Escolar Documentos

Profissional Documentos

Cultura Documentos

Acin Ecc5 SD 0005

Enviado por

surendrasimhaTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Acin Ecc5 SD 0005

Enviado por

surendrasimhaDireitos autorais:

Formatos disponíveis

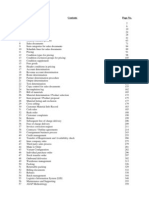

Notes

SAP AG 9 - 1 WINLEN

SAP AG 2005

Sales Process

Overview of the sales process

Sales processes

Sales from Factory - Configuration

Cancellation of Excise Invoice

Excise Invoice Printing

Fortnightly Utilization

Other features

Contents:

Notes

SAP AG 9 - 2 WINLEN

SAP AG 2005

After completing this unit, you will be able to:

Understand Excise related sales processes

Understand Sales Tax related sales processes

Run the sales processes

Sales Process : Unit Objectives

Notes

SAP AG 9 - 3 WINLEN

SAP AG 2005

Sales Process : Business Scenario

Removal of goods

Free Supplies

Excise Invoice Cancellation

Fortnightly utilisation

Notes

SAP AG 9 - 4 WINLEN

SAP AG 2005

Removal of Goods - Overview

Full Compliance across the

Distribution Process

Full Compliance across the

Distribution Process

Removal of Goods

From Factory From Depot

Sale Transfer to Factory

Return to Vendor Transfer to Depot

Return from Customer Transfer to Subcontractor

Sale Transfer to Factory

Return to Vendor Transfer to Depot

Return from Customer Transfer to Subcontractor

Removal of goods - Factory Sale

Generation of excise invoice at the time of removal of goods

Printing of Excise Invoice based on Customizable Layout Set

Fortnightly utilization of CENVAT

RG23D register entries at depot during delivery

Notes

SAP AG 9 - 5 WINLEN

SAP AG 2005

CENVAT Availment & Utilization

CENVAT on hold

for Cap Goods

CENVAT Account

VENDOR EXCISE

INVOICEPROCESS

GOODS

RECEIPT

DESPATCH

SALES EXCISE

INVOICE PROCESS

Excise Duty

Payable A/C

PLA A/C

DEPOSIT

FUNDS

IN PLA

ACCOUNT

Credit

PLA Account

SELECT

REGISTER Excise duty

Utilization

Transaction

ON-LINE TRANSACTIONS

FORTNIGHTLY TRANSACTIONS

Credit ED Payable A/c

(Consolidated Entry)

Debit ED Payable A/c

Debit PLA A/c

Debit CENVAT A/c

Credit CENVAT A/c

Credit CENVAT

on-hold A/c

CENVAT accounts are credited during the procurement cycle.

During removal of goods, excise invoice is created and printed. Also the duty liability is booked.

During fortnightly payment, the credit available in the CENVAT/PLA accounts is utilized.

Immediate utilization of CENVAT during excise invoice creation through customizing based on series

group.

Notes

SAP AG 9 - 6 WINLEN

SAP AG 2005

Sales from Factory

Single Excise Invoice and Commercial Invoice

Separate Excise Invoice and Commercial Invoice

Free Supplies

Sales - Processes

Notes

SAP AG 9 - 7 WINLEN

SAP AG 2005

Sales from Factory - Process

Batch Utilization

Excise Invoice Creation in Background

Automatic Determination of Excise and Series Group

Provision for immediate utilization of CENVAT

Posting to Profitability segment

DELIVERY

GOODS ISSUE

COMMERCIAL INVOICE PROFORMA INVOICE

EXCISE INVOICE GENERATION

AND PRINTING

EXCISE INVOICE GENERATION

AND PRINTING

COMMERCIAL INVOICE

Streamlined Excise

Tax Processing

Excise invoice can be created automatically in the background during creation of billing document based

on customizing for excise group

Posting of excise invoice to profitability segment if CO-PA has been set up in the system.

