Escolar Documentos

Profissional Documentos

Cultura Documentos

How To Handle Your Money

Enviado por

pjs15Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

How To Handle Your Money

Enviado por

pjs15Direitos autorais:

Formatos disponíveis

with BENJAMIN GRAHAM--------

Expert on Investments

HOW TO HANDLE YOUR MONEY

Never before have so many peoplehc:id.

exira money oul of income. to save or invest.

Millions wonder where 10 put this n10ney

-for safely, relurn, rise in value.

Do U. S. savings bonds pay enough? Is

common slocksqJe?

What advantages do municipal bonds

offer? What about corporation bonds?

Togetcompefenl answers to Ihese.and

At NEW YORK

Q Do you recommend, Mr. Graham, that a man of mod-

erate means -include, as a general rule, some common stock

when he invests his savings for the long term?

A My answer \..,ould be definitely "Yes," under normal

conditions.

Q Why?

A Because common stocks have the advantage, in the first

instance, of representing sound, growing investments in the

American economy, with a higher return than YOll would get

on bonds, and, secondly, because they do carry some measure

of protection against inRation-against further inflation of the

kind we've lived through as a result of the last two wars.

o Would you say there is some risk in not including some

common stocks in savings?

AYes. The experience of my lifetime has shown it is a

very definite risk to have your investment only in bonds.

Q Will YOH detail that a bit for us?

A Yes. Since 1913, the price level has approximately

tripled, and, at the same time, interest rates have gone down

a good deal. The old bonds with high coupon rates have been

pretty weU called, no longer exist. The result is that the man

whose investments were solely in bonds has suffered both a

reduction in income return on a percentage basis and a large

reduction in the purchasing power of whatever income or

principal he had.

a 'Will you give 115 the other side of that now? What would

have happened to the same man jf he had bought some stocks?

A \'Vell, if he would have diversified his holdings aUlong

representative common stocks in 1913, or in most other

periods since 1913, he would have had aa advance in value

and in income which would have at least kept paee with the

rise in the cost of living.

a Now a man with an income of, say, $5,000 who but

little saved, and doesn't expect to accumulate much out of

that kind of income-would you recommend common

stock for him?

42

other questions now raised for 59

News & World Report consulted an authority,

Benjamin Graham, security analyst qnd

widely read Iluthoron investments, was one

of the experts invited by the Senatttto testify

at . ................ .

.Mr. Graham is adjundprofessor.at

Columbia University's School ofBlisiness, .

where he teaches investment analysl.! ....

A On the whole, I would say "No," largely because wh.!t

he could gain by having it common-stock componen t in his

savings isn't large enough to warrant the amount of intelli-

gence and character needed to carryon an investment pro-

gram in common stocks soundly.

a He would be better off to buy something with a safe

principal and a fixed return?

A I think so, even though it involved some risk of loss of

purchaSing power.

a And in a situation like that, would you recommend, say,

No.1, insurance No.2, Government honds? Or what

would you recommend?

A Yes. I think the usual combination of insurance and Gov-

ernment bonds is correct.

a What is that combination-what proportion?

A \Vell, that's difficult to say, because I think the insur-

ance depends almost entirely on his protection requirements.

1 don't believe that the amonnt of insurance should be related

to his sHvings program particularly. The savings are important

in insurance, but they are incidental.

Perhaps I should correct my previous statement ;,t little bit

by saying that it is possible for the small man, the $5,000-01-

year man, who wishes to build up an interest in common

stocks out of his rather modest savings, to do so reasonably

well by following one of these accumulation programs in the

investment-fulld area-

a Investment companies?

A Yes, investment companies. Yes, he ('ould do it, and I

think on balauce it would probably he better for him to do it

if he wants to do so rather than not to do it. There are SOllie

risks iIlvolved in that program, but there are also some ali"

vantages, too.

a If he goes into that, you would recommend three ele-

ments, then: whatever insurance his family needs for protC('-

tion, some savings bonds, and some

purchases?

A That is right, yes.

u. NEWS &. WORLD REPORT. June 3,

Who Should Buy Common Stocks Ways to Offset Wide

Price Swings

Investing at Different Income Levels

Q When you speak of Government bonds, you mean sav-

ings bonds?

A Oh, yes. I see no reason whatever for the small man to

invest in Government securities other than the very attractive

savings bonds which he now can buy. .

Q You thjnk they are a good buy for the average man?

A A very good buy in terms of fixed-interest investments.

Q You are talking primarily about the E bond?

A The H bond and the E bond. Actually, the E bond is

better than the H bond because a man who is saving doesn't

need to get current interest and reinvest it. It's better to have

it compounded for him automatically.

Q This $5,000 man we were talking

about-

A Actually, I should like to say this

about the $5,000-a-year man. The original

question assumed that his $5,000 was

pretty well fixed. But that may he rather

unrealistic. Most $5,OOO-a-year men are

expecting to earn more than that as they

go along, in one way or another.

The young man who has reached $5,000

in his career naturally expects to do bet-

It'!", and it wouldn't hurt him at all to start

(jilt in some common-stock program and

an education in common stocks, in

pa rt, by practice.

Q He would get mostly education,

wouldn't he? Because he wouldn't have

t'lIolIgh surplus income to invest much-

to year with more equanimity than those whose sole financial

support is their capital funds.

Q You mean they are less likely to face a time when they

have to sell their stocks whether they want to or not because

they find that the price has gone down-is that it?

A That's the way it's usually expressed, but my experience

has been that it's not the outer compulsion that governs it so

much as the inner compulsion, drive, the inner apprehension.

Most people sell stocks at low prices not because they have

to but because they are scared.

Q They won't hold on long enough?

A They won't see the situation through.

Let's take a widow who has all her money

in common stocks, or nearly all, and is

doing pretty well with it for a while. Then

the market has one of its old lashings, it

collapses, and she finds her principal value

greatly reduced. She is likely to get so

_panicky that she might sell out at the

bottom, or near the bottom, and have a

harrowing experience as a result of that.

A businessman or a man with a career

earning a good deal of money may do the

same thing, but he's not as likely to do it,

particularly if he has educated himself to

know and be familiar with the normal

vicissitudes of the stock market.

Q You were talking about putting two

thirds of savings for the long term in

common stocks. Which man is that-which

man should do that? A No, but I mean he could start with

Ill!' amount that he has in his savings

I!J do something in the common-stocks

I\I-Il I more advantageously for his future

BENJAMIN GRAHAM

A That would be the $10,000 to $20,-

OOO-a-year earner who feels he may go

further than that in the future.

