Escolar Documentos

Profissional Documentos

Cultura Documentos

Pitt Meadows - 2013 Statement of Financial Information

Enviado por

Monisha Caroline MartinsDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Pitt Meadows - 2013 Statement of Financial Information

Enviado por

Monisha Caroline MartinsDireitos autorais:

Formatos disponíveis

To: Chief Administrative Officer File No: 05-1830-02/13

From: Director of Finance & Bylaw/Policy No:

Facilities

Date: May 23, 2014

RECOMMENDATIONS:

THAT Council:

A. Approve the 2013 Statement of Financial Information (Attachment A) for

submission to the Ministry of Community, Sport and Cultural Development

and for availability to the public; OR

The purpose of this report is to obtain Council approval of the 2013 Statement of

Financial Information.

BACKGROUND:

The Statement of Financial Information is an annual requirement of the Financial

Information Act under BC Regulation 371/93. This information must be approved

by Council and the Director of Finance and Facilities, the Chief Financial Officer

assigned responsibility for financial administration under the Community Charter,

by July 2, 2014.

The Statement of Financial Information is submitted to the Ministry of

Community, Sport and Cultural Development and is also made available to the

public.

CITY OF PITT MEADOWS

COUNCIL

!N

COMMITTEE REPORT

Subject: 2013 Statement of Financia Information

B. Other.

PURPOSE:

#119584v1

- 58 -

2013 Statement of Financial Information 2

POLICY:

None identified.

FINANCIAL IMPLICATIONS:

None identified.

DISCUSSION:

The Statement of Financial Information is comprised of the following:

Statement of Financial Information Approval

Management Report

2013 Audited Financial Statements

Schedule of Council and Employee Remuneration and Expenses

The remuneration schedule in past years contained two columns one

column for remuneration, which included both base salary and benefits

and a second column for expenses that included costs such as: mileage

and conferences.

As recommended by the GVRD Regional Finance Advisory Committee,

the format of the 2013 schedule has been changed with the objective of

providing better base salary comparisons across municipalities. As a

result of this change, the base salary has been separated from the

benefits and the schedule now contains three columns: base salary,

benefits and expenses. For your information, the benefit column includes

a variety of items such as: taxable benefits (MSP, Group Life), vacation

payouts, overtime and acting pay.

It is important to note that the schedule lists the employees whose

combined base salary and benefits are more than $75,000 in the fiscal

year along with the total amount of expenses paid to or on behalf of those

employees.

As well, a consolidated total of all remuneration paid to all other

employees who earn less than $75,000 is provided.

Schedule of Payments to Suppliers of Goods and Services

This schedule provides the payments to each supplier of goods or

services during the fiscal year that is greater than $25,000. Also included

is a consolidated total of all other payments made to suppliers of goods or

services during the fiscal year.

#11 9584v1

- 59 -

2013 Statement of Financial Information 3

Statement of Severance Agreements

There were no severance agreements made between the City and its non-

unionized employees during 2013.

Statement of Contracts with Council members or former Council members

There were no contracts with current or former Council members.

The provision of the information in this format also fulfills the requirements of

section 168(1) of the Community Charter for the reporting of Council

remuneration, expenses and contracts.

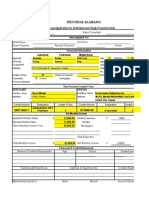

Based on Councils request in past, staff have also provided a document

(Attachment B) that shows the payments to suppliers over $25,000, indicating if

the payment is for a capital contractor/consultant, an operating

contractor/consultant or neither with a brief description of the goods or service

they provided. This document does not get sent to the ministry and is for internal

information only.

SUMMARY/CONCLUSION:

Approval of this information is required for submission to the Ministry of Community,

Sport and Cultural Development and for public release.

Respectfully submitted,

Mark Roberts

Director of Finance & Facilities

ATTACHMENTS:

Attachment A: 2013 Statement of Financial Information

Attachment B: Payments to Suppliers over $25,000 with Contractor/Consultant

Information

#119584v1

- 60 -

ATTACHMENT A

CITY OF PITT MEADOWS

2013 STATEMENT OF FINANCIAL INFORMATION

As required by the Financial Information Act

Statement of Financial Information Approval

Management Report

2013 Audited Financial Statements

Schedule of Council and Employee Remuneration and Expenses

Schedule of Payments to Suppliers of Goods and Services

Statement of Severance Agreements

Additional information to conform with Community Charter S. 168 (1)(d) and (2)

Disclosure of contracts with Council members or former Council members

#119576v1

- 61 -

CORPORATION OF THE CITY OF PITT MEADOWS

STATEMENT OF FINANCIAL INFORMATION APPROVAL

The undersigned, as authorized by the Financial Information Regulation, Schedule 1,

subsection 9(2), approves all the statements and schedules included in this Statement of

Financial Information, produced under the Financial Information Act.

