Escolar Documentos

Profissional Documentos

Cultura Documentos

Spe 168645

Enviado por

jgrindal15850 notas0% acharam este documento útil (0 voto)

98 visualizações20 páginasUS Hydraulic Fracturing Fluid System and Proppant Trends

Título original

SPE-168645

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoUS Hydraulic Fracturing Fluid System and Proppant Trends

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

98 visualizações20 páginasSpe 168645

Enviado por

jgrindal1585US Hydraulic Fracturing Fluid System and Proppant Trends

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 20

SPE 168645

Anal ysis of US Hydraulic Fracturing Fluid System and Proppant Trends

P.S. Patel, PacWest Consulting Partners; C.J . Robart, PacWest Consulting Partners; M. Ruegamer, Kingsfield

Consulting; A. Yang, PacWest Consulting Partners

Copyright 2014, Society of PetroleumEngineers

This paper was prepared for presentation at the SPE Hydraulic Fracturing Technology Conference held in The Woodlands, Texas, USA, 46 February 2014.

This paper was selected for presentation by an SPE program committee following review of information contained in an abstract submitted by the author(s). Contents of the paper have not been

reviewed by the Society of Petroleum Engineers and are subject to correction by the author(s). The material does not necessarily reflect any position of the Society of Petroleum Engineers, its

officers, or members. Electronic reproduction, distribution, or storage of any part of this paper without the written consent of the Society of Petroleum Engineers is prohibited. Permission to

reproduce in print is restricted to an abstract of not more than 300 words; illustrations may not be copied. The abstract must contain conspicuous acknowledgment of SPE copyright.

Abstract

Building upon the analysis contained in a related paper (SPE-163875), Analysis of U.S. Hydraulic Fracturing Design

Trends, presented at the 2013 SPE Hydraulic Fracturing Technology Conference, this paper will provide a more

comprehensive and robust analysis of hydraulic fracturing fluid systems and proppant trends across major shale plays in the

United States between 2011 and the first half of 2013. This paper will present key insights gleaned from the categorization

and analysis of over 55,000 hydraulic fracturing treatments, collected from FracFocus.org.

FracFocus.org is a website established in early 2011 with a centralized registry to provide hydraulic fracturing chemical

disclosures across the United States. The website provides the data for the analysis presented in this paper, consisting of

chemical disclosure records for nearly 55,000 hydraulically fractured wells. The data set includes information on all chemicals

and proppants, fracture date, TVD, water volume, production type. We have collected all available data, identified key

constituent materials, and classified each treatment according to a widely used set of frac type categories.

This paper investigates changes in key hydraulic fracturing technical parameters at the both the aggregate US level and

regional level between 2011 and the first half of 2013. The analysis identifies changes over time in frac type, using the broad

categories of conventional, water frac, hybrid, energized, etc. The paper also includes analysis on proppant trends, including

usage rates for key proppant types (sand, resin-coated sand, and ceramics) and proppant loading trends.

To date, most knowledge of aggregate consumption trends on hydraulic fracturing chemicals and proppant is anecdotal and

based on the direct experience of operators or service companies. This paper provides a more rigorous quantitative perspective

on hydraulic fracturing fluid trends in the United States between 2011 and the first half of 2013.

Introduction

FracFocus.org was launched in early 2011 to serve as the national hydraulic fracturing chemical registry. The registry is

managed by the Groundwater Protection Council and the Interstate Oil and Gas Compact Commission to provide the public

with access to reported chemicals used for hydraulic fracturing within their area. As of the date of analysis for this paper,

there were nearly 55,000 wells reported via the website.

Although the FracFocus website was developed with the intention of providing the public with disclosure to the chemicals

injected downhole within a given area, the chemical disclosure data sheets contain a wealth of technical data about hydraulic

fracturing fluid systems and proppants pumped downhole. The FracFocus website is structured on a well-by-well basis, which

means that it is not possible to understand how each fracturing stage was treated. However, if one assumes that all frac stages

in a well are treated using generally similar frac designs and fluid systems, we have access to a rich data source about frac

fluid systems that allows one to analyze frac fluid and proppant trends across the United States.

Each FracFocus chemical disclosure data sheet contains basic information about the treated well, including fracture date,

latitude/longitude, TVD, and water volume. In addition, the sheet contains detailed information about every additive injected

downhole during the hydraulic fracturing treatment, including trade name, purpose, supplier, ingredients, CAS number, and

2 SPE 168645

maximum ingredient concentrations in the additive and hydraulic fracturing fluid. See Figure 1 and Figure 2 below for a

comprehensive list of FracFocus chemical disclosure data elements and an example of a FracFocus disclosure data sheet,

respectively.

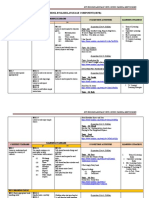

Figure 1: Data Elements of FracFocus.org Chemical Disclosure

Well & Frac Details Detailed Fluid Composition

Fracture date Well number

Additive trade name Additive purpose

State and county Latitude and longitude

Additive supplier Additive ingredients

Well API number Production type

Chemical abstract number

Well operator True vertical depth

Max ingredient concentration in additive

Well name Total water volume

Max ingredient concentration in fluid

Source: FracFocus.org

Figure 2: Example of FracFocus.org Chemical Disclosure Data Sheet

Source: FracFocus.org

SPE 168645 3

Since early 2011, PacWest Consulting Partners has been collecting, parsing, cleaning, and analyzing all data available on the

FracFocus.org website. At the date of analysis for this paper, the database contained nearly 55,000 wells and more than

1,000,000 additive ingredients. After successfully importing the raw data, we developed a decision-tree and algorithm to

classify all wells into a fracture treatment type, based on the constituents pumped downhole during the hydraulic fracturing

treatment. Within this paper, we have utilized two classification systems, which we have called the Technical and Simple

classification systems. The Technical classification system reflects a classification scheme that is widely used by engineering

professionals throughout the industry. The Simple classification system reflects a classification scheme that is used more

widely by commercial and non-technical professionals throughout the industry. See Figure 3 and Figure 4 below for the two

classification system developed to characterize the hydraulic fracturing treatments into different categories of fluid systems.