Iltoj.{mm than in connection with anything he may accomplish

IlO\\', For example, if he's going to make mistakes, it's better

Ihlll llt' make them with the small amount of money that he

hru lililn with a larger amount of money that he might have

l"I,<!

o "'HlIld you say there are many men in the $10,000 and

who should be buying stocks but who are not?

A I'd pllt it this way: There are thousands who should have

hFt'H Inl\'illg stocks and who didn't.

Q Hut with the market level aside-

A I .. vel aside, I would say that $10,000 to $20,000

JURI WPIIld h(' well advised, as a whole, to have a systematic

l!fPfi"1<lownl program in common stocks.

o lin\\' their investments be divided, roughly?

A ()o Ill!" wlH)je, they can go higher in the common-stocks

than the persons who don't have earnings inde-

J!$i'Mi,,,,,' oj capital. They could get into the two-thirds-com-

;II-l'a vcrI' soundly.

\"h}'Y

J wailli), because of the fact that they can take the

ffn'olv('d 111 challges in the economic situation from year

MW% 1 WO'IO REPORT, June 3,1955

Q As we go on up higher, as we get into $25,000 and $30,-

000, would you recommend a higher proportion in common

stocks?

A I don't believe so, because., when you get beyond that

range, you get to a different question where it's not so essen-

tial to try to get the maximum results out of your investment,

but it becomes important to feel that you are protected

against any eventuality.

One of the advantages of having a lot of money is that

nothing should be able to hurt you. If you have a fair amount

of your money in the Government-bond area and another fair

amount in common stocks, you're in an ideal position.

Q Do you recommend corporate bonds for the man making

$20,OOO?

A No. I don't see any reason under conditions today, and

those we've seen for many years past, why a man should buy

corporation bonds.

Q Why?

A The yields of the good bonds are only slightly in eXCess

of what he could get on U. S. savings bonds. On the second-

(Continued on next page)

43

\

.. IIlnvesting a few thousand-you can't do it casually, by tipsll

grade bonds, the risk elenwnt offst'ls, ;lppr{)\illl:l!t'ly at l(,:ls\'

the additional income. There is, oj ,"(IIll'SI', tilt' qllt'Sti()lI of

!;Lx-exempt bonds, whidl is a SCp.II;!!,' Lwltlr; a 820,000-a-

H'ar Imn1alTietl m:m llll!.dil (ilid til!' LI\-n,'lllpls

the lll:lrril,d 1\\,111 \\ illl c-;:2().()O() illt'OIlll' prohahly

\\'llUldn't.

Q \Vl.'y( hl't'll I;dl.im!, lip 10 IIO\\", implication at least,

onlv ahmd ill\ nlillt:, lIlotH'," to gel in('lllile. Is there a stage at

which ill\'('\!llll'lIh Iw('olll(' lo!-',i('al for lung-term appreciation

i" "iWH' profit (";111 hI' llladt hy an advance in the

1-", \ ;Ihw 01 ;1

A (Ill. \1'\, 1 Illilll- ill 1111' t';lrly part of one's career, in busi-

'II lilt' il have considerable interest in

illl,lllI'i,d 111,dl"I\ .1" people have, and want to educate

.1\ LII ,1\ \11l! l',UI ill finance, there, if you wish to get

IIII' Iidl .1,1\ 'lilt of your education, the <ldvantage would

10(" 111 !lllnlllll'llt 1"01' ;\ppret'iation, The rewards are greater, of

,'''III','' ill ;lppn'eiatioll than they are in income, <lnd there's

lit! le.ISoll \\'ily a person shouldn't aim at those things.

Q EVl'1l at <l rebtively low income level?

A I k could do that, too, a.s H matter of fact, and get more

illkrt'sl out of life .. heing a skillful investor for appreciation on

;\ SIlHIll scale, thall he would if he just did it to get a few

dollars a year income.

a You' think the average person is cnpable of doing this?

A \Ven, taking everything into account, 1 would say "No."

I mean, if yon took a person at random and gave him the ideal

surroundings and education and counsel, and so on, you might

turn him i1;to a person capable of doing this. But, under the

circullls(allcPs in which he li\'e-s, he prohahly would not do

;) good job.

Q \"ho would, then?

A It would be good for a person who has considerable

tive intellil!:ence and abilit\' and who has a real interest in

fin.mei:tl and is Willing to devote the amount of time

:Iml energy to it.

a And who has time for it-the time is important?

A \Vell, everybody has enongh time for it. It's really the

dde-l"lllill:ltion that counts. 1 mean, investing a few thousand

dollars is not a joh. But it is a joh that you can't do

(,:lSll<ll1y, hy tips, :tnd so forth.

a "'here ean the man !!:et his information? How

does he go :.thout it?

A 'lOll mea]) his education. lnformatioll is one thing and

edll(,;ltioll is anotber, ;t more fundamental thing in connec-

tion with investment. Naturally, the wav he can do th,lt is b\'

pmsuing some of the m't'mIt'S ;)f instruction that are open.

can hlkt' coursE'S, as many do. Those who are in New York

of courst', have a he-He-l' opportunity than those who are in

Slll.lIl tmnlS.

Q Around the though, 111:.111)' can't get such in-

stnl(:tion, e'lll they?

A 'VeIL the :1\'('ragg mnn \yon't do it. But I wouldn't be

\\'jlling to admit that he can't do it. A person who is really

d('knnint-'d to prepnre himself to be an intelligent investor

vall do it. For example, he can take :l corn:spondence COurse.

You learn tht' job just the way you learn to play the piano.

Q \Vhat about the man who lives \..,here such a course

simply is not available? As 0.\ matter of fnet, most people aren't

willing to devote the time for such courses, anyway. What's

the next best thing?

A The next best thing for him to do is to decide that he

(';)])not exppc-t to get optimum investment results without this

44

optimum preparation, and consequently he has to accept a

more representative or average investment program, He can

do that by deciding to follow a simple but very definite plan-

first, dividing his money into the compartments we discussed

before and, secondly, following a systematic and simple pro-

cedure with respect to the commonstock components.

For example, 1 suggest that he buy

slures on a regular.basis. That brings in the concept of dollar

averaging, which has now become so familiar and popular.

That would be a sound procedure. The main thing for him is

not to go off suddenly on a tangent, believing that he had

suddenly become an expert because the market has gone up

and he h<.1S been making some money.

a '''hat do you mean by "dollar averaging"?