The profitability segment in the excise invoice is derived from the item profitability segment in the billing

document

Immediate utilization of CENVAT during excise invoice creation through customizing based on series

group.

Notes

SAP AG 9 - 8 WINLEN

SAP AG 2005

Sales Order

Delivery

Excise Duty posting

Proforma Invoice

Excise Invoice

Printing

Commercial Invoice

Separate Commercial and Excise Invoice

Posting to Excise duty payable

account

Posting to CENVAT accounts for

immediate Utilization

Excise invoice can be prepared and sent along with the goods.

The document flow in such a case would be OR - > JF - > JEX - > F2 . Here OR is the sales document

type, JF is the delivery type ( JF is a copy of standard delivery type LF) , JEX is the Proforma billing

document type ( JEX is a copy of standard Proforma F8 ) and F2 is the invoice.

A Proforma Excise Invoice of type JEX can be created only if Goods issue has been completed for the

Delivery. The system prevents creation of multiple Proforma Excise Invoices.

The Proforma Excise Invoice serves as the basis for MODVAT utilization. This document has to be sent

along with the Goods dispatched in case the commercial invoice is not yet created.

Notes

SAP AG 9 - 9 WINLEN

SAP AG 2005

Sales Order

Delivery

Excise Duty posting

Invoice

Invoice Printing

Single Commercial and Excise Invoice

Posting to Excise duty payable

account

Posting to CENVAT accounts for

immediate Utilization

The document flow in such a case would be OR - > LF - > F2 .

Notes

SAP AG 9 - 10 WINLEN

SAP AG 2005

Free Supplies

Can be combined with a normal order

100% discount condition added to the item pricing

Item category changed to free-of-charge

Excise posting done

In certain cases, materials are supplied free of charge while excise duty is payable on them e.g., free

supplies as volume discounts. Although the material itself is free of charge, the vendor has to pay excise

duty, since excise duty, by definition is paid on the manufacture of goods

Material can be sent free of charge, in such a case the excise should be calculated and paid at the time of

delivery but it is not charged to the customer.

If the material is to be sent free of charge, then in the pricing procedure of the reference document against

the discount condition (last condition in the pricing procedure) maintain 100%. The excise duty amount is

calculated as in case of normal sales but the customer is not billed for anything because of the 100%

discount. The excise utilization transaction picks up the excise value mentioned in the reference

document and posts it.

A separate tax code is created for Free Supplies.

Notes

SAP AG 9 - 11 WINLEN

SAP AG 2005

Sales from Factory - Configuration

Document Flow

OR LF F2

OR JF JEX F2

Define Allowed Delivery types to Billing types

Define Invoice split through data transfer formula in copy

control

Delivery types can be assigned to billing types though the following menu path IMG -> Logistic General -

> Tax on Goods Movement -> India -> Business Transactions -> Outgoing Excise Invoice -> Assign

excise invoice billing type to delivery type

Maintain the following entries

JF JEX

LF F2

LF JEX

NL JEX

Excise duty payable account needs to be configured in CIN related Settings.

Maintain G/L accounts against transaction type DLFC

Negative balances should be allowed for this account in FI/GL configuration

Notes

SAP AG 9 - 12 WINLEN

SAP AG 2005

Copy control formula for validation

Two possible requirements are

When excise and commercial invoice are the same

Copy Control Formula : OR LF F2

When excise and commercial invoice are difference. (ie) Multiple

excise invoice for one commercial invoice

Copy Control Formula : OR JF JEX F2

Sales from Factory - Configuration

The following formulas are provided to establish necessary controls required for

generating the excise invoice.

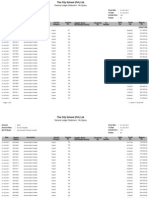

Formula Type Default Level Remarks

310 Copying

Req

JF F2 Item To ensure excise posting take place before billing

311 Copying

Req

JF JEX Heade

r

To ensure post goods issue is done for delivery doc

To ensure duplicate excise doc does not get created

350 Updaing the

Official

numbering

JF F2 Item The Official Document number will be updated based

on VAT / BOS.

