Escolar Documentos

Profissional Documentos

Cultura Documentos

Structured Cash Deposits: What Do I Do When The Irs Cid Agent Comes?

Enviado por

Michael Lowe, Attorney at Law0 notas0% acharam este documento útil (0 voto)

160 visualizações10 páginasAvoiding Federal Fingerpointing of the Finances of Cash Heavy Businesses in the Money-Laundering and Terrorism Era of Law Enforcement – When Professionals and Small Businesses Get Charged for Violating Federal Money Laundering Laws

What is the responsibility of an American business owner in making deposits in the company bank accounts to keep them from being flagged as an alert of potential wrongdoing, i.e., to avoids a Currency Transaction Report (“CTR”) being sent by the financial institution, as required by federal regulation, to the United States Treasury and the Internal Revenue Service?

Hopefully, this article will provide help to countless businesses that deal with lots of cash payments in their ordinary course of operations each day and who want to avoid the suggestion that they’re doing something illegal or wrong, or a more formal investigation by the federal authorities.

In other words, this article hopes to educate individuals and businesses on how not to deposit cash in staggered manner or in structured cash deposits that can make the business owner criminally liable for “structuring,” and what they can face if they are targeted for violation of federal structuring laws.

Título original

STRUCTURED CASH DEPOSITS: WHAT DO I DO WHEN THE IRS CID AGENT COMES?

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoAvoiding Federal Fingerpointing of the Finances of Cash Heavy Businesses in the Money-Laundering and Terrorism Era of Law Enforcement – When Professionals and Small Businesses Get Charged for Violating Federal Money Laundering Laws

What is the responsibility of an American business owner in making deposits in the company bank accounts to keep them from being flagged as an alert of potential wrongdoing, i.e., to avoids a Currency Transaction Report (“CTR”) being sent by the financial institution, as required by federal regulation, to the United States Treasury and the Internal Revenue Service?

Hopefully, this article will provide help to countless businesses that deal with lots of cash payments in their ordinary course of operations each day and who want to avoid the suggestion that they’re doing something illegal or wrong, or a more formal investigation by the federal authorities.

In other words, this article hopes to educate individuals and businesses on how not to deposit cash in staggered manner or in structured cash deposits that can make the business owner criminally liable for “structuring,” and what they can face if they are targeted for violation of federal structuring laws.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

160 visualizações10 páginasStructured Cash Deposits: What Do I Do When The Irs Cid Agent Comes?

Enviado por

Michael Lowe, Attorney at LawAvoiding Federal Fingerpointing of the Finances of Cash Heavy Businesses in the Money-Laundering and Terrorism Era of Law Enforcement – When Professionals and Small Businesses Get Charged for Violating Federal Money Laundering Laws

What is the responsibility of an American business owner in making deposits in the company bank accounts to keep them from being flagged as an alert of potential wrongdoing, i.e., to avoids a Currency Transaction Report (“CTR”) being sent by the financial institution, as required by federal regulation, to the United States Treasury and the Internal Revenue Service?

Hopefully, this article will provide help to countless businesses that deal with lots of cash payments in their ordinary course of operations each day and who want to avoid the suggestion that they’re doing something illegal or wrong, or a more formal investigation by the federal authorities.

In other words, this article hopes to educate individuals and businesses on how not to deposit cash in staggered manner or in structured cash deposits that can make the business owner criminally liable for “structuring,” and what they can face if they are targeted for violation of federal structuring laws.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 10

STRUCTURED CASH DEPOSITS: WHAT DO I DO WHEN THE IRS

CID AGENT COMES?

Avoiding Federal Fingerpointing of the Finances of Cash Heavy Businesses in the Money-

Laundering and Terrorism Era of Law Enforcement When Professionals and Small Businesses

Get Charged for Violating Federal Money Laundering Laws

Written by: Michael Lowe, Esq. on February 5, 2014

What is the responsibility of an American business owner in making deposits in the company

bank accounts to keep them from being flagged as an alert of potential wrongdoing, i.e., to

avoids a Currency Transaction Report (CTR) being sent by the financial institution, as required

by federal regulation, to the United States Treasury and the Internal Revenue Service?

Hopefully, this article will provide help to countless businesses that deal with lots of cash

payments in their ordinary course of operations each day and who want to avoid the suggestion

that theyre doing something illegal or wrong, or a

more formal investigation by the federal authorities.

In other words, this article hopes to educate

individuals and businesses on how not to deposit cash

in staggered manner or in structured cash deposits

that can make the business owner criminally liable for

structuring, and what they can face if they are

targeted for violation of federal structuring laws.

