Escolar Documentos

Profissional Documentos

Cultura Documentos

Article 2014 06 Analytic Insights Mispriced Risk

Enviado por

lcmgroupeDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Article 2014 06 Analytic Insights Mispriced Risk

Enviado por

lcmgroupeDireitos autorais:

Formatos disponíveis

GordonTLong.

com

MISPRICED RISK & CREDIT CRACKS

TRIGGER$ - JUNE 2014

Gordon T Long

5/28/2014

MISPRICED RISK & CREDIT CRACKS

We have talked extensively over the last few years, of the specific Moral Hazard and Unintended

Consequences that has emerged as a result of what I have referred to as Monetary Malpractice.

This is not to suggest that it is driven

by incompetence, but rather it is part

of an orchestrated plan to ensure

government debt financing continues

despite the magnitude it has grown

to.

The most important role of the all

Central Banks, but seldom mentioned,

is to make sure that proliferate

government spending is funded.

When Taxes (which include all forms

and levels of taxes, licenses, fees,

penalties etc) and then the stealth tax

of Inflation run out of room,

democratic governments are forced

to resort to the Macro Prudential

strategy of Financial Repression.

The corner stone of Financial Repression is

sustained negative real interest rates. As

such the Federal Reserve has steadily

orchestrated a continuous and highly

controlled (as can be seen how tightly the

10 Year UST channel declines as shown

here) to reduce nominal interest rates and

the consequence of reduced financing

costs for government debt financing.

If we were paying interest rates we had

only a few years ago the US government

and most developed economies would be

in the midst of even a worse financial and

currency crisis.

The point here is that this sort of

manipulation does not come free, as has

been most evidently witnessed by the serial

bubbles that we have experienced over at

least the last two decades.

When we look at factors such as Margin Debt

levels it is blatantly obvious we are once

again at levels that have proven in the past

not to be kind to the equity markets. Actually

we are levels we have never experienced

since the US came off the gold standard.

No doubt you are familiar with the Emotional

Euphoric Cycle which the equity markets go

through. An example of which is shown here on the left. What you may not be as familiar with is that

the credit markets go through a similar cycle despite it being more analytic and traditionally more

conservative that equity markets.

When you map developments and milestones in the credit markets you immediately see we are at levels

that are traditionally considered elevated and excessive.

US distressed debt spreads have now reached five year highs. We are quickly reaching levels which we

witnessed prior to the 2008 financial crisis and when you look at the details appear to be accelerating.

Though this is a US chart I would be a miss if I didnt tell you that Chinas is even more dramatic with

Non-Performing Loans going through the roof.

COVENANT LITE & PIK LOANS

There are various kinds of loans such as PIK Loans (which is short for Payment in Kind), Covenant Lite

Loans and others that are good indicators of the risk being taken by lenders and borrowers assuming

higher levels of leveraged risk. As you can see they are also at extremes.

I have mentioned previously in Trigger$ of a Bloomberg Proprietary Credit analysis which involves a

regression analysis of a number of key credit metrics. I refer you to PAY ATTENTION TO CREDIT

MARKETS for more detail. I have been finding it extremely accurate if analyzed properly.

It is presently signaling a significant 70 point S&P 500 divergence. If credit weakens further, which I

expect, this divergence could worsen. Certainly it says caution is advised near term or volatility may

soon be the order of the day.

BOND ROTATION

I am also seeing signs of a potential bond

rotation and potentially major portfolio

rebalancing moves from equity positions to

Treasuries.

As big as the US deficit is it must be

remembered it is being brought down from

well over $1T to the $600-$700B level. This

means shrinking near term supply. When

you couple it with the actions of the Fed to

dominate the buying of USTs there is a

potential supply shortage coming that any

sort of fear trade would ignite.

This is precisely what the engineers of Financial Repression would consider a home run and would map

perfectly to the long term treasury chart I showed earlier.

