Escolar Documentos

Profissional Documentos

Cultura Documentos

PRINTED - Mahoney SecReg Fall 2013

Enviado por

Erin JacksonTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

PRINTED - Mahoney SecReg Fall 2013

Enviado por

Erin JacksonDireitos autorais:

Formatos disponíveis

1

SECURITIES REGULATION

FALL 2013

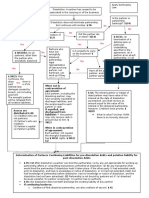

All transactions have to be registered (I) or exempted (II).

I. Public Offering Process

1. Gun jumping = violation of 5

a. Selling unregistered securities that are not exempted

b. Making an offer before filing RS.

c. Sell securities before effectiveness

d. Prospectus not in conformity with R433 conditions

e. Send prospectus (written solicitation) w/o accompanying PP

f. Didnt deliver securities

2. Prefiling Period 5(c)

a. Forms: S-1 for IPO and S-3 for reporting issuers

i. S-3 vs. S-1 registration:

1) Most info about the issuer incorporated by references to past and future periodic

reports;

2) SEC does not review all S-3 RS (only auditing them).

ii. S-3 Reporting companies eligibility

1) Registrant:

a) a reporting company for 12 months that are

b) current in reports.

2) Transaction:

a) Any cash primary offerings by an issuer with a public float (common

equity held by non-affiliates) of $75 million or more;

b) Primary debt offerings if having issued $1 billion debts in the past 60 days

or

c) Having outstanding debt securities worth $750 million

iii. WKSI = S-3 issuers with a public float of $700 million. Rule 405

b. Regulations: Reg S-K for non-financial info, S-X for financial info.

i. Reg S-K Item 10(b): Forward-looking statements are encouraged and shielded from

fraud claims if made with good faith and reasonable basis and presented in proper

format (i.e., avoiding half-truths)..

ii. Reg S-K Item 303:MD&A! risk analysis: discussing liquidity, capital resources, results

of operations, OBS arrangements/risks and tabular disclosure of contractual

obligations covering full fiscal years and discussing material changes in financial

condition and results of operations in quarterly reports.

c. IPO: No offer to sell or offer to buy any security in the prefiling period. 5(c)

i. 4(a)(1) exempts everyone except an issuer, UW, or dealer.

ii. Offer includes 2(a)(3)

1) Solicitation: preliminary negotiation/agreement.

a) Anything thats designed to interest investors in a particular security:

any attempt = offer

b) Conditioning the market: Any type of information promoting the

company when the company is considering IPO could potentially be

deemed as an offer. SEC Release 3844 (p.156, 1957)

2

c) Trying to balance restriction on releasing information to the public vs.

companys need to continue business as usual.

2) Research reports by offering participants (unless theyve been publishing the

same kind regularly).

a) EXCEPTION: can public research reports for EGC. 2(a)(3)

iii. EXCEPTIONS of offer

1) 5(d): EGC can solicit institutional investors freely before filing RS.

a) BUT has to take steps to prevent the information being distributed to retail

investors (cover letter, etc.).

i) 2(a)(19): EGC = annual gross revenue < $1B. Can remain as EGC for

5 years.

b) 6(e): an EGC prior to IPO may confidentially submit a draft of RS for

non-public review.

i) YuMe: Wanted to find out what SEC thinks of the adjusted EBITDA

number.

2) 2(a)(3) UWs communication: preliminary negotiations or agreement between

an issuer and any UW OR among UW.

a) Does NOT include dealers. ! Can start assembly UW syndicate, but NOT

dealer group.

3) Rule 135 Notice of offering: issuer can make a public statement to state the

fact that it plans to sell securities:

a) The notice can only contain very limited information.

i) Type, amount, anticipated timing of securities.

ii) Can NOT name UW

iii) Can NOT contain pricing info.

b) Exclusive safe harbor rule: have to obey

4) Rule 163A 30 day communication: Communications that

a) Do NOT reference the offering

b) Take place > 30 days before filing.

c) Made by or on behalf of the issuer AND

i) R163A(c): can NOT be made by an offering participant such as

UW.

d) The issuer takes reasonably steps to prevent further distribution or

publication within the 30 day period.

5) Rule 169: Regularly released factual business information by non-

reporting issuer is exempted if

a) 169(3)(b): Its

i) Factual information about the issuer, its business or financial

developments or other aspects of its business OR

ii) Advertisements about the issuer's services or products.

b) 169(3)(d)(1) The issuer has previously released or disseminated this type

of information in ordinary course of business

c) 169(3)(d)(2): The timing, manner and form have to be consistent with past

practice.

i) If you use to advertise in the local area, dont start doing it nationally

d) 169(3)(d)(3): The information is for intended use by persons

OTHER THAN in their capacities as (potential) investors.

e) Non-exclusive safe harbor rule: if you dont obey, doesnt mean you

violated the statute.

d. WKSI is exempt from 5(c)

i. Rule 163 They can engage in solicitation activity even before filing RS.

3

1) BUT any written solicitation that they engage in constitutes a FWP ! has to:

a) R163(b)(1) Contain a legend informing investors about availability of RS in

the future.

b) R163(b)(2) Be Filed after filing RS

c) 2(a)(10)(a) Accompanied or preceded by a FP after effectiveness.

ii. Rule 168 Can publish factual-business information (R169 for IPO) AND forward-

looking information.

1) FW-looking information: forecasts or discussions of future business plans.

2) Extends to other reporting issuers too BUT can NOT reference the offering.

3. Waiting Period 5(a), (b)(1)

a. 5(a) No sale or carrying of security for sale before effectiveness.

i. Effective date of registration is 20th day after filing OR earlier if SEC is okay with

that (accelerate). 8(a).

b. 5(b)(1) No prospectus EXCEPT prospectus permitted under 10.

i. Prospectus = any written offer or offer by radio or TV 2(a)(10)

1) Offer = any solicitation 2(a)(3). Very broad.

ii. EXAM Alert!: If its not an offer " NOT a prospectus

1) R135: Notice of offering: not an offer

2) R163A 30 day communication

3) R169: Regularly released business factual information: not an offer

c. Communication allowed:

i. Oral communication. See 2(a)(10), 5(b)(1)

1) BUT written is interpreted broadly to include all electronic media except for

real-time communication to a live audience. Rule 405 "Graphic

Communication"

ii. 2(a)(10) Exemptions: exempts communication with respect to a security if

1) 2(a)(10)(b) Tombstone ad (p.166): communication states from whom a written

prospectus (meeting the requirements of 10) may be obtained, and only ID the

security, state the price, and state by whom orders will be executed.

2) Rule 134 Identifying statements:

a) Permissible info:

i) Information on the mechanics of the offering and basic business

information may be provided.

ii) Rule 134(d): can send out written communication to any investor

asking to express interest by completing a card or form = book

building

1. Must be accompanied or preceded by PP

2. Must contain statement that no offer to buy can be accepted and

that no payment can be received until registration statement is

effective

3. Have to inform customer that offer can be withdrawn anytime

before acceptance is given

b) Legend: make available the effective RS

c) Not useful tool if company is not already well-known

iii. Rule 430 Preliminary prospectus: statutory prospectus w/o pricing/UW-related

information is allowed under 10(b).

1) Need to be filed with SEC but not deemed not part of the RS.

2) Any prospectus with substantive changes from the filed prospectus need to be

filed at the same time of the first use under Rule 424(a).

4

iv. Rule 431 Summary prospectus:

1) Issuer must be reporting company for 36 months

2) Contents of summary prospectus are set forth in the end of Form S-1.

v. Rule 164 FWP meeting Rule 433 conditions.

1) Rule 163 WKSI can issue FWP (written communication) anytime BUT has to

a) Contains a legend informing investors about availability of RS in the future.

R163(b)(1)

b) File the FWP after filing RS R163(b)(2)

c) Accompany or precede FWP by a FP after effectiveness. 2(a)(10)(a).

2) Rule 164(a): FWP complies with 10(b) (and therefore 5(b)(1)) as long as it

satisfies Rule 433 conditions:

a) Has to contain a legend notifying where RS is available. R433(c)(2)(i)

b) Filing conditions:

i) Rule 433(d)(1)(i): Issuer has to file (1) issuer fwp; (2) issuer

information in fwp used by other offering participant; (3) description of

final terms.

