Escolar Documentos

Profissional Documentos

Cultura Documentos

Qa: A2

Enviado por

Price LangDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Qa: A2

Enviado por

Price LangDireitos autorais:

Formatos disponíveis

THE OKLAHOMAN | NEWSOK.COM SUNDAY, JUNE 1, 2014 .

3C

BUSINESS

What do you do when

you dont know the answer

to something?

Certified public ac-

countant Jim Denton be-

lieves his response to that

interview question in 1984

is what cinched the job for

him at Arledge & Associ-

ates in Edmond, where

hes built a 30-year career

in audits, commercial tax

returns and bookkeeping.

Denton showed up un-

announced at John Ar-

ledges accounting firm

and, perhaps because he

dropped the name of a

church friend who was Ar-

ledges banker, was grant-

ed an impromptu inter-

view with the owner.

If I dont know some-

thing, I go to the master

tax guide and look it up,

Denton replied.

Thats just what I

wanted to hear! boomed

Arledge, who gave Denton

his chance.

Today, Denton is ma-

naging partner and simi-

larly prods associates to

look up, in the now online

tax codes, what they dont

know. Young people of-

ten want to just ask some-

one, because it takes less

time, he said.

Arledge & Associates

employs 26 including

bookkeeping services di-

rector Mona McCool,

whos been with the firm

since it opened in July

1983. Denton expects an-

nual revenues to top $3

million this year.

From his firms 13,000-

square-foot office build-

ing at 309 N Bryant, Den-

ton, 56, sat down with The

Oklahoman on Tuesday to

talk about his life and ca-

reer. This is an edited tran-

script:

Q: Tell us about your

roots.

A: My father was from

Denison, Texas, studied

geophysics at SMU and

worked in mechanical en-

gineering for 35 years with

Conoco. He met my

mother when he was

working in Yoakum, Texas,

her hometown. I grew up

in Ponca City with two

younger brothers. Ive lost

both parents and one

brother who had Down

syndrome.

Q: What was your

thing growing up?

A: Music. I played Little

League baseball (my dad

was the coach) and some

football until ninth grade,

but music is what stuck. I

started playing bass in the

fourth grade, and played in

Putnam City High

Schools orchestra and jazz

and concert bands. I took

private lessons in high

school, and won a full

scholarship to UCO (then

Central State), where I

earned a bachelors in vo-

cal and instrumental mu-

sic education. My late fa-

ther-in-law, Coleman

Smith, was my professor

and choral director in the

mens glee club. My senior

year, Dr. Smith recruited

me to play bass for the

coed, touring group The

Tunesmiths in which his

daughter and my future

wife, Cathie, sang. Cathie

and I dated all that year,

got engaged soon after

graduation and married a

year later, in May 1981.

Q: So you started out

as a music teacher?

A: Yes. I taught two

years of high school band

at Pond Creek-Hunter,

north of Enid. I loved

teaching one-on-one and

choosing music for con-

test. But I realized I wasnt

cut out for teaching over

the long haul. It was diffi-

cult being an outsider in a

small town, and I was

nervous being in charge of

a roomful of students. I

oversaw the marching and

concert bands, but not or-

chestra, which is what I

was trained in.

Q: What led you to pur-

sue accounting?

A: Cathie suggested

looking in the employment

ads in the paper to see

what paid well. One job for

an accountant, with two

years experience, paid

$42,000 plus benefits; I

was earning $13,000 as a

teacher. Cathie said, Be

one of those (an account-

ant), and I didnt know

what one of those was.

My father who was al-

ways the smartest guy in

the room did his own

taxes, and paying someone

for professional services

was foreign to me. We

moved back to Oklahoma

City for me to pursue ac-

counting full time at Cen-

tral State, while Cathie,

whod taught in Enid,

worked full time as a sec-

retary. Throughout our

marriage, shes taught pri-

vate piano lessons, until

only recently retiring.

Q: Tell us more about

how you landed your job

with this firm.