Figure 3: Technical Classification System for Frac Treatment Types

Frac Type Definition

Conventional

Treatment type that uses a gelling agent and one or more crosslinkers in order to transport proppant

into a hydraulic fracture.

Water Frac

Treatment type that uses a friction reducer, a gelling agent or a viscoelastic surfactant in order to

transport proppant into a hydraulic fracture.

Hybrid

Treatment type that uses a combination of a friction reducer, gelling agent, acid gelling agent, or one

or more crosslinkers in order to transport proppant into a hydraulic fracture.

Energized

Treatment type that incorporates an energizer, normally nitrogen or carbon dioxide, into the base

fluid in order to generate foam that transports proppant into a hydraulic fracture.

Other/Unknown

Treatment type category that includes the following less common treatment types: Acid Frac, Gas

Frac, Matrix Acidizing. This category also includes records for which a classification was unknown

or unavailable, generally due to incomplete data.

Figure 4: Simple Classification System for Frac Treatment Types

Frac Type Definition

Hybrid Crosslinked/Slickwater

Treatment type that uses a combination of a friction reducer, gelling agent, and one or

more crosslinkers in order to transport proppant into a hydraulic fracture.

Hybrid Linear Gel/Slickwater

Treatment type that uses a combination of a friction reducer and gelling agent in order to

transport proppant into a hydraulic fracture.

Slickwater

Treatment type that uses a friction reducer in order to transport proppant into a hydraulic

fracture.

Linear Gel

Treatment type that uses a gelling agent in order to transport proppant into a hydraulic

fracture.

Crosslinked

Treatment type that uses a gelling agent and one or more crosslinkers in order to

transport proppant into a hydraulic fracture.

Energized

Treatment type that incorporates an energizer, normally nitrogen or carbon dioxide, into

the base fluid in order to generate foam that transports proppant into a hydraulic fracture.

Other/Unknown

Treatment type category that includes the following treatment types: Acid Frac, Gas

Frac, Matrix Acidizing. This category also includes records for which a classification

was unknown or unavailable, generally due to incomplete data.

Within this paper we have classified proppant types into three categories: Sand, Resin-Coated Sand, and Ceramics. Figure 5

below provides definitions for the three proppant types. Additionally, wells often contain more than one proppant; therefore it

is necessary to develop a more comprehensive classification system to define proppant design. Figure 6 below provides

definitions for all the proppant design analyzed within this paper.

Figure 5: Proppant Type Definitions

Proppant Type Definition

Sand

Includes all raw frac sand types, including Northern White, Ottawa, Brady, Brown Sand,

Texas Gold, etc.

Resin-Coated Sand

Includes only resin-coated proppants for which the substrate is sand. This category does

NOT include any double-counting with the Sand category described above.

Ceramic

Any proppant for which the substrate is a ceramic or otherwise manufactured proppant.

Resin-coated ceramic proppant is included in this category.

4 SPE 168645

Figure 6: Proppant Design Classification System

Proppant Design Definition

Sand Only A well that contains only raw sand.

Sand +RCS +Ceramic A well that contains sand, resin-coated sand, and ceramic proppant.

Sand +RCS A well that contains sand and resin-coated sand.

Sand +Ceramic A well that contains sand and ceramic proppant.

RCS Only A well that contains resin-coated sand only.

RCS +Ceramic A well that contains resin-coated sand and ceramic proppant.

Ceramic Only A well that contains ceramic proppant only.

This paper investigates changes in key hydraulic fracturing technical parameters at the both the aggregate US level and

regional level between 2011 and the first half of 2013. The analysis identifies changes over time in frac treatment type, using

two related classification systems. The paper also provides analysis on proppant trends, including usage rates for key proppant

types (sand, resin-coated sand, and ceramics) and proppant loading trends.

This paper contains analysis of metrics commonly used in the industry. However, due to limited data availability, in some

cases the definition and methodology of the calculations used in this paper differ slightly from the conventional approach. In

numerous cases in this paper we have analyzed proppant loading. Within this paper proppant loading is defined as total

proppant mass divided by total water volume, which differs from the generally accepted definition.

At the date of analysis for this paper, the database contained nearly 55,000 wells and more than 1,000,000 additive ingredients.

However, of the 54,534 wells contained in the complete data set, 29,350 wells were classified as horizontal wells and 25,184

wells were classified as vertical or directional wells. Horizontal wells have become the dominant drilling and construction

approach for E&Ps operating in unconventional oil/gas plays in the US. Due to their overwhelming importance in todays

oil/gas market, we have chosen to limit the analysis contained in this paper to only the 29,350 horizontal well records.

Figure 7 below provides analysis of the sample size of the available horizontal wells data for each quarter between the first

quarter of 2011 and the second quarter of 2013. The sample size increases from roughly 1,000 records in the first quarter of

2011 to nearly 3,000 records by the first and second quarters of 2013, providing a highly representative population of wells for

which to undertake a robust analysis of well trends.

Figure 7: Sample Size of US Horizontal Well Records

Source: FracFocus.org

Anal ysi s of Aggregate US Hydraul ic Fracturing Flui d System and Proppant Trends

The US oil/gas market has shifted dramatically since early 2011, from one focused on gas development and production to one

focused primarily on oil and liquids development and production. This shift can be attributed to falling natural gas prices,

prompting operators to focus their development efforts away from gas plays and towards oil/liquids plays. A typical frac

design in an unconventional gas play includes relatively small grades of proppant (40/70 and 100 mesh), carried into fractures

by a low viscosity fluid with friction reducer additive to allow high pump rates. The high pump rate allows for the creation of

1,098

1,633

1,991

2,098

2,552

2,772

2,591 2,604

2,948 2,832

0

500

1000

1500

2000

2500

3000

11Q1 11Q2 11Q3 11Q4 12Q1 12Q2 12Q3 12Q4 13Q1 13Q2

SPE 168645 5

complex fracture networks. However, unconventional oil and liquids-rich plays generally require larger grades of proppant

(20/40 and 30/50) than gas plays. Since the larger grades of proppant require higher viscosity fluids to carry them into

fractures, the fluid viscosity is increased with gelling and crosslinking agents to increase fluid viscosity and proppant carrying

capacity. After much experimentation, many operators have also combined the two frac design approaches into hybrid

systems which have high proppant carrying capacity and can create complex fracture networks. See Figure 8 for geographic

distribution of the most common fracture treatment types for select US plays.