1. Any supplementary material describing final terms must be filed

by issuer within 2 days, even if issuer did not prepare this

information BUT issuers and offering participants have to retain

any free writing prospectuses for 3 years

ii) Rule 433(d)(1)(ii): Offering participant has to file any fwp distributed

in a manner "reasonably designed to lead to its broad unrestricted

dissemination"

1. E.g., underwriter's internal briefings if broadly disseminated to

clients

iii) Bona fide electronic road show exception: one version made available

to any person (if not entirely oral and thus not a prospectus at all).

iv) Other exceptions: (1) no material change from previously filed fwp; (2)

issuer info filing obligation is not applicable if the info is in previously

filed fwps.

c) Needs to be accompanied or preceded by the most recently filed PP

containing a price range. Rule 433(b)(2)

i) Requirement for unseasoned/non-reporting issuers only.

ii) Silent filing is not going to have price range " have to wait for SEC

comments

iii) Delivery: Can physically hand it over OR send a hyperlink to the most

recent preliminary prospectus.

iv) Information: can contain information beyond RS BUT can NOT

conflict with RS or any reports incorporated in the RS

3) Special types of FWP

a) Road show

i) Rule 433(d)(8): if deemed a graphic communication, then road show

is a form of FWP

1. Rule 405: Graphic communication does NOT include

transmission of real-time presentation to a live audience that

does not originate from a recorded form " NOT FWP

a. Includes PPT presentations

2. FWP Include:

a. Written communications (including ones used in road show)?

b. Broadcast that is NOT in real-time

ii) Requirements for FWP

5

1. Must include legend + accompany w/ PP

2. There is NO filing requirement if by

a. A reporting company

b. a non-reporting company issuing non-equity securities

c. Bona-fide electronic road show available to public

b) Info or hyperlink from an issuer's website

i) Rule 433(e): linked information is an offer " FWP subject to the filing

requirements of Rule 433(d)

ii) Rule 433(e)(2): historical information about issuer that is identified

and appears in separate section is not considered to be an offering of

security " exempted

1. P.4-31 (p.188): its okay to be prepared by a brokerage company

but its pushing the boundary of what constitutes historical issuer

information

c) Media publication:

i) Rule 433(f): 3

rd

party "independent" (unpaid) communication based

on issuer provided info: the issuer or other offering participant does

NOT have to deliver statutory prospectus, only have to file copy of

story w/in 4 business days after becoming aware of the publication.

ii) BUT the issuer or those acting on its behalf have a FWP subject to Rule

433 if they prepare, pay, or give consideration for preparation of

communication in media

d. Research Reports by UW

i. Research Reports: creation and dissemination of financial/investment information in

securities markets

1) Participant in distribution is not defined

a) Covers issuer, underwriters, members of selling group

b) Does not cover brokers who receive compensation from customers and not

underwriter

ii. 2(a)(3): Research report about an EGC deemed NOT to constitute an offer

! Not a prospectus ! Does NOT have to file

1) Prob 4-17 (p.173): okay if Omega is an EGC.

iii. IPO: the only way is through FWP R433

1) Has to accompany w/ a PP that has a price range.

2) Has to contain a legend

3) Filing requirement: R433(d)(1)(ii): Has to file if its used for broad

unrestricted dissemination (because its by UW not issuer)

a) Prob 4-17 (p.173): Not an issuer FWP. The UW will send it to other dealers,

etc. ! probably safer to file.

4) Once its effective, can always send out any information as long as

accompany/precede w/ a FP. 2(a)(10)(A).

iv. Rule 137: nonparticipating dealers can publish or distribute research reports

1) Does NOT apply if broker or dealer receives compensation or has special

arrangement with issuer, selling security holder, or any participant in

distribution for that research report

2) Applies to all issuers

v. Rule 138: All UW & dealer may publish opinions or recommendations for the type of

securities NOT issued.

1) Reporting issuers only: No IPO

2) Exmpl: UW working on distribution of non-convertible preferred stock/debt

security can publish about the issuers common stock and vice versa.

6

3) Rationale: little danger of creating investor interest in a senior non-convertible

security by promoting common stock

4) Condition: broker/dealer must have previously published or distributed in regular

course of business, research reports on similar types of securities

vi. Rule 139: broker or dealer (whether or not participating) can publish opinions and

recommendations focused solely on the issuer or the industry

1) Reporting issuers only: No IPO

2) Issuer-specific reports:

a) S-3 eligible reporting issuers only.

b) Broker/dealer must have previously distributed or published a report in

the regular course of business that does not represent the initiation or re-

initiation after discontinuance of a report about issuer

3) Extends to industry reports

a) Must contain similar information with respect to substantial number of

other issuers in issuers industry OR include comprehensive list of

securities currently recommended by broker/dealer

b) Issuer cannot be given greater prominence in publication of industry

reports analysis

c) Report must be issued in regular course of business

4. Post effective Period 5(b)

a. Getting ready for post-effectiveness: once amend PP, can request for acceleration.

i. R460: can grant acceleration request if there was sufficient circulation of preliminary

prospectus (after filing and before effective) among underwriters and dealers AND

there was adequacy of information

ii. R461: can grant if prospectus was reasonably concise and readable

b. 5(b)(1): written communications would have to be accompanied by final prospectus

i. BUT R172(a)(1): Confirmations of sales containing info limited to Rule 10b-10 can

be sent W/O FP;

1) BUT R15c2-8(b): UW have to deliver a PP to buyers at least 48 hours before

sending confirmation of sale.

ii. 2(a)(10)(A): any communication accompanied or preceded by a FP is NOT

prospectus:

1) Can send anything they want w/o satisfying FWP requirements (filing, legend) as

long as they send FP.

c. How to get an effective RS w/o pricing the deal

i. Rule 430A SEC permits offering price-related info to be omitted from the final

amend to RS if a later Rule 424(b) filing is undertaken

1) Made to deal with UW' concern about committing to a price before making sure a

deal could done (i.e., getting an effective RS).

ii. Rule 424(b): FP (with Rule 430A info) must be filed by the EARLIER of

1) 2 business days after pricing the deal by underwriters R424(b)(1), OR.

2) 15 business days after RS effectiveness. R430A

d. 5(b)(2) FP delivery requirement: security delivered to buyers has to be accompanied or

preceded by FP

i. Alternative methods to really delivering a final prospectus

1) Rule 172(b) Access equals delivery: Filing FP = delivered.

2) BUT Rule 173: Should send FP or give a notice of registration to the purchaser

within 2 business days of the sale. ! Could violate 5 if doesnt satisfy the

conditions but can still enjoy R172 exemption.

7

ii. How long does the delivery obligation last?

1) Issuer: continuing obligation if it sells the securities directly. 4(a)(1)

2) UW: always subject to delivery req. No exemption. 4(a)(3)(C). Hypo A

a) If sold all the allotment " no longer an UW but can act as a dealer.

3) Dealer = solicit investors interest

a) If its a selected dealer (have K with UW syndicate): always subject to

delivery req until the unsold allotment is gone. 4(a)(3)(C). Hypo B.

b) Other dealers:

i) 0 days if

1. The issuer was a reporting company (R174) or

2. Has securities trading on an exchange already (R153).

ii) 25 days if its an IPO to be listed on an exchange/NASDAQ R174(d).

iii) 40 days if the issuer has made other registered offering. 4(a)(3)(B).

iv) 90 days if its an IPO not to be listed on an exchange. 4(a)(3)

c) Dealer has this obligation regardless where he got the securities.

i) Hypo E: dealer (bought from investor and sold to another investor)

still has to deliver if the transaction happened in a certain time period

ii) Hypo C&D: dealer has a delivery obligation w/in the 40 day time period,

BUT NOT afterwards b/c it doesnt qualify for the exemption..

4) Broker acting on investors behalf: exempt entirely. 4(a)(4). Hypo D Broker

[contacted the D on Investors command].

5) Investor: NO obligation. 4(a). Hypo E [Investor A selling to Dealer].

a) BUT is it an UW?

5. Shelf Registration

a. Rule 415 allows shelf registration by reporting companies

i. Permits a RS to become effective even though the prospectus it contains omits

information that is not yet known but which otherwise would be required.