Mark Roberts

Director of Finance & Facilities

Date:_________________

V

Prepared pursuant to Financial information Regulation, Schedule 1, section 9. #119577v1

- 62 -

CORPORATION OF THE CITY OF PITT MEADOWS

MANAGEMENT REPORT

The Financial Statements contained in this Statement of Financial Information under the

Financial Information Act have been prepared by management in accordance with

generally accepted accounting principles or stated accounting principles, and the

integrity and objectivity of these statements are managements responsibility.

Management is also responsible for all the statements and schedules, and for ensuring

that this information is consistent, where appropriate, with the information contained in

the financial statements.

Management is also responsible for implementing and maintaining a system of internal

controls to provide reasonable assurance that reliable financial information is produced.

Council is responsible for ensuring that management fulfils its responsibilities for

financial reporting and internal control.

The external auditors, BDO Canada LLP, conduct an independent examination, in

accordance with generally accepted auditing standards, and express their opinion on the

financial statements. Their examination does not relate to the other schedules and

statements required by the Act. Their examination includes a review and evaluation of

the Citys system of internal control and appropriate tests and procedures to provide

reasonable assurance that the financial statements are presented fairly. The external

auditors have full and free access to Council and meet with it on an annual basis.

On behalf of the Corporation of the City of Pitt Meadows,

Mark Roberts

Director of Finance & Facilities

Date:

)1g

?44

Prepared pursuant to Financial Information Regulation, Schedule 1, section 9. #1 19578v1

- 63 -

3J()

Tel: 6046885421 BDO Canada LIP

N

Fax: 604 688 5132 600 Cathedral Place

_________________

vancouver@bdo.ca 925 West Georgia Street

www.bdo.ca Vancouver BC V6C 31.2 Canada

INDEPENDENT AUDITORS REPORT

To the Mayor and Council of the City of Pitt Meadows

We have audited the accompanying consolidated financial statements of the City of Pitt Meadows,

which comprise the Consolidated Statement of Financial Position as at December 31, 2013, and the

Consolidated Statements of Operations, Change in Net Financial Assets and Cash flow for the year then

ended, and a summary of significant accounting policies and other explanatory information.

Managements Responsibility for the Consolidated Financial Statements

Management is responsible for the preparation and fair presentation of these consolidated financial

statements in accordance with Canadian public sector accounting standards, and for such internal

control as management determines is necessary to enable the preparation of consolidated financial

statements that are free from material misstatement, whether due to fraud or error.

Auditors Responsibility

Our responsibility is to express an opinion on these consolidated financial statements based on our

audit. We conducted our audit in accordance with Canadian generally accepted auditing standards.

Those standards require that we comply with ethical requirements and plan and perform the audit to

obtain reasonable assurance about whether the consolidated financial statements are free from

material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in

the consolidated financial statements. The procedures selected depend on the auditors judgment,

including the assessment of the risks of material misstatement of the consolidated financial

statements, whether due to fraud or error. In making those risk assessments, the auditor considers

internal control relevant to the entitys preparation and fair presentation of the consolidated financial

statements in order to design audit procedures that are appropriate In the circumstances, but not for

the purpose of expressing an opinion on the effectiveness of the entitys internal control. An audit also

includes evaluating the appropriateness of accounting policies used and the reasonableness of

accounting estimates made by management, as well as evaluating the overall presentation of the

consolidated financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis

for our audit opinion.

Opinion

In our opinion, the consolidated financial statements present fairly in all material respects, the

consolidated financial position of the City of Pitt Meadows as at December 31, 2013 and its

consolidated results of operations and its consolidated cash flows for the year then ended, in

accordance with Canadian public sector accounting standards.

Chartered Accountants

Vancouver, British Columbia

May 13, 2014

BOO Canada LU, a Canadian limited liability partnership, Is a member of BOO International Limited, a UK company limited by

guarantee, and forms part of the international BOO network of independent member firms.

- 64 -

City of Pitt Meadows

Consolidated Statement of Financial Position

As at December31, 2013

2013 2012

FINANCIAL ASSETS

Cash and Equivalents

Portfolio Investments (Note 2)

Accounts Receivable (Note 3)

Development Installments (Note 4)

5 351,178

21,874,448

4,721,984

1,012,385

$ 360,847

21,820,533

4,129,877

495,663

27,959,995 26,806,920

LIABILITIES

Accounts Payable and Accrued Liabflities

Other Government Payable

Contractor Holdbacks

Prepaid Taxes

Refundable Performance Deposits

Deferred Revenue (Note 5)

Employee Benefit Obligation (Note 6)

Development Cost Charges (Note 7)

Debt (Note 8)