Figure 8: Most Common Frac Treatment Type for Select US Plays (2013YTD)

Source: FracFocus.org

As illustrated in Figure 9 below, US operators have transitioned from Slickwater frac treatments, in favor of Hybrid

Crosslinked/Slickwater frac treatments. Between the first quarter of 2011 and the first quarter of 2012, operators decreased the

proportion of horizontal wells treated with a Slickwater system from 45% to 25%. Similarly, as illustrated in Figure10 below,

over the same time period US operators have transitioned from Water Frac treatments, in favor of Hybrid frac treatments that

incorporate a gelling and/or a crosslinking agent, in addition to a friction reducer. Since early 2012, the proportion of wells

treated with a Slickwater system has been stable, accounting for between 23% and 29% of horizontal wells.

Hybrid frac treatments have accounted for the majority of horizontal wells treated since late 2011. From a low of 42% of

horizontal wells in the first quarter of 2011, hybrid frac treatments increased market share quickly, to 57% of horizontal wells

in the fourth quarter of 2011. The use of Conventional frac treatments has increased since early 2011 but has never amounted

to more than 17% of horizontal wells. Since the third quarter of 2012, conventional frac treatments have fallen moderately in

popularity, amounting to 14% of horizontal wells treated in the second quarter of 2013.

Other frac treatment systems, including Energized, Acid Frac, Matrix Acidizing, and others (herein referred to as Secondary

treatment types, for convenience) , account for a relatively small proportion of horizontal wells treated in the US between 2011

and the first half of 2013. In 2011 and 2012, these Secondary frac treatment types accounted for between 1% and 2% of

horizontal wells treated. In the first and second quarters of 2013, the proportion of horizontal wells treated with these

Secondary types accounted for 3% to 4%, but the increase is due to an increase in the number of records that were classified as

unknown, rather than due to an increase in the number of Secondary treatment types.

Bakken

DJ Basin

Marcellus

6 SPE 168645

Figure 9: US Frac Design Trends (Technical) Figure 10: US Frac Design Trends (Simple)

Source: FracFocus.org, Baker Hughes Source: FracFocus.org, Baker Hughes

Proppant is critical to the production of an unconventional well, creating conductivity in an otherwise low-permeability

formation. The choice of proppant has been much debated among completion engineers and other technical professionals

involved in hydraulic fracturing design. Premium proppants (resin-coated sand and ceramic proppant) have been much

touted for their superior crush-strength, relative to sand. This paper will not attempt to provide an opinion into the ongoing

debate. However, it will attempt to provide an analysis of the proppant design of operators in the US in an attempt to

accurately represent historical trends.

Sand is the overwhelmingly the dominant proppant used in the US for hydraulic fracturing, used in approximately 90% of

wells. However, it is common to pump more than one proppant type in a well during the course of a hydraulic fracturing

treatment. Common combinations include Sand+RCS (sand with resin-coated sand) and Sand+Ceramic (sand with ceramic

proppant). As seen in Figure below there has been a considerable shift in US proppant design trends since early 2011.

The use of resin-coated sand and ceramic proppant increased significantly between early 2011 and mid-2012, from inclusion

in 11% of horizontal wells in the first quarter of 2011 to 35% of wells in the third quarter of 2012. Conversely, the use of sand

as the only proppant has decreased considerably, from 11% of horizontal wells in the first quarter of 2011 to 65% in the third

quarter of 2012. This time period coincides well with the exploration phase for a number of key oil/liquids plays in the US,

most notably the Bakken, Eagle Ford, and Permian unconventional plays. The increase in the use of ceramic and resin-coated

proppant demonstrated in Figure 11 below can partially be explained by increasing representation of these plays in the

population of wells. Another reason for their rapid increase could be increased testing and experimentation with these

proppants, in an effort to determine the proppant design choice that results in the best production.

The use of resin-coated sand and ceramic proppant appears to have decreased quickly since late 2012, from 35% of horizontal

wells in the fourth quarter of 2012 to 25% in the second quarter of 2013. This rapid shift is most likely explained by a focus

on cost management by operators. After a period of rapid cost escalation in the 2010-2011 time period operators began to

focus on optimizing their upstream operations and rationalizing their costs. There is no doubt that premium proppants have

superior crush strength and create improved conductivity downhole; however, the improvement in conductivity comes at a

higher price. It appears that many operators reached the conclusion, sometime in 2012, that the use of only sand as a proppant

in their wells was sufficient for their needs. Between the fourth quarter of 2012 and the second quarter of 2013, the proportion

of horizontal wells that included only sand as a proppant increased from 65% to 75%.

0%

20%

40%

60%

80%

100%

11Q1 11Q2 11Q3 11Q4 12Q1 12Q2 12Q3 12Q4 13Q1 13Q2

XL XL/SW

LG/SW SW

LG ENG

Other/Unknown Oil Rigs (% of Total)

0%

20%

40%

60%

80%

100%

11Q1 11Q2 11Q3 11Q4 12Q1 12Q2 12Q3 12Q4 13Q1 13Q2

Conventional Hybrid

Water Frac Energized

Other/Unknown Oil Rigs (% of Total)

SPE 168645 7

Figure 11: US Proppant Design Trends

Source: FracFocus.org

Total proppant consumption in the US has increased quickly as horizontal drilling and multi-stage hydraulic fracturing

techniques have been applied to unconventional oil/gas plays across the country. One far-reaching trend that has been widely

discussed within industry is the increasing lateral length of horizontal wells, often used as a metric of service intensity.

Increasing service intensity has important implications for many industries that provide products and services to operators, for

example, the proppants industry.

Conventional wisdom implies that the mass of proppant consumed per well has been steadily increasing in the last few years.