Many Legitimate Businesses Deal With

Lots of Cash Payments Today

Lots of folks that own small to medium size businesses

receive large amounts of cash. This cash eventually

gets deposited in the business bank account. The

amounts received in cash can vary depending on the

type of business.

2

For example, a Pharmacy, Doctors Office, or Dental Office will likely receive cash payments in

small increments from a large number of customers or clients. This is the most common way

that cash in collected in a small to medium size business. Other businesses occasionally receive

large payments from big clients in cash. This scenario is a less common, of course.

There are special federal reporting rules that apply to each of these cases. For example, a

business owner who receives more than $10,000 cash from a single customer (whether paid in

increments or lump sum) will be required to fill out an IRS Form 8300 which is found on the

Internal Revenue Service website. This paper is not geared to explain this situation, since it is

more uncommon with regard to federal criminal prosecutions for violation of the laws requiring

reporting of certain financial transactions to the Federal Government.

Overview of Business Owner Responsibility from a Criminal

Defense Lawyers Perspective

Here, the focus is upon the business owners responsibility to not make deposits in bank

accounts so as to prevent the bank from triggering a Currency Transaction Report (CTR) to the

United States Treasury and the Internal Revenue Service (IRS). Since I have a great deal of

experience defending so called structuring cases in Federal Court, I will also explain how the

Federal Sentencing Guidelines apply to these types of prosecutions. I will also describe the

types of evidence upon which the United States Attorneys Office will likely rely to prove their

case in court. Finally, I will clarify plea negotiation considerations for these types of cases and

how an experienced defense attorney can navigate the negotiation with the United States

Attorneys Office so that his client receives the lowest possible Federal Sentencing Guideline

calculation and ultimately the best sentence possible.

What is Structuring?

Structuring is lawyer jargon (legalese) for a process whereby a person or business (not exempt

under title 31, section 5313(d),(e)) makes a series of cash deposits in one or many bank

accounts in increments of $10,000 or less so as to cause the depositing bank to likely not make

a CTR to the Federal Government. The person intentionally breaks down cash into a series of

smaller deposits so the deposits fly under the radar of deposit amounts that the bank must

report to the federal government. Hopefully, the federal government never knows about all this

cash that is slowly drifting through the banks processes (if the plan works).

Banks have to report big cash deposits to the federal government as a way to fight crime.

Specifically, money laundering.

Congress has set the amount of $10,000 as the minimum amount of cash being presented in a

single deposit to a financial institution governed by United States law which must be reported

to the federal government as part of the federal authorities fight against money laundering of

3

ill-gotten gains. Deposits of $10,000 or more arent private: under federal law, the IRS and the

U.S. Department of Treasury will be informed of this transaction.

The Money Laundering Control Act and Currency and Foreign Transactions

Reporting Act

The law that imposes the CTR requirement upon the Bank derives from the Money Laundering

Control Act of 1986 and the earlier enacted Currency and Foreign Transactions Reporting Act

(Bank Secrecy Act) of 1970, two laws passed by Congress many years ago as the federal

government responded to more and more U.S. financial institutions being used as

intermediaries by criminals with cash on hand. Money-laundering is the target. Of importance

here, regarding federal reporting requirements placed upon banks are Title 31 USC Section

5313(a) and Code of Federal Regulation (CFR) title 31, section 1010.3131.

The reporting requirement, Section 5313(a), applies to domestic financial transactions. Section

5313(a) reads:

(a) When a domestic financial institution is involved in a transaction for the payment, receipt, or

transfer of United States coins or currency (or other monetary instruments the Secretary of the

Treasury prescribes), in an amount, denomination, or amount and denomination, or under

circumstances the Secretary prescribes by regulation, the institution and any other participant in

the transaction the Secretary may prescribe shall file a report on the transaction at the time and

in the way the Secretary prescribes. A participant acting for another person shall make the

report as the agent or bailee of the person and identify the person for whom the transaction is

being made.

To thwart banks getting around this federal reporting requirement, there is a corresponding

anti-structuring provision, 31 U. S. C. 5324, and penalties are delineated for those who

willfully violate these laws in 31 U. S. C. 5322 which includes the following punishment:

(a) A person willfully violating this subchapter or a regulation prescribed or order issued under

this subchapter (except section 5315 or 5324 of this title or a regulation prescribed under

section 5315 or 5324), or willfully violating a regulation prescribed under section 21 of the

Federal Deposit Insurance Act or section 123 of Public Law 91508, shall be fined not more than

$250,000, or imprisoned for not more than five years, or both.