1,802,544

2,961,670

162,790

1,515,368

721,006

287,995

527,500

5,543,757

8,032,014

1,145,659

2,671,937

215,004

1,454,683

704,617

272,432

503,300

4,581,473

7,422,763

21,554,644 18,971,868

NET FINANCIAL ASSETS 6,405,351 7,835,052

NON FINANCIAL ASSETS

Tangible Capital Assets (Note 9, Schedule 1)

Inventories of Supplies

Prepaici Expenses

172,953,030

143,211

1,615,975

170,883,384

123,080

122,297

ACCUMULATED SURPLUS (Note 10)

174,712,216

$181,117,567

171,128,761

$178,963,813

See accompanying Notes to the Consolidated Financial Statements.

Deb Walters, Mayor

2

- 65 -

City of Pitt Meadows

Consolidated Statement of Operations

For the Year Ended December 31, 2013

2013 Budget 2013 Actual 2012 Actual

(Note 14)

REVENUES

Municipal Property Taxes (Schedule 2) $ 15,654757 $ 15,443,484 $ 15,199,525

Parcel Taxes 30000 21,390 29,295

Private Utility Company Taxes 261,071 270,748 241,699

Water Levy 3,621,371 3,655,057 3,436,947

SewerLevy 2,114,354 2,131,952 2,031,376

Drainage Levy 1,405,412 1,407,828 1,310,931

Solid Waste Levy 1,298,969 1,207,710 1,213,265

Dyking Levy 13,004 12,860 12,872

Sale of Services 1,899,146 1,687,192 1,701,614

Licenses, Permits, Penalties, and Fines 649,625 872,567 768,240

Investment Income 758,600 479,912 454,598

Government Grants 3,957,000 450,624 803,758

Contributions by Developers 635,900 953,400 737,967

Contnbutions by Others 860,229 1,895,848 1,353,394

Gain (Loss) on Disposal of TCA (53,611) (53,611) 12,220,961

33,105,827 30,436,961 41,516,442

EXPENSES

General Government Services 4,489,607 4,622,114 4,388,974

Protective Services 6,428,184 6,252,073 6,531,148

Transportation Services 4,103,785 3,798,646 3,777,093

Water Services 3,167,138 2,950,511 3,046,776

Sewer Services 1,970,867 1,837,951 1,654,271

Drainage Services 1,482,463 1,501,619 1,251,957

Solid Waste Services 1,459,930 1,463,008 1,438,585

Dyking Services 217,260 211,725 216,441

Recreation and Cultural Services 6,110,339 5,787,430 5,707,785

Planning Services 395,120 369,573 343,515

29,824,693 28,794,650 28,356,545

Less: Internal Equipment Charges (641,596) (511,443) (474,633)

29,183,097 28,283,207 27,881,912

ANNUAL SURPLUS $ 3,922,730 2,153,754 13,634,530

ACCUMULATED SURPLUS, BEGINNING OF YEAR 178,963,813 165,329,283

ACCUMULATED SURPLUS, END OF YEAR $181,117,567 $178,963,813

See accompanying Notes to the Consolidated Financial Statements.

3

- 66 -

City of Pitt Meadows V

Consolidated Statement of Change in Net Financial Assets (Debt)

For the Year Ended December 31, 2013

2013 Budget 2013 Actual 2012 Actual

(Note 14)

Annual Surplus $ 3,922730 $ 2,153,754 $ 13,634,530

Acquisition of Tangible Capital Assets (13,594,600) (6,949,176) (6,576,735)

Amortization of Tangible Capital Assets 4,810,080 4,810,080 4,591,381

Proceeds on Disposal of Tangible Capital Assets 15,839 15,839 12,595,151

Loss (Gain) on Disposal of Tangible Capital Assets (Note 9) 53,611 53,611 (12,220,961)

(8,715,070) (2,069,646) (1,611,164)

Net Use (Acquisition) of Inventories of Supplies 0 (20,131) 15,397

Net Use (Acquisition) of Prepaid Expenses 0 (1,493,678) 15,630

INCREASE (DECREASE) iN NET FINANCIAL ASSETS (DEBT) (4,792,340) (1,429,701) 12,054,393

NET FINANCIAL ASSETS (DEBT), BEGINNING OF YEAR 7,835,052 (4,219,341)

NET FINANCIAL ASSETS, END OF YEAR $ 6,405,351 $ 7,835,052

See accompanying Notes to the Consolidated Financial Statements.