A Dollar averaging is a method of investment under which

you set aside regularly a fixed amount of money and invest it

in common stocks generally, either in a single common stock

or preferably in a group investment through investment-

company shares. By investing the Same amount of money at

regular intervals-say, every three months-you get two

vantages. One is that over the years your investment re-

flects the average market price rather than the high market

levels-which is where you afe likely to buy if you follow

the crowd.

Secondly, the arithmetic of dollar averaging gives you more

shares at the lower prices than at the higher prices, so that

your average cost is lower than the arithmetical average. If

you are putting $1,000 in one kind of stock and the price is

$10, you'd get 100 shares. If later it's $20, you'd get 50 shares.

You bought nlOre stock at the 810 basis than at $20. Conse-

quently 'your average price would be less than $15.

COMMON STOCKS, "They do corry some

measure of protection against inflation"

U. S. NEWS & WORLD REPORT, June 3,1955

IIDoliar averaging-the soundest and most simple plan

ll

Q Do you think the dollar-averaging plan for an individual

l, sound?

A Yes, I think it's the soundest and most simple plan open

In everybody that I know of.

Q About how long does it take for dollar averaging to

produce results?

A Over past experience, it's generally felt that a seven-year

period is a kind of minimum. A IO-year peliod is usually the

one that is talked ahout.

Q That being the case, one could start at any time?

A Yes. The reason you talk about a IO-year period is that

past analysis shows that had you started at any time, even at

the top of the market in 1929, you would have done all right

by 10 years later.

o Then the man of moderate means has two alternatives

in buying stocks: If he hasn't a lot of time and know-how, he

is well to buy conservatively, either to buy

ment shares or to buy stocks when they are at

reasonable prices. Or if he has a Jot of time, then he can go

into it with more detail, take more risks, buy

shares, and not be so conservative about it. Is that the sum

of it?

A I would question, in a way, your expression. You men-

tion the fact that he would take more risks, and that is the

usual concept where one buys securities that are not so well

known. But when you consider the matter carefully you'll see

that the purchase of securities that are not so weB known at

low prices-which is what a man wants to use his particular

skill for-does not really involve more risk. It involves less risk

on the whole. It only appears to be riskier.

Q Still, the point is that, if he doesn't have the time to think

about it or the know-how, he's got to buy something like in-

v:stment-company shares the standard blue chips-isn't that

right? He has no other ChOice, has he?

A Yes, that's true. And, when departs from those pro-

cedures, the are that he make mistakes, and per-

haps very by buymg the kind of thing that's

to hIS attention by salesmen or others who operate

by tIps.

a a man is to use dollar averaging, the

first thmg he wants to do IS to select a group of stocks that

he's going to buy. Now, maybe he'd prefer to invest directly

rather than through an investment company. What should he

do? Should he go to his broker to seek advice?

A I don't want to disparage the service that brokers can

render. I think they can render good services in many cir-

cumstances. But I don't believe that on the whole the service

they can render for this particular man would tU;'n out to be

best. Because his limited objective is to buy sound securities

over a period of years, and it's easier for him to follow that

general it is for to get good specific advice.

The broker IS lIkely to have Ius thoughts pretty much on

what seems to be good at the moment, and that' would not

fit in too well with this long-term investment plan.

a What would be the best plan for this long-term

He's going to try to select a group of investments that he

going to buy over a period of years and he does not feel con-

fident in himself to sit down and figure out what those issues

should be-

A It seems to me that the investment company is just made

to order for that man.

(Continued on next page)

WATCHING THE PRICES IN A BROKER'S OFFICE

"A person who is really determined to prepare himself to be an intelligent investor can do it"

U. S. NEWS & WORLD REPORT, June 3, 1955

45

\.

.. At $100,000, "half to two thirds in common stocks"

Q But aren't investmentwcomp:my Sil:IH'S {'x)H'llsin' lu

deal in?

A They are expensive 011 :I sllorl-knll h<lsis. Till'}" :l1"t' not

particularly expensive on :1 ;)'Isis. The cOJllmission

rates run, let's say, 7.';) In K pn 1'1'1l!. If a mall wcre to hold

his investment for;1 10-\1';11' pniod, that would llH',Hl it cost

him about thr(,{' 01 ;t Pt'!" {'('lit a year on his principaL

He's also payillg :1 ("l'rLlill alllollllt, perhaps 6 or "I per eent

out of tlw inc!)!!)!', 101 OIJl'Lllill),! j-'X1WIIS(-'S. \Vhile that is llot

ncgligible ,II all. I dOli" \H'lit'H' ii's prohibitive.

Ollt' Ihill).! \ 011 IIllIS! ri'IlWIIlIH'r is that if he bought his in-

diH'dl> aud tht'11 later sold them, he would have

,Ill 'lggrq . .;ak (,(1l1l1Ilissioll thaI might be about one third to a

ball o! what II!' would pay 10 buy into an open-cnd il)vest-

1111'111 IUlid.

a So tll:ll till' jlH'cstment fund is for the man who is mak-

illg long-h'flll invcstments, the man who is saving for the

htltlrl'?

A Y(s. by all ll1eans. I don't think it makes sense for allY

111'01'0SI'<I illVl'sttnent for less than a number of years.

a And pnrticuJarly for the man who hasn't great amounts

In invcst and not too much time to go into it?

A \Vell, it's not limited to him necessarily, but it's of

great cst advantage for the man who \vants to invest over a

pI'riod of time in a simple manner.

AT $50,000 OF INCOME-

Q What about higher up in the income scale? ,"'hat about

the man who is earning a year?

A He, nattlrally, would feel that he would like to look

(]\'er the situation in investments at least and consider making

decisions of his own in the kind of securities that he wallts.

The amount of monev that he has would make it worth while

to give it thought and considerable care. I'm not so sure that

this man would necessarily do any better than he would do if

he bought investmentHfm{d but it's more natural and

IIHlre interesting for him to do other things.

You must never minimize the personal equation. 1.fost men

like to make th. ir own decisions.

a To go back to what a man can do-is it impractical

fur the average investor, for instance, to deal with an invest

ment counselor?

A For the small man, yes. The investment counselor gen-

('rally deals with a person with $100,000 or more to iuvest in

s{'curities, particularly commOn stocks, It doesn't make 1111H:Jl

S{'llse for a man to bring to an investment counselor a

portfolio, He can invest that money in bOllds with-

Ollt paying the charges of an inve$tInent You need

to he fairly wealthy to do that.

Q What about the investment services that are published

IlHlnthly 01' weekly?