Examples of Cash Transactions Gone Rogue: The Small

Doctors Office Structuring Scenario

Here is an example of what happens here in real life. Say that you own and operate a small

Doctors Office. You collect cash payments and co-pays from patients. Lets say that instead of

depositing this money in your business operating account, you keep the money in a safe

4

deposit box or under your mattress; it doesnt really matter where it is. Let say you do this for

several years and accumulate approximately $650,000 in cash.

Now imagine that you want to buy a sweet piece of real estate so that you can break ground on

your new Doctors office. You negotiate a purchase price of $650,000. You want to use all that

stashed cash to buy the property.

Of course, the United States Treasury Department and the IRS dont know you have that cash

and you want to keep it that way so you wont have to pay any income tax on that cash. If you

decide to deposit the cash in the bank, you know that if you show up to your Bank of America,

Wells Fargo or Chase Bank with $650,000 in cash or to get a cashiers check, the Bank will file

the CTR. You will likely get an IRS Criminal Investigation Division Special Agent (IRS CID)

knocking on your door in short order.

Instead you decide that it would be great if your family and friends could help you out. Maybe

you could convince them to take some of your money and deposit the money in numerous

bank accounts under different names over the course of a year. You instruct your family

members and friends that are helping you out with this endeavor, to only make deposits

$10,000 or less, and do it in a way that makes it less likely the Bank will file a CTR.

Now picture youve deposited all of that loot and you want to show up to closing with enough

money to pay cash for the land. You show up with several dozen cashiers checks drawn upon

numerous different bank accounts all of which add up to the purchase price of $650,000.

Little do you know that the title company is a little suspicious. Someone at the title company

calls their favorite IRS agent to make a report concerning the transaction. You dont know about

the call. You buy the land and the title is transferred into your name. The next thing you know

the IRS is contacting you about the source of the funds.

WHAT WILL HAPPEN NOW? IRS INVESTIGATIONS OF STRUCTURING CASES:

ENTER THE U.S. ATTORNEYS OFFICE

The IRS will likely investigate you in conjunction with the United State Attorneys Office. These

are the attorneys who represent the federal government in criminal trials; they are the federal

prosecutors who try structuring cases.

The IRS and the federal prosecutors will investigate their new Doctors Office case, as reported

by the Title Company phone call, for at least two different violations of criminal law.

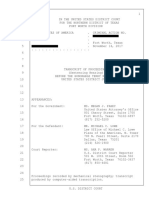

You may receive a US Attorneys Office Target Letter, like this one.

This letter will come from an Assistant US Attorney in connection with one of two different

proceedings, a forfeiture suit and a grand jury criminal investigation. If the money is subject to

forfeiture, you can expect that the US Attorneys Office will file a lawsuit in federal court and

5

serve you with it. The procedure typically used to freeze the assets is called a Warrant for

Arrest of Property in Rem. This is how the federal government goes after the money itself,

so the government can take it as you forfeit your ownership and legal right to the cash.

The US Attorneys Office will also file a Civil Complaint and will seek a forfeiture of the property

you purchased with the structured funds claiming a violation of 31 U.S.C. section 5317(c) and 18

U.S.C. sections 981 and 984. Here, they are going after the land that you bought with the cash

which you planned to be the site of the new Doctors Office.

You will also likely be subject to a Grand Jury investigation of federal criminal law violations,

and you may be asked to provide discovery to the Federal Grand Jury or even to give testimony

to the Federal Grand Jury. Of course, you would need to hire an experienced Federal Criminal

Defense Lawyer, like me, to help you. (This is particularly important when Grand Jury

proceedings are involved since individuals may not get the same protections in a grand jury

proceeding that they may receive in a criminal trial or police investigation.)

BUT IMNOT A CRIMINAL! IM A PROFESSIONAL, WHY ARE THEY

COMING AFTER ME?

The above Doctors Office scenario is fictional, I made it up. It does not reflect, in any way, a

real case that Ive handled, although I have represented professionals facing similar allegations.

I understand what might be going through your mind when you find yourself in this sort of

situation. Ive heard it many times: But I earned that money legitimately. I am not a criminal! I

dont do anything illegal. I am just a Doctor or a Dentist or a Pharmacist or a Lawyer. I am not

involved in any criminal transactions. I am not a drug dealer!

I know you earned the money legitimately. Your federal accusers may know it, too. The only

concern the U.S. Attorneys Office will have is whether you violated a couple of laws (Title 31

USC 5324 or Title 18 USC section 371) in conjunction with the aforementioned statute. Its how

you handled the cash that is the issue here, not how you earned it.