CONSUMER CREDIT MARKETS

In a recent article entitled Consumer Credit Cracks - The 'New Shadow Banking' Collateral Problem I

showed the emerging cracks in the US consumer lending details and practices. Whether we are talking:

1. HELOC Delinquencies

2. Non Performing Student Loan levels,

3. Car Loan subprime lending and leasing levels,

4. Home Mortgage credit scores

5. Housing Down payment requirements

6. Shipping Credit

.. . There is mounting evidence of serious decay in credit.

The problem is that most of this credit is funded through the shadow banking intermediation channel. A

process built on borrowing short and lending loan with significant duration risk exposures if credit was

to tighten abruptly due to fear for whatever reason. During the financial crisis it was an Asset Backed

Commercial Paper problem. Today the acronyms have changed but the exposure is the same when we

delve into the world of Repos and Collateral Transformations.

Dodd Franks has done almost nothing to fix this systemic hot spot.

Another article I recently wrote entitled Risk is Leaving the Market - Stealth Movements Warn of

Potential Q2 Market Troubles I showed the cascading nature of risk-off leaving the market. By that I

mean how the higher risk stocks are weakening ahead of what is considered the less risky stocks. This is

a classic market topping signal. It may not be a long term top but is likely, minimally an intermediate

term top.

The large players are leaving as the public begins feeling confident enough to re-enter. As usual it is the

fear of missing out that attracts them when the risk is the highest.

An indicator I like for situations like this is the Russell 2000 to Russell 1000 ratio. As risk leaves and risk-

off begins to take hold the ratio will fall, which it has. You then pay attention to the moving average

crosses for confirmation of a trend reversal. We see here this is also happening though the oscillators

suggest is may be overdone in the short term. As I said earlier, Credit is not a great market timing device

but it does do a great job of keeping you out of trouble at critical times.

KEY LONG TERM INDICATORS

I would like to shift gears slightly and talk about credit from the big picture perspective. F.F. Wiley

published at the Cyniconomics blog three interesting charts.

The first chart shows the percentage of total borrowing thats funded by the three riskiest sources of

funds. Three periods stand out for an unusually high percentage of risky borrowing. The first two

coincide with the creeping inflation of the 1960s and Great Inflation of the 1970s. The third overlaps

the serial bubbles of the last two decades and leads into the 2008 financial crisis. Problems with either

inflation or financial instability are exactly what you should expect when debt funding is tilted

heavily towards risky sources.

The second chart divides risky

borrowing by GDP. This chart can

help you gauge how hard the

economy might fall after the

inevitable cracks appear in credit

markets. Not surprisingly, it shows

that the three periods with the

greatest amounts of risky

borrowing were followed by the

three hardest falls severe

recessions in 1973-75, 1980-82

and 2008-09. Virtually every

recession follows a drop in risky

borrowing. Large amounts of risky

borrowing eventually lead to

vicious circles in which soured

loans and a slower borrowing pace

drag economic activity lower then you should expect recessions to occur after risky borrowing

peaks. This is exactly what we see.

The third indicator measures the change in risky borrowing using a two year change. It helps to

narrow down recession probabilities. And while it doesnt offer ironclad proof that borrowing in excess

of non-money savings leads to recessions (theres no such thing), it fits into the very process

described by economists whove dared suggest that such borrowing is risky.

These charts ring hard when we consider this next chart.

Companies are reporting revenue problems though they are still able maintain the bottom line through

labor costs cuts, financial engineering, low interest rates, and stock buybacks (as well as dividends to

keep stock prices up), but for how long?

A recession scare is not out of line from a historical perspective.

My work with Richard Duncan says that there is a liquidity problem coming in the 2

nd

half if the TAPER

program is maintained. I personally expect that by Q4 the Fed will be forced insert liquidity or face a

potential recession. The markets will react to all of this with fear from very elevated levels.

COPPOCK LONG WAVES

My Macro Analytics Co-Host Charles Hugh Smith recently posted this chart.

