Escolar Documentos

Profissional Documentos

Cultura Documentos

A Tribute To Benjamin Graham by Irving Kahn

Enviado por

pjs15Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

A Tribute To Benjamin Graham by Irving Kahn

Enviado por

pjs15Direitos autorais:

Formatos disponíveis

'.:: .

1------

I

A TRIBUTEOfo

BENJAMIN GRAHAM

1894-1976

N" '.' "V'- L......\c.-

__ \ _.

by IRVING KAHN

B

ENJAMIN GRAHAM is widely known as the Father of the Profession

of Security or Financial Analysts. His business .b.egan 1914

and was continuous until 1956. All who are IdentifIed with the

Over-the-Counter area of the securities industry will be interested

in the impact of Benjamin Graham's teachings on OTC securities. Most

investors do not realize how many more corporations have their securi-

ties traded in the OTC market than the 3,000 companies whose issues

are listed on an exchange. When Benjamin Graham began developing

his methods of analyzing corporate securities, he realized that many

factors were of greater importance than the listing.

Graham's teachings concentrated on discovering if the subject

company's stocks or bonds were at a price that justified buying the en-

tire business if it could be bought at that price. Because OTC securities

are usually less frequently traded, and outside the glare of the publicity

spotlight, he consistently found many more attractive issues among

those that were not listed. The thousands of students and practitioners

who have followed the precepts in "Security Analysis" or "The Intelli-

gent Investor" have also found more attractive purchases, with less

risk of being deceived into buying issues which are in current fashion,

by combing the range of issues not traded on any exchange.

When we think back to all of our teachers at school and college,

only a few stand out as major influences on our Jater life. For thousands

of men and women in the world of finance. Ben Graham was such a

memorable teacher. He taught classes of serious students, who finished

the day's work to come up to Columbia Schoo! of Business and be

exposed to his rigorous logic. His lectures on security analysis, like-the

classes of Socrates, invited interrupting questions and challenges. The

contents of these lectures were as current as this week's securities

market. Principles were developed or demolished with actual examples

from corporate reports of the same companies the students studied

in their daily jobs.

From the first classes in 1928 until Ben's academic retirement in

1955, these classes were continuously weU attended. Bull market or

bear market, there were always enough keen analysts who sought to

improve their skills. Because his teaChing always used current exam-

ples, many students kept repeating the course.

It was from these lectures that our "Bible", the standard text of

our profession, "Security Analysis" by Graham and Dodd, evolved in

1934. The use of this text by uiliversities and business schools allover

the country, and its re-issue in many editions, proves how solid its

principles have proven. Among the many thousands of his students,

we find leading officials in investment firms, banks, insurance com-

panies and corporations. Through Ben's classes, both at Columbia and

even earlier at the N.Y. Stock Exchange's Institute of Finance, an entire

generation was influenced in several major areas. These include creat-

ing professional standards. This has flowered into the three examina-

tions now required to achieve recognition as a Chartered Financial

Analyst. Ben was an important influence on the founding and growth

of the New York Society of Security Analysts. He was a major force in

the creation of the Financial Analysts Journal which the N.Y. Society

subsequently transferred to the National Financial Analysts Federation.

His articles in the Journal, which he modestly submitted under a nom

ABOUT THE AUTHOR

Irving Kahn, the author of this tribute, became Benjamin

Graham's student in his first class in security analysis at the

Columbia Graduate School of Business in 1928. He kept attend-

ing each semester until he became Graham's assistant. Doing

research work on the first edition of Graham & Dodd's "Security

Analysis" in 1934 earned the author's acknowledgment. Kahn

was an original shareholder of the now famous Graham-Newman

Corp. some of whose holders are still with him as an investment

adviser. Mr. Kahn was formerly a partner in Abraham & Co., now

merged into Lehman Brothers inc. He was formerly a director of

Grand Union Co. Since 1946 he has been associate editor of The

Analysts Journal. Two of his sons, A/an and Tom, have continued

the Graham tradition of value analYSis into the new generation,

being associated with Lehman Brothers.

A re<::ent pkture of Ben Graham.

de plume, were widely read and heeded. When Ben and Jerome

Newman incorporated their now famous Graham-Newman Corporation,

in the winter of 1936, they opened a new area of sophisticated money

management. They were pioneers in set:ing high critical standards for

their selection of securities. Instead of following the crowd and buying

well known listed corporations, Graham-Newman concentrated on find-

ing values in securities wherever they might be. This resulted in a

heavy selection of Over-the-Counter issues, including companies with

limited floats. The twenty year record of Graham-Newman Corporation,

which dissolved in the Summer of 1956, was probably at or near the

top of any investment trust then extant. This writer was an original

stockholder and remembers that he received dividends, in cash or

kind, of over 20% per year and the liquidating value was greater than

the initial investment.