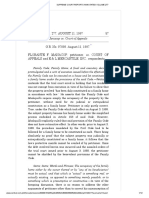

As the United States Supreme Court explained in the case of Ratzlaf v. U.S., 510 U.S. 135

(1994): Undoubtedly there are bad men who attempt to elude official reporting

requirements in order to hide from Government inspectors such criminal activity as

laundering drug money or tax evasion. But currency structuring is not inevitably

nefarious.

Well, you say, prove it! They cant prove I did this! That might be true, but my experience is that

these cases are very easy to prove (The Feds call it Low Hanging Fruit). Its mostly a paper

case.

6

The Feds look at the deposit amounts, the dates and the locations of the bank deposit runs. The

FBI or IRS talk to witnesses like bank employees, your CPA, and the other folks that might have

helped to make the deposits. The U.S. Attorneys Office isnt going to take the case unless it

comes to them on a silver platter and thats exactly what the IRS Special Agent is trying to

accomplish in their investigation. Banks keep lots of records; building a paper trial in these

cases isnt that hard to do.

WHAT PROFESSIONAL SMALL BUSINESS OWNERS CAN FACE: SERIOUS PRISON

TIME

Back to the Doctors Office Scenario. Lets assume the IRS Special Agent has done his job and

the case has been made against you. What do you do? What do your family members do that

may also be investigated for the same thing?

This is where having an experienced Federal Criminal Defense Attorney can make all of the

difference between spending the next 10 years incarcerated behind bars in the federal Bureau

of Prisons system (BOP), or getting probation, or a short trip your local Prison Camp. Because

time behind bars in a federal facility is in your future if the

federal prosecutor gets his or her way.

Choose wisely, the lawyer might say to you. Your choice? Trial

or negotiate a deal with the Feds.

If you elect to go to trial and win, great. But if you go to trial and

you lose, did you know that you will likely be facing up to ten

years in the BOP? Thats right, under 31 USC 5324(d)(2), if the

Assistant United States Attorney (AUSA) can show you made or conspired to make at least

$100,000 in structured deposits as a part of a pattern of illegal activity over the course of 12

months and those funds were sourced from illegal activities (e.g., Mail Fraud, Wire Fraud,

Conspiracy to Distribute or Manufacture Cocaine or Methamphetamine), your cap goes from

five years in the BOP to 10 years in the federal prison system.

FEDERAL SENTENCING GUIDELINES FOR STRUCTURING CASES

What choice should you make? This is where you need to consult with a smart lawyer that

understands how the federal sentencing guidelines will apply in your case, and how the

sentencing process works in the federal prosecutorial system, BEFORE you start negotiating

with the U.S. Attorneys Office. In the federal system, in order to try and keep federal sentences

all across the land as fair as possible by being as uniform as possible (so the same crime gets

punished the same in Oregon as Texas, for example), a series of sentencing guidelines has

been created.

7

The federal judge is not limited to the specific guidelines; she can make her own calls on a case.

However, these guidelines are very influential and powerful. Federal sentencing guidelines will

be the general rule that is followed, unless the defense lawyer can show an exception should

apply.

Having a lawyer at your side as soon as possible in these situations is extremely important in

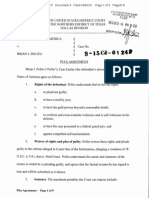

structuring situations. Why? Imagine that you and your lawyer negotiate a plea deal with the

AUSA assigned to you case. In the Doctors Office Scenario, for example, say you agree to plead

guilty as long as no charges are filed against your best friend, who helped you out in your land

purchase plan.

If you plead guilty in federal court to a federal judge, then you will go with your lawyer to see

the United State Probation Officer (USPO) assigned to write the Presentence Report in your

case.

WHAT IS A PRESENTENCE REPORT?

Here, the federal Probation Officer must write a report and make a recommended guideline

calculation for the Judge to consider before he or she sentences you. Most USPOs will write

their report in a way that maximizes the total offense level.

That is, the federal probation officer will look to the so called relevant conduct and the USPO

will apply as many guideline enhancements that he can find in the United States Sentencing

Guidelines (USSG). (You can read the Guidelines online here.)

Now, I know you are going to say: But the USSG are only advisory. And youd be correct. But,

my experience is that most Judges will give the USSG calculation a great deal of deference.

Having an advocate on your side when you are dealing with the probation officer as well as in

the sentencing hearing before the federal judge is both critical and comforting.

FEDERAL SENTENCING GUIDELINES IN A STRUCTURING CASE

So what are the guideline provisions that typically come into play in these so called Structuring

cases? Lets start off with the applicable guideline provisions.

In the factual Doctors Office scenario described above, one could plead guilty to potentially

two different criminal violations. One could plead guilty to a violation of the substantive law in

Title 31 section 5324(d)(1) or sections 5324(d)(2). Since the latter section deals with an

enhanced ten year statutory cap, its unlikely you would want to plead to that section.