I have long prized the Coppock measure in the bond market so I found the analysis interesting. This

chart shows the Coppock Curve for the S&P 500, overlaid against previous deflationary secular Bear

Markets in the late 1800s, the U.S market in the 1920s and 30s and the Japanese Nikkei stock market

index from 1986 to the present. Charles added notes to the chart to mark the potential market

bottom in early 2015 and a possible peak in Fall 2016. He also added a note that suggests the

shallow troughs in 2005 and 2011 were the result of unprecedented financial engineering by central

banks> He suggests that financial authorities have been dead-set on limiting market declines and

"buying time" so the broken parasitic financial system could feed off the real economy long enough to

restore its viability.

It fits with our expectations of a an Intermediate correction/consolidation into the fall elections and

then a rise to new highs in the first half of 2015. Charles Coppock Curve suggests this could last

longer and go higher than my forecast for the final hyperinflation wave

BE PATIENT WAIT FOR THE DEATH CROSSES

As a lay out in Be Patient: Wait for the Death Crosses! The key here is to anticipate but wait on

confirmations.

I expect major liquidity injection announcements from the ECB by June and the BOJ in Q3. These will be

market movers as will Ukraine events and a potential US$ damaging Energy deal between Russia and

China.

The bottom line to me is that I see volatility increasing over the next 60 days, between now and June

quadruple witch with a major market correction beginning by July options expiration and lasting into the

fall.

Gordon T Long

Publisher & Editor

general@GordonTLong.com

Gordon T Long is not a registered advisor and does not give investment advice. His comments are an expression of opinion only

and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity

or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his

own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate

regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that you are encouraged to

confirm the facts on your own before making important investment commitments.

Copyright 2014 Gordon T Long. The information herein was obtained from sources which Mr. Long believes reliable, but he does

not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a

solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may

from time to time invest in securities that are recommended or otherwise covered on this website. Mr. Long does not intend to

disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this

possibility before investing in any security based upon statements and information contained in any report, post, comment or

suggestions you receive from him.

Você também pode gostar

- Follow the Money: Fed Largesse, Inflation, and Moon Shots in Financial MarketsNo EverandFollow the Money: Fed Largesse, Inflation, and Moon Shots in Financial MarketsAinda não há avaliações

- The New Depression: The Breakdown of the Paper Money EconomyNo EverandThe New Depression: The Breakdown of the Paper Money EconomyNota: 4 de 5 estrelas4/5 (5)

- Is The Credit Crisis Winding DownDocumento8 páginasIs The Credit Crisis Winding DownAnanthAinda não há avaliações

- Credit Suisse, Market Focus, Jan 17,2013Documento12 páginasCredit Suisse, Market Focus, Jan 17,2013Glenn ViklundAinda não há avaliações

- Economyths: How the Science of Complex Systems is Transforming Economic ThoughtNo EverandEconomyths: How the Science of Complex Systems is Transforming Economic ThoughtNota: 3.5 de 5 estrelas3.5/5 (18)

- Fed Up!: Success, Excess and Crisis Through the Eyes of a Hedge Fund Macro TraderNo EverandFed Up!: Success, Excess and Crisis Through the Eyes of a Hedge Fund Macro TraderAinda não há avaliações

- The Coming Bond Market Collapse: How to Survive the Demise of the U.S. Debt MarketNo EverandThe Coming Bond Market Collapse: How to Survive the Demise of the U.S. Debt MarketAinda não há avaliações

- September 15, 2010 PostsDocumento478 páginasSeptember 15, 2010 PostsAlbert L. PeiaAinda não há avaliações

- What's+Behind+the+Downturn Howard+Marks Oaktree 9-7-11Documento13 páginasWhat's+Behind+the+Downturn Howard+Marks Oaktree 9-7-11mdenglaAinda não há avaliações

