Escolar Documentos

Profissional Documentos

Cultura Documentos

Tax Certificate for Elementary School Teacher

Enviado por

Zandie GarciaTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Tax Certificate for Elementary School Teacher

Enviado por

Zandie GarciaDireitos autorais:

Formatos disponíveis

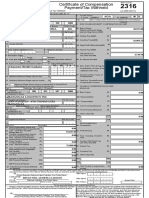

02/19/2014***14:OS:O50420120301631

ri J

BIR Form No.

i..

Kagawaran ng Pananalapi

Republika ng Pilipinas

Certificate of Compensation

2316

e

.

Kawanihan ng Rentas Internas

Payment/Tax Withheld

For Compensation Payment With or Without Tax Withheld July 2008 (ENCS)

Fill in all aDolicable soaces. Mark all aoorooriate boxes with an "X"

I For the Year

I

2 For the Period

R2

(

yYyy

)

20131 From (MM/DO) To (MM/DO)

Part I Employee Information Part IV-B

Details of Compensation Income and Tax Withheld from Present Employer

3 Taxpayer

1 ~~ I F 1

Amount

Identification No. i i A. NONTAXABLE/EXEMPT COMPENSATION INCOME

32Basic Salary/ 32

I

_

4 Employee's Name (Last Name, First Name, Middle Name) 5 R_D_O Code

' r-RI

Ll

_

Statutory Minimum Wage

6 Registered Address 6A Zip Code

.

Minimum Wage Earner (MWE)

I

Vi P 33 Holiday Pay (MWE) 33

Overtime Pay (MWE) 34

35 Night Shift Differential (MWE) 35

36 Hazard Pay (MWE) 36

61 1 3 Local Home Address 6C Zip Code ____________

1 mik'

;r M7 wt(

!? 3/ i O

I

6DForeign Address

JL

6E Zip Code

7 Date of Birth (MMIDD/YYYY

_

8 Tehone Number

________________________

______________________

_ 1

37 1 3th Month Pay 37

and Other Benefits

9,650.00

9 Exemption Status

[ -I_i_I

Single Married

___

9A Is the wife claigjhe additional exemption for qualified dependent children?

iiefL L C) W A N cE 51000.00

I

L__i

Yes No

39 SSS, GSIS, PHIC& Pag-ibig 39

__

27,732.00

-

1 0 Name of Qualified Dependent Children 1 1 Date of Birth (MM/DDIYYYY)

Contribns,&Unbon0s

(Employee share only)

40 Salaries & Other Forms 40

Compensation ? ERA I_24_000._00

1 21

1 2 Statutory Minimum Wage rate per day

1 3 Statutory Minimum Wage rate per month 1 3 41 Total Non-Taxable/Exempt 41 I

8 5382. 00 Compensation Income

I

1 4

J

Minimum Wage Earner whose compensation is exempt from

withholding tax and not subject _to income tax B. TAXABLE COMPENSATION INCOME

REGULAR

42 Basic Salary 42

[ _

23 1, 279. 67

Representation 43

r

Transportation 44

i

_

Part_II_ Employer _Information _(Present)

1 5 Taxpayer_

_________

j_ --I.- IdentificationNo.P

9S8_

li_. Employer's Name

P1

flFPEDflT)TSI flN_

fly

URORL\FLEMFNTAR' _

1 7 Registered Address 17A Zip Code

_

_

PL

SAN LUIS, AURORA j _ T

3.01

45Cost of Living AlInwnr.a 45

46 Fixed Housing Allowance 46

-. _

Main_ Employer _flSecondary _Employer

__

Part _III _Employer _Information _(Previous)

1 8 Taxpayer

II

T_ j

Identification No.

P

,

.

1 9 Employer's _Name 47 Others(Specify)

47A

]

47A{

_

20 Registered Address - 20A Zip_ 47B

T -= -1

47B[ __

-

-I

I L...._ I .j -.. - ... -

I SUPPLEMENTARY

1 48 Commission 48

16, 661. 67

Part IV-A Summary

21 Gross Compensation Income from 21

Present Employer (Item 41 plus Item 55)

22 Less: Total Non-Taxable! 22

49 Profit Sharing 49

Exempt (Item 41 )

231, 27 9. 67

23 Taxable Compensation Income 23

from Present Employer (Item (55) 50 Fees Including Director's 50

Iii1 24 Add: Taxable Compensation 24 Fees

Income from Previous Employer

25 Gross Taxable 25 231, 279. 67

Taxable 1 3th Month Pay 51

I 0. 00

Compensation Income and Other Benefits

(_

75 .

