Escolar Documentos

Profissional Documentos

Cultura Documentos

Chapter 13: Capital Structure and Dividends Learning Goals

Enviado por

nikowawaDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Chapter 13: Capital Structure and Dividends Learning Goals

Enviado por

nikowawaDireitos autorais:

Formatos disponíveis

Chapter 13: Capital Structure and

Dividends

Learning Goals

Describe the basic types of capital, external assessment of capital structure,

the capital structure of non-United States firms, and the optimal capital

structure.

Discuss the EBIT-EPS approach to capital structure.

e!ie" the return and ris# of alternati!e capital structures and their lin#a$e to

mar#et !alue, and other important capital structure considerations.

Explain cash di!idend payment procedures, di!idend rein!estment plans, the

residual theory of di!idends, and the #ey ar$uments "ith re$ard to di!idend

rele!ance or irrele!ance.

Understand the #ey factors in!ol!ed in formulatin$ a di!idend policy and the

three basic types of di!idend policies.

E!aluate the #ey aspects of stoc# di!idends, stoc# splits, and stoc#

repurchases.

The Firms Capital Structure

%ccordin$ to finance theory, firms possess a tar$et capital structure that

"ill minimi&e their cost of capital.

Unfortunately, theory can not yet pro!ide financial mana$ers "ith a

specific methodolo$y to help them determine "hat their firm's optimal capital

structure mi$ht be.

Theoretically, ho"e!er, a firm's optimal capital structure "ill (ust balance

the benefits of debt financin$ a$ainst its costs.

The ma(or benefit of debt financin$ is the tax shield pro!ided by the

federal $o!ernment re$ardin$ interest payments.

The costs of debt financin$ result from)

The increased probability of ban#ruptcy caused by debt obli$ations.

The a$ency costs resultin$ from lenders monitorin$ the firm's actions.

The costs associated "ith the firm's mana$ers ha!in$ more information

about the firm's prospects than do in!estors *asymmetric information+.

,apital Structures of United States and -on-United States

.irms

In $eneral, non-United States companies ha!e much hi$her debt le!els

than United States companies primarily because United States capital mar#ets

are relati!ely more de!eloped.

In addition, in most European countries and /apan, ban#s are more

in!ol!ed because they are permitted to ma#e e0uity in!estments in non-financial

corporations1a practice prohibited in the United States.

Similarities bet"een United States and forei$n corporations include)

Similarity of industry capital structure patterns.

Similarity of lar$e corporation capital structures.

In addition, it is expected that differences in capital structures "ill further

diminish as countries rely less on ban#s and more on security issuance.

The Optimal Capital Structure

In $eneral, it is belie!ed that the mar#et !alue of a company is maximi&ed

"hen the cost of capital *the firm's discount rate+ is minimi&ed.

The !alue of the firm can be defined al$ebraically as follo"s)

Debt atios !or Selected "ndustries

#$S%#&"T 'pproach to Capital Structure

The EPS-EBIT approach to capital structure in!ol!es selectin$ the capital

structure that maximi&es EPS o!er the expected ran$e of EBIT.

Usin$ this approach, the emphasis is on maximi&in$ the o"ners' returns

*EPS+.

% ma(or shortcomin$ of this approach is the fact that earnin$s are only one

of the determinants of shareholder "ealth maximi&ation.

This method does not explicitly consider the impact of ris#.

Example

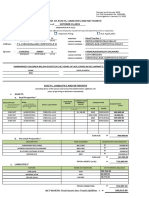

The capital structure of Bu&& ,ompany, a soft drin# manufacturer is sho"n in the table

belo". ,urrently, Bu&& ,ompany uses only e0uity in its capital structure. Thus the current debt

ratio is 2.223. %ssume Bu&& ,ompany is in the 423 tax brac#et.

EPS-EBIT coordinates for Bu&& ,ompany's current capital structure can

be found by assumin$ t"o EBIT !alues and calculatin$ the associated EPS in the

table belo".

Bu&& ,ompany is considerin$ alterin$ its capital structure "hile

maintainin$ its ori$inal 5622,222 capital base as sho"n in the table belo".

This may be sho"n $raphically as sho"n on the follo"in$ slide.

&asic Shortcoming o! #$S%#&"T 'nal(sis

%lthou$h EPS maximi&ation is $enerally $ood for the firm's shareholders,

the basic shortcomin$ of this method is that it does not necessary maximi&e

shareholder "ealth because it fails to consider ris#.

If shareholders did not re0uire ris# premiums *additional return+ as the firm

increased its use of debt, a strate$y focusin$ on EPS maximi&ation "ould "or#.

Unfortunately, this is not the case.

