Escolar Documentos

Profissional Documentos

Cultura Documentos

ECON1101

Enviado por

MRML96Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

ECON1101

Enviado por

MRML96Direitos autorais:

Formatos disponíveis

Chapter 4 - Elasticity

Price elasticity of demand: percentage change in quantity from a 1 percent change in price

% change in Q / % change in P

ed = P/Q x 1/slope

Elastic demand: price elasticity is greater than 1

Inelastic demand: price elasticity is less than 1

Unit elastic: price elasticity is equal to 1

Determinants of price elasticity of demand

o substitution possibilities

o budget share

o time

Perfectly elastic demand: elasticity of demand is infinite, where demand curve is horizontal

Perfectly inelastic demand: elasticity of demand is 0, where demand curve is vertical

Cross-price elasticity of demand: percentage by which the quantity demanded of a good

changes in response to 1 percent change in price of a second good

Income-price elasticity of demand: percentage by which the quantity demanded of a good

changes in response to a 1 per cent change in income

Price elasticity of supply: percentage change in supply due to a 1 per cent change in price

Determinants of supply elasticity:

o Flexibility of inputs

o Mobility of inputs

o Ability to produce substitute inputs

o Time

Chapter 6 - Perfectly Competitive Supply: the Cost Side in the Market

Addition of multiple supply curves: add horizontally, from price to quantity

Profit maximisation firm: primary goal is to maximise the difference between revenue and

cost

Perfectly competitive markets (4 conditions):

o All firms sell the same standardised product

o Market has many buyers and sellers, which only exchanges in small quantity

o Sellers are able to leave and enter the market as they like

o Buyers and sellers are well informed

Short run: when at least one of the factors of production are fixed

Long run: when all firm's factors of production are variable

Fixed factors of production: input whose quantity does not change as output changes

Variable factors of production: input whose quantity changes as output changes

Law of diminishing returns: In the short run, successive increases in input of variable factor

eventually yield smaller output

Condition for short-run shutdown: firm should shut down if price is lower than the minimum

value AVC

If P x Q is less than VC for every level of Q

MC curve is upwards sloping due to diminishing return, and cuts the AVC and ATC at

minimum points

Chapter 7 - Efficiency and exchange

Pareto efficient: no opportunity for exchange that will make one person better off

any further trade will harm someone

Deadweight loss: reduction in total economic surplus that arises when market operate at

price and output other than the one at marginal benefit equals costs

Review the graphs

Chapter 9 - Quest for Profit and the Invisible Hand

Explicit Cost: the opportunity costs of resources supplied outside the firm, calculated as the

actual payment to its factors of production

Implicit cost: the opportunity costs of the next best alternative when it uses resources

supplied by owner

Economic profit: the difference between revenue and the sum of explicit and implicit costs

Economic loss: when economic profit is less than 0

Accounting profit: the difference between revenue and the explicit costs

Normal profit: (Implicit costs) the level of accounting profit when economic profit is zero and

is equal to the opportunity cost of the resources supplied to a business by its owners

When new firms enter markets with economic profits, output increases as shown by the

rightward shift in supply curve, reducing price and profit.

When existing firms leave markets with economic loss, causes leftwards shift in supply curve,

which increase price and profits

Rationing function of price: distribute scarce resources to those who place highest value

Allocative function of price: to direct resources away from overcrowded to underserved

markets

Invisible hand theory: actions of self-interested, independent buyers and sellers will result in

socially optimal allocation of resources

Economic Rent: part of payment for factor of production that exceeds the owner's

reservation price

Present value: amount of money we would need to invest today at a given interest rate in

order to generate a given amount of money at a specified date in the future

= M/(1+r)^t

Efficient markets hypothesis: theory that the current price of shares in company reflects all

relevant information about its current and future earnings prospects

'No Cash On The Table': if someone owns a valuable resource, the market price of the

resource reflect its economic value

Chapter 10 - Monopoly and other forms of Imperfect Competition

Imperfectly competitive market: when firms have some power over price

Pure monopoly: a market where a single firm produces all the output and there are no close

substitutes

Natural monopoly: a monopoly resulting from economies of scale

Oligopoly: a market where a few rival firms produces products of close substitutes

Monopolistic competition: a market where large number of firms produces close substitute

goods

Market power: ability for a firm to influence the demand & supply of goods, as well as price

Barriers to entry include:

o Exclusive control over inputs

o Government-created monopolies

o Economies of scale

Average total cost of production decreases as output rises [ATC=F/Q+M]

Total cost of production increase as output increases [TC=F+MQ]

Profit maximisation for price setters: marginal benefit is marginal revenue

Profit is maximised when marginal revenue equal marginal cost

Profit is only earned if the price is greater than the ATC

Price discrimination: charging different prices for the same product.

