Escolar Documentos

Profissional Documentos

Cultura Documentos

Exxon Mobil First

Enviado por

maulana1989Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Exxon Mobil First

Enviado por

maulana1989Direitos autorais:

Formatos disponíveis

Synergy[edit]

The motivations for the Exxon-Mobil merger reflected the industry forces. Companies needed a

secure presence in the regions with high potential for oil/gas discoveries and stronger position to

make large investments. The benefits of the merger fell broadly in two categories: near-term

operating synergies and capital productivity improvements.

[27]

Near-term operating synergies. $2.8 billion in annual pre-tax benefits from

operating synergies (increases in production, sales and efficiency, decreases in unit costs and

combining complementary operations). Management expected to realize the full benefits by the third

year after the merger. During the first two years, the benefits should have been partly offset by one-

time costs at $2 billion for business integration. The firms also planned to eliminate about 9,000 jobs.

A year later, pre-tax annual savings were re-assessed and increased to $3.8 billion.

[32]

Capital productivity improvements. Management also believed the combined company could use

its capital more profitably than either company on its own. These improvements were realized due to

efficiencies of scale, cost savings, and sharing of best management practices. The businesses and

assets of Exxon and Mobil were highly complementary in key areas. In the exploration and

production area, for example, Mobil's and Exxon's respective strengths in West Africa, the Caspian

region, Russia, South America, and North America lined up well, with minimal overlap. The firms

also had a presence in natural gas, with combined sales of about 14 bcfd. And Mobil contributed its

LNG assets and experience to the venture.

[27]

There were technology synergies as well. In upstream, Exxon and Mobil owned proprietary

technologies in the areas of: deepwater and arctic operations, heavy oil, gas-to-liquids processing,

LNG, and high-strength steel. In downstream, their proprietary technology focused on refining and

chemical catalysts. Exxons lube base stocks production fitted well with Mobil's leadership in lubes

marketing.

[27]

Generally, the Exxon-Mobil deal was a move by the dominant partner to increase its

asset base by 30 percent while raising capital productivity.

Upstream

The strength of our global organization allows us to explore for and capture all resource types,

across all geological and geographical environments, using industry-leading technology and

capabilities. We use our unique geoscience capabilities and understanding of the global

hydrocarbon endowment to identify and prioritize all quality resources.

Major projects are more capital intensive, and operating complexity places even greater emphasis

on execution excellence. What remains unchanged is our long-term perspective, disciplined

approach to investment, technological leadership and focus on world-class operational performance.

The strength of our global organization allows us to explore for and capture all resource types,

across all geological and geographical environments, using industry-leading technology and

capabilities. We use our unique geoscience capabilities and understanding of the global

hydrocarbon endowment to identify and prioritize all quality resources.

We deliver industry-leading project execution for a portfolio of diverse opportunities that includes

conventional, heavy oil, tight gas, shale gas, deepwater, liquefied natural gas (LNG), Arctic and sour

gas projects.

We focus on safe operations, reservoir management, continuous improvement and on applying

production operations best practices around the world. With experience and applied technology, we

can capture more oil and gas reserves at both new and mature fields. Advances in seismic imaging,

reservoir simulation, drilling and facility design allow us to reach deposits that were previously

unidentified or unreachable.

Downstream

As the largest global refiner, the majority of our refining capacity is integrated with our lubes and/or

chemical businesses. Our global functional organization facilitates efficient development and

deployment of global best practices and new technologies.

Our downstream operations refine and distribute products derived from crude oil and other feedstocks.

Our global network of manufacturing plants, transportation systems, and distribution centers provides

fuels, lubricants, and other high-value products to customers.

We are the worlds number one supplier of lube basestocks and the largest global marketer of finished

lubricants. Supported by a highly trained field force, a strong distributor network and a robust supply,

ExxonMobil delivers high-quality products and application expertise to customers around the world.

We also create long-term value by selling high-quality products and services daily to millions of

customers across the globe. We market our fuels products to millions of customers worldwide through

our retail service stations and three global business-to-business segments Industrial and Wholesale,

Aviation, Marine Fuels and Marine Lubricants.

2009 Downstream Recap

Exxon Mobil reported GAAP earnings of $1.8 billion, and a return on capital employed of 7% in 2009.

The company's immense complex of refineries produced 5.4 million barrels per day, and Exxon Mobil

invested $3.2 billion in its downstream operations during the year.

Macro View

Exxon Mobil believes that transportation energy demand will grow by 35% by 2030, driven by demand

from the non-OECD or developing world. Despite this growth, Exxon Mobil recognizes the tough current

business environment in the refining and marketing business. The company attributes this to increased

capacity coming on line and new regulatory mandates expected in 2010.

Downstream Strategy

One way that Exxon Mobil will manage through this environment is through cost cutting. The company

has cut its operating expenses by 10% since 2005 in fuels marketing, and plans to continue this in 2010

and beyond.

