenues From Irport RicingreasonorgAinda não há avaliações

- 4ff6a1b3981fcee5a7864ff6eb3dab12Documento167 páginas4ff6a1b3981fcee5a7864ff6eb3dab12reasonorgAinda não há avaliações

- Edited by Geoffrey F. SegalDocumento81 páginasEdited by Geoffrey F. SegalreasonorgAinda não há avaliações

- A24 Tobacco Cigars Cigarettes Smokers' Requisites: XXXX A24B A24B XXXXDocumento5 páginasA24 Tobacco Cigars Cigarettes Smokers' Requisites: XXXX A24B A24B XXXXIzut HutaurukAinda não há avaliações

- MAPEH 9 Health 2nd QuarterDocumento85 páginasMAPEH 9 Health 2nd QuarterPrincess Wishel DinawanaoAinda não há avaliações

- Analytical Exposition AifaDocumento2 páginasAnalytical Exposition Aifaangel margatrehaAinda não há avaliações

- October 16th, 2013 IssueDocumento12 páginasOctober 16th, 2013 IssueMaple Lake MessengerAinda não há avaliações

- LKPD 3.4 Exercise NEWS ITEM PAULUS ADITYADocumento6 páginasLKPD 3.4 Exercise NEWS ITEM PAULUS ADITYAAndi Pondang FajarAinda não há avaliações

- Collection of 101 Scathing Humor ColumnsDocumento215 páginasCollection of 101 Scathing Humor ColumnssbmemonAinda não há avaliações

- Revised Nurul Islam Vs Bangladesh GovDocumento3 páginasRevised Nurul Islam Vs Bangladesh GovNafisaRafaAinda não há avaliações

- Class 12 Bio Project 2.0Documento23 páginasClass 12 Bio Project 2.0Yousuf SiddiquiAinda não há avaliações

- Electronic Cigarettes Information Health Care Workers Oct16v2Documento5 páginasElectronic Cigarettes Information Health Care Workers Oct16v2Akash DasAinda não há avaliações

- Project MridulDocumento20 páginasProject MriduldhawalAinda não há avaliações

- Reading - Passage - The Risks of Cigarette SmokeDocumento6 páginasReading - Passage - The Risks of Cigarette SmokeSusmita BiswasAinda não há avaliações

- упражненияDocumento13 páginasупражненияDaiana SokrutAinda não há avaliações

- Case Study 2Documento18 páginasCase Study 2John Ermond Gentica Jacobo75% (4)

- Engl201 Book 1Documento340 páginasEngl201 Book 1Farm EnglandAinda não há avaliações

- Full Download Dynamic Business Law The Essentials 4th Edition Kubasek Solutions ManualDocumento35 páginasFull Download Dynamic Business Law The Essentials 4th Edition Kubasek Solutions Manualyriskriger9100% (25)

- Why people start and continue smoking cigarettesDocumento7 páginasWhy people start and continue smoking cigarettesJaypee CabinganAinda não há avaliações

- Questionnaire of Smoking UrgesDocumento6 páginasQuestionnaire of Smoking UrgesJuan E. SarmientoAinda não há avaliações

- Nineteenth World Congress: Virtual 2-6 JulyDocumento41 páginasNineteenth World Congress: Virtual 2-6 Julytriaji safarinaAinda não há avaliações

- (darsenglizy.com موقع درس انجليزي) امتحان التابلت 2 ثانوي الفترة المسائيةDocumento2 páginas(darsenglizy.com موقع درس انجليزي) امتحان التابلت 2 ثانوي الفترة المسائيةsherifgouda197Ainda não há avaliações

- Bio ProjectDocumento68 páginasBio ProjectShalini Jain100% (1)

- ACR On MAES SELGDocumento29 páginasACR On MAES SELGGemma Lyn Dungo SungaAinda não há avaliações

- Georgia State University study analyzes youth vaping epidemicDocumento50 páginasGeorgia State University study analyzes youth vaping epidemicLovely Keate Malijana100% (1)