However, analysis of the available data demonstrates a more complex story. Figure 12 below provides an analysis of the

average mass of proppant consumed per horizontal well in the US between the first quarter of 2011 and the second quarter of

2013. It appears that average proppant mass per horizontal well actually decreased significantly between the first quarter of

2011 and the third quarter of 2012, from approximately 4 million pounds to nearly 3.5 million pounds. The decrease in

average proppant mass is most likely due to a shift in the well population towards smaller exploration-phase wells in new

oil/liquids plays, away from larger development-phase wells in more established gas plays.

Proppant consumption increased rapidly between the third quarter of 2012 and the second quarter of 2013, from nearly 3.5

million pounds to nearly 4.3 million pounds, an increase of 24% in less than one year. This increase is partially explained by

increasing well sizes in key US plays, particularly the Bakken, Eagle Ford, Marcellus, and Permian. However another

important factor is the rapid increase in proppant loading during this time period. As seen in Figure 12 below, proppant

loading (defined as total proppant mas / total water mass) increased dramatically between the fourth quarter of 2012 and the

second quarter of 2013, from approximately 1.0 lbs/gal H

2

O to 1.1 lbs/gal H

2

O, a 10% increase. Although the reasons are still

unclear, it appears that operators are pumping more proppant per gallon of water.

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

11Q1 11Q2 11Q3 11Q4 12Q1 12Q2 12Q3 12Q4 13Q1 13Q2

Sand Only Sand+RCS Sand+Ceramic Ceramic Only Sand+RCS+Ceramic RCS Only RCS+Ceramic

8 SPE 168645

Figure 12: Aggregate US Proppant Mass per Well (MM lbs) vs Proppant Loading (lbs/gal H2O)

Source: FracFocus.org

Note: Proppant loading is defined as the total pounds of proppant divided by the total gallons of water

As discussed above, proppant consumption is a complex story, with significant variance in consumption per well and proppant

loading across treatment types, as demonstrated in Figure 13 and Figure 14 below. Proppant loading in horizontal wells has

increased by 8% per annum since 2011 in Hybrid treatments, but only by 5% in Conventional treatments. Conversely,

proppant loading has decreased by 8% in Water Frac treatments. As discussed above, Hybrid and Conventional treatments

accounted for nearly 70% of horizontal wells in the first half of 2013, therefore increases in proppant loading within these well

populations have a dominant effect on the average of the total population of all horizontal wells. Per well proppant

consumption has increased in all treatment types, with the exception of Slickwater frac treatments. Most notably, between

2012 and 2013 year-to-date, proppant mass per horizontal well increased by 44% for Conventional treatment types.

Figure 13: US Proppant Loading (lbs proppant/gal H2O) Figure 14: US Proppant Mass per Well (MM lbs)

Source: FracFocus.org Source: FracFocus.org

Note: Proppant loading is defined as the total pounds of proppant divided by the total gallons of water

In an effort to better understand proppant loading trends, we have provided a detailed analysis of proppant loading (lbs

proppant/1,000 gal H

2

O) for two common frac treatment types: Hybrid Crosslinked/Slickwater and Slickwater (see Figure 15

and Figure 15 below). These treatment types were chosen because together they account for 68% of all available horizontal

wells in our data set, and they each demonstrate very different trends.

Within the population of horizontal wells treated with a Hybrid Crosslinked/Slickwater fluid system (see Figure 15 below),

proppant loading has increased steadily since early 2011, with growth accelerating in the first half of 2013. Also notable are

0.96

0.98

1.00

1.02

1.04

1.06

1.08

1.10

1.12

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

4.0

4.5

11Q1 11Q2 11Q3 11Q4 12Q1 12Q2 12Q3 12Q4 13Q1 13Q2

L

o

a

d

i

n

g

M

a

s

s

P

e

r

W

e

l

l

Proppant Mass Per Well Proppant Loading

0.0

0.2

0.4

0.6

0.8

1.0

1.2

1.4

XL/SW LG/SW SW LG XL ENG

2011 2012 2013

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

4.0

4.5

5.0

XL/SW LG/SW SW LG XL ENG

2011 2012 2013

SPE 168645 9

the changes in loading trends for the different proppant types. Proppant loading for resin-coated sand and ceramic proppant

increased quickly between the first and fourth quarters of 2011, whereas proppant loading for sand appears stable until the first

half of 2013, when it increased quickly.

Proppant loading within the population of horizontal wells treated with a Slickwater fluid system (see Figure 16 below) has

increased steadily since early 2011, from over 0.9 lbs/gal H

2

O in the first quarter of 2011 to under 0.7 lbs/gal H

2

O in the first

quarter of 2013. Proppant loading of resin-coated sand and ceramic proppant is also considerably lower for Slickwater

treatment types. Proppant loading for Slickwater treatments has decreased by the equivalent of approximately 9% per annum

since 2011.

Figure 15: US Crosslinked/Slickwater Proppant Loading Trends Figure 16: US Slickwater Proppant Loading Trends

Source: FracFocus.org Source: FracFocus.org

Note: Proppant loading is defined as the total pounds of proppant divided by the total gallons of water

Anal ysi s of Regional US Hydrauli c Fracturing Flui d System and Proppant Trends

This section will provide an analysis of fracture designs and proppant trends for three plays: the Bakken, DJ Basin, and

Marcellus.

Bakken

Operators unlocked the full potential of the Bakken tight oil play though horizontal drilling and multi-stage hydraulic

fracturing, resulting in a sharp increase in activity since 2011. Production of oil in the Bakken requires the use of viscous

crosslinked gels with large-mesh proppants to create and sustain wide and deep fractures. Many fracs in the Bakken now

include a slickwater portion to the frac fluid in order to create a complex network of fractures, while keeping the advantages

present with using a crosslinked gel.

The number of stages and frac size has increased in the Bakken as well, faster than the national average since 2012. In

addition, proppant loading in the Bakken has increased faster than the national average, resulting in a 30% increase in proppant

per well 2013. Bakken is unusual in that nearly half of Bakken wells use ceramic proppant, and in large volumes rather than a

small amount at the end of a stage. Much research and testing is being done to test the cost effectiveness of this practice, but

early data from 2013 indicate that ceramic will be used less than in 2012.

The number of Bakken wells in the database has increased dramatically from 2011 to 2013. Although the data is not complete,

the amount of data nevertheless reflects the increase in Bakken horizontal drilling and completion activity and provides a

robust data set for analysis.