)(_ r

26 Less: Total Exemptions 26

52 Hazard Pay 52

27 Less: Premium Paid on Health 27

0. 00 and/or Hospital Insurance (it applicable)

28 Net Taxable 28

53 Overtime Pay 53

1S6, 279 . 67

Compensation Income

29 Tax Due 29 54 Others (Specify)

30 Amount of Taxes Withheld

MA

54

26, :;'i;. ?2

30A Present Employer 3OA

,S69. _92

3OB Previous Employer

30B

54B 54

_

31Total Amount of Taxes Withfleld 31

55 Total Taxable Compensation 55

[ As adjusted

26__S69.

i9. income 2fl_ 7

We declare, under the penalties of perjury, that this certificate has been made in good faith, verified by us, and to the best of our knowledge and belief. is true and correct

pursuant to the and the regulations issued una!hiritY.Jie,r1 of.

1 :1 1 ]

56 Date Signed

.-

________ ____

Present Employer!

AuthQ(

dzed Agent Signature Over Printed Name

. CONFORME:-o

57 -.-:R L_INIA ..A ._VAL_INO Date Signed

CTCNo. Employee Signature Over Printed Name Amount Paid

uii-nivayoe

' ' (

,

V I

Placeoflssuo

_ rt/1 -L4\Ptj'

Dateoflssue

j .01 I - o7iI

--------.. To_be accomplis4jider substituted _filing

I declare, under the penalties of perjury that I am qualified under substituted filing of I declare, under the penalties ofperjury, that the Information herein stated are reported

under BIR Form No. 1 604CF which has been filed with the Bureau of internal Revenue. Income Tax Returns (BIR Form No. 1 700), since I received purely compensation Income

.

from only one employer in the Phils. for the calendar year: that taxes have been

MI CHELLE M. VAL.ENZUELA

correctly withheld by my employer (tax due equals tax withheld): that the BIR Form

58 No. 1 604CF filed by my employer to the BIR shall constitute as my income tax return:

and that BIR Form o9,26 shall serve tbe sa1 purpose as if BIR Form No. 1 700

had been filed pursuafrs as amended.

Present Employer/Authorized Agent Signature Over Printed Name

(Head of Accounting/ Human Resource or Authorized Representative)

59 -,

Employee Signature Over Printed Name

- - - - ... -...-... -I 1 ,.,.,,, .,_ rif, r ..

42

20J 727. 84

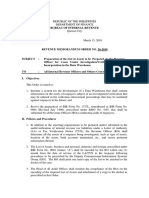

r,J1 c?/201 4***1 : 57: 1 2 042 01 2 4436223

DLII:

0

BIR Form No

Republika ng Pilipinas

Certificate of Compensation

Kagawaran ng Pananalapi

, Kawanihan ng Rentas tnternas

Payment/Tax Withheld

2316

For Compensation Payment With or Without Tax Withheld

July 2008 (ENCS)

Fijiin

all aDDlicable sDaces. Mark all aDDrooriate

boxes with an

(

YYYy

)

_gq4

From (MM/DD) LI iI I I E.i

To (MM/DD)

1 I1 I Forthe Year

2 ForthePenod

Part I

Employee Information

Part IV-B

Details of Compensation Income and

Tax Withheld from Present Employer

Amount

3 Taxpayer

p

LIE

J[03iIF I L_I.LII1

A.

NONTAXABLEJEXEMPT COMPENSATION INCOME

Identification No

E

(Last Name, First Name, Mid le Name)

5 ROCCode

LINDA

32Basic Salary!

32

MA

Statutory Minimum Wage

6Registeredre

6A ZiCode

Minimum Wage Earner (MWE)

[iLI ] 33Holiday Pay (MWE)

33

r1

I

66

Local Home Address

6C Zip Code

I 7 qk

34Overtime Pay (MWE)

34

_L tAy

6D ForqLqn Address

_______ ________6E

Zip Code

] LI I I I I I I I I I I I I I 1

35

Night Shift Differential (MWE) 35

Number 36 Hazard Pay (MWE)

36

7Dateof Birth (MM!DD/YYYYI JT

I

37 1 3th Month Pay

26,302-00.

9 Exemption Status

and Other Benefits

rii

Single

F=x

Married

L]

Yes

exemption fgglifled dependent children?