A: Id been working as

an intern, through tax sea-

son my senior year, with

another small firm, which

I anticipated would keep

me, but was laid off right

when I graduated. It was a

rugged time. It was 84

and the oil bust, and only

three UCO accounting

graduates were hired by

big eight accounting firms.

I was handing out resumes

right and left, and making

calls eight hours a day, to

no avail. But then John Ar-

ledge took a chance on me.

He was the consummate

mentor.

Q: What are some of

the biggest lessons you

learned from John Ar-

ledge, the founder and

former chief executive of

your firm?

A: He taught us that as

professionals, we must al-

ways give our very best ef-

fort in serving our clients

and the public. Clients hire

us because were honest.

Were providing a service

on which they depend to

help improve their lives.

Its a very personal service.

Clients change firms be-

cause of people, usually

partners. Mr. Arledge also

taught us the importance

of staying in a professional

mode; that were con-

stantly representing the

firm and the accounting

profession with our ac-

tions and words, even

when were away from

work.

Q: I noticed your pic-

ture with Stephen R. Cov-

ey. Are you a fan?

A: I am. His 7 Habits of

Highly Effective People

has been one of the most

influential books to me,

along with Good to

Great by Jim Collins and

True Professionalism by

David Maister. Im cur-

rently reading The Ele-

ments of Persuasion by

Richard Maxwell. Its

about the art of storytell-

ing in our businesses.

World-class leaders know

how to tell a story from the

inside out. This book de-

tails what makes a great

business story. I just fin-

ished Boundaries for

Leaders: Results, Rela-

tionships, and Being Ri-

diculously In Charge by

Henry Cloud. Its about

having the discipline to

determine what the main

thing is, and deciding what

you will allow and not al-

low in your business.

EXECUTIVE Q&A WITH JAMES S. JIM DENTON

Former high school band teacher

finds niche in public accounting

Tax director Jim Porter, tax specialist Shannon Lavicky and Jim Denton, managing partner at Arledge & Associates, an Edmond CPA firm

look over some papers.

PHOTO BY DAVID MCDANIEL, THE OKLAHOMAN

PERSONALLY SPEAKING

Position: Arledge & Associates P.C., managing

partner

Birth date and hometown: Feb. 4, 1958; Ponca

City

Family: Wife Cathie (they celebrated their 33rd

wedding anniversary in May) and daughter Abby

Bruce of Edmond

Residence: Edmonds Turtle Creek addition

Education: University of Central Oklahoma,

bachelors in accounting and bachelors in music

education

Church: Crossings Community Church

Professional involvement: Edmond Area Cham-

ber of Commerce and Oklahoma Venture Forum

For fun: He and Cathie sing in the Canterbury

Choral Society, hold season Thunder tickets and

follow the band and orchestra of Western Heights

High School where their daughter and son-in-law

teach music education

BUSINESS WRITER

Paula

Burkes

pburkes@

opubco.com

Oklahomas strong

community-banking

background is a big reason

why the state was ranked

the third-best state for af-

fordable banking, accord-

ing to GOBankingRates

.com.

The Websites study,

which looked at credit

unions and banks in all 50

states and the District of

Columbia, identified the

10 Best and Worst Places

for Affordable Banking.

Key factors evaluated

included minimum bal-

ance requirements, annual

percentage yields, as well

as average fees and

monthly charges for de-

posit accounts.

The study also looked at

the number of financial

institutions available to

state residents, because

accessibility plays into af-

fordability quite closely,

said Jennifer Calonia, GO-

BankingRates senior edi-

tor.

Easy access to a banks

ATM network as well as

the ability to work directly

with bank representatives

in a branch or to talk to a

lender contribute to a cus-

tomers overall knowledge

and the ability to keep fees

low, Calonia said.

The most competitive

states with affordable

banking were concentrat-

ed mainly in the Midwest

and South, with the ex-

ception of Massachusetts

and Rhode Island in the

Northeast.