- How to Prepare for the NEXT Financial & Economic Crash A Concise Pocket GuideNo EverandHow to Prepare for the NEXT Financial & Economic Crash A Concise Pocket GuideAinda não há avaliações

- Chart 1: Leading Economic Indicators: Page 1 of 11 445 Park Avenue, 5 Floor - New York, NY 10022 - 212.201.5800Documento11 páginasChart 1: Leading Economic Indicators: Page 1 of 11 445 Park Avenue, 5 Floor - New York, NY 10022 - 212.201.5800sugumar_rAinda não há avaliações

- Crisis Control For 2000 and Beyond: Boom or Bust?: Seven Key Principles to Surviving the Coming Economic UpheavalNo EverandCrisis Control For 2000 and Beyond: Boom or Bust?: Seven Key Principles to Surviving the Coming Economic UpheavalAinda não há avaliações

- Reinventing Banking: Capitalizing On CrisisDocumento28 páginasReinventing Banking: Capitalizing On Crisisworrl samAinda não há avaliações

- Credit Supernova!: Investment OutlookDocumento0 páginaCredit Supernova!: Investment OutlookJoaquim MorenoAinda não há avaliações

- Disequilibrium: How America's Great Inflation Led to the Great RecessionNo EverandDisequilibrium: How America's Great Inflation Led to the Great RecessionNota: 4 de 5 estrelas4/5 (1)

- Strategic Value: Value Analysis as a Business WeaponNo EverandStrategic Value: Value Analysis as a Business WeaponAinda não há avaliações

- SocGen End of The Super Cycle 7-20-2011Documento5 páginasSocGen End of The Super Cycle 7-20-2011Red911TAinda não há avaliações

- The Wall Street Journal Guide to the End of Wall Street as We Know It: What You Need to Know About the Greatest Financial Crisis of Our Time—and How to Survive ItNo EverandThe Wall Street Journal Guide to the End of Wall Street as We Know It: What You Need to Know About the Greatest Financial Crisis of Our Time—and How to Survive ItAinda não há avaliações

- Jimmy Stewart Is Dead: Ending the World's Ongoing Financial Plague with Limited Purpose BankingNo EverandJimmy Stewart Is Dead: Ending the World's Ongoing Financial Plague with Limited Purpose BankingNota: 3 de 5 estrelas3/5 (5)

- Cards 10.10Documento4 páginasCards 10.10LOLAinda não há avaliações

- Volume 2.1 Global Disequilibria Feb 3 2010Documento14 páginasVolume 2.1 Global Disequilibria Feb 3 2010Denis OuelletAinda não há avaliações

- The Financial System Limit: The world's real debt burdenNo EverandThe Financial System Limit: The world's real debt burdenNota: 3.5 de 5 estrelas3.5/5 (11)

- The Pessimist Complains About The Wind The Optimist Expects It To Change The Realist Adjusts The Sails.Documento17 páginasThe Pessimist Complains About The Wind The Optimist Expects It To Change The Realist Adjusts The Sails.brundbakenAinda não há avaliações

- Engineering the Financial Crisis: Systemic Risk and the Failure of RegulationNo EverandEngineering the Financial Crisis: Systemic Risk and the Failure of RegulationNota: 5 de 5 estrelas5/5 (1)

- Quarterly: Third QuarterDocumento16 páginasQuarterly: Third Quarterrichardck61Ainda não há avaliações

- FinTech Rising: Navigating the maze of US & EU regulationsNo EverandFinTech Rising: Navigating the maze of US & EU regulationsNota: 5 de 5 estrelas5/5 (1)

- Ulman Financial Fourth Quarter Newsletter - 2018-10Documento8 páginasUlman Financial Fourth Quarter Newsletter - 2018-10Clay Ulman, CFP®Ainda não há avaliações

- Current Issues in Financial MarketsDocumento5 páginasCurrent Issues in Financial Marketsreb_nicoleAinda não há avaliações

