Escolar Documentos

Profissional Documentos

Cultura Documentos

2014.04 Local Market Update by City

Enviado por

Bill HopkinsDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

2014.04 Local Market Update by City

Enviado por

Bill HopkinsDireitos autorais:

Formatos disponíveis

A RESEARCH TOOL PROVIDED BY METROLIST

SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

City April 2014

Agate 2 Greenwood Village 35

Arvada 3 Henderson 36

Aurora 4 Highlands Ranch 37

Bailey 5 Idaho Springs 38

Bennett 6 Indian Hills 39

Bow Mar 7 Keenesburg 40

Brighton 8 Kiowa 41

Broomfield 9 Kittredge 42

Byers 10 Lafayette 43

Castle Pines North 11 Lakewood 44

Castle Rock 12 Larkspur 45

Centennial 13 Littleton 46

Local Market Updates

Centennial 13 Littleton 46

Cherry Hills Village 14 Lone Tree 47

Columbine Valley 15 Longmont 48

Commerce City 16 Louisville 49

Conifer 17 Louviers 50

Dacono 18 Morrison 51

Deckers 19 Northglenn 52

Deer Trail 20 Parker 53

Denver 21 Sedalia 54

Edgewater 22 Sheridan 55

Elbert 23 Simla 56

Elizabeth 24 Strasburg 57

Englewood 25 Superior 58

Evergreen 26 Thornton 59

Federal Heights 27 Twin Lakes 60

Firestone 28 Watkins 61

Fort Lupton 29 Westminster 62

Foxfield 30 Wheat Ridge 63

Franktown 31

Frederick 32

Glendale 33

Golden 34

All data from Metrolist. Metrolist is a registered trademark of Metrolist, Inc. 2014 Metrolist, Inc. All rights reserved.

2013 2014 + / 2013 2014 + /

Active Listings 5 1 - 80.0% -- -- --

Under Contract Listings 2 1 - 50.0% 7 1 - 85.7%

New Listings 2 0 - 100.0% 11 1 - 90.9%

Sold Listings 2 1 - 50.0% 4 1 - 75.0%

Total Days on Market 55 36 -34.5% 28 36 + 28.6%

Median Sold Price* $552,500 $280,000 - 49.3% $283,250 $280,000 - 1.1%

Average Sold Price* $552,500 $280,000 - 49.3% $321,125 $280,000 - 12.8%

Percent of Sold Price to List Price* 99.2% 87.5% - 11.8% 101.9% 87.5% - 14.1%

Local Market Update April 2014

A RESEARCH TOOL PROVIDED BY METROLIST

SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

Agate

- 100.0% - 50.0% - 49.3%

Change in

New Listings

Change in

Sold Listings

Change in

Median Sold Price**

April Year to Date (YTD)

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

11

Year to Date (YTD)

2013 2014

2 2

April

2013 2014

All MLS

Agate

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used

in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing.

Due to differences in statistical methodologies figures may vary from other market reports provided by Metrolist

- 60%

- 50%

- 40%

- 30%

- 20%

- 10%

0%

+ 10%

+ 20%

+ 30%

1-2008 7-2008 1-2009 7-2009 1-2010 7-2010 1-2011 7-2011 1-2012 7-2012 1-2013 7-2013 1-2014

Change in Median Sold Price from Prior Year (6-Month Average)

b

a

4

1 1

New Listings Sold Listings

- 75.0% - 90.9%

0

1

New Listings Sold Listings

- 50.0% - 100.0%

Due to differences in statistical methodologies, figures may vary from other market reports provided by Metrolist.

2013 2014 + / 2013 2014 + /

Active Listings 127 182 + 43.3% -- -- --

Under Contract Listings 223 282 + 26.5% 807 910 + 12.8%

New Listings 224 256 + 14.3% 781 795 + 1.8%

Sold Listings 197 173 - 12.2% 642 610 - 5.0%

Total Days on Market 52 28 -46.2% 58 38 -34.5%

Median Sold Price* $242,222 $271,000 + 11.9% $237,500 $262,000 + 10.3%

Average Sold Price* $277,344 $290,058 + 4.6% $265,425 $289,962 + 9.2%

Percent of Sold Price to List Price* 99.1% 99.5% + 0.4% 99.0% 99.2% + 0.2%

+ 11.9%

Change in

New Listings

Change in

Sold Listings

Change in

Median Sold Price**

April Year to Date (YTD)

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

Local Market Update April 2014

A RESEARCH TOOL PROVIDED BY METROLIST

SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

Arvada

+ 14.3% - 12.2%

781

642

795

610

Year to Date (YTD)

2013 2014

224

197

256

173

April

2013 2014

All MLS

Arvada

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used

in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing.

Due to differences in statistical methodologies figures may vary from other market reports provided by Metrolist

- 20%

- 15%

- 10%

- 5%

0%

+ 5%

+ 10%

+ 15%

+ 20%

1-2008 7-2008 1-2009 7-2009 1-2010 7-2010 1-2011 7-2011 1-2012 7-2012 1-2013 7-2013 1-2014

Change in Median Sold Price from Prior Year (6-Month Average)

b

a

New Listings Sold Listings

- 5.0% + 1.8%

173

New Listings Sold Listings

- 12.2% + 14.3%

Due to differences in statistical methodologies, figures may vary from other market reports provided by Metrolist.

2013 2014 + / 2013 2014 + /

Active Listings 415 531 + 28.0% -- -- --

Under Contract Listings 770 890 + 15.6% 2,410 3,026 + 25.6%

New Listings 825 799 - 3.2% 2,500 2,471 - 1.2%

Sold Listings 542 569 + 5.0% 1,862 1,864 + 0.1%

Total Days on Market 46 29 -37.0% 55 40 -27.3%

Median Sold Price* $190,000 $220,000 + 15.8% $179,950 $202,500 + 12.5%

Average Sold Price* $206,586 $234,810 + 13.7% $198,451 $220,154 + 10.9%

Percent of Sold Price to List Price* 100.3% 99.7% - 0.6% 99.8% 99.3% - 0.5%

+ 15.8%

Change in

New Listings

Change in

Sold Listings

Change in

Median Sold Price**

April Year to Date (YTD)

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

Local Market Update April 2014

A RESEARCH TOOL PROVIDED BY METROLIST

SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

Aurora

- 3.2% + 5.0%

2,500

1,862

2,471

1,864

Year to Date (YTD)

2013 2014

825

542

799

569

April

2013 2014

All MLS

Aurora

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used

in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing.

Due to differences in statistical methodologies figures may vary from other market reports provided by Metrolist

- 25%

- 20%

- 15%

- 10%

- 5%

0%

+ 5%

+ 10%

+ 15%

+ 20%

+ 25%

1-2008 7-2008 1-2009 7-2009 1-2010 7-2010 1-2011 7-2011 1-2012 7-2012 1-2013 7-2013 1-2014

Change in Median Sold Price from Prior Year (6-Month Average)

b

a

New Listings Sold Listings

+ 0.1% - 1.2%

542

New Listings Sold Listings

+ 5.0% - 3.2%

Due to differences in statistical methodologies, figures may vary from other market reports provided by Metrolist.

2013 2014 + / 2013 2014 + /

Active Listings 62 61 - 1.6% -- -- --

Under Contract Listings 41 30 - 26.8% 114 105 - 7.9%

New Listings 31 24 - 22.6% 105 92 - 12.4%

Sold Listings 23 11 - 52.2% 72 69 - 4.2%

Total Days on Market 112 28 -75.0% 120 78 -35.0%

Median Sold Price* $222,500 $223,000 + 0.2% $187,500 $210,000 + 12.0%

Average Sold Price* $208,675 $231,973 + 11.2% $198,786 $212,898 + 7.1%

Percent of Sold Price to List Price* 97.1% 99.5% + 2.5% 96.7% 98.0% + 1.3%

+ 0.2%

Change in

New Listings

Change in

Sold Listings

Change in

Median Sold Price**

April Year to Date (YTD)

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

Local Market Update April 2014

A RESEARCH TOOL PROVIDED BY METROLIST

SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

Bailey

- 22.6% - 52.2%

105

72

92

69

Year to Date (YTD)

2013 2014

31

23

24

April

2013 2014

All MLS

Bailey

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used

in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing.