Arkansas and Iowa were

the top ranked states.

According to the study,

Oklahoma banks and

credit unions are consum-

er friendly when it comes

to fees and charges.

Consumer friendly

The primary reason, I

believe, is that Oklahoma

is predominantly a com-

munity bank state, which

means that the banks that

operate here really operate

on the basis of the rela-

tionship with the custom-

er rather than treating

customers as an objective

series of numbers, said

Roger Beverage, president

and CEO of the Oklahoma

Bankers Association. And

that is big. You get to know

your customer.

Many bankers within

the state also have sur-

vived downturns over the

last several years. They

didnt get caught up in real

estate problems during the

Great Recession, and they

have been laser focused on

the survival of their cus-

tomers and communities,

he said.

If the customer doesnt

survive, then the bank los-

es and the community los-

es, Beverage added.

Calonia agreed that Ok-

lahoma is nearly unique in

the states large market

share of community

banks, as opposed to out-

of-state banks.

I found about 76 per-

cent or so of the market

share is attributed to com-

munity banks, whether on

a larger or smaller scale,

she added.

Community banks are

invested in their local

communities, putting

funds back into the com-

munities they serve and

offering quality products

to residents, Calonia said.

They are able to offer com-

petitive products, she said.

According to the study,

Oklahoma ranked second

best for fees associated

with checks that are re-

turned because of insuffi-

cient funds.

Oklahomas average fee

for returned checks that

dont have sufficient funds

is $27 compared to $33 in

Arizona, the worst state

for affordable banking, ac-

cording to the study.

Oklahomas average

checking annual percent-

age yield is 0.380 percent

on an average checking

minimum balance re-

quirement of $2,275.

The states average sav-

ings annual percentage

yield is 0.149 percent on an

average savings minimum

balance requirement of

$884.

Oklahoma has an aver-

age monthly maintenance

fee of $4 for savings ac-

counts and $9 for checking

accounts of all types, ac-

cording to the study.

Website ranks OK banks, credit unions as affordable

BY LAURIE WINSLOW

Tulsa World

laurie.winslow@tulsaworld.com

If the customer doesnt survive, then

the bank loses and the community

loses.

ROGER BEVERAGE

PRESIDENT AND CEO OF THE

OKLAHOMA BANKERS ASSOCIATION

Você também pode gostar

- Taxi Driver—The Ill Fated Lad: From Heaven to HellNo EverandTaxi Driver—The Ill Fated Lad: From Heaven to HellAinda não há avaliações

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesNo EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesNota: 4 de 5 estrelas4/5 (9)

- Appetite For Success: Teaching TeachersDocumento16 páginasAppetite For Success: Teaching TeacherselauwitAinda não há avaliações

- Pulling Customers Back To Small Business: A 7 Topic Guide For Small Business Owners & Store ManagersNo EverandPulling Customers Back To Small Business: A 7 Topic Guide For Small Business Owners & Store ManagersNota: 5 de 5 estrelas5/5 (2)

- 2011-2012 MNA Better Newspaper Contest Winners BookDocumento80 páginas2011-2012 MNA Better Newspaper Contest Winners BookMN Newspaper Assoc.Ainda não há avaliações

- The Road to Success: How to Achieve Success in Business, Life, and LoveNo EverandThe Road to Success: How to Achieve Success in Business, Life, and LoveAinda não há avaliações

- 26065951Documento137 páginas26065951shridharAinda não há avaliações

- American Fathers: A Tale of Intrigue, Inspiration, and the Entrepreneurial SpiritNo EverandAmerican Fathers: A Tale of Intrigue, Inspiration, and the Entrepreneurial SpiritAinda não há avaliações

- Good Company: How to Build a Business without Losing Your ValuesNo EverandGood Company: How to Build a Business without Losing Your ValuesAinda não há avaliações