- RK&S Smart Solutions, Inc.: Risk ManagementDocumento6 páginasRK&S Smart Solutions, Inc.: Risk ManagementantishrillwebdesignAinda não há avaliações

- Financial MarketDocumento10 páginasFinancial MarketwildahAinda não há avaliações

- March 292010 PostsDocumento12 páginasMarch 292010 PostsAlbert L. PeiaAinda não há avaliações

- Why We Must End Too Big To FailDocumento21 páginasWhy We Must End Too Big To FailBryan CastañedaAinda não há avaliações

- Global Market Outlook July 2011Documento8 páginasGlobal Market Outlook July 2011IceCap Asset ManagementAinda não há avaliações

- Why Real Yields Matter - Pictet Asset ManagementDocumento7 páginasWhy Real Yields Matter - Pictet Asset ManagementLOKE SENG ONNAinda não há avaliações

- Air Phase1 0Documento13 páginasAir Phase1 0drkwng100% (1)

- The Crisis & What To Do About It: George SorosDocumento7 páginasThe Crisis & What To Do About It: George SorosCarlos PLAinda não há avaliações

- China and the US Foreign Debt Crisis: Does China Own the USA?No EverandChina and the US Foreign Debt Crisis: Does China Own the USA?Ainda não há avaliações

- Leveraged: The New Economics of Debt and Financial FragilityNo EverandLeveraged: The New Economics of Debt and Financial FragilityMoritz SchularickAinda não há avaliações

- Warsh Speech 20100628Documento11 páginasWarsh Speech 20100628Samy SudanAinda não há avaliações

- X-Factor Report 1/28/13 - Will The Market Ever Correct?Documento10 páginasX-Factor Report 1/28/13 - Will The Market Ever Correct?streettalk700Ainda não há avaliações

- Bill GrosBill GrossDocumento4 páginasBill GrosBill GrossJuan HervadaAinda não há avaliações

- Shamik Bhose The Coming Economic ChangesDocumento5 páginasShamik Bhose The Coming Economic ChangesshamikbhoseAinda não há avaliações

- An Interesting Theory -Why Interest Rates are Important but not for the Reasons Commonly AssumedNo EverandAn Interesting Theory -Why Interest Rates are Important but not for the Reasons Commonly AssumedAinda não há avaliações

- Stocks: Once More Up, Then The Big Down: NY Times' Krugman: We Are Entering The Third DepressionDocumento36 páginasStocks: Once More Up, Then The Big Down: NY Times' Krugman: We Are Entering The Third DepressionAlbert L. PeiaAinda não há avaliações

- The Deflation-Inflation Two-Step - Too Complex For Deflationsts To Grasp - MargDocumento10 páginasThe Deflation-Inflation Two-Step - Too Complex For Deflationsts To Grasp - MargcportzAinda não há avaliações

- A Recession Is Coming (Eventually) - Here's Where You'll See It First. - The New York TimesDocumento5 páginasA Recession Is Coming (Eventually) - Here's Where You'll See It First. - The New York TimestrajrajAinda não há avaliações

- Real Investment ReportDocumento24 páginasReal Investment ReportGediminas VedrickasAinda não há avaliações

- Last Resort: The Financial Crisis and the Future of BailoutsNo EverandLast Resort: The Financial Crisis and the Future of BailoutsAinda não há avaliações

- Burch Wealth Management 05.09.11Documento3 páginasBurch Wealth Management 05.09.11admin866Ainda não há avaliações

- Monthly Market Analytics & Technical Analysis: Sectional ReportDocumento12 páginasMonthly Market Analytics & Technical Analysis: Sectional ReportlcmgroupeAinda não há avaliações

- RPT GMTP 2016 04 PEEK PDFDocumento31 páginasRPT GMTP 2016 04 PEEK PDFlcmgroupeAinda não há avaliações

- RPT MMC 2016 05 PeekDocumento3 páginasRPT MMC 2016 05 PeeklcmgroupeAinda não há avaliações

