Escolar Documentos

Profissional Documentos

Cultura Documentos

Phase 5

Enviado por

api-257082110Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Phase 5

Enviado por

api-257082110Direitos autorais:

Formatos disponíveis

Phase 5 - Retirement

I will start this Phase at 65 years old. In this Phase I am no longer in the working force and I am

able to access my superannuation. The definition of a superannuation is: regular payment made

into a fund by an employee towards a future pension. Because Im not working I have to find a

way to continue to gain money or else we might run out.

How has life changed and what obligations will you have?

My children are now raising kids and working hard while Rhonda and I sit back relax and enjoy

life. Because neither one of us are working we need to have an income. That is why I have

previously bought two apartments in Narrabeen which I have rented out. I have also done the

same with an apartment in Clontarf that I have inherited from my parents. Rhonda and I are now

both entitled to our superannuation but we wont need it because we have saved A$4 187

726.2.

What is your income potential?

From the apartment in Narrabeen at 4/1277 Pittwater Road (domain,2014), I would receive a

weekly rental income of $500 a week but I agreed with my tenant that he would pay me the

yearly rent instead of weekly at the start of the year. So I will receive 26 000 at the start of the

year. I have also done this with my fathers house at 19 moore st Clontarf, which I inherited

when he died. From the house in clontarf I will rent it out and also with my tenant will pay me

$104 000 from the start of the year, the equivalent of $2000 a year. In total I will receive A$139

000 at the start of the year.

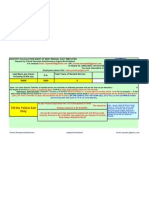

What expenses will you incur?

Fixed expenses A$ Monthly

Mortgage - on two homes 1656.25 + 3546.30 =

5202.55

car expenses - service, fuel etc (beside insurance) 430

necessities - cleaning products and equipment, toiletries, and

food

600

bills - gas, electricity, phone, internet etc 400

Total 6632.55

Variable expenses A$ Monthly

Variable Expenses A$ Monthly

Clothes 1000

social and recreational e.g movies, dinning out 3000

total 4000

Where will you live and what will it cost?

Me and my partner Rhonda, will still be living at 5/87 Birkley Road Manly (domain, 2014). The

house has 2 bedrooms, one games room, one bathroom and 1 car parking space and is close

to manly shops.

What additional financial obligations will you have and why?

Additional Expenses(A$) Paid in one go, or throughout the year

Dogs funeral 625 (bit of heaven, 2001)

holidays 7000

transport expenses 1560

total 9185

Budget yearly A$

Savings 4 187 726.2

income 139 000

expenses 136 775.6

saved 2224.4

What could go wrong and who can help?

Cant pay mortgage- If I can't pay off my mortgage, for help, I can visit MoneySmart, a

government website that can provide me with:

Charities and emergency help

help with debts

help with legal issues

help with housing

government assistance and concessions

free financial counsellors

fair trading contacts

(ASIC, 2014)

Você também pode gostar

- RflectDocumento4 páginasRflectapi-257082110Ainda não há avaliações

- BibliographyDocumento6 páginasBibliographyapi-257082110Ainda não há avaliações

- Hannahjune 6Documento1 páginaHannahjune 6api-257082110Ainda não há avaliações

- Judd Mahalo5Documento1 páginaJudd Mahalo5api-257082110Ainda não há avaliações

- Judd Mahalo2Documento1 páginaJudd Mahalo2api-257082110Ainda não há avaliações

- Hannahjune 5Documento1 páginaHannahjune 5api-257082110Ainda não há avaliações

- Hannahjune 4Documento1 páginaHannahjune 4api-257082110Ainda não há avaliações

- Judd Mahalo6Documento1 páginaJudd Mahalo6api-257082110Ainda não há avaliações

- Hannahjune 3Documento1 páginaHannahjune 3api-257082110Ainda não há avaliações

- Hannahjune 2Documento1 páginaHannahjune 2api-257082110Ainda não há avaliações

- Judd Mahalo3Documento1 páginaJudd Mahalo3api-257082110Ainda não há avaliações

- Judd Mahalo4Documento1 páginaJudd Mahalo4api-257082110Ainda não há avaliações

- Kate Upton1Documento1 páginaKate Upton1api-257082110Ainda não há avaliações

- Kate Upton5Documento1 páginaKate Upton5api-257082110Ainda não há avaliações

- Juddmahalo 1Documento1 páginaJuddmahalo 1api-257082110Ainda não há avaliações

- Phase 4Documento3 páginasPhase 4api-257082110Ainda não há avaliações

- Kate Upton6Documento1 páginaKate Upton6api-257082110Ainda não há avaliações

- Kate Upton4Documento1 páginaKate Upton4api-257082110Ainda não há avaliações

- Ashish Banjit2Documento1 páginaAshish Banjit2api-257082110Ainda não há avaliações

- Kate Upton2Documento1 páginaKate Upton2api-257082110Ainda não há avaliações

- Ashish Banjit6Documento1 páginaAshish Banjit6api-257082110Ainda não há avaliações

- Kate Upton3Documento1 páginaKate Upton3api-257082110Ainda não há avaliações

- Ashish Banjit5Documento1 páginaAshish Banjit5api-257082110Ainda não há avaliações