Due to differences in statistical methodologies figures may vary from other market reports provided by Metrolist

- 30%

- 20%

- 10%

0%

+ 10%

+ 20%

+ 30%

1-2008 7-2008 1-2009 7-2009 1-2010 7-2010 1-2011 7-2011 1-2012 7-2012 1-2013 7-2013 1-2014

Change in Median Sold Price from Prior Year (6-Month Average)

b

a

72

69

New Listings Sold Listings

- 4.2% - 12.4%

11

New Listings Sold Listings

- 52.2% - 22.6%

Due to differences in statistical methodologies, figures may vary from other market reports provided by Metrolist.

2013 2014 + / 2013 2014 + /

Active Listings 10 26 + 160.0% -- -- --

Under Contract Listings 9 20 + 122.2% 33 50 + 51.5%

New Listings 9 15 + 66.7% 39 46 + 17.9%

Sold Listings 8 8 0.0% 25 26 + 4.0%

Total Days on Market 46 61 + 32.6% 53 59 + 11.3%

Median Sold Price* $108,400 $141,750 + 30.8% $210,500 $162,850 - 22.6%

Average Sold Price* $142,989 $158,838 + 11.1% $218,486 $215,485 - 1.4%

Percent of Sold Price to List Price* 100.2% 92.6% - 7.6% 99.6% 97.3% - 2.3%

+ 30.8%

Change in

New Listings

Change in

Sold Listings

Change in

Median Sold Price**

April Year to Date (YTD)

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

Local Market Update April 2014

A RESEARCH TOOL PROVIDED BY METROLIST

SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

Bennett

+ 66.7% 0.0%

39

46

Year to Date (YTD)

2013 2014

9

15

April

2013 2014

All MLS

Bennett

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used

in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing.

Due to differences in statistical methodologies figures may vary from other market reports provided by Metrolist

- 60%

- 40%

- 20%

0%

+ 20%

+ 40%

+ 60%

+ 80%

1-2008 7-2008 1-2009 7-2009 1-2010 7-2010 1-2011 7-2011 1-2012 7-2012 1-2013 7-2013 1-2014

Change in Median Sold Price from Prior Year (6-Month Average)

b

a

25

26

New Listings Sold Listings

+ 4.0% + 17.9%

9

8 8

New Listings Sold Listings

0.0% + 66.7%

Due to differences in statistical methodologies, figures may vary from other market reports provided by Metrolist.

2013 2014 + / 2013 2014 + /

Active Listings 4 5 + 25.0% -- -- --

Under Contract Listings 0 1 -- 6 5 - 16.7%

New Listings 4 1 - 75.0% 8 7 - 12.5%

Sold Listings 2 1 - 50.0% 5 2 - 60.0%

Total Days on Market 40 4 -90.0% 95 238 + 150.5%

Median Sold Price* $792,000 $752,500 - 5.0% $799,000 $1,753,750 + 119.5%

Average Sold Price* $792,000 $752,500 - 5.0% $887,800 $1,753,750 + 97.5%

Percent of Sold Price to List Price* 99.2% 100.5% + 1.3% 95.4% 96.2% + 0.8%

Local Market Update April 2014

A RESEARCH TOOL PROVIDED BY METROLIST

SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

Bow Mar

- 75.0% - 50.0% - 5.0%

Change in

New Listings

Change in

Sold Listings

Change in

Median Sold Price**

April Year to Date (YTD)

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

8

5

7

Year to Date (YTD)

2013 2014

4

April

2013 2014

All MLS

Bow Mar

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used

in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing.

Due to differences in statistical methodologies figures may vary from other market reports provided by Metrolist

- 40%

- 20%

0%

+ 20%

+ 40%

+ 60%

+ 80%

1-2008 7-2008 1-2009 7-2009 1-2010 7-2010 1-2011 7-2011 1-2012 7-2012 1-2013 7-2013 1-2014

Change in Median Sold Price from Prior Year (6-Month Average)

b

a

5

2

New Listings Sold Listings

- 60.0% - 12.5%

2

1 1

New Listings Sold Listings

- 50.0% - 75.0%

Due to differences in statistical methodologies, figures may vary from other market reports provided by Metrolist.

2013 2014 + / 2013 2014 + /

Active Listings 117 131 + 12.0% -- -- --

Under Contract Listings 100 119 + 19.0% 338 395 + 16.9%

New Listings 106 126 + 18.9% 372 350 - 5.9%

Sold Listings 84 80 - 4.8% 273 257 - 5.9%

Total Days on Market 72 43 -40.3% 77 58 -24.7%

Median Sold Price* $220,000 $246,500 + 12.0% $215,000 $243,000 + 13.0%

Average Sold Price* $256,900 $262,333 + 2.1% $245,692 $263,879 + 7.4%

Percent of Sold Price to List Price* 98.9% 100.8% + 1.9% 98.6% 99.5% + 0.9%

+ 12.0%

Change in

New Listings

Change in

Sold Listings

Change in

Median Sold Price**

April Year to Date (YTD)

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

Local Market Update April 2014

A RESEARCH TOOL PROVIDED BY METROLIST

SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

Brighton

+ 18.9% - 4.8%

372

273

350

257

Year to Date (YTD)

2013 2014

106

84

126

80

April

2013 2014

All MLS

Brighton

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used

in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing.

Due to differences in statistical methodologies figures may vary from other market reports provided by Metrolist

- 20%

- 15%

- 10%

- 5%

0%

+ 5%

+ 10%

+ 15%

+ 20%

+ 25%

1-2008 7-2008 1-2009 7-2009 1-2010 7-2010 1-2011 7-2011 1-2012 7-2012 1-2013 7-2013 1-2014

Change in Median Sold Price from Prior Year (6-Month Average)

b

a

New Listings Sold Listings

- 5.9% - 5.9%

84

80

New Listings Sold Listings

- 4.8% + 18.9%

Due to differences in statistical methodologies, figures may vary from other market reports provided by Metrolist.

2013 2014 + / 2013 2014 + /

Active Listings 87 134 + 54.0% -- -- --

Under Contract Listings 114 145 + 27.2% 375 428 + 14.1%

New Listings 125 131 + 4.8% 394 417 + 5.8%

Sold Listings 87 81 - 6.9% 297 267 - 10.1%

Total Days on Market 51 37 -27.5% 56 46 -17.9%

Median Sold Price* $305,000 $335,000 + 9.8% $284,900 $308,500 + 8.3%

Average Sold Price* $336,229 $381,689 + 13.5% $329,259 $364,388 + 10.7%

Percent of Sold Price to List Price* 98.9% 99.5% + 0.6% 98.6% 99.3% + 0.7%

+ 9.8%

Change in

New Listings

Change in

Sold Listings

Change in

Median Sold Price**

April Year to Date (YTD)

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

Local Market Update April 2014

A RESEARCH TOOL PROVIDED BY METROLIST

SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

Broomfield

+ 4.8% - 6.9%

394

297

417

267

Year to Date (YTD)

2013 2014

125

87

131

81

April

2013 2014

All MLS

Broomfield

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used

in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing.

Due to differences in statistical methodologies figures may vary from other market reports provided by Metrolist

- 20%

- 15%

- 10%

- 5%

0%

+ 5%

+ 10%

+ 15%

+ 20%

+ 25%

+ 30%

1-2008 7-2008 1-2009 7-2009 1-2010 7-2010 1-2011 7-2011 1-2012 7-2012 1-2013 7-2013 1-2014

Change in Median Sold Price from Prior Year (6-Month Average)

b

a

267

New Listings Sold Listings

- 10.1% + 5.8%

81

New Listings Sold Listings

- 6.9% + 4.8%

Due to differences in statistical methodologies, figures may vary from other market reports provided by Metrolist.

2013 2014 + / 2013 2014 + /

Active Listings 7 8 + 14.3% -- -- --

Under Contract Listings 4 8 + 100.0% 18 18 0.0%

New Listings 7 3 - 57.1% 15 11 - 26.7%

Sold Listings 4 1 - 75.0% 15 5 - 66.7%

Total Days on Market 91 187 + 105.5% 90 70 -22.2%

Median Sold Price* $195,000 $270,000 + 38.5% $170,000 $270,000 + 58.8%

Average Sold Price* $190,500 $270,000 + 41.7% $196,704 $263,000 + 33.7%

Percent of Sold Price to List Price* 97.7% 97.3% - 0.4% 97.5% 99.3% + 1.8%

+ 38.5%

Change in

New Listings

Change in

Sold Listings

Change in

Median Sold Price**

April Year to Date (YTD)

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

Local Market Update April 2014

A RESEARCH TOOL PROVIDED BY METROLIST

SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

Byers

- 57.1% - 75.0%

15 15

11

Year to Date (YTD)

2013 2014

7

April

2013 2014

All MLS

Byers

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used

in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing.

