Escolar Documentos

Profissional Documentos

Cultura Documentos

W 2

Enviado por

prads12590 notas0% acharam este documento útil (0 voto)

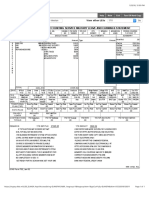

113 visualizações6 páginasThis document is an IRS Form W-2 (Wage and Tax Statement) containing information about an employee's wages, taxes, and other compensation for the tax year. The form includes sections for the employer and employee identification information as well as boxes for reporting wages, taxes withheld, and other payroll details. Copies A through D provide instructions for distribution of the form to the Social Security Administration, employee, and tax agencies at the federal, state, and local levels.

Descrição original:

W2

Título original

w2

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoThis document is an IRS Form W-2 (Wage and Tax Statement) containing information about an employee's wages, taxes, and other compensation for the tax year. The form includes sections for the employer and employee identification information as well as boxes for reporting wages, taxes withheld, and other payroll details. Copies A through D provide instructions for distribution of the form to the Social Security Administration, employee, and tax agencies at the federal, state, and local levels.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

113 visualizações6 páginasW 2

Enviado por

prads1259This document is an IRS Form W-2 (Wage and Tax Statement) containing information about an employee's wages, taxes, and other compensation for the tax year. The form includes sections for the employer and employee identification information as well as boxes for reporting wages, taxes withheld, and other payroll details. Copies A through D provide instructions for distribution of the form to the Social Security Administration, employee, and tax agencies at the federal, state, and local levels.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 6

For Privacy Act and Paperwork Reduction

Act Notice, see back of Copy D.

1

Employees social security number

Retirement

plan

Third-party

sick pay

Statutory

employee

6

2

Employers name, address, and ZIP code

Allocated tips 7

Advance EIC payment

8

10 9

Wages, tips, other compensation Federal income tax withheld

Social security tax withheld Social security wages

12a 11

Employers state ID number

4 3

Employer identification number (EIN)

Medicare wages and tips

Social security tips

13

5

Control number

Employees first name and initial Nonqualified plans

Medicare tax withheld

15

14

17 16

Other

18

Employees address and ZIP code

State income tax State State wages, tips, etc. Locality name

Copy A For Social Security Administration Send this entire page with

Form W-3 to the Social Security Administration; photocopies are not acceptable.

Department of the TreasuryInternal Revenue Service

Do Not Cut, Fold, or Staple Forms on This Page Do Not Cut, Fold, or Staple Forms on This Page

Form

Dependent care benefits

See instructions for box 12

Cat. No. 10134D

a

b

c

d

e

f

Void

W-2

Wage and Tax

Statement 2

22222

0 0 7

OMB No. 1545-0008

For Official Use Only

Last name

C

o

d

e

12b

C

o

d

e

12c

C

o

d

e

19 Local wages, tips, etc. 20 Local income tax

12d

C

o

d

e

Suff.

1

Retirement

plan

Third-party

sick pay

Statutory

employee

6

2

Employers name, address, and ZIP code

Allocated tips 7

Advance EIC payment

8

10 9

Wages, tips, other compensation Federal income tax withheld

Social security tax withheld Social security wages

12a 11

Employers state ID number

4 3

Employer identification number (EIN)

Medicare wages and tips

Social security tips

13

5

Control number

Employees first name and initial Nonqualified plans

Medicare tax withheld

15

14

17 16

Other

18

Employees address and ZIP code

State income tax State State wages, tips, etc. Locality name

Copy 1For State, City, or Local Tax Department

Department of the TreasuryInternal Revenue Service

Form

Dependent care benefits

b

c

d

e

f

W-2

Wage and Tax

Statement 2 0 0 7

OMB No. 1545-0008

Last name

C

o

d

e

12b

C

o

d

e

12c

C

o

d

e

19 Local wages, tips, etc. 20 Local income tax

12d

C

o

d

e

Suff.