Perfectly discriminating firm: charging each buyer their exact reservation price for each unit

Group pricing: form of price discrimination where different discounts are offered in different

submarket

Perfect hurdle: an obstacles that completely segregates buyer whose reservation prices is

above it from those below it

Hurdle method of price discrimination: when a seller offers a discount for buyers who

overcome an obstacle

REVIEW THE EXAMPLES

Chapter 11 - Thinking Strategically

Basic elements of a game: (i) the players (ii) strategies available (iii) the playoffs

Dominant strategy: a strategy that gives the player the highest playoff, independent of the

other player's strategy

Dominated strategy: any other strategies other than the dominant strategy

Nash equilibrium: a point where no player has an incentive to deviate from their dominant

strategy

Prisoner's dilemma: a game where each player plays their dominant strategy and the

resulting playoff is smaller than if their dominated strategy was played. for e.g. game to

confess or remain silent

Repeated prisoner's dilemma: same game is played out with outcome observed from

previous games

Tit-for-tat: cooperate on the first move and then mimic opponent's move

Cartel: any group of firms that conspires and coordinate production and price prisoner's

dilemma: collusions break down as players have incentive to deviate from agreed strategy to

maximise its own profits

Credible threat: a threat to take an action that the threatener will carry out

Credible promise: a promise to take an action that the promised will carry out

Commitment problem: a situation in which people cannot achieve their goals because of

incredible threats and promises

Ultimatum game: where division of money is played. Player 1 proposes a solution and the

2nd player can either reject or accept

Chapter 12 - Externalities, Common Resources and Property Rights

External cost (negative externality): the cost of an activity that falls on those who didn't

pursue the activity

External benefit (positive externality): the benefit of an activity that falls on those who didn't

pursue the activity

When externalities are present, individuals will pursue in self interest, which will not result

in goods being produced at socially optimal level. Therefore outcome is inefficient.

Coase Theorem: when competitive markets, at no cost, can negotiate the purchase and sale

of right to perform activities that causes externality, they can always arrive at efficient

solutions to problems caused by externalities. For e.g. toxin in river example: one party can

offer payments in return for a favour, tax & subsidies

Market based instruments: policies that use a range of approaches to positively influence

the behaviour of people to achieve targeted outcome

Quantity market-based instruments: (cap and trade) carbon permits

Optimal level of pollution: when MB curve intersects MC curve. Indicates socially optimal

level of pollution

The problem of unused resources For e.g. number of cows sent onto a common grazing area.

Socially optimal number of cows in relation to marginal income

Common resources: resources that are difficult to exclude people and are rival

Tragedy of the commons: tendency of consumption of common resources until marginal

benefit is 0

Introduce private ownership to overcome this issue

Open access: when there is no restriction or regulation on a resource, exploitation is based

on first-come first serve

Common property: type of property rights regime where resources are controlled by

community of users, where rules are enforced locally

State property: type of property regime where resources are controlled by the government

and regulatory controls are centralised

Positional externality: when a change in one person's performance changes the expected

reward of another in situations in which depends on relative performance. For e.g.

