Escolar Documentos

Profissional Documentos

Cultura Documentos

Valuation of Mergers and Acquisitions

Enviado por

Sainaath RDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Valuation of Mergers and Acquisitions

Enviado por

Sainaath RDireitos autorais:

Formatos disponíveis

Valuation of Mergers and Acquisitions

Illustration 1 - X Ltd. is intending to acquire B Ltd. (by merger) and the following information is available

in respect of the companies.

Particulars X Ltd. B Ltd.

No. of Equity hares !"##"### $"##"###

Earnings after ta% (&s.) '!"##"### ("##"###

)ar*et value per share (&s.) '+ +,

(i) -hat is the present E. of both the companies/

(ii) 0f the proposed merger ta*es place" what would be the new earning per share for X Ltd. (assuming that the merger

ta*es place by e%change of equity shares and the e%change ratio is based on the current mar*et prices).

(iii) -hat should be e%change ratio" if B Ltd. want to ensure the same earnings to members as before the merger ta*es

place/

Illustration 2 - X Ltd. is considering the proposal to acquire 1 Ltd. and their financial information is given

below2

Particulars X Ltd. Y Ltd.

No. of Equity shares +#"##"### 3"##"###

)ar*et price per share (&s.) $# +4

)ar*et 5apitalisation (&s.) $"##"##"### +"#4"##"###

X Ltd. intend to pay &s. +",#"##"### in cash for 1 Ltd." if 1 Ltd.6s mar*et price refl ects only its value as

a separate entity. 5alculate the cost of merger 2 (i) -hen merger is fi nanced by cash (ii) -hen merger is

financed by stoc*.

Illustration 3 - East 5o. Ltd. is studying the possible acquisition of -est 5o. Ltd. by way of merger. 7he

following data are available in respect of the companies2

Particulars East Co. Ltd . West Co. Ltd.

Earnings after ta% (&s.) '"##"### 3#"###

No. of equity shares ,#"### +#"###

)ar*et value per share (&s.) +! +'

(i) 0f the merger goes through by e%change of equity share and the e%change ratio is based on the current

mar*et price" what is the new earnings per share for East 5o. Ltd./ (ii) -est 5o. Ltd. wants to be sure that

the earnings available to its shareholders will not be diminished by the merger. -hat should be the

e%change ratio in that case/

Illustration 4 - 8 Ltd. is considering ta*eover of B Ltd. and 5 Ltd. 7he fi nancial data for the three

companies are as follows 2

Particulars A Ltd. B Ltd. C ltd

.Equity hare 5apital of &s.+# each (&s. crores) ,!# +4# (#

Earnings (&s. crores) (# +4 +4

)ar*et price of each share (&s.) 3# $9 ,3

5alculate 2

(i) .rice earnings ratios

(ii) Earning per share of 8 Ltd. after the acquisition of B Ltd. and 5 Ltd. separately. -ill you

recommend/ the merger of either:both of the companies/ ;ustify your answer.

Illustration 5 - X1< Ltd. is considering merger with 8B5 Ltd. X1< Ltd.6s shares are currently traded at

&s. '!. 0t has '"##"### shares outstanding and its profits after ta%es (.87) amount to &s. &s. ,"##"###.

8B5 Ltd. has +"##"### shares outstanding= its current mar*et price is &s. +'.!# and its .87 are &s.

+"##"###. 7he merger will be effected by means of a stoc* swap (e%change). 8B5 Ltd. has agreed to a

plan under which X1< Ltd. will offer the current mar*et value of 8B5 Ltd.6s shares2

(i) -hat is the pre>merger earnings per share (E.) and .:E ratios of both the companies/

(ii) 0f 8B5 Ltd.6s .:E ratio is 4" what is its current mar*et price/ -hat is the e%change ratio/ -hat

willX1< Ltd.6s post>merger E. be/

(iii) -hat must the e%change ratio be for X1< Ltd.6s that pre and post>merger E. to be the same/

Illustration 6 2 5ompany X is contemplating the purchase of 5ompany 1" 5ompany X has $"##"###

shares having a mar*et price of &s. $# per share" while 5ompany 1 has '"##"### shares selling at &s. '#

per share. 7he E. are &s. ,.## and &s. '.'! for 5ompany X and 1 respectively. )anagements of both

companies are discussing two alternative proposals for e%change of shares as indicated below2

(i) in proportion to the relative earnings per share of two 5ompanies.

(ii) #.! share of 5ompany X for one share of company 1 (! 2 +).

1ou are required2

(i) to calculate the Earnings .er hare (E.) after merger under two alternatives= and

(ii) to show the impact on E. for the shareholders of two companies under both alternatives.