351 Split

Formula

JF F2 &

JF JEX

Item Split items of a delivery into multiple billing /

proforma documents.

Split is based on

Dist Channel + Div + Delivery number +

Excise Registration ID + Chapter-ID +

Max no of items (specified in CIN customising)

For further details on routine #350 OSS Note no. 607851 can be referred.

Notes

SAP AG 9 - 13 WINLEN

SAP AG 2005

Sales pricing (Formula based Condition Types)

Pricing procedure - JFACT

Tax procedure TAXINJ

Excise based on material and customer data

Manual over-ride for excise value

Sales tax rate from the tax code

VAT , CST - LST determination based on tax classification

Sales from Factory - Configuration

TAXINJ procedure is attached to the country IN and a formula 352 in the calculated call of TAXINJ looks

up CIN master tables and calculates the excise duty

No jurisdiction codes are assigned to Tax Procedure TAXINJ

JFACT pricing procedure has a condition UTXJ for which the access JIND has been delivered by CIN.

The condition category of UTXJ is 1.

In JFACT pricing procedure all other tax conditions have conditions category as D.

The tax code relevant for the Sales order is picked up from the condition record of UTXJ

The tax code for VAT/LST/CST should be created individually.

The tax rate will be brought in Sales order through the Tax code determined in UTXJ condition type.

The Tax code will be determined based on the Plant Region / Customer Region and Tax Classification of

the Material and Customer. Please note that the Access table 368 is the standard access table which has

all these fields. The Access Sequence JIND used for the UTXJ condition type must have the access table

368.

Maintain Prices in

Sales and Distribution Master Data Pricing Prices

Material Price Maintain PR00 price

Others Maintain JEX2, JEXA, JEXS, JCED, JECX

Others Maintain UTXJ

Notes

SAP AG 9 - 14 WINLEN

SAP AG 2005

Sales pricing (Conditions record based Excise Condition Types)

Pricing procedure - JINFAC

Tax procedure TAXINN

Excise based on condition technique only

Excise based on material and customer data

Chapter Id needs to be maintained in IMG

Sales from Factory - Configuration

As of release R/3 Enterprise, TAXINN procedure can also be used for country IN

No jurisdiction codes are assigned to Tax Procedure TAXINN

During Pricing, Excise & Sales Tax are determined based on only condition technique

JINFAC pricing procedure has excise condition types with access sequences, so that the condition

records for calculating excise can be created for these conditions in SD through VK11.

The chapter-ids will have to be maintained in the Customization option IMG -> Logistics General -> Tax

on Goods movements -> India -> master data > Maintain Chapter Ids.

Notes

SAP AG 9 - 15 WINLEN

SAP AG 2005

Sales pricing (Conditions record based Excise Conditions)

Pricing procedure - JINFAC

Tax procedure TAXINN

Manual over-ride for excise value

No excise indicator required for customer

Sales from Factory - Configuration

Maintain the Chapter ids for the material in the additional tab for CIN related data in Foreign trade import

as well as Foreign trade export tab in material master maintenance.

Customer add on data for CIN also need to be maintained in the Customer master, however, customer

excise indicator can be ignored now as all the conditions are based on condition technique and not on

formulae for calculating excise

For each element of Excise there are three conditions one percentage condition, one quantity based

condition and one total condition which give the total duty as the sum of the other two.

For example:

Basic Excise duty percentage is mapped to condition JEXP

Basic Excise duty quantity is mapped to condition JEXQ

JEXT gives the sum of JEXP and JEXQ to give the total excise duty

Similarly conditions for Additional Excise, Special Excise and Cess need to be maintained.

