Escolar Documentos

Profissional Documentos

Cultura Documentos

IFI Project Draft

Enviado por

anujalivesTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

IFI Project Draft

Enviado por

anujalivesDireitos autorais:

Formatos disponíveis

INTERNATIONAL FINANCIAL INSTITUTIONS

International financial institutions (IFIs) are financial institutions that have been

established (or chartered) by more than one country, and hence are subjects of

international law. Their owners or shareholders are generally national governments,

although other international institutions and other organizations occasionally figure as

shareholders. The most prominent IFIs are creations of multiple nations, although some

bilateral financial institutions (created by two countries) exist and are technically IFIs.

Many of these are multilateral development banks (MDB).

1. Multilateral development bank

A multilateral development bank (MDB) is an institution, created by a group of

countries that provides financing and professional advising for the purpose of

development. MDBs have large memberships including both developed donor countries

and developing borrower countries. MDBs finance projects in the form of long-term

loans at market rates, very-long-term loans (also known as credits) below market

rates, and through grants.

The following are usually classified as the main MDBs:

World Bank

European Investment Bank(EIB)

Asian Development Bank (ADB)

European Bank for Reconstruction and Development (EBRD)

Inter-American Development Bank Group (IDB, IADB)

2. Bretton Woods institutions

The best-known IFIs were established after World War II to assist in the reconstruction

of Europe and provide mechanisms for international cooperation in managing

the global financial system . They include the World Bank, the IMF, and

the International Finance Corporation. Today the largest IFI in the world is the

European Investment Bank which leant 61 billion euros to global projects in 2011.

IMF International Monetary Fund

IBRD International Bank for Reconstruction and Development

IFC International Finance Corporation

IDA International Development Association

ICSID, International Centre for Settlement of Investment Disputes

MIGA Multilateral Investment Guarantee Agency

3. Regional Development Bank

The regional development banks consist of several regional institutions that have

functions similar to the World Bank group's activities, but with particular focus on a

specific region. Shareholders usually consist of the regional countries plus the major

donor countries. The best-known of these regional banks cover regions that roughly

correspond to United Nations regional groupings, including the Inter-American

Development Bank, the Asian Development Bank; the African Development Bank;

the Central American Bank for Economic Integration; and the European Bank for

Reconstruction and Development.

4. Bilateral development banks and agencies

A bilateral development bank is a financial institution set up by one individual country

to finance development projects in a developing country and its emerging market,

hence the term bilateral, as opposed to multilateral.

5. Other regional financial institutions

Financial institutions of neighboring countries established themselves internationally

to pursue and finance activities in areas of mutual interest; most of them arecentral

banks, followed by development and investment banks.

World Bank

World Bank is United Nations international financial institution that provides financial

and technical assistance to developing countries around the world. World Bank was

established in 1944 at Bretton Woods Conference. It provides low-interest loans,

interest-free credits, and grants for basic needs of people in developing nations and

invests in their capital programs. These support a wide array of investments in such

areas as education, health, public administration, infrastructure, financial and private

sector development, agriculture, and environmental and natural resource

management.

World Bank provides or facilitates financing through co-financing with government,

other multilateral institutions, commercial banks, export credit agencies, private

sector investors, and trust fund partnerships with bilateral and multilateral donors.

President: Dr. Jim Yong Kim

HEADQUARTERS

The World Bank

1818 H Street, NW

USA

Washington, DC 20433

Country Office: India

Sunita Malhotra

New Delhi

smalhotra@worldbank.org

The institutions of the World Bank Group are:

1. International Bank for Reconstruction and Development (IBRD)

2. International Development Association (IDA)

3. International Finance Corporation (IFC)

4. Multilateral Investment Guarantee Agency (MIGA)

5. International Centre for Settlement of Investment Disputes (ICSID).

IBRD

The International Bank for Reconstruction and Development (IBRD) aims to reduce

poverty in middle-income countries and creditworthy poorer countries by promoting

sustainable development through loans, guarantees, risk management products, and

analytical and advisory services. Established in 1944 as the original institution of the

World Bank Group, IBRD is structured like a cooperative that is owned and operated

for the benefit of its 188 member countries.