1) R415(a)(1)(x): securities registered on form S-3 can be offered and sold on a

continuous or delayed basis.

ii. S-3 reporting companies may file a shelf RS for future offerings.

iii. WKSI: Shelf RS automatically becomes effective upon filing.

b. Information flow in a shelf registration and takedown

i. Rule 430B(a) Base prospectus may omit information

1) Unknown or not reasonably available to the issuer..

a) WKSI's base prospectus: may omit amounts of different specified types of

securities.

i) Can amend to add types of securities.

b) S-3 reporting issuers: identity of UW.

ii. Rule 424(b)(2) Has to file prospectus supplement within 2 business days of pricing

(and usually using it to complete the deal at the same time)

1) Must incorporate material changes from previously filed RS and material info

related to the distribution. Item 512(a) of Reg S-K.

6. Integrated disclosure

a. Reg. S-K (nonfinancial information) and Reg. S-X (accounting information) list certain

items that both 33 and 34 Act filing refer to.

7. Summary: Supp. P. 66!!!

8

II. Registration Exemptions

1. Exempted securities 3

a. What's exempt?

i. Only sec. 5 registration requirements, not anti-fraud provisions.

ii. Some 3 only exempt transactions " resales are NOT exempted.

b. Exempt securities

i. 3(a)(2): 4 categories

1) Government securities,

a) Domestic govt only.

b) US govt: Treasury

i) Nothing is required on the Treasury.

c) State & local govt: municipal securities

i) SEC regulates municipal securities by requiring broker/dealer to

obtain disclosure documents (official statement) from the issuer and

make them available on request from prospective investors. Rule 15c2-

12.

ii) Dolphin and Bradbury (p.444): an UW who uses the untrue official

statement to its customers will be at risk of liability " UW will check?

d) US/local govt sponsored entities: student loan, port authority of new York,

etc.

2) Industrial bond formally issued by state govt:

a) Interest is tax exempted but backed by a non-govt entity (airport, stadium,

etc.)

3) Bank issued or guaranteed securities:

a) In asset-backed/mortgage-backed securities, the issuer is NOT the bank, but

the SPV.

b) Includes domestic branches of foreign banks.

c) BUT securities of BHCs (who own the banks) are NOT exempt

4) Common/Collective Trust funds:

a) Bank-maintained common trust funds or

b) Collective trust funds for employee benefit.

ii. 3(a)(3): ST notes (Commercial Papers Exemption)

1) The security has to be

a) Prime quality notes,

b) The debt arises out of current transaction, or the proceeds are used in

current operations,

i) The debt usually arises out of the timing difference between selling an

asset and getting paid.

ii) Can only use the proceeds to invest in assets easily convertible

iii) In practice CP issuers rely on 4(a)(2) private placement exemption (at

least partly) to do away with "current operation" requirement altogether

(so dont have to track what the money is used for).

AND

c) < 9 months maturity

2) Manner of issuing: not ordinarily purchased by the general public

a) Among merchants/institutions.

iii. 3(a)(4): Non-profit organizations' securities.

9

iv. 3(a)(5): S&Ls and other cooperatives.

v. 3(a)(8): Insurance and annuity products: policies? (other than variable insurance

products).

vi. 3(a)(9): security exchange offer. Exempt only transactions.

c. Exempted transactions:

i. 3(b)(1): Small issuer offerings ($5 million max)

1) Reg A

a) Now allow SEC to exempt up to $50M. 3(b)(2).

2) Rules 504 and 505 of Reg D, and

3) Rule 701.

ii. No resale exemptions!

2. Exempted Primary Transactions (from issuer)

a. NOTE:

i. Only exempts certain transactions, NOT the securities forever.

ii. Only exempt 5 registration requirements, not anti-fraud provisions.

b. 4(a)(2) Private placement

i. Exempts transactions by an issuer not involving any public offering.

1) Self-executing: if you satisfy, you are exempted.

ii. Factors for public offering/distribution (p.263, 1985, Supp. 85!)

1) Number of offerees: double digits

a) NOT just purchasers

2) Number of units offered

a) The more units there are, the easier it is to break up the purchase to resell to

other people

3) Manner of offering: face to face vs. mass communication

4) Offerees sophistication: able to fend for themselves Ralston Purina (p.264,

1953) [wanted to make stock options to key employees.]

a) Issuer should carefully prequalify offerees and consider facts including

whether they

i) Can evaluate the nature/riskiness of the investments and

ii) Are represented by a financial expert.

b) Kenton Capital (p.270, broker called investors from hotel): the information

asked does NOT indicate investors are sophisticated. Need to ask for

complete information on background and experience.

5) Offerees information access that comes in various forms - equivalent to that

provided in a RS. 5th Cir. cases (p.269)

a) require

i) Insider status, Direct provision of informational circulars; OR

ii) Promise of access and realistic expectation that the offeree is going to

take advantage of the information

b) The mere fact highly sophisticated purchasers can ask and get information

might give them access to information

6) Resale limitation: so that resales do not retroactively invalidate the protection

of the 4(a)(2) exemption

a) Have to take steps to reasonably ensure that the 1st round of purchasers are

buying w/ investment intent (holding on to them): the securities need to

come to rest before being resold.

b) In practice:

10

i) Purchasers sign statements about their investment (rather than

distribution) intent

ii) Transfer restrictions are legended on the stock certificates

iii) Transfer agent of the issuer would not register any transfers unless

instructed by the company

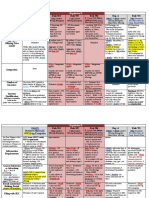

c. Regulation D (p.278, Supp. 91)

i. EXAM Alert: if doesnt satisfy Reg D, does it satisfy 4(a)(2)??

Rule 504 Rule 505 Rule 506

Aggregate offering

price p.297

# $1M sale in previous 12

mon

# $5M sale in

previous 12 mon

# No $ limit

Summary # Exempted

o If its done

exclusively under

blue sky law filing

OR

o If its done

exclusively

according to state

law exemptions from

registration only

to AI.

# Has to comply with

ALL of R502

conditions

# 2 options:

o No GS+ Allows

sophisticated non-AI

OR

o GS + Only AI (have to

verify)

Issuer Nature # Not a reporting or

investment company

# Can NOT be

investment

company. R505(a)

o Use R506(b).

# None

Integration R502(a) # Yes # Yes # Yes

# of purchaser limit

R501(e)(1)

# No # 35:

o Does NOT

include AI.

(BUT

information

disclosure!)

# 35:

o Does NOT include AI.

(BUT information

disclosure!)

Investor qualification

# Old option:

o NO unsophisticated

purchasers/rep: even

non-AI has to have

such knowledge and

experience in financial

and business matters.

R506(b)(ii)

# New option:

o Issuer has to take

reasonable steps to

verify the investors

are all AI.

R506(c)(2)(ii)

Information

disclosure R502(b)

# No # Yes for non-AI. # Yes for non-AI.

General solicitation?

R502(c)

# Allowed if offered under

state law. R504(b)

# Not allowed # Old option: Not allowed

# New option: Allowed

Resale Limitation

R502(d)

# No if offered under state

law. R504(b)

# Yes # Yes

11

ii. Key concepts

1) R501(a): Accredited investors (AI)

a) Types:

i) R501(a)(1): Institutional investors.

ii) R501(a)(3): any organization w/ assets >$5M

iii) R501(a)(4): Directors & officers ! Control + Restricted securities

iv) R501(a)(5): Individuals w/net worth > $1M.

1. (a)(5)(i)(A): BUT primary residence is NOT included as an

asset. A million-dollar house is not enough to make you

sophisticated.

v) R501(a)(6): Individuals annual income > $200K or couple > $300K

vi) R501(a)(8): Entity in which all of the equity owners are accredited

investors (partnership formed by high-level individuals).

b) R501(h): Non-accredited investors can still fend for themselves if they are

represented by someone whos highly sophisticated AND is acting in

their best interest.

2) R501(e)(1)(iv): Counting 35 purchasers (for R505 & 506)

a) Does NOT include accredited investors or relatives sharing the same

principal residence with an accredited investor or a majority-owned entity

by an accredited investor and his relatives.

b) Looking-through. Entities formed by non-accredited investors will be

looked-through.

3) R502(a): Integration

a) All sales that are part of the same Reg. D offering must meet all of the

terms and conditions of Reg. D: If an issuer simultaneously has an

offering type that has less restrictive conditions and another offering type

with more restrictive conditions you have to comply with the more

restrictive conditions.

b) Safe harbor: 6 months before and after.

4) R502(b): Information requirement for non-AI

a) Information equivalent to RS should be provided to any non-accredited

investor.

i) If sells to AI, the disclosure is govd by the market not this regulation

b) National treatment. Information provided to AI should also be provided

to non-AI. R502(b)(2)(iv).