- America Must Choose The Road AheadDocumento2 páginasAmerica Must Choose The Road AheadlcmgroupeAinda não há avaliações

- Central Bank Intervention Coming!: Too Many Cracks To Allow Further DelayDocumento2 páginasCentral Bank Intervention Coming!: Too Many Cracks To Allow Further DelaylcmgroupeAinda não há avaliações

- Uncertainty & Apprehensive Uneasiness: Sentiment Takes On A Tone of WorryDocumento2 páginasUncertainty & Apprehensive Uneasiness: Sentiment Takes On A Tone of WorrylcmgroupeAinda não há avaliações

- Central Bank Intervention Coming!: Global Macro & Tipping PointsDocumento37 páginasCentral Bank Intervention Coming!: Global Macro & Tipping PointslcmgroupeAinda não há avaliações

- The Coming Global Auto Abyss: Full GMTP Data FileDocumento37 páginasThe Coming Global Auto Abyss: Full GMTP Data FilelcmgroupeAinda não há avaliações

- Global Slow Down Steepening: Credit Cycle Is ReactingDocumento3 páginasGlobal Slow Down Steepening: Credit Cycle Is ReactinglcmgroupeAinda não há avaliações

- RPT GMTP 2015 PEEKDocumento36 páginasRPT GMTP 2015 PEEKlcmgroupeAinda não há avaliações

- "Qe For The People": Helicopter Money (OMF) Coming During The Next DrawdownDocumento2 páginas"Qe For The People": Helicopter Money (OMF) Coming During The Next DrawdownlcmgroupeAinda não há avaliações

- RPT-GM rpt-GMTP-2015-11-Peek - pdfTP-2015-11-PeekDocumento37 páginasRPT-GM rpt-GMTP-2015-11-Peek - pdfTP-2015-11-PeeklcmgroupeAinda não há avaliações

- Artemis Q32015 Volatility and Prisoners DilemmaDocumento52 páginasArtemis Q32015 Volatility and Prisoners Dilemmalcmgroupe100% (1)

- Monthly Market Analytics & Technical Analysis: Full Research Data FileDocumento11 páginasMonthly Market Analytics & Technical Analysis: Full Research Data FilelcmgroupeAinda não há avaliações

- RPT MMC 2015 09 PeekDocumento2 páginasRPT MMC 2015 09 PeeklcmgroupeAinda não há avaliações

- Monthly Market Analytics & Technical Analysis: Sectional ReportDocumento11 páginasMonthly Market Analytics & Technical Analysis: Sectional ReportlcmgroupeAinda não há avaliações

- Value Vortex: Why Value Is Getting Harder To Find!Documento2 páginasValue Vortex: Why Value Is Getting Harder To Find!lcmgroupeAinda não há avaliações

- RPT MMC 2015 07 PeekDocumento2 páginasRPT MMC 2015 07 PeeklcmgroupeAinda não há avaliações

- RPT MMC 2015 06 PeekDocumento2 páginasRPT MMC 2015 06 PeeklcmgroupeAinda não há avaliações

- War On Cash: GMTP Data File IndexDocumento32 páginasWar On Cash: GMTP Data File IndexlcmgroupeAinda não há avaliações

- RPT MTA 2015 06 PEEKDocumento10 páginasRPT MTA 2015 06 PEEKlcmgroupeAinda não há avaliações

- Risk Management in Banks Under Basel NormsDocumento53 páginasRisk Management in Banks Under Basel NormsSahni SahniAinda não há avaliações

- Effective Annual RateDocumento2 páginasEffective Annual RateVinay ThakurAinda não há avaliações

- Tutorial FIN221 Chapter 3 - Part 2 (Q&A)Documento13 páginasTutorial FIN221 Chapter 3 - Part 2 (Q&A)jojojoAinda não há avaliações

- Nigerian Banks: Resilience Built inDocumento52 páginasNigerian Banks: Resilience Built inapanisile14142Ainda não há avaliações