Due to differences in statistical methodologies figures may vary from other market reports provided by Metrolist

- 40%

- 20%

0%

+ 20%

+ 40%

+ 60%

+ 80%

+ 100%

1-2008 7-2008 1-2009 7-2009 1-2010 7-2010 1-2011 7-2011 1-2012 7-2012 1-2013 7-2013 1-2014

Change in Median Sold Price from Prior Year (6-Month Average)

b

a

5

New Listings Sold Listings

- 66.7% - 26.7%

4

3

1

New Listings Sold Listings

- 75.0% - 57.1%

Due to differences in statistical methodologies, figures may vary from other market reports provided by Metrolist.

2013 2014 + / 2013 2014 + /

Active Listings 0 2 -- -- -- --

Under Contract Listings 0 0 -- 0 0 --

New Listings 0 2 -- 0 2 --

Sold Listings 0 0 -- 0 0 --

Total Days on Market 0 0 -- 0 0 --

Median Sold Price* 0 0 -- 0 0 --

Average Sold Price* 0 0 -- 0 0 --

Percent of Sold Price to List Price* 0 0 -- 0 0 --

--

Change in

New Listings

Change in

Sold Listings

Change in

Median Sold Price**

April Year to Date (YTD)

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

Local Market Update April 2014

A RESEARCH TOOL PROVIDED BY METROLIST

SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

Castle Pines

North

-- --

2

Year to Date (YTD)

2013 2014

2

April

2013 2014

All MLS

Castle Pines North

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used

in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing.

Due to differences in statistical methodologies figures may vary from other market reports provided by Metrolist

- 20%

- 15%

- 10%

- 5%

0%

+ 5%

+ 10%

+ 15%

+ 20%

1-2008 7-2008 1-2009 7-2009 1-2010 7-2010 1-2011 7-2011 1-2012 7-2012 1-2013 7-2013 1-2014

Change in Median Sold Price from Prior Year (6-Month Average)

b

a

0 0 0

New Listings Sold Listings

-- --

0 0 0

New Listings Sold Listings

-- --

Due to differences in statistical methodologies, figures may vary from other market reports provided by Metrolist.

2013 2014 + / 2013 2014 + /

Active Listings 251 404 + 61.0% -- -- --

Under Contract Listings 206 242 + 17.5% 706 780 + 10.5%

New Listings 252 273 + 8.3% 783 861 + 10.0%

Sold Listings 175 150 - 14.3% 525 490 - 6.7%

Total Days on Market 64 38 -40.6% 74 51 -31.1%

Median Sold Price* $317,034 $335,000 + 5.7% $306,900 $319,950 + 4.3%

Average Sold Price* $377,969 $368,158 - 2.6% $374,206 $374,697 + 0.1%

Percent of Sold Price to List Price* 98.9% 99.2% + 0.3% 98.6% 98.8% + 0.2%

+ 5.7%

Change in

New Listings

Change in

Sold Listings

Change in

Median Sold Price**

April Year to Date (YTD)

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

Local Market Update April 2014

A RESEARCH TOOL PROVIDED BY METROLIST

SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

Castle Rock

+ 8.3% - 14.3%

783

861

Year to Date (YTD)

2013 2014

252

175

273

April

2013 2014

All MLS

Castle Rock

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used

in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing.

Due to differences in statistical methodologies figures may vary from other market reports provided by Metrolist

- 20%

- 15%

- 10%

- 5%

0%

+ 5%

+ 10%

+ 15%

+ 20%

1-2008 7-2008 1-2009 7-2009 1-2010 7-2010 1-2011 7-2011 1-2012 7-2012 1-2013 7-2013 1-2014

Change in Median Sold Price from Prior Year (6-Month Average)

b

a

525

490

New Listings Sold Listings

- 6.7% + 10.0%

175

150

New Listings Sold Listings

- 14.3% + 8.3%

Due to differences in statistical methodologies, figures may vary from other market reports provided by Metrolist.

2013 2014 + / 2013 2014 + /

Active Listings 103 140 + 35.9% -- -- --

Under Contract Listings 265 256 - 3.4% 822 782 - 4.9%

New Listings 247 230 - 6.9% 806 708 - 12.2%

Sold Listings 210 185 - 11.9% 628 500 - 20.4%

Total Days on Market 34 24 -29.4% 49 32 -34.7%

Median Sold Price* $281,630 $325,000 + 15.4% $277,090 $299,945 + 8.2%

Average Sold Price* $305,044 $345,870 + 13.4% $303,447 $321,932 + 6.1%

Percent of Sold Price to List Price* 99.3% 99.3% 0.0% 99.0% 98.9% - 0.1%

+ 15.4%

Change in

New Listings

Change in

Sold Listings

Change in

Median Sold Price**

April Year to Date (YTD)

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

Local Market Update April 2014

A RESEARCH TOOL PROVIDED BY METROLIST

SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

Centennial

- 6.9% - 11.9%

806

628

708

500

Year to Date (YTD)

2013 2014

247

210

230

185

April

2013 2014

All MLS

Centennial

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used

in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing.

Due to differences in statistical methodologies figures may vary from other market reports provided by Metrolist

- 20%

- 15%

- 10%

- 5%

0%

+ 5%

+ 10%

+ 15%

+ 20%

1-2008 7-2008 1-2009 7-2009 1-2010 7-2010 1-2011 7-2011 1-2012 7-2012 1-2013 7-2013 1-2014

Change in Median Sold Price from Prior Year (6-Month Average)

b

a

500

New Listings Sold Listings

- 20.4% - 12.2%

New Listings Sold Listings

- 11.9% - 6.9%

Due to differences in statistical methodologies, figures may vary from other market reports provided by Metrolist.

2013 2014 + / 2013 2014 + /

Active Listings 41 52 + 26.8% -- -- --

Under Contract Listings 14 18 + 28.6% 42 45 + 7.1%

New Listings 13 18 + 38.5% 69 53 - 23.2%

Sold Listings 19 14 - 26.3% 40 27 - 32.5%

Total Days on Market 109 68 -37.6% 127 75 -40.9%

Median Sold Price* $1,050,000 $1,662,500 + 58.3% $1,230,000 $1,600,000 + 30.1%

Average Sold Price* $1,239,532 $1,923,571 + 55.2% $1,508,040 $1,924,090 + 27.6%

Percent of Sold Price to List Price* 96.4% 94.8% - 1.7% 95.6% 93.4% - 2.3%

+ 58.3%

Change in

New Listings

Change in

Sold Listings

Change in

Median Sold Price**

April Year to Date (YTD)

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

Local Market Update April 2014

A RESEARCH TOOL PROVIDED BY METROLIST

SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

Cherry Hills

Village

+ 38.5% - 26.3%

69

53

Year to Date (YTD)

2013 2014

13

19

18

14

April

2013 2014

All MLS

Cherry Hills Village

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used

in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing.

Due to differences in statistical methodologies figures may vary from other market reports provided by Metrolist

- 50%

- 40%

- 30%

- 20%

- 10%

0%

+ 10%

+ 20%

+ 30%

+ 40%

+ 50%

+ 60%

1-2008 7-2008 1-2009 7-2009 1-2010 7-2010 1-2011 7-2011 1-2012 7-2012 1-2013 7-2013 1-2014

Change in Median Sold Price from Prior Year (6-Month Average)

b

a

40

27

New Listings Sold Listings

- 32.5% - 23.2%

New Listings Sold Listings

- 26.3% + 38.5%

Due to differences in statistical methodologies, figures may vary from other market reports provided by Metrolist.