Choosing the Optimal Capital Structure

The follo"in$ discussion "ill attempt to create a frame"or# for ma#in$

capital bud$etin$ decisions that maximi&es shareholder "ealth *i.e., considers

both ris# and return+.

Perhaps the best "ay to demonstrate this is throu$h the follo"in$

example.

%ssume that Bu&& ,ompany is attemptin$ to choose the best of se!eral

alternati!e capital structures1specifically, debt ratios of 2, 72, 82, 92, 42, 62,

and :2 percent. .urthermore, for each of these capital structures, the firm has

estimated EPS, the ,; of EPS, and re0uired return.

If "e assume that all earnin$s are paid out as di!idends, "e can use the

&ero $ro"th !aluation model <P2 = EPS>ks? to estimate share !alue as sho"n in

the table belo".

Other "mportant Considerations

Dividend Fundamentals

,ash Di!idend Payment Procedures

% di!idend is a redistribution from earnin$s.

@ost companies maintain a di!idend policy "hereby they pay a re$ular di!idend on a

0uarterly basis.

Some companies pay an extra di!idend to re"ard shareholders if they'!e had a

particularly $ood year. @any companies pay di!idends accordin$ to a preset payout ratio, "hich

measures the proportion of di!idends to earnin$s.

@any companies ha!e paid re$ular di!idends for o!er a hundred years.

,ash Di!idend Payment Procedures

Di!idend $ro"th tends to la$ behind earnin$s $ro"th for most corporations *see example

next slide+.

Since di!idend policy is one of the factors that dri!es an in!estor's decision to purchase a

stoc#, most companies announce their di!idend policy and tele$raph any expected chan$es in

policy to the public.

Therefore, it can be seen that many companies use their di!idend policy to pro!ide

information not other"ise a!ailable to in!estors.

,ash Di!idend Payment Procedures

Date of record) The date on "hich in!estors must o"n shares in order to recei!e the

di!idend payment.

ex di!idend date) .our days prior to the date of record. The day on "hich a stoc# trades

ex di!idend *exclusi!e of di!idends+.

In the financial press) Transactions in the stoc# on the ex di!idend date are indicated by

an AxB next to the !olume of transactions.

In $eneral, stoc# prices fall by an amount e0ual to the 0uarterly di!idend on the ex

di!idend date.

Distribution date) The day on "hich a di!idend is paid *payment date+ to stoc#holders. It

is usually t"o or more "ee#s before stoc#holders "ho o"ned shares on the date of record

recei!e their di!idends.

Cash Dividend $a(ment $rocedures

Example

%t the 0uarterly di!idend meetin$ on /une 72th, the /illian ,ompany board

of directors declared an 5.C2 cash di!idend for holders of record on @onday, /uly

7st. The firm had 722,222 shares of stoc# outstandin$. The payment

*distribution+ date "as set at %u$ust 7st. Before the meetin$, the rele!ant

accounts sho"ed the follo"in$.

Dhen the di!idend "as announced by the directors, 5C2,222 of the

retained earnin$s *5.C2>share

x

722,222 shares+ "as transferredto the di!idends

payable account. %s a result, the #ey accounts chan$ed as follo"s)

/illian ,ompany's stoc# be$an sellin$ ex di!idend on /une 86th, 4 days

prior to the date of record */uly 7st+. This date "as found by subtractin$ : days

*because of the "ee#end+ from /uly 7st.

Stoc#holders of record on /une 84th or earlier recei!ed the ri$hts to the

di!idends, "hile those purchasin$ on /une 86th or later did not. %ssumin$ a

stable mar#et, the price of the stoc# "as expected to drop by 5.C2>share on /une

86th. Dhen the %u$ust 7st payment date arri!ed, the firm mailed payments to

holders of record and recorded the follo"in$)

Thus, the net effect of the di!idend payment is a reduction of the firm's

assets *throu$h a reduction in cash+ and e0uity *throu$h a reduction in retained

earnin$s+ by a total of 5C2,222 *the di!idend payment+.

Dividend einvestment $lans

Di!idend rein!estment plans *DIPS+ permit stoc#holders to rein!est their di!idends to

purchase additional shares rather than to be paid out in cash.

Dith bank-directed DIPS, ban#s purchase additional shares on the open mar#et in hu$e

bloc#s "hich substantially reduces per share commissions.

Dith company-directed DIPS, the company itself issues ne" shares in exchan$e for the

cash di!idend completely eliminatin$ commissions.

Dith brokerage-directed DIPS, bro#era$e firms such as ,harles Sch"ab "ill rein!est

di!idends for shareholders "ho hold stoc#s in street name at no char$e.

'dvantages o! D"$S

.or Stoc#holders

Substantial reduction in commission costs.