4

- 67 -

City of Pitt Meadows

Consolidated Statement of Cash Flow

For the Year Ended December 31, 2013

2013 Actual 2012 Actual

OPERATING TRANSACTIONS

Annual Surplus V 2,153,754 13,634,530

Non Cash Items Included in Annual Surplus:

Contributions from Developers and Others (825,249) (409,535)

Amortization

4,810,080 4,591,381

Loss (Gain) on Disposal of Tangible Capital Assets (Note 9) 53,611 (12,220,961)

Decrease (Increase) in Inventories of Supplies (20,131) 15,397

Decrease (Increase) in Prepaid Expenses (1,493,678) 15,630

Decrease in Non Cash Operating Items 387,182 173,633

Increase in Development Installments (516,722) (395,971)

Increase in Refundable Performance Deposits 16,389 172,941

Decrease in Deferred Revenue 15,563

V

(40,127)

Cash Provided by Operating Transactions 4,580,799 5,536,918

CAPITAL TRANSACTIONS

Proceeds on Disposal of Tangible Capital Assets 15,839 12,595,151

Cash Used to Acquire Tangible Capital Assets (6,695,136) (6,547,561)

Cash Acquired (Applied) by Capital Transactions (6,679,297) 6,047,590

INVESTING TRANSACTIONS

Net Purchase of Portfolio Investments (53,915) (3,860,643)

FINANCING TRANSACTIONS

V

Development Cost Charge Receipts and Interest 1,533,493 933,027

Proceeds from Long-term Debt and Temporary Borrowing 3,874,546 745,000

Repayment of Temporary Borrowing (Note 8) (3,000,000) (9,189,000)

Repayment of Long Term Debt (265,295) (179,576)

Cash Provided (Used) in Financing Transactions 2,142,744 (7,690,549)

INCREASE (DECREASE) IN CASH AND EQUIVALENTS (9,669) 33,316

CASH AND EQUIVALENTS, BEGINNING OF YEAR 360,847 327,531

CASH AND EQUIVALENTS, END OF YEAR 351,178 360,847

See accompanying Notes to the Consolidated Financial Statements.

5

- 68 -

City of Pitt Meadows

Notes to the Consolidated Financial Statements

For the Year Ended December 31, 2013

The City was incorporated as a District Municipality in 1914 under the Municipal Act (now a combination

of the Community Charter and the Local Government Act), a statute of the Province of British Columbia.

Effective January 1, 2007, the articles of incorporation of the municipality were changed by an Order in

Council of the provincial government to reflect a change in its name to the City of Pitt Meadows. Its

principal activities include the provision of local government services to the residents of the incorporated

area. These services include community planning, protective, transportation, recreational, solid waste,

water, sewer, drainage and dyking services.

I. SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The consolidated financial statements of the City of Pitt Meadows are the representations of management

prepared in accordance with Canadian public sector accounting standards as prescribed by the Public

Sector Accounting Board (PSAB) of the Chartered Professional Accountants Canada.

In 2013, the City adopted the provisions of the public sector accounting standard PS3410 Government

Transfers. This new standard can be applied either retroactively or prospectively, and the City elected to

apply the standard prospectively which resulted in no impact to the previous years. Government transfers

are recognized as revenue when authorized and eligibility critera have been met unless the transfer

contains stipulations that create a liability. If the transfer contains stipulations that create a liability, the

related revenue is recognized over the period that the liability is extinguished.

In 2013, the City also adopted the provisions of the public sector accounting standard, PS3510 Tax

Revenue. The requirements of this standard did not differ from the treatment the City had previously

been following and therefore, no change was required

The consolidated financial statements reflect the assets, liabilities, revenues, expenses, and accumulated

surplus of the reporting entity which is comprised of all organizations that are accountable for the

administration of their financial affairs and resources to the Council and are controlled or owned by the

City, including the Pitt Meadows Economic Development Corporation which was incorporated on March

5, 2010. Inter-entity balances and transactions have been eliminated on consolidation.

Use of Estimates

The preparation of consolidated financial statements in conformity with Canadian public sector accounting

standards requires management to make estimates and assumptions that affect the reported amounts of

assets and liabilities and the reported amounts of revenues and expenses during the period. Significant

areas requiring use of management estimates relate to the determination of employee benefit obligations,

useful life of tangible capital assets, liabilities associated with legal claims, and collectability of accounts

receivable. As such, actual results could differ from those estimates.

Revenue Recognition

Revenue is recorded on the accrual basis and included in revenue in the period in which the transactions

or events occurred that give rise to the revenues. Revenue unearned in the current period is recorded as

deferred revenue.

Taxes are recorded at estimated amounts when they meet the definition of an asset, have been

authorized and the taxable event occurs. Annual levies for non-optional municipal services and general

administrative services are recorded as taxes for municipal services in the year they are levied. Taxes

receivable are recognized net of an allowance for anticipated uncollectable amounts. Levies imposed by

other taxing authorities are not included as taxes for municipal purposes.