2013 2014 + / 2013 2014 + /

Active Listings 4 1 - 75.0% -- -- --

Under Contract Listings 3 0 - 100.0% 10 3 - 70.0%

New Listings 1 0 - 100.0% 10 0 - 100.0%

Sold Listings 3 1 - 66.7% 10 3 - 70.0%

Total Days on Market 83 195 + 134.9% 94 128 + 36.2%

Median Sold Price* $716,000 $1,350,000 + 88.5% $698,000 $1,350,000 + 93.4%

Average Sold Price* $665,333 $1,350,000 + 102.9% $786,484 $1,293,667 + 64.5%

Percent of Sold Price to List Price* 96.7% 100.0% + 3.4% 95.2% 95.8% + 0.6%

+ 88.5%

Change in

New Listings

Change in

Sold Listings

Change in

Median Sold Price**

April Year to Date (YTD)

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

Local Market Update April 2014

A RESEARCH TOOL PROVIDED BY METROLIST

SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

Columbine Valley

- 100.0% - 66.7%

10 10

Year to Date (YTD)

2013 2014

3

April

2013 2014

All MLS

Columbine Valley

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used

in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing.

Due to differences in statistical methodologies figures may vary from other market reports provided by Metrolist

- 40%

- 20%

0%

+ 20%

+ 40%

+ 60%

+ 80%

+ 100%

+ 120%

1-2008 7-2008 1-2009 7-2009 1-2010 7-2010 1-2011 7-2011 1-2012 7-2012 1-2013 7-2013 1-2014

Change in Median Sold Price from Prior Year (6-Month Average)

b

a

0

3

New Listings Sold Listings

- 70.0% - 100.0%

1

0

1

New Listings Sold Listings

- 66.7% - 100.0%

Due to differences in statistical methodologies, figures may vary from other market reports provided by Metrolist.

2013 2014 + / 2013 2014 + /

Active Listings 86 62 - 27.9% -- -- --

Under Contract Listings 106 94 - 11.3% 348 374 + 7.5%

New Listings 120 87 - 27.5% 367 301 - 18.0%

Sold Listings 88 72 - 18.2% 261 262 + 0.4%

Total Days on Market 44 42 -4.5% 50 50 0.0%

Median Sold Price* $196,750 $250,750 + 27.4% $195,000 $237,751 + 21.9%

Average Sold Price* $197,906 $240,363 + 21.5% $191,206 $229,202 + 19.9%

Percent of Sold Price to List Price* 100.3% 100.5% + 0.2% 100.4% 99.8% - 0.6%

+ 27.4%

Change in

New Listings

Change in

Sold Listings

Change in

Median Sold Price**

April Year to Date (YTD)

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

Local Market Update April 2014

A RESEARCH TOOL PROVIDED BY METROLIST

SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

Commerce City

- 27.5% - 18.2%

367

261

301

262

Year to Date (YTD)

2013 2014

120

88 87

April

2013 2014

All MLS

Commerce City

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used

in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing.

Due to differences in statistical methodologies figures may vary from other market reports provided by Metrolist

- 20%

- 15%

- 10%

- 5%

0%

+ 5%

+ 10%

+ 15%

+ 20%

+ 25%

+ 30%

1-2008 7-2008 1-2009 7-2009 1-2010 7-2010 1-2011 7-2011 1-2012 7-2012 1-2013 7-2013 1-2014

Change in Median Sold Price from Prior Year (6-Month Average)

b

a

New Listings Sold Listings

+ 0.4% - 18.0%

72

New Listings Sold Listings

- 18.2% - 27.5%

Due to differences in statistical methodologies, figures may vary from other market reports provided by Metrolist.

2013 2014 + / 2013 2014 + /

Active Listings 43 57 + 32.6% -- -- --

Under Contract Listings 22 21 - 4.5% 83 69 - 16.9%

New Listings 45 27 - 40.0% 99 83 - 16.2%

Sold Listings 23 10 - 56.5% 60 43 - 28.3%

Total Days on Market 123 66 -46.3% 128 73 -43.0%

Median Sold Price* $292,000 $420,750 + 44.1% $321,250 $368,000 + 14.6%

Average Sold Price* $330,731 $482,540 + 45.9% $327,210 $465,455 + 42.2%

Percent of Sold Price to List Price* 97.2% 98.1% + 0.9% 96.6% 97.3% + 0.7%

+ 44.1%

Change in

New Listings

Change in

Sold Listings

Change in

Median Sold Price**

April Year to Date (YTD)

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

Local Market Update April 2014

A RESEARCH TOOL PROVIDED BY METROLIST

SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

Conifer

- 40.0% - 56.5%

99

83

Year to Date (YTD)

2013 2014

45

27

April

2013 2014

All MLS

Conifer

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used

in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing.

Due to differences in statistical methodologies figures may vary from other market reports provided by Metrolist

- 20%

- 15%

- 10%

- 5%

0%

+ 5%

+ 10%

+ 15%

+ 20%

+ 25%

1-2008 7-2008 1-2009 7-2009 1-2010 7-2010 1-2011 7-2011 1-2012 7-2012 1-2013 7-2013 1-2014

Change in Median Sold Price from Prior Year (6-Month Average)

b

a

60

43

New Listings Sold Listings

- 28.3% - 16.2%

23

27

10

New Listings Sold Listings

- 56.5% - 40.0%

Due to differences in statistical methodologies, figures may vary from other market reports provided by Metrolist.

2013 2014 + / 2013 2014 + /

Active Listings 4 9 + 125.0% -- -- --

Under Contract Listings 2 4 + 100.0% 10 22 + 120.0%

New Listings 7 3 - 57.1% 18 19 + 5.6%

Sold Listings 1 5 + 400.0% 9 15 + 66.7%

Total Days on Market 41 8 -80.5% 28 20 -28.6%

Median Sold Price* $174,000 $299,000 + 71.8% $189,900 $271,000 + 42.7%

Average Sold Price* $174,000 $308,600 + 77.4% $185,644 $241,223 + 29.9%

Percent of Sold Price to List Price* 102.4% 101.1% - 1.3% 97.9% 103.8% + 6.0%

+ 71.8%

Change in

New Listings

Change in

Sold Listings

Change in

Median Sold Price**

April Year to Date (YTD)

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

Local Market Update April 2014

A RESEARCH TOOL PROVIDED BY METROLIST

SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

Dacono

- 57.1% + 400.0%

18

19

15

Year to Date (YTD)

2013 2014

7

5

April

2013 2014

All MLS

Dacono

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used

in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing.

Due to differences in statistical methodologies figures may vary from other market reports provided by Metrolist

- 100%

- 50%

0%

+ 50%

+ 100%

+ 150%

+ 200%

+ 250%

1-2008 7-2008 1-2009 7-2009 1-2010 7-2010 1-2011 7-2011 1-2012 7-2012 1-2013 7-2013 1-2014

Change in Median Sold Price from Prior Year (6-Month Average)

b

a

9

New Listings Sold Listings

+ 66.7% + 5.6%

1

3

New Listings Sold Listings

+ 400.0% - 57.1%

Due to differences in statistical methodologies, figures may vary from other market reports provided by Metrolist.

2013 2014 + / 2013 2014 + /

Active Listings 0 1 -- -- -- --

Under Contract Listings 0 0 -- 0 0 --

New Listings 0 0 -- 0 0 --

Sold Listings 0 0 -- 0 0 --

Total Days on Market 0 0 -- 0 0 --

Median Sold Price* 0 0 -- 0 0 --

Average Sold Price* 0 0 -- 0 0 --

Percent of Sold Price to List Price* 0 0 -- 0 0 --

Local Market Update April 2014

A RESEARCH TOOL PROVIDED BY METROLIST

SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

Deckers

-- -- --

Change in

New Listings

Change in

Sold Listings

Change in

Median Sold Price**

April Year to Date (YTD)

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

Year to Date (YTD)

2013 2014

April

2013 2014

All MLS

Deckers

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used

in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing.

Due to differences in statistical methodologies figures may vary from other market reports provided by Metrolist

- 20%

- 15%

- 10%

- 5%

0%

+ 5%

+ 10%

+ 15%

+ 20%

1-2008 7-2008 1-2009 7-2009 1-2010 7-2010 1-2011 7-2011 1-2012 7-2012 1-2013 7-2013 1-2014

Change in Median Sold Price from Prior Year (6-Month Average)

b

a

0 0 0 0

New Listings Sold Listings

-- --

0 0 0 0

New Listings Sold Listings

-- --

Due to differences in statistical methodologies, figures may vary from other market reports provided by Metrolist.