They pro!ide in!estors "ith an automatic sa!in$s mechanism.

.or ,ompanies

Eood"ill

eduction in cost of deli!erin$ di!idend chec#s.

%n inexpensi!e means of raisin$ e0uity capital for firms company-directed

plans.

Dividend $olic( Theor(

The esidual Theory of Di!idends

The residual theory of di!idends su$$ests that di!idend payments should

be !ie"ed as residual1the amount left o!er after all acceptable in!estment

opportunities ha!e been underta#en.

Usin$ this approach, the firm "ould treat the di!idend decision in three

steps as sho"n on the follo"in$ slide.

The esidual Theory of Di!idends

In sum, this theory su$$ests that no cash di!idend is paid as lon$ as the

firm's e0uity need is in excess of the amount of retained earnin$s.

.urthermore, it su$$ests that the re0uired return demanded by

stoc#holders is not influenced by the firm's di!idend policy1a premise that in

turn su$$ests that di!idend policy is irrele!ant.

Di!idend Irrele!ance %r$uments

@erton @iller and .ranco @odi$liani *@@+ de!eloped a theory that sho"s

that in perfect financial mar#ets *certainty, no taxes, no transactions costs or

other mar#et imperfections+, the !alue of a firm is unaffected by the distribution of

di!idends.

They ar$ue that !alue is dri!en only by the future earnin$s and ris# of its

in!estments.

etainin$ earnin$s or payin$ them in di!idends does not affect this !alue.

Di!idend Irrele!ance %r$uments

Some studies su$$ested that lar$e di!idend chan$es affect stoc# price

beha!ior.

@@ ar$ued, ho"e!er, that these effects are the result of the information

con!eyed by these di!idend chan$es, not to the di!idend itself.

.urthermore, @@ ar$ue for the existence of a Aclientele effect.B

In!estors preferrin$ di!idends "ill purchase hi$h di!idend stoc#s, "hile

those preferrin$ capital $ains "ill purchase lo" di!idend payin$ stoc#s.

Di!idend Irrele!ance %r$uments

In summary, @@ and other di!idend irrele!ance proponents ar$ue that1

all else bein$ e0ual1an in!estor's re0uired return, and therefore the !alue of the

firm, is unaffected by di!idend policy because)

F The firm's !alue is determined solely by the earnin$ po"er and ris# of its assets.

F If di!idends do affect !alue, they do so because of the information content, "hich si$nals

mana$ement's future expectations.

F % clientele effect exists that causes shareholders to recei!e the le!el of di!idends they

expect.

Di!idend ele!ance %r$uments

,ontrary to di!idend irrele!ance proponents, Eordon and Gintner

su$$ested stoc#holders prefer current di!idends and that a positi!e relationship

exists bet"een di!idends and mar#et !alue.

.undamental to this theory is the Abird-in-the-handB ar$ument "hich

su$$ests that in!estors are $enerally ris#-a!erse and attach less ris# to current

as opposed to future di!idends or capital $ains.

Because current di!idends are less ris#y, in!estors "ill lo"er their re0uired

return1thus boostin$ stoc# prices.

Factors that '!!ect Dividend $olic(

Ge$al ,onstraints

@ost state securities re$ulations pre!ent firms from payin$ out di!idends

from any portion of the company's Ale$al capitalB "hich is measured by the par

!alue of common stoc#1or par !alue plus paid-in-capital.

Di!idends are also sometimes limited to the sum of the firm's most recent

and past retained earnin$s1 althou$h payments in excess of current earnin$s is

usually permitted.

@ost states also prohibit di!idends "hen firms ha!e o!erdue liabilities or

are le$ally insol!ent or ban#rupt.

E!en the IS has ruled in the area of di!idend policy.

Specifically, the IS prohibits firms from ac0uirin$ earnin$s to reduce

stoc#holders' taxes.

The IS can determine that a firm has accumulated an excess of earnin$s

to allo" o"ners to delay payin$ ordinary income taxes *on di!idends+, it may le!y

an excess earnin$s accumulation tax on any retained earnin$s abo!e 5862,222.

It should be noted, ho"e!er, that this rulin$ is seldom applied.

,ontractual ,onstraints

In many cases, companies are constrained in the extent to "hich they can

pay di!idends by restricti!e pro!isions in loan a$reements and bond indentures.

Eenerally, these constraints prohibit the payment of cash di!idends until a

certain le!el of earnin$s are achie!ed or to a certain dollar amount or percenta$e

of earnin$s.

%ny !iolation of these constraints $enerally tri$$ers the demand for

immediate payment.

Internal ,onstraints

% company's ability to pay di!idends is usually constrained by the amount

of a!ailable cash rather than the le!el of retained earnin$s a$ainst "hich to

char$e them.