0.0

0.2

0.4

0.6

0.8

1.0

1.2

1.4

11Q1 11Q2 11Q3 11Q4 12Q1 12Q2 12Q3 12Q4 13Q1 13Q2

Sand RCS Ceramic

0.0

0.2

0.4

0.6

0.8

1.0

11Q1 11Q2 11Q3 11Q4 12Q1 12Q2 12Q3 12Q4 13Q1 13Q2

Sand RCS Ceramic

10 SPE 168645

Figure 17: Sample Size of Bakken Horizontal Well Records

Source: FracFocus.org

Figure 18 and Figure 19 are maps of 2013 Bakken frac activity. Conventional crosslinked frac fluid activity is primarily

concentrated in the eastern portion of the active play, while there are clumps of hybrid crosslinked gel and slickwater fracs in

the surrounding areas.

Figure 18: Map of Bakken Wells, by Frac Treatment Type (2013YTD)

Source: FracFocus.org

Figure 19: Map of Bakken Counties, by Most Common Frac Treatment Type (2013YTD)

Source: FracFocus.org

74

99

211

260

367

476

516

467

481

396

0

100

200

300

400

500

11Q1 11Q2 11Q3 11Q4 12Q1 12Q2 12Q3 12Q4 13Q1 13Q2

SPE 168645 11

In the Bakken, operators have been switching to hybrid fracs in order to allow for more fracture complexity and networking,

but still allow for larger proppant grades to provide near wellbore conductivity. Conventional or crosslinked frac fluids have

been on a constant decline since the beginning of 2011. However, Hybrid horizontal frac share increased from 20% in the first

quarter of 2011 to more than 70% in 13Q3. Experimentation with slickwater and linear gel fracs appears to emerge in 2012,

but subsides to 2011 levels by mid-2013. Despite the strong shift to Hybrid fracs, Conventional frac designs appear to

maintain roughly 30% share of horizontal fracs. See Figure 20 and Figure 21 for quarterly frac design trends in the Bakken.

Figure 20: Bakken Frac Design Trends (Technical) Figure 21: Bakken Frac Design Trends (Simple)

Source: FracFocus.org Source: FracFocus.org

Bakken operators have been the primary consumer of ceramic proppant. A greater proportion of Bakken wells use ceramic

proppant than any other play in the United States. In the third quarter of 2012, the peak of Ceramic usage in the US, 15% of

wells in the US used Ceramic (see Figure 11). In the Bakken, 50% of the third quarter of 2012 wells used Ceramic, and that

number was higher in the second quarter of 2012 and the fourth quarter of 2012. For their preference for ceramic proppant,

operators cite the geology of the Bakken and need to maintain near wellbore conductivity by avoiding proppant degradation,

embedment, stress and flowback as especially important in a liquids play as reasons. Regional oilfield culture and accepted

practices may also be a factor. Figure 22 below shows proppant design trends in the Bakken. The proportion of fracs using

only sand declined by 20% in 2012, in favor of treatments using only ceramic proppant or ceramic proppant with sand.

However, the use of ceramics has declined in 2013, as many operators shift to lower-cost proppants, such as sand and resin-

coated sand.

Figure 22: Bakken Proppant Design Trends

Source: FracFocus.org

Both proppant loading and proppant mass per well increased the past year, following a decline from 2011 to 2012. Proppant

0%

20%

40%

60%

80%

100%

11Q1 11Q2 11Q3 11Q4 12Q1 12Q2 12Q3 12Q4 13Q1 13Q2

Hybrid Water Frac Conventional

Energized Other/Unknown

0%

20%

40%

60%

80%

100%

11Q1 11Q2 11Q3 11Q4 12Q1 12Q2 12Q3 12Q4 13Q1 13Q2

XL/SW LG/SW SW LG XL ENG Other/Unknown

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

11Q1 11Q2 11Q3 11Q4 12Q1 12Q2 12Q3 12Q4 13Q1 13Q2

Sand Only Sand+RCS+Ceramic Sand+RCS Sand+Ceramic RCS Only RCS+Ceramic Ceramic Only

12 SPE 168645

loading increased 17% YoY from the second quarter of 2012 to the second quarter of 2013 while mass per well increased 35%

YoY in the same period, mirroring the national trend where about half the increase in mass per well can be attributed to an

increase in proppant loading while the other half can be attributed to an increase in fluid pumped. The increase in the Bakken

was steeper than the national average, however (See figure 23 for details).

Figure 23: Bakken Proppant Mass per Well (MM lbs) vs Proppant Loading (lbs/gal H2O)

Source: FracFocus.org

Fracture treatment fluids have different proppant loading and proppant mass per well characteristics. Crosslinked slickwater

hybrid fracs and conventional crosslinked fracs, the two most common in the Bakken, both demonstrated a decrease in average

loading from 2011 to 2013, but both showed a dramatic increase in mass per well. Figure 24 and Figure 245 show the yearly

proppant mass per well and proppant loading by frac types. Slickwater proppant loading decreased every year even though the

Slickwater mass of proppant has increased, indicating a dramatic increase in frac size. The caveat though is that there were

very few slickwater fracs in 2011 and 2013. The trend for crosslinked fracs is that same as the one for hybrid fracs, showing a

general trend of increasing frac sizes, although mass per well decreased in 2012 7% from 2011 while loading decreased 19%.

Similar to national trends, Crosslinked Gel and Crosslinked/Slickwater hybrids had the highest proppant loadings among the

frac types.

Figure 24: Bakken Proppant Loading (lbs proppant/gal H2O) Figure 25: Bakken Proppant Mass per Well (MM lbs)

Source: FracFocus.org Source: FracFocus.org

Note: Proppant loading is defined as the total pounds of proppant divided by the total gallons of water

An interesting trend appears when examining the proppant design distribution for wells using both sand and ceramic proppant.

Rather than wells using primarily Sand with a tail-in of Ceramic, Bakken sand and ceramic wells use more than 40% ceramics.

Figure 26 provides a detailed analysis of this distribution from 2011 to 2013.