5) R502(c): General solicitation

a) No mass media: any communication through mass media or

seminar/meeting resulting therefrom.

i) BUT R135c: reporting companies can make a simple notice of

unregistered offering publicly (cant name UW or condition the

market)

ii) R135e journalist access: US journalists may be provided with access to

press conferences on truly global offerings (i.e., not a Reg D offering

limited to US investors).

AND

b) There must be pre-existing relationship between the offeree (NOT just

purchaser!) and issuer OR those acting on behalf of the issuer.

i) 3

rd

party websites accepting unsolicited clients or soliciting clients

through B&Ds using their pre-existing relationship.

12

ii) B&Ds may solicit clients after a cooling-off period (e.g., 45 days)

following setting up the a/c for a new client; No action letters: EF

Hunton; Batman;

6) R502(d): Resale Limitation:

a) Issuer must take reasonable care to assure the purchasers are not for

distribution purpose

i) Reasonable inquiry,

ii) Written disclosure about resale restrictions and

iii) Legend the certificates.

b) Purchasers cant be UW = Anyone who buys from issuer w/ the purpose of

reselling.

i) UW is defined broadly.

ii) Can NOT sell to IB and then sell to public BUT IB can act as

placement consultants (never buy but help issuers sell: have to be

disclosed on Form D).

7) R503: Filing requirement = Form D w/in 15 days of first sale.

8) Sophistication under R506:

a) Vague principle. the purchaser has knowledge and expertise in financial and

business matters so that he is capable of evaluating the merits and risks of

the investment.

b) Practice. Merely asking questions is not enough. FSC Securities.

9) R508: Substantial compliance

a) Small deviations may be remedied if not intended to directly protect the

particular investor and remedied in good faith

i) Key: Good faith & reasonable attempt to comply.

b) Significant and non-remediable:

i) Dollar ceilings,

ii) Numerical purchaser limits,

iii) No general solicitation.

iii. Who are using Reg D?

1) Startups selling equity to angel investors (high level individuals)

2) Domestic issuers for debt financing

a) Reg D equity financing not often because 12(g) reporting obligations attach

once you reach 500 investor and $10 million assets

3) Foreign issuers for both equity and debt financing

a) B/c 12g3-2(b) exemption

b) Hedge fund financing

d. Regulation A/Crowdfunding (p. 309-313, 318- 332)

i. Limitation

1) Issuer has to be non-reporting companies.

2) Mini-registration:

a) procedurally like IPO

i) SEC has to qualify the offering statement before sale. R251(d)

ii) Final offering circular has to be delivered w/ the confirmation of sale.

R251(c)

3) $5M

a) 3(b)(2): authorizes up to $50M

ii. Advantage:

1) Testing the water: permits offeror to engage in public solicitation prior to file F-

A. R254

13

a) much like pre-filing fwps used by WKSIs

b) R254(d): Its okay to abandon Reg A and go directly to IPO if testing the

market turned out well: 30 day cooling period BUT doesnt apply if only

solicited AI.

2) Doesnt need to provide audited F/S or comply with Reg. S-X

3) Not limited to AI

iii. R251(c): Intergradation: See below!

iv. Crowd-funding portals:

1) 4(a)(6) & 4A: internet portals for small business in offerings up to 1M BUT

limitations

e. Integration

i. Same Offering? Rule 502(a)

1) Part of a single plan of financing

2) Issuance of the same class of securities

3) Made at or about the same time

4) Same type of consideration received

5) Made for the same general purpose

ii. Safe harbors HYPO!!!

1) Rule 251(c) Successful Reg A offerings will NOT be integrated with

a) Any prior offerings

i) BUT prior Reg D might be integrated with Reg. A offering if its w/in

6 months! 502(a)

1. R505 " Reg A: Okay because there was no public solicitation

anyway but might taint R505?

2. Reg A " R505: not okay b/c it might taint R505

ii) ! Wait 6 months OR go through multi-factor test to argue that should

not be integrated

b) Any private offerings 6 months later.

c) Any subsequent registered or Reg S offerings

2) Rule 254(d) Abandoned Reg A offerings will NOT be integrated with

a) Any subsequent public offering if a bona fide abandonment of a Reg A

offering and after 30-day cooling off period..

b) If decide to go with Reg D offering, have to follow R502(a) " best to wait

6 months

3) Rule 502(a) Successful Reg D offerings will NOT be integrated with

a) Any prior same Reg. D offerings 6 months before

b) Any subsequent Reg. D offerings 6 months later..

4) Rule 152 Successful 4(a)(2) offerings will NOT be integrated with

a) Any subsequent public offerings, even if the planning activities begin

5) Rule 155: Includes offerings exempt under Sec. 4(2), 4(6) and Rule 506

a) Abandoned private offering will NOT be integrated with

i) A subsequent public offering if

1. the private offering does not sell any securities;

2. all offering activities terminated;

3. statutory prospectus discloses the abandoned deal;

4. RS is not filed until 30 days after termination of offering activities

unless the private offering's solicitation is limited to accredited and

sophisticated investors.

b) Abandoned public offering will NOT be integrated with

i) A subsequent private offering if

1. No sales in the public offering

14

2. Withdrawal of the RS

3. No private offering activity until 30 days after the withdrawal

4. Notifies offeree in private offering about the nature and risks of

the private offering and the abandoned deal

5. Any disclosure doc in private offering should disclose any

material changes since the filing of RS.

3. Exempted secondary transactions (resale)

a. NOTE: purchasers can purchase in private transactions and resell if its in a registered

transaction! (All sales must be registered or exempted!)

i. PIPE (private investment in public equity) = Privately-placed stocks w/ the view of

selling it publicly later.

b. Safe harbor 1: Rule 144 exemptions (p.367)

i. EXAM Alert:

1) Does the sale satisfy 4(1-1/2)??

2) Non-affiliate purchasers can argue they are not UW!!

ii. Types of securities covered by Rule 144

1) Restricted securities Rule 144(a)(3)

a) Include:

i) 4(a)(2) private placement,

ii) Reg D that are subject to R502(d) resale limitation = R505, 506

1. Even if the issuer messed up, still applies because only says

subject to resale limitation

2. Reg D issuer is supposed to put legend on the securities. Once

sold through a valid R144 way can remove the legend.

iii) Rule 144A resales

iv) Domestic equity issuers under Reg S

v) Rule 801 rights offerings

b) NOT restricted securities:

i) Rule 144: A valid sale of R144 washes away its restricted status.

ii) Reg A

iii) Reg S non-US issuers & US issuers of debt

2) Control securities sold by affiliates or someone selling on behalf of affiliates

(UW)

a) Affiliates/Control persons: control or common control relationship of the

seller with the issuer

i) "Control" is a fact-specific inquiry and SEC only sets forth a vague

standard - "the power to influence the policy of the issuer".

ii) "Person" also includes his spouse, relative or spouse's relative if

residing in the same home as the person and any trust or entity 10%

beneficially owned by them.

b) Rationale: due to control person's inherent informational advantage, their

resales of the issuer's securities have to be registered OR under R144

control

3) If its neither (resale of publicly offered securities by non-affiliates, etc.), its

freely tradable.

15

iii. 3 types of transactions (p.367)

1) Non-affiliate resales of restricted securities

Non-Affiliate +

Restricted

Reporting issuer

R144(b)(1)(i)

Non-reporting issuer

R144(b)(1)(ii)

Definition # Reporting C for at least 90

days before

Resale

Requirement

# 6 month w/ public

information req in

144(c)(1).

# 1 year w/ no restriction

# 1 year w/ no restriction

a) Can add on previous purchasers time:

i) Issuer " A (Reg. D. transaction) " B 3months later: B gets credit for

the 3 month A had: B only had to hold 3 more months.

2) Control unrestricted securities resales

a) No holding period req:

b) Public information available

i) Reporting issuers: current in reports; R144(c)(1)

ii) Non-reporting issuers: public information available under Rule 15c2-11.

R144(c)(2)

c) Limitation on disposable amount R144(e)(1)

i) Volume of current resale + sales within prior 3 months <= the max of

1. 1% of total outstanding shares or

2. average weekly trading volume for prior 4 weeks

d) Manner of sale R144(f)

i) No general solicitation and

ii) Can only sell through brokers' transactions

e) Filing requirements:

i) Form 144 if sells more than 5000 shares or $50K. R144(h)(1).