Employees social security number a

22222

1

Retirement

plan

Third-party

sick pay

Statutory

employee

6

2

Employers name, address, and ZIP code

Allocated tips 7

Advance EIC payment

8

10 9

Wages, tips, other compensation Federal income tax withheld

Social security tax withheld Social security wages

12a 11

Employers state ID number

4 3

Employer identification number (EIN)

Medicare wages and tips

Social security tips

13

5

Control number

Employees first name and initial Nonqualified plans

Medicare tax withheld

15

14

17 16

Other

18

Employees address and ZIP code

State income tax State State wages, tips, etc. Locality name

Copy BTo Be Filed With Employees FEDERAL Tax Return.

This information is being furnished to the Internal Revenue Service.

Department of the TreasuryInternal Revenue Service

Form

Dependent care benefits

See instructions for box 12

b

c

d

e

f

W-2

Wage and Tax

Statement 2 0 0 7

Last name

C

o

d

e

12b

C

o

d

e

12c

C

o

d

e

19 Local wages, tips, etc. 20 Local income tax

12d

C

o

d

e

Safe, accurate,

FAST! Use

Visit the IRS website

at www.irs.gov/efile.

Suff.

Employees social security number a

OMB No. 1545-0008

1

Retirement

plan

Third-party

sick pay

Statutory

employee

6

2

Employers name, address, and ZIP code

Allocated tips 7

Advance EIC payment

8

10 9

Wages, tips, other compensation Federal income tax withheld

Social security tax withheld Social security wages

12a 11

Employers state ID number

4 3

Employer identification number (EIN)

Medicare wages and tips

Social security tips

13

5

Control number

Employees first name and initial Nonqualified plans

Medicare tax withheld

15

14

17 16

Other

18

Employees address and ZIP code

State income tax State State wages, tips, etc. Locality name

Copy CFor EMPLOYEES RECORDS (See Notice to

Employee on the back of Copy B.)

Department of the TreasuryInternal Revenue Service

Form

Dependent care benefits

See instructions for box 12

b

c

d

e

f

W-2

Wage and Tax

Statement 2 0 0 7

Last name

C

o

d

e

12b

C

o

d

e

12c

C

o

d

e

19 Local wages, tips, etc. 20 Local income tax

12d

C

o

d

e

This information is being furnished to the Internal Revenue Service. If you

are required to file a tax return, a negligence penalty or other sanction

may be imposed on you if this income is taxable and you fail to report it.

Safe, accurate,

FAST! Use

Suff.

Employees social security number a

OMB No. 1545-0008

1

Retirement

plan

Third-party

sick pay

Statutory

employee

6

2

Employers name, address, and ZIP code

Allocated tips 7

Advance EIC payment

8

10 9

Wages, tips, other compensation Federal income tax withheld

Social security tax withheld Social security wages

12a 11

Employers state ID number

4 3

Employer identification number (EIN)

Medicare wages and tips

Social security tips

13

5

Control number

Employees first name and initial Nonqualified plans

Medicare tax withheld

15

14

17 16

Other

18

Employees address and ZIP code

State income tax State State wages, tips, etc. Locality name

Copy 2To Be Filed With Employees State, City, or Local

Income Tax Return.

Department of the TreasuryInternal Revenue Service

Form

Dependent care benefits

b

c

d

e

f

W-2

Wage and Tax

Statement 2 0 0 7

Last name

C

o

d

e

12b

C

o

d

e

12c

C

o

d

e

19 Local wages, tips, etc. 20 Local income tax

12d

C

o

d

e

Suff.

Employees social security number a

OMB No. 1545-0008

1

Retirement

plan

Third-party

sick pay

Statutory

employee

6

2

Employers name, address, and ZIP code

Allocated tips 7

Advance EIC payment

8

10 9

Wages, tips, other compensation Federal income tax withheld

Social security tax withheld Social security wages

12a 11

Employers state ID number

4 3

Employer identification number (EIN)

Medicare wages and tips

Social security tips

13

5

Control number

Employees first name and initial Nonqualified plans

Medicare tax withheld

15

14

17 16

Other

18

Employees address and ZIP code

State income tax State State wages, tips, etc. Locality name

Copy DFor Employer.

