Escolar Documentos

Profissional Documentos

Cultura Documentos

SM 0112 B

Enviado por

sokhamangTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

SM 0112 B

Enviado por

sokhamangDireitos autorais:

Formatos disponíveis

Commercial Insights | Sales and Marketing January 2012 | ABA Center for Commercial Lending & Business Banking

g | aba.com

Copyright 2012 American Bankers Association, All Rights Reserved

Sales and Marketing

Leveraging Your Network in Prospecting

Ned Miller, Senior Vice President, MZ Bierly Consulting

I recently attended a planning session at which the bank management team reviewed the results of a survey of their

business customers. One of the questions asked was how likely the customers were to recommend a company with

similar needs to the bank. To the delight (if not the surprise) of the bankers in the room, nearly 80 percent of the banks

customers said they would.

At a break, one of the senior managers recounted how he had gone on a call with a business banker whose main

objective was to ask a long-time customer for help in getting in to see several prospects. When the time came to ask, the

Relationship Manager (RM) seemed to freeze. He could not ask his customer who by all reports was extremely happy

with the bank and the RM for assistance.

The senior manager chalked this up to fear. He sensed that his subordinate was afraid of being turned down in front of his

boss. Afterwards the RM groped to explain why he was not comfortable asking and assured his manager that he would do

so the next time he met with his client.

Is this bankers reluctance to ask for referrals unusual? Research in 2007 before the gyrations in the economy created

tensions between many borrowers and their bankers indicated that only 22 percent of small business customers and

37 percent of middle market customers had been approached for referrals in the previous 12 months. I have collected

enough anecdotal evidence in workshops with bankers over the last year to believe that, if anything, the percentages

today are worse.

Many business owners really do like their banks and would gladly refer their Relationship Managers to others. Not all

banks have scores as high as my clients 80 percent the surveys suggest that on average community banks score in

the 70s, regional banks in the 60s and megabanks in the 50s. Its worth noting that generally individual RMs score higher

than their banks.

Bankers know that referrals really do improve their chances in prospecting. All have been encouraged by their Sales

Managers to leverage their networks. Some clearly do, but many do not.

Without delving into the reasons why bankers are skittish about asking for referrals I will address that in a future article

and conceding that this is not exactly a new phenomenon, why is it important?

Most banks are looking to their commercial and small business banking teams for significant revenue contributions in

2012. With retail divisions laboring under new restrictions on fees and higher compliance costs, their commercial partners

have to find ways to grow revenue.

While deepening relationships with existing clients is a high priority, many commercial bankers are convinced that

acquiring new clients is critical to their success. With the demand for loans still sluggish and the competition for good

credits fierce, prospectors have their work cut out for them.

Commercial Insights | Sales and Marketing January 2012 | ABA Center for Commercial Lending & Business Banking | aba.com

Copyright 2012 American Bankers Association, All Rights Reserved

The first two challenges that every RM faces in prospecting are getting a first appointment and then creating enough

momentum in the initial meeting to get a second and third (and usually a fourth, fifth and sixth) call. Recent surveys of

business customers indicate that getting in the door the first time may be easier than it has ever been. Many small to mid-

sized businesses are disenchanted with their current banks and are seriously contemplating changing their primary

banking relationship in the next 12 months. (According to data from Barlow Research and Greenwich Associates,

companies banking with several of the largest national banks are most likely to move; those with healthy regional and

community banks are less inclined to head for greener pastures.)

But, you protest, it is still hard to schedule appointments with prospects.

Maybe, but here is where the preceding discussion about referrals comes

in to play. If you are cold calling your prospects for appointments, good

luck. It can work, but it is usually not that effective. One of the big problems

with cold calling is that even if you land an appointment, the chances of

closing a piece of business with the prospect are remote. (See sidebar for

one bankers analysis of the math of cold calling.)

The Business Banking Board has published data that demonstrates that

referrals have a much higher probability of closing than cold calling. Here

is a quick test. All of the following could be part of a commercial or small

business bankers network. All could create qualified leads. How would

you rank the likelihood of an RM closing a piece of business from each

source?

1. The RMs current clients

2. Business brokers

3. Former clients

4. Other bank employees (Cash Management, Wealth Management,

Capital Markets, etc.)