All these conditions are Discount and Surcharge conditions and are posted using the Accounting key

EXD

All excise conditions are determined using the access JEXC

Notes

SAP AG 9 - 16 WINLEN

SAP AG 2005

Sales pricing (Conditions record based Excise Conditions)

Pricing procedure - JINFAC

Tax procedure TAXINN

Sales tax rate from the tax code

CST - LST determination based on tax classification

Sales from Factory - Configuration

Since the Tax rates are determined through the Condition record the tax code will not have any rates.

Even if you put the rates, the rate will disappear once you save the Tax code.

You may create only one tax code SD and put it in the Condition Record.

Sales Tax conditions are

Central Sales Tax JCST and JCSR

Local Sales Tax JLST and JLSR

VAT Condition JIVP

CST in VAT Regime - JIVC

All these are tax conditions are posted with the account key MWS or MW3

The Account key for these conditions should be created both in SD and FI. The condition types will be non

statistical condition in SD Pricing Procedure JINFAC. The GL account assignment for the account key will

be assigned in FI. When the system find the condition as Tax condition then it uses the same account key

assigned in SD Pricing procedure and determine the GL account from FI account key.

The Central Sale Tax can be determined using the access JCST and Local Sales Tax can be determined

using access JLST

Notes

SAP AG 9 - 17 WINLEN

SAP AG 2005

Sales pricing

Concessional Taxes

Tax Procedure TAXINJ with Pricing Procedure JINFAC

Tax Procedure TAXINN with Pricing Procedure JFACT

Sales from Factory - Configuration

Concessional taxes are calculated based on tax classification fields.

During transaction the tax classification may be changed to show the new tax status. This will result in a

new tax calculation.

Since the tax rates are maintained in the Tax code and the tax codes are determined based on the Tax

classification. The condition record for UTXJ should be created with the new classification with different

tax code.

The Concessional taxes for TAXINN will not be working in the similar way of changing the tax

classification as there is no tax code concept in the TAXINN Procedure.

Procedure TAXINJ can be used with both JFACT and JINFAC

For use of JINFAC with TAXINJ, the excise condition types present in TAXINJ should also be present in

JINFAC with the zero base value

Further, the duty total condition types in JINFAC should also be changed to JEX2, JEXA, JEXS, JCED,

JECX. These are Discount and Surcharge condition types

Similarly, procedure TAXINN can be used with JFACT and JINFAC

Notes

SAP AG 9 - 18 WINLEN

SAP AG 2005

Sales from Factory Configuration

Menu Path: SPRO Logistics General Tax on Goods

Movement India

Master Data

Maintain Form Types

Form Types Maintenance

In this IMG activity, you can define which form types you want to record in the system. You can only

use form tracking for the form types that you enter here.

Notes

SAP AG 9 - 19 WINLEN

SAP AG 2005

Sales Order

Delivery

Excise Invoice Creation

Invoice

Invoice Cancellation

Cancellation of outgoing excise invoice

Cancellation of excise invoice made simple

Reversal of excise invoice without marking it for cancellation

Notes

SAP AG 9 - 20 WINLEN

SAP AG 2005

Excise Invoice Printing

Outbound excise invoice printing facility provided

Selection based on

Excise invoice numbers

Excise year

Excise Invoice Date

Billing document

Series Group

Plant

Tracking of Printed Excise Invoice facilitating reprint of Excise

Invoice

To access this function, you can use transaction J1IP

Customize the output for billing documents as shown:

Sales and Distribution (SD)Basic Functions Output ControlOutput Determination Output

Determination Using Condition Technique Maintain Output Determination for Billing Documents.

You can use output type J1I0 and the SAPscript form J_1I_EXC_INVOICE. The driving program is

J_1IEXCP. The output determination has been set up for the billing document that is used as the

excise invoice reference.

Maintain condition records for the output

Logistics Sales and Distribution Master Data Output Billing Document Create. This

ensures that output gets copied to all the excise reference documents.

Notes

SAP AG 9 - 21 WINLEN

SAP AG 2005

Fortnightly Utilization

Facilitates payment of duty accumulated.

Includes

Display of pending invoices

Option for Posting date

Posting to a Business area

Selection based on a range of dates

Optionally, Selection based on a range of invoices

Option of Utilizing the Service tax Credit.

Option for Payment of Service tax from Cenvat

Facilitates Utilization strategy based on customization settings

Posting of TR6 Challan entry to PLA account

Transaction code for fortnightly utilization is J2IUN

Payment of duty accumulated .

Normal sales

For other movements

Reversals for material write-off, material non-production and other adjustments

Payment of Duties from Service tax.

Payment of Service tax from Cenvat

Consolidated debit entry is posted in the Part 2 table

Posting of TR6 Challan entry can be done to the PLA account using transaction J1IH

Notes

SAP AG 9 - 22 WINLEN

SAP AG 2005

Fortnightly Utilization

Option for Cenvat

Payment from Service

Tax

Option for Service tax

Payment from Cenvat

Service Tax / ECS

Credit Account

Service

tax / ECS

Payment

account

While Paying the Cenvat from Service tax the Service tax / ECS on Service tax credit account should be

entered manually.

While Paying Service tax from Cenvat account the Service tax / ECS on Service Tax Payable account should

be entered manually.

Notes

SAP AG 9 - 23 WINLEN

SAP AG 2005

Fortnightly Utilization

The top of the screen is the duty Payable and bottom of the screen is Available balance. You may distribute

the amount to various accounts.

Once you distribute all the amounts to various accounts then the duty at the top will show as Green.

Select the other duty and click on the Select Duty icon to utilize the next duty.

Once you utilize all the Duties then only the Save Icon will be active.

Notes

SAP AG 9 - 24 WINLEN

SAP AG 2005

Other Features

Excise Invoice in Background

Invoice Split

Excise Document Flow

Utilization due list

Batch Utilization

Notes

SAP AG 9 - 25 WINLEN

SAP AG 2005

Excise Invoice In Background

Excise invoice created automatically in background during

creation of billing document

Feature made optional and triggered based on customization

settings

Excise group and Series group automatically determined based

on customization

Provision to print excise invoice immediately after automatic

creation of excise invoice

This functionality facilitates the creation of the outgoing excise invoice in background at the time of

creation of billing document.

After the creation of excise invoice system prompts for printing .

Effects on Customizing

IMG -> Logistic General -> Tax on Goods Movement -> India -> Basic Settings -> Maintain Excise

Groups

Mark the 'Create excise invoice in background

IMG -> Logistic General -> Tax on Goods Movement -> India -> Business Transactions ->

Maintain Default Excise group - Series group determination

For export sales, maintain whether under bond, no bond, deemed exports

Optionally, Maintain sub-transaction type

Automatic determination of excise and series group

During creation of outgoing excise invoice, excise and series group along with sub-transaction type and

export type can be automatically determined by maintaining appropriate customization

Notes

SAP AG 9 - 26 WINLEN

SAP AG 2005

Sales Order

Delivery

Excise Duty posting

Proforma Invoice

Excise Invoice Print

Commercial Invoice

Excise Duty posting

Proforma Invoice

Excise Invoice Print

Excise Duty posting

Proforma Invoice

Excise Invoice Print

Invoice Split

The separation of excise invoice and commercial invoice allows for multiple excise invoices (through split

criteria) while invoicing the customer with a single commercial invoice.

The excise Invoice split in the Proforma excise invoice is based on split criteria like number of items in

preprinted stationery or the material chapter-id. No accounting takes place at this stage. This is a template

for the final Excise invoice to be sent to the customer.

Notes

SAP AG 9 - 27 WINLEN

SAP AG 2005

Delivery

Ship-to-party : 2300

Item Material Qty

10 400 5

Order

Sold-to-party : 2300

Item Material Qty

10 400 5

Billing

Bill-to-party : 2300

Item Material Qty

10 400 5

Excise Invoice

Sold-to-party : 2300

Item Material Qty

10 400 5

SAP AG 1999

Document flow of Excise Invoice

Order

. Delivery

. . Billing

. . .Excise Invoice

Excise Document Flow

Displays all the preceding documents of an outgoing excise invoice.

Also displays cancelled invoices, if any.

Notes

SAP AG 9 - 28 WINLEN

SAP AG 2005

Utilization Due List

Listing of all billing documents due for utilization

provided

Also includes ability to view,

Account balances

Total duty amount needed to utilize the displayed billing

documents

Deficit, if any

Notes

SAP AG 9 - 29 WINLEN

SAP AG 2005

Batch utilization

Excise Invoices can be created in batches

Provision of additional fields in selection screen like

Billing date

SD document category

Billing document category

Notes

SAP AG 9 - 30 WINLEN

SAP AG 2005

You should now be able to:

Understand Excise related sales processes

Understand Sales Tax related sales processes

Run the sales processes

Sales Process : Unit Summary

Você também pode gostar

- Solar Light SystemsDocumento17 páginasSolar Light Systemsswapnil2288Ainda não há avaliações

- SAP SD FAQ'sDocumento8 páginasSAP SD FAQ'ssurendrasimhaAinda não há avaliações

- Solar SystemsDocumento80 páginasSolar SystemssurendrasimhaAinda não há avaliações

- SAP SD DeterminationsDocumento4 páginasSAP SD DeterminationssurendrasimhaAinda não há avaliações

- Acin Ecc5 SD 0007Documento18 páginasAcin Ecc5 SD 0007surendrasimhaAinda não há avaliações

- 1) On Which Conditions We Can Determine Pricing Procdure and How Condition Types and Access Sequence Actully Work. Please Answer With Examples?Documento1 página1) On Which Conditions We Can Determine Pricing Procdure and How Condition Types and Access Sequence Actully Work. Please Answer With Examples?surendrasimhaAinda não há avaliações

- Enterprise StructureDocumento3 páginasEnterprise StructuresurendrasimhaAinda não há avaliações

- Acin Ecc5 SD 0008Documento27 páginasAcin Ecc5 SD 0008surendrasimhaAinda não há avaliações

- Acin Ecc5 SD 0006Documento45 páginasAcin Ecc5 SD 0006surendrasimhaAinda não há avaliações

- Rebate Configuration in SAP SDDocumento31 páginasRebate Configuration in SAP SDVamsi SiripurapuAinda não há avaliações

- SAP SD Configuration GuideDocumento363 páginasSAP SD Configuration Guiderajendrakumarsahu94% (52)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Partnership Accounting Questions and AnswersDocumento3 páginasPartnership Accounting Questions and AnswersLeah Isabelle Nodalo Dandoy100% (1)

- QuickBooks Online Core Certification Exercise Book V22.4.1Documento28 páginasQuickBooks Online Core Certification Exercise Book V22.4.1Shirshah LashkariAinda não há avaliações

- Fa MCQDocumento259 páginasFa MCQPRATIK MUKHERJEEAinda não há avaliações

- 34924bos24617cp5 6Documento51 páginas34924bos24617cp5 6Piyal HossainAinda não há avaliações

- Introduction to FGE Accounting and Financial ManagementDocumento61 páginasIntroduction to FGE Accounting and Financial ManagementGirma100% (4)

- Poa SbaDocumento34 páginasPoa Sbaannmarie100% (2)

- Accounting ProjectDocumento31 páginasAccounting ProjectDaisy Marie A. Rosel50% (2)

- Managerial Accounting Part 2 Job Order CostingDocumento11 páginasManagerial Accounting Part 2 Job Order CostingAllyzzaBuhainAinda não há avaliações

- Read Best Tally ERP top interview questionsDocumento6 páginasRead Best Tally ERP top interview questionsRuqaya AhadAinda não há avaliações

- Acc Addtnl LecDocumento11 páginasAcc Addtnl LecEros EvetryAinda não há avaliações

- Test Bank For Advanced Accounting 3th Edition by Halsey HopkinsDocumento21 páginasTest Bank For Advanced Accounting 3th Edition by Halsey HopkinsVIVI0% (1)

- EobiDocumento6 páginasEobiAmir MirzaAinda não há avaliações

- Bank Reconciliation Statement and Rectification of Errors PDFDocumento16 páginasBank Reconciliation Statement and Rectification of Errors PDFYuki KrAinda não há avaliações

- Common Errors in APP (Automatic Payment Program) - SAP BlogsDocumento5 páginasCommon Errors in APP (Automatic Payment Program) - SAP BlogsAman VermaAinda não há avaliações

- View Answer Correct Answer: (A) Convention of ConservatismDocumento145 páginasView Answer Correct Answer: (A) Convention of ConservatismChinmay Sirasiya (che3kuu)Ainda não há avaliações

- Date General Journal Debit CreditDocumento14 páginasDate General Journal Debit CreditJalaj GuptaAinda não há avaliações

- Soal Mojakoe-UTS Akuntansi Keuangan 1 Ganjil 2020-2021Documento9 páginasSoal Mojakoe-UTS Akuntansi Keuangan 1 Ganjil 2020-2021Vincenttio le CloudAinda não há avaliações

- Bengkel "Maju": Jurnal UmumDocumento4 páginasBengkel "Maju": Jurnal UmumVanesia S MAinda não há avaliações

- Corporate Liquidation - Theory and ProblemsDocumento20 páginasCorporate Liquidation - Theory and ProblemsCarl Dhaniel Garcia SalenAinda não há avaliações

- Form No. 3Cb (See Rule 6G (1) (B) ) Audit Report Under Section 44AB of The Income-Tax Act, 1961 in The Case of A Person Referred To in Clause (B) of Sub-Rule (1) of Rule 6GDocumento10 páginasForm No. 3Cb (See Rule 6G (1) (B) ) Audit Report Under Section 44AB of The Income-Tax Act, 1961 in The Case of A Person Referred To in Clause (B) of Sub-Rule (1) of Rule 6GsamaadhuAinda não há avaliações

- JpmcstatementDocumento6 páginasJpmcstatementxcygonAinda não há avaliações

- Admas University Bishoftu Campus: Course Title - Title: Group Assignment 2 Name ID Section Division DeptDocumento4 páginasAdmas University Bishoftu Campus: Course Title - Title: Group Assignment 2 Name ID Section Division DeptKalkidan Mesfin sheferawAinda não há avaliações

- Savitribai Phule Pune University: Study of With Special Reference To Transport Agency) - A Synopsis Submitted ToDocumento22 páginasSavitribai Phule Pune University: Study of With Special Reference To Transport Agency) - A Synopsis Submitted ToRiya PatelAinda não há avaliações

- CA Inter Accounts Suggested Answer Nov 2022Documento29 páginasCA Inter Accounts Suggested Answer Nov 2022adityatiwari122006Ainda não há avaliações

- Department of Education: Learning Activity Sheet Third QuarterDocumento18 páginasDepartment of Education: Learning Activity Sheet Third QuarterMark Joseph Bielza100% (1)

- Accounting in Action: Accounting Principles, Ninth EditionDocumento51 páginasAccounting in Action: Accounting Principles, Ninth EditionHusni Rasyidin CervinnyAinda não há avaliações

- Balance SheetDocumento28 páginasBalance SheetrimaAinda não há avaliações

- LAPD-VAT-G03 - VAT 409 Guide For Fixed Property and Construction - External GuideDocumento87 páginasLAPD-VAT-G03 - VAT 409 Guide For Fixed Property and Construction - External GuideUrvashi KhedooAinda não há avaliações

- General Accounting and Auditing Test QnsDocumento11 páginasGeneral Accounting and Auditing Test QnsVrinda BAinda não há avaliações

- Set 3Documento14 páginasSet 3Prakshi KansalAinda não há avaliações