1.0

1.1

1.2

1.3

1.4

1.5

1.6

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

11Q1 11Q2 11Q3 11Q4 12Q1 12Q2 12Q3 12Q4 13Q1 13Q2

L

o

a

d

i

n

g

M

a

s

s

P

e

r

W

e

l

l

Mass Per Well Loading

0.0

0.5

1.0

1.5

2.0

XL/SW LG/SW SW LG XL ENG

2011 2012 2013

0.0

1.0

2.0

3.0

4.0

XL/SW LG/SW SW LG XL ENG

2011 2012 2013

SPE 168645 13

Figure 26: Bakken Sand+Ceramic Proppant Distribution (MM lbs)

Source: FracFocus.org

Note: Proppant loading is defined as the total pounds of proppant divided by the total gallons of water

DJ Basin

The landscape of hydraulic fracturing activity in the DJ Basin has changed significantly in the past three years, shifting from

primarily vertical/directional to horizontal wells. The DJ Basin is primarily oil/liquids rich play, therefore activity in the region

has ramped up recently due to relatively low natural gas prices. Similar to the Bakken, oil production in the DJ Basin requires

a fracture treatment that employs a viscous gel combined with a proppant to prevent closure of fractures. As a result, wells in

the DJ Basin generally include a Hybrid treatment type with sand and resin-coated sand for additional crush-resistance

downhole. These trends are expected to continue as horizontal well sizes increase along with the number of stages treated.

The dataset used for the analysis of horizontal wells in the DJ Basin increased significantly from early 2011 (see Figure 27).

However, the number of records available is much smaller than other plays, resulting in some variability for certain detailed

analyses.

Figure 27: Sample Size of DJ Basin Horizontal Well Records

Source: FracFocus.org

0%

10%

20%

30%

40%

50%

60%

70%

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

4.0

4.5

11Q1 11Q2 11Q3 11Q4 12Q1 12Q2 12Q3 12Q4 13Q1 13Q2

Sand Ceramic Ceramic % by Mass

21

34

49

57

89

126

136

163

145

127

0

20

40

60

80

100

120

140

160

11Q1 11Q2 11Q3 11Q4 12Q1 12Q2 12Q3 12Q4 13Q1 13Q2

14 SPE 168645

In the area of activity within the DJ Basin, most of the wells consist of a Hybrid Crosslinked/Slickwater treatment type, while

wells with a Conventional (Crosslinked) treatment type constitute much of the remainder (see Figure 28 and Figure 29).

Figure 28: Map of DJ Basin Wells, by Treatment Type (2013YTD)

Source: FracFocus.org

Figure 29: Map of DJ Basin Counties, by Most Common Frac Treatment Type (2013YTD)

Source: FracFocus.org

Figure 30 and Figure 31 show the treatment type distribution for horizontal wells in the DJ Basin between 2011 and 2013.

Horizontal wells in the DJ Basin were overwhelmingly treated with a Hybrid design. In 2011, more than 20% were

Conventional (Crosslinked) treatments, but over the next two years, this percentage fell to less than 10%. Although some

wells treated still utilize a Slickwater design, most operators have switched over to a Hybrid treatment design.

SPE 168645 15

Figure 30: DJ Basin Frac Design Trends (Technical) Figure 31: DJ Basin Frac Design Trends (Simple)

Source: FracFocus.org Source: FracFocus.org

Figure 32 below provides an analysis of proppant design trends in the DJ Basin. The two major proppant design profiles in the

DJ basin are sand only and a combination of sand and resin-coated sand. Following the first half of 2011, the most common

treatment design shifted from using predominantly sand to sand and resin-coated sand. This proportion peaked in 2012, but has

decreased steadily to 61% in the second quarter of 2013 as operators slowly shift away from premium proppants to sand,

likely in an effort to minimize costs.

Figure 32: DJ Basin Proppant Design Trends

Source: FracFocus.org

Figure 33 provides an analysis of proppant mass per well and proppant loading in the DJ Basin. The quarter-on-quarter changes

are much more volatile than in the other plays, most likely due to limited sample size in this region. Despite the instability in

the analysis results, mass per well and proppant loading appear closely correlated.

0%

20%

40%

60%

80%

100%

2011 2012 2013

Hybrid Water Frac Conventional Energized

0%

20%

40%

60%

80%

100%

2011 2012 2013

XL/SW LG/SW SW LG XL ENG

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

11Q1 11Q2 11Q3 11Q4 12Q1 12Q2 12Q3 12Q4 13Q1 13Q2

Sand Only Sand+RCS Sand+RCS+Ceramic Sand+Ceramic RCS Only

16 SPE 168645

Figure 33: DJ Basin Proppant Mass per Well (MM lbs) vs Proppant Loading (lbs/gal H2O)

Source: FracFocus.org

Note: Proppant loading is defined as total proppant mass divided by total gallons of water.

Figure 34 and Figure 35 below show the changes in loading and mass per well by treatment type. Although the quarterly

changes appear erratic, the trends look clearer when the data is viewed on a yearly basis for each treatment type. Since the

Crosslinked/Slickwater treatment type constitutes for 85% of horizontal wells in the DJ Basin, a small sample size causes

much of the fluctuations in other treatment designs.

Figure 34: DJ Basin Proppant Loading (lbs proppant/gal H2O) Figure 35: DJ Basin Proppant Mass per Well (MM lbs)

Source: FracFocus.org Source: FracFocus.org

Note: Proppant loading is defined as total proppant mass (pounds) divided by total water volume (gallons)

Unlike the fracture treatments in the Bakken, using both sand and ceramic proppant, sand with resin-coated sand fracs in the

DJ Basin contain a small proportion of resin-coated sand by mass of total proppant. The trends are slightly volatile, but the

proportion of the well using resin-coated sand consistently stays below 30%. Figure 36 demonstrates the trends between 2011

and 2013 year-to-date.