3) Control restricted securities resale

a) Timing req:

i) Reporting: 6 month + information req.

ii) Non-reporting: 1 year + information req

b) Other limitations: public information available, amount; manner of sale,

filing requirement

c. Safe harbor 2: Rule 144A Exemption

i. Resales of restricted securities among QIBs are deemed to qualify as 4(a)(1)

transactions or 4(a)(3)(C)

1) QIB = purely institutional investors.

ii. Conditions to obtain the exemption R144A(d)

1) Seller believes the purchaser to be a QIB

2) Purchaser is made aware of the restricted nature of the security

a) Prob 6-28 (p.383): prefer to sell to Dealer under Reg D and then dealer sells

to QIB under 144A because issuer has to make sure purchaser doesnt resell

under Reg D.

3) The security is not fungible = not the same class as securities already publically

traded. R144A(d)(3)(i)

4) If the issuer is not a reporting company, the seller and the purchaser has the right

to request basic information from the issuer.

iii. Practical use

16

1) Domestic issuers: debt offerings using Reg D (to i-banks) " 144A (to

institutional investors by i-banks)

2) Foreign issuers: equity/debt offerings using Reg S (to i-banks) " 144A (to

institutional investors by i-banks)

iv. End result: restricted securities freely transferable among QIBs but remaining

restricted ! The restriction only goes away after the QIB sells the securities under

R144 after the holding period

d. Other transactions: The reseller is not an UW.

i. If a person is an UW, then his sale is NOT exempted under 4(a)(1) " register OR find

an exemption.

1) 4(a)(1) exemption really depends on the transaction/registration history

a) If issuer files RS for transactions (issuer " UW " public), after that

further transactions are presumptively exempt under 4(a)(1).

i) EXCEPT controlled securities*!

b) vs. Private transactions (Reg D: Issuer " AI, etc.) the purchasers can

NOT resell w/o registering: the securities are restricted (sold in private

transactions), selling to public is a distribution and therefore has to be

made through registered public offering.

2) UW = 2(a)(11):

a) Defined broadly: prevent broad secondary market in unregistered

securities unless theres broad spread of information

i) Resales of registered (publicly offered) securities by non-affiliates of

the issuer never a problem

ii. Option 1: Purchasers didnt:

1) Purchase with a view to distribution

a) EXAM Alert: Dont forget about distribution!! " 4(1-1/2)

b) Factors (Pre-R144)

i) Time lapsed: usually 2 years = come to rest

ii) Reasons for selling: bona fide resale w/in 2 years due to genuine

change of circumstances in the purchaser's financial circumstances is

OK.

1. Bad investment is NOT a legitimate excuse. Gilligan (p.349)

[bought securities and realized its a bad investment. Tried to

pawned off to the public. Not okay.]

2. NOT used in R144! ! not really important anymore

iii) Distribution:

1. Size

2. Manner

OR

2) Offers or sells for an issuer in connection with a distribution

a) EXAM Alert: Dont forget about distribution!! " 4(1-1/2)

b) "For an issuer" does NOT require compensation & can be entirely

voluntary. Chinese Consolidated Benevolent Association (2nd Cir., p.340)

i) ! Anyone in any way assisting the issuer getting money from the

public = UW

ii) Would have been okay if the bonds were registered.

c) CP = issuer for the purpose of determining whos an UW. 2(a)(11)

i) Anyone who sells for CP is always an underwriter if the sale is a

distribution Wolfson (p.357, READ AGAIN!!) [broke the

transactions up.]

17

1. Register, or

2. Seek safe harbors under Rule 144.

ii) Even if the CP acquired the securities through public offering!!

iii) Wolfson (p.357): Brokers could prob fit in 4(a)(4) exemption if the

broker doesnt know, but maybe the broker should make inquiries

iii. 4(1-1/2)Exemption: Private resales are not distribution and such resellers are not

underwriters.

1) Scope:

a) Private resales of restricted securities by non-affiliates before Rule 144

provides protection - e.g., w/in 6 months of the purchase;

b) Private resales of control securities by affiliates when Rule 144 does not

provide protection or cannot accommodate the size of the deal w/in 6

months in case of restricted securities or exceeding trading/size limitations

in Rule 144 (Ackerberg, p.384).

2) How to qualify for the exemption: Ackerberg (p.384) [sophistication CPs

purchaser signed a statement saying that he had experience and knowledge in

buying, knows the securities are restricted.] The sale to him is not a distribution

a) The resale itself is not distribution

i) = public offering for issuers under 4(a)(2). Ralston Purina

1. Large in size or

2. Accompanied through forms of public solicitation: manner.

3. Sophistication of investor

4. Information access.

ii) Trying to separate purchasers for distribution vs. ordinary secondary

transaction (doesnt have to be registered)

b) Cannot be purchased with a view to distribution = securities need to

come to rest = 2 years

i) Prof: this is different from 4(1-1/2)!!

ii) If the seller only wants to sell in a private transaction, might be okay

to sell w/in 2 years (because he didnt buy with a view to

distribution) if the purchaser is an institutional investor, but its best

to wait 2 years if to an individual. Ackerberg (p.384); Prob 6-3 (p.390)

iii) Solution: get a broker to sell on behalf of CP because the broker is not

an UW because hes not selling w/ connection to a distribution.

3) Practice: a chain of contractual agreements between rounds of purchasers on

keeping the resales from going public.

a) the seller may have purchased initially with the intention of selling to

another sophisticated purchaser which is NOT a distribution " did NOT

purchase with a view to distribution

18

4. Reg S Offshore Offering

a. The purpose and usage of Reg S

i. Allow US domestic issuers to tap foreign capital markets w/o 33 Act concerns

ii. Allow FPIs tap foreign markets w/o 33 Act concerns

iii. Actual use:

1) US issuers do Eurodollar debt offerings under category 2 rules;

2) US issuers do global offerings with 33 Act registration only for US portion (plus a

10% buffer);

3) FPIs do simultaneous Reg S (overseas)/Rule 144A (after private placement in

US) offerings w/o US registration.

b. Definitions

i. SUSMI (substantial US market interest): foreign issuers only

19

1) Equity: (1) US trading market the largest single trading market for the issuer; OR

(2) 20% US trading and less than 55% trading in any single foreign market

2) Debt: (1) 300 US person investors of record; (2) $1 billion held by US persons;

and (3) 20% of the outstanding principal held by US persons.

ii. Overseas directed offering R903(b)(1)(ii)

1) Foreign issuer: offering directed into a single foreign country and made in

accordance with local rules

2) Domestic issuer: debt offerings directed into a single foreign country and made in

accordance with local rules

c. Conditions for the 3 Categories

i. Category 1 - General conditions only

1) R903(a)(1) The offer/sale is an offshore transaction R902(h)

a) The offer is NOT made to a person in the US, and

b) The buyer is outside the US OR transaction is executed overseas

2) R903(a)(2) No "directed selling efforts" in the US R902(c)

a) Activity intended or reasonably expected to condition the US market

(attract investors in US) for the security (various exceptions for regular or

necessary US communication)

ii. Category 2 - General conditions + Restrictions during 40-day compliance period

1) R903(b)(2)(i) Offering restrictions (R902(g))

a) Each distributor promises in writing to comply with Reg S & not to

engage in hedging transactions of a domestic issuer's equity securities, and

b) Offering materials are legended regarding US law restrictions.

AND

2) R903(b)(2)(ii):Seller has to make sure the buyer is not US person (regardless of

location)

AND

3) R903(b)(2)(iii): Distributor has to notifies the buyer they are subject to the

same category 2 restrictions.

a) EXAM Alert: these are NOT restricted securities " can be resold in US

under 4(a)(1) exemption after the compliance period if not a distribution

iii. Category 3 - General conditions + Restrictions during the 40-day (debt) or 1 year/6

months (equity; non-reporting/reporting) compliance period

1) R903(b)(3)(ii) Offering restrictions, and

a) Distribution agrees in writing to comply and no hedging

b) Legend on US law restrictions.

2) R903(b)(3)(ii) Debt: securities represented by a temporary global security is not

exchangeable until the later of

a) 40-day period's expiration or

b) In the case of non-distributor buyer, a certification of non-US person status

or an exemption available (e.g., Rule 144A).