%lthou$h it is possible to borro" to pay di!idends, lenders are usually

reluctant to $rant them because usin$ the funds for this purpose produces no

operatin$ benefits that help to repay them.

Ero"th Prospects

-e"er, rapidly-$ro"in$ firms $enerally pay little or no di!idends.

Because these firms are $ro"in$ so 0uic#ly, they must use most of their

internally $enerated funds to support operations or finance expansion.

Hn the other hand, lar$e, mature firms $enerally pay cash di!idends since

they ha!e access to ade0uate capital and may ha!e limited in!estment

opportunities.

H"ner ,onsiderations

%s mentioned earlier, empirical e!idence supports the notion that

in!estors tend to belon$ to AclientelesB1 "here some prefer hi$h di!idends, "hile

others prefer capital $ains.

They tend to sort themsel!es in this "ay for a !ariety of reasons,

includin$)

F Tax status

F In!estment opportunities

F Potential dilution of o"nership

@ar#et ,onsiderations

Perhaps the most important aspect of di!idend policy is that the firm

maintain a le!el of predictability.

Stoc#holders that prefer di!idend-payin$ stoc#s prefer a continuous

stream of fixed or increasin$ di!idends.

Shareholders also !ie" the firm's di!idend payment as a Asi$nalB of the

firm's future prospects.

.ixed or increasin$ di!idends are often considered a Apositi!eB si$nal,

"hile erratic di!idend payments are !ie"ed as Ane$ati!eB si$nals.

T(pes o! Dividend $olicies

,onstant-Payout-atio Policy

Dith a constant-payout-ratio di!idend policy, the firm establishes that a

specific percenta$e of earnin$s is paid to shareholders each period.

% ma(or shortcomin$ of this approach is that if the firm's earnin$s drop or

are !olatile, so too "ill the di!idend payments.

%s mentioned earlier, in!estors !ie" !olatile di!idends as ne$ati!e and

ris#y1"hich can lead to lo"er share prices.

e$ular Di!idend Policy

% re$ular di!idend policy is based on the payment of a fixed-dollar

di!idend each period.

It pro!ides stoc#holders "ith positi!e information indicatin$ that the firm is

doin$ "ell and it minimi&es uncertainty.

Eenerally, firms usin$ this policy "ill increase the re$ular di!idend once

earnin$s are pro!en to be reliable.

Go"-e$ular-and-Extra Di!idend Policy

Usin$ this policy, firms pay a lo" re$ular di!idend, supplemented by

additional di!idends "hen earnin$s can support it.

Dhen earnin$s are hi$her than normal, the firm "ill pay this additional

di!idend, often called an extra di!idend, "ithout the obli$ation to maintain it

durin$ subse0uent periods.

This type of policy is often used by firms "hosesales and earnin$s are

susceptible to s"in$s in the business cycle.

Other Forms o! Dividends

Stoc# Di!idends

% stoc# di!idend is paid in stoc# rather than in cash.

@any in!estors belie!e that stoc# di!idends increase the !alue of their

holdin$s.

In fact, from a mar#et !alue standpoint, stoc# di!idends function much li#e

stoc# splits. The in!estor ends up o"nin$ more shares, but the !alue of their

shares is less.

.rom a boo# !alue standpoint, funds are transferred from retained

earnin$s to common stoc# and additional paid-in-capital.

If Trimline declares a 723 stoc# di!idend and the current mar#et price of

the stoc# is 576>share, 5762,222 of retained earnin$s *723

x

722,222 shares

x

576>share+ "ill be capitali&ed.

The 5762,222 "ill be distributed bet"een the common stoc# *par+ account

and paid-in-capital in excess of par account based on the par !alue of the

common stoc#. The resultin$ balances are as follo"s.

.rom a shareholder's perspecti!e, stoc# di!idends result in a dilution of

shares o"ned.

.or example, assume a stoc#holder o"ned 722 shares at 582>share

*58,222 total+ before a stoc# di!idend.

If the firm declares a 723 stoc# di!idend, the shareholder "ill ha!e 772

shares of stoc#. Io"e!er, the total !alue of her shares "ill still be 58,222.

Therefore, the !alue of her share must ha!e fallen to 57C.7C>share

*58,222>772+.

Disad!anta$es of stoc# di!idends include)

The cost of issuin$ the ne" shares.

Taxes and listin$ fees on the ne" shares.

Hther recordin$ costs.

%d!anta$es of stoc# di!idends include)

The company conser!es needed cash.

Si$nalin$ effect to the shareholders that the firm is retainin$ cash because

of lucrati!e in!estment opportunities.