0

0.2

0.4

0.6

0.8

1

1.2

1.4

1.6

0

0.5

1

1.5

2

2.5

3

3.5

4

11Q1 11Q2 11Q3 11Q4 12Q1 12Q2 12Q3 12Q4 13Q1 13Q2

L

o

a

d

i

n

g

M

a

s

s

p

e

r

W

e

l

l

Mass Per Well Loading

0.0

0.5

1.0

1.5

2.0

XL/SW LG/SW SW LG XL ENG

2011 2012 2013YTD

0.0

1.0

2.0

3.0

4.0

XL/SW LG/SW SW LG XL ENG

2011 2012 2013YTD

SPE 168645 17

Figure 36: DJ Basin Sand+Resin-Coated Sand Proppant Distribution (MM lbs)

Source: FracFocus.org

Marcellus

The Marcellus Shale, one of the largest natural gas resources in the world and has been, since 2008, the centerpiece of the

hydraulic fracturing and Shale boom. Since a drop in natural gas prices, activity has declined but has not stopped. There are

still hundreds of horizontal wells drilled every quarter, and operators are still refining their frac designs to lower costs and

increase production.

One distinguishing characteristic of the Marcellus shale is the proliferation of linear gel and slickwater hybrids that include

less proppant per gallon of water than pure slickwater fracs do, in contrast with hybrid gel and slickwater fracs in other plays.

Marcellus treatments have had relatively constant proppant loading, possibly due to the proppant carrying capacity of

slickwater and linear gel slickwater hybrids, but have increased in size, leading a to higher overall usage of fine mesh sands.

Marcellus sample is not as large and does not increase as fast as the sample in the Bakken, though it starts at a much higher

level than the DJ basin. Though Figure 37 is not accurate count of Marcellus drilling and completion activity, it does reflect

general trends in the activity. The number of horizontal wells increases quickly in the beginning of 2011, before slowing down

and eventually collapsing due to low natural gas prices, and then stabilizes in the third quarter of 2012.

Figure 37: Sample Size of Marcellus Horizontal Well Records

Source: FracFocus.org

0%

5%

10%

15%

20%

25%

30%

35%

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

4.0

4.5

11Q1 11Q2 11Q3 11Q4 12Q1 12Q2 12Q3 12Q4 13Q1 13Q2

Sand RCS RCS Proppant (% of Total Mass)

172

245

296

306

264

298

205

200

223

231

0

50

100

150

200

250

300

350

11Q1 11Q2 11Q3 11Q4 12Q1 12Q2 12Q3 12Q4 13Q1 13Q2

18 SPE 168645

In Figure 38 below, we see that slickwater fracs are mostly concentrated in the northeast while linear gel slickwater hybrids are

spread throughout the rest of the play in 2013.

Figure 38: Map of Marcellus Wells, by Frac Treatment Type (2013YTD)

Source: FracFocus.org

Figure 39: Map of Marcellus Counties, Classified by Most Common Frac Treatment Type (2013YTD)

Source: FracFocus.org

Marcellus is a shale gas play that uses slickwater fracs to increase fracture complexity. It has seen an increase in hybrid fracs,

although unlike most other regions, these hybrids are of linear gel and slickwater (See Figure 40 and Figure 41 below). By our

technical classification, Marcellus has been treated by a combination of Hybrid and Water Frac designs. By our simple

classification, the overwhelming majority have been either linear gel/slickwater or slickwater treatment designs. Slickwater

treatments started out in the majority of horizontal wells (58%), with roughly 31% of wells using linear gel/slickwater

treatments. In the second quarter of 2012, the slickwater share decreased to 39% while the linear gel/slickwater hybrid share

increased to 53%. In the past four quarters, the percentages have fluctuated with no specific trend. There has been a small

increase of the percentage of crosslinked gel and slickwater hybrid fracs from 2% to 14% in the first quarter of 2013. This

could be attributed to Utica activity, where the target production is liquids and therefore use a more viscous frac fluid.

SPE 168645 19

Figure 40: Marcellus Treatment Design Trends (Technical) Figure 41: Marcellus Treatment Design Trends (Simple)

Source: FracFocus.org Source: FracFocus.org

In contrast, with the DJ Basin and Bakken, proppant choice in Marcellus has been overwhelmingly been sand only. Towards

the middle of 2012, there seems to appear some experimentation with tailing in ceramic proppants or resin-coated sands, but

this trend seems to be dying down. This contrast with Bakken and DJ Basin can be attributed to the nature of the production.

The low price of natural may force operators to seek lower drilling and completion costs and Gas may require less near

wellbore conductivity than liquids do. Figure 42 shows that there were never more than 13% of wells in the Marcellus that

used proppants other than sand. This experimentation with higher price proppants seems to have peaked in the third quarter of

2012, although the usage of ceramics peaked in the second quarter of 2012.

Since the Marcellus produces dry gas, the overwhelming preference for frac sand might be attributed to a lower necessity to

avoid proppant degradation and prevention of flowback control. Surprisingly, the experimentation with higher priced

proppants looks like it occurred after natural gas prices collapsed.

Figure 42: Marcellus Proppant Design Trends

Source: FracFocus.org

Notes: The scales minimumis at 80% so that the usages of other proppant profiles besides Sand Only can be seen

Proppant loading has increased and then decreased over the period shown, but the difference between the peak in the first

quarter of 2012 and the through the third quarter of 2012 as seen in Figure 43 was only 13%. Proppant mass per well, in the

other hand, increased 37% from the first quarter of 2011 to the second quarter of 2013.

0%

20%

40%

60%

80%

100%

11Q1 11Q2 11Q3 11Q4 12Q1 12Q2 12Q3 12Q4 13Q1 13Q2

Hybrid Water Frac Conventional

0%

20%

40%

60%

80%

100%

11Q1 11Q2 11Q3 11Q4 12Q1 12Q2 12Q3 12Q4 13Q1 13Q2

XL/SW LG/SW SW LG XL

80%

82%

84%

86%

88%

90%

92%

94%

96%

98%

100%

11Q1 11Q2 11Q3 11Q4 12Q1 12Q2 12Q3 12Q4 13Q1 13Q2

Sand Only Sand+RCS+Ceramic Sand+RCS Sand+Ceramic RCS Only RCS+Ceramic Ceramic Only

20 SPE 168645

Figure 43: Marcellus Proppant Mass per Well (MM lbs) vs Proppant Loading (lbs/gal H2O)

Source: FracFocus.org

Note: Proppant loading is defined as total proppant mass (pounds) divided by total water volume (gallons)

Looking at proppant usage by frac type will yield similar results: loading remained flat, but mass per well increased

significantly. Proppant loading in the most common frac types has stayed flat from 2011 to 2013 in the Marcellus as shown in

Figure 44 and Figure 45. The proppant loading for wells using linear gel/slickwater treatments remained stable around one

pound per gallon of water, while the loading for wells using slickwater treatments was slightly higher This is in contrast to

other plays where gelled fracs generally have higher proppant loadings than slickwater fracs. In both cases, however the

proppant mass per well increased in 2013 over 2011 and 2012.