Illustration 7 2 8B5 Ltd. is run and managed by an efficient team that insists on reinvesting 3#? of its

earnings in pro@ects that provide an &AE (&eturn of Equity) of +#? despite the fact that the firm6s

capitaliBation rate (C) is +!?. 7he firm6s currently year6s earnings is &s. +# per share. 8t what price will

the stoc* of 8B5 Ltd. sell/ -hat is the present value of growth opportunities/ -hy would such a firm be

a ta*eover target/

Illustration 8 2 Dollowing are the fianancial statement for 8 Ltd. for the current financial year. Both the

frim operate in the same industry2

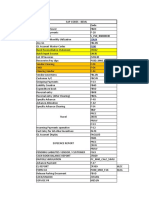

Balance Seet !Rs."

Particulars A Ltd. B. Ltd.

7otal 5urrent assets +,"##"### +#"##"###

7otal Di%ed assets (net) +#"##"### !"##"###

',"##"### +!"##"###

Equity capital (of &s. +# each) +#"##"### 4"##"###

&etained earnings '"##"###

+,? Long>term debt !"##"### $"##"###

7otal 5urrent liabilities 9"##"### ,"##"###

',"##"### +!"##"###

Inco#e-State#ents !Rs."

Particulars A Ltd. B. Ltd.

Net sales ,"!#"### +9"##"###

5ost of goods sold '9"3#"### +$"3#"###

Eross profit 3"(#"### $",#"###

Aperating e%penses '"##"### +"##"###

0nterest 9#"### ,'"###

Earning before ta%es ,"'#"### +"(4"###

7a%es (!#?) '"+#"### (("###

Earning after ta%es (E87) '"+#"### (("###

8dditional 0nformation

Number of equity shares +#"### 4"###

Fivident payment ratio (F:.) ,#? 3#?

)ar*et price per share ().) &s. ,## &s. +!#

8ssume that the two firms are in the process of negotiating a merger through an e%change of equity

shares. 1ou have been as*ed to assist in establishing equitable e%change terms" and are required to G

(i) Fecompose the share prices of both the companies into E. and .:E components" and also segregate

their E. figures into return on equity (&AE) and boo* value:intrinsic value per share (BH.)

components.

(ii) Estimate future E. growth rates for each firm.

(iii) Based on e%pected operating synergies" 8 Ltd. estimates that the intrinsic value of B6s equity share

would be &s. '## per share on its acquisition. 1ou are required to develop a range of @ustifiable equity

share e%change ratios that can be offered by 8 Ltd. to B Ltd. Is shareholders. Based on your analysis in

parts (i) and (ii) would you e%pect the negotiated terms to be closer to the upper" or the lower e%change

ratio limits/ -hy/

(iv) 5alculate the post>merger E. based on an e%change ratio of #.,2+ being offered by 8 Ltd. 0ndicate

the immediate E. accretion or dilution" if any" that will occur for each group of shareholders.

(v) Based on a #.,2+ e%change ratio" and assuming that 86s pre>merger .:E ratio will continue after the

merger" estimate the post>merger mar*et price. how the resulting accretion or dilution in pre>merger

mar*et prices.

-or*er price per share ().) J E. % .:E ratio or .:E &atio J ). : E.

0llustration ( 2 Dat Ltd. wants to acquire Lean Ltd. the Balance sheet of Lean Ltd. as on $+st )arch" '##(

is as follows2

Liabilities Rs. Assets Rs.

Equity share capital (3#"### hares)3##### cash '####

&etained Earnings '##### debtors $####

+'? Febentures '##### 0nvestments +9####

5reditors and other liabilities $'#### .lant "equipments ++#####

+$'#### +$'####

8dditional information2

(i) hareholders of Lean Ltd. will get one share in Dat Ltd. for every two shares. E%ternal liabilities

aree%pected to be settled aat &s. $"##"###. hares of Dat Ltd. would be issued at its current price of &s. +!

per share. Febentureholders will get +$? convertible debentures in the purchasing company for the same

amount. Febtors and inventories are e%pected to realise &s. +"4#"###.

(ii) Dat Ltd. has decided to operate the business of Lean Ltd. as a separate division. 7he division is li*ely

to give cash flows (after ta%) to the e%tent of &s. $"##"### per year for 3 years. Dat Ltd. Kas planned that"

after 3 years this division would be demerged and disposed of for &s. +"##"###.

(iii) 5ompany6s cost of capital is +,?. )a*e a report to the managing director advising him about the fi

nancial feasibility of the acquisition. Note2 .resent Halue of &e. + for si% years L +,?2 #2499'" #.93(!"

#.39!#" #.!('+" #.!+(, and #.,!!3.