- Steve BelkinDocumento13 páginasSteve BelkinpodxAinda não há avaliações

- What Do You Do Around Here Anyway?: Real-Life Discussion Generators for Wannabe PrincipalsNo EverandWhat Do You Do Around Here Anyway?: Real-Life Discussion Generators for Wannabe PrincipalsAinda não há avaliações

- Becoming the Millionaire Employee: How to Become Rich While Working for a PaycheckNo EverandBecoming the Millionaire Employee: How to Become Rich While Working for a PaycheckAinda não há avaliações

- The Debt-Free Lifestyle: A Strategy for the Average CanadianNo EverandThe Debt-Free Lifestyle: A Strategy for the Average CanadianAinda não há avaliações

- Practical Networking: How to Give and Get Help with JobsNo EverandPractical Networking: How to Give and Get Help with JobsAinda não há avaliações

- News Excellence Sept 20 C7Documento1 páginaNews Excellence Sept 20 C7Contest PagesAinda não há avaliações

- The Principles of Business: Understanding What Makes a Business Successful and Valuable to SocietyNo EverandThe Principles of Business: Understanding What Makes a Business Successful and Valuable to SocietyAinda não há avaliações

- Blue Collar Success Laws: Your No-Nonsense Guide to Problem-Solving, Productivity, & ProfitNo EverandBlue Collar Success Laws: Your No-Nonsense Guide to Problem-Solving, Productivity, & ProfitAinda não há avaliações

- What It Takes: Lessons in the Pursuit of ExcellenceNo EverandWhat It Takes: Lessons in the Pursuit of ExcellenceNota: 4.5 de 5 estrelas4.5/5 (19)

- Investing with Purpose: Capitalize on the Time and Money You Have to Create the Tomorrow You DesireNo EverandInvesting with Purpose: Capitalize on the Time and Money You Have to Create the Tomorrow You DesireAinda não há avaliações

- Audible - Law School ConfidentialDocumento31 páginasAudible - Law School ConfidentialMa. Mae Chastine VillarAinda não há avaliações

- Taking A Break From Worries: Inside This IssueDocumento16 páginasTaking A Break From Worries: Inside This IssueelauwitAinda não há avaliações

- Women With Know How November 2012Documento50 páginasWomen With Know How November 2012Mimi ZelmanAinda não há avaliações

- 2014-09-25 Dawson Community College SpeechDocumento4 páginas2014-09-25 Dawson Community College SpeechsenatortesterAinda não há avaliações

- My Spiritual Journey: Night Club Manager, Orphanage Worker, PsychologistNo EverandMy Spiritual Journey: Night Club Manager, Orphanage Worker, PsychologistAinda não há avaliações

- Writing Michigan ECCE - OdtDocumento10 páginasWriting Michigan ECCE - OdtEleni BakousiAinda não há avaliações

- Builder JULY 2012 NewsletterDocumento2 páginasBuilder JULY 2012 Newsletterbabyface51224Ainda não há avaliações

- Smart People Should Build Things: How to Restore Our Culture of Achievement, Build a Path for Entrepreneurs, and Create New Jobs in AmericaNo EverandSmart People Should Build Things: How to Restore Our Culture of Achievement, Build a Path for Entrepreneurs, and Create New Jobs in AmericaNota: 4.5 de 5 estrelas4.5/5 (54)

- SOLD! A Top Producer's Blueprint for a Standout Real Estate CareerNo EverandSOLD! A Top Producer's Blueprint for a Standout Real Estate CareerAinda não há avaliações

- How to Land the Best $100,000 Job in America: Your Guide to High-Paying Careers in Commercial Real Estate ManagementNo EverandHow to Land the Best $100,000 Job in America: Your Guide to High-Paying Careers in Commercial Real Estate ManagementAinda não há avaliações

- Doctor Lawyer Engineer: How to Pursue Your Dreams without Giving Your Parents a Heart AttackNo EverandDoctor Lawyer Engineer: How to Pursue Your Dreams without Giving Your Parents a Heart AttackNota: 2 de 5 estrelas2/5 (1)