- Ashish Banjit1Documento2 páginasAshish Banjit1api-257082110Ainda não há avaliações

- Ashish Banjit4Documento1 páginaAshish Banjit4api-257082110Ainda não há avaliações

- Phase 3Documento3 páginasPhase 3api-257082110Ainda não há avaliações

- Ashish Banjit3Documento1 páginaAshish Banjit3api-257082110Ainda não há avaliações

- Phase 2Documento3 páginasPhase 2api-257082110Ainda não há avaliações

- Phase 1Documento3 páginasPhase 1api-257082110Ainda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Case Study - Financial Statement AnaysisDocumento8 páginasCase Study - Financial Statement Anaysisssimi137Ainda não há avaliações

- Tata Motors CSR positively impacts communitiesDocumento25 páginasTata Motors CSR positively impacts communitiesjasdeepAinda não há avaliações

- Investors ClinicDocumento21 páginasInvestors ClinicDeepa SolankiAinda não há avaliações

- North South University Accounting Course ReportDocumento23 páginasNorth South University Accounting Course ReportAntor Podder 1721325Ainda não há avaliações

- Strategic Food Marketing of Parle-GDocumento18 páginasStrategic Food Marketing of Parle-GShipra SainiAinda não há avaliações

- Chapter 14 - Bus. Combination Part 2Documento16 páginasChapter 14 - Bus. Combination Part 2PutmehudgJasdAinda não há avaliações

- Problem Ch.14Documento3 páginasProblem Ch.14kenny 322016048100% (1)

- 6e ch08Documento42 páginas6e ch08Ever PuebloAinda não há avaliações

- Intangible Assets HomeworkDocumento5 páginasIntangible Assets HomeworkIsabelle Guillena100% (2)

- Ambit PDFDocumento70 páginasAmbit PDFshahavAinda não há avaliações

- Retirement Gratuity Calculation For West Bengal Govt EmployeeDocumento4 páginasRetirement Gratuity Calculation For West Bengal Govt EmployeePranab Banerjee100% (1)

- Introduction To Managerial Economics: Module-I PART - TIME - Jan 2012Documento27 páginasIntroduction To Managerial Economics: Module-I PART - TIME - Jan 2012alpamehtaAinda não há avaliações

- Accounting For Income TaxesDocumento101 páginasAccounting For Income TaxesRicardo Tan100% (4)

- Tax & TDS Calculation From Salary Income (20-21 Assess Year) - ShortDocumento17 páginasTax & TDS Calculation From Salary Income (20-21 Assess Year) - ShortMohammad Shah Alam ChowdhuryAinda não há avaliações

- IRS English-Spanish Tax GlossaryDocumento39 páginasIRS English-Spanish Tax GlossaryruthieAinda não há avaliações

- Ahold Financial Report 2010Documento137 páginasAhold Financial Report 2010George Traian VoloacăAinda não há avaliações

- 75 KPIs Every Manager Needs To Know About HR IsDocumento6 páginas75 KPIs Every Manager Needs To Know About HR IsAbu anasAinda não há avaliações

- Non-Current Assets Held For Sale Discontinued OperationsDocumento32 páginasNon-Current Assets Held For Sale Discontinued Operationsnot funny didn't laughAinda não há avaliações

- Asian Paints Limited Consolidated Balance SheetDocumento40 páginasAsian Paints Limited Consolidated Balance SheetSehajpal SanghuAinda não há avaliações

- Fundamentals of Cost-Volume-Profit Analysis: Mcgraw-Hill/IrwinDocumento17 páginasFundamentals of Cost-Volume-Profit Analysis: Mcgraw-Hill/Irwinimran_chaudhryAinda não há avaliações

- XI Business Studies Short Notes PDFDocumento97 páginasXI Business Studies Short Notes PDFTushar SinghAinda não há avaliações

- Comprehensive Accounting Cycle Review Problem-1Documento11 páginasComprehensive Accounting Cycle Review Problem-1api-296886708100% (1)

- Roma Youth HungaryDocumento50 páginasRoma Youth HungarymajkoeAinda não há avaliações

- Presidential Decree No. (27, 175, 410, 892, and 316)Documento10 páginasPresidential Decree No. (27, 175, 410, 892, and 316)Romeo A. Garing Sr.100% (2)

- Pricol Limited - Broker Research - 2017 PDFDocumento25 páginasPricol Limited - Broker Research - 2017 PDFnishthaAinda não há avaliações

- Shoppers StopDocumento8 páginasShoppers StopRavish SrivastavaAinda não há avaliações

- Mahindra & Mahindra vs. Tata Motors: Financial analysis and ratio comparisonDocumento20 páginasMahindra & Mahindra vs. Tata Motors: Financial analysis and ratio comparisonPratik Kalekar100% (1)

- Branch Accounting Examination BankDocumento71 páginasBranch Accounting Examination BankNicole TaylorAinda não há avaliações

- Management Thesis On Performance of Public Sector Banks Pre and Post Financial CrisisDocumento36 páginasManagement Thesis On Performance of Public Sector Banks Pre and Post Financial Crisisjithunair13Ainda não há avaliações

- Epf Notification 2015Documento3 páginasEpf Notification 2015Visu VijiAinda não há avaliações