2013 2014 + / 2013 2014 + /

Active Listings 5 10 + 100.0% -- -- --

Under Contract Listings 2 3 + 50.0% 7 6 - 14.3%

New Listings 1 5 + 400.0% 6 11 + 83.3%

Sold Listings 3 1 - 66.7% 7 3 - 57.1%

Total Days on Market 59 110 + 86.4% 136 66 -51.5%

Median Sold Price* $191,000 $239,500 + 25.4% $113,900 $239,500 + 110.3%

Average Sold Price* $173,833 $239,500 + 37.8% $131,914 $194,883 + 47.7%

Percent of Sold Price to List Price* 97.7% 95.8% - 1.9% 98.6% 95.3% - 3.3%

+ 25.4%

Change in

New Listings

Change in

Sold Listings

Change in

Median Sold Price**

April Year to Date (YTD)

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

Local Market Update April 2014

A RESEARCH TOOL PROVIDED BY METROLIST

SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

Deer Trail

+ 400.0% - 66.7%

7

11

Year to Date (YTD)

2013 2014

5

April

2013 2014

All MLS

Deer Trail

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used

in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing.

Due to differences in statistical methodologies figures may vary from other market reports provided by Metrolist

- 100%

- 50%

0%

+ 50%

+ 100%

+ 150%

+ 200%

+ 250%

+ 300%

+ 350%

+ 400%

+ 450%

1-2008 7-2008 1-2009 7-2009 1-2010 7-2010 1-2011 7-2011 1-2012 7-2012 1-2013 7-2013 1-2014

Change in Median Sold Price from Prior Year (6-Month Average)

b

a

6

7

3

New Listings Sold Listings

- 57.1% + 83.3%

1

3

1

New Listings Sold Listings

- 66.7% + 400.0%

Due to differences in statistical methodologies, figures may vary from other market reports provided by Metrolist.

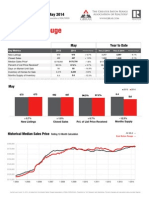

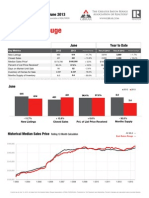

2013 2014 + / 2013 2014 + /

Active Listings 932 1,336 + 43.3% -- -- --

Under Contract Listings 1,443 1,762 + 22.1% 4,785 5,951 + 24.4%

New Listings 1,556 1,624 + 4.4% 5,069 5,261 + 3.8%

Sold Listings 1,209 1,181 - 2.3% 3,670 3,738 + 1.9%

Total Days on Market 45 35 -22.2% 57 44 -22.8%

Median Sold Price* $283,000 $280,000 - 1.1% $255,000 $265,250 + 4.0%

Average Sold Price* $338,175 $348,242 + 3.0% $315,780 $329,820 + 4.4%

Percent of Sold Price to List Price* 99.4% 99.6% + 0.2% 99.1% 98.9% - 0.2%

- 1.1%

Change in

New Listings

Change in

Sold Listings

Change in

Median Sold Price**

April Year to Date (YTD)

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

Local Market Update April 2014

A RESEARCH TOOL PROVIDED BY METROLIST

SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

Denver

+ 4.4% - 2.3%

5,069

3,670

5,261

3,738

Year to Date (YTD)

2013 2014

1,556

1,209

1,624

1,181

April

2013 2014

All MLS

Denver

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used

in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing.

Due to differences in statistical methodologies figures may vary from other market reports provided by Metrolist

- 40%

- 30%

- 20%

- 10%

0%

+ 10%

+ 20%

+ 30%

+ 40%

1-2008 7-2008 1-2009 7-2009 1-2010 7-2010 1-2011 7-2011 1-2012 7-2012 1-2013 7-2013 1-2014

Change in Median Sold Price from Prior Year (6-Month Average)

b

a

,

New Listings Sold Listings

+ 1.9% + 3.8%

New Listings Sold Listings

- 2.3% + 4.4%

Due to differences in statistical methodologies, figures may vary from other market reports provided by Metrolist.

2013 2014 + / 2013 2014 + /

Active Listings 1 1 0.0% -- -- --

Under Contract Listings 7 4 - 42.9% 32 24 - 25.0%

New Listings 6 6 0.0% 31 20 - 35.5%

Sold Listings 13 9 - 30.8% 29 24 - 17.2%

Total Days on Market 19 11 -42.1% 33 24 -27.3%

Median Sold Price* $235,000 $247,500 + 5.3% $235,000 $241,063 + 2.6%

Average Sold Price* $223,692 $247,736 + 10.7% $215,164 $230,622 + 7.2%

Percent of Sold Price to List Price* 101.1% 99.8% - 1.3% 99.9% 99.9% 0.0%

+ 5.3%

Change in

New Listings

Change in

Sold Listings

Change in

Median Sold Price**

April Year to Date (YTD)

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

Local Market Update April 2014

A RESEARCH TOOL PROVIDED BY METROLIST

SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

Edgewater

0.0% - 30.8%

31

29

20

24

Year to Date (YTD)

2013 2014

13

9

April

2013 2014

All MLS

Edgewater

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used

in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing.

Due to differences in statistical methodologies figures may vary from other market reports provided by Metrolist

- 20%

- 15%

- 10%

- 5%

0%

+ 5%

+ 10%

+ 15%

+ 20%

+ 25%

+ 30%

1-2008 7-2008 1-2009 7-2009 1-2010 7-2010 1-2011 7-2011 1-2012 7-2012 1-2013 7-2013 1-2014

Change in Median Sold Price from Prior Year (6-Month Average)

b

a

20

New Listings Sold Listings

- 17.2% - 35.5%

6 6

New Listings Sold Listings

- 30.8% 0.0%

Due to differences in statistical methodologies, figures may vary from other market reports provided by Metrolist.

2013 2014 + / 2013 2014 + /

Active Listings 17 22 + 29.4% -- -- --

Under Contract Listings 3 7 + 133.3% 11 17 + 54.5%

New Listings 6 5 - 16.7% 21 21 0.0%

Sold Listings 1 1 0.0% 9 7 - 22.2%

Total Days on Market 7 39 + 457.1% 130 144 + 10.8%

Median Sold Price* $285,000 $393,500 + 38.1% $340,000 $393,500 + 15.7%

Average Sold Price* $285,000 $393,500 + 38.1% $362,322 $406,200 + 12.1%

Percent of Sold Price to List Price* 98.3% 98.7% + 0.4% 96.6% 94.1% - 2.6%

+ 38.1%

Change in

New Listings

Change in

Sold Listings

Change in

Median Sold Price**

April Year to Date (YTD)

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

Local Market Update April 2014

A RESEARCH TOOL PROVIDED BY METROLIST

SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

Elbert

- 16.7% 0.0%

21 21

Year to Date (YTD)

2013 2014

6

5

April

2013 2014

All MLS

Elbert

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used

in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing.

Due to differences in statistical methodologies figures may vary from other market reports provided by Metrolist

- 40%

- 20%

0%

+ 20%

+ 40%

+ 60%

+ 80%

+ 100%

+ 120%

1-2008 7-2008 1-2009 7-2009 1-2010 7-2010 1-2011 7-2011 1-2012 7-2012 1-2013 7-2013 1-2014

Change in Median Sold Price from Prior Year (6-Month Average)

b

a

9

7

New Listings Sold Listings

- 22.2% 0.0%

1 1

New Listings Sold Listings

0.0% - 16.7%

Due to differences in statistical methodologies, figures may vary from other market reports provided by Metrolist.

2013 2014 + / 2013 2014 + /

Active Listings 43 73 + 69.8% -- -- --

Under Contract Listings 39 42 + 7.7% 116 129 + 11.2%

New Listings 39 44 + 12.8% 122 130 + 6.6%

Sold Listings 23 22 - 4.3% 94 71 - 24.5%

Total Days on Market 98 69 -29.6% 84 70 -16.7%

Median Sold Price* $345,000 $400,175 + 16.0% $344,000 $385,000 + 11.9%

Average Sold Price* $347,202 $408,145 + 17.6% $340,332 $371,300 + 9.1%

Percent of Sold Price to List Price* 98.6% 99.0% + 0.4% 98.7% 98.5% - 0.2%

+ 16.0%

Change in

New Listings

Change in

Sold Listings

Change in

Median Sold Price**

April Year to Date (YTD)

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

Local Market Update April 2014

A RESEARCH TOOL PROVIDED BY METROLIST

SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

Elizabeth

+ 12.8% - 4.3%

122

94

130

Year to Date (YTD)

2013 2014

39

44

April

2013 2014

All MLS

Elizabeth

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used

in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing.