- Pyq Merge f9Documento90 páginasPyq Merge f9Anonymous gdA3wqWcPAinda não há avaliações

- Future Phoenix of WorldDocumento10 páginasFuture Phoenix of WorldPradipta DashAinda não há avaliações

- Engineering EconomicsDocumento2 páginasEngineering EconomicsGoverdhan ShresthaAinda não há avaliações

- Describe The Functions Performed by Federal Reserve BanksDocumento3 páginasDescribe The Functions Performed by Federal Reserve BanksShandyAinda não há avaliações

- TB 18Documento24 páginasTB 18Marc Raphael Ong100% (1)

- TVM Stocks and BondsDocumento40 páginasTVM Stocks and Bondseshkhan100% (1)

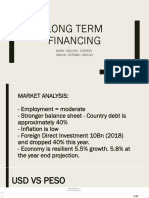

- LONG TERM FINANCING Finma FinalDocumento36 páginasLONG TERM FINANCING Finma FinalJane Baylon100% (2)

- Interest/Maturity Gap and SensitivityDocumento11 páginasInterest/Maturity Gap and SensitivityJamie RossAinda não há avaliações

- Lecture questions-CC-Solved in ClassDocumento6 páginasLecture questions-CC-Solved in ClassLaiba RazaAinda não há avaliações

- Procductivity Year 2 Productivity Year 1Documento13 páginasProcductivity Year 2 Productivity Year 1Iris TrầnAinda não há avaliações

- UPSC Economy MCQ For IAS Prelims Vol 1Documento18 páginasUPSC Economy MCQ For IAS Prelims Vol 1Fatheela K BDO MlpAinda não há avaliações

- Determinants of Exchange RateDocumento5 páginasDeterminants of Exchange RatedayaksdAinda não há avaliações

- A Study On The Role and Importance of Treasury Management SystemDocumento6 páginasA Study On The Role and Importance of Treasury Management SystemPAVAN KumarAinda não há avaliações

- Practice Multiple Choice Test 9: .08 (1n C) /.08 (LN 2.5)Documento8 páginasPractice Multiple Choice Test 9: .08 (1n C) /.08 (LN 2.5)api-3834751Ainda não há avaliações

- Unit 6 Example 2Documento2 páginasUnit 6 Example 2RicardoMoody100% (1)

- Understanding Corporate BondsDocumento2 páginasUnderstanding Corporate BondsjoshuadormancogAinda não há avaliações

- PPP IrpDocumento29 páginasPPP IrpSam SmithAinda não há avaliações

- Brexit EssayDocumento7 páginasBrexit Essayapi-3793297810% (1)

- When Collateral Is KingDocumento12 páginasWhen Collateral Is KingCoolidgeLowAinda não há avaliações

- Bus 315 - Chapter 5 - Risk, Return, and The Historical RecordDocumento37 páginasBus 315 - Chapter 5 - Risk, Return, and The Historical Recordmiaotianrun0810Ainda não há avaliações

- Financial Model and Valuation: Niharika Consumer Products LimitedDocumento17 páginasFinancial Model and Valuation: Niharika Consumer Products LimitedRanDeep SinghAinda não há avaliações

- Par Forward-Average Rate ForwardDocumento3 páginasPar Forward-Average Rate ForwardNarayan SetharamanAinda não há avaliações

- Vol-5 Introduction To Fundamental AnalysisDocumento10 páginasVol-5 Introduction To Fundamental AnalysisearreguiAinda não há avaliações

- BTLP Unit-1Documento102 páginasBTLP Unit-1Dr.Satish RadhakrishnanAinda não há avaliações

- Account - Statement - 011022 - 311022Documento17 páginasAccount - Statement - 011022 - 311022Anjani DeviAinda não há avaliações

- High Yield CDsDocumento4 páginasHigh Yield CDsAnonymous hWRGcOe4XAinda não há avaliações