What makes this result even more impressive was the high quality

of the things they bought. While the names of the securities were often

less than household names, their intrinsic high value made them far

safer investments than most big listed companies.

The acid test of their management was the terms of management

compensation. Ben and Jerry paid themselves 20% of completed gains,

but, unlike most present money managers, required that any losses had

to be made up before that year's gains were computed. Other examples

of how Ben's principles and methods influenced the securities industry

are his ethical standards. These included demanding full disclosures of

pertinent facts both in the balance sheet and the income account. He

was just as forthright in critiCizing the obsolete dividend policies of

AT & T as with some family-controlled company that accumulated mas-

sive cash to the detriment of their public shareholders. He was a pio-

neer in the movement that achieved the dividend passthrough for

regulated mutual funds. His objections to double taxation of corporate

income, first at the corporation and, secondly, to the individual receiving

the dividend, may yet become part of our tax structure. Ben saw the

advantages of issuing rights to buy new capita! stock over the earlier

traditional underwritten issues.

In his management of Graham-Newman Corp., he practiced what

he preached. Anyone who recommended a new security situation was

given the brokerage busines, despite his wide family of friends in Wafl

Street. If a tender offer was made to acquire shares from a large holder,

it was also made to every other shareholder, however small.

! would urge readers of the Over-the-Counter Securities Review to

get their Graham and Dodd off the shelf and, even though it may be

an earlier edition. look back at the basic ideas which are largely ap-

plicable to laday's markets. If they do not already own it, one of the

best investments they can now make is to buy the last edition of

Graham's "The Intelligent Investor."

Ben was completely skeptical about any consistent advantage ob-

tainable from methods that depended upon charts or so-called market

Of technical analysis. He repeatedly exposed the inconSistencies of

such claims even when they were temporarily popular. WaH Street, be-

ing the meeting place of fads, fictions, and phonies, there had to be

times when Graham's teachings seemed to be eclipsed. But, as sure

as sunrise, the varieties of .... his logical analyses proved to be correct.

The growth of pension funds and money managers made an im-

portant shift in what the new generation of security analysts identified

as their fields of concentration. The big new money was directed almost

eXClusively into two kinds of securities. Either the "favored 50" or

"vestal Virgins" or else smaller companies whose sales, if not earnings,

were growing several times more quickly than their industry competitors.

Ben's was almost a lone voice in exposing the fallacies of both

such aberrations. He showed how concentration of large funds into

shares of major corporations must swell their price/earnings ratios

making them acquire a "scarcity value." When the inevitable cyclical

or regulatory changes brought Jess than optimistic news, these high

price/earnings ratios led to, not normal, but heavy selling from institu-

Você também pode gostar

- A Prophet On Wall StreetDocumento11 páginasA Prophet On Wall Streetpjs15Ainda não há avaliações

- The 400% Man: How A College Dropout at A Tiny Utah Fund Beat Wall Street, and Why Most Managers Are Scared To Copy HimDocumento5 páginasThe 400% Man: How A College Dropout at A Tiny Utah Fund Beat Wall Street, and Why Most Managers Are Scared To Copy Himrakeshmoney99Ainda não há avaliações

- Klarman InterviewDocumento20 páginasKlarman InterviewalanyingAinda não há avaliações

- Klarman Yield PigDocumento2 páginasKlarman Yield Pigalexg6Ainda não há avaliações

- The Future of Common Stocks Benjamin Graham PDFDocumento8 páginasThe Future of Common Stocks Benjamin Graham PDFPrashant AgarwalAinda não há avaliações

- Nick Train The King of Buy and HoldDocumento13 páginasNick Train The King of Buy and HoldkessbrokerAinda não há avaliações

- Seth Klarman IIMagazine 2008Documento2 páginasSeth Klarman IIMagazine 2008BolsheviceAinda não há avaliações

- High Conviction Barrons Talks With RiverParkWedgewood Fund Portfolio Manager David RolfeDocumento3 páginasHigh Conviction Barrons Talks With RiverParkWedgewood Fund Portfolio Manager David RolfebernhardfAinda não há avaliações

- Jean Marie Part 1Documento5 páginasJean Marie Part 1ekramcalAinda não há avaliações

- Class 1 Introduction To Value InvestingDocumento36 páginasClass 1 Introduction To Value Investingoo2011Ainda não há avaliações

- David Tepper S 2007 Presentation at Carnegie Mellon PDFDocumento7 páginasDavid Tepper S 2007 Presentation at Carnegie Mellon PDFPattyPattersonAinda não há avaliações