Due to differences in statistical methodologies figures may vary from other market reports provided by Metrolist

- 20%

- 15%

- 10%

- 5%

0%

+ 5%

+ 10%

+ 15%

+ 20%

+ 25%

1-2008 7-2008 1-2009 7-2009 1-2010 7-2010 1-2011 7-2011 1-2012 7-2012 1-2013 7-2013 1-2014

Change in Median Sold Price from Prior Year (6-Month Average)

b

a

71

New Listings Sold Listings

- 24.5% + 6.6%

23

22

New Listings Sold Listings

- 4.3% + 12.8%

Due to differences in statistical methodologies, figures may vary from other market reports provided by Metrolist.

2013 2014 + / 2013 2014 + /

Active Listings 51 110 + 115.7% -- -- --

Under Contract Listings 110 165 + 50.0% 368 500 + 35.9%

New Listings 113 137 + 21.2% 390 456 + 16.9%

Sold Listings 89 87 - 2.2% 271 308 + 13.7%

Total Days on Market 48 34 -29.2% 45 37 -17.8%

Median Sold Price* $230,000 $245,000 + 6.5% $222,400 $244,950 + 10.1%

Average Sold Price* $279,672 $303,897 + 8.7% $257,642 $310,130 + 20.4%

Percent of Sold Price to List Price* 99.2% 99.0% - 0.2% 98.8% 98.2% - 0.6%

+ 6.5%

Change in

New Listings

Change in

Sold Listings

Change in

Median Sold Price**

April Year to Date (YTD)

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

Local Market Update April 2014

A RESEARCH TOOL PROVIDED BY METROLIST

SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

Englewood

+ 21.2% - 2.2%

390

271

456

308

Year to Date (YTD)

2013 2014

113

89

137

87

April

2013 2014

All MLS

Englewood

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used

in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing.

Due to differences in statistical methodologies figures may vary from other market reports provided by Metrolist

- 20%

- 15%

- 10%

- 5%

0%

+ 5%

+ 10%

+ 15%

+ 20%

+ 25%

1-2008 7-2008 1-2009 7-2009 1-2010 7-2010 1-2011 7-2011 1-2012 7-2012 1-2013 7-2013 1-2014

Change in Median Sold Price from Prior Year (6-Month Average)

b

a

271

New Listings Sold Listings

+ 13.7% + 16.9%

89

87

New Listings Sold Listings

- 2.2% + 21.2%

Due to differences in statistical methodologies, figures may vary from other market reports provided by Metrolist.

2013 2014 + / 2013 2014 + /

Active Listings 132 203 + 53.8% -- -- --

Under Contract Listings 63 73 + 15.9% 238 240 + 0.8%

New Listings 78 111 + 42.3% 271 286 + 5.5%

Sold Listings 76 48 - 36.8% 170 148 - 12.9%

Total Days on Market 104 75 -27.9% 116 84 -27.6%

Median Sold Price* $377,000 $425,000 + 12.7% $352,000 $400,000 + 13.6%

Average Sold Price* $590,053 $499,064 - 15.4% $482,714 $462,493 - 4.2%

Percent of Sold Price to List Price* 97.2% 97.7% + 0.5% 97.1% 97.3% + 0.2%

+ 12.7%

Change in

New Listings

Change in

Sold Listings

Change in

Median Sold Price**

April Year to Date (YTD)

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

Local Market Update April 2014

A RESEARCH TOOL PROVIDED BY METROLIST

SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

Evergreen

+ 42.3% - 36.8%

271

286

Year to Date (YTD)

2013 2014

78

76

111

April

2013 2014

All MLS

Evergreen

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used

in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing.

Due to differences in statistical methodologies figures may vary from other market reports provided by Metrolist

- 25%

- 20%

- 15%

- 10%

- 5%

0%

+ 5%

+ 10%

+ 15%

+ 20%

+ 25%

1-2008 7-2008 1-2009 7-2009 1-2010 7-2010 1-2011 7-2011 1-2012 7-2012 1-2013 7-2013 1-2014

Change in Median Sold Price from Prior Year (6-Month Average)

b

a

170

148

New Listings Sold Listings

- 12.9% + 5.5%

48

New Listings Sold Listings

- 36.8% + 42.3%

Due to differences in statistical methodologies, figures may vary from other market reports provided by Metrolist.

2013 2014 + / 2013 2014 + /

Active Listings 4 0 - 100.0% -- -- --

Under Contract Listings 6 5 - 16.7% 19 14 - 26.3%

New Listings 8 4 - 50.0% 18 9 - 50.0%

Sold Listings 1 6 + 500.0% 12 13 + 8.3%

Total Days on Market 26 66 + 153.8% 61 55 -9.8%

Median Sold Price* $94,172 $210,500 + 123.5% $142,250 $195,000 + 37.1%

Average Sold Price* $94,172 $191,048 + 102.9% $132,360 $174,776 + 32.0%

Percent of Sold Price to List Price* 96.6% 100.5% + 4.0% 94.2% 101.1% + 7.3%

+ 123.5%

Change in

New Listings

Change in

Sold Listings

Change in

Median Sold Price**

April Year to Date (YTD)

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

Local Market Update April 2014

A RESEARCH TOOL PROVIDED BY METROLIST

SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

Federal Heights

- 50.0% + 500.0%

18

12

13

Year to Date (YTD)

2013 2014

8

6

April

2013 2014

All MLS

Federal Heights

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used

in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing.

Due to differences in statistical methodologies figures may vary from other market reports provided by Metrolist

- 60%

- 40%

- 20%

0%

+ 20%

+ 40%

+ 60%

+ 80%

1-2008 7-2008 1-2009 7-2009 1-2010 7-2010 1-2011 7-2011 1-2012 7-2012 1-2013 7-2013 1-2014

Change in Median Sold Price from Prior Year (6-Month Average)

b

a

12

9

New Listings Sold Listings

+ 8.3% - 50.0%

1

4

New Listings Sold Listings

+ 500.0% - 50.0%

Due to differences in statistical methodologies, figures may vary from other market reports provided by Metrolist.

2013 2014 + / 2013 2014 + /

Active Listings 16 16 0.0% -- -- --

Under Contract Listings 15 18 + 20.0% 54 48 - 11.1%

New Listings 16 19 + 18.8% 65 45 - 30.8%

Sold Listings 12 4 - 66.7% 36 31 - 13.9%

Total Days on Market 13 82 + 530.8% 54 67 + 24.1%

Median Sold Price* $247,000 $299,475 + 21.2% $246,500 $275,000 + 11.6%

Average Sold Price* $255,617 $288,796 + 13.0% $243,392 $258,846 + 6.3%

Percent of Sold Price to List Price* 100.6% 104.0% + 3.4% 99.9% 99.5% - 0.4%

+ 21.2%

Change in

New Listings

Change in

Sold Listings

Change in

Median Sold Price**

April Year to Date (YTD)

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

Local Market Update April 2014

A RESEARCH TOOL PROVIDED BY METROLIST

SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

Firestone

+ 18.8% - 66.7%

65

45

Year to Date (YTD)

2013 2014

16

12

19

April

2013 2014

All MLS

Firestone

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used

in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing.

Due to differences in statistical methodologies figures may vary from other market reports provided by Metrolist

- 20%

- 15%

- 10%

- 5%

0%

+ 5%

+ 10%

+ 15%

+ 20%

+ 25%

1-2008 7-2008 1-2009 7-2009 1-2010 7-2010 1-2011 7-2011 1-2012 7-2012 1-2013 7-2013 1-2014

Change in Median Sold Price from Prior Year (6-Month Average)

b

a

36

31

New Listings Sold Listings

- 13.9% - 30.8%

12

4

New Listings Sold Listings

- 66.7% + 18.8%

Due to differences in statistical methodologies, figures may vary from other market reports provided by Metrolist.