S

- 69 -

City of Pitt Meadows

Notes to the Consolidated Financial Statements

Forthe Year Ended December 31, 2013

1. SIGNIFICANT ACCOUNTING POLICIES (continued)

Unrestricted revenue for the sale of goods and services are reported as revenue at the time the services

or products are provided.

Contributions for specific purposes are recorded as deferred revenue and recognized as revenue in the

year in which the related expenses are incurred.

Through the British Columbia Assessment Authoritys appeal process, taxes may be adjusted by way of

supplementary roll adjustments. The effects of these adjustments on taxes are recognized at the time

they are awarded.

Government Transfers

Government transfers, which include legislative grants, are recognized as revenue in the financial

statements when the transfer is authorized and any eligibility criteria are met, except to the extent that

transfer stipulations give rise to an obligation that meets the definition of a liability. Transfer are

recognized as deferred revenue when the transfer stipulations give rise to a liability. Transfer revenue is

recognized in the statement of operations as the stipulation liabilities are settled.

Expense Recognition

Expenses are recognized in the period the goods and services are acquired and a liability is incurred or

transfers are due.

Cash anti Equivalents

Cash and equivalents consist of cash, bank balances, highly liquid money market investments and short-

term investments with maturities of less than 90 days at acquisition.

Portfolio Investments

Investments, other than Municipal Finance Authority Pooled Funds which are recorded at fair market

value, are amortized. Investment premiums and discounts are amortized over the term of the respective

investment. Investments are written down when there is, in the opinion of management, a permanent

decline in value.

Non Financial Assets

Tangible capital and other non financial assets are reported as assets as they can be used to provide

government services in future periods. These assets do not normally provide resources to discharge

liabilities unless they are sold.

Tangible Capital Assets

Tangible Capital Assets, comprised of capital assets and capital work-in-progress, are recorded at cost

which includes all amounts that are directly attributable to acquisition, construction, development and

betterment of the assets. Interest incurred during construction is capitalized.

7

- 70 -

City of Pitt Meadows

Notes to the Consolidated Financial Statements

For the Year Ended December 31, 2013

1. SIGNIFICANT ACCOUNTING POLICIES (continued)

The cost, less residual value, is amortized on a straight-line basis over the estimated useful lives of the

assets as follows:

Land No amortization

Road Infrastructure 20 to 100 years

Drainage infrastructure 30 to 80 years

Water Infrastructure 10 to 80 years

Sewer Infrastructure 30 to 80 years

Dyking Infrastructure No amortization

Other Infrastructure 50 to 100 years

Buildings 20 to 50 years

Land Improvements 20 to 30 years

Vehicles 5 to 20 years

Equipment and Furnishings 4 to 10 years

In the year of acquisition, amortization begins the first day of the month the asset is in service.

Contributed tangible capital assets are recorded at their fair value at the date of contribution. The

contribution is also recorded as revenue.

Employee Future Benefits

The City and Its employees make contributions to the Municipal Pension Plan. The Municipal Pension

Plan is a multi-employer contributory defined pension plan. These contributions are expensed as

incurred.

The City also accrues sick leave, deferred vacation, supplementary vacation, vacation in year of

retirement, overtime and service severance benefits, The liability relating to these benefits is actuarially

determined based on service and best estimates of retirement ages and expected future salary and wage

increases. The liability under this benefit plan is accrued based on projected benefits as the employees

render services necessary to earn the future benefits.

Property Tax Collections for Other Governments

The City is required by legislation to bill and collect property taxes on behalf of other governments. These

revenues and payments are not included in the Citys financial statements.

2. PORTFOLIO INVESTMENTS

The Citys portfolio of investments include bonds, deposits and notes of provincial governments and

agencies, deposits and notes of chartered banks, and deposits in the Municipal Finance Authority Money

Market Fund and Short Term Bond Fund.

The various instruments have stated rates of return ranging from 2.03% to 3.979% (2012 1.75% to

4.95%), with varying maturity dates up to August 3, 2022. The market value of the investments as at

December 31, 2013 was $21,907,500 (2012 $21,980,600). It is the Citys practice to buy and hold

investments to maturity in order to realize the stated rate of return.

8

- 71 -

City of Pitt Meadows

Notes to the Consolidated Financial Statements

For the Year Ended December 31, 2013

3. ACCOUNTS RECEIVABLE

: .2O12-

Property taxes and utilities receivable $ 1,948,955 $ 1,504,953

Other government receivable 2,301 78 1,901,546

General and interest receivable 471,051 723,378

Total $ 4,721,984 $ 4,129,877

4. DEVELOPMENT INSTALLMENTS

Development installments represent funds due from developers and others within two years. Funds

realized upon collection of these receivables can only be used for expenditures as provided by the

Development Cost Charge Reserve Fund Expenditure Bylaw and the relevant sections of the Local

Government Act, unless otherwise authorized by the Ministry of Community, Sport and Cultural

Development.

