Escolar Documentos

Profissional Documentos

Cultura Documentos

Annual Review Presentation!!! Final

Enviado por

Misha IasinskyiDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Annual Review Presentation!!! Final

Enviado por

Misha IasinskyiDireitos autorais:

Formatos disponíveis

1

st

Year PhD

Annual Review

Research Title:

The global financial crisis and its impact on

banking M&As in the European Union

PhD Candidate: Mykhailo Iasinskyi

Supervisors: Dr Beat Reber

Dr Dev Vencappa

Student ID: 4213471

Presentation Plan:

1. Research background

2. Literature review

Theoretical studies

Empirical studies

3. Contribution

4. Data and methodology

5. Timeline to completion

The Background of the Research

Factors influencing changes in banking M&A

market over last 2 decades:

1. Technological progress;

2. Globalisation of financial markets;

3. Improved supervision and regulatory environment;

4. Introduction of the Euro;

5. Establishment of the European Single Market.

The Background of the Research

Figure 1. Number of M&As in the European banking

sector

Source: ECB Report, Nov. 2013

The Background of the Research

Explanations in the academic literature:

Procyclical behaviour (over-lending during upward

phase and over-cautious lending during downward

phase (Goddard et al.,2007 );

Informational asymmetries;

Herd behaviour;

Institutional memory (Altman et al., 2005), Berg et al.,

2005), Bikker and Metzemakers, 2005)

The Background of the Research

Merger waves in history:

Period Name Special attributes

1897 - 1904 First wave

Horizontal mergers

1916 - 1929 Second wave

Vertical mergers

1965 - 1969 Third wave

Conglomerate mergers

1981 - 1989 Fourth wave

Hostile takeovers, junk

bonds-driven LBOs

1992 - 2000 Fifth wave

Global and cross-border

mergers

2003 - 2008 Sixth wave

High volumes, cross-

border mergers,

shareholders activism

The Background of the Research

Recent merger waves in the EU banking:

Fifth merger wave

characteristics

- growth in cross-border deals;

- large number of strategic

bidders;

- extreme losses suffered by

acquirers;

- ended after dot.com crash (2000)

Sixth merger wave

characteristics

- motivated and driven by

excessive liquidity;

- therefore large stake of cash-

financed mergers;

- high volumes of merger deals;

- ended after subprime mortgage

market crashed (2008)

The Background of the Research

Figure 2. Number of financial institutions in the EU:

Source: ECB Press release, 21 Jan. 2014

The Background of the Research

General characteristics of banking M&As in

the EU:

Almost 30% of deals number and 40% of total deals

value in all European mergers;

Prevalence of low-volume domestic deals in the 1990s;

Countries with the most intensive merger activities:

Germany, France, Italy, Austria;

Relatively low number of cross-border deals (<20%)

since banking M&A market reached its peak in 1999.

The Background of the Research

Figure 3. Cross-border penetration in the EU financial

sector

Source: ECB Monthly Reports

The Background of the Research

General characteristics of banking M&As in

the EU:

Almost 30% of deals number and 40% of total deals

value in all European mergers;

Prevalence of low-volume domestic deals in the 1990s;

Countries with the most intensive merger activities:

Germany, France, Italy, Austria;

Relatively low number of cross-border deals (<20%)

since banking M&A market reached its peak in 1999.

The Background of the Research

Explanation of low level of cross-border

activities:

Ineffective merger control;

Misuse of political and regulatory powers;

Disharmonised taxation systems in EU members;

Differences in language and culture.

The Background of the Research

Mechanism of external shock caused by global

financial crisis:

Credit boom and easy access to liquidity undermined long-term risk

assessment by banks;

Subprime mortgage market crashed in late 2007, leading to downturn in

American markets

Collapse of Lehman Brothers triggered liquidity shortages in the US and the

EU banking systems;

Banks restricted operations and crisis began to influence the real economy

sector.