51 000.00

9A is the wife claiming the additional

No

1 0 Name of Qualified Dependent

Children

1 1 Date of Birth (MM/DDIYYYY) rill b. 10

39 SSS, GSIS, PHIC & Pag-ibig 39

____

Contributions, & Union Dues

rst (Employee share only)

I A t. '"

------- -

H____

40 Salaries & Other Fos OERA

40

24, 000. 0= 0

1 2 Statutory Minimum Wage rate per day

1 2

mpensation

IIIIIII1

1 3 Statutory Minimum Wage rate per month

1 3F

_________

41

Compensation Income

Total Non-Taxable/Exempt 41

r ' 98 1

1 4

Minimum Wage Earner whose compensation is exempt from

withholding tax and not subject to income tax

B. TAXABLE COMPENSATION INCOME

Em ployer

--'' REGULAR -

Part II

Employer unTormauo" rrueuu

1 5 Taxpayer

TTJ 1 1 TT

42

____________________ _____________________________

Basic Salary

Identification No ___________________

16Em lo ers Name

1 1 -1 DEPED-DIVISION OF AURORA-ELEMENT'AR

43Representation

1 7Re istered Address

hA Zip Code

44 Transportation

SAN LUIS, AUFUHA

- 1 1 5A.. '1 ' fliS'nndsrv Emolover

45 Cost of Living Allowance

Part iii

Employer

1 8 Taxpayer

Identification No.

0.

1 yrsName

20 Rered Address

Part IV-A

21 Gross Compensation income from

Present Employer (Item 41 plus item 5!

22 Less: Total Non-Taxable!

Exempt (Item 41 )

23 Taxable Compensation income

from Present Employer (item (55)

24Add: Taxable Compensation

Income from Previous Employer

25 Gross Taxable

Compensation Income

26Less: Total Exemptions

27 Less: Premium Paid on Health

and/or Hospital inu,aflce (ifapplicable)

28 Net Taxable

('.nmnAnsation Income Income

47 Otherspcify)

]4 T AL__________

L____ _J

SUPPLEMENTARY

48 Commission 48 r

I

21

22

23

24

25

26

27

28

cEiCDi7cC). kiLl

49Profit Sharing

50 Fees Including Director's

Fees

51 Taxable 1 3th Month Pay

and Other Benefits

52 Hazard Pay

53 Overtime Pay

f3CL 1 9fTh 1 6

206 .' 7. 4

201 727.

1 25 000. 00

00

8 1 77 4

Information (Previous )

Fixed Housing Allowance

20A Zip Code

P1

49

5O

EL.

51

52r

53 L

EL.

-.

J

29Tax Due 29

57

54 Others (Specify)

84 5

1

30 Amount of Taxes Withheld

57

MB

30A Present Employer

As adjusted

31

f

84 5. j7 :i

-

ILIncome

2O6 727. 84

T otal T axable Compensation 55

54B[

309Previous Employer 30B

____ ____

31 Total Amount of Taxes Withheld

We declare, under the penalties of perjury, that this certificate has been made in good faith, verified by us, and to the best of our knowledge and belief, is true and correct

pursuant to the

and the regulations issued

2O4--------

DateSigned

I I

56

___ /iitzed Agent Signature Over jje Name

__________________________

Present Em

MA LINDA U. AI3ERO

Date Signed f

1J3lJ 2Ol '7

CONFORME

57

Th -- -

______________

I

Amount Paid

crc No.

Empioyature Over P

f Employ**

7

Plac e uf issu(,

Date of issue

r_:::_.IIIIIIIIIJ

_ ________

7

No.1 604CF declare, under the penalties of peu that I am qualified under substituted filing of

ne employer rithe Phils for the calendar year;that taxes have been

I declare, under the

stated are retxrted

Returns (BIR Form No 1 700), since I received puroly compensation income

under BIR Form No. 1 604CF which has been filed with the Bureau of Intemal Revenue

P1 1 CHELLE P1 .

VALENZUELA

hheld by my employer (tax due equals tax withheid), that the SIR Form

58

filed by my employer to the SIR shall constitute as my income tax return;

Present Employer/Autho.iz.j Agent Signature Over Printed Name

(Head of Accounting/ Human Resource orAuthorized Representative)

had

Form No. 231 6 shall serve the same

purpose as if SIR Form 'k 1 70

..

as smando -

59

- I-

or' incluiri

es c all

-

Você também pode gostar

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNo EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionAinda não há avaliações

- 2316Documento1 página2316EmmanuelClementCastilloTalimoroAinda não há avaliações

- Gadiano 2316Documento2 páginasGadiano 2316Jypy Torrejos100% (1)

- 2316 (1) 1Documento2 páginas2316 (1) 1dolores100% (1)

- 2316 139520 PDFDocumento1 página2316 139520 PDFAnonymous EVdPq3NlAinda não há avaliações

- Certificate of Compensation Payment/Tax WithheldDocumento1 páginaCertificate of Compensation Payment/Tax WithheldJM HernandezAinda não há avaliações

- Rmo 12 2013 List of Unused Expired Orssiscis Annex D Docxdocx PDF FreeDocumento2 páginasRmo 12 2013 List of Unused Expired Orssiscis Annex D Docxdocx PDF FreeShitake MitsukiAinda não há avaliações

- 2307 LessorDocumento3 páginas2307 LessorPaul EspinosaAinda não há avaliações

- Applying for a Philippine Tax ClearanceDocumento2 páginasApplying for a Philippine Tax Clearanceejay niel100% (1)

- 1601EDocumento7 páginas1601EEnrique Membrere SupsupAinda não há avaliações

- Employer'S Virtual Pag-Ibig Enrollment FormDocumento2 páginasEmployer'S Virtual Pag-Ibig Enrollment FormRobert Paul A Moreno0% (2)

- Sworn Application For Tax Clearance: Annex CDocumento1 páginaSworn Application For Tax Clearance: Annex CJose Edmundo DayotAinda não há avaliações

- Revenue Memorandum Order 26-2010Documento2 páginasRevenue Memorandum Order 26-2010Jayvee OlayresAinda não há avaliações

- Efps Letter 009Documento1 páginaEfps Letter 009ElsieJhadeWandasAmandoAinda não há avaliações

- Electronic Business Permit - Renewal: Subject To InspectionDocumento3 páginasElectronic Business Permit - Renewal: Subject To InspectionRose Salminao100% (1)

- Requirements for securing tax clearanceDocumento1 páginaRequirements for securing tax clearanceDenzel Edward Cariaga100% (2)

- Pasig BPLO Charter. Udate 12-6-2018Documento7 páginasPasig BPLO Charter. Udate 12-6-2018Roy LataquinAinda não há avaliações

- Table of ContentsDocumento1 páginaTable of ContentsMacLaw MacOfficeAinda não há avaliações

- Annex C.2: Sworn Application For Tax ClearanceDocumento1 páginaAnnex C.2: Sworn Application For Tax ClearanceIan Bernales OrigAinda não há avaliações

- 1604-C Jan 2018 Final Annex A PDFDocumento1 página1604-C Jan 2018 Final Annex A PDFAs Li NahAinda não há avaliações

- SEC MC 28 Cover SheetDocumento1 páginaSEC MC 28 Cover SheetAngieLlantoCurioso100% (1)

- Payroll TemplateDocumento3 páginasPayroll TemplateAmry IrawanAinda não há avaliações

- Application For Fsec Fsic FormDocumento2 páginasApplication For Fsec Fsic FormRozel Laigo Reyes100% (1)

- Employee 1 PayslipDocumento6 páginasEmployee 1 PayslipJeric Lagyaban AstrologioAinda não há avaliações

- GLEH CertificateOfInvestmentDocumento1 páginaGLEH CertificateOfInvestmentkc_ariesAinda não há avaliações

- Electronic Official Receipt: City Government of Manila City Treasurer'S OfficeDocumento1 páginaElectronic Official Receipt: City Government of Manila City Treasurer'S OfficeMine MinisoAinda não há avaliações

- 1601e Form PDFDocumento3 páginas1601e Form PDFLee GhaiaAinda não há avaliações

- SampleDocumento11 páginasSampleYanyan RivalAinda não há avaliações

- Payslip Spreadsheet - OdsDocumento2 páginasPayslip Spreadsheet - OdsKevin Galo100% (1)

- APPLICATION FOR REGISTRATION/ACCREDITATION AS AN ECOZONE SERVICE ENTERPRISE (For Customs Broker, Freight Forwarder/Trucker and Security Agency)Documento7 páginasAPPLICATION FOR REGISTRATION/ACCREDITATION AS AN ECOZONE SERVICE ENTERPRISE (For Customs Broker, Freight Forwarder/Trucker and Security Agency)Albert YsegAinda não há avaliações

- Fs - Evilla, E. (Vertam Farms Opc) 2020Documento44 páginasFs - Evilla, E. (Vertam Farms Opc) 2020Ma Teresa B. Cerezo100% (2)

- Pag-IBIG Employer Enrollment FormDocumento1 páginaPag-IBIG Employer Enrollment FormDarlyn Etang100% (1)

- Annex D Bir InventoryDocumento17 páginasAnnex D Bir InventoryDada SalesAinda não há avaliações

- Authorization To TransactDocumento1 páginaAuthorization To Transactjoy buedoAinda não há avaliações

- Earnings Taxable Non Taxable Hours Total: OvertimeDocumento1 páginaEarnings Taxable Non Taxable Hours Total: OvertimeIamRachaelAinda não há avaliações

- Social Security Collection ListDocumento8 páginasSocial Security Collection ListLala MagayanesAinda não há avaliações

- Eaínings Amount Deductions Amount: PayslipDocumento1 páginaEaínings Amount Deductions Amount: PayslipKuhramaAinda não há avaliações

- SM TAYTAY - New Tenant Profile Form PDFDocumento2 páginasSM TAYTAY - New Tenant Profile Form PDFtokstutonAinda não há avaliações

- Philhealth Online Access FormDocumento2 páginasPhilhealth Online Access Formallan jhay contaweAinda não há avaliações

- Application for Authority to Print Receipts and InvoicesDocumento1 páginaApplication for Authority to Print Receipts and InvoicesShane Shane100% (4)

- China Banking Corporation Bir E-Fps Payment Manual: May 2011 V 6.0Documento48 páginasChina Banking Corporation Bir E-Fps Payment Manual: May 2011 V 6.0KyonAinda não há avaliações

- HGST Philippines PayslipDocumento2 páginasHGST Philippines PayslipMvans MnlstsAinda não há avaliações

- Bpi Endorsement LetterDocumento1 páginaBpi Endorsement LetterLawrence MangaoangAinda não há avaliações

- Bir Form 2307Documento2 páginasBir Form 2307Geraldine BacoAinda não há avaliações

- Authority of Signatory Special Power of AttorneyDocumento2 páginasAuthority of Signatory Special Power of AttorneyRj BengilAinda não há avaliações

- 1701A Annual Income Tax ReturnDocumento1 página1701A Annual Income Tax ReturnmoemoechanAinda não há avaliações

- Income Payor DeclarationDocumento1 páginaIncome Payor DeclarationMahko albert RslesAinda não há avaliações

- 1701A Annual Income Tax ReturnDocumento2 páginas1701A Annual Income Tax ReturnJaneth Tamayo NavalesAinda não há avaliações

- HDMF Contributions and Loan PaymentDocumento29 páginasHDMF Contributions and Loan PaymentRocelle IndicoAinda não há avaliações

- Bir Form 2306 PDFDocumento3 páginasBir Form 2306 PDFErwin Bucasas100% (1)

- Signage Permit Application FormDocumento1 páginaSignage Permit Application FormDenise LorejoAinda não há avaliações

- Business PermitDocumento1 páginaBusiness PermitVELOX MABUHAYAinda não há avaliações

- Mercury Drug CertificationsDocumento7 páginasMercury Drug CertificationsHarold LandichoAinda não há avaliações

- Bir Tax ClearanceDocumento95 páginasBir Tax ClearanceJeline ReyesAinda não há avaliações

- 2316Documento13 páginas2316Ariel BarkerAinda não há avaliações

- Certificate of Compensation Payment and Tax Withheld FormDocumento2 páginasCertificate of Compensation Payment and Tax Withheld FormjonbelzaAinda não há avaliações

- BIR Form 2316 and 1700 TemplateDocumento16 páginasBIR Form 2316 and 1700 Templatepogiman_0167% (3)

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocumento1 páginaKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldRoger BernasorAinda não há avaliações

- Itr 2316Documento1 páginaItr 2316joshua158150% (2)

- 2316Documento1 página2316Leizel Pavia TagraAinda não há avaliações

- 'Ojoi Bud Os! 40 Bud Dmdjdp.'040D Bu D 01Dm 0101 F5U 06010 Bur) 040D 06W 40 Ojo'Oqdd O) 0101 Bud 06010 D6W AdwDocumento16 páginas'Ojoi Bud Os! 40 Bud Dmdjdp.'040D Bu D 01Dm 0101 F5U 06010 Bur) 040D 06W 40 Ojo'Oqdd O) 0101 Bud 06010 D6W AdwZandie GarciaAinda não há avaliações

- IzaDocumento2 páginasIzaZandie GarciaAinda não há avaliações

- Eio6Iq Ar) /N: Dieuisflj 6ud Osal Advv Diflddw Ad Djawown6 Et"OqDocumento7 páginasEio6Iq Ar) /N: Dieuisflj 6ud Osal Advv Diflddw Ad Djawown6 Et"OqZandie GarciaAinda não há avaliações

- District of Dipaculao School Student Roster FormDocumento1 páginaDistrict of Dipaculao School Student Roster FormZandie GarciaAinda não há avaliações

- KhenDocumento4 páginasKhenZandie GarciaAinda não há avaliações

- I I N W: LLLW Ii 0 I I IIDocumento4 páginasI I N W: LLLW Ii 0 I I IIZandie GarciaAinda não há avaliações

- Simplified Business Plan SampleDocumento28 páginasSimplified Business Plan SampleZandie Garcia100% (2)

- 10 FinalDocumento6 páginas10 FinalZandie GarciaAinda não há avaliações

- Simplified Business Plan SampleDocumento28 páginasSimplified Business Plan SampleZandie GarciaAinda não há avaliações

- Upmv Aun: Ou Oiri6 Bu!Ldp Opwei D6W 'Uoepj ÇJ O Ewoj 6U "CF 6U 6uonj. Onqdu Off L 6U O6W BuvDocumento3 páginasUpmv Aun: Ou Oiri6 Bu!Ldp Opwei D6W 'Uoepj ÇJ O Ewoj 6U "CF 6U 6uonj. Onqdu Off L 6U O6W BuvZandie GarciaAinda não há avaliações

- DSWD Aurora Office Contact DetailsDocumento1 páginaDSWD Aurora Office Contact DetailsZandie GarciaAinda não há avaliações

- Ijieitti I Tiii10 Aii IDocumento2 páginasIjieitti I Tiii10 Aii IZandie GarciaAinda não há avaliações

- DocumentDocumento2 páginasDocumentZandie GarciaAinda não há avaliações

- DocumentDocumento1 páginaDocumentZandie GarciaAinda não há avaliações

- Community Tax Certificate Form and RequirementsDocumento1 páginaCommunity Tax Certificate Form and RequirementsZandie GarciaAinda não há avaliações

- CD 0 0 CD CD CD 0 (1) O CD CD CDR, - .: CL) CHDocumento5 páginasCD 0 0 CD CD CD 0 (1) O CD CD CDR, - .: CL) CHZandie GarciaAinda não há avaliações

- 11 Ljii I: Certificate of Live BirthDocumento2 páginas11 Ljii I: Certificate of Live BirthZandie GarciaAinda não há avaliações

- DocumentDocumento1 páginaDocumentZandie GarciaAinda não há avaliações

- DocumentDocumento2 páginasDocumentZandie GarciaAinda não há avaliações

- Cryptic code documentDocumento1 páginaCryptic code documentZandie GarciaAinda não há avaliações

- Marriage Certificate DetailsDocumento1 páginaMarriage Certificate DetailsZandie GarciaAinda não há avaliações

- DSWD Aurora Office Contact DetailsDocumento1 páginaDSWD Aurora Office Contact DetailsZandie GarciaAinda não há avaliações

- 13Documento1 página13Zandie GarciaAinda não há avaliações

- 5 - FaveDocumento1 página5 - FaveZandie GarciaAinda não há avaliações

- Untitled 1Documento1 páginaUntitled 1Zandie GarciaAinda não há avaliações

- 10Documento1 página10Zandie GarciaAinda não há avaliações

- Cash Card:, Uo Xxv. 8Documento3 páginasCash Card:, Uo Xxv. 8Zandie GarciaAinda não há avaliações

- 12Documento1 página12Zandie GarciaAinda não há avaliações

- 11Documento1 página11Zandie GarciaAinda não há avaliações

- Case Study On Geetanjali GemsDocumento26 páginasCase Study On Geetanjali Gemssap444333222111Ainda não há avaliações

- HRM - AskaribankDocumento23 páginasHRM - AskaribankSharjil ZaiDiAinda não há avaliações

- Resource and Talent Planning (RST) Assessment Activity 2 TemplateDocumento12 páginasResource and Talent Planning (RST) Assessment Activity 2 TemplatehayaAinda não há avaliações

- The Social Function of Business: Lesson IIDocumento12 páginasThe Social Function of Business: Lesson IIcj jamesAinda não há avaliações

- Contract - Active RpoDocumento6 páginasContract - Active RpoEduardo LaraAinda não há avaliações

- Internet Filtering in The Workplace ProDocumento3 páginasInternet Filtering in The Workplace Promovie.abc.friend.101Ainda não há avaliações

- 2.1 Article On Reasonable Compensation Job Aid 4-15-2015Documento3 páginas2.1 Article On Reasonable Compensation Job Aid 4-15-2015Michael GregoryAinda não há avaliações

- Useful Document - OHS - What Every Worker Should Know PDFDocumento20 páginasUseful Document - OHS - What Every Worker Should Know PDFeastAinda não há avaliações

- Administrative Principles of ManagementDocumento29 páginasAdministrative Principles of ManagementStefan Ivetic100% (1)

- 6 Conditions of Work PDFDocumento47 páginas6 Conditions of Work PDFkeirahlaviegnaAinda não há avaliações

- Quality Assurance in Nursing: Presented by Mr. Migron Rubin M.Sc. Nursing Ist Year Pragyan College of NursingDocumento75 páginasQuality Assurance in Nursing: Presented by Mr. Migron Rubin M.Sc. Nursing Ist Year Pragyan College of Nursingsangeeta sharma100% (1)

- Novulis - Organizational Structure - Revised - The Strategist - 05012024Documento16 páginasNovulis - Organizational Structure - Revised - The Strategist - 05012024neelimaAinda não há avaliações

- BG Speedy FIN REPORT 2014 EN PDFDocumento79 páginasBG Speedy FIN REPORT 2014 EN PDFAnnisa FithriAinda não há avaliações

- Mindanao Young Leaders Programme 2019Documento8 páginasMindanao Young Leaders Programme 2019International Alert PhilippinesAinda não há avaliações

- Technip AR2012Documento316 páginasTechnip AR2012Larry Lau100% (1)

- HRM at Vodafone Group PLCDocumento7 páginasHRM at Vodafone Group PLCJaveria Shuja100% (1)

- Ethical Leadership FinalDocumento22 páginasEthical Leadership FinalMalav VaruAinda não há avaliações

- SIHDocumento25 páginasSIHangrishdeepakAinda não há avaliações

- CHN role in community healthDocumento12 páginasCHN role in community healthDhon ProkopyoAinda não há avaliações

- Hayashi, F. and Prescott, E. (2002) - The 1990s in Japan A Lost DecadeDocumento38 páginasHayashi, F. and Prescott, E. (2002) - The 1990s in Japan A Lost DecadezeroshardstyleAinda não há avaliações

- Human Genome ProjectDocumento72 páginasHuman Genome ProjectAmiya Kumar SahooAinda não há avaliações

- History of Performance ManagementDocumento18 páginasHistory of Performance ManagementSruthy KrishnaAinda não há avaliações

- Workshop Catalog: Training & DevelopmentDocumento26 páginasWorkshop Catalog: Training & DevelopmenthiramloiseAinda não há avaliações

- Key Differences Between Entrepreneur and Manager: Managerial Roles and Managerial SkillsDocumento3 páginasKey Differences Between Entrepreneur and Manager: Managerial Roles and Managerial SkillsvijayakumarAinda não há avaliações

- 16 Passage 1 - Grey Workers Q1-13Documento7 páginas16 Passage 1 - Grey Workers Q1-13Cương Nguyễn DuyAinda não há avaliações

- DBBF - Plc.DMU IHCDocumento39 páginasDBBF - Plc.DMU IHCቤል የእናቷ ልጅ100% (1)

- Tell Me About Yourself - Interview Question PDFDocumento3 páginasTell Me About Yourself - Interview Question PDFNur AishahAinda não há avaliações

- 5-Year Manistee County Parks and Rec PlanDocumento197 páginas5-Year Manistee County Parks and Rec PlanJeffrey Harold ZideAinda não há avaliações

- Occupations: Conversation Cheat SheetDocumento2 páginasOccupations: Conversation Cheat SheetKai KokoroAinda não há avaliações

- SKDocumento81 páginasSKSuman BaghelAinda não há avaliações