5. Centers-of-Influence (COIs) like attorneys, CPAs, realtors, investment bankers, executives of trade associations

and governmental authorities, etc.

6. Bank Board and Advisory Board members

7. Customers and suppliers of current clients

8. College alumni

9. Leads group members (sometimes referred to as BNI groups for Business Networking International)

10. Friends who sell for a living

11. The RMs prospects

12. Trade association contacts

13. Members of civic and fraternal organizations the RM belongs to

14. Parents of friends of the RMs children

You will not be surprised to learn that according to the Business Banking Board, satisfied current clients are number one.

(For those of you who have changed jobs recently, former clients are also good referral sources. While you are madly

trying to hustle them for their business, do not forget to think about them for referrals.)

Business brokers are a close second, but do not take that as a blanket endorsement of the deals they send your way.

Many bankers are appropriately wary of transactions from certain brokers (and while we are at it, certain investment

bankers).

Although I dont have empirical

evidence to support this, Ive found

that if you are cold calling and you get

an appointment, 95 percent of the

time the company cannot be banked

(as good companies generally have

bankers swarming all over them and

dont need to take cold calls) and 5

percent of the time you are simply

lucky as your timing was spot on.

So, to put this in real terms, if you

have a 10 percent hit rate with cold

calling (might be aggressive), you

need to make about 200 cold calls to

get one good appointment. Thats not

time well spent.

(A senior vice president from a

regional bank)

Commercial Insights | Sales and Marketing January 2012 | ABA Center for Commercial Lending & Business Banking | aba.com

Copyright 2012 American Bankers Association, All Rights Reserved

Your line of business partners are next, in a virtual dead heat with COIs. In both cases, their familiarity with an RMs

capabilities makes them great potential lead sources. What is interesting is that a lead from a satisfied customer is twice

as likely to close as a lead from either of them. Why the difference? With your colleagues, it may be a question of not

knowing precisely what opportunities match your target market and risk criteria. In the case of COIs the banker is rarely

the only option suggested by the CPA or attorney. I will address how to work with both groups in more detail in future

articles.

Okay, if this is stuff you already know, you are probably yawning. Are you ready for a NAP? I am talking about a Network

Activation Plan for 2012. If you are interested in improving your prospecting results, here is a chance to build some

momentum through a step-by-step process designed to help you build and leverage your personal network. In this series

of ABA Commercial Insights articles you will receive specific tips on how to:

Identify which members of your current network to approach for assistance;

Plan when and how to ask for assistance; and

Execute more confidently on a referral-based prospecting approach.

I will provide specific assignments, tools and other resources. But you have to commit to doing something. If prospecting

is important to your success, not leveraging your network is a cardinal sin. If you are unsure of whether this is for you, talk

it over with your Sales Manager. If you still have questions, feel free to email me at nmiller@mzbierlyconsulting.com.

NAP Assignment 1:

Build a list of your satisfied customers. Come up with as many as you can but try to get at least 10 to 15. How

do you know if they are satisfied? They may have told you that they were at some point in the not too distant past.

They might have made a similar comment to others your boss, say. Maybe they have even referred business

to you. (If they have, you might also consider scheduling an appointment with them now to thank them again and

explore with them names on your prospect list.)

Develop a list of at least 50 other people in your business network. If you get stuck, go to the list of potential

referral sources included in this article.

These lists have to be in writing. Some people can memorize phone books but most bankers I know cannot. If you would

like an Excel spreadsheet to use in this effort, go to mzbierlyconsulting.com/building-a-network-list/.

Next month: How to Confidently Ask Customers for Referrals

----------

Ned Miller is with MZ Bierly Consulting, Inc. in Malvern, Pa. He works with regional and community banks to improve

results with commercial and small business customers and prospects. Sign up for his blog at

mzbierlyconsulting.com/bank-sales-corner-blog/. Connect with him on LinkedIn at linkedin.com/in/nedmillerbankingsales.