IBRD raises most of its funds on the world's financial markets and has become one of

the most established borrowers since issuing its first bond in 1947. The income that

IBRD has generated over the years has allowed it to fund development activities and

to ensure its financial strength, which enables it to borrow at low cost and offer

clients good borrowing terms.

supports long-term human and social development needs that private creditors

do not finance;

preserves borrowers' financial strength by providing support in crisis periods,

which is when poor people are most adversely affected;

uses the leverage of financing to promote key policy and institutional reforms

(such as safety net or anticorruption reforms);

creates a favorable investment climate in order to catalyze the provision of

private capital;

provides financial support (in the form of grants made available from the

IBRD's net income) in areas that are critical to the well-being of poor people in

all countries.

India was the 4

th

largest borrower from IBRD in the World Bank Fiscal Year (FY) 2012

with respect to the Share of Total Loans Outstanding with IBRD and total borrowings

of $ 47.9 Billion.

IDA

IDA is one of the largest sources of assistance for the worlds 82 poorest countries, 40

of which are in Africa. It is the single largest source of donor funds for basic social

services in these countries. IDA-financed operations deliver positive change for 2.5

billion people, the majority of whom survive on less than $2 a day.

IDA lends money on concessional terms. This means that IDA charges little or no

interest and repayments are stretched over 25 to 40 years, including a 5- to 10-year

grace period. IDA also provides grants to countries at risk of debt distress.

Since its inception, IDA has supported activities in 108 countries. Annual commitments

have increased steadily and averaged about $16 billion over the last three years, with

about 50 percent of that going to Africa. For the fiscal year ending on June 30, 2013,

IDA commitments reached $16.3 billion spread over 160 new operations.

IFC

IFC was established to stimulate private investment in the Bank's borrowing countries.

IFC has three business

1. Investment Services- IFC provides a broad suite of financial products and services

including loans, equity, trade finance, structured finance, and syndications

designed to promote development in emerging economies.

2. Advisory Services- IFC offers advice, problem solving, and training to companies,

industries, and governments, all aimed at helping private sector enterprises

overcome obstacles to growth.

3. IFC Asset Management- IFC mobilizes and manages third-party capital funds for

investment in developing and frontier markets.

IFC coordinates its activities with the other institutions of the World Bank Group but is

legally and financially independent. India is IFC member since July 20, 1956.

IFC Executive Vice President and CEO - Jin-Yong Cai

Headquarters:

International Finance Corporation

2121 Pennsylvania Avenue, NW

Washington, DC 20433 USA

MIGA

MIGA is a member of the World Bank Group and has mission to promote foreign direct

investment (FDI) into developing countries. MIGA focuses on insuring investments in

following areas-

Countries eligible for assistance from the International Development

Association (the worlds poorest countries)

Conflict-affected environments

Complex deals in infrastructure and extractive industries, especially those

involving project finance and environmental and social considerations

Middle Income Countries where we can have impact

MIGAs guarantees protect investments against-non-commercial risks and can help

investors obtain access to funding sources with improved financial terms and

conditions. MIGA was established in 1988 and has issued more than $28 billion in

political risk insurance for projects in a wide variety of sectors, covering all regions of

the world.

Executive Vice President- Keiko Honda

Headquarters

Multilateral Investment Guarantee Agency

1818 H Street, NW

Washington DC

20433 USA

International Monetary Fund

Você também pode gostar

- JAL Balance Sheet 31.03.14Documento123 páginasJAL Balance Sheet 31.03.14anujalivesAinda não há avaliações

- Jal Ar Fy2014Documento178 páginasJal Ar Fy2014anujalivesAinda não há avaliações

- Business Etiquette: 1. Self-IntroductionDocumento3 páginasBusiness Etiquette: 1. Self-IntroductionanujalivesAinda não há avaliações

- 38 Ratio AnalysisDocumento11 páginas38 Ratio AnalysisBrian JonesAinda não há avaliações

- AZMINDocumento2 páginasAZMINanujalivesAinda não há avaliações

- Hello World XDDocumento1 páginaHello World XDanujalivesAinda não há avaliações

- Blue ScreenDocumento9 páginasBlue ScreenRafik DjoucampAinda não há avaliações

- Assignment On Movie The Great EscapeDocumento1 páginaAssignment On Movie The Great EscapeanujalivesAinda não há avaliações

- Hello World XDDocumento1 páginaHello World XDanujalivesAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Hostile TakeoverDocumento4 páginasHostile TakeoverSaqib Kazmi100% (1)

- Iso Cie 8995-1Documento2 páginasIso Cie 8995-1basmangeorge20% (5)

- Life Insurance Market Appears VibrantDocumento7 páginasLife Insurance Market Appears VibrantdollyAinda não há avaliações