Stoc# Split

% stoc# split is a recapitali&ation that affects the number of shares

outstandin$, par !alue, earnin$s per share, and mar#et price.

The rationale for a stoc# split is that it lo"ers the price of the stoc# and

ma#es it more attracti!e to indi!idual in!estors.

.or example, assume a share of stoc# is currently sellin$ for 5796 and

splits 9 for 8.

The ne" share price "ill be e0ual to 8>9

x

5796, or 5J2.

,ontinuin$ "ith the example, assume that the in!estor held 722 shares

before the split "ith a total !alue of 579,622.

%fter the split, the shareholder "ill hold) 579,622>5J2 = 762 shares "orth

5J2 each

% re!erse stoc# split reduces the number of shares outstandin$ and raises

stoc# price1the opposite of a stoc# split.

The rationale for a re!erse stoc# split is to add respectability to the stoc#

and con!ey the meanin$ that it isn't a (un# stoc#.

-ot only do stoc# splits lea!e the mar#et !alue of shareholders unaffected, but they also

ha!e little affect from an accountin$ standpoint as this 8-for-7 split demonstrates.

Stoc# epurchases

Stoc# repurchase) The purchasin$ and retirin$ of stoc# by the issuin$

corporation.

% repurchase is a partial li0uidation since it decreases the number of

shares outstandin$.

It may also be thou$ht of as an alternati!e to cash di!idends.

%lternati!e easons for Stoc# epurchases

To use the shares for another purpose

To alter the firm's capital structure

To increase EPS and HE resultin$ in a hi$her mar#et price

To reduce the chance of a hostile ta#eo!er

Você também pode gostar

- How Cooking the Books WorksDocumento16 páginasHow Cooking the Books Worksrahul_k811Ainda não há avaliações

- Chapter 11 Dividend Policy: 1. ObjectivesDocumento8 páginasChapter 11 Dividend Policy: 1. Objectivessamuel_dwumfourAinda não há avaliações

- Managing Financial Resources & DecisionsDocumento23 páginasManaging Financial Resources & DecisionsShaji Viswanathan. Mcom, MBA (U.K)Ainda não há avaliações

- DIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)No EverandDIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)Ainda não há avaliações

- C 3 A F S: Hapter Nalysis of Inancial TatementsDocumento27 páginasC 3 A F S: Hapter Nalysis of Inancial TatementskheymiAinda não há avaliações

- Weighted Average Cost of CapitalDocumento12 páginasWeighted Average Cost of CapitalAkhil RupaniAinda não há avaliações

- Capital Structure Mix and Costs: A Study of Reliance IndustriesDocumento6 páginasCapital Structure Mix and Costs: A Study of Reliance IndustriesAnonymous nTxB1EPvAinda não há avaliações

- Factors Affecting Dividend PolicyDocumento11 páginasFactors Affecting Dividend Policyalbinus1385Ainda não há avaliações

- Report On Dividend PolicyDocumento21 páginasReport On Dividend PolicyMehedi HasanAinda não há avaliações

- Dividend Policy (I) .: Both Cash and Stock Dividends Reduce The Value Per ShareDocumento10 páginasDividend Policy (I) .: Both Cash and Stock Dividends Reduce The Value Per Sharekhurram36Ainda não há avaliações

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNo EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingAinda não há avaliações

- Capital StructureDocumento13 páginasCapital StructureAjay ManchandaAinda não há avaliações

- Chap 017Documento88 páginasChap 017limed1Ainda não há avaliações

- 1 What Are Corporate Actions?: CreditorsDocumento14 páginas1 What Are Corporate Actions?: CreditorsBadal ShahAinda não há avaliações

- 100 Business Ideas: Discover Home Business Ideas, Online Business Ideas, Small Business Ideas and Passive Income Ideas That Can Help You Start A Business and Achieve Financial FreedomNo Everand100 Business Ideas: Discover Home Business Ideas, Online Business Ideas, Small Business Ideas and Passive Income Ideas That Can Help You Start A Business and Achieve Financial FreedomNota: 2.5 de 5 estrelas2.5/5 (2)

- History of BAT Bangladesh and its Dividend Policy Over 100 YearsDocumento12 páginasHistory of BAT Bangladesh and its Dividend Policy Over 100 YearsShoyeb MahmudAinda não há avaliações

- Group 5 PresentationDocumento73 páginasGroup 5 PresentationSourabh Arora100% (4)

- Capital IQ, Broadridge, Factset, Shore Infotech Etc .: Technical Interview QuestionsDocumento12 páginasCapital IQ, Broadridge, Factset, Shore Infotech Etc .: Technical Interview Questionsdhsagar_381400085Ainda não há avaliações