Department of the TreasuryInternal Revenue Service

Form

Dependent care benefits

See instructions for box 12

b

c

d

e

f

W-2

Wage and Tax

Statement 2 0 0 7

Last name

C

o

d

e

12b

C

o

d

e

12c

C

o

d

e

19 Local wages, tips, etc. 20 Local income tax

12d

C

o

d

e

For Privacy Act and Paperwork Reduction

Act Notice, see the back of Copy D.

Suff.

Employees social security number a

Void

OMB No. 1545-0008

Você também pode gostar

- Vystar StatementDocumento13 páginasVystar StatementPatsy Hilll100% (2)

- 9YWwhh55h5384810244629010109102 PDFDocumento2 páginas9YWwhh55h5384810244629010109102 PDFDave Yerznkyan100% (1)

- DateDocumento4 páginasDatechatiresAinda não há avaliações

- TGDocumento2 páginasTGpr995Ainda não há avaliações

- Explanation of Amount Due: Click Here To Pay OnlineDocumento2 páginasExplanation of Amount Due: Click Here To Pay OnlinePhillipAinda não há avaliações

- MyPay PDFDocumento1 páginaMyPay PDFPaul BeznerAinda não há avaliações

- Lili Monthly Statement 2021-11Documento2 páginasLili Monthly Statement 2021-11Clifton WilsonAinda não há avaliações

- MSB RegistrationDocumento1 páginaMSB RegistrationWiredEnterpriseAinda não há avaliações

- Sears Canada: Electric DryerDocumento10 páginasSears Canada: Electric Dryerquarz11100% (1)

- 4th Quarter NYS-45 2014 PDFDocumento2 páginas4th Quarter NYS-45 2014 PDFMichael WalkerAinda não há avaliações

- Gov. Walz 2019 Federal Tax Return - RedactedDocumento11 páginasGov. Walz 2019 Federal Tax Return - RedactedTim Walz for GovernorAinda não há avaliações

- Tax RecordDocumento1 páginaTax RecordmicantbabyAinda não há avaliações

- Your Adv Plus Banking: Account SummaryDocumento4 páginasYour Adv Plus Banking: Account SummaryYazmin UrbinaAinda não há avaliações

- PDF Document 2 PDFDocumento1 páginaPDF Document 2 PDFac acAinda não há avaliações

- Fin 320 - Individual AssignmentDocumento14 páginasFin 320 - Individual AssignmentAnis Umaira Mohd LutpiAinda não há avaliações

- Wage and Tax StatementDocumento4 páginasWage and Tax StatementMark OasayAinda não há avaliações

- Wage and Tax StatementDocumento4 páginasWage and Tax StatementRich1781Ainda não há avaliações

- Bluebird Statement - Bluebird - 1625594969518Documento2 páginasBluebird Statement - Bluebird - 1625594969518daniel floydAinda não há avaliações

- Harvey Metabank Jan22Documento1 páginaHarvey Metabank Jan22Mark Dewey0% (1)

- Statement BOA 21.01.2020-21.03.2020Documento1 páginaStatement BOA 21.01.2020-21.03.2020Viktoria DenisenkoAinda não há avaliações

- Wage and Tax Statement: OMB No. 1545-0008Documento7 páginasWage and Tax Statement: OMB No. 1545-0008LUZILLE MEDINAAinda não há avaliações

- MyfileDocumento1 páginaMyfileanon-302065Ainda não há avaliações

- Michael Easley 1040 2017Documento2 páginasMichael Easley 1040 2017MichaelAinda não há avaliações

- Ka/Lfh: Lee A Vinal Inc 401 Aiken Ave DRACUT, MA 01826Documento4 páginasKa/Lfh: Lee A Vinal Inc 401 Aiken Ave DRACUT, MA 01826Jonathan Seagull LivingstonAinda não há avaliações

- Pine Ridge Apartment Welcome LetterDocumento2 páginasPine Ridge Apartment Welcome LetterKamil KowalskiAinda não há avaliações

- Pay StubDocumento1 páginaPay StubLulu HuttonAinda não há avaliações

- Ajax PDFDocumento2 páginasAjax PDFGeorge AndoneAinda não há avaliações

- 1098T17Documento2 páginas1098T17RegrubdiupsAinda não há avaliações

- 61 F 28319 Bcac 1Documento1 página61 F 28319 Bcac 1MickeyAinda não há avaliações