Você também pode gostar

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Invisible CitiesDocumento14 páginasInvisible Citiesvelveteeny0% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- 2500 Valve BrochureDocumento12 páginas2500 Valve BrochureJurie_sk3608Ainda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Plastic Properties HandbookDocumento15 páginasPlastic Properties HandbookguilloteARGAinda não há avaliações

- The Effect of Co-Op Approach in Improving Visual Motor Integration Skills in Children With Learning DisabilityDocumento7 páginasThe Effect of Co-Op Approach in Improving Visual Motor Integration Skills in Children With Learning DisabilityIJAR JOURNALAinda não há avaliações

- Philodendron Plants CareDocumento4 páginasPhilodendron Plants CareSabre FortAinda não há avaliações

- Leadership and Management in Different Arts FieldsDocumento10 páginasLeadership and Management in Different Arts Fieldsjay jayAinda não há avaliações

- Genuine Fakes: How Phony Things Teach Us About Real StuffDocumento2 páginasGenuine Fakes: How Phony Things Teach Us About Real StuffGail LeondarWrightAinda não há avaliações

- AMICO Bar Grating CatalogDocumento57 páginasAMICO Bar Grating CatalogAdnanAinda não há avaliações

- Grade 7 Nap MayDocumento6 páginasGrade 7 Nap Mayesivaks2000Ainda não há avaliações

- Been There, Done That, Wrote The Blog: The Choices and Challenges of Supporting Adolescents and Young Adults With CancerDocumento8 páginasBeen There, Done That, Wrote The Blog: The Choices and Challenges of Supporting Adolescents and Young Adults With CancerNanis DimmitrisAinda não há avaliações

- RARE Manual For Training Local Nature GuidesDocumento91 páginasRARE Manual For Training Local Nature GuidesenoshaugustineAinda não há avaliações

- DIR-819 A1 Manual v1.02WW PDFDocumento172 páginasDIR-819 A1 Manual v1.02WW PDFSerginho Jaafa ReggaeAinda não há avaliações

- Hele Grade4Documento56 páginasHele Grade4Chard Gonzales100% (3)

- Angle Modulation: Hệ thống viễn thông (Communication Systems)Documento41 páginasAngle Modulation: Hệ thống viễn thông (Communication Systems)Thành VỹAinda não há avaliações

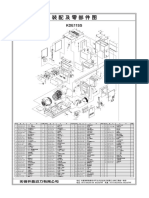

- KDE11SSDocumento2 páginasKDE11SSluisgomezpasion1Ainda não há avaliações

- A Comparative Study of Public Private Life Insurance Companies in IndiaDocumento5 páginasA Comparative Study of Public Private Life Insurance Companies in IndiaAkansha GoyalAinda não há avaliações

- Active Hospital Network List For Vidal Health Insurance Tpa PVT LTD As On 01 Feb 2023Documento119 páginasActive Hospital Network List For Vidal Health Insurance Tpa PVT LTD As On 01 Feb 2023jagdeepchkAinda não há avaliações

- Trina 440W Vertex-S+ DatasheetDocumento2 páginasTrina 440W Vertex-S+ DatasheetBrad MannAinda não há avaliações

- 2201 IntGCSE (9-1) Subject Grade Boundaries V1Documento4 páginas2201 IntGCSE (9-1) Subject Grade Boundaries V1Fariha RahmanAinda não há avaliações

- IR2153 Parte6Documento1 páginaIR2153 Parte6FRANK NIELE DE OLIVEIRAAinda não há avaliações

- Modular Q1 WK3-4Documento3 páginasModular Q1 WK3-4JENIFFER DE LEONAinda não há avaliações

- (Sat) - 072023Documento7 páginas(Sat) - 072023DhananjayPatelAinda não há avaliações

- Borges, The SouthDocumento4 páginasBorges, The Southdanielg233100% (1)

- Song Book Inner PagesDocumento140 páginasSong Book Inner PagesEliazer PetsonAinda não há avaliações

- 10 1108 - TQM 03 2020 0066 PDFDocumento23 páginas10 1108 - TQM 03 2020 0066 PDFLejandra MAinda não há avaliações

- Research FinalDocumento55 páginasResearch Finalkieferdem071908Ainda não há avaliações

- Ultracold Atoms SlidesDocumento49 páginasUltracold Atoms SlideslaubbaumAinda não há avaliações

- VimDocumento258 páginasVimMichael BarsonAinda não há avaliações

- Chapter 13 CarbohydratesDocumento15 páginasChapter 13 CarbohydratesShanna Sophia PelicanoAinda não há avaliações

- John DrydenDocumento3 páginasJohn DrydenDunas SvetlanaAinda não há avaliações