- A Freelancer's Survival Guide to Maximizing Your SuccessNo EverandA Freelancer's Survival Guide to Maximizing Your SuccessAinda não há avaliações

- Full-time to Fulfilled - The blueprint to success as an independent consultantNo EverandFull-time to Fulfilled - The blueprint to success as an independent consultantAinda não há avaliações

- Economic Blueprint' For Staten Island: WBCLDC Expanding FootprintDocumento32 páginasEconomic Blueprint' For Staten Island: WBCLDC Expanding FootprintelauwitAinda não há avaliações

- Fire Your Financial Advisor: 40 Years of Greed & Exploitation of the American Retiree, and How You Can Fight BackNo EverandFire Your Financial Advisor: 40 Years of Greed & Exploitation of the American Retiree, and How You Can Fight BackAinda não há avaliações

- Campaign Announcement Speech FinalDocumento5 páginasCampaign Announcement Speech FinalJackie CilleyAinda não há avaliações

- The Integrated Entrepreneur: Achieving Happiness in Relationships, Business & LifeNo EverandThe Integrated Entrepreneur: Achieving Happiness in Relationships, Business & LifeAinda não há avaliações

- Journey of John KalenchDocumento6 páginasJourney of John KalenchMahadiMohdDinAinda não há avaliações

- Personal Narrative EssayDocumento2 páginasPersonal Narrative Essay02 Vandan Agarwal0% (1)

- October 16, 2012: The Second Obama-Romney Presidential DebateDocumento31 páginasOctober 16, 2012: The Second Obama-Romney Presidential DebatePablo BlancoAinda não há avaliações

- Putnam Voice - 1/11/12Documento10 páginasPutnam Voice - 1/11/12The Lima NewsAinda não há avaliações

- Culpwrit Ward White's Career Path Provides Tips For Landing Your First JobDocumento3 páginasCulpwrit Ward White's Career Path Provides Tips For Landing Your First JobMegan WhiteAinda não há avaliações

- Bethel Focuses On Finances: Clip Resized 55% From A03Documento2 páginasBethel Focuses On Finances: Clip Resized 55% From A03Price LangAinda não há avaliações

- Bin 26499 677705 1Documento1 páginaBin 26499 677705 1Price LangAinda não há avaliações

- LPS Still Calculating How Many Students Were Lost: Sep 20 A001Documento7 páginasLPS Still Calculating How Many Students Were Lost: Sep 20 A001Price LangAinda não há avaliações

- Bin 26499 679653 1Documento1 páginaBin 26499 679653 1Price LangAinda não há avaliações

- Bin 26499 680509 1Documento10 páginasBin 26499 680509 1Price LangAinda não há avaliações

- Bin 26499 676127 1Documento1 páginaBin 26499 676127 1Price LangAinda não há avaliações

- Bin 26499 677749 1Documento3 páginasBin 26499 677749 1Price LangAinda não há avaliações

- Jett Wins Runoff: Bice Will Take On Kendra Horn in NovemberDocumento6 páginasJett Wins Runoff: Bice Will Take On Kendra Horn in NovemberPrice LangAinda não há avaliações

- Bin 26499 678079 1Documento4 páginasBin 26499 678079 1Price LangAinda não há avaliações

- Sep 10 A005: The Duncan BannerDocumento3 páginasSep 10 A005: The Duncan BannerPrice LangAinda não há avaliações

- In Oklahoma, Epic's Operator Refuses To Release Spending Records. in California, Records Are PublicDocumento4 páginasIn Oklahoma, Epic's Operator Refuses To Release Spending Records. in California, Records Are PublicPrice LangAinda não há avaliações

- Bin 26499 673103 1Documento9 páginasBin 26499 673103 1Price LangAinda não há avaliações

- Oklahoma Runoff Takeaways: Stephanie Bice Wins, Incumbents FallDocumento1 páginaOklahoma Runoff Takeaways: Stephanie Bice Wins, Incumbents FallPrice LangAinda não há avaliações