3) R903(b)(3)(iii) Equity:

a) Non-distributor buyer certification of non-US person status or an exemption

available;

b) Buyer promise to sell pursuant to Reg S/registration/exemption;

c) Securities are properly legended regarding US law restrictions;

d) Issuer made sure no violating transfer could occur.

d. Rule 905 Equity securities of US issuers sold overseas are restricted securities " 4(a)(1)

is NOT available unless selling under R144, etc.

i. But none of the other securities are restricted " Category 2 can resell

20

e. Rule 904 Offshore resales (outside US)

i. General conditions as primary offerings

ii. For resales by dealers/brokers W/In the compliance period:

1) Make sure the buyer is not US person and

2) Notify the purchaser of US law restrictions

iii. For resales by senior officers:

1) Make sure resales through brokers involve only normal commissions (no

additional selling efforts).

III. Disclosure in Reorganization, Reacquisition, and Acquisition (p.395-425)

1. What is sale: disposition for value. 2(a)(3).

2. Typical transactions:

a. New debt securities in debt restructurings

b. Holding company incorporated and issuing shares in exchange for shares of the operating

company

c. Acquiring company issuing new shares in stock-for-stock acquisitions

d. A company forming a subsidiary to spin off certain business lines and distributing the shares

of the subsidiary to the company's shareholders

3. Spin-offs

a. Mechanics:

i. Create wholly owned subsidiary: transfer assets to newly formed company (all stock

owned by original corporation)

1) Separates incompatible operations; comply with local/federal antitrust laws;

segregate hazardous activities; settle s/h disputes

ii. Distribute subsidiarys stock pro rata amongst parent corps s/h

iii. Subsidiary is public if parent is public

b. Spin-offs are generally considered sales "for value" and need to be registered. Datronics

(p.402)

i. Has to register under 34 Act, and

ii. Immediately provide RS to SH.

4. Stock giveaways = sale because theres value to the insiders

a. Private companies can NOT give away its stocks w/o registration

5. M&A Rule 145

a. Covered transactions:

i. All types of stock-for-stock mergers (tender offer) and sales of assets for stocks

ii. EXCEPT if the company is just trying to change its domicile. R145(a)(2).

b. Consequences:

i. 5 registration duty attaches to the acquirer.

1) Form S-4: proxy stmt + prospectus/F-4;

ii. Communication restrictions before filing S-4.

1) This is NOT an offer " NOT gun-jumping. R165(a)

a) BUT written communications must be filed as a prospectus under

R425(b). R165(b). (much like Rule 163 FWP by WKSIs): have to tell SH

about this plan.

2) Rule 135 bare bones notice: filed before first use under R425(a).

c. Rule 144 resale restrictions (notwithstanding the registered status of the securities acquired)

if any shell company (other than a business combination related shell company) is involved

apply to the acquired securities. Rule 145(c) &(d).

6. Debt Restructuring (Exchange one security for another)

a. Exchange of one security for another constitutes sale. R145(a)(1).

21

i. There is an exchange if theres a material change in a security's economic or rights.

SEC No-Action Ltrs.

1) Bond for stocks: Exchange

2) Different maturity dates for the same security: Exchange

3) Change in charter/bylaws where the board is changed to a staggered board: NOT

exchange because this is not a new kind of security.

b. BUT the exchange could be exempted

i. Under 3(a)(9) if:

1) The exchange is between securities of the same issuer: no other party may be

involved;

2) Only old holders can be the new holders;

3) No new consideration (other than the old securities) may be given by the old

(new) security holders.

a) BUT the issuer can give new consideration to the security holders

4) "No commission for solicitation": the issuer may not hire 3

rd

parties (broker,

etc.) to solicit the acceptance of the exchange offer

a) Makes it uncommon for company to do this because they usually hire

someone.

ii. This is just a transaction exemption: if the D security outstanding were issued in a

private placement (4a2/Reg D), the issuer exchanges some stocks for the bond, the

stocks become restricted security just like the bonds were.

c. A/B Exchange (Exxon Capital)

i. Company does private placement of debt to institutions (restricted security); institutions

get registration rights (to ask Co. to file RS). Company registers another set of identical

securities and exchange them with the ones the institutions have because Company

wants to do this on their own timeline

IV. 33 Act Civil Liability

1. 13: SOL

a. 1 year from time of discovery for misstatements or selling violating securities (12(a)(1))

and

b. 3-year as an absolute bar

2. 11 Misstatement in RS

a. Elements of the cause of action

i. "When such part became effective": is it true or false @ effective date?

1) Shelf registration (base prospectus + prospectus supplement): supplement is

deemed to have been included in the base prospectus and the supplement date is

a new effective date. Rule 430B(f).

ii. Material misstatements

1) Material: a substantial likelihood that a reasonable investor making

investment decision will consider the fact significant

2) "Misstatements":

a) Untrue;

b) Omitting facts required to be stated (by the SEC forms);

c) Omitting facts to make the statement not misleading: cant present a one-

sided view of a topic (only note the good but not the bad, etc.).

22

b. Who can sue?

i. Anyone who purchased the securities

ii. No privity is required - any purchaser (from IPO or in secondary market) during the 1

year period may sue

1) Tracing problem for seasoned issuers: plaintiffs other than direct purchasers in

an offering will have difficulty establishing he purchased securities offered last

time rather than years ago, because courts require them to prove tracing.

iii. No reliance is required

1) Theoretically, issuer may defend by proving the purchaser knew the truth. Hard

to prove.

2) P doesnt even need to show that hes aware of the misstatement.

3) BUT need to show reliance if the issuer has provided full 12 months of earning

statements.

iv. No causation is required

1) BUT D can defend by showing a lack of causation: the damages is attributable to

other factors

c. Who can be sued?

i. No intent/scienter is required

ii. Issuer is strictly liable UNLESS can prove

1) Purchaser knew the truth

2) The decline in value was caused by something other than the misstatement.

iii. Non-issuer: Due-diligence defenses

1) Defendants: BarChris suggests different levels of responsibility for different

groups?

a) Company insiders (executives) >= Directors > UW/Auditor?

b) Accountants and other experts named in the RS (for expertised portion only),

and

c) UW (liability limited to their distributed amount unless they are specially

compensated than other underwriters)

2) DD duties for different parties: BarChris (p.491)

a) Experts

i) Expertised portion 11(b)(3)(B): Audited financial statements, legal

opinions for corporate matters, geological reports, etc.

1. DD +

2. Reasonable ground to believe in the truthfulness +

3. Actual belief

ii) Non-expertised portion:

1. NO duty

b) Non-experts

i) Expertised portion 11(b)(3)(C)

1. Reasonable belief +

2. Actual belief

ii) Non-expertised portion: 11(b)(3)(A)

1. DD +

2. Reasonable belief +

3. Actual belief.

iii) NOTE:

1. Includes outside directors that have just started working.

BarChris.

23

2. Outside counsels comfort letters are NOT a certificate, but only

intended to help UW to demonstrate that they have performed

their DD.

c) Reasonable investigation (DD):

i) UW/Accountants must do reasonable follow-up work beyond merely

asking the management questions and accepting answers at their

face value. BarChris (p.502).

1. Including look at underlying business documents (doc review).

ii) Court might consider the directors own expertise: BarChris (p.498)

held that Grant (a director but also a lawyer) should have undertaken

several kinds of investigation.

iii) DD obligation has to continue until the effectiveness of RS.

d) Reasonable ground to believe:

i) When theres a red flag, even if theres no DD obligation, a non-

issuer might NOT be able to demonstrate that his belief is reasonable.

WorldCrom (p.504) [Shelf registration. Their expense/revenue ratio

on the audited F/S is very out of line w/ the rest of the industry.]

ii) Reduced DD duty for shelf-takedowns? Rule 176 seems to suggest a

sliding scale test, while the WorldCom court flatly rejected any reduced

duty. Prof doesnt think R176 is very helpful..

e) Shelf registration: hire an UW who hires counsel to do an ongoing DD for

shelf takedown.

d. Damages: actual damages

i. = Purchased price (but capped @ public offering price) value @ time of

suit/disposition before suit decrease in value due to something else.

1) Negative causation analysis to show lack of causation, e.g., using statistical

models. Akerman (p.515): when the misstatement was announced, the share price

didnt drop but went up.

ii. Liability is joint & several BUT UWs damage is limited to their distribution %.

3. 12(a)(2): Material misstatements in prospectus/oral communication

a. Only materials in a "public offering" by the issuer are covered. Gustafson (p.528) [SH is

not the issuer " His K w/ the purchaser is not covered under 12(a)(2).]

i. "Public offering" is determined by the Ralston Purina test under 4(a)(2).