The Background of the Research

Theoretic consequences of financial crisis for

the EU banking M&As:

Banks suffered from a liquidity

shortage due to frozen interbank

lending facilities and could pursue

asset consolidation to maintain

stable level of funds

Banking market remained

fragmented and institutions found

themselves in higher competition

conditions in terms of

deteriorating markets, thus

pursuing asset consolidation

The Background of the Research

Broad research question:

What is the impact of crisis on the European banking M&As?

General research questions:

How do the European banking mergers perform during crisis?

What are the most important factors that determine banking

M&As after the sixth merger wave?

What are the possible consequences of new post-crisis regulatory

initiatives for the EU banking M&As (e.g. seventh merger wave?)

Literature Review

Motives of banking M&As:

1) Value-maximizing motives

synergy

economies of scape and scope

increased market power

risk diversification

capital strength

2) Non-value maximizing motives

agency motives

hubris

Literature Review

Value-maximizing motives of banking M&As:

I. Synergy

= [

)] ( +)

= the combined value of the two banks

= bank A measure of its value (acquirer)

= the market value of bank B stock (target)

P = premium paid for target bank

E = expenses of the acquisition process

Literature Review

Synergy sources according to Lawrence (2001):

Operating economies

Financial economies

Increased market power

Literature Review

Financial synergy sources:

1) Tax advantages (Myers and Majluf, 1984)

2) Lower costs of internal funds due to better match

between resources and investment opportunities

(Palepu, 1986)

3) Better debt protection (due to larger asset

backing)(Higgins and Schall, 1975; Kim and McConnell,

1977)

Literature Review

Value-maximizing motives of banking M&As:

II. Economies of scale and scope

Examples:

Closing redundant branches;

Consolidation of back offices;

Optimization of payment systems.

to distribute fixed costs over

higher output

Economy of

scale

to offer wider range of services

exploiting existing facilities

Economy of

scope

Literature Review

Value-maximizing motives of banking M&As:

III. Increased market power

Sources (according to Gaughan, 1996):

Product differentiation

Barriers to entry

Market share

Literature Review

Value-maximizing motives of banking M&As:

IV. Capital strength

One of the most important motive in the modern EU

banking;

In terms of strong impact of external liquidity shock,

banks try to reach high capital adequacy and asset

quality via M&As.

Literature Review

Non-value-maximizing motives of banking

M&As:

I. Agency motive

M&As are considered as mechanism of substituting ineffective

managers (Manne, 1965);

Management tries to maximise their wages by maximising the

bank size empire-building (Mueller, 1969; Murphy, 1999);

Alternative theory: managers draw attention to the company by

participating in M&As (given developed rankings

system)(Ravencraft and Scherer, 1987)

Literature Review

Non-value-maximizing motives of banking

M&As:

II. Hubris

Classic theory by Roll, 1986 firms compete for target company,

but lose the vision of fair value and winner pays much higher

price (winners curse);

Individual hubris worst-performing deals are performed by

best performing companies, as their managers believe in their

constant and faultless estimation and strategic plans (Morck et al,

1990)

Literature Review

Determinants of banking M&As:

1) Internal determinants

Target operating performance

Capitalisation

Prospects for future growth

Size

Management incentives

2) External determinants

Deregulation and laws

Macroeconomic environment

Technological development

Globalisation

Literature Review

General theoretical patterns of internal

determinants:

1. Less profitable banks are more likely to be acquired (Hannan

and Piloff, 2006);

2. Less capitalised banks are more likely to be acquired (Lanine

and Vander Vennet, 2007) mixed evidence! (Akhigbe et al.,

2004 have opposite results);

3. Slower growing banks are more likely to be merged (Lanine

and Vander Vennet, 2007) - mixed evidence! (Pasiouras et al.,

2007 have opposite results);

4. Smaller banks are more likely to be acquired (Pasiouras et al,

2007);

5. Management is always opposing mergers, especially

participating in management ownership schemes (Hadlock et

al, 1999)

Literature Review

Regulatory impact on the EU M&A market

(Group of Ten, 2001):

1. Through effects on market competition and entry

conditions;

2. Through approval/disapproval decisions for individual

merger transactions;