0llustration +# 2 X1< Ltd. is considering merger with 8B5 Ltd.6s shares are currently traded at &s. '##. 0t

has '!"### shares outstanding and its profi t after ta%es (.87) amount to &s. !"##"###. 8B5 Ltd. has

+"'!"### shares outstanding" its current mar*et price is &s. +## and its .87 are &s. +"'!"###. 7he merger

will be effected by means of a stoc* swap (e%change). 8B5 Ltd. has agreed to a plan under which X1<

Ltd. -ill offer the current mar*et value of 8B5 Ltd.6s shares2

(i) -hat is the pre>merger earning per share (E.) and .:E ratios of both the companies/

(ii) 0f 8B5 Ltd.6s .:E ratio is 3.," what is its current mar*et price/ -hat is the e%change ratio/ -hat will

X1< Ltd.6s post>merger E. be/

(iii) -hat should be the e%change ratio" if X1< Ltd.6s pre>merger and post>merger E. are to be the

same/

0llustration ++ 2 ) Ltd. is studying the possible acquisition of N Ltd. by way of merger. 7he following

data are available in respect of the companies2

Particulars M Ltd. N Ltd.

.rofits after ta% (.87) &s. 4#"##"### . ',"##"###

No. of equity shares +3"##"### ,"##"###

)ar*et value per share &s. '## +3#

(i) 0f the merger goes through by e%change of equity and the e%change ratio is based on the current mar*et

price" what is the new earnings per share for ) Ltd./

(ii) N Ltd. wants to be sure that the earnings available to its sharesholders will not be diminished by the

merger. what should be the e%change ratio in that case/

0llustration2 +' 2 B Ltd. is intending to acquire < Ltd. by merger and the following information is available

in respect of the companies2

B Ltd. Z Ltd.

Number of equity shares +###### 3#####

Earning after ta% !###### +4#####

)ar*et value per share ,' '4

&equired 2

(i) -hat is the present E. of both the companies/

(ii) 0f the proposed merger ta*es place" what would be the new earning per share for B Ltd./ 8ssume that

the merger ta*es place by e%change of equity shares and the e%change ratio is based on the current mar*et

price.

(iii) -hat should be e%change ratio" if < Ltd. wants to ensure the earning to members are as before the

merger ta*es place/

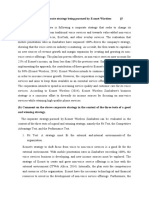

0llustration +$ 2 7he following information is provided related to the acquiring fi rm )ar* Limited and the

target fi rm )as* Limited2

Mark Liited Mask Liited

.rofi ts after ta% (.87) '###la*hs >>>>>>>> ,##la*hs

Number of shares outstanding'##la*hs +##la*hs

.:E ratio (times) +# !

&equired2

(i) -hat is the swap ratio based on current mar*et price/

(ii) -hat is the E. of )ar* Limited after acqusition/

(iii) -hat is the e%pected mar*et price per share of )ar* Limited after acquisition" assuming .:E ratio of

)ar* Limited remains unchanged/

(iv) Fetermine the mar*et value of the merged fi rm.

(v) 5alculate gain:loss for shareholdeependent companies after acqusition.

Você também pode gostar

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Work ManualDocumento116 páginasWork ManualSainaath RAinda não há avaliações

- Digital Marketing Vocabulary ListDocumento17 páginasDigital Marketing Vocabulary Listmorgan haferAinda não há avaliações

- ST ManagDocumento26 páginasST ManagSainaath RAinda não há avaliações

- F9 Practice Kit 400 McqsDocumento186 páginasF9 Practice Kit 400 Mcqsjarom100% (6)

- Revlon Case Report - Big BossDocumento32 páginasRevlon Case Report - Big BossMohd EizraAinda não há avaliações

- Strategic Plan of UnileverDocumento14 páginasStrategic Plan of Unileverkaka kynAinda não há avaliações

- Black Book ProjectDocumento55 páginasBlack Book ProjectTrupti Kuvalekar75% (4)

- 51 GST Flyer Chapter48Documento4 páginas51 GST Flyer Chapter48Sainaath RAinda não há avaliações

- TCS On Sale of Goods: Padmanathan K V, Chartered AccountantDocumento20 páginasTCS On Sale of Goods: Padmanathan K V, Chartered AccountantSainaath RAinda não há avaliações

- Webnote Ps 25jan19Documento1 páginaWebnote Ps 25jan19Sainaath RAinda não há avaliações

- Man Fin InstDocumento9 páginasMan Fin InstSainaath RAinda não há avaliações

- Worksheet November 21 SolutionsDocumento7 páginasWorksheet November 21 SolutionsSainaath R0% (1)