- 2010 08 15 - BillDocumento2 páginas2010 08 15 - Billteporocho9Ainda não há avaliações

- Marylynn Huggins - Clifden Ut State Tax Return 2013Documento4 páginasMarylynn Huggins - Clifden Ut State Tax Return 2013api-2573405260% (1)

- Current Pay Statement: This Is A Statement of Earnings and Deductions. This Pay Statement Is Non-NegotiableDocumento1 páginaCurrent Pay Statement: This Is A Statement of Earnings and Deductions. This Pay Statement Is Non-Negotiablekevin kuhnAinda não há avaliações

- Cesar Simon Abreu Suarez 7320 SW 72Nd Avenue Miami FL 33143-4203Documento4 páginasCesar Simon Abreu Suarez 7320 SW 72Nd Avenue Miami FL 33143-4203CESAR ABREUAinda não há avaliações

- Monica L Lindo Tax FormDocumento2 páginasMonica L Lindo Tax Formapi-299234513Ainda não há avaliações

- OutputDocumento6 páginasOutputSylvia MorenoAinda não há avaliações

- Direct Deposit Authorization Form Telesforo ChuidianDocumento1 páginaDirect Deposit Authorization Form Telesforo ChuidianpayneAinda não há avaliações

- Capital One TaxDocumento2 páginasCapital One Tax16baezmcAinda não há avaliações

- Direct Deposit Enrollment Form: Account InformationDocumento1 páginaDirect Deposit Enrollment Form: Account InformationGERALDAinda não há avaliações

- 20 TR 08894502584200889450Documento2 páginas20 TR 08894502584200889450Josh JasperAinda não há avaliações

- OMB Control No. 2900-0086 Respondent Burden: 15 MinutesDocumento2 páginasOMB Control No. 2900-0086 Respondent Burden: 15 MinutesPatrickCharlesAinda não há avaliações

- Anil Gupta 2021 w2Documento2 páginasAnil Gupta 2021 w2Kawljeet Singh KohliAinda não há avaliações

- Kenndal D Crawford 109 Inwood Court Spartanburg, SC 29302: Employer Use Only Corp. DeptDocumento2 páginasKenndal D Crawford 109 Inwood Court Spartanburg, SC 29302: Employer Use Only Corp. Depttaylorizabella1Ainda não há avaliações

- Profit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Documento2 páginasProfit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Thomas LawrenceAinda não há avaliações

- Copart Wire IntructionsDocumento1 páginaCopart Wire IntructionsGeorge PlishkoAinda não há avaliações

- Wage and Tax Statement: OMB No. 1545-0008 Visit The IRS Website atDocumento3 páginasWage and Tax Statement: OMB No. 1545-0008 Visit The IRS Website atcofi kenteAinda não há avaliações

- December StatementDocumento3 páginasDecember StatementNoriely Altagracia Paulino Rivas100% (1)

- TaxDocumento3 páginasTaxJames Bleeker100% (1)

- Pay StatementDocumento1 páginaPay Statementjmatos_297262Ainda não há avaliações

- Nolasco W2Documento2 páginasNolasco W2MARCOS NOLASCOAinda não há avaliações

- 941 1st QTR 2010Documento2 páginas941 1st QTR 2010Larry BartonAinda não há avaliações

- Earnings Statement: Non-NegotiableDocumento1 páginaEarnings Statement: Non-NegotiableSrilatha YagniAinda não há avaliações

- Paycheck 20201230 001387 Pravallika 202101241910Documento1 páginaPaycheck 20201230 001387 Pravallika 202101241910Prabhakar AenugaAinda não há avaliações

- Filename PDFDocumento3 páginasFilename PDFIvette PizarroAinda não há avaliações

- Christopher Collins March Bank StatementDocumento2 páginasChristopher Collins March Bank StatementJim BoazAinda não há avaliações

- CmregionsstatementDocumento1 páginaCmregionsstatementDae MacAinda não há avaliações

- U.S. Individual Income Tax Return: Filing StatusDocumento2 páginasU.S. Individual Income Tax Return: Filing Statuskenneth kittleson100% (1)

- 497603760Documento2 páginas497603760chrissyanspach100% (1)