3. Through limits on the range of permissible activities for

service providers;

4. Through public ownership of institutions;

5. Through effects to minimise the social costs of failures.

Literature Review

Key European regulatory initiatives in M&A

control:

Adoption of Single Banking Initiative

(creation of universal banking model in the

EU)(Nellis, 2000)

1992

Adoption of Financial Services Action

Plan (unification of accounting practices

and prudential rules)(Hamoir, 2005)

1999

Basel II Accord (establishing obligatory

conditions of capitalisation for the financial

institutions)(Kanbay, 2005)

2004

Literature Review

Impact of the technological development on

the EU banking M&A market:

Increase in production (credit

cards)

Enhanced efficiency in risk

management (derivatives)

Economies of scale (economic

research)

Literature Review

Impact of macroeconomic environment on the

EU banking M&As:

1. Cycles of capital markets are synchronised with M&A

cycles (Mueller, 1989);

2. GDP and inflation growth have positive influence on

banks performance and, therefore, on the positive M&A

outcomes (King and Levine, 1993; Rajan and Zingales,

1998);

3. Unemployment rate, interest rate and production

productivity are in mixed correlation with the financial

sector performance (Molyneux and Thorton, 1992;

Pasiouras and Kosmidou, 2005)

Literature Review

Market performance studies

Short-term:

1) Target company: positive abnormal returns (Houston and

Ryngaert, 1994; Hawawini and Swary, 1990; Cybo-Ottone and

Murgia, 2000; Campa and Hernando, 2006);

2) Acquirer company: mixed evidence (majority of scholars

find zero or insignificant abnormal returns - Cornett et al.,

2003; Anderson et al., 2004; DeLong and DeYoung, 2007),

however, significant positive returns are reported by Beitel et

al., 2004 and Campa and Hernando (2006);

3) the EU studies are in contrast to the US market, where

acquirer experiences significant negative abnormal returns

Long-term:

1) Combined entity: negative effect in long run (Limmack, 1991;

Ikenberry, Lakonishok and Vermaelen, 1995; Gregory and

McCorriston, 2005)

Literature Review

Impact of deal characteristics on performance:

1) Mood of the deal: mixed results (Gregory, 1997 and Cosh and

Guest, 2001 find that hostile deals outperform friendly deals;

while Goergen and Renneboog, 2004 provide opposite

evidence);

2) Listed status: mergers with private banks involved

outperform public mergers (Draper and Paudyal, 2006)

3) Method of payment: cash-financed deals outperform stock-

financed deals (Loughran and Vijh, 1997; Myers and Majluf,

1984);

4) Acquirer/target relative size: mixed evidence; deals with

larger target banks show higher CARs (Bruner, 2002),

however Sudarsanam, 1996 find negative relationship;

5) Merger experience: frequent bidders enjoy higher abnormal

returns (Baker and Limmack, 2001)

Literature Review

Operating performance studies (levels of

study):

1. To reveal overall performance patterns (sometimes with

focus on deal types, payment methods etc.)

2. To examine factors of performance changes (cost

reductions and profit improvements)

3. To investigate the time scale over which performance

changes are actualized (with focus on synergy effects

timing etc.)

Literature Review

Operating performance studies:

1) Generally, mixed evidence: several papers report zero

changes in operating performance (Zollo and Singh,

2004; Akhavein et al., 1997); however, Cornett et al., 2006

testify significant positive gains for combined entities;

2) EU context shows mixed results: while Vander Vennet,

2002; Campa and Hernando, 2006 find positive changes,

Altunbas and Ibanez (2004) report no changes in the

operating performance;

3) The latest studies testify significant profit efficiencies

(Chronopoulos et al., 2011, Chronopoulos et al., 2013);

4) Studies on national markets show negative results for

Switzerland and Italy (Rime and Stiroh, 2003; Casu and

Girardone, 2002).

Contributions

- The research aims to estimate the impact of financial

crisis on the European financial mergers and

acquisitions.