A Fnmkly speaking, I don't know much about them, But

it's ohvious that the small man couldn't soundly pay money

lor a \\leekl)' investment service and try to foHow their sug-

j!t'stions every week or month, That would imply that he

is going to be active all the time in the market, and that

is all entirely different thing from the kind of investment

that w(' arc talking about, If he's a speculator. that's an-

other :-;Iory.

a For the man who is going to spend some time of his

own, of buying the list or investment

sll:lres-and youve already suggested that the broker

46

help him much-where docs he get the factual information

that he needs in order to exercise his own judgment?

A Nmv, I don't want to do an injustice to brokers here. I

would say that the man who had a purely conventional pro-

gram and watlted to select some issue for longHterm, repeated

investment probHbly wouldn't get much help from a broker,

On the other hamL if he W<lllts to do a eontinuous studv of

the financial and hllsiness situation, he could get advice from

a hroker.

Q What does he get from a broker?

A In the first place, he'd get the information he needs

ill convenieHt form-

a The factual information?

A Yes. He doesn't have to subscribe to and Stand-

ard & Poor's, and so on. He can use the broker's facilities.

a The broker will ten him about a company's financial COJ1-

(lition, its record, dividends, and that sort of thing?

A That's right. He can get all of that d'-lta, which is, of

course, essential if he wants to do any studying. He can get

anaJyses from the broker-presenting the information in a

little better way, perhaps, than he could get it himself by

just reading the sources. Alld he call also get points of view,

recommendations, and so on, which mav he hettel', on the

whole, than ones he wOllld make up for himself.

a What about a man with a $100.000 income? Take man

with that much income and savings luid aside

-how should he (Hvide his savings among various types of

investments?

A I would say that ullder llormal conditions, in the light

of the l'xperiellce of the last 50 years, he would likely aim at

from half to two thirds of his investment in

common !-itocks as his objective.

a And the rest?

A The fest could be ill insuralllx;, saving.s, to some extent,

though generally the insurance savings arc not con!-iidered

a part of your funds today, They do act as H protection. Any

combination of Governmellt and ta;x-free bonds-mu-

nicipal or State bonds-would do for the rest.

STOCKS FOR $100,000 MAN-

Q What is the kind of stocks that this man should buy

on a donar-averaging basis? Is he going to buy the blue

chips? Is he going to buy his stocks in terms of longRterm

growth? '

A That man is probably not going to be such a dollarH

averager, because the higher up YOli are on the income scale,

the mOre variable generally, is the amount of money that

yon have available for investment. It's not so simple for him

to adopt or pursue a dollar-averaging plan. Typica}]y, he in-

vests mone\' as it hecomes available. There his selection of

stocks will, 'I snppose, depend on the amount of attention that

he is able to give to the subject, his personal equipment, and

so forth,

If he w;lllted to become something of an expert investor.

then he would go over into the field of interesting situations.

based upon his knowledge and study. They could include

"growth" stocks. on the one hand, they could include bargain

securities Oil the other, and special situations of various sorts,

If you assume that he doesn't want to give the amount oj

attention to the business that it requires to do it properly, then

actual1y there isn't too Bluch point in his trying to be selectin'

at all.

U, S. NEWS & WORLD REPORT, June 3, 1955

II A widow with $SO,OOO-olmost an insoluble problem

ll

That's where a broker can corne in handy. He asks the

broker from time to time to make up a list of good,

scntative securities, of the kind that are in the

industrial average, and he would probably do about as well

with these as he would in trying to use a rather inexpert way

of picking out the things that seem to be good to him from year

to year or day to day.

You know, people say there's no point in comparing things

with the averages because you don't buy the averages. And

I've always added: Why not? There's no particular reason

why a person couldn't buy 10 shares or 100 shares of an the

stocks in the Dow-Jones averages and actually get their results.

People don't do it, for ODe reason or another, but there's

nothing impossible or unsound about it.

a But for the average fellow who does not have an oppor-

tunity or inclination to become expert, to follow the situation

very closely, you think that buying the blue chips would be

about as good as anything that he could do?

A Yes. He should do that normallv, But, as I've said often,

he ought, however, to be reasonably 'sure that he's not paying

excessive prices for them.

a By definition, isn't the growth company one you think of

as putting a large part of its profits back into growth instead

of paying it out in dividends?

A That should be the idea of a growth company-

WHAT A "GROWTH" STOCK IS-

Q Unless you think of a uranium company-

A Well, that's another type of thing. But basically a growth

company is one which (a) will be expanding its business and

its profits at more than the average rate, and (b) will in the

course thereof be investing a large part of its profits back in

the business.

Q When you get into the growth stocks, you get into a

situation where a man needs a good deal of knowledge?

A I think so. But even then it's hard to tell how good your

knowledge is, because growth stocks lead to the future, and

you don't really ever have any knowledge of the future. You

may have a more expert guess than the Jther man, but it's

still a guess. And many mistakes have been made in buying

growth stocks on the theory that the future will duplicate the

past.

Q In trying to buy something for growth, you

ordinarily have to recognize, one, that you are taking a

chance and, two, you perhaps have to sacrifice income along

the way in order to achieve a growth. Isn't that

ordinarily the case?

A Yes. The chance is basically related to the point that

you pay a higher price for a security in terms of its past and

current earnings and dividends than you would for nongrowth

securities, and there is always a possibility of disapPointment.

The company would have to be better than the average

company to justify the price you pay for it. Maybe it won't be,

but you think it will.

You start with a sacrifice of income generally and you are

apt to find it continuing for some years. But that is not par-

ticularly important to people if they are right in their estimate

of the company's future expansion. The fact that the income

is small is not a real sacrifice if you don't need the income to

spend.

Q What about a widow who gets her husband's insurance

of, say, $50,000? How should she invest it? Or should she

U. S. NEWS & WORLD REPORT, June 3, 1955

leave it all in the insurance company, drawing monthly

payments?

A "VeIl, the widow would like, if possible, to earn enough

income to pay her living e;x:penses. Naturally there is a great

aversion against using up capital. Yet, for most widows of

whom we are talking, those particularly within the $50,-

000-to-$100,000 capital range, thaCs almost an insoluble

problem.

a You mean with those sums there isn't enough income

to leave the capital alone?

A Not if she were dependent upon the income from that

money-unless she were living in rather unusual conditions,

a very small town, and so forth, where her wants were ex-

tremely limited. But the average widow wants to live some-

what in the stvle to which she was accustomed when her

husband was $100,000 in one way or another,

including insurance, and she would find it very difficult to

make it do. And that, as you probably know, is one of the

most difficult problems that investment counsel have to deal

with nowadays.

a How is it usually resolved-by a compromise?