completing master's degree to make employment easier

Positional arms race: a series of mutually offsetting investments in performance

enhancement that is stimulated by positional externality

Positional arms control agreements: an agreement in which contestants attempt to a

positional arm race

Chapter 13 - Public Goods and their Financing

Rivalry: the extent to which consumption of a good or service by one person diminishes the

availability to others

Excludability: the extent to which a good or service is excluded to non-payers

4 types of goods:

o Public goods: non-rival & non-excludable - e.g. national defence, parks

o Private goods: rival & excludable - e.g. cars, cheeseburger

o Collective goods: non-rival & excludable - e.g. pay-TV, toll road

o Common goods: rival & non-excludable - e.g. fish in the sea, the atmosphere

Free-rider problem: an incentive to not contribute to the provision of the good when

individuals can still consume the good without contributing to the cost

If marginal cost of producing a certain good is 0, then it would be inefficient to charge the

users of the good

Advantage of government-produced public goods is once a tax collection agency is

established, it can be expanded at relatively low costs to finance other goods

Advantage is government has the power to tax and can assign responsibility for recovering

the cost

Disadvantage of exclusive government-produced public goods is the tax system makes

taxpayers pay for good they don't want

Private provision of public goods:

o Funding by donation

o Development of new means to exclude non-payers

o Private contracting

The benefit of an addition unit of a private good is the highest sum that any individuals are

willing to pay

The benefit of an addition unit of a public good is the sum of the reservation price of all

people

Regressive tax: tax decreases in proportion as income increases

progressive tax: tax increases in proportion as income increases

proportional tax: pay the same percentage of income in tax

Taxes on inelastic activities may generate small deadweight loss, while taxes on negative

externalities may increase economic efficiency

Pork barrelling: enacting legislation whose total costs exceed total benefit, but is favoured

because their benefits from the expenditure by more than their share of the resulting extra

taxes

Logrolling: practise whereby legislators support one another's legislative proposals

Rent seeking: socially unproductive efforts of people or firms to win a prize

Crowding out: when government borrow funds from the private sector, causing increased

interest rates

Chapter 14: The Economics of Information

Middlemen: intermediary in a transaction of information

Expected value of gamble: the average outcome if the game is played infinitely.

Calculated as the sum of the product of outcome and their respective probability

Fair gamble: where expected value is zero

Better-than-fair gamble: where expected value is greater zero

Risk-neutral person: someone who accepts the gamble if it is fair or better

Risk-adverse person: someone who rejects all gamble

Asymmetrical information: where people on opposite sides in an exchange are not equally

informed

The Lemons Model: George Akerlof's explanation of how asymmetric information about the

characteristics of goods tend to reduce the average quality of used goods offered for sale

Principle-Agent problem: situation when the agent's actions are costly to monitor and

whose objective is not aligned with the principal's, takes action that favours the agent

Principal: someone who hires another party to provide goods and services on their behalf

Agent: someone who is hired by a principal

Costly-to-fake principle: idea that to communicate information credibly to a potential rival,

a signal must be costly or difficult to fake

Credibility problem can be overcome through warranties, mass advertisements -

Statistical discrimination: making judgements about the quality of people or products, based

on the groups they belong to

Adverse selection: when people on the informed side of a market (seeking insurance) self-

select in the actions they choose (to take insurance at a given price) in a way that those on

the other side are harmed

Moral hazard: tendency of people to change their behaviour once they become in a contract

Disappearing political discourse: theory that people who support a position remain silent as

speaking out would create a risk of being misclassified

First dollar insurance coverage: insurance that pays all expenses associated with claims

generated by insured activity

Você também pode gostar

- Fins3626 NotesDocumento3 páginasFins3626 NotesMRML96Ainda não há avaliações

- Fins3626 Week 3 TutorialDocumento1 páginaFins3626 Week 3 TutorialMRML96Ainda não há avaliações

- Fins1612 Week 7 TutorialDocumento1 páginaFins1612 Week 7 TutorialMRML96Ainda não há avaliações

- Fins3626 Week 4 TutorialDocumento2 páginasFins3626 Week 4 TutorialMRML96Ainda não há avaliações

- Childhood Fears: This Is Not Real, Tommy Assured Himself. It Just Part of Your Silly Imagination. Just Like Mother SaidDocumento2 páginasChildhood Fears: This Is Not Real, Tommy Assured Himself. It Just Part of Your Silly Imagination. Just Like Mother SaidMRML96Ainda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Sherman Motor CompanyDocumento5 páginasSherman Motor CompanyshritiAinda não há avaliações

- Global Supply Chain Disruptions Evolution, Impact, Outlook BISDocumento9 páginasGlobal Supply Chain Disruptions Evolution, Impact, Outlook BISJae Hee LeeAinda não há avaliações

