Escolar Documentos

Profissional Documentos

Cultura Documentos

The Framework of Islamic Financial Products

Enviado por

fashdeen0 notas0% acharam este documento útil (0 voto)

50 visualizações30 páginasDiscussion around the general framework for Islamic products

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDiscussion around the general framework for Islamic products

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

50 visualizações30 páginasThe Framework of Islamic Financial Products

Enviado por

fashdeenDiscussion around the general framework for Islamic products

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 30

INCEIF

The Global University in Islamic finance

Kuala Lumpur, Malaysia

CI FP

The framework of Islamic financial products based on various

Shariah principles and their classifications.

Semester January, 2012

FASHOLA OLAYINKA NURUDEEN

Student ID: 1100275

2

Abstract.

ALLAH has created man as a social being by nature. Thus, he needs others

whom will deal with him in all matters of his life such as trading and marriage

in order to benefit each other, individually or collectively. Due to the negative

side of man, such as having a soul which always command him to do bad

things, the Lawgiver has enacted the law for financial transactions and He has

ordained regulations for disposition of man.

Therefore, it is necessary for everyone to have an adequate knowledge of these

financial laws, their nature and varieties; their essential requirements and

conditions; their rules and legal effects, etc. This write up seeks to explore the

Islamic financial products, their classifications base on the Shariah principles

and how they can be applied to the Islamic banking and general financial

transactions towards ensuring that the limits and laws of ALLAH are

protected.

3

Objectives of the research.

To identify the various Shariah principles in Islamic financial transactions

To identify the classifications of the Shariah principles in Islamic financial

transactions

To discuss the framework of the Shariah principles and its classification in the design

and development of Islamic financial products.

To discuss how Shariah principles are applied to modern Islamic banking and finance.

Key terms of the research

* Shariah Principles *Islamic Banking *Islamic Financial Products *Ijarah * Musharakah

4

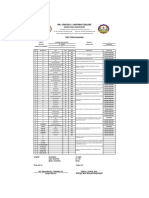

Table of Content

1.0 Introduction. .................................................................................................................... 5

2.0 Shariah Principles in Islamic Finance. ............................................................................ 7

3.0 Classification of Shariah Principles in Financial Transaction. ............................................ 9

3.1 Sales Base Principles. ..................................................................................................... 11

3.2 Profit-sharing principle. ................................................................................................. 13

3.3 Lease-based Principles ................................................................................................... 14

3.4 Benevolent-loan Principles. ........................................................................................... 14

3.5 Fee-based Principles ....................................................................................................... 14

3.6 Supporting Principles. .................................................................................................... 15

4.0 Application of Sharia Principles. ....................................................................................... 17

4.1 Islamic Deposits/ Investment Accounts. ........................................................................ 17

4.2 Islamic Financial Products. ............................................................................................ 18

4.3 Takaful products. ............................................................................................................ 20

4.4 Equity based products. ................................................................................................... 21

5.0 Lease Based Principles Ijarah. ........................................................................................ 22

5.1 Definition ....................................................................................................................... 22

5.2 Ruling on Ijarah. ............................................................................................................. 22

5.3 Types of Ijarah. .............................................................................................................. 22

5.4 Application of Ijarah. ..................................................................................................... 23

5.4.1 Financial lease to obtain desired asset......................................................................... 23

5.4.2 Financial lease to get cash. .......................................................................................... 25

6.0 Profit Sharing Base Principles Musharakah ................................................................... 27

6.1 Asset finance via Musharakah........................................................................................ 27

7.0 Conclusion ......................................................................................................................... 29

8.0 References .......................................................................................................................... 30

5

1.0 Introduction.

Islamic finance is finance under Islamic law (or Shariah) principles. The basic sources of

Shariah are the Quran and the Sunna, which are followed by the consensus of the jurists

and interpreters of Islamic law. The central feature of the Islamic finance system is the

prohibition in the Quran of the payment and receipt of interest (or riba). The strong

disapproval of interest by Islam and the vital role of interest in modern commercial banking

systems led Muslim thinkers to explore ways and means by which commercial banking could

be organised on an interest-free basis.

Islamic financial institutions are relatively recent creations: one of the first Islamic banks was

set up in Egypt in 1963. Although the origin of modern Islamic banking was in Egypt, it

probably would not have developed as an important financial force without the strong support

of Saudi investors. The Islamic Development Bank (IDB) was established in 1975 and gave

momentum to the Islamic banking movement. It was the first time in modern Muslim history

that an international financial institution committed itself to conduct its activities in

conformity with the Shariah. Instead of working on the basis of interest, the bank was

authorised to levy a service fee to cover its administrative expenses.