- Haryana 2016Documento2.137 páginasHaryana 2016Sumit SavaraAinda não há avaliações

- LEGAL FRAMEWORK IN BANKSDocumento18 páginasLEGAL FRAMEWORK IN BANKSAnkita DharodAinda não há avaliações

- Tigbauan National High School Volleyball Tournament (Mixed)Documento8 páginasTigbauan National High School Volleyball Tournament (Mixed)Roland ArtiedaAinda não há avaliações

- cfos/ lgb{lzsf, @)^^ ;f/;+IfkDocumento727 páginascfos/ lgb{lzsf, @)^^ ;f/;+IfkKrishna Kumar Shrestha100% (1)

- Demokratia Da Mokalakeoba 2017 Meore Gamocema - Compressed PDFDocumento285 páginasDemokratia Da Mokalakeoba 2017 Meore Gamocema - Compressed PDFMako KeratishviliAinda não há avaliações

- Bank TaglinesDocumento2 páginasBank TaglinesershailitAinda não há avaliações

- 2juris in InsuranceDocumento3 páginas2juris in InsuranceTess LegaspiAinda não há avaliações

- Jackie McLean - I Hear A Rhapsody (Transcription)Documento2 páginasJackie McLean - I Hear A Rhapsody (Transcription)Cameron Campbell0% (1)

- Trade Facilitation Centre and Industry Associations in AhmedabadDocumento8 páginasTrade Facilitation Centre and Industry Associations in AhmedabadInnoplexus India100% (1)

- Monthly Registration Stats 2015 - DecemberDocumento3 páginasMonthly Registration Stats 2015 - DecemberBernewsAdminAinda não há avaliações

- Ultimate Shortcut Trick To Remember Bank Headquarters in India Bankers AmbitionDocumento8 páginasUltimate Shortcut Trick To Remember Bank Headquarters in India Bankers AmbitionSahil GuptaAinda não há avaliações

- 78th (Dec-13) DAIBB All Banks Subject WiseDocumento78 páginas78th (Dec-13) DAIBB All Banks Subject Wiseসামিমুর রহমান সামিমAinda não há avaliações

- 2023 Diplomatic Missions GuideDocumento345 páginas2023 Diplomatic Missions GuideSamus TaylorAinda não há avaliações

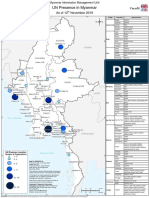

- Map UN Presence Map MIMU825v12 09jan2020 A3Documento1 páginaMap UN Presence Map MIMU825v12 09jan2020 A3Zaw Moe AungAinda não há avaliações

- Masterlist As of June 2014Documento50 páginasMasterlist As of June 2014Aye Japuz PacamalanAinda não há avaliações

- 8 TH Semester Corporate Law SyllabusDocumento4 páginas8 TH Semester Corporate Law SyllabusNasma AbidiAinda não há avaliações

- SBI vs Bank of Baroda Financial Performance ReportDocumento108 páginasSBI vs Bank of Baroda Financial Performance Reportritesh palitAinda não há avaliações

- Companies Act 2013Documento90 páginasCompanies Act 2013Ankush Kunzru100% (2)

- Business Finance Report On MCB ACQUIRES RBSeport Final MCB ACQUIRES RBSDocumento21 páginasBusiness Finance Report On MCB ACQUIRES RBSeport Final MCB ACQUIRES RBSBilalAinda não há avaliações

- Bank List in ZambiaDocumento4 páginasBank List in ZambiaNavin TulsyanAinda não há avaliações

- Iec 507Documento60 páginasIec 507Vicente Granda GarciaAinda não há avaliações

- Abbreviations of All International Organization PDFDocumento7 páginasAbbreviations of All International Organization PDFZulfaqar AhmadAinda não há avaliações

- Various Types of Companies Under Companies Act, 1956-11Documento54 páginasVarious Types of Companies Under Companies Act, 1956-11Upneet Sethi67% (3)

- Iec 60119-1960Documento100 páginasIec 60119-1960Jose mirandaAinda não há avaliações

- 1.10 International Organization NewDocumento14 páginas1.10 International Organization NewArbind YadavAinda não há avaliações

- 2022年丹麦Documento351 páginas2022年丹麦wolf wolf wolfAinda não há avaliações

- Pipe Rack BoqDocumento12 páginasPipe Rack BoqJayakannan SubbiahAinda não há avaliações