In refining, Exxon Mobil has increased its purchases of what it calls "challenged crude" or crude oil

feedstock that is more difficult to refine due to its characteristics. Since this feedstock is more difficult to

refine, it trades at a discount to other grades. Exxon Mobil believes the company can utilize its

technology, efficiency and integrated downstream operations and earn an acceptable margin on this

feedstock.

Return On Capital Employed

Exxon Mobil has historically maintained a higher return on capital employed than its competitors in the

downstream, achieving an average return on capital employed of 23% over the 2002-2009 cycle.

Other companies focused on the down stream are also having problems with margins. Frontier Oil

Corporation (NYSE:FTO) reported a loss for the fourth quarter of 2009 and full year, due to what the

company called "weak demand for refined products, particularly distillates, and narrow crude

differentials."

Tesoro Corp (NYSE:TSO) is considering closing its refinery in Hawaii, and turning it into a fuel terminal.

The refinery is operating well under its capacity of 93,500 barrels per day, and averaged only 68,000

barrels per day in 2009.

Sunoco Inc. (NYSE:SUN) reported a loss from continuing operations of $135 million in the fourth quarter

of 2009. The company blamed weak demand for fuel due to the economy.

Bottom Line

Exxon Mobil will attempt to continue making a profit in its downstream operations despite the poor

environment that is plaguing the industry. If history is to be a guide, the company will do better than its

competitors here. (Before jumping into this hot sector, learn how these companies make their money.

To learn more, read Oil And Gas Industry Primer.)

The process of crude oil refining

Printer-friendly version

Once crude oil is extracted from the ground, it must be transported and refined into petroleum products that have any

value. Those products must then be transported to end-use consumers or retailers (like gasoline stations or the

company that delivers heating oil to your house, if you have an oil furnace). The overall well-to-consumer supply

chain for petroleum products is often described as being segmented into three components (shown graphically in

Figure 1).

Upstream activities involve exploring for crude oil deposits and the production of crude oil. Examples of firms

that would belong in the upstream segment of the industry include companies that own rights to drill for oil

(e.g. ExxonMobil) and companies that provide support services to the drilling segment of the industry (e.g.

Halliburton).

Midstream activities involve the distribution of crude oil to refiners; the refining of crude oil into saleable

products; and the distribution of products to wholesalers and retailers. Examples of firms that would belong

in the midstream segment of the industry include companies that transport oil by pipeline, truck or barge

(e.g. Magellan Pipeline); and companies that refine crude oil (e.g. Tesoro).

Downstream activities involve the retail sale of petroleum products. Gasoline stations are perhaps the most

visible downstream companies, but companies that deliver heating oil or propane would also fall into this

category.

Figure 1 Well-to-consumer supply chain for petroleum products. Upstream midstream and downstream

Some companies in the petroleum industry have activities that would fall into upstream, midstream and downstream

segments. ExxonMobil is one example of such a firm. Others have activities that fall primarily into only one segment.

The KinderMorgan pipeline company is an example of a specialized petroleum firm, in this case belonging to the

midstream segment. Many regions have local gas station brands that would specialize in the downstream segment of

the industry. One of the best-known regional examples is the WaWa chain of gas stations and convenience stores in

eastern Pennsylvania, but large grocery stores and retailers like Costco and Wal-Mart are increasingly involved in

downstream sales of petroleum products.

Petroleum refineries are large-scale industrial complexes that produce saleable petroleum products from crude oil

(and sometimes other feedstocks like biomass). The details of refinery operations differ from location to location, but

virtually all refineries share two basic processes for separating crude oil into the various product components. Actual

refinery operations are very complicated. The link below will take you to a 10-minute long video that provides more

details on the various refining processes.

The first process is known as distillation. In this process, crude oil is heated and fed into a distillation column. A

schematic of the distillation column is shown in Figure 2. As the temperature of the crude oil in the distillation column

rises, the crude oil separates itself into different components, called fractions. The fractions are then captured

separately. Each fraction corresponds to a different type of petroleum product, depending on the temperature at

which that fraction boils off the crude oil mixture.

Figure 2: Crude Oil Distillation

Credit: EIA

Figure 3: Important processes of a refinery

Credit: EIA

The second process is known as cracking and reforming. Figure 3 provides a simplified view of how these processes

are used on the various fractions produced through distillation. The heaviest fractions, including the gasoils and

residual oils, are lower in value than some of the lighter fractions, so refiners go through a process called cracking

to break apart the molecules in these fractions. This process can produce some higher-value products from heavier

fractions. Cracking is most often utilized to produce gasoline and jet fuel from heavy gasoils. Reforming is typically

utilized on lower-value light fractions, again to produce more gasoline. The reforming process involves inducing

chemical reactions under pressure to change the composition of the hydrocarbon chain.

The production of final petroleum products differs from refinery to refinery, but in general the oil refineries in the U.S.

are engineered to produce as much gasoline as possible, owing to high demand from the transportation sector.

Figure 4 shows the composition of output from a typical U.S. refinery.