- Pandemic Spurs Enrollment at Oklahoma Virtual Charter SchoolDocumento10 páginasPandemic Spurs Enrollment at Oklahoma Virtual Charter SchoolPrice LangAinda não há avaliações

- Rainbow Fleet 8-14-20Documento1 páginaRainbow Fleet 8-14-20Price LangAinda não há avaliações

- Oklahoma County Judge Imposes $500,000 Fine On Epic Charter Schools' NonprofitDocumento4 páginasOklahoma County Judge Imposes $500,000 Fine On Epic Charter Schools' NonprofitPrice LangAinda não há avaliações

- Bin 26499 673831 1Documento2 páginasBin 26499 673831 1Price LangAinda não há avaliações

- Bin 26499 674983 1Documento2 páginasBin 26499 674983 1Price LangAinda não há avaliações

- Trillium Opens Fast-Fill Public CNG Station in Los AngelesDocumento1 páginaTrillium Opens Fast-Fill Public CNG Station in Los AngelesPrice LangAinda não há avaliações

- (DLC) The Journal Record - Aug 4 2020Documento1 página(DLC) The Journal Record - Aug 4 2020Price LangAinda não há avaliações

- Charter School Numbers Spike Amid Pandemic: Michael D. SmithDocumento6 páginasCharter School Numbers Spike Amid Pandemic: Michael D. SmithPrice LangAinda não há avaliações

- Tulsa Beacon 8-6-20Documento2 páginasTulsa Beacon 8-6-20Price LangAinda não há avaliações

- Bin 26499 670745 1Documento14 páginasBin 26499 670745 1Price LangAinda não há avaliações

- Bin 26499 671315 1Documento2 páginasBin 26499 671315 1Price LangAinda não há avaliações

- Journal Record 8-6-20Documento1 páginaJournal Record 8-6-20Price LangAinda não há avaliações

- Hominy Schools Re-Opening Plan ReleasedDocumento3 páginasHominy Schools Re-Opening Plan ReleasedPrice LangAinda não há avaliações

- Foundation Seeks Wall of Fame Nominations: COVID-19 and The People Side of Business ContinuityDocumento1 páginaFoundation Seeks Wall of Fame Nominations: COVID-19 and The People Side of Business ContinuityPrice LangAinda não há avaliações

- Epic Now Largest School District in State: D VinciDocumento2 páginasEpic Now Largest School District in State: D VinciPrice LangAinda não há avaliações

- We Are All Invited To Learn Better Conversations': Workplace Safety Plans Must Address COVID-19Documento1 páginaWe Are All Invited To Learn Better Conversations': Workplace Safety Plans Must Address COVID-19Price LangAinda não há avaliações

- Enrollment Shifting Online As Digital Divide Lingers: Aug 01 A006Documento5 páginasEnrollment Shifting Online As Digital Divide Lingers: Aug 01 A006Price LangAinda não há avaliações

- Gap Analysis of IRCTCDocumento37 páginasGap Analysis of IRCTCHitesh SethiAinda não há avaliações

- AFLT-14 QAMT-14 Mock AMCATDocumento3 páginasAFLT-14 QAMT-14 Mock AMCATsrijani palAinda não há avaliações

- JBC Travel and ToursDocumento15 páginasJBC Travel and ToursArshier Ching0% (1)

- MIB, Semester 1 Accounting and Finance Luvnica Rastogi: Amity International Business SchoolDocumento25 páginasMIB, Semester 1 Accounting and Finance Luvnica Rastogi: Amity International Business SchoolRatika GuptaAinda não há avaliações

- Form of Application For Repurchase of UnitsDocumento2 páginasForm of Application For Repurchase of UnitsHaritha SankarAinda não há avaliações

- The Danish Asia Trade 1620 1807Documento26 páginasThe Danish Asia Trade 1620 1807zargis1Ainda não há avaliações