- Review of Literature: Author Info Arnoudwaboot Anjan V ThakorDocumento9 páginasReview of Literature: Author Info Arnoudwaboot Anjan V ThakorAnonymous nTxB1EPvAinda não há avaliações

- Chapter 14 For bfc2140 For MonashDocumento69 páginasChapter 14 For bfc2140 For MonashtjgoemsAinda não há avaliações

- Relevance N Irrelevance of Dividend PlicyDocumento8 páginasRelevance N Irrelevance of Dividend PlicyGagandeep VermaAinda não há avaliações

- CCC CCM C C: Let's Look at Each in DetailDocumento4 páginasCCC CCM C C: Let's Look at Each in DetailElderWandOwnerAinda não há avaliações

- Unit Iii-1Documento13 páginasUnit Iii-1Archi VarshneyAinda não há avaliações

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementNo EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementAinda não há avaliações

- Capital StructureDocumento5 páginasCapital StructureRudy Gel C. VillaruzAinda não há avaliações

- Corporate FinanceDocumento13 páginasCorporate FinanceAditya BajoriaAinda não há avaliações

- Accounting For Retained EarningsDocumento11 páginasAccounting For Retained EarningsSarah Johnson100% (1)

- Capital Structure 2Documento51 páginasCapital Structure 2moydozukkuAinda não há avaliações

- Weighted Average Cost of CapitalDocumento13 páginasWeighted Average Cost of CapitalAkhil RupaniAinda não há avaliações

- 2.corporate Goals F12Documento14 páginas2.corporate Goals F12Jenny CheAinda não há avaliações

- A-Passive Residual Theory of Dividends: 1. Explain The Following TermsDocumento8 páginasA-Passive Residual Theory of Dividends: 1. Explain The Following TermsJemmy RobertAinda não há avaliações

- Topic 3 - Capital StructureDocumento17 páginasTopic 3 - Capital StructureSandeepa KaurAinda não há avaliações

- UEU Manajemen Keuangan Pertemuan 10Documento70 páginasUEU Manajemen Keuangan Pertemuan 10Abank FurniawanAinda não há avaliações

- Assignment No. - 3: Ans 1: A Condition Where A Company Cannot Meet or Has Difficulty Paying Off ItsDocumento3 páginasAssignment No. - 3: Ans 1: A Condition Where A Company Cannot Meet or Has Difficulty Paying Off ItsashishthecoolAinda não há avaliações

- Bezu Aster Kema HW - 3Documento8 páginasBezu Aster Kema HW - 3Michael SeyiAinda não há avaliações

- Major Assignment 11150Documento9 páginasMajor Assignment 11150M ASIFAinda não há avaliações

- Chapter 7 Capital StructureDocumento39 páginasChapter 7 Capital StructureKenyi Kennedy SokiriAinda não há avaliações

- Introduction To Financial Accounting ProjectDocumento12 páginasIntroduction To Financial Accounting ProjectYannick HarveyAinda não há avaliações

- The Entrepreneur’S Dictionary of Business and Financial TermsNo EverandThe Entrepreneur’S Dictionary of Business and Financial TermsAinda não há avaliações

- MBA Exam 1 Spring 2009Documento12 páginasMBA Exam 1 Spring 2009Kamal AssafAinda não há avaliações

- What is a bonus share issueDocumento22 páginasWhat is a bonus share issuecutie_pixieAinda não há avaliações

- Our ProjectDocumento7 páginasOur ProjectYoussef samirAinda não há avaliações

- Problem Set 1 SolutionsDocumento13 páginasProblem Set 1 SolutionsVictor100% (1)

- Fin Week 2Documento3 páginasFin Week 2Morgan JunkemailAinda não há avaliações

- The Study of Capitalisation Involves An Analysis of Three AspectsDocumento7 páginasThe Study of Capitalisation Involves An Analysis of Three AspectsBoobalan RAinda não há avaliações

- The Key Responsibilities of The CFO: Corporate FinanceDocumento16 páginasThe Key Responsibilities of The CFO: Corporate FinancepothigaiselvansAinda não há avaliações

- Financial ManagementDocumento8 páginasFinancial ManagementManjeet SinghAinda não há avaliações

- Dividend Investing 101 Create Long Term Income from DividendsNo EverandDividend Investing 101 Create Long Term Income from DividendsAinda não há avaliações

- In-Text Activity Capital StructureDocumento6 páginasIn-Text Activity Capital StructureKeana MendozaAinda não há avaliações

- Capital Structure PlanningDocumento5 páginasCapital Structure PlanningAlok Singh100% (1)