2013 2014 + / 2013 2014 + /

Active Listings 16 26 + 62.5% -- -- --

Under Contract Listings 11 12 + 9.1% 29 36 + 24.1%

New Listings 9 13 + 44.4% 27 37 + 37.0%

Sold Listings 7 3 - 57.1% 22 19 - 13.6%

Total Days on Market 79 45 -43.0% 66 74 + 12.1%

Median Sold Price* $169,900 $185,000 + 8.9% $147,000 $177,000 + 20.4%

Average Sold Price* $167,207 $224,667 + 34.4% $159,930 $216,705 + 35.5%

Percent of Sold Price to List Price* 100.8% 101.4% + 0.6% 99.0% 99.1% + 0.1%

+ 8.9%

Change in

New Listings

Change in

Sold Listings

Change in

Median Sold Price**

April Year to Date (YTD)

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

Local Market Update April 2014

A RESEARCH TOOL PROVIDED BY METROLIST

SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

Fort Lupton

+ 44.4% - 57.1%

27

22

37

Year to Date (YTD)

2013 2014

9

13

April

2013 2014

All MLS

Fort Lupton

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used

in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing.

Due to differences in statistical methodologies figures may vary from other market reports provided by Metrolist

- 30%

- 20%

- 10%

0%

+ 10%

+ 20%

+ 30%

+ 40%

+ 50%

+ 60%

1-2008 7-2008 1-2009 7-2009 1-2010 7-2010 1-2011 7-2011 1-2012 7-2012 1-2013 7-2013 1-2014

Change in Median Sold Price from Prior Year (6-Month Average)

b

a

22

19

New Listings Sold Listings

- 13.6% + 37.0%

7

3

New Listings Sold Listings

- 57.1% + 44.4%

Due to differences in statistical methodologies, figures may vary from other market reports provided by Metrolist.

2013 2014 + / 2013 2014 + /

Active Listings 1 4 + 300.0% -- -- --

Under Contract Listings 0 1 -- 3 5 + 66.7%

New Listings 3 4 + 33.3% 5 7 + 40.0%

Sold Listings 1 0 - 100.0% 3 1 - 66.7%

Total Days on Market 3 0 -100.0% 64 6 -90.6%

Median Sold Price* $715,000 0 - 100.0% $417,000 $460,000 + 10.3%

Average Sold Price* $715,000 0 - 100.0% $506,167 $460,000 - 9.1%

Percent of Sold Price to List Price* 100.0% 0 - 100.0% 95.9% 100.0% + 4.3%

- 100.0%

Change in

New Listings

Change in

Sold Listings

Change in

Median Sold Price**

April Year to Date (YTD)

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

Local Market Update April 2014

A RESEARCH TOOL PROVIDED BY METROLIST

SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

Foxfield

+ 33.3% - 100.0%

5

7

Year to Date (YTD)

2013 2014

3

4

April

2013 2014

All MLS

Foxfield

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used

in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing.

Due to differences in statistical methodologies figures may vary from other market reports provided by Metrolist

- 100%

- 50%

0%

+ 50%

+ 100%

+ 150%

+ 200%

1-2008 7-2008 1-2009 7-2009 1-2010 7-2010 1-2011 7-2011 1-2012 7-2012 1-2013 7-2013 1-2014

Change in Median Sold Price from Prior Year (6-Month Average)

b

a

3

1

New Listings Sold Listings

- 66.7% + 40.0%

1

0

New Listings Sold Listings

- 100.0% + 33.3%

Due to differences in statistical methodologies, figures may vary from other market reports provided by Metrolist.

2013 2014 + / 2013 2014 + /

Active Listings 25 40 + 60.0% -- -- --

Under Contract Listings 7 9 + 28.6% 26 32 + 23.1%

New Listings 9 14 + 55.6% 38 39 + 2.6%

Sold Listings 6 6 0.0% 18 17 - 5.6%

Total Days on Market 135 159 + 17.8% 139 121 -12.9%

Median Sold Price* $490,000 $488,500 - 0.3% $482,500 $500,000 + 3.6%

Average Sold Price* $538,167 $598,667 + 11.2% $541,944 $548,159 + 1.1%

Percent of Sold Price to List Price* 94.2% 96.4% + 2.3% 95.8% 97.4% + 1.7%

- 0.3%

Change in

New Listings

Change in

Sold Listings

Change in

Median Sold Price**

April Year to Date (YTD)

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

Local Market Update April 2014

A RESEARCH TOOL PROVIDED BY METROLIST

SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

Franktown

+ 55.6% 0.0%

38

39

Year to Date (YTD)

2013 2014

9

14

April

2013 2014

All MLS

Franktown

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used

in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing.

Due to differences in statistical methodologies figures may vary from other market reports provided by Metrolist

- 40%

- 30%

- 20%

- 10%

0%

+ 10%

+ 20%

+ 30%

+ 40%

1-2008 7-2008 1-2009 7-2009 1-2010 7-2010 1-2011 7-2011 1-2012 7-2012 1-2013 7-2013 1-2014

Change in Median Sold Price from Prior Year (6-Month Average)

b

a

18

17

New Listings Sold Listings

- 5.6% + 2.6%

9

6 6

New Listings Sold Listings

0.0% + 55.6%

Due to differences in statistical methodologies, figures may vary from other market reports provided by Metrolist.

2013 2014 + / 2013 2014 + /

Active Listings 13 25 + 92.3% -- -- --

Under Contract Listings 20 17 - 15.0% 73 63 - 13.7%

New Listings 9 13 + 44.4% 65 62 - 4.6%

Sold Listings 21 17 - 19.0% 59 38 - 35.6%

Total Days on Market 51 9 -82.4% 77 33 -57.1%

Median Sold Price* $270,000 $265,500 - 1.7% $238,500 $243,450 + 2.1%

Average Sold Price* $286,263 $261,385 - 8.7% $247,276 $248,714 + 0.6%

Percent of Sold Price to List Price* 97.6% 100.3% + 2.8% 98.4% 99.7% + 1.3%

- 1.7%

Change in

New Listings

Change in

Sold Listings

Change in

Median Sold Price**

April Year to Date (YTD)

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

Local Market Update April 2014

A RESEARCH TOOL PROVIDED BY METROLIST

SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

Frederick

+ 44.4% - 19.0%

65

59

62

38

Year to Date (YTD)

2013 2014

21

17

April

2013 2014

All MLS

Frederick

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used

in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing.

Due to differences in statistical methodologies figures may vary from other market reports provided by Metrolist

- 20%

- 15%

- 10%

- 5%

0%

+ 5%

+ 10%

+ 15%

+ 20%

1-2008 7-2008 1-2009 7-2009 1-2010 7-2010 1-2011 7-2011 1-2012 7-2012 1-2013 7-2013 1-2014

Change in Median Sold Price from Prior Year (6-Month Average)

b

a

38

New Listings Sold Listings

- 35.6% - 4.6%

9

13

New Listings Sold Listings

- 19.0% + 44.4%

Due to differences in statistical methodologies, figures may vary from other market reports provided by Metrolist.

2013 2014 + / 2013 2014 + /

Active Listings 2 0 - 100.0% -- -- --

Under Contract Listings 4 0 - 100.0% 7 1 - 85.7%

New Listings 3 0 - 100.0% 9 1 - 88.9%

Sold Listings 2 0 - 100.0% 3 2 - 33.3%

Total Days on Market 34 0 -100.0% 23 21 -8.7%

Median Sold Price* $176,750 0 - 100.0% $127,000 $127,500 + 0.4%

Average Sold Price* $176,750 0 - 100.0% $160,167 $127,500 - 20.4%

Percent of Sold Price to List Price* 96.9% 0 - 100.0% 97.8% 99.1% + 1.3%

- 100.0%

Change in

New Listings

Change in

Sold Listings

Change in

Median Sold Price**

April Year to Date (YTD)

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

Local Market Update April 2014

A RESEARCH TOOL PROVIDED BY METROLIST

SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

Glendale

- 100.0% - 100.0%

9

Year to Date (YTD)

2013 2014

3

2

April

2013 2014

All MLS

Glendale

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used

in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing.

Due to differences in statistical methodologies figures may vary from other market reports provided by Metrolist

- 20%

- 10%

0%

+ 10%

+ 20%

+ 30%

+ 40%

+ 50%

+ 60%

1-2008 7-2008 1-2009 7-2009 1-2010 7-2010 1-2011 7-2011 1-2012 7-2012 1-2013 7-2013 1-2014

Change in Median Sold Price from Prior Year (6-Month Average)

b

a

3

1

2

New Listings Sold Listings

- 33.3% - 88.9%

2

0 0

New Listings Sold Listings

- 100.0% - 100.0%

Due to differences in statistical methodologies, figures may vary from other market reports provided by Metrolist.