- Michael J Phillips - Ethics and Manipulation in Advertising - Answering A Flawed Indictment-Praeger (1997)Documento219 páginasMichael J Phillips - Ethics and Manipulation in Advertising - Answering A Flawed Indictment-Praeger (1997)Ilham RamdaniAinda não há avaliações

- McqsDocumento22 páginasMcqsChandra Sai KumarAinda não há avaliações

- AkiliDocumento21 páginasAkiliEdward MwamtambuloAinda não há avaliações

- Marx Modes of ProductionDocumento10 páginasMarx Modes of Productionnandini negiAinda não há avaliações

- ABM 101 All Types of Financial ModelsDocumento3 páginasABM 101 All Types of Financial ModelsElla FuenteAinda não há avaliações

- Measuring Exchange Rate MovementsDocumento10 páginasMeasuring Exchange Rate Movementsmuhammad ahmadAinda não há avaliações

- Investment Centers and Transfer PricingDocumento9 páginasInvestment Centers and Transfer PricingMohammad Nurul AfserAinda não há avaliações

- Wage Determination Under Free Market ForcesDocumento5 páginasWage Determination Under Free Market ForcesKrishna Das ShresthaAinda não há avaliações

- PPC ActivityDocumento2 páginasPPC ActivityJohn JohnsonAinda não há avaliações

- Research Paper MacroeconomicsDocumento7 páginasResearch Paper Macroeconomicsaflbskzqa100% (1)

- PPT04 - Creating Your Business ModelDocumento28 páginasPPT04 - Creating Your Business ModelAgus PriyonoAinda não há avaliações

- Albaraka Islamic BankDocumento66 páginasAlbaraka Islamic BankKazi Ramiz UddinAinda não há avaliações

- Group Assigment Eco560. 2021Documento7 páginasGroup Assigment Eco560. 2021Hazim Tasnim09Ainda não há avaliações

- End Sem Derivatives 2021Documento2 páginasEnd Sem Derivatives 2021vinayAinda não há avaliações

- Development CommunicationDocumento253 páginasDevelopment CommunicationEsther Hle KhiaAinda não há avaliações

- Metodologi of NIEDocumento21 páginasMetodologi of NIEStevanus Gabriel PierreAinda não há avaliações

- Ch04 Case and FairDocumento24 páginasCh04 Case and FairrazialamAinda não há avaliações

- EconomicsDocumento113 páginasEconomicsdevanshsoni4116Ainda não há avaliações

- Lesson 1-2 DISSDocumento9 páginasLesson 1-2 DISSangie vibarAinda não há avaliações

- Samsung Electronics IN Thailand: Final CaseDocumento25 páginasSamsung Electronics IN Thailand: Final Caselipzgalz9080Ainda não há avaliações

- EC3332 Tutorial 3 AnswersDocumento3 páginasEC3332 Tutorial 3 AnswersKabir MishraAinda não há avaliações

- 1.8 - An Introductory Note On The Environmental Economics of The Circular EconomyDocumento9 páginas1.8 - An Introductory Note On The Environmental Economics of The Circular EconomyKaroline Brito Coutinho FerreiraAinda não há avaliações

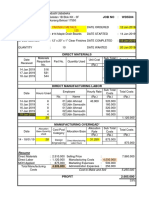

- COST SHEET Atau JOB COSTDocumento1 páginaCOST SHEET Atau JOB COSTWiraswasta MandiriAinda não há avaliações

- WP47 Kelton PDFDocumento30 páginasWP47 Kelton PDFEugenio MartinezAinda não há avaliações

- Exam Practice Paper 1 IB EconomicsDocumento12 páginasExam Practice Paper 1 IB EconomicsVarna Kanungo83% (6)

- Chapter 7 - Consumerism - Norton AugustDocumento20 páginasChapter 7 - Consumerism - Norton AugustaanillllAinda não há avaliações

- Mechanism Design: Recent Developments: 1 Possibility Results and RobustnessDocumento14 páginasMechanism Design: Recent Developments: 1 Possibility Results and RobustnessElghamourou SalaheddineAinda não há avaliações

- The Basic Economic Problem: Section IDocumento10 páginasThe Basic Economic Problem: Section IhbuzdarAinda não há avaliações