Figure 44: Marcellus Proppant Mass per Well (MM lbs) Figure 45: Marcellus Proppant Loading (lbs/gal H2O)

Source: FracFocus.org Source: FracFocus.org

Note: Proppant loading is defined as total proppant mass (pounds) divided by total water volume (gallons)

0.6

0.7

0.8

0.9

1.0

1.1

1.2

1.3

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

11Q1 11Q2 11Q3 11Q4 12Q1 12Q2 12Q3 12Q4 13Q1 13Q2

L

o

a

d

i

n

g

M

a

s

s

p

e

r

W

e

l

l

Mass Per Well Loading

0.0

2.0

4.0

6.0

8.0

10.0

XL/SW LG/SW SW LG XL ENG

2011 2012 2013

0.0

0.2

0.4

0.6

0.8

1.0

1.2

1.4

1.6

XL/SW LG/SW SW LG XL ENG

2011 2012 2013

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Deconstructing The PopularDocumento8 páginasDeconstructing The PopularShreyas AdhikariAinda não há avaliações

- Creating A Total Safety CultureDocumento23 páginasCreating A Total Safety CultureAnnisa S. DilaAinda não há avaliações

- Duryodhana Sows Seeds of DiscordDocumento117 páginasDuryodhana Sows Seeds of DiscordSrikanth VAinda não há avaliações

- The Psychodynamic Diagnostic ManualDocumento3 páginasThe Psychodynamic Diagnostic ManualJrtabletsmsHopeAinda não há avaliações

- Quality Control Charts Track Hemoglobin TestingDocumento2 páginasQuality Control Charts Track Hemoglobin TestingDayledaniel SorvetoAinda não há avaliações

- 2 Ac 05Documento3 páginas2 Ac 05saranya baraniAinda não há avaliações

- Brauer Graph AlgebrasDocumento55 páginasBrauer Graph AlgebrasbbteenagerAinda não há avaliações

- IQRA University Sample PaperDocumento9 páginasIQRA University Sample PaperFaryal Mughal100% (1)

- Martin Luther King Jr. - The Modern Negro Activist (1961)Documento4 páginasMartin Luther King Jr. - The Modern Negro Activist (1961)Vphiamer Ronoh Epaga AdisAinda não há avaliações

- SabutanDocumento6 páginasSabutanIcas PhilsAinda não há avaliações

- Happy: D.R. ® 2020 Organización Harmon Hall, A.C. 1Documento7 páginasHappy: D.R. ® 2020 Organización Harmon Hall, A.C. 1Omar AlfaroAinda não há avaliações

- CTET 2012 English Question Paper with Key & ExplanationsDocumento7 páginasCTET 2012 English Question Paper with Key & ExplanationsSureshkumaryadavAinda não há avaliações

- ASRB NET Fruit Science 2023Documento17 páginasASRB NET Fruit Science 2023Zara ElzebathAinda não há avaliações

- Control PlanDocumento6 páginasControl PlanEshioAinda não há avaliações

- Stiso H W Topic 1Documento6 páginasStiso H W Topic 1api-235839943Ainda não há avaliações

- Astm D3612 2009 PDFDocumento22 páginasAstm D3612 2009 PDFWendi MustafaAinda não há avaliações

- 5e Half Orc Barbarian Berserker LVL 13Documento3 páginas5e Half Orc Barbarian Berserker LVL 13UMMMM NOAinda não há avaliações

- 14 Day Walk With ChristDocumento15 páginas14 Day Walk With ChristlarryclouseAinda não há avaliações

- Skills Workbook: Unit 6Documento90 páginasSkills Workbook: Unit 6Rivka Share100% (1)

- K Essence, Superluminal Propagation, Causality and Emergent GeometryDocumento34 páginasK Essence, Superluminal Propagation, Causality and Emergent GeometrycarlabernalAinda não há avaliações

- The Allure of The Bisexual WomanDocumento3 páginasThe Allure of The Bisexual WomanSAF Social0% (2)

- Ibuprofen Toxicity and Renal Tubular Acidosis.Documento1 páginaIbuprofen Toxicity and Renal Tubular Acidosis.jingerbruno100% (1)

- Garfield Practice Hints 6-2018Documento4 páginasGarfield Practice Hints 6-2018bblythe1Ainda não há avaliações

- TractatusDocumento185 páginasTractatusSattyaki BasuAinda não há avaliações

- 1.3bsa-Cy2-Am - Far2 - 8200413 - Reveral, Angela R. - Case#2Documento4 páginas1.3bsa-Cy2-Am - Far2 - 8200413 - Reveral, Angela R. - Case#2Angela Ricaplaza ReveralAinda não há avaliações

- Heterogeneous Reaction KineticDocumento48 páginasHeterogeneous Reaction KineticChristian NwekeAinda não há avaliações

- Foundation of Special and Inclusive EducationDocumento21 páginasFoundation of Special and Inclusive EducationErirose ApolinarioAinda não há avaliações

- Yr2 Think of An Eel Teaching SequenceDocumento3 páginasYr2 Think of An Eel Teaching Sequencejoy_simpson38450% (2)

- RPT Suggestion Activities For Cefr Created by Nurul FazeelaDocumento7 páginasRPT Suggestion Activities For Cefr Created by Nurul FazeelaIna NaaAinda não há avaliações

- Magna Carta Foundation by 2024 Module 1 Polity & Governance ThemeDocumento15 páginasMagna Carta Foundation by 2024 Module 1 Polity & Governance ThemeAtulJhaKumarAinda não há avaliações