- Syracuse City School District Superintendent S Proposed 2011-2012 Budget Executive SummaryDocumento29 páginasSyracuse City School District Superintendent S Proposed 2011-2012 Budget Executive SummaryTime Warner Cable NewsAinda não há avaliações

- Power of The Commissioner To Interpret Tax Laws and To Decide Tax CasesDocumento3 páginasPower of The Commissioner To Interpret Tax Laws and To Decide Tax CasesLovelyAinda não há avaliações

- Labeling, Handling and Collection of Healthcare WasteDocumento28 páginasLabeling, Handling and Collection of Healthcare WasteKanze AhiuAinda não há avaliações

- SITXWHS001 - Participate in Safe Work Practices Student Assessment GuideDocumento34 páginasSITXWHS001 - Participate in Safe Work Practices Student Assessment GuideKAROL ESTEFANIA GARCIAAinda não há avaliações

- Statistik MBADocumento41 páginasStatistik MBAFarisAinda não há avaliações

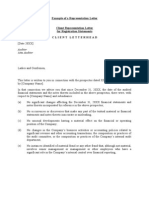

- Example of A Representation LetterDocumento8 páginasExample of A Representation LetterPradhikta RumbagaAinda não há avaliações

- Master Plan BecDocumento54 páginasMaster Plan BecJelena Mitrovic SimicAinda não há avaliações

- Multiple Choice Questions Distrubution Logistic PDFDocumento14 páginasMultiple Choice Questions Distrubution Logistic PDFYogesh Bantanur50% (2)

- Aggregate Supply: Module ObjectivesDocumento5 páginasAggregate Supply: Module ObjectivesshutupfagAinda não há avaliações

- ADVENT'19 Encipher: Case It To Ace It: The Commerce Society - Kirori Mal CollegeDocumento3 páginasADVENT'19 Encipher: Case It To Ace It: The Commerce Society - Kirori Mal CollegeParth ChawlaAinda não há avaliações

- Contract & Accounts (CE6G) - TenderDocumento24 páginasContract & Accounts (CE6G) - TenderRamaiz DarAinda não há avaliações

- 6 Stocks Double Investors' Wealth Since Last Ganesh ChaturthiDocumento8 páginas6 Stocks Double Investors' Wealth Since Last Ganesh ChaturthiJayaprakash MuthuvatAinda não há avaliações

- Honda Case StudyDocumento11 páginasHonda Case StudySarjodh SinghAinda não há avaliações

- Induction Training 182Documento1 páginaInduction Training 182Satyam mishraAinda não há avaliações

- Discurs LeninDocumento2 páginasDiscurs LeninGeanina IchimAinda não há avaliações

- Pakistan Next Generation Report Part 02Documento23 páginasPakistan Next Generation Report Part 02ZafarH100% (1)

- Statement OF Financial Interests: Nadc Form C-1Documento4 páginasStatement OF Financial Interests: Nadc Form C-1nebraskawatchdogAinda não há avaliações

- Holiday Lighting Story With GraphicDocumento2 páginasHoliday Lighting Story With GraphickourtneygeersAinda não há avaliações

- Firstmasterclass TB Progress Test 3 A4Documento4 páginasFirstmasterclass TB Progress Test 3 A4Adri ChAinda não há avaliações

- COIMBATOREDocumento3 páginasCOIMBATOREYashAinda não há avaliações

- Country Profile Official Name in Other Official LanguagesDocumento53 páginasCountry Profile Official Name in Other Official LanguagesMarnelli MabiniAinda não há avaliações

- PayslipDocumento2 páginasPayslipJericho Funtilar GarciaAinda não há avaliações

- Perverse Consequences of Well-Intentioned Regulation: Evidence From India's Child Labor BanDocumento2 páginasPerverse Consequences of Well-Intentioned Regulation: Evidence From India's Child Labor BanCato InstituteAinda não há avaliações

- GD Steam TurbinesDocumento1 páginaGD Steam Turbinesmadhusudanan.asbAinda não há avaliações