Figure 4: Products made from crude oil

Credit: EIA

Nearly half of every barrel of crude oil that goes into a typical U.S. refinery will emerge on the other end as gasoline.

Diesel fuel, another transportation fuel, is generally the second-most-produced product from a refinery, representing

about one-quarter of each barrel of oil.

Você também pode gostar

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- RCA2600 User Manual Rev C PDFDocumento9 páginasRCA2600 User Manual Rev C PDFMarcus DragoAinda não há avaliações

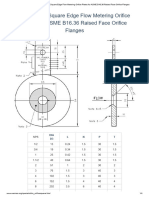

- Wermac - Dimensions of Square Edge Flow Metering Orifice Plates For ASME B16.36 Raised Face Orifice FlangesDocumento4 páginasWermac - Dimensions of Square Edge Flow Metering Orifice Plates For ASME B16.36 Raised Face Orifice Flangestechnicalei sulfindoAinda não há avaliações

- Vintage Airplane - Nov 1973Documento20 páginasVintage Airplane - Nov 1973Aviation/Space History LibraryAinda não há avaliações

- Pipe SupportDocumento224 páginasPipe SupportViswanath NeswaAinda não há avaliações

- Powder Actuated ToolsDocumento1 páginaPowder Actuated ToolsJayvee Baradas ValdezAinda não há avaliações

- Construction HSE ManualDocumento16 páginasConstruction HSE ManualAndika Apish67% (3)

- Engine Technology International - September 2014Documento108 páginasEngine Technology International - September 2014Guilherme PfeilstickerAinda não há avaliações

- Engineered Industrial Refrigeration Systems Application PDFDocumento389 páginasEngineered Industrial Refrigeration Systems Application PDFNor Firdaus YunusAinda não há avaliações

- SIRL en Circular Silencers.Documento2 páginasSIRL en Circular Silencers.CTLAinda não há avaliações

- Investment Casting Engineer in UaeDocumento4 páginasInvestment Casting Engineer in UaeSubramanian Subburu100% (1)

- Mitsubishi Manuals 1045Documento297 páginasMitsubishi Manuals 1045popica_barosanu1986100% (2)

- PEO Referee QuestionnaireDocumento2 páginasPEO Referee QuestionnaireVineeth Kumar C G100% (1)

- BMI Vietnam Oil and Gas Report Q2 2014Documento137 páginasBMI Vietnam Oil and Gas Report Q2 2014Phạm ThaoAinda não há avaliações

- KAIZEN® BASICS-Need For Kaizen in Everyday Business Life: Kaicho Masaaki ImaiDocumento23 páginasKAIZEN® BASICS-Need For Kaizen in Everyday Business Life: Kaicho Masaaki ImaiAshish KariyaAinda não há avaliações

- 05 - FIDIC and NEC3Documento55 páginas05 - FIDIC and NEC3Ka Yu YeungAinda não há avaliações

- Genus Power IIFL ICDocumento17 páginasGenus Power IIFL ICarif420_999Ainda não há avaliações

- Csic April 2013Documento52 páginasCsic April 2013prof_ktAinda não há avaliações

- Clemson University Starbucks Coffee Company: Architects Project No. 0816.01Documento35 páginasClemson University Starbucks Coffee Company: Architects Project No. 0816.01Machu SoPe100% (1)

- PP (SCM) Consultant Certification Question BankDocumento121 páginasPP (SCM) Consultant Certification Question BankSuraj Kamble100% (1)

- ECA Presentation Outline (Customer Copy)Documento12 páginasECA Presentation Outline (Customer Copy)prabuharan89Ainda não há avaliações

- 20120522022911 (1)Documento153 páginas20120522022911 (1)FlankerSparrowAinda não há avaliações

- Oertli - SculeDocumento307 páginasOertli - SculeDore EmilAinda não há avaliações

- A Manager's Introduction To Agile Development: Pete Deemer CPO, Yahoo! India R&DDocumento11 páginasA Manager's Introduction To Agile Development: Pete Deemer CPO, Yahoo! India R&DEmran HasanAinda não há avaliações

- IJ GIS en - CompressedDocumento24 páginasIJ GIS en - CompressedpopaminoAinda não há avaliações

- CIM Question BankDocumento5 páginasCIM Question Bankselvi6496Ainda não há avaliações

- Client Server ComputingDocumento27 páginasClient Server Computingshriharsh123100% (1)

- Introduction To Operations ManagementDocumento40 páginasIntroduction To Operations ManagementDanielGómezAinda não há avaliações

- Steps To Maximize Screening Efficiency - Pit & Quarry - Pit & QuarryDocumento4 páginasSteps To Maximize Screening Efficiency - Pit & Quarry - Pit & QuarryAndreasAinda não há avaliações

- Evolution and Future of Electronic Media in PakistanDocumento6 páginasEvolution and Future of Electronic Media in PakistanAdilMirAinda não há avaliações

- STD1 Crimping Chart March 2020 Final 2Documento1 páginaSTD1 Crimping Chart March 2020 Final 2Bernd RichterAinda não há avaliações