- Profit or Loss From Business: Linda Gercken 156-56-8670Documento2 páginasProfit or Loss From Business: Linda Gercken 156-56-8670ROB100% (1)

- T Mobile BillDocumento7 páginasT Mobile Billchenelson058Ainda não há avaliações

- Income Statement Template V3Documento21 páginasIncome Statement Template V3Third WheelAinda não há avaliações

- Attention:: Not File Copy A Downloaded From This Website With The SSA. The OfficialDocumento11 páginasAttention:: Not File Copy A Downloaded From This Website With The SSA. The OfficialMia JacksonAinda não há avaliações

- Attention:: Not File Copy A Downloaded From This Website With The SSA. The OfficialDocumento11 páginasAttention:: Not File Copy A Downloaded From This Website With The SSA. The OfficialHaiOuAinda não há avaliações

- Big Basket CouponDocumento2 páginasBig Basket Couponprads1259Ainda não há avaliações

- Invoice - Num Invoice - Date Invoice - Currency - Code SourceDocumento1 páginaInvoice - Num Invoice - Date Invoice - Currency - Code Sourceprads1259Ainda não há avaliações

- Invoice # : Bill To: Ship ToDocumento1 páginaInvoice # : Bill To: Ship Toprads1259Ainda não há avaliações

- Invoice - Num Invoice - Date Source Invoice - Currency - Co DE Invoice - AmountDocumento1 páginaInvoice - Num Invoice - Date Source Invoice - Currency - Co DE Invoice - Amountprads1259Ainda não há avaliações

- Invoice - Num Invoice - Date Invoice - Currency - Code SourceDocumento1 páginaInvoice - Num Invoice - Date Invoice - Currency - Code Sourceprads1259Ainda não há avaliações

- FifthDocumento1 páginaFifthprads1259Ainda não há avaliações

- Invoice Number: INVOICE - NUMDocumento1 páginaInvoice Number: INVOICE - NUMprads1259Ainda não há avaliações

- Generating Depth Based Tree From Hierarchical Data in MySQL (No CTEs) - Stack OverflowDocumento4 páginasGenerating Depth Based Tree From Hierarchical Data in MySQL (No CTEs) - Stack Overflowprads1259Ainda não há avaliações

- Invoice - Num Invoice - Date Invoice - Currency - Code Invoice - Amount SourceDocumento1 páginaInvoice - Num Invoice - Date Invoice - Currency - Code Invoice - Amount Sourceprads1259Ainda não há avaliações

- Invoice - Num Invoice - Date Invoice - Currency - Code Source: For-EachDocumento1 páginaInvoice - Num Invoice - Date Invoice - Currency - Code Source: For-Eachprads1259Ainda não há avaliações

- CountryDocumento1 páginaCountryprads1259Ainda não há avaliações

- Invoice No: Invoice Date: Line Number Item Name Item TypeDocumento1 páginaInvoice No: Invoice Date: Line Number Item Name Item Typeprads1259Ainda não há avaliações

- Plan Amount Term Premium Taxes Education CessDocumento3 páginasPlan Amount Term Premium Taxes Education Cessprads1259Ainda não há avaliações

- A.Emplid: A.Name - Type A.Name A.Last - Name A.First - NameDocumento1 páginaA.Emplid: A.Name - Type A.Name A.Last - Name A.First - Nameprads1259Ainda não há avaliações

- TTD Accommodation ReceiptDocumento2 páginasTTD Accommodation ReceiptDharani KumarAinda não há avaliações

- BestPractices PDFDocumento14 páginasBestPractices PDFAnonymous tChrzngvAinda não há avaliações

- Concept of InsuranceDocumento4 páginasConcept of InsuranceNazrul HoqueAinda não há avaliações

- Stock Trak AssignmentDocumento4 páginasStock Trak AssignmentPat ParisiAinda não há avaliações

- Manuall Cryton-Yamaha 2015Documento57 páginasManuall Cryton-Yamaha 2015Abel PachecoAinda não há avaliações

- Book Review Module 8Documento18 páginasBook Review Module 8Asherah Mica MarquezAinda não há avaliações