So, most lawyers will plead their client to the 5324(d)(1) violation. However, that would be a

mistake in my opinion in many cases. This will take a little while to explain, so bear with me.

8

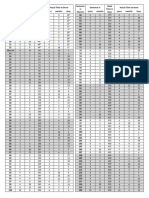

When we calculate your guidelines in USSG 2S1.3 we start off with a level 6 and then add the

appropriate theft table level as shown in USSG section 2B1.1.

Thats right, the USSG treat all of the money structured in the same way as if all of that

deposited money were stolen or embezzled. Then we add 2 levels under USSG 2S1.3(b)(2) if

you were convicted under Title 31 and more than $100,000 if a 12 month period was

structured.

Well, that doesnt seem fair does it? Do I have to plead to a Title 31 violation? The answer is,

maybe not.

In the scenario Ive described, you could also plead in to an 18 U.S.C. section 371 Conspiracy

violation. That is, you could also plead guilty to Conspiracy to Structure Cash Bank Deposits,

not an actual substantive count for Structuring.

Conspiring to do something isnt the same thing as doing it, so there are two different statutes

involved here.

If your lawyer is sharp enough to do this, he just saved you two levels off of your sentence,

which could mean more than a year in some cases. Whats more, your lawyer may have saved

you up to 8 levels off of your sentence.

In the Doctors Office scenario Ive described above, the source of the funds was lawful.

Remember, we are talking about a Doctors Office; not wire fraud money, drug money, or

racketeering cash.

If you dont plead to a Title 31 count and the source of the funds were legit, then you could also

receive a 6 level reduction under USSG 2S1.3(b)(3). Now lets do the math in the best case

scenario for the Doctors Office structuring example above.

BEST CASE SCENARIO IN SENTENCING FOR THE DOCTORS OFFICE

We start off with a level 6 and add 14 levels pursuant to USSG 2B1.1(b)(1)(H) because the total

amount structured falls between $400,000 and $1,000,000. We would then reduce by 6 levels

under 2S1.3(b)(3) which yields total of level 14, and then take an additional three levels off for

acceptance of responsibility under USSG section 3E1.1 (a),(b) which now yields a total of level

11.

Assuming you have no criminal history, we are talking about a zone B sentence anywhere

from 8 to 14 months. In zone B, the judge will likely be looking to give you home confinement

or a combination of home confinement and actual confinement under the recommendations in

USSG section 5C1.1.

Thats a great result. Now lets look at this case from a worst case perspective.

9

WORST CASE SCENARIO IN SENTENCING FOR THE DOCTORS OFFICE

In my experience, United States Attorneys like to initiate structuring violations against folks

they believe may also be involved in other illegal conduct. That is, the Federal Prosecutor wants

to catch someone for structuring even though he/she really believes them to be guilty of some

other crime they cannot actually prove beyond a reasonable doubt in front of a jury.

Remember how the federal government finally put Al Capone behind bars for tax evasion after

not being able to gather enough facts to prove him guilty of any other crimes? That same

strategy is still used all the time by the Feds.

From that perspective, lets assume the AUSA will claim that you derived the structured cash via

some other criminal conduct. In the Doctors Office case, that might be Medicare fraud,

Medicaid fraud, prescription fraud or any other wire or mail fraud violation the AUSA can come

up with.

Now we go to the federal sentencing guideline enhancements. Remember, the federal

probation officer will be looking for ways to increase your sentence, not reduce your sentence.

Thats why you pay the lawyer big bucks when you are guilty; to help get a lower sentence.

Negotiation here often involves getting the least amount of punishment as possible, not a get

out of jail free card. The more experienced in negotiating these deals, the better your lawyer

will be arguing for the lowest sentence possible.

The USPO will likely claim at least 2 different USSG enhancements in this type of case. First, you

will likely see an enhancement under USSG Section 2S1.3(b)(1)(A), wherein the federal

probation officer is going to argue that you knew the source of the structured cash was illegal

or unlawful activity.

Mind you, they arent going to need to prove beyond a reasonable doubt that you committed

another crime. They only need to show by a preponderance of the evidence that you knew the

loot came from unlawful activity. In making a recommendation, the probation officer doesnt

have the same high burden of proof that the prosecutor would have had to meet at trial.

The second enhancement you will likely see in a case like this Doctors Office scenario, is a 2

level role adjustment under either USSG section 3B1.3 because you are a Medical Doctor and

you used your position of Public Trust to commit the offense or used some other special skill to

conceal it. You may also see another 2 to 4 level enhancement for a role adjustment for being a

leader organizer in the Conspiracy to commit Structuring under USSG 3B1.1 Aggravated Role.