- Notes From A Seth Klarman MBA LectureDocumento5 páginasNotes From A Seth Klarman MBA LecturePIYUSH GOPALAinda não há avaliações

- Peter LynchDocumento2 páginasPeter LynchShiv PratapAinda não há avaliações

- Value Investor Insight - March 31, 2014Documento11 páginasValue Investor Insight - March 31, 2014vishubabyAinda não há avaliações

- SchlossDocumento188 páginasSchlossEduardo FreitasAinda não há avaliações

- Value Investing (Greenwald) SP2018Documento5 páginasValue Investing (Greenwald) SP2018YOG RAJANIAinda não há avaliações

- Distressed Debt InvestingDocumento5 páginasDistressed Debt Investingjt322Ainda não há avaliações

- Marcato Capital 4Q14 Letter To InvestorsDocumento38 páginasMarcato Capital 4Q14 Letter To InvestorsValueWalk100% (1)

- VII332Documento21 páginasVII332currygoatAinda não há avaliações

- Reading List J Montier 2008-06-16Documento12 páginasReading List J Montier 2008-06-16rodmorley100% (2)

- 10 "The Rediscovered Benjamin Graham"Documento6 páginas10 "The Rediscovered Benjamin Graham"X.r. GeAinda não há avaliações

- Private Debt Investor Special ReportDocumento7 páginasPrivate Debt Investor Special ReportB.C. MoonAinda não há avaliações

- East Coast Q1 2015 MR Market RevisitedDocumento17 páginasEast Coast Q1 2015 MR Market RevisitedCanadianValue0% (1)

- To: From: Christopher M. Begg, CFA - CEO, Chief Investment Officer, and Co-Founder Date: July 16, 2012 ReDocumento13 páginasTo: From: Christopher M. Begg, CFA - CEO, Chief Investment Officer, and Co-Founder Date: July 16, 2012 Recrees25Ainda não há avaliações

- Sees Candy SchroederDocumento15 páginasSees Candy SchroederAAOI2Ainda não há avaliações

- Scion 2006 4q Rmbs Cds Primer and FaqDocumento8 páginasScion 2006 4q Rmbs Cds Primer and FaqsabishiiAinda não há avaliações

- Bob Robotti - Navigating Deep WatersDocumento35 páginasBob Robotti - Navigating Deep WatersCanadianValue100% (1)

- Interviews For Intelligent Investors Toby Carlisle Wes GrayDocumento20 páginasInterviews For Intelligent Investors Toby Carlisle Wes GraySylvester MalapasAinda não há avaliações

- Arithmetic of EquitiesDocumento5 páginasArithmetic of Equitiesrwmortell3580Ainda não há avaliações

- Geico Case Study PDFDocumento22 páginasGeico Case Study PDFMichael Cano LombardoAinda não há avaliações

- Investing Without PeopleDocumento18 páginasInvesting Without PeopleZerohedgeAinda não há avaliações

- RV Capital June 2015 LetterDocumento8 páginasRV Capital June 2015 LetterCanadianValueAinda não há avaliações

- 2009 Annual LetterDocumento5 páginas2009 Annual Letterppate100% (1)

- Screening For Stocks Using The Dividend Adjusted Peg RatioDocumento6 páginasScreening For Stocks Using The Dividend Adjusted Peg RatioHari PrasadAinda não há avaliações

- Vinall 2014 - ValuationDocumento19 páginasVinall 2014 - ValuationOmar MalikAinda não há avaliações

- Value Investor Insight Play Your GameDocumento4 páginasValue Investor Insight Play Your Gamevouzvouz7127100% (1)

- Tiananmen Square To Wall Street - ArticleDocumento3 páginasTiananmen Square To Wall Street - ArticleGabe FarajollahAinda não há avaliações

- East Coast Asset Management (Q4 2009) Investor LetterDocumento10 páginasEast Coast Asset Management (Q4 2009) Investor Lettermarketfolly.comAinda não há avaliações

- Arlington Value 2006 Annual Shareholder LetterDocumento5 páginasArlington Value 2006 Annual Shareholder LetterSmitty WAinda não há avaliações

- Chuck Akre Transcript VIC 2011Documento13 páginasChuck Akre Transcript VIC 2011harishbihaniAinda não há avaliações

- 04 April IssueDocumento23 páginas04 April Issueasw310Ainda não há avaliações

- Buffett On ValuationDocumento7 páginasBuffett On ValuationAyush AggarwalAinda não há avaliações

- Anon - Housing Thesis 09 12 2011Documento22 páginasAnon - Housing Thesis 09 12 2011cnm3dAinda não há avaliações