- Int Trade FinDocumento14 páginasInt Trade FinSainaath RAinda não há avaliações

- ImportantpointsunderGSTregime 20170613051600.632 XDocumento3 páginasImportantpointsunderGSTregime 20170613051600.632 XSainaath RAinda não há avaliações

- Acct & Finance Harmonized Curriculum 3RD Round FinalDocumento184 páginasAcct & Finance Harmonized Curriculum 3RD Round FinalSainaath R100% (10)

- Inter Office Memo Amh / Gen. / / 2016, Sept 08, Beml LTD HyderabadDocumento1 páginaInter Office Memo Amh / Gen. / / 2016, Sept 08, Beml LTD HyderabadSainaath RAinda não há avaliações

- The Companies Act 2013 by Cs Shishir DudejaDocumento141 páginasThe Companies Act 2013 by Cs Shishir DudejaSainaath RAinda não há avaliações

- AstroDocumento3 páginasAstroSainaath RAinda não há avaliações

- Nsic HRDocumento2 páginasNsic HRSainaath RAinda não há avaliações

- Experience Cum Relieving Certificate: Date: 01.09.2014Documento1 páginaExperience Cum Relieving Certificate: Date: 01.09.2014Sainaath RAinda não há avaliações

- Value Chain DiagramDocumento8 páginasValue Chain DiagramjameelrahmanAinda não há avaliações

- Economics For Decision Making MBA 641Documento25 páginasEconomics For Decision Making MBA 641Binyam RegasaAinda não há avaliações

- PoM Case-Study FinalDocumento13 páginasPoM Case-Study FinalArun VermaAinda não há avaliações

- Brooks Drive in CinemaDocumento32 páginasBrooks Drive in CinemakanwaliftiAinda não há avaliações

- Revolving Loan Application FormDocumento1 páginaRevolving Loan Application FormJames LangAinda não há avaliações

- Goods X and Y Are Compliments WhileDocumento48 páginasGoods X and Y Are Compliments Whilem-amirAinda não há avaliações

- Jack and Jones Analysis: Subject-Elements of FashionDocumento12 páginasJack and Jones Analysis: Subject-Elements of FashionShrutiAinda não há avaliações

- Example Assignment 7003Documento14 páginasExample Assignment 7003Javeriah Arif75% (4)

- AssignmentDocumento5 páginasAssignmentpeter chadaAinda não há avaliações

- TOS IA SchemeDocumento4 páginasTOS IA SchemePradeep BiradarAinda não há avaliações

- Conversion Rate Optimization QuickStart GuideDocumento3 páginasConversion Rate Optimization QuickStart GuideherryaptAinda não há avaliações

- MKT201 Term PaperDocumento8 páginasMKT201 Term PaperSumaiyaNoorAinda não há avaliações

- Account Determination MM en USDocumento81 páginasAccount Determination MM en USkamal_dipAinda não há avaliações

- Sales Management: Some of The Important Terms Are As UnderDocumento14 páginasSales Management: Some of The Important Terms Are As UnderSarthak GuptaAinda não há avaliações

- May June - P3 - 9708 - s14 - QP - 32Documento12 páginasMay June - P3 - 9708 - s14 - QP - 32Afifa At SmartEdgeAinda não há avaliações

- New Criteria For Market Segmentation by YankelovichDocumento12 páginasNew Criteria For Market Segmentation by YankelovichShahidul SumonAinda não há avaliações

- 1854 RulesDocumento16 páginas1854 RulestobymaoAinda não há avaliações

- Maf451 Question July 2020Documento12 páginasMaf451 Question July 2020JannaAinda não há avaliações

- MID TERM Internet - Marketing CHAPTER 6Documento185 páginasMID TERM Internet - Marketing CHAPTER 6BHAGYASHREE SHELARAinda não há avaliações

- Collection of RRLsDocumento14 páginasCollection of RRLsZedrielle MartinezAinda não há avaliações

- (402504092) Auditing Problems-SyllabusDocumento3 páginas(402504092) Auditing Problems-SyllabusOW YuAinda não há avaliações

- Variance AnalysisDocumento21 páginasVariance Analysismark anthony espiritu0% (1)

- 3rd Sem Tourism MarketingDocumento2 páginas3rd Sem Tourism MarketingakashbpradeepcorpusAinda não há avaliações

- Iare Befa Tutorial Question Bank-Converted 0Documento20 páginasIare Befa Tutorial Question Bank-Converted 0test caseAinda não há avaliações

- Transaction Cycle - Audit SeparateDocumento4 páginasTransaction Cycle - Audit SeparateNoj Werdna50% (2)