In summary, the worst case scenario described above, would result in a guideline sentence

many, many years higher than the best case scenario described.

CONCLUSION

10

From the above, you can see that these cases are very fact dependent, no two structuring cases

are the same, and they can be very complex. How the money was generated is a separate issue

from how the money was moved through the financial institution. Many professionals are

surprised to discover that they are charged with federal structuring violations when they have

earned their cash in legitimate ways.

Regardless of where the cash was made, if anyone in Texas is being investigated for violation of

structuring statutes, then they will need a lawyer that know all of the facts, has done a

reasonable investigation, and has the necessary experience to navigate the Federal Criminal

Justice system in the most advantageous manner on their behalf.

____________________________________

About the Author: Michael Lowe is a Texas trial attorney practicing criminal defense law in the

Dallas area for many years after first serving as a felony prosecutor for the Office of the District

Attorney for Dallas County. He is Board Certified by the State Bar of Texas in Criminal Law. Mr.

Lowe has tried to verdict over 150 criminal trials so far in the state and federal systems.

Você também pode gostar

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- State Bar of Texas Grievance Complaint Against John JacksonDocumento72 páginasState Bar of Texas Grievance Complaint Against John JacksonMichael Lowe, Attorney at LawAinda não há avaliações

- PPP FRAUD INDICTMENT Southern District of Texas (Houston)Documento18 páginasPPP FRAUD INDICTMENT Southern District of Texas (Houston)Michael Lowe, Attorney at LawAinda não há avaliações

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Rules On Civil Procedure: Bar Matter No. 803 Dated April 8, 1997Documento37 páginasRules On Civil Procedure: Bar Matter No. 803 Dated April 8, 1997Ayla Herazade Salendab100% (1)

- DefamationDocumento14 páginasDefamationTanya Tandon33% (3)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Motion For Release of Brendan Dassey Pending Appeal of Wrongful Conviction RulingDocumento48 páginasMotion For Release of Brendan Dassey Pending Appeal of Wrongful Conviction RulingMichael Lowe, Attorney at Law100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Good Time Table 2019Documento4 páginasGood Time Table 2019Michael Lowe, Attorney at LawAinda não há avaliações

- Case Digest Department of Agriculture Vs NLRCDocumento3 páginasCase Digest Department of Agriculture Vs NLRCLang Banac Limocon50% (2)

- Administrative Law NotesDocumento18 páginasAdministrative Law Notesjaisamada0% (2)

- Criminal LawDocumento58 páginasCriminal LawDanilo Pinto dela BajanAinda não há avaliações

- The Indian Patent Act, 1970Documento29 páginasThe Indian Patent Act, 1970guddan1591Ainda não há avaliações

- Duenas JR V HRET and Angelito P ReyesDocumento2 páginasDuenas JR V HRET and Angelito P ReyesJulius Robert JuicoAinda não há avaliações

- Malaysia Legal System (Criminal Proceeding)Documento47 páginasMalaysia Legal System (Criminal Proceeding)Eden Yok50% (2)

- Amonoy Vs GutierrezDocumento4 páginasAmonoy Vs GutierrezNikki AndradeAinda não há avaliações

- Ray Jackson Complaint AffidavitDocumento16 páginasRay Jackson Complaint AffidavitMichael Lowe, Attorney at LawAinda não há avaliações

- JDGMTDEC8Documento4 páginasJDGMTDEC8Michael Lowe, Attorney at LawAinda não há avaliações

- Transcript Jan. 8, 2018Documento23 páginasTranscript Jan. 8, 2018Julie Turkewitz100% (1)

- Sent Hearing Dec 8Documento6 páginasSent Hearing Dec 8Michael Lowe, Attorney at LawAinda não há avaliações

- 2018 USSG AmendmentsDocumento129 páginas2018 USSG AmendmentsMichael Lowe, Attorney at Law100% (1)

- 2016 U.S. Sentencing TableDocumento1 página2016 U.S. Sentencing TableMichael Lowe, Attorney at Law100% (1)

- Washington Et Al. v. Sessions Et Al., 07-CV-05625 (S.D.N.Y.) - ComplaintDocumento89 páginasWashington Et Al. v. Sessions Et Al., 07-CV-05625 (S.D.N.Y.) - ComplaintBen Adlin100% (1)

- Federal Sentencing Guidelines 2G2.2Documento5 páginasFederal Sentencing Guidelines 2G2.2Michael Lowe, Attorney at LawAinda não há avaliações