- CDJ Page5Documento4 páginasCDJ Page5UyenAinda não há avaliações

- BUSINESS FINANCE: THE FUNCTIONS OF A FINANCIAL MANAGERDocumento67 páginasBUSINESS FINANCE: THE FUNCTIONS OF A FINANCIAL MANAGERMatin Chris KisomboAinda não há avaliações

- Leverage: Let's DiscussDocumento9 páginasLeverage: Let's DiscussClaudette ManaloAinda não há avaliações

- FormulationDocumento14 páginasFormulationAl AminAinda não há avaliações

- Chapter 8 Strategic ManagementDocumento6 páginasChapter 8 Strategic ManagementnikowawaAinda não há avaliações

- CDC UP Training Plan TemplateDocumento11 páginasCDC UP Training Plan TemplatenikowawaAinda não há avaliações

- Chapter 1: Introduction To Management Information SystemsDocumento14 páginasChapter 1: Introduction To Management Information SystemsvinuoviyanAinda não há avaliações

- TN 48 Sun MicrosystemsDocumento31 páginasTN 48 Sun Microsystemsnikowawa100% (1)

- Management Flow Diagram: DirectorDocumento18 páginasManagement Flow Diagram: DirectornikowawaAinda não há avaliações

- Functions and Forms of BankingDocumento5 páginasFunctions and Forms of Bankingمحمد أحمد عبدالوهاب محمدAinda não há avaliações

- Economics: General QuestionsDocumento2 páginasEconomics: General QuestionsnikowawaAinda não há avaliações

- Electronic Book Resource ListDocumento9 páginasElectronic Book Resource ListnikowawaAinda não há avaliações

- Recruitment PrintableDocumento15 páginasRecruitment PrintableAnonymous C5sDarOAinda não há avaliações

- PG Apps Training HandoutsDocumento9 páginasPG Apps Training HandoutsnikowawaAinda não há avaliações

- NCL Mis AdministratorDocumento3 páginasNCL Mis AdministratornikowawaAinda não há avaliações

- Gatech-Opns MGMT SylDocumento7 páginasGatech-Opns MGMT SylstudioshahAinda não há avaliações

- What Is An E-Contract: Through The InternetDocumento3 páginasWhat Is An E-Contract: Through The InternetnikowawaAinda não há avaliações

- Smart Cities: As Enablers of Sustainable Development: A European ChallengeDocumento3 páginasSmart Cities: As Enablers of Sustainable Development: A European ChallengenikowawaAinda não há avaliações

- Lecture 1 - Accounting in The Czech RepublicDocumento12 páginasLecture 1 - Accounting in The Czech RepublicUmar SulemanAinda não há avaliações

- Defining Smart Sustainable CitiesDocumento71 páginasDefining Smart Sustainable CitiesnikowawaAinda não há avaliações

- ABI-301 Lecture Note No. 1Documento6 páginasABI-301 Lecture Note No. 1Aderaw GashayieAinda não há avaliações

- Evolving Sustain AblyDocumento22 páginasEvolving Sustain AblyHenry DongAinda não há avaliações

- Introduction To Multivariate Regression AnalysisDocumento7 páginasIntroduction To Multivariate Regression AnalysisnikowawaAinda não há avaliações

- Budget Template Guide for Effective Program FundingDocumento2 páginasBudget Template Guide for Effective Program FundingnikowawaAinda não há avaliações

- Information Systems and Performance An AnalyticalDocumento11 páginasInformation Systems and Performance An AnalyticalnikowawaAinda não há avaliações

- Standard Document: Short Form Agreement For Services: Notes and Instructions For UseDocumento20 páginasStandard Document: Short Form Agreement For Services: Notes and Instructions For UsenikowawaAinda não há avaliações

- Hybrid Syllabus: MBA 500: Essentials of Business ManagementDocumento10 páginasHybrid Syllabus: MBA 500: Essentials of Business ManagementnikowawaAinda não há avaliações

- Budget WorksheetDocumento2 páginasBudget WorksheetnikowawaAinda não há avaliações

- Chapter 23 Capital Structure: Learning ObjectivesDocumento19 páginasChapter 23 Capital Structure: Learning ObjectivesnikowawaAinda não há avaliações

- Monthly Expenses: Sample Budgeting WorksheetDocumento2 páginasMonthly Expenses: Sample Budgeting WorksheetnikowawaAinda não há avaliações

- Information Systems For Business and BeyondDocumento20 páginasInformation Systems For Business and BeyondnikowawaAinda não há avaliações

- CSR Disclosure Banking Sector Saudi ArabiaDocumento20 páginasCSR Disclosure Banking Sector Saudi ArabianikowawaAinda não há avaliações

- Ford Case (2990)Documento8 páginasFord Case (2990)nikowawaAinda não há avaliações