- Aquamarine - 2013Documento84 páginasAquamarine - 2013sb86Ainda não há avaliações

- Office Hours With Warren Buffett May 2013Documento11 páginasOffice Hours With Warren Buffett May 2013jkusnan3341Ainda não há avaliações

- Prem Watsa - The 2 Billion Dollar Man - Toronto Live - 04-2009Documento6 páginasPrem Watsa - The 2 Billion Dollar Man - Toronto Live - 04-2009Damon MengAinda não há avaliações

- BridgewaterDocumento7 páginasBridgewaterkirksoAinda não há avaliações

- Value Investor Insight Issue 239Documento24 páginasValue Investor Insight Issue 239STAinda não há avaliações

- Value Investing With Legends (Santos, Greenwald, Eveillard) SP2015Documento6 páginasValue Investing With Legends (Santos, Greenwald, Eveillard) SP2015ascentcommerce100% (1)

- The Wit and Wid Som of Peter LynchDocumento4 páginasThe Wit and Wid Som of Peter LynchTami ColeAinda não há avaliações

- Arlington Value 2014 Annual Letter PDFDocumento8 páginasArlington Value 2014 Annual Letter PDFChrisAinda não há avaliações

- David WintersDocumento8 páginasDavid WintersRui BárbaraAinda não há avaliações

- Investing in Credit Hedge Funds: An In-Depth Guide to Building Your Portfolio and Profiting from the Credit MarketNo EverandInvesting in Credit Hedge Funds: An In-Depth Guide to Building Your Portfolio and Profiting from the Credit MarketAinda não há avaliações

- The Moses of Wall Street: Investing The Right Way For The Right ReasonsNo EverandThe Moses of Wall Street: Investing The Right Way For The Right ReasonsAinda não há avaliações

- ONE-WAY POCKETS: The Book of Books on Wall Street SpeculationNo EverandONE-WAY POCKETS: The Book of Books on Wall Street SpeculationAinda não há avaliações

- Should Rich But Losing Corporations Be LiquidatedDocumento2 páginasShould Rich But Losing Corporations Be Liquidatedpjs15Ainda não há avaliações

- The Graham + Dodd Luncheon Symposium Transcript 20081002Documento69 páginasThe Graham + Dodd Luncheon Symposium Transcript 20081002pjs15Ainda não há avaliações

- How To Handle Your MoneyDocumento7 páginasHow To Handle Your Moneypjs150% (1)

- Distressed Debt Investing - Wisdom From Seth Klarman - Part 1Documento5 páginasDistressed Debt Investing - Wisdom From Seth Klarman - Part 1pjs15100% (1)

- Toward A Science of Security AnalysisDocumento4 páginasToward A Science of Security Analysispjs15Ainda não há avaliações

- Where's The Bar - Introducing Market-Expected Return On InvestmentDocumento17 páginasWhere's The Bar - Introducing Market-Expected Return On Investmentpjs15Ainda não há avaliações

- A Conversation With Benjamin GrahamDocumento2 páginasA Conversation With Benjamin Grahampjs15Ainda não há avaliações

- Why Strategy Matters - Exploring The Link Between Strategy, Competitive Advantage and The Stock MarketDocumento8 páginasWhy Strategy Matters - Exploring The Link Between Strategy, Competitive Advantage and The Stock Marketpjs15Ainda não há avaliações

- 1995.12.13 - The More Things Change, The More They Stay The SameDocumento20 páginas1995.12.13 - The More Things Change, The More They Stay The SameYury PopovAinda não há avaliações

- Academy Awards, Sharon Stone and Market EfficiencyDocumento10 páginasAcademy Awards, Sharon Stone and Market Efficiencypjs15Ainda não há avaliações

- Value Explosion - Exploring Barriers To Entry For Internet CompaniesDocumento12 páginasValue Explosion - Exploring Barriers To Entry For Internet Companiespjs15Ainda não há avaliações

- To Buy or Not To Buy - Issues and Considerations Surrounding Share RepurchaseDocumento24 páginasTo Buy or Not To Buy - Issues and Considerations Surrounding Share Repurchasepjs15Ainda não há avaliações

- The Ecosystem EdgeDocumento11 páginasThe Ecosystem Edgepjs15Ainda não há avaliações

- The Fat Tail That Wags The Dog - Demystifying The Stock Market's PerformanceDocumento16 páginasThe Fat Tail That Wags The Dog - Demystifying The Stock Market's Performancepjs15100% (1)

- Thoughts On Valuation - Part 2 - An Epistemological ViewDocumento8 páginasThoughts On Valuation - Part 2 - An Epistemological Viewpjs15Ainda não há avaliações