- 18 Uscs - 2252Documento3 páginas18 Uscs - 2252Michael Lowe, Attorney at LawAinda não há avaliações

- 18 Uscs - 2252Documento3 páginas18 Uscs - 2252Michael Lowe, Attorney at LawAinda não há avaliações

- Jeff Sessions Memo Charging and Sentencing Policy, Dated 10 May 2017Documento2 páginasJeff Sessions Memo Charging and Sentencing Policy, Dated 10 May 2017KimLaCapriaAinda não há avaliações

- Rule 41 Letter To DOJ From Congress October 2016Documento3 páginasRule 41 Letter To DOJ From Congress October 2016Michael Lowe, Attorney at LawAinda não há avaliações

- Forest Park Medical Center Kickback IndictmentDocumento44 páginasForest Park Medical Center Kickback IndictmentmedtechyAinda não há avaliações

- Inspector General DOJ Forfeiture Report March 2017Documento74 páginasInspector General DOJ Forfeiture Report March 2017Michael Lowe, Attorney at LawAinda não há avaliações

- Dallas County Bond Schedule 2017Documento2 páginasDallas County Bond Schedule 2017Michael Lowe, Attorney at LawAinda não há avaliações

- Attorney Overhearings Section37Documento2 páginasAttorney Overhearings Section37Michael Lowe, Attorney at LawAinda não há avaliações

- Dallas Domestic Violence Taskforce Report 2014-2015Documento30 páginasDallas Domestic Violence Taskforce Report 2014-2015Michael Lowe, Attorney at LawAinda não há avaliações

- Notice of Appeal-DasseyDocumento1 páginaNotice of Appeal-DasseyLaw&CrimeAinda não há avaliações

- USAttyManual ReleaseandDetentionPendingJudclPrcdgsDocumento8 páginasUSAttyManual ReleaseandDetentionPendingJudclPrcdgsMichael Lowe, Attorney at LawAinda não há avaliações

- Special Court of Review in Re Etta MullinDocumento29 páginasSpecial Court of Review in Re Etta MullinMichael Lowe, Attorney at LawAinda não há avaliações

- Indictment of Dennis Hastert May 2015Documento7 páginasIndictment of Dennis Hastert May 2015Michael Lowe, Attorney at LawAinda não há avaliações

- State of Texas Task Force On Domestic Violence Report 2015Documento46 páginasState of Texas Task Force On Domestic Violence Report 2015Michael Lowe, Attorney at LawAinda não há avaliações

- Thomas Vs TexasDocumento16 páginasThomas Vs TexasMichael Lowe, Attorney at LawAinda não há avaliações

- Texas Commission of Judicial Conduct Public Sanctions For FY 2015 Including Public Admonition of Etta MullinDocumento80 páginasTexas Commission of Judicial Conduct Public Sanctions For FY 2015 Including Public Admonition of Etta MullinMichael Lowe, Attorney at LawAinda não há avaliações

- Factual Resume in U.S. v. Brian J. PolitoDocumento4 páginasFactual Resume in U.S. v. Brian J. PolitoMichael Lowe, Attorney at LawAinda não há avaliações

- Plea Agreement: US V PolitoDocumento9 páginasPlea Agreement: US V PolitoMichael Lowe, Attorney at LawAinda não há avaliações

- Reading 2Documento6 páginasReading 2Mary Grace CernechezAinda não há avaliações

- BOM Case SummaryDocumento12 páginasBOM Case SummaryterencebctanAinda não há avaliações

- Cleaves v. American Management Services Central, L. L. C. Et Al - Document No. 13Documento2 páginasCleaves v. American Management Services Central, L. L. C. Et Al - Document No. 13Justia.comAinda não há avaliações

- Edwin Wayne Joyce v. Michael Bumgarner B. Miller, 961 F.2d 211, 4th Cir. (1992)Documento3 páginasEdwin Wayne Joyce v. Michael Bumgarner B. Miller, 961 F.2d 211, 4th Cir. (1992)Scribd Government DocsAinda não há avaliações

- Better Mouse Company v. Giga-Byte Technology Et. Al.Documento5 páginasBetter Mouse Company v. Giga-Byte Technology Et. Al.PriorSmartAinda não há avaliações

- Lim-Lua Vs LuaDocumento17 páginasLim-Lua Vs LuaChristine FloreteAinda não há avaliações

- 2 Allied Banking v. SalasDocumento2 páginas2 Allied Banking v. SalasStephanie SerapioAinda não há avaliações

- G.O. 309 of 2016 PDFDocumento4 páginasG.O. 309 of 2016 PDFKulandaivelu Advocate OfficeAinda não há avaliações