- Economics of Money and BankingDocumento12 páginasEconomics of Money and BankingGhazal HussainAinda não há avaliações

- Insurance Law SummariesDocumento44 páginasInsurance Law SummariescindyAinda não há avaliações

- Garcia v. CA G.R. No. 133140Documento1 páginaGarcia v. CA G.R. No. 133140Neslie MarieAinda não há avaliações

- About IndustryDocumento36 páginasAbout IndustryHardik AgarwalAinda não há avaliações

- Servicewide Specialists Inc Vs Intermediate Appellate CourtDocumento6 páginasServicewide Specialists Inc Vs Intermediate Appellate CourtJunalyn BuesaAinda não há avaliações

- A Study of Agricultural Finance by CommercialDocumento7 páginasA Study of Agricultural Finance by CommercialBiju JosephAinda não há avaliações

- Managerial Accounting Chapter 13Documento63 páginasManagerial Accounting Chapter 13Mollah Md NaimAinda não há avaliações

- Heirs of Manlapat V CA (2005)Documento20 páginasHeirs of Manlapat V CA (2005)easyisthedescentAinda não há avaliações

- Code RosDocumento2 páginasCode RosDhann CromenteAinda não há avaliações

- Advance Payment - F-48Documento4 páginasAdvance Payment - F-48amit.ahiniya4398Ainda não há avaliações

- Vardhman Polytex Report on Working Capital ManagementDocumento69 páginasVardhman Polytex Report on Working Capital ManagementRanjeet Brar50% (2)

- Pan Pacific Service Contractors V PCI BankDocumento1 páginaPan Pacific Service Contractors V PCI BankRalph JuradoAinda não há avaliações

- MML WhitepaperDocumento5 páginasMML WhitepaperKors van der WerfAinda não há avaliações

- Cebu Cpar Center: Auditing Problems Preweek Lecture Problem No. 1Documento18 páginasCebu Cpar Center: Auditing Problems Preweek Lecture Problem No. 1Kelvin Kenneth ValmonteAinda não há avaliações

- The DataDocumento7 páginasThe DatashettyAinda não há avaliações

- What Is A Bank Confirmation Letter (BCL) ?: Financial InstitutionDocumento4 páginasWhat Is A Bank Confirmation Letter (BCL) ?: Financial InstitutionTomislav TomasAinda não há avaliações

- Citi BankDocumento21 páginasCiti BankVysakh PkAinda não há avaliações

- TPA Final DraftDocumento12 páginasTPA Final DraftAyushi AgrawalAinda não há avaliações

- Marketing Management: A Case Study of National Bank of Pakistan (NBP)Documento38 páginasMarketing Management: A Case Study of National Bank of Pakistan (NBP)babar2620% (1)

- RESTITUTA M. IMPERIAL, Petitioner, vs. ALEX A. JAUCIAN, Respondent. G.R. No. 149004 April 14, 2004 Panganiban, J.: FactsDocumento2 páginasRESTITUTA M. IMPERIAL, Petitioner, vs. ALEX A. JAUCIAN, Respondent. G.R. No. 149004 April 14, 2004 Panganiban, J.: FactsAdi LimAinda não há avaliações

- Telangana Strike Salary Loan 42 DaysDocumento2 páginasTelangana Strike Salary Loan 42 DaysSEKHARAinda não há avaliações

- Chapter 3: Calculating Mortgage ReturnsDocumento14 páginasChapter 3: Calculating Mortgage Returnsbaorunchen100% (1)

- Corporate AccountingDocumento2 páginasCorporate AccountingSunni ZaraAinda não há avaliações

- Replace Your Mortgage Ebook - No - Companion PDFDocumento62 páginasReplace Your Mortgage Ebook - No - Companion PDFJeff Smith100% (2)

- Business Risk & Financial RiskDocumento33 páginasBusiness Risk & Financial RiskdianaAinda não há avaliações

- Financial Environment DefinitionDocumento3 páginasFinancial Environment DefinitionHira Kanwal MirzaAinda não há avaliações

- Case Digest - Oriel Magno v. CADocumento2 páginasCase Digest - Oriel Magno v. CAAnonymous QB5OLkMUEzAinda não há avaliações

- How To Outright Cancel 100 of Your Unsecured Debt Rev 2018-05-21Documento50 páginasHow To Outright Cancel 100 of Your Unsecured Debt Rev 2018-05-21dbush103490% (10)

- Joint Venture AgreementsDocumento83 páginasJoint Venture AgreementsmysorevishnuAinda não há avaliações

- Philippine National Bank Vs DeeDocumento3 páginasPhilippine National Bank Vs DeeJezenEstherB.PatiAinda não há avaliações