1) Lower courts will try to include issuers action under 12(a)(2) by declaring it

as a public offering and hence doesnt qualify for exemption. Hyer (p534)

[investors in real estate development projects (claim solicited by oral and written

communications) never received ownership interests and proceeds of their

investment were distributed to other investors]: this could be a public offering.

ii. 12(a)(2) does NOT include

1) 4(a)(1) resale exemption

2) 4(a)(2) private placement exemptions

3) Unresolved issues:

a) Do Reg D offerings automatically get exemption? Maybe yes.

b) Do exempted primary offerings (CPs, Reg A and Reg S) that are "public"

in nature still have to be covered? Maybe yes.

b. Elements of the cause of action

i. Defendants = "Seller" under 12(a)(1).

ii. Plaintiffs: original purchasers from the "sellers"

iii. Misstatements

1) Communications covered.

24

a) Statutory prospectus, preliminary prospectus, summary prospectus

b) FWP filed with SEC is public and could be the basis for liability

irrespective of its actual distribution method given that it's filed. Rule

433(a).

c) Post-sale (after the contract of sale) information is NOT a basis for 12(a)(2)

liability. Rule 159.

2) Untrue or omissions of facts necessary to make the statements not misleading

iv. No reliance reqd

1) BUT D may prove P knew the truth

v. No causation reqd

1) BUT D may conduct negative causation analysis

vi. DD defense: no actual knowledge and could not know even by exercising reasonable

care

c. Damages: recession

4. 12(a)(1): Violation of 5

a. Anyone offers or sells a security in violation of 5.

i. Unregistered, non-conforming prospectus, gun jumping rules, defective exemption sales

(Reg D/144), etc.

ii. Strict liability: offer or sell in violation of 5 " liable to anyone who purchased such

security from you.

1) No defenses.

2) Liab even if the other party knew of/agreed to this violation.

b. "Seller": defined broadly.

i. Anyone who solicits to not merely serve the interest of the buyer. Pinter v. Dahl

(p.522).

1) No privity req.

2) Does NOT have to be paid. ! Chinese benevolent Assn

3) Not a seller if done purely for the buyers benefits.

4) R506 private placement agent: subject to 12(a)(1).

ii. Issuer is always a seller for primary offering Rule 159A(a).

1) Unless the buyer is relying on fwp not prepared by the issuer (e.g., a dealer

purchasing from an underwriter relying on the latter's independently prepared

fwp).

2) UW is not responsible for sales using a fwp not prepared by him. Rule 159A(b).

c. Damages: recession

i. Consequence: give buyer a 1-year put option:

1) If the price goes down " asks for recession

2) If the price goes up " holds the stocks

5. 15: Controlling persons (parent, etc.) of the directly liable parties (subsidiary, etc.) under

11 and 12 are jointly liable for their controlled persons' liabilities,

a. Unless they could prove

i. No knowledge of the facts or

ii. A reasonable ground to believe in any misstatements.

b. Most of them already liable under 11.

6. 17 Anti-fraud for interstate transaction

a. ! 10b-5

i. 17(a)(1: scienter req

25

ii. 17(a)(2), (3): no scienter req.

b. No private right of action

V. 34 Act: Regulation of Secondary Market

1. General

a. Whos subject to registration requirements

i. EA 12(a): any security (equity or debt) traded on an exchange.

1) This is separate from 33 registration!

ii. EA 12(g): >$10 million assets and equity securities held either by 2000 ppl or 500

non-AI shareholders.

1) Exemptions for FPI (foreign private issuers): Rule 12g3-2

a) R12g3-2(a): FPI is exempted from 12(g) if

i) it has < 300 US SH of record,

ii) In addition to meeting the 500 shareholder/10 million asset requirements.

b) R12g3-2(b): FPI is exempted from 12(g) if:

i) Not required to report

ii) Exchanges in a "foreign primary trading market": average daily

trading volume reaches (i) 55% in a single foreign country or (ii) 55%

in two foreign countries, one of which is larger than that in the US.

iii) Made available all public information disclosed in foreign markets

available to US investors in English.

c) Example: ADR

i) Sell to US IB (Reg D) " Sell to QIB under R144A; pay IB to set up an

ADR + Does an ongoing obligation under 2(b) in English

ii) But if they ever decide to register under 33 Act " becomes subject

under 15(d).

2) Deregistration under 12(g): have fewer than 300 record shareholders.

iii. EA 15(d): any security (equity or debt) that files RS under 33 Act but not otherwise

required to register under 34 Act:

1) Issues debt securities to the public but its equity is not public traded b/c debt

security is usually not on an exchange.

2) Sells equity, but after the sale, has <2000 & <500 non-AI SH.

3) ! Becomes a reporting company (NOT subject to registration but just

reporting company). Doesnt trigger many of the 34 Act provisions.

b. Periodic Disclosures EA 13(a)

i. 10-K, 10-Q, 8-K.

ii. Reg FD's limitation on selective disclosure to securities professionals

1) R100(a): Any disclosure

a) By an issuer/acting on behalf of issuer

b) Of material, non-public information

c) To an outside person who is a

i) BD, investment adviser, investment company or a SH reasonably

believed will act upon the information

d) Must be made public (through 8-K).

i) Simultaneously, if intentionally disclosed

ii) Promptly, if non-intentionally disclosed

2) Exceptions:

a) To a person owing a duty of trust or confidence to the issuer: lawyer, etc.

b) to a person expressly agreeing to maintain confidence;

26

c) To any credit rating agency.

3) Limited sanctions: not relevant for 10b-5 anti-fraud determination or "current

public information" analysis under Rule 144 if there is a failure to comply with

Reg FD.

c. Internal Controls on disclosures:

i. Keep a reasonably good books and records system and an internal control system over

accounting practices. Sec. 13(b) and World-Wide Coin System.

ii. Requirements on auditors

1) Whistleblowing duty following audit. The audit must include procedure providing

reasonable assurance of detecting illegal acts and report on such discoveries. Sec.

10A(a) & (b).

2) Avoiding conflicts of interest. CEO or CFO or CAO of an issuer may not be

employed by its auditor in the preceding year.

iii. Internal control certifications by management and auditor. SOX Sec. 404

1) Management shall state its responsibility and make an assessment of its ICFR and

its auditor shall independently evaluate the assessment as well.

2) Related regs and standards: SEC Release 33-8810, PCAOB AS No. 5, COSO

(private initiative).

iv. Weak clawbacks for financial restatements. SOX Sec. 304

1) CEO and CFO shall reimburse the issuer for any bonus or incentive-based

compensation received during 12-month period following the misstated financial

statements and any profits realized from selling the issuer's securities during that

period.

d. Market manipulation:

i. Sec. 9 expressly lists trading practices the Congress viewed as concerns for market

integrity, e.g., wash trading, rumoring and short sales, margin lending (through Fed

Reg), etc.

2. Proxy & Corporate Governance

a. SH voting and proxy regulation: Regulation 14A

i. Any person soliciting proxies from SH must first make proper disclosure on a filed

proxy stmt (Schedule 14A). R14a-3.

1) "Proxy": every proxy, consent or authorization, including failure to object or

dissent. R14a-1(f).

2) "Solicitation": R14a-1(l)

a) Actual request for, to execute, or revoke, a proxy + Any communication

"under circumstances reasonably calculated to result in the procurement,

withholding or revocation of a proxy".

b) EXCEPTIONS:

i) R14a-1(l)(2)(iv) SH can make public announcement of voting

position & reasons for the positions:

1. Through mass media or

2. Directed to one's beneficial owners (e.g., a BD as a record holder).

ii) R14a-2(a) Solicitation exempted from entire Reg. 14A:

1. Broker (recordholder) asks beneficial owners how they want to

vote, or

2. Beneficial owner when directs broker how to vote

iii) R14a-2(b): Solicitation exempted from proxy stmt req BUT still

subject to anti-fraud:

1. The SH or involved party is not affiliated with management

27

2. Do not have an individual interest in the proposal to which the

solicitation relates, and

3. Do NOT seek actual proxy authority.

4. Research reports, etc.

iv) R14a-12 Solicitations that do not actually request proxy w/o proxy

statement is allowed if

1. The communication is filed with SEC before use,

2. Has a proper legend, and

3. The actual proxy form (when later sent) is accompanied by a

proxy statement.

v) R14a-1(l)(2)(i) Reply to unsolicited request for a proxy.