- Annual Premium Statement: Bhupesh GuptaDocumento1 páginaAnnual Premium Statement: Bhupesh GuptaBhupesh GuptaAinda não há avaliações

- Problem Sheet 3 - External Forced Convection - WatermarkDocumento2 páginasProblem Sheet 3 - External Forced Convection - WatermarkUzair KhanAinda não há avaliações

- Comprehension: The Boy Is Playing With A Fire TruckDocumento79 páginasComprehension: The Boy Is Playing With A Fire Truckbhupendra singh sengarAinda não há avaliações

- Site AnalysisDocumento4 páginasSite AnalysisS O NALAinda não há avaliações

- E. What Was The Chinese POW Death Rate in WW2 and The Second Sino-Japanese WarDocumento3 páginasE. What Was The Chinese POW Death Rate in WW2 and The Second Sino-Japanese WarPamela SantosAinda não há avaliações

- 2.fundamentals of MappingDocumento5 páginas2.fundamentals of MappingB S Praveen BspAinda não há avaliações

- AI LabDocumento17 páginasAI LabTripti JainAinda não há avaliações

- Ecological Pyramids WorksheetDocumento3 páginasEcological Pyramids Worksheetapi-26236818833% (3)

- MMG 302Documento164 páginasMMG 302piyush patilAinda não há avaliações

- Adherence Tradeoff To Multiple Preventive Therapies and All-Cause Mortality After Acute Myocardial InfarctionDocumento12 páginasAdherence Tradeoff To Multiple Preventive Therapies and All-Cause Mortality After Acute Myocardial InfarctionRoberto López MataAinda não há avaliações

- Consider Typical Robots Consider Typical RobotsDocumento16 páginasConsider Typical Robots Consider Typical RobotsOthers ATBP.Ainda não há avaliações

- Shock Cat 2009Documento191 páginasShock Cat 2009gersonplovasAinda não há avaliações

- Accessing Biodiversity and Sharing The BenefitsDocumento332 páginasAccessing Biodiversity and Sharing The BenefitsNelson MartínezAinda não há avaliações

- SPE-171076-MS The Role of Asphaltenes in Emulsion Formation For Steam Assisted Gravity Drainage (SAGD) and Expanding Solvent - SAGD (ES-SAGD)Documento14 páginasSPE-171076-MS The Role of Asphaltenes in Emulsion Formation For Steam Assisted Gravity Drainage (SAGD) and Expanding Solvent - SAGD (ES-SAGD)Daniel FelipeAinda não há avaliações

- Ajol File Journals - 404 - Articles - 66996 - Submission - Proof - 66996 4813 136433 1 10 20110608Documento12 páginasAjol File Journals - 404 - Articles - 66996 - Submission - Proof - 66996 4813 136433 1 10 20110608Lovely Joy Hatamosa Verdon-DielAinda não há avaliações

- Barista TestDocumento7 páginasBarista Testwinnie chanAinda não há avaliações

- Fluid Mechanics and Machinery Laboratory Manual: by Dr. N. Kumara SwamyDocumento4 páginasFluid Mechanics and Machinery Laboratory Manual: by Dr. N. Kumara SwamyMD Mahmudul Hasan Masud100% (1)

- Ventilation WorksheetDocumento1 páginaVentilation WorksheetIskandar 'muda' AdeAinda não há avaliações

- ITR-C (Instrument) 16cDocumento1 páginaITR-C (Instrument) 16cMomo ItachiAinda não há avaliações

- Improving Radar Echo Lagrangian Extrapolation Nowcasting by Blending Numerical Model Wind Information: Statistical Performance of 16 Typhoon CasesDocumento22 páginasImproving Radar Echo Lagrangian Extrapolation Nowcasting by Blending Numerical Model Wind Information: Statistical Performance of 16 Typhoon CasesLinh DinhAinda não há avaliações

- Fractal Approach in RoboticsDocumento20 páginasFractal Approach in RoboticsSmileyAinda não há avaliações

- Check To Make Sure You Have The Most Recent Set of AWS Simple Icons Creating DiagramsDocumento48 páginasCheck To Make Sure You Have The Most Recent Set of AWS Simple Icons Creating DiagramsarunchockanAinda não há avaliações