- M&As during pre-crisis period, crisis period and post-

crisis period will be assessed and compared;

- Thesis aims to establish relationship between

macroeconomic/legal environment and the market of

financial M&As;

- The objective of the thesis is to capture the wide range

of factors that influence banking M&As, providing

complex approach to the problem.

Contributions

Research questions:

1. What are the main differences between post-merger performance

patterns in European banking in periods of crisis and economic

upturn? What factors have contributed to the post-merger effects

for banks and financial institutions?

2. What are the post-merger efficiency changes for the deals that took

place during the financial crisis comparing to pre-crisis takeovers?

3. What is the effect of pre-crisis and crisis macroeconomic

environment on the European banking mergers in terms of

uncertainty?

4. How regulatory and legal environment influence the M&A

processes in the European banking sector and what are results for

banks in different legal systems?

5. What is the effect of capital requirements on merger performance

in the European banking sector during financial crisis?

Methodologies

1. Short-term event study: to determine short-term abnormal

returns for participants in banking mergers in three different

periods: pre-crisis (1990-2006), crisis (2007-2009) and post-

crisis (2009-2014)(Brown and Warner, 1985);

2. Long-term event study: long-term abnormal returns for EU

merged banks will be evaluated (buy-and-hold

methodology)(Ritter, 1991; Barber and Lyon, 1997)

3. Regression analysis will contain GARCH technique to

capture volatility effect during crisis (according to

methodology by Savickas, 2003; Maditinos et al., 2009);

4. Accounting data analysis technique similar to one in Healy

et al., (1992) will be implemented to assess merged European

banks post-acquisition performance;

5. Logistic regression will be deployed to evaluate the

probabilities of banking institutions to merge under

regulatory pressure (Basel III Accord)(following Hernando

and Nieto, 2009).

Methodologies

1. Short-term event study:

), therefore:

=

=

=

=

=

where:

- market return;

- company return; , -

coefficients;

- cumulative abnormal return

2. Long-term event study:

= 1 +

((1 +

))

=1

=1

where: T is number of months after trigger event;

- buy-

and-hold return;

- company return for month t.

Data

Main source: Datastream and Thomson Financial Database;

Data covers period between January 1st, 1990 and February 20th,

2014 which resulted in 13988 transactions;

Data includes countries of European Union (28 members),

Switzerland and Norway;

Restricting criteria:

1) the stake of acquired shares should be more than 50%;

2) the involved companies should belong to financial sector;

3) the target and bidder are listed;

4) the target and bidder companies should be registered or

headquartered in the European Union, Switzerland or

Norway.

After preliminary exclusion of deals with absent data, 1400

transactions remained.

The Timeline to Completion

Stage Timeline

July August, 2014 finishing and updating literature review based

on Annual Review Assessment comments and

feedback

September October, 2014 preliminary data collection, ensuring access to

the databases

October November, 2014 optimising models and research

methodologies, finalising model specification

November - December, 2014 final data collection

January - March, 2015 structuring the collected data, constructing

sample for the research chapters

April May, 2015 empirical work, testing the hypothesis,

structuring results

June, 2015 presenting 2

nd

year Annual Review

July November, 2015 finalising empirical part

November 2015 April 2016 writing up of the thesis

April May, 2016 finalising and editing

June 2016 presenting thesis at viva voce

Você também pode gostar

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Master Plan vs. Strategic Plan vs. Business PlanDocumento59 páginasMaster Plan vs. Strategic Plan vs. Business PlanCoco ColnAinda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Fact Sheet en June 2019 1 PDFDocumento3 páginasFact Sheet en June 2019 1 PDFalexandru_cornea01Ainda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Write UpDocumento5 páginasWrite UpAli Tariq ButtAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Decorative Interior IncDocumento12 páginasDecorative Interior IncManisheel GautamAinda não há avaliações

- IC Accounts Payable Ledger 9467Documento2 páginasIC Accounts Payable Ledger 9467Rahul BadaikAinda não há avaliações