Since the creation of the IDB, a number of Islamic banking institutions have been established

all over the world and some countries have taken the necessary steps to organise their

banking systems along Islamic lines. The first private Islamic commercial bank, the Dubai

Islamic Bank, was founded in 1975.

Because of the restriction on interest-earning investments, Islamic banks must obtain their

earnings through profit-sharing investments or fee-based returns. When loans are given for

business purposes, the lender, if he wants to make a legitimate gain under the Shariah,

6

should take part in the risk. If a lender does not take part in the risk, his receipt of any gain

over the amount loaned is classed as interest. Islamic financial institutions also have the

flexibility to engage in leasing transactions, including leasing transactions with purchase

options.

Traditionally an Islamic bank offers two kinds of services:

Those for a fee or a fixed charge, such as safe deposits, fund transfer, trade financing,

property sales and purchases or handling investments

Those that involve partnerships in investments and the sharing of profits and losses.

7

2.0 Shariah Principles in Islamic Finance.

The basic framework for an Islamic financial system is a set of rules and laws, collectively

referred to as Shariah, governing economic, social, political and cultural aspects of Islamic

societies. Shariah originates from the rules dictated by the Quran and its practices, and

explanations rendered (more commonly known as Sunnah) by the Prophet Muhammad.

Further elaboration of the rules is provided by scholars in Islamic jurisprudence within the

framework of the Quran and Sunnah. The basic principles of an Islamic financial system can

be summarized as follows:

1. Prohibition of interest :

Prohibition of Riba, a term literally meaning "an excess" and interpreted as "any unjustifiable

increase of capital whether in loans or sales" is the central tenet of the system. More

precisely, any positive, fixed, predetermined rate tied to the maturity and the amount of

principal (i.e.) guaranteed regardless of the performance of the investment) is considered

Riba and is prohibited.

The general consensus among Islamic scholars is that Riba covers not only usury but also the

charging of "interest" as widely practiced. This prohibition is based on arguments of social

justice, equality, and property rights. Islam encourages the earning of profits but forbids the

charging of interest because profits, determined ex post, symbolize successful

entrepreneurship and creation of additional wealth whereas interest, determined ex ante, is a

cost that is accrued irrespective off the outcome of business operations and may not create

wealth if there are business losses. Social justice demands that borrowers and lenders share

8

rewards as well as losses in an equitable fashion and that the process of wealth accumulation

and distribution in the economy be fair and representative of true productivity.

2. Risk sharing :

Because interest is prohibited, suppliers of funds become investors instead of creditors. The

provider of financial capital and the entrepreneur share business risks in return for shares of

the profits.

3. Money as Potential" Capital :

Money is treated as "Potential" capital -that is, it becomes actual capital only when it joins

hands with other resources to undertake a productive activity. Islam recognizes the time value

of money, but only when it acts as capital, not when it is "Potential" capital.

4. Prohibition of speculative behavior :

An Islamic financial system discourages hoarding and prohibits transactions featuring

extreme uncertainties, gambling, and risks.

5. Sanctity of contracts :

Islam upholds contractual obligations and the disclosure of information as a sacred duty. This

feature is intended to reduce the risk of asymmetric information and moral hazard.

9

3.0 Classification of Shariah Principles in Financial Transaction.

The shariah has established the basic foundation and principles upon which any financial

transactions can be valid under the Islamic law. These principles have been highlighted in the

section above. Furthermore, the development of financial products in Islam must also key

into these principles.

There are various ways of classifying Islamic financial product and this is largely based on

the perspective the jurist or the individual is looking at it from. A transaction can be valid

(Sahih), voidable (Fasid) and void (batil). Below are the other classification base on different

perspectives:

Transaction pertaining to transfer of property

o Bay and its sort

o Hadiyyah, Hibah/Minhah

o Wasiyyah

o Ihya al-Mawat

o Shufah

Transaction pertaining to the utilisation of Usufruct

o Ijarah

10

o Qard/ Salaf /Ariyah

o Waqf / Habs

Transaction pertaining to do a job

o Wikalah

o Jualah

o Musaqah, Muzaraah, Mugharasah

o Istisna

Transaction pertaining to Investment

o Wadiah

o Sharikah and its sort

Transaction pertaining to Authentication

o Rahn

o Kafalah

o Hawalah

Transaction pertaining to Protection of Rights

o Taaddi, Ghasb and Ihtikar

o Hajr and Taflis

o Isa

11

o Luqtah

Transaction Pertaining to Settlement of rights and disputation

o Tahkim

o Sulh and Iqalah

o Qismah

One of the well known approaches in classifying financial transaction in Islam is from the

view point of the practice of modern banking and finance. Base on this method, classification

is made base on funding as practiced by modern Islamic banks. Thus Islamic financial

transaction can be classified base on the following:

Sales-based Principles

Profit-sharing Principles

Lease-based Principles

Benevolent-loan Principles

Fee-based Principles

Supporting Principles

3.1 Sales Base Principles.

The sales base principle is considered as the fundamental shariah principle in financial

transition in Islam. The sales base principles can be further classified as shown below:

Base on legitimacy of the transaction

o Sahih transaction: this is a lawful and valid transaction.