- Still Powerful - The Internet's Hidden OrderDocumento17 páginasStill Powerful - The Internet's Hidden Orderpjs15Ainda não há avaliações

- Greenlight Capital Open Letter To AppleDocumento5 páginasGreenlight Capital Open Letter To AppleZim VicomAinda não há avaliações

- CHAPTER 13 Without AnswerDocumento3 páginasCHAPTER 13 Without AnswerlenakaAinda não há avaliações

- Basics of Financial Markets PDFDocumento10 páginasBasics of Financial Markets PDFBinu RajAinda não há avaliações

- SunGard Data SystemsDocumento6 páginasSunGard Data SystemsAmit SharmaAinda não há avaliações

- Stock Mock - Backtest Index StrategiesDocumento9 páginasStock Mock - Backtest Index StrategiesAvinash GaikwadAinda não há avaliações

- NinftyDocumento16 páginasNinftysonalliAinda não há avaliações

- Lancaster Engineering Inc Lei Has The Following Capital Structure WhichDocumento1 páginaLancaster Engineering Inc Lei Has The Following Capital Structure WhichAmit PandeyAinda não há avaliações

- Stock Market - The Place Where The Shares or Stocks of Publicly Listed Companies Are TradedDocumento21 páginasStock Market - The Place Where The Shares or Stocks of Publicly Listed Companies Are TradedCarl ReyAinda não há avaliações

- Asset Management's Guide To The MarketsDocumento71 páginasAsset Management's Guide To The MarketsKhaled batticheAinda não há avaliações

- Star Media Group Berhad - Weighted by Lower Advertising Expenditure - 180228Documento3 páginasStar Media Group Berhad - Weighted by Lower Advertising Expenditure - 180228Sheng Fai ChanAinda não há avaliações

- Case Analysis - Compania de Telefonos de ChileDocumento4 páginasCase Analysis - Compania de Telefonos de ChileSubrata BasakAinda não há avaliações

- MODULE 10.2 - Treasury Shares, Dividends and Retained EarningsDocumento42 páginasMODULE 10.2 - Treasury Shares, Dividends and Retained EarningsFRANCES JEANALLEN DE JESUSAinda não há avaliações

- DD Problems PDFDocumento36 páginasDD Problems PDFSai Krishna TejaAinda não há avaliações

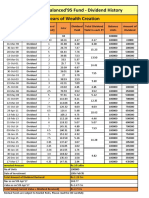

- Dividend HistoryDocumento1 páginaDividend HistoryJeetendra KumarAinda não há avaliações

- INTACCDocumento6 páginasINTACCAeliey AceAinda não há avaliações

- Tutorial EPSDocumento3 páginasTutorial EPSRil LlAinda não há avaliações

- In Venture Growth & Securities Ltd.Documento424 páginasIn Venture Growth & Securities Ltd.adhavvikasAinda não há avaliações

- Retained EarningsDocumento6 páginasRetained EarningsRuth MacaspacAinda não há avaliações

- ADV2 Chapter12 QADocumento4 páginasADV2 Chapter12 QAMa Alyssa DelmiguezAinda não há avaliações

- Accounting Quiz 2Documento8 páginasAccounting Quiz 2Camille G.Ainda não há avaliações

- NILEX List 0f Member FirmsDocumento5 páginasNILEX List 0f Member Firmstahiliani9Ainda não há avaliações

- ch13 EssayDocumento25 páginasch13 EssaySusan CornelAinda não há avaliações

- Rags To RichesDocumento77 páginasRags To RichesIshan MishraAinda não há avaliações

- Fundamental and Technical Analysis - Technical PaperDocumento16 páginasFundamental and Technical Analysis - Technical PaperGauree AravkarAinda não há avaliações

- Lesson 8 Stock Day Trading System: Gap Up News Scalp (GUNS)Documento61 páginasLesson 8 Stock Day Trading System: Gap Up News Scalp (GUNS)sesilya 14Ainda não há avaliações

- Trading Rules and ProceduresDocumento20 páginasTrading Rules and ProceduresAmir Shahzad TararAinda não há avaliações

- Guide Venture CapitalDocumento22 páginasGuide Venture CapitalAnand ArivukkarasuAinda não há avaliações

- A4-Equity ValuationDocumento3 páginasA4-Equity ValuationMariya PatelAinda não há avaliações

- Problems Stocks ValuationDocumento3 páginasProblems Stocks Valuationmimi96Ainda não há avaliações

- Classroom Notes 6389Documento2 páginasClassroom Notes 6389Mary Grace Galleon-Yang OmacAinda não há avaliações