5. DEFERRED REVENUE

:2O12.:

Business licenses $ 142,874 $ 124,897

Other revenues received in advance 145,121 147,535

Total $ 287,995 $ 272,432

6. EMPLOYEE BENEFIT OBLIGATION

The City provides non-vested sick leave, service severance, overtime bank, and vacation benefits to its

employees. These benefits are described as follows:

a) Non-Vested Sick Leave: Employees are entitled to a sick leave benefit of 1.5 days for each month

of service which may be accumulated to a maximum of 250 days.

b) Service Severance: Upon retirement, employees are eligible for a payout of 3 days per year of

service accumulated after January 1, 1969, paid at his or her current rate of pay. Upon

termination or death, employees who have completed 8 or more years of service accumulated

after January 1, 1969 are eligible for a payout of 1 day per year of service paid at his or her

current rate of pay.

c) Overtime Bank: Employees may accumulate overtime hours in a bank. Upon termination,

retirement or death accrued overtime is paid out at his or her current rate of pay.

d) Deferred Vacation: Employees may defer a portion of their annual vacation entitlement.

Employees in the collective bargaining unit who are entitled to 25 vacation days or more are

subject to a maximum accumulation of 20 days. Exempt employees are subject to a maximum of

15 days.

e) Supplementary Vacation: Employees are entitled to 5 days of supplementary vacation every five

years. Employees in the collective bargaining unit are entitled commencing the fifteenth year of

service. Exempt employees are entitled commencing the fifth year of service. The

supplementary days must be used during the five year period following entitlement.

9

- 72 -

City of Pitt Meadows

Notes to the Consolidated Financial Statements

Forthe Year Ended December 31, 2013

6. EMPLOYEE BENEFIT OBLIGATION (continued)

Information about obligations for employee sick leave, overtime, vacation and retirement benefits are as

follows:

r

2013

Accrued Benefit Obligation, beginning of year $ 503,300 $ 543,500

Current Service Cost 50,900 62,000

Interest Cost 18,600 20,800

Past Service Cost - 6,100

Benefits Paid (63,700) (46,900)

Actuarial (Gain) Loss 18,400 (82,200)

Accrued Benefit Obligation, end of year $ 527,500 $ 503,300

The most recent actuarial valuation of the Citys employee benefit obligation was completed as at

Deember3l, 2012.

The significant actuarial assumptions used in measuring the Citys accrued benefit obligations include

estimated future wage increases and the following:

2013 2012

Discount Rate 4.10% 3.50%

Expected Future Inflation Rate 2.50% 2.50%

7. DEVELOPMENT COST CHARGES

The change in Development Cost Charges is as follows:

Development Cost Charges, beginning of year $ 4,581,473 $ 4,028,807

Net Developer Contributions (Refunds) 1,429,305 830,870

Interest Earnings 104,188 102,157

Project Funding and Revenue Recognized (571,209) (380,361)

Development Cost Charges, end of year $ 5,543,757 $ 4,581,473

8. DEBT

Debt includes long-term debt and temporary borrowing as follows:

[

I

Long-term debt (a) $ 7,299,070 $ 4,422,763

I

Temporary Borrowing (b) 732,944 3,000,000

L

Total $ 8,032,014 $ 7,422,763

a) Long-term debt:

The City obtains debt financing through the Municipal Finance Authority in accordance with the

Community Charter to finance certain capital expenditures.

10

- 73 -

City of Pitt Meadows

Notes to the Consolidated Financial Statements

For the Year Ended December 31, 2013

8. DEBT (continued)

The gross and outstanding amounts of the long-term debt are as follows:

..-

:. . .2013.

.:

., 20i2

Civic Centre, Bylaw 2368, 3.73%, due 2035 $ 2,403,278 $ 2,471,440

Arena Acquisition, Bylaw 2408, 3.73%, due 2025 1,832,730 1,951,323

Facility Construction and Revitalization Bylaw 2429, 2%, due 2033 3,063,062 -

Total $ 7,299,070 $ 4,422,763

Future sinking fund and principal payments on net outstanding long-term debt over the next five

years and thereafter are as follows:

Year 4Amount.

2014 $ 344,458

2015 357,188

2016 365,192

2017 373,517

2018 382,175

Thereafter 5,476,540

Total $7,299,070

b) Temporary Borrowing:

The City has temporary capital financing through the Municipal Finance Authority Interim

Financing program for the following capital projects:

. -. . .