A Yes, it's usually resolved by a compromise. There's been

a tendency through recent years to be bolder and bolder in

advice to widows, suggesting that they consider getting up

pretty high in the percentage of investments in common

stocks on the twin grounds, first, that they do need the in-

come badly and, secondly, that it's not unsound or risky for

them to put their money in well-selected or representative

common stocks. And that advice was really good advice at

a time when one could say with conviction that the price

level of common stocks was an attractive one.

a That's for the widow with $50,000. Now, for the widow

drawing a smaller amount, $10,000 or $15,000, you would

not suggest that she put any part of it into common stocks?

A I think not. I'm afraid that, when you take into account

the psychological factors in that kind of thing, which can create

real problems, and compare that with the monetary advantages

of a small common-stock investment, the psychological dangers

far outweigh the monetary advantages.

WHY PREFERRED STOCK-

a What do you think of preferred stocks?

A Preferred stocks are a hybrid investment. Theoretically

they are all wrong, but that doesn't prevent them from working

out all right practically. I say they're an wrong because, for

one thing, if they are really a good investment for the investor,

they me not a good security for the corporation. The corpora-

tion should issue a bond and get the advantage of the income

tax saving. If the corporation can't afford to issue a bond for

that particular amount of capital, then they're not too good

for the investor. That's the wav it is in theOlv.

In practice, however, corporatio"ns issue

good preferred stocks-I think by a wrong policy on their par!

-and investors can buy them soundly. The of preferred

stocks is not quite as bad as you'd expect it to he. ;'\Jcvertlwlcss,

it turns out that when the market is weak, prdt'lT{'(j stock,

generaJIy behave quite badly, not ne,nly so well as lHllHi,

would behave if they were in the sam(' gt'lIt'r:d positioll.

Q What about mortgages as an inveslllH'nt for lilt'

vidual?

A I've felt that the FHA guaranteed Illorlg;q . .!cs ;IlT PI'!

(Continued on l1('xl lW!!.!!

I!. !.

47

"Ordinary man more apt to get poorer by speculating"

sound. \Ve've bought them for inSULIIIt'!' (,OIHP;lllics thaI

I am identified with, and r scc lIO wason \\-11: tIlt' indiddual

shouldn't buy them, exccpt that tlll'\" Hld\' 1)(' a lilll!' too 1l11H.:h

of a nuisance for him to h;IIHI1t'. ! ,1111 llot 1'\IWrivlwtd at all in

the mortgage field for iluli\-idll;d im"t'slols, Bllt in principle I

don't sec nll ill\ 1",101 ('0111<111" dn q!!itc \\,,,11 with these

guarantecd tIHfrl.I!;lg('''_ 1'111 ("llllyill('('d Ill;!! the Cov('rnment's

nhligatioll llll'rt, !WdlTth d{'jll'll<iahk.

Q ill ral"(' do inclividuHJs buy mort-

gagt'S, ('ul'pmalioll homb ,mel pl'dt'lTcd stocks-isn't that gen-

nail" truer

AWIIL i! 1I"l'd III Ill' tJIH' Illal bonds and preferred stocks

\\/'11' ,I .,LllId;lId P;!I-! ld still a standard

Pol!! o! pnrIJ,dio.' ,Hlnlillisll'n,d by hanks for even average in-

\I",I(I!' 1'lil'II!" II! Inlsl Jll!HIs. But now thetendencv-and I think

il'., ,I '-.0111111 (JIll' is ill the direction of dividing the individual

pUI t! I,] II J iI II {) I'it Ill'r Government bonds or tax-free securities

"II till' IJ!H' llawl alld common stocks on the other.

a (;oill,C: inlo this current stock market, you've indicated a

{'u\lph of liuII,,'s that some of your answers would not apply to

lilt' market <IS it is today. Is that right?

A \\'('11, it might not apply, 'What I meant was that, if one

I wi it '\ \'S 111,11 the present market is definitely too high, it would

!lot lit' sOlllld for an investor to start out by putting H substan-

I i;tl p;lrl 01 his funds in it. There is some question v,/hether he

.,holdd slart donal' averaging when the market is too high.

FOR THE NEW INVESTOR-

Q For the average man who has neVer invested in stocks,

hut who no'" discovers he has a surplus income and feels that

II(' should stMi building up some equities-should he not start

loday at the current level of stock prices?

A The best suggestion I call make is that if he wt're sure

! hal he could follow a dollar-averaging program, he could start

l()(j,IY. If he has any doubts Oll that subject, either because of

his financial situation or his psycho1ogical situation, I'd advise

him to hold off" This is not the most satisfactory time to start

in stocks.

Q Might it be better for him to wait anyway, even if he

thinks he (:all keep his progra1ll going?

A \Vell, waiting is a diffictdt operation itself. \\'hile you're

waiting, you're wondering how much you're missing, whether

ever have a chance to get back at a better time. \Vhen

I he chance does occm. wonder when is the right moment

! 0 start coming in. AlI those thing:'!" are difficult decisions to

make. It's easier to do the thillg mechanically' than it is to do

it hy these judgments.

a From what you say here and what you've written, you

dn not advise people to speculate-ordinary people, that is,

Isn't that right?

A \Ve11, being against speculation is almost like being

against sin. But speculation really is a sin to the untrained

HH'lllber of the public.

a So that the ordinary man is not going to get rich by

spe{'ulating on the market?

A No, hut more apt to get poorer. The main point is that

a m,lJ) can earn some money by takjng a sensible attitude

toward investment. but I don't see how a man can earn money

by being an untmi;led speculator. He just doesn't put enougil

into it to justify his hopes of getting something out of, it.

o Do you have the feeling that we are at a point in history

where, again, the market fever is hitting the little people and

48

that speculation with cash savings is possibly going to spread

to rather dangerous levels?

A Yes, I'm quite apprehensive about it.

a Do you think a good many issues are too high now?

A Yes. That is undoubtedly true.

a This would indicate there are a good many well-

accepted issues which today would appear to be overpriced?

A I think that's so. I think they carry with them some

dangers.

a Do you also feel that there are issues in the market

which are underpriced?

A Yes, I think there are considerable numbers of those

issues. Actually, among the thousands of issues that are dealt

in, quite a number of them are still selHng at considerably

under what I would consider to be their true value. However,

I should add that nearly all of those securities tend most of

the time to sell under their true value"

a So that they would later as well as now?

A Yes. Except at more or less the top of the market.

o How does one identify these issues?