12

o Batil transactions: this is a form of sales that are unlawful and not valid

examples are bai al-mulamasah sale is concluded by touching an article.

bai al-hasat a transaction determined by throwing stones

Base on Exchange of Items

o Bayal-Muqayadah (Barter Trading): This is a sales where one commodity

is exchange with another. However, if the commodity falls within the class of

ribawi items then both commodities must be of the same genus.

o Bayal-Mutlaq (General Sale): This is a sale of goods for money and its the

most preferable mode of sales.

o Bayal-Sarf: This type of sale involves the exchange of any common currency

for another.

Base on deferment of payment or subject matter.

o Normal Sale: This is a normal sale in which no deferment is effected on either

the payment or subject matter.

o Sale with deferred payment (Bay bithaman ajil): This is a sale where the

payment is deferred to a latter time but the subject matter is exchanged in the

session.

o Forward Sale (Bay al-salam): This is a sale where the purchaser pays the

price in advance and the subject matter is delivered at a specified future date.

Base on disclosure of cost price and profit.

o Normal bargaining sale (bay al-musawamah): This sale is where both

parties agrees on the price and thereafter exchange the subject matter.

o Fiduciary sales (buyu al-amanh): This is a type of sales where the buyer

depends and relies totally on the integrity of the seller as regards the cost and

13

profit/loss that he discloses to the buyer. This can be further categories as

below:

Cost-plus sale (bay al-murabaha): This is a sale where the subject

matter is sold at a price covering the purchase price plus the profit

margin agreed upon between the contracting parties.

Tawliyyah: This is a sale at the original cost price with no profit or

loss to the seller.

Wadiah: This is a sale at a discount from the original cost.

3.2 Profit-sharing principle.

The profit- sharing principle is often used by the Islamic bank for most of their transactions.

There are basically two types of profit sharing principles as detailed below

Mudarabah: It is a type of trading partnership in which capital is contributed by the

capital provider (rabb al-mal) and labour from the entrepreneur (mudarib). The profit

is shared between them. In case of loss, it is born by the capital provider. The

entrepreneur only suffers from the fruitless efforts.

Shirkah: It is a profit and loss sharing partnership and takes three major forms.

o Shirkat al-Amwal: It is a partnership in which participation is based on the

contribution of capital by all partners.

o Shirkat al-Abdan: It is a partnership in which participation by the partners is

based on labour or skill.

o Shirkat al-Wujuh: It is a partnership based on the credit- worthiness of the

partners. The ratio of loss is based on theliability borne whereby the ratio of

profit could be based on either the liability borne by each partner or mutual

agreement between them.

14

3.3 Lease-based Principles

The lease-based principle uses the concept of Ijrah. Ijarah means lease, rent or wage.

Generally, Ijarah concept means selling the benefit of use or service for a fixed price or wage.

Under this concept, the Bank makes available to the customer the use of service of assets /

equipments such as plant, office automation, motor vehicle for a fixed period and price.

3.4 Benevolent-loan Principles.

This principle is based on the concept of Qard Hassan. A virtuous loan. Loan in the meaning

of a virtuous loan that is interest-free and extended on goodwill basis, mainly for welfare

purposes, the borrower is only required to pay back the borrowed amount. The loan is

payable on demand and repayment is obligatory. But if a debtor is in difficulty, the

lender/creditor is expected to extend time or even to voluntarily waive repayment of the

whole or a part of the loan amount. Islam allows loan as a form of social service among the

rich to help the poor and those who are in need of financial assistance. Qard Hasan may be

viewed as something between giving charity or gift and giving a loan (qard). A debtor may

voluntarily choose to pay an extra amount to the lender/creditor over the principal amount

borrowed (without promising it) as a token of appreciation. This type of loan does not violate

the prohibition on Riba, since it is the only type of loan that does not compensate the creditor

for the time value of money. Such loans have not been uncommon in human history among

peers, friends, family and relatives.

3.5 Fee-based Principles

The fee-based principle is used by the Islamic bank to generate legitimate income. Among

the most important concept used are detailed below:

15

Wakalah Agency: This is a contract of agency in which one party appoints another

party to perform a certain task on its behalf, usually for payment a fee or commission.

An agency arrangement without provision for payment of a fee cannot be considered

irrevocable, thus allowing an agent the right to terminate the agency at any time. Can

be commutative or non-commutative. A bank may charge fees or providing certain

services to its customers; the bank can also pay a fee to perform an activity on behalf

of the bank, such as an agent to take delivery of goods or investing the banks funds.

Kafalah: Surety, An obligation in addition to an existing obligation in respect of a

demand for something. Lit: responsibility or suretyship. It is a covenant or pledge

given. Legally, a third party becomes surety for the payment of a debt of another.

Suretyship in Shariah is the creation of an additional liability with regard to a claim,

not to the debt or the assumption only of a liability and not of the debt. A person

providing surety or a guarantor is known as Kafil. Islamic banks use Kafalah to issue

guarantees for their business customers, for example, the bank may guarantee the

customers standing to facilitate any business endeavours that may require such

guarantees, or the bank may give a surety to the owner of a ship or the shipping agent,

to discharge goods imported by a customer on arrival of the carrying ship, pending

receipt of the original shipping documents before the customer can take delivery of

the imported goods.

3.6 Supporting Principles.

The supporting principles are based on the concept highlighted below:

Hawalah: Literally, it means transfer; legally, it is an agreement by which a debtor is

freed from a debt by another becoming responsible for a debt or the transfer of a claim

of a debt by shifting the liability for payment from one person to another, such as a

contract for assignment of debt. Thus the responsibility for payment shifts to another

16

party. It also refers to the document by which the transfer or assignment takes place,

such as a bill of exchange, promissory note, cheque or draft.The mechanism of

Hawalah is used for settling accounts by book transfers without the need for physical

transfer of cash.

Rahn: This is a pledge. Collateral; technically and legally, it means to pledge or

lodge a real or tangible property of material value as security for a debt or pecuniary

obligation so as to make it possible for the creditor to recover the debt, in case of non-

payment or default, by selling the pledged property. A security given for the payment

of a debt.

Wadiah: Literally it means safekeeping. In Islamic banking, wadiah refers to the

deposited property, the acceptance of sums of money for safe-keeping in a Shari'ah-

compliant framework, under which it will be repaid. Islamic banks use the concept of

Wadiah (and Amanah) to accept deposits from customers. A bank is deemed as a

keeper and trustee of funds and becomes wholly responsible and liable for its

safekeeping with a guarantee refund of the entire amount of the deposit, or any part of

the outstanding amount, when the depositor demands repayment. The bank may at its

discretion and in certain circumstances reward the customer with a payment in the

form of Hibah as appreciation for keeping the funds with the bank

17

4.0 Application of Sharia Principles.

The Islamic banks and the Islamic financial institutions develops products base on customers

request towards the satisfaction of the customers requirement. However, these product must

at every time and all times be shariah compliant. Thus in the development of Islamic financial

product the principles of shariah is applied.

This sections looks at the various products offered by the modern Islamic bank and financial

institutions and how they have applied the various concepts of the shariah principles. Detailed

below are the various Islamic financial products and the shariah principles applied.

4.1 Islamic Deposits/ Investment Accounts.

For the Islamic banking products and service, their products are broadly categorized into two:

deposit and financing. In the case of deposit there are two main category which are

transactional accounts comprising both saving and current account as well as investment

accounts represented by Mudarabah. The table below shows a summary of the banking

products and the shariah principle applied.

Account Types Shariah Principles Notes

Savings Account Wadiah yad dhamanah Liability to the bank

Qard Liability to the bank

Mudarabah No Liability to the bank

Current Account Wadiah yad dhamanah Liability to the bank

Qard Liability to the bank

Hybrid of Qard and Mudarabah Liability to the bank and profit sharing

18

4.2 Islamic Financial Products.

The Islamic financial products are meant for many different purposes which are broadly

categorized into two main categories, retail and corporate. However, looking from the

perspective of the purpose of the product, these products could be classified as either asset

financing, cash or personal financing, or project financing, trade financing, or SME

financing. The table below depicts these products and the shariah principle applied.

Products Shariah Principles Notes

Housing Financing

Murabahah This is a mark-up sale

Istisna (Parallel Istisna) A form of progressive

payment for house under

construction

Ijarah muntahiya bittamleek Lease with an option to

purchase at the end of the

lease period

Forward Ijarah Financing house under

construction base on advance

rental payment

Musharakah mutanaqisah A form of decreasing

partnership ended up with

ultimate ownership by the

customer

Vehicle Financing Murabahah A form of mark-up sale

Ijarah muntahiya bittamleek /

Ijarah thumma al-bay

Lease with an option to

purchase at the end of the

19

lease period

Working Capital Financing Murabahah A form of mark-up sale

Ijarah muntahiya bittamleek /

Ijarah thumma al-bay

Lease with an option to

purchase at the end of the

Tawarruq A form of cash financing

Salam A form of forward sales

Sales and Leas Back Refinancing

Project Financing Murabahah Profit sharing with the banks

and client

Musharakah Profit and loss sharing with

the bank and the client

Istisna and Parallel Istisna Progressive payment

Sales and Leas Back Refinancing

Murabahah Working capital

Tawarruq A form of cash financing

Trade Financing LC based on Wakalah A fee-based transaction

LC based Murabahah A mark-up sales

LC based Musharakah Profit and loss sharing with

the bank and the client

Debit Card Set-off (muqasah) No Liability

Charge Card Tawarruq / Inah Cash facility

Kafalah A fee-based transaction

Overdraft Tawarruq / Inah Cash facility

Factoring Bay al-dayn A sales of debt to another

20

party

Letter of guarantee Kafalah A fee-based transaction

Personal Financing Tawarruq / Inah Cash facility

Service Financing Ijarah (sub-lease) Based on sub-leas

4.3 Takaful products.

Another important segment of the Islamic financial landscape is Takaful Islamic Finance.

Products within this space are for the purpose of providing indemnity and compensation for

the participants. The table below shows the two major takaful products and the shariah

principles used for its applications.

Products Shariah Principles Notes

General Takaful Tabarru (Donation) A contract of Wakala is signed

between the participants and the

takaful operator.

Waqf (Endowment) A contract of Mudarabah is signed

between the participants and the

takaful operator.

Family Takaful Tabarru and Mudarabah A contract of Wakalah and

Mudarabah is signed between the

participants and the takaful

operator.

Tabrru A contract of Wakala is signed

between the participants and the

takaful operator.

21

4.4 Equity based products.

Equity is an ownership position in an organisation or project or venture taken through an

investment. Returns on the investment are dependent on the profitability of the organisation

or project. These types of products are for Islamic capital market a summary of these

products and the underlining shariah principles are detailed below:

Products Shariah Principles Notes

Share/ Equity Musharakah The company must have been

screened using the shariah

criteria before investing in the

company can be valid.

Mutual Funds/ Unit Trust Musharakah and Wakalah An agreement of musharakah is

signed amongst the investors and

a wakalah agreement between

the investors and fund managers.

Private Equity Funds Musharakah and Wakalah This can be used during the

acquisition and management of

companies

REITs Musharakah and Wakalah A form of investment in real

estate related assets

Specific funds e.g aircraft

leasing fund

Musharakah and Wakalah Investment in specified

underlying assets

22

5.0 Lease Based Principles Ijarah.

5.1 Definition

Jurists have defined Ijarah as A contract pertaining to usufruct transfer, with compensation.

The important points from the definitions are :

It differs with sales and purchase of goods concept. Lease is selling and purchasing of

usfruts of goods. However, the goods are still subjected to the ownership of the lessor.

The right to use the usufructs of the asset has switched from owner to the lessee. For

consideration, the lessee has to pay am amount of rental payment to the owner of the

asset.

5.2 Ruling on Ijarah.

The Quranic proof is derived from the verses And if they sukle your offspring, gic=ve them

their recompense (At-Tahrim:6).

The proff from the Sunnah is derived from the hadith: Pay the hired worker his wage before

his sweat dries off (Ibn Maja, no 1980)

It is also known that the Muslim nation during the time of the prophet (SAW) reached a

consensus on the permissibility of leasing. In this regards, the observable usufruct of goods is

clear benefit to the people, thus rending leasing such usufruct, valid based on the validity of

selling the objects themselves.

5.3 Types of Ijarah.

The majority of the jurists have classified lease according to various perspective, the flowing

are the two main perspectives:

Subject Matter of the leased asset: From this perspective of item that is the subject

matter of the lease contract. Leasing can be further classified into three as listed

below:

23

o Ijarah Ain: To lease the usufruct from the specific goods or assets.

o Ijarah Amal: To lease out workers or self skills

o Ijarah Muswsufah Fi Az-Zimmah: this is a form of Ijarah where the assets

needs to be described in details in advance but not is not available at the time

of contract.

Usage and its new structure: if Ijarah is to be viewed from the perspective of its

utilization and its new structure, it can be divided into two new types of lease as

flows:

o Operating Lease: this is the original form of Ijarahain thus the contents and

terms of the contract are similar to a normal lease, especially in the view point

of asset ownership and the responsibility to maintain the asset.

o Financial Lease: It is a type of lease which is normally used by the banks in

order to help their customer to obtain desired asset or obtain cash for various

purpose.

5.4 Application of Ijarah.

The Islamic banks use the concept of Ijarah to help finance asset for their clients. Two

example of the application of Ijarah will be looked at as detailed below:

5.4.1 Financial lease to obtain desired asset.

In order for the customer to purchase the desired assets, he will approach the bank asking for

a financing product, then the flowing process will take place:

24

Bank

Customer

Asset Seller

2

1

3

4

Buy Asset

Lease

Promise Undertaking

Sell @ ownership

transfer

Figure 1: Financial Lease to obtain asset

Base on the illustrations above the following applies:

Promise to undertake: the customer undertakes to lease the asset from the bank. This

process will take place after the customer has identified the desired asset.

Purchase the assets; the bank will purchase the from the seller for cash.

Leasing Contract: after having the beneficial ownership on the asset, the bank will

lease it out to the customer.

Full transfer of ownership; it is done after the end of the last period of the lease, the

bank will transfer its full ownership to the customer, either in the form of gift (then it

is called Ijarah wal iqtina or Ijarah muntahiyah bit tamleek) or selling at the

minimum price (then it is called as Ijarah thumma al-bai)

25

5.4.2 Financial lease to get cash.

In certain situations, the customer might be in need of cash in order to extend its business.

For example a company which posses its own high valuable assets, it can use financial lease

product to obtain cash. The illustration below explains how Ijarah can be used to raise funds.

Bank

Customer

1

2

3

Lease

Sell

Sell @ ownership transfer

Figure 2: Financial Lease to get cash.

Base on the illustrations above the following applies:

The customer, who posses its asset for example machineries, sell it to the bank for the

cash needed by it. The cost of the asset should be valued at market price for example

the machineries cost 1 Million Dollars. Subsequently the bank pays the money to the

customer.

After having ownership of the asset the bank lease it to the customer for the value of

rent, including the profit for example 1.2 Million dollars as a total accumulated rents

for a period of 2 years.

26

After the 2 years period ends and the customer successfully settles out his rental

payment as per agreed, the bank will give its beneficial ownership as a gift to the

customer or sell it at a minimum price.

The outcome of this is that the customer obtains the cash, that is, 1 Million Dollars.

The bank make a profit of 200,000 Dollars from the rent payment

Both parties are able to stay away from riba based loan and their business is

permissible and valid.

27

6.0 Profit Sharing Base Principles Musharakah

Musharakah is a word of Arabic origin which literally means sharing. In the context of

business and trade it means a joint enterprise in which all the partners share the profit or loss

of the joint venture. It is an ideal alternative for the interest based financing.

6.1 Asset finance via Musharakah.

One of the ways in which Islamic Banks finance assets is the use of Musharakah, the flow

belows shows a practical application of how this concept is used to finance a house.

Islamic Bank

Customer 2

Musharakah contract

4

Assets Seller

3

1

Purchase a

house and

pay 10% as

deposit

Lease shares

Pay 90% of the price

5

Sell by installment

Figure 3: Musharakah contract for Asset purchase

Base on the illustrations above the following applies:

A customer wishes to buy a house identify the property and executes a sale and

purchase agreement, follow by a 10% payment. If the house cost 1 Million dollars, he

pays 100,000 Dollars.

28

In order to obtain the balance of 90% of the house price, the customer applies for a

Musharakah financing from an Islamic Bank. The bank will agree to enter into a

Musharakah contract with the customer to co-join in having ownership of the house.

Subsequently a Musharakah contract is executed.

The bank pays the remaining 90% of the price, that is, 900,000 dollars and agrees to

be a partner in the ownership of the house. Thus the bank owns 90% and the customer

owns 10% of the house.

Since the house is owned by the bank and the customer the bank concludes a lease

agreement with the customer whereby the bank will lease its portion of the ownership

to the customer monthly for a period of 20 years. The rent payment is calculated base

on the target for the total sum of profit by the bank in this finance. For example if the

bank is expected to make a profit 200,000 dollars on this transaction. The customer is

expected to pay back 1.2 Million dollars within 20 years that will translate to 60,000

Dollars yearly which means 5,000 dollars monthly.

At the end of the 20 years the customer would have completely owned the house

100% and it now fully and solely belongs to the customer.

29

7.0 Conclusion

The importance of the Shariah principles in the design, development, implementation and

management of Islamic financial products cannot be over emphasized. Thus every Islamic

financial product must be certified base on the principles of the Shariah. Furthermore in the

evolution of these products to meet the demands of modern times the Islamic banks must also

ensure that they are not driven by profit or wanting to compete with their conventional banks,

Muslims must ensure that at all times the principle of the Shariah is guided jealously.

There is need for an internationally recognized product development and certification body

for the Muslim world that will set the direction for certified Islamic financial products, what

we have today is that in different regions of the world people have different interpretation and

implementation of the Shariah as regards the permissibility or otherwise of some certain

financial products. The objectives of the Shariah are to serve man, make life easy and prevent

any harm to be inflicted upon them. Having this at the back of our mind if the Shariah

principles are well coordinated and implemented the world will be a better place for all.

Hence every Muslim must strive for the implementation of the Shariah financial principles in

the discharge of their economic and financial detailing.

30

8.0 References

Freshfields Bruckhaus Deringer, S and P - IF Outlook, 2006. HSBC Amanah, IF Basic

principles and structures - IF relevance & growth, IBS journal.

INCEIF (2012), CIFP Manual: Shariah Rules in Financial Transaction. INCEIF, Kuala

Lumpur, Malaysia.

INCEIF (2011), CIFP Manual: Shariah Aspects of Business and Finance. INCEIF, Kuala

Lumpur, Malaysia.

Razali HJ. Nawawi (2009). Islamic law on commercial transactions. CERT Publications

Malaysia.

Zaharuddin Abd.Rahman (2010). Contract and the products of Islamic Banking. CERT

Publications Malaysia.

Você também pode gostar

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Strategic Business PlanDocumento10 páginasStrategic Business PlanfashdeenAinda não há avaliações

- SH1002 Shariah AssignmentDocumento26 páginasSH1002 Shariah AssignmentfashdeenAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Wealth Planning and Management - Islamic ViewDocumento24 páginasWealth Planning and Management - Islamic ViewfashdeenAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Islamic Capital MarketDocumento9 páginasIslamic Capital MarketfashdeenAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- Takaful Operators and The Competitive MarketDocumento20 páginasTakaful Operators and The Competitive MarketfashdeenAinda não há avaliações

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Islamic Ethics - The Missing Link in Corporate Governance.Documento15 páginasIslamic Ethics - The Missing Link in Corporate Governance.fashdeenAinda não há avaliações

- Shariah Issues in TakafulDocumento16 páginasShariah Issues in Takafulfashdeen100% (2)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Shariah Requirements in The Contracting PartiesDocumento26 páginasShariah Requirements in The Contracting PartiesfashdeenAinda não há avaliações

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Risk Management in Islamic Financial InstitutionDocumento14 páginasRisk Management in Islamic Financial InstitutionfashdeenAinda não há avaliações

- Customer Profile - Islamic DepositDocumento11 páginasCustomer Profile - Islamic DepositfashdeenAinda não há avaliações

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- Islamic EconomicsDocumento14 páginasIslamic EconomicsfashdeenAinda não há avaliações

- Islamic Capital MarketDocumento9 páginasIslamic Capital MarketfashdeenAinda não há avaliações

- Financial Reporting in IslamDocumento9 páginasFinancial Reporting in IslamfashdeenAinda não há avaliações

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Financial Due-Diligence in IslamDocumento14 páginasFinancial Due-Diligence in IslamfashdeenAinda não há avaliações

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Ethics and Governance in IslamDocumento12 páginasEthics and Governance in IslamfashdeenAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Alternative To Riba - Case Study of Tricent Capital NigeriaDocumento10 páginasAlternative To Riba - Case Study of Tricent Capital NigeriafashdeenAinda não há avaliações

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Islamic EconomicsDocumento14 páginasIslamic EconomicsfashdeenAinda não há avaliações

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- Feasibility Report On Fish Farm ProductionDocumento14 páginasFeasibility Report On Fish Farm Productionfashdeen86% (49)

- Islamic Capital MarketDocumento9 páginasIslamic Capital MarketfashdeenAinda não há avaliações

- Good Goverance in Islamic FinanceDocumento12 páginasGood Goverance in Islamic FinancefashdeenAinda não há avaliações

- Islamic Economics World ViewDocumento4 páginasIslamic Economics World ViewfashdeenAinda não há avaliações

- Table No 91Documento2 páginasTable No 91ssfinserv100% (1)

- Monument Square RFPDocumento16 páginasMonument Square RFPCecelia SmithAinda não há avaliações

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Central BankingDocumento22 páginasCentral BankingKhalid AzizAinda não há avaliações

- 19-01 Audit Report - Grove Harbour Marina - FINAL PDFDocumento11 páginas19-01 Audit Report - Grove Harbour Marina - FINAL PDFal_crespoAinda não há avaliações

- Powers of The PresidentDocumento3 páginasPowers of The PresidentGiancarla Maria Lorenzo DingleAinda não há avaliações

- Central Excise DutyDocumento25 páginasCentral Excise DutyAbhinav SharmaAinda não há avaliações

- SBI Overview: History, Leadership, OperationsDocumento59 páginasSBI Overview: History, Leadership, Operationspuneetbansal14Ainda não há avaliações

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- SME'sDocumento7 páginasSME'sJiezelEstebeAinda não há avaliações

- Meter or That The Subject Properties Be Sold To A Third Party, VOLCANO LAKEVIEW RESORTS, INC. (Claimed ToDocumento3 páginasMeter or That The Subject Properties Be Sold To A Third Party, VOLCANO LAKEVIEW RESORTS, INC. (Claimed ToDiane ヂエンAinda não há avaliações

- 2007-Garcia - v. - Social - Security - Commission - Legal and Collection PDFDocumento13 páginas2007-Garcia - v. - Social - Security - Commission - Legal and Collection PDFKatrina BarrionAinda não há avaliações

- ACCT 3110 CH 7 Homework E 4 8 13 19 20 27Documento7 páginasACCT 3110 CH 7 Homework E 4 8 13 19 20 27John Job100% (1)

- Delivery Receiving InstructionsDocumento2 páginasDelivery Receiving InstructionsadilsyedAinda não há avaliações

- Frank Catania Complaint Answer - Misappropriating A Client's MoneyDocumento25 páginasFrank Catania Complaint Answer - Misappropriating A Client's MoneyAll About The TeaAinda não há avaliações

- Clarity Inquiry #4y8tjzb6g4Documento56 páginasClarity Inquiry #4y8tjzb6g4Patricia CarvajalAinda não há avaliações

- Tax Law Notes - Income From BusinessDocumento12 páginasTax Law Notes - Income From BusinessWinson Li100% (1)

- Branch Accounting TestbankDocumento5 páginasBranch Accounting TestbankCyanLouiseM.Ellixir100% (6)

- Mortage Meaning and Kinds of Mortgage: Central University of South Bihar GAYA-823001Documento5 páginasMortage Meaning and Kinds of Mortgage: Central University of South Bihar GAYA-823001CHANDAN KUMARAinda não há avaliações

- El Texto en Pasado SimpleDocumento2 páginasEl Texto en Pasado SimpleValentin BatenAinda não há avaliações

- IB235 Seminar 2 - Qs PDFDocumento4 páginasIB235 Seminar 2 - Qs PDFWizzy BonderAinda não há avaliações

- What Is LAFDocumento3 páginasWhat Is LAFTaruna JunejaAinda não há avaliações

- Accounts 11th Class Sample PaperDocumento8 páginasAccounts 11th Class Sample PaperVineet SinghAinda não há avaliações

- Affordable Housing Recommendations To The Mayor ReportDocumento30 páginasAffordable Housing Recommendations To The Mayor ReportMinnesota Public RadioAinda não há avaliações

- Annual Report 2011 Eitzen ChemicalsDocumento88 páginasAnnual Report 2011 Eitzen Chemicals1991anuragAinda não há avaliações

- Ohnb18 14052 CreditorsDocumento2 páginasOhnb18 14052 CreditorsAnonymous YU6gbBcvu3Ainda não há avaliações

- The Reporting Entity and Consolidation of Less-than-Wholly-Owned Subsidiaries With No DifferentialDocumento76 páginasThe Reporting Entity and Consolidation of Less-than-Wholly-Owned Subsidiaries With No Differentialhalvawin100% (1)

- Financial Accounting and Analysis Exam QuestionsDocumento2 páginasFinancial Accounting and Analysis Exam QuestionsPraveena MallampalliAinda não há avaliações

- Mortgage BasicsDocumento37 páginasMortgage BasicsAnkita DasAinda não há avaliações

- Dr. Carlos S. Lanting College Test Item AnalysisDocumento1 páginaDr. Carlos S. Lanting College Test Item AnalysisEdna Grace Abrera TerragoAinda não há avaliações

- Oblicon DigestsDocumento33 páginasOblicon Digestsjlumbres100% (1)

- Ackman's Letter To PWC Regarding HerbalifeDocumento52 páginasAckman's Letter To PWC Regarding Herbalifetheskeptic21100% (1)

- Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do NotNo EverandRich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do NotAinda não há avaliações

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeNo EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeNota: 4.5 de 5 estrelas4.5/5 (85)

- Baby Steps Millionaires: How Ordinary People Built Extraordinary Wealth--and How You Can TooNo EverandBaby Steps Millionaires: How Ordinary People Built Extraordinary Wealth--and How You Can TooNota: 5 de 5 estrelas5/5 (321)

- Summary: The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness by Morgan Housel: Key Takeaways, Summary & Analysis IncludedNo EverandSummary: The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness by Morgan Housel: Key Takeaways, Summary & Analysis IncludedNota: 5 de 5 estrelas5/5 (78)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)No EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Nota: 4.5 de 5 estrelas4.5/5 (12)