. 2013 -. 2012

Drainage Utility, Bylaw 2430 $ 4,500,000 $ 732,944 $ -

Facility Construction and Revitalization, Bylaw 2429 7,150,000 - 3,000,000

Total $11,650,000 $ 732,944 $ 3,000,000

Regular principal payments are not required, but funds borrowed under this program must either

be repaid or converted to long term borrowing through a debenture issue within five years. The

outstanding balance bears interest at approximately prime less 1.25%, which is paid monthly.

9. TANGIBLE CAPITAL ASSETS

Schedule I details Tangible Capital Asset cost and accumulated amortization information. As at

December 31, 2013, the City held $3,163,590 in assets under construction that were not yet amortized

(2012 -$1,380,609)

During the year the assets valued at $254,040 (2012 -$29,174) were contributed to the City and recorded

as revenue.

During fiscal 2012, the City incurred a gain of $12.3 million on the disposal of two parcels of property.

1].

- 74 -

City of Pitt Meadows

Notes to the Consolidated Financial Statements

For the Year Ended December 31, 2013

10. ACCUMULATED SURPLUS

Accumulated Surplus includes Equity in Tangible Capital Assets, Current Fund Surplus and Statutory

Reserves as follows:

:2013r: 2012;::

Unappropriated Balance

Current Fund Surplus $ 13,730 $ 206,765

Appropriated Surplus

Statutory Operating Reserves 2,898,082 1,957,574

Statutory Capital Reserves 13,284,739 13,338,853

16,182,821 15,296,427

Investment in Tangible Capital Assets 164,921,016 163,460,621

Total Accumulated Surplus $181,117,567

I

$178,963,813

11. SEGMENTED INFORMATION

For reporting purposes, City activities have been aggregated into functional segments based on the

services each activity provides. The Consolidated Schedule of Segment Disclosure (Schedule 3) reports

the revenues and expenses that are directly attributable to each functional segment. The revenues and

expenses that cannot be directly attributable or allocated on a reasonable basis to individual segments

are reported in the unallocated segment. The following describes the services included in each segment:

Genera! Government Services

The General Government segment includes administration, legislative, financial, human resources,

information technology, economic development and sustainability services.

Protective Services

The Protective Services segment includes Police services provided by the RCMP and support services by

the District of Maple Ridge, fire protection, bylaw enforcement, business licensing, building inspection,

animal control and emergency program services.

Transportation Services

The Transportation Services segment includes engineering, operations administration, and roads

maintenance services.

Utility, Solid Waste and Dyking Services

The Utility, Solid Waste and Dyking Services segment includes drainage, water, and sewer utility

services, the solid waste collection and disposal service and dyking services.

Recreation and Cultural Services

The Recreation and Cultural Services segment includes parks and recreation services provided by the

District of Maple Ridge, library services provided by the Fraser Valley Regional Library, and the

operations of the Pitt Meadows Arena.

Planning Services

The Planning Services segment includes services for managing development and community planning.

12

- 75 -

City of Pitt Meadows

Notes to the Consolidated Financial Statements

For the Year Ended December 31, 2013

11. SEGMENTED INFORMATION (continued)

Unallocated

The Unallocated segment includes the following revenues and expenses that cannot be directly

attributable or reasonably allocated to a segment: municipal property taxation and penalties and interest

charged thereon, taxes in lieu, return on investments, and interest paid on development cost charge

funds and tax prepayment accounts.

12. MUNICIPAL PENSION PLAN

The municipality and its employees contribute to the Municipal Pension Plan (the Plan), a jointly trusteed

pension plan. The board of trustees, representing plan members and employers, is responsible for

overseeing the management of the Plan, including investment of the assets and administration of

benefits. The Plan is a multi-employer contributory pension plan. Basic pension benefits provided are

based on a formula. The plan has about 179,000 active members and approximately 71,000 retired

members. Active members include approximately 62 contributors from the City of Pitt Meadows.

The most recent actuarial valuation as at December 31, 2012 indicated a $1,370 million funding deficit for

basic pension benefits. The next valuation will be as at December 31, 2015 with results available in

2016. Employers participating in the Plan record their pension expense as the amount of employer

contributions made during the fisal year (defined contribution pension plan accounting). This is because

the Plan records accrued liabilities and accrued assets for the Plan in aggregate with the result that there

is no consistent and reliablebasis for allocating the obligation, assets and cost to the individual employers

participating in the Plan.

The City of Pitt Meadows paid $385,168 (2012 - $368,811) for employer contributions while employees

contributed $324,957 (2012 - $317,172) to the Plan in fiscal 2013.