,I A The simplest test that I've had is the value of the com-

pany as a private business. If you can look at a company and

,

J say that at this price for the stock the whole entelprise is sell-

ing at a figure which is clearly less than it would be worth

r to me if it were my business, if I owned it-you can divide the

\, figures by 10 or 100 to make them comparable to the kind

of business you are familiar with in private practice-if that

\

' test shows that the price is quite low, then it's generally a

, reasonably good guide to your evaluation of the stock itself,

I In some cases, the very fact that the company is selling con-

i

' siderably under the working capital alone, with no value given

to all the fixed assets, is a prima facie indication that the price

BUYING ON MARGIN-

a What is your opinion of an individual buying stocks on

margin?

A I would say the average member of the public, who does

not make a business of huying and selling securities, makes an

error in buying securities on margin-most of the time. It

would only be under exceptional circumstances that he would

be justified in doing so.

o Such as?

A Such as the conviction on his own part that the market

level is unusuallv low.

a Should man who has considerable money to put

into investments, and who has been doing so, should he per-

haps compromise at this point and continue buying more

carefully?

A No. I think it you take the man you are talking about-

he's already been in the market and has a considerable stake

in common stocks now-it would be sounder for him to start

a se1ling policy at this stage. It could be on an upward scale,

involving small amounts at present, or if he reany feels appre-

hensive, he should sell larger amounts. Nobody can tell him

how fast to sell.

a What does he do when he sells-put his money into

Government bonds until the market goes down?

A I imagine that's what he ought to do. He may wait a year,

decide he was wrong, and then go back in the market on a

dollar-averaging basis again. At least he could say he was

wrong intelligently.

U. S" NEWS & WORLD REPORT, June 3, 1955

Você também pode gostar

- Facebook InitiationDocumento60 páginasFacebook InitiationChristina SmithAinda não há avaliações

- VOYA JPM InitiationDocumento42 páginasVOYA JPM InitiationEnterprisingInvestorAinda não há avaliações

- Mick McGuire Value Investing Congress Presentation Marcato Capital ManagementDocumento70 páginasMick McGuire Value Investing Congress Presentation Marcato Capital Managementmarketfolly.comAinda não há avaliações

- Benjamin Graham's Memoirs Reveal His Early Career Success on Wall StreetDocumento11 páginasBenjamin Graham's Memoirs Reveal His Early Career Success on Wall Streetpjs15Ainda não há avaliações

- Li Lu's 2010 Lecture at Columbia My Previous Transcript View A More Recent LectureDocumento14 páginasLi Lu's 2010 Lecture at Columbia My Previous Transcript View A More Recent Lecturepa_langstrom100% (1)

- Scion 2006 4q Rmbs Cds Primer and FaqDocumento8 páginasScion 2006 4q Rmbs Cds Primer and FaqsabishiiAinda não há avaliações

- The Mechanics of Economic Model-Of-DFC - ROIC - CAPDocumento29 páginasThe Mechanics of Economic Model-Of-DFC - ROIC - CAPLouis C. MartinAinda não há avaliações

- Profit Guru Bill NygrenDocumento5 páginasProfit Guru Bill NygrenekramcalAinda não há avaliações

- Focus InvestorDocumento5 páginasFocus Investora65b66inc7288Ainda não há avaliações

- Published July 20, 2005 News Index - News Arch: Alumni DirectoryDocumento4 páginasPublished July 20, 2005 News Index - News Arch: Alumni DirectoryBrian LangisAinda não há avaliações

- 9 - Case Shopping MallDocumento11 páginas9 - Case Shopping MallRdx ProAinda não há avaliações

- Competitive Advantage PeriodDocumento6 páginasCompetitive Advantage PeriodAndrija BabićAinda não há avaliações

- Coho Capital Letter Highlights Self-Reinforcing Business Models in TechDocumento13 páginasCoho Capital Letter Highlights Self-Reinforcing Business Models in TechraissakisAinda não há avaliações

- David Einhorn NYT-Easy Money - Hard TruthsDocumento2 páginasDavid Einhorn NYT-Easy Money - Hard TruthstekesburAinda não há avaliações

- Distressed Debt InvestingDocumento5 páginasDistressed Debt Investingjt322Ainda não há avaliações

- Value Investing Congress NY 2010 AshtonDocumento26 páginasValue Investing Congress NY 2010 Ashtonbrian4877Ainda não há avaliações

- Buffett On Valuation PDFDocumento7 páginasBuffett On Valuation PDFvinaymathew100% (1)

- Value Investor Insight Play Your GameDocumento4 páginasValue Investor Insight Play Your Gamevouzvouz7127100% (1)

- RV Capital June 2015 LetterDocumento8 páginasRV Capital June 2015 LetterCanadianValueAinda não há avaliações

- Reading List J Montier 2008-06-16Documento12 páginasReading List J Montier 2008-06-16rodmorley100% (2)

- Start PDFDocumento20 páginasStart PDFiyerpadmaAinda não há avaliações

- Sequoia Fund Investor Day 2014Documento24 páginasSequoia Fund Investor Day 2014CanadianValueAinda não há avaliações

- Anon - Housing Thesis 09 12 2011Documento22 páginasAnon - Housing Thesis 09 12 2011cnm3dAinda não há avaliações

- Mauboussin - Does The M&a Boom Mean Anything For The MarketDocumento6 páginasMauboussin - Does The M&a Boom Mean Anything For The MarketRob72081Ainda não há avaliações

- David Einhorn MSFT Speech-2006Documento5 páginasDavid Einhorn MSFT Speech-2006mikesfbayAinda não há avaliações

- The Future of Common Stocks Benjamin Graham PDFDocumento8 páginasThe Future of Common Stocks Benjamin Graham PDFPrashant AgarwalAinda não há avaliações

- Understanding the different levels of investing as a gameDocumento11 páginasUnderstanding the different levels of investing as a gamePradeep RaghunathanAinda não há avaliações

- Eileen Segall of Tildenrow Partners: Long On ReachLocalDocumento0 páginaEileen Segall of Tildenrow Partners: Long On ReachLocalcurrygoatAinda não há avaliações

- Arlington Value 2006 Annual Shareholder LetterDocumento5 páginasArlington Value 2006 Annual Shareholder LetterSmitty WAinda não há avaliações

- Aquamarine Fund Reports Strong Gains in JanuaryDocumento7 páginasAquamarine Fund Reports Strong Gains in JanuaryBrajesh MishraAinda não há avaliações

- VALUEx Vail 2014 - Visa PresentationDocumento19 páginasVALUEx Vail 2014 - Visa PresentationVitaliyKatsenelson100% (1)

- 5x5x5 InterviewDocumento7 páginas5x5x5 InterviewspachecofdzAinda não há avaliações

- Wet Seal - VLDocumento1 páginaWet Seal - VLJohn Aldridge ChewAinda não há avaliações

- Corner of Berkshire & Fairfax Message Board: Hello ShoelessDocumento15 páginasCorner of Berkshire & Fairfax Message Board: Hello Shoelessgl101Ainda não há avaliações

- Free Cash Flow Investing 04-18-11Documento6 páginasFree Cash Flow Investing 04-18-11lowbankAinda não há avaliações

- Distressed Debt Investing: Seth KlarmanDocumento4 páginasDistressed Debt Investing: Seth Klarmanjt322Ainda não há avaliações

- Teledyne and Henry Singleton A CS of A Great Capital AllocatorDocumento34 páginasTeledyne and Henry Singleton A CS of A Great Capital Allocatorp_rishi_2000Ainda não há avaliações

- (Note The Footnotes) : Jim Donald Food RetailingDocumento5 páginas(Note The Footnotes) : Jim Donald Food RetailingDealBook100% (1)

- CGRP38 - Corporate Governance According To Charles T. MungerDocumento6 páginasCGRP38 - Corporate Governance According To Charles T. MungerStanford GSB Corporate Governance Research InitiativeAinda não há avaliações

- Benjamin Graham's Impact on the Financial Analysis ProfessionDocumento1 páginaBenjamin Graham's Impact on the Financial Analysis Professionpjs15Ainda não há avaliações

- MS - Good Losses, Bad LossesDocumento13 páginasMS - Good Losses, Bad LossesResearch ReportsAinda não há avaliações

- Bruce Greenwald Fall 2015Documento24 páginasBruce Greenwald Fall 2015ValueWalk100% (1)

- Schloss-10 11 06Documento3 páginasSchloss-10 11 06Logic Gate CapitalAinda não há avaliações

- KFADocumento11 páginasKFABishnu DhamalaAinda não há avaliações

- 1976 Buffett Letter About Geico - FutureBlindDocumento4 páginas1976 Buffett Letter About Geico - FutureBlindPradeep RaghunathanAinda não há avaliações

- Lazard Secondary Market Report 2022Documento23 páginasLazard Secondary Market Report 2022Marcel LimAinda não há avaliações

- Michael Kao The Tao of Asymmetric InvestingDocumento18 páginasMichael Kao The Tao of Asymmetric InvestingValueWalk100% (1)

- Cadbury Trian LetterDocumento14 páginasCadbury Trian Letterbillroberts981Ainda não há avaliações

- Graham & Doddsville - Issue 20 - Winter 2014 - FinalDocumento68 páginasGraham & Doddsville - Issue 20 - Winter 2014 - Finalbpd3kAinda não há avaliações

- Strong Returns in 2014Documento8 páginasStrong Returns in 2014ChrisAinda não há avaliações

- Summary New Venture ManagementDocumento57 páginasSummary New Venture Managementbetter.bambooAinda não há avaliações

- Raising the Bar: Integrity and Passion in Life and Business: The Story of Clif Bar Inc.No EverandRaising the Bar: Integrity and Passion in Life and Business: The Story of Clif Bar Inc.Nota: 3.5 de 5 estrelas3.5/5 (15)

- Financial Fine Print: Uncovering a Company's True ValueNo EverandFinancial Fine Print: Uncovering a Company's True ValueNota: 3 de 5 estrelas3/5 (3)

- Investing in Credit Hedge Funds: An In-Depth Guide to Building Your Portfolio and Profiting from the Credit MarketNo EverandInvesting in Credit Hedge Funds: An In-Depth Guide to Building Your Portfolio and Profiting from the Credit MarketAinda não há avaliações

- Summary of Bruce C. Greenwald, Judd Kahn & Paul D. Sonkin's Value InvestingNo EverandSummary of Bruce C. Greenwald, Judd Kahn & Paul D. Sonkin's Value InvestingAinda não há avaliações

- Leadership Risk: A Guide for Private Equity and Strategic InvestorsNo EverandLeadership Risk: A Guide for Private Equity and Strategic InvestorsAinda não há avaliações

- MKT Outlook Q1 2013Documento87 páginasMKT Outlook Q1 2013pjs15Ainda não há avaliações

- The Graham + Dodd Luncheon Symposium Transcript 20081002Documento69 páginasThe Graham + Dodd Luncheon Symposium Transcript 20081002pjs15Ainda não há avaliações

- The Right Stuff - Why Walter Schloss Is Such A Great InvestorDocumento6 páginasThe Right Stuff - Why Walter Schloss Is Such A Great Investorpjs15Ainda não há avaliações

- BRK PainewebberDocumento60 páginasBRK Painewebberscottleey50% (2)

- Should Rich But Losing Corporations Be LiquidatedDocumento2 páginasShould Rich But Losing Corporations Be Liquidatedpjs15Ainda não há avaliações

- Benjamin Graham's Impact on the Financial Analysis ProfessionDocumento1 páginaBenjamin Graham's Impact on the Financial Analysis Professionpjs15Ainda não há avaliações

- Toward A Science of Security AnalysisDocumento4 páginasToward A Science of Security Analysispjs15Ainda não há avaliações

- Security in An Insecure WorldDocumento13 páginasSecurity in An Insecure Worldpjs15Ainda não há avaliações

- Small Slam ArticleDocumento3 páginasSmall Slam ArticleceojiAinda não há avaliações

- Advice From A Value Investor Best Inver Asset ManagementDocumento6 páginasAdvice From A Value Investor Best Inver Asset Managementpjs15Ainda não há avaliações

- Are Investors Reluctant To Realize Their LossesDocumento0 páginaAre Investors Reluctant To Realize Their LossesdyashyAinda não há avaliações

- A Conversation With Benjamin GrahamDocumento2 páginasA Conversation With Benjamin Grahampjs15Ainda não há avaliações

- Distressed Debt Investing - Wisdom From Seth Klarman - Part 1Documento5 páginasDistressed Debt Investing - Wisdom From Seth Klarman - Part 1pjs15100% (1)

- Judgment in Managerial Decision Making SummaryDocumento9 páginasJudgment in Managerial Decision Making Summaryapi-26172897100% (1)

- Chanos Transcript - Charlie RoseDocumento25 páginasChanos Transcript - Charlie Rosepjs15Ainda não há avaliações

- Options Strategies Quick GuideDocumento36 páginasOptions Strategies Quick GuideParikshit KalyankarAinda não há avaliações

- Why Strategy Matters - Exploring The Link Between Strategy, Competitive Advantage and The Stock MarketDocumento8 páginasWhy Strategy Matters - Exploring The Link Between Strategy, Competitive Advantage and The Stock Marketpjs15Ainda não há avaliações

- Biological Basis For Errors in Risk AssessmentDocumento24 páginasBiological Basis For Errors in Risk Assessmentpjs15Ainda não há avaliações

- Academy Awards, Sharon Stone and Market EfficiencyDocumento10 páginasAcademy Awards, Sharon Stone and Market Efficiencypjs15Ainda não há avaliações

- Darwins Mind The Evolutionary Foundations of Heuristics and Biases 122002 James MontierDocumento32 páginasDarwins Mind The Evolutionary Foundations of Heuristics and Biases 122002 James Montierpjs15Ainda não há avaliações

- Where's The Bar - Introducing Market-Expected Return On InvestmentDocumento17 páginasWhere's The Bar - Introducing Market-Expected Return On Investmentpjs15Ainda não há avaliações

- What Drives The Disposition Effect - An Analysis of A Long-Standing Preference-Based ExplanationDocumento48 páginasWhat Drives The Disposition Effect - An Analysis of A Long-Standing Preference-Based Explanationpjs15Ainda não há avaliações

- 1995.12.13 - The More Things Change, The More They Stay The SameDocumento20 páginas1995.12.13 - The More Things Change, The More They Stay The SameYury PopovAinda não há avaliações

- Nickerson Confirmation BiasDocumento46 páginasNickerson Confirmation BiasZeghaiderAinda não há avaliações

- Value Explosion - Exploring Barriers To Entry For Internet CompaniesDocumento12 páginasValue Explosion - Exploring Barriers To Entry For Internet Companiespjs15Ainda não há avaliações

- Valuation - MauboussinDocumento4 páginasValuation - MauboussinRamesh Mane100% (2)

- Saint Lucia PassportDocumento8 páginasSaint Lucia PassportChiến NguyễnAinda não há avaliações

- Financial Analytics PPT EtfDocumento11 páginasFinancial Analytics PPT EtfKeerthana Gowda .13Ainda não há avaliações

- Senior High School: First Semester S.Y. 2020-2021Documento9 páginasSenior High School: First Semester S.Y. 2020-2021sheilame nudaloAinda não há avaliações

- Corporate Finance Homework 3Documento4 páginasCorporate Finance Homework 3Thao PhamAinda não há avaliações

- Housing Delivery SystemDocumento48 páginasHousing Delivery SystemKaren Mae MaravillaAinda não há avaliações

- Yield CurveDocumento9 páginasYield Curvejackie555Ainda não há avaliações

- Financial Covenant Product TermsDocumento5 páginasFinancial Covenant Product TermsOmiros SarikasAinda não há avaliações

- CM Fact Book 2021 SifmaDocumento92 páginasCM Fact Book 2021 SifmaSachin DegavekarAinda não há avaliações

- Investment Risk and Portfolio Management GuideDocumento20 páginasInvestment Risk and Portfolio Management GuideJUNEAinda não há avaliações

- Lehman Brothers A Model of The Yield Curve With TimeVarying Interest Rate TargetsDocumento18 páginasLehman Brothers A Model of The Yield Curve With TimeVarying Interest Rate TargetsShefali AgarwalAinda não há avaliações

- 2018 BAR TAX UPDATES As of 06 May 2018Documento320 páginas2018 BAR TAX UPDATES As of 06 May 2018nomercykillingAinda não há avaliações

- Madhya Pradesh Sahakari Krishi Aur Vikas Bank Adhiniyam1999 PDFDocumento25 páginasMadhya Pradesh Sahakari Krishi Aur Vikas Bank Adhiniyam1999 PDFLatest Laws TeamAinda não há avaliações

- #3 Financial Accounting and Reporting Test BankDocumento32 páginas#3 Financial Accounting and Reporting Test BankPatOcampo100% (5)

- Analysis of Investment DecisionsDocumento81 páginasAnalysis of Investment DecisionsSagar Paul'gAinda não há avaliações

- MSA 2 Winter 2019 PDFDocumento4 páginasMSA 2 Winter 2019 PDFSuman UroojAinda não há avaliações

- Annual Report 2019Documento179 páginasAnnual Report 2019YudyChenAinda não há avaliações

- A Study On Investor Perception Towards Mutual FundsDocumento68 páginasA Study On Investor Perception Towards Mutual FundsTom Salunkhe0% (1)

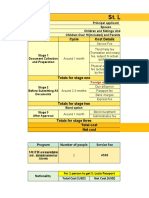

- Process Flow of The Bond Issuance ProcessDocumento14 páginasProcess Flow of The Bond Issuance Processmeor_ayob100% (1)

- Role of The Company SecretaryDocumento6 páginasRole of The Company SecretaryJasmine DixonAinda não há avaliações

- FRM 2011 Practice ExamDocumento122 páginasFRM 2011 Practice ExamEakkarat PattrawutthiwongAinda não há avaliações

- For RetakeDocumento62 páginasFor RetakeIsaiah John Domenic M. CantaneroAinda não há avaliações

- AIA Elite Balanced Fund SGD SummaryDocumento11 páginasAIA Elite Balanced Fund SGD SummarydesmondAinda não há avaliações

- Final Prospectus - ATRKE Equity Opportunity FundDocumento54 páginasFinal Prospectus - ATRKE Equity Opportunity FundArjay Royales CarandangAinda não há avaliações

- Investment Analysis NotesDocumento15 páginasInvestment Analysis NotesManikandan PitchumaniAinda não há avaliações

- Language of The-Stock Market-Powerpoint Presentation 1122g1Documento44 páginasLanguage of The-Stock Market-Powerpoint Presentation 1122g1deepag100% (13)

- Liabilities ReviewerDocumento7 páginasLiabilities ReviewerLouiseAinda não há avaliações

- Working Towards A Harmonized Framework For Impact Reporting For Social BondsDocumento11 páginasWorking Towards A Harmonized Framework For Impact Reporting For Social BondsbodnartiAinda não há avaliações

- Gmo 7 Year Asset Class Forecast (1q2017)Documento1 páginaGmo 7 Year Asset Class Forecast (1q2017)superinvestorbulletiAinda não há avaliações

- Tugas Akuntansi Menengah Ii Dilutive Securities & Earnings Per ShareDocumento2 páginasTugas Akuntansi Menengah Ii Dilutive Securities & Earnings Per ShareClarissa NastaniaAinda não há avaliações

- Supreme Court Rules on Boracay Land Reclamation CaseDocumento28 páginasSupreme Court Rules on Boracay Land Reclamation CaseJay Jay CatindigAinda não há avaliações