- Manacop v. CADocumento12 páginasManacop v. CAPrincess MadaniAinda não há avaliações

- People V RafananDocumento3 páginasPeople V RafananJessel May CasugaAinda não há avaliações

- Amoco Rocmount Company, a Delaware Corporation, as Unit Operator Of, and as an Individual Interest Owner in the Anschutz Ranch East Unit Champlin Petroleum Company, a Delaware Corporation, as an Individual Interest Owner in the Anschutz Ranch East Unit v. The Anschutz Corporation, a Kansas Corporation, Defendant/third Party v. Jerry D. Armstrong J.H. Bander Ray O. Brownlie James B. Wallace Bwab, Inc. Chevron U.S.A., Inc. Mesa Petroleum Company Mts Limited Partnership Mobil Rocky Mountain, Inc. Pan Canadian Petroleum, Inc., Third Party Amoco Rocmount Company, a Delaware Corporation, as Unit Operator Of, and as an Individual Interest Owner in the Anschutz Ranch East Unit, and Champlin Petroleum Company, a Delaware Corporation, as an Individual Interest Owner in the Anschutz Ranch East Unit v. The Anschutz Corporation, a Kansas Corporation v. Jerry D. Armstrong J.H. Bander Ray O. Brownlie James B. Wallace Bwab, Inc. Chevron U.S.A., Inc. Mesa Petroleum Company Mts Limited Partnership MobilDocumento21 páginasAmoco Rocmount Company, a Delaware Corporation, as Unit Operator Of, and as an Individual Interest Owner in the Anschutz Ranch East Unit Champlin Petroleum Company, a Delaware Corporation, as an Individual Interest Owner in the Anschutz Ranch East Unit v. The Anschutz Corporation, a Kansas Corporation, Defendant/third Party v. Jerry D. Armstrong J.H. Bander Ray O. Brownlie James B. Wallace Bwab, Inc. Chevron U.S.A., Inc. Mesa Petroleum Company Mts Limited Partnership Mobil Rocky Mountain, Inc. Pan Canadian Petroleum, Inc., Third Party Amoco Rocmount Company, a Delaware Corporation, as Unit Operator Of, and as an Individual Interest Owner in the Anschutz Ranch East Unit, and Champlin Petroleum Company, a Delaware Corporation, as an Individual Interest Owner in the Anschutz Ranch East Unit v. The Anschutz Corporation, a Kansas Corporation v. Jerry D. Armstrong J.H. Bander Ray O. Brownlie James B. Wallace Bwab, Inc. Chevron U.S.A., Inc. Mesa Petroleum Company Mts Limited Partnership MobilScribd Government DocsAinda não há avaliações

- DULI YANG AMAT MULIA TUNKU IBRAHIM ISMAIL v. CAPTAIN HAMZAHDocumento18 páginasDULI YANG AMAT MULIA TUNKU IBRAHIM ISMAIL v. CAPTAIN HAMZAHNotWho Youthink IamAinda não há avaliações

- That He Enters The Dwelling of AnotherDocumento7 páginasThat He Enters The Dwelling of AnotheryoungkimAinda não há avaliações

- Malgeri v. United States, 89 F.3d 823, 1st Cir. (1996)Documento2 páginasMalgeri v. United States, 89 F.3d 823, 1st Cir. (1996)Scribd Government DocsAinda não há avaliações

- Gregg v. Georgia, 428 U.S. 153 (1976)Documento68 páginasGregg v. Georgia, 428 U.S. 153 (1976)Scribd Government DocsAinda não há avaliações

- People V SantuilleDocumento5 páginasPeople V SantuilleMp CasAinda não há avaliações

- Guanio V ShangrilaDocumento13 páginasGuanio V Shangrilavon jesuah managuitAinda não há avaliações

- Singson Vs BPIDocumento2 páginasSingson Vs BPITenet ManzanoAinda não há avaliações

- Gulayan Criteria For Judging 2022 Result of JudgesDocumento2 páginasGulayan Criteria For Judging 2022 Result of JudgesMaestro GallaAinda não há avaliações

- United States Court of Appeals, Fourth CircuitDocumento7 páginasUnited States Court of Appeals, Fourth CircuitScribd Government DocsAinda não há avaliações

- G.R. No. L-21438 September 28, 1966 AIR FRANCE, Petitioner, Rafael Carrascoso and The Honorable Court of APPEALS, RespondentsDocumento33 páginasG.R. No. L-21438 September 28, 1966 AIR FRANCE, Petitioner, Rafael Carrascoso and The Honorable Court of APPEALS, RespondentsangelescrishanneAinda não há avaliações