3) Filing of proxy statements R14a-6.

a) Preliminary one must be filed 10 days before first use of the definitive one,

unless it's an uncontested annual meeting regarding routine matters.

b) File definitive proxy statement on the date of use.

4) Requirements of proxy form. R14a-4.

a) Who is doing soliciting; date of execution; matter or group of matters

intended to be acted upon at meeting in question

ii. Proxy fraud. R14a-9.

1) No false or misleading statements or omissions regarding material facts in the

solicitation.

2) Implied private right of action exists. Borak (p. 972).

a) But reliance (presumed if material) and causation still need to be proved.

Sandberg (p.972): the minority SH didnt prove they were misled by the

misstatements; the majority could have gone forward with the merger

anyway (majority only asked minority SH to vote because they wanted 100%

approval).

b. Shareholder Proposals. R14a-8.

i. Eligible SH R14a-8(b):

1) 1% or $2,000 worth of stocks continuously held for 1 year before submitting

proposal and through the meeting.

ii. Exclusions R14a-8(i):

1) R14a-8(i)(1): Improper subject for shareholder action under state law;

2) R14a-8(i)(7): The proposal relates to ordinary business operations;

3) R14a-8(i)(8): Proposals that seek to affect the outcome of the upcoming election

of directors

c. Board Committee Structure & Executive Compensation

i. Mandatory proxy access for certain SH director nominees under proposed Rule 14a-

11 is stricken down by DC Circuit in Business Roundtable (p.960, D.C. Cir.)

1) Get your own proxy stmt?

ii. EA 10A(m)(3): members of audit committee must be independent from the issuer

and deal with the issuer's auditor directly.

iii. EA 10C(a)(2) - members of compensation committee must be independent from the

issuer and potential conflicts of compensation consultant must be dealt with carefully

and disclosed properly

iv. EA 14A(a)(1) - non-binding "say on pay" (at least every 3 years), "say on frequency

of say on pay" (at least every 6 years) and "say on golden parachute" (in any proxy

solicitation regarding a business combination subject to shareholders' approval).

v. EA 14B - issuers must analyze why they have or don't have separation of chairman

and CEO.

28

3. Tender Offer

a. Early warning

i. Disclosure requirements ! 5% beneficial ownership. SE 13(d).

1) R13d-1: Has 10 days to file Sch 13D

a) Exception: Sch 13G for institutional investors not holding more than 10%

without intent of control.

2) R13d-2: has to amend Sch. 13D anytime theres a material change, including

acquisition of disposition of > 1%.

ii. "Beneficial ownership" R13d-3.

1) R13d-3(a): Any voting or investment power in respect of the security through

any contract or otherwise;

2) R13d-3(b): Anti-parking. Cant try to evade reporting obligation by parking

the shares under someone elses name.

3) R13d-5: Aggregation rules in determining beneficial ownership when " 2

persons agree to act together for the purpose of acquiring, holding, voting or

disposing of equity securities.

a) E.g., an informal understanding to dispose of shares together could result

in aggregation and trigger 13(d) reporting obligation. Wellman (p.988).

b. 3rdP TO Regulation. SE 14(d), (e).

i. What's a TO? Wellman test:

1) Active and widespread solicitation of public shareholders;

2) Made for a substantial percentage of the issuer's stock;

3) Offer at a premium;

4) Terms are firm, not negotiable;

5) Contingent on minimum tendered shares;

6) Open for a limited period;

7) Offeree subjected to pressure to sell;

8) Public announcements precede or accompany a rapid accumulation of the target

shares.

ii. Scope:

1) 14(d): Only regulates TO of registered equity securities:

2) 14(e): Its unlawful to make any untrue stmt of a material fact or omit or

engage in fraudulent, deceptive, or manipulative acts or practice with any TO.

iii. Communication regulations:

1) 14(d)(1): Its unlawful to make TO for equity securities of any publicly held

company, if the bidder upon commencement will own > 5% of class in question

afterwards, unless bidder files and transmits to target company a Sch TO

a) Have to file Sch TO upon commencement. R14d-3(a).

2) "Commencement": the bidder published, sent or given the means to tender.

R14d-2(a).

a) Pre-commencement communications is allowed if dont tell SH how to

tender AND file it under cover of Sch TO before use. R14d-2(b).

i) " R165: if you are offering shares for shares, you can communicate

prior to filing a RS, so long as the communications are filed under

R425.

b) Commencement communication triggers Sch. TO filing obligation. R14d-

3(a).

c) Post-commencement communications: file any update as amendment

before use. R14d-3.

3) R14d-4: 3 ways to transmit the offer to SH

29

a) Publish the offer document in the newspaper. Almost never done. too long.

R14d-4(a)(1)

b) Summary publication in newspaper. R14d-4(a)(2)

c) Theoretically, target company has to turn over its shareholder list to you

under R14d-5, but it will sue you for sure for fraud. R14d-4(a)(3)

4) Target C communications

a) Similar disclosure regime by filing under cover of Schedule 14D-9. R14d-9.

b) Stop-look-and-listen statement exempt from filing. The target company may

issue such a communication to urge shareholders to delay their decision

until the target company responds.

5) Mandatory T company announcement of position. Within 10 business days of

the tender offer, T should issue a statement regarding its position on the tender

offer. R14e-2.

iv. Substantive regulation

1) R14e-1(a): Have to keep the offer open for 20 business days.

a) 10 more business days if you change price/amount of securities. R14e-

1(b). Very common when a 3rdP comes in and starts a bidding war.

2) R14d-7:Tendered securities may be withdrawn freely during the entire TO open

period.

3) R14d-8: If the TO is for <100% of Ts shares, and a greater number is deposited,

the securities taken up must be pro rata (cant say first come first serve).

4) R14d-10: requires equal treatment of security holders

a) 10(a)(1) All holder rule: has to be open to all security holders

b) 10(a)(2) Best price rule: everyone gets the same price

i) 14(d)(7): Everyone gets the increase in price even if theyve already

tendered their shares.

ii) R14e-5(a): Cant escape best price rule by arranging side deals

iii) Closely related acquisitions can be intergrated as one TO. Field v.

Trump (p.1009) [bidder terminated tender offer, negotiated with a

significant shareholder successfully and re-opened the tender offer at

lower price. The whole is intergrated.]/Epstein (p.1003)

5) R14e-4: no short tender. Cant tender more than you own.

c. Self-tender regulation. SE 13(e).

i. R13e-1: No repurchases during a 3

rd

P TO period unless first filing a public

statement.

1) Include purchase in the open market.

ii. R13e-3: going private transaction proposed by issuer or affiliates

1) If the A party is affiliate of Ts company and T is going private as a result, then

the TO document has to include additional set of disclosures aiming at to

convince SH why its a fair price.

a) Brought fairness into equation at a management buyout situation.

2) In response to Santa Fe: as long as everythings disclosed, it doesnt matter SH

doesnt like the price.

iii. R13e-4: Self-tenders are subject to the same disclosure and substantive regulation as

3

rd

party TO.

d. Global TO/self tenders by FPIs

i. Partial exemption from Reg 14D.

1) R14d-1(c): Tier I = US SH # 10%

a) Largely exempt from Reg 14D and most of 14E (disclosure and withdrawal

right requirements)

30

i) Still subject to anti-fraud and insider trading rules of 14(e) and Reg.

14E.

b) R14d-1(c)(1): US SH have to be given the same deals as the other SH.

c) R14d-1(c)(2):If only non-cash consideration is paid, there is 33 Act

registration exemption under Rule 802 if the following conditions are met

i) US holders have 10% or less ownership in the issuer

ii) US holders are given equal treatment.

iii) US holders are given equal information, which should be legended

properly.

2) R14d-1(d): Tier II = 10% - 40%

a) Exempt from certain requirements conflicting with foreign laws.

e. R14e-3: anyone in possession of NPMI can NOT trade on it.

4. Regulation of Broker/Dealers

a. SEC general regulation:

i. EA 15(a): BD have to register to enter the business

1) Can register as a firm

ii. EA 15(b)(4)(D) & (E): SEC can sanction BD when they

1) Willfully violate or aid & abet violation of securities law

OR

2) Failed to reasonably to supervise another who violated the securities law.

John Gutfreund (p.1025) [Salomon Brothers BD submitted false bids. Senior

officials knew but did nothing. The BD committed 2 other violations]

a) Even though the firm GC didnt directly supervise the BDs work, he