2013 2014 + / 2013 2014 + /

Active Listings 115 144 + 25.2% -- -- --

Under Contract Listings 98 74 - 24.5% 313 264 - 15.7%

New Listings 110 101 - 8.2% 344 290 - 15.7%

Sold Listings 80 58 - 27.5% 235 201 - 14.5%

Total Days on Market 85 36 -57.6% 102 51 -50.0%

Median Sold Price* $352,000 $399,000 + 13.4% $375,750 $364,000 - 3.1%

Average Sold Price* $399,020 $416,818 + 4.5% $410,356 $390,011 - 5.0%

Percent of Sold Price to List Price* 98.7% 98.7% 0.0% 98.4% 98.0% - 0.4%

+ 13.4%

Change in

New Listings

Change in

Sold Listings

Change in

Median Sold Price**

April Year to Date (YTD)

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

Local Market Update April 2014

A RESEARCH TOOL PROVIDED BY METROLIST

SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

Golden

- 8.2% - 27.5%

344

235

290

Year to Date (YTD)

2013 2014

110

80

101

April

2013 2014

All MLS

Golden

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used

in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing.

Due to differences in statistical methodologies figures may vary from other market reports provided by Metrolist

- 20%

- 15%

- 10%

- 5%

0%

+ 5%

+ 10%

+ 15%

+ 20%

+ 25%

1-2008 7-2008 1-2009 7-2009 1-2010 7-2010 1-2011 7-2011 1-2012 7-2012 1-2013 7-2013 1-2014

Change in Median Sold Price from Prior Year (6-Month Average)

b

a

235

201

New Listings Sold Listings

- 14.5% - 15.7%

58

New Listings Sold Listings

- 27.5% - 8.2%

Due to differences in statistical methodologies, figures may vary from other market reports provided by Metrolist.

2013 2014 + / 2013 2014 + /

Active Listings 54 62 + 14.8% -- -- --

Under Contract Listings 27 35 + 29.6% 99 106 + 7.1%

New Listings 53 34 - 35.8% 153 117 - 23.5%

Sold Listings 32 24 - 25.0% 75 62 - 17.3%

Total Days on Market 68 36 -47.1% 88 57 -35.2%

Median Sold Price* $804,500 $655,000 - 18.6% $615,000 $640,000 + 4.1%

Average Sold Price* $831,108 $810,288 - 2.5% $751,283 $764,830 + 1.8%

Percent of Sold Price to List Price* 97.9% 99.3% + 1.4% 97.4% 97.7% + 0.3%

- 18.6%

Change in

New Listings

Change in

Sold Listings

Change in

Median Sold Price**

April Year to Date (YTD)

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

Local Market Update April 2014

A RESEARCH TOOL PROVIDED BY METROLIST

SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

Greenwood

Village

- 35.8% - 25.0%

153

117

Year to Date (YTD)

2013 2014

53

34

April

2013 2014

All MLS

Greenwood Village

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used

in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing.

Due to differences in statistical methodologies figures may vary from other market reports provided by Metrolist

- 30%

- 20%

- 10%

0%

+ 10%

+ 20%

+ 30%

+ 40%

+ 50%

+ 60%

+ 70%

1-2008 7-2008 1-2009 7-2009 1-2010 7-2010 1-2011 7-2011 1-2012 7-2012 1-2013 7-2013 1-2014

Change in Median Sold Price from Prior Year (6-Month Average)

b

a

75

62

New Listings Sold Listings

- 17.3% - 23.5%

32

34

24

New Listings Sold Listings

- 25.0% - 35.8%

Due to differences in statistical methodologies, figures may vary from other market reports provided by Metrolist.

2013 2014 + / 2013 2014 + /

Active Listings 6 21 + 250.0% -- -- --

Under Contract Listings 10 36 + 260.0% 29 100 + 244.8%

New Listings 9 36 + 300.0% 26 99 + 280.8%

Sold Listings 10 18 + 80.0% 21 47 + 123.8%

Total Days on Market 89 14 -84.3% 73 27 -63.0%

Median Sold Price* $247,000 $272,750 + 10.4% $245,000 $250,000 + 2.0%

Average Sold Price* $217,330 $277,968 + 27.9% $231,569 $255,968 + 10.5%

Percent of Sold Price to List Price* 97.9% 104.1% + 6.3% 98.8% 101.6% + 2.8%

+ 10.4%

Change in

New Listings

Change in

Sold Listings

Change in

Median Sold Price**

April Year to Date (YTD)

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

Local Market Update April 2014

A RESEARCH TOOL PROVIDED BY METROLIST

SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

Henderson

+ 300.0% + 80.0%

99

Year to Date (YTD)

2013 2014

36

April

2013 2014

All MLS

Henderson

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used

in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing.

Due to differences in statistical methodologies figures may vary from other market reports provided by Metrolist

- 20%

- 15%

- 10%

- 5%

0%

+ 5%

+ 10%

+ 15%

+ 20%

+ 25%

+ 30%

+ 35%

1-2008 7-2008 1-2009 7-2009 1-2010 7-2010 1-2011 7-2011 1-2012 7-2012 1-2013 7-2013 1-2014

Change in Median Sold Price from Prior Year (6-Month Average)

b

a

26

21

47

New Listings Sold Listings

+ 123.8% + 280.8%

9

10

18

New Listings Sold Listings

+ 80.0% + 300.0%

Due to differences in statistical methodologies, figures may vary from other market reports provided by Metrolist.

2013 2014 + / 2013 2014 + /

Active Listings 76 159 + 109.2% -- -- --

Under Contract Listings 263 292 + 11.0% 848 858 + 1.2%

New Listings 250 268 + 7.2% 816 811 - 0.6%

Sold Listings 190 177 - 6.8% 609 523 - 14.1%

Total Days on Market 25 20 -20.0% 43 31 -27.9%

Median Sold Price* $316,250 $347,000 + 9.7% $319,000 $342,000 + 7.2%

Average Sold Price* $354,442 $406,283 + 14.6% $354,381 $383,535 + 8.2%

Percent of Sold Price to List Price* 99.4% 99.6% + 0.2% 98.8% 99.1% + 0.3%

+ 9.7%

Change in

New Listings

Change in

Sold Listings

Change in

Median Sold Price**

April Year to Date (YTD)

* Does not account for seller concessions and/or down payment assistance. | Note: Activity for one month can sometimes look extreme due to small sample size.

Local Market Update April 2014

A RESEARCH TOOL PROVIDED BY METROLIST

SINGLE FAMILY LISTINGS ONLY RESIDENTIAL AND CONDO

Highlands Ranch

+ 7.2% - 6.8%

816

609

811

523

Year to Date (YTD)

2013 2014

250

190

268

177

April

2013 2014

All MLS

Highlands Ranch

Each dot represents the change in median sold price from the prior year using a 6-month weighted average. This means that each of the 6 months used

in a dot are proportioned according to their share of sales during that period. | All data from Metrolist. | Powered by 10K Research and Marketing.

Due to differences in statistical methodologies figures may vary from other market reports provided by Metrolist

- 20%

- 15%

- 10%

- 5%

0%

+ 5%

+ 10%

+ 15%

+ 20%

1-2008 7-2008 1-2009 7-2009 1-2010 7-2010 1-2011 7-2011 1-2012 7-2012 1-2013 7-2013 1-2014

Change in Median Sold Price from Prior Year (6-Month Average)

b

a

523

New Listings Sold Listings

- 14.1% - 0.6%

177

New Listings Sold Listings

- 6.8% + 7.2%

Due to differences in statistical methodologies, figures may vary from other market reports provided by Metrolist.

2013 2014 + / 2013 2014 + /

Active Listings 25 30 + 20.0% -- -- --

Under Contract Listings 8 12 + 50.0% 25 34 + 36.0%

New Listings 10 11 + 10.0% 23 33 + 43.5%

Sold Listings 2 4 + 100.0% 17 19 + 11.8%

Total Days on Market 154 122 -20.8% 115 102 -11.3%