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

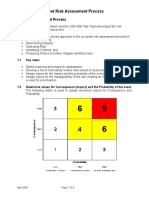

- 4 Fleet Risk Assessment ProcessDocumento4 páginas4 Fleet Risk Assessment ProcessHaymanAHMEDAinda não há avaliações

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- May 2017Documento7 páginasMay 2017Patrick Arazo0% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Study Online,: Graduate On CampusDocumento28 páginasStudy Online,: Graduate On CampusattackcairoAinda não há avaliações

- University of Madras: B.Sc. (Ism) and Bcom. (Informationsystemsmanagement) Degree Examinations, April 2014Documento6 páginasUniversity of Madras: B.Sc. (Ism) and Bcom. (Informationsystemsmanagement) Degree Examinations, April 2014Dolce UdayAinda não há avaliações

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Maintenance - Invoice - Q4 2017 PDFDocumento1 páginaMaintenance - Invoice - Q4 2017 PDFArunAinda não há avaliações

- Intdiff Ltot Ldisrat Lusdisrat Lusprod LrexrDocumento4 páginasIntdiff Ltot Ldisrat Lusdisrat Lusprod LrexrsrieconomistAinda não há avaliações

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Intramuros Adminstration - Exec Summary 06Documento9 páginasIntramuros Adminstration - Exec Summary 06Anonymous p47liBAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Financial Analysis Hoa Phat Joint Stock Company: Lecture By: Tran Thi Nga Presented byDocumento22 páginasFinancial Analysis Hoa Phat Joint Stock Company: Lecture By: Tran Thi Nga Presented byMinh NguyệtAinda não há avaliações

- Professor Elliott Parker Spring 2005 Midterm Exam 1 Name: ECON 102 - Principles of MicroeconomicsDocumento9 páginasProfessor Elliott Parker Spring 2005 Midterm Exam 1 Name: ECON 102 - Principles of Microeconomicshyung_jipmAinda não há avaliações

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Feasibility and Business Planning: Back To Table of ContentsDocumento55 páginasFeasibility and Business Planning: Back To Table of ContentsJK 9752Ainda não há avaliações

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Bilal PDF DissertationDocumento115 páginasBilal PDF DissertationkamilbismaAinda não há avaliações

- Shruti ShrivastavDocumento1 páginaShruti Shrivastavsiddus1Ainda não há avaliações

- SAP FI Sensitive T Codes List: General LedgerDocumento5 páginasSAP FI Sensitive T Codes List: General Ledgerprakash_kumAinda não há avaliações

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Functional Structure 2. Divisional Structure 3. The Strategic Business Unit (SBU) Structure 4. The Matrix StructureDocumento17 páginasThe Functional Structure 2. Divisional Structure 3. The Strategic Business Unit (SBU) Structure 4. The Matrix StructureYousab KaldasAinda não há avaliações

- 7 P'sDocumento14 páginas7 P'sReena RialubinAinda não há avaliações

- IIT TenderDocumento10 páginasIIT TenderB DroidanAinda não há avaliações

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Fascination Factor by Mark LevyDocumento11 páginasThe Fascination Factor by Mark LevyClsales100% (1)

- Resource Based Theory (RBT) - AK S1Documento9 páginasResource Based Theory (RBT) - AK S1cholidAinda não há avaliações

- Grievance 1Documento10 páginasGrievance 1usham deepika100% (1)

- Types of Risk of An EntrepreneurDocumento15 páginasTypes of Risk of An Entrepreneurvinayhn0783% (24)

- MQM Flyer NewDocumento1 páginaMQM Flyer NewAHS ManajemenAinda não há avaliações

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Case SummaryDocumento3 páginasCase SummaryWilliam WeilieAinda não há avaliações

- Digital Banking, Customer PDFDocumento27 páginasDigital Banking, Customer PDFHafsa HamidAinda não há avaliações

- Agile User Stories and Workshop - Moduele 1Documento24 páginasAgile User Stories and Workshop - Moduele 1Ajersh Paturu100% (1)

- Budgeting in GhanaDocumento57 páginasBudgeting in GhanaJohn Bates BlanksonAinda não há avaliações