13. CONT1NGENT LIABILiTIES AND COMMITMENTS

a) The City is a member of the Municipal Insurance Association (MIA), which operates under a

reciprocal insurance exchange agreement The main purposes of the exchange agreement are:

(1) to pool the risk of third party liability claims against member municipalities (approximately 170)

in order to allow for stable financial planning related to those liability claims; and (2) to engage in

broad risk management strategies to reduce accidents or occurrences that may result in liability

claims against the City. The City is assessed an annual premium by MIA based on factors such

as population, administrative costs, premium tax and re-insurance costs. MIA is subject to

financial oversight by the Provincial Government.

b) The City self insures for certain potential financial losses arising from the penetration of water into

building envelopes (leaky buildings) and acts of terrorism, for any claims made after January 1,

2002.

c) The City has cost sharing agreements with the District of Maple Ridge to provide services in a

more efficient and cost effective manner. These agreements cover the provision of all parks and

leisure services, and police housing and support services. The costs are shared on the basis of

proportionate population, and Council can terminate the agreement(s) by providing four months to

one years notice.

13

- 76 -

City of Pitt Meadows

Notes to the Consolidated Financial Statements

For the Year Ended December 31, 2013

13. CONTINGENT LIABILITIES AND COMMITMENTS (continued)

d) The City has a long-term service agreement with another organization for the provision of fire and

public works dispatch services. This agreement has an annual cost of approximately $34,000

and will expire on December 31, 2014.

e) The City has been named defendant in a number of claims that are currently pending. In

determining their estimated exposure the City has relied upon their understanding of the claims,

including activities undertaken by the other parties, as well as discussions with legal counsel. In

those cases where an unfavourable outcome is likely, a provision for anticipated costs has been

accrued. In the opinion of management, the amount of any loss from these claims cannot be

reasonably estimated, nor can the likelihood of their outcomes be known at this time. Therefore,

management has made no provision for these claims and any future settlement will be accounted

for in the year of settlement.

f) As at December 31, 2013 there were various property assessment appeals pending. The

outcome of those appeals may result in adjustments to property taxes receivable for the current

and prior years. The City has made no specific provision for these appeals as the outcome is

indeterminable.

g) The City is a member of E-Comm, an organization comprised predominately of member

municipalities, for the purpose of providing emergency dispatch services. The City is represented

on the board, and as a Class A shareholder has voting rights should the organization want to

incur additional debt. The E-Comm facility was constructed using debt as a financing mechanism

and members are liable for a proportionate share of that debt. This debt is repaid by members

through annual fees charged by E-Comm. Should E-Comm dissolve, members would be liable

for a proportionate share of any residual debt. Alternatively should a member choose to opt out

of E-Comm, they would be liable for a proportionate share of debt at the time of withdrawal.

h) On September 15, 2009 the City agreed to an Offer to Lease for approximately 12,200 square

feet of space at 12059 Harris Road, Pitt Meadows for the purpose of relocating the Pitt Meadows

Library in 2011. The lease commenced March 1, 2012, ninety days after the fixturing period, for a

term of ten years. The annual minimum rent is $151,000 and is subject to annual CPI increases

in the second five year period of the term.

i) In October, 2010 the City signed an Offer to Lease for approximately 9,500 square feet of space

in a seniors residential facility for the purposes of operating a Seniors Centre. Construction of

the facility began in 2011, and the lease commenced in January 2013. The term of the lease is

forty years plus a 20 year renewal option. The rent for the initial 40 year term is $1,549,506,

prepaid at the commencement of the lease in 2013.

j)

In February, 2011 the City signed an Operating and Maintenance Agreement with Nustadia

Recreation Inc. for the operation and maintenance of the Pitt Meadows Arenas. The agreement

was effective May 1, 2011, with an initial term of five years and four optional renewal periods. An

annual management fee of $100,000 is payable under the agreement (adjusted annually for

inflation), with payments due in equal monthly installments.

k) The City has a long-term service agreement with the Province of British Columbia for the

provision of police services by the Royal Canadian Mounted Police with an annual cost of

approximately $3.3 million. The current agreement commenced April 1, 2012 with an expiry date

of March 31, 2032.

4

- 77 -

City of Pitt Meadows

Notes to the Consolidated Financial Statements

For the Year Ended December 31, 2013

13. CONTINGENT LIABILITIES AND COMMITMENTS (continued)

I) In March 2013 the City was the recipient of funds under the Green Municipal Fund (Project

10297) Loan and Grant Agreement in the amount of $3,141,602 in loan proceeds and $378,320

in grant proceeds. A portion of the funds have been used to repay the 2012 $3,000,000 balance

of the temporary borrowing for the Facility Construction and Revitalization, Bylaw 2429.

14. BUDGET

The budget amounts which are presented for comparative purposes reflect the statutory balanced budget

as adopted by Council on February 5, 2013 adjusted for amortization and other items for comparability

with the actual results.

The following reconciles the balanced statutory budget and the budget surplus reported on the

Consolidated Statement of Operations.

Add:_Budgeted_Capital_Expenditures

General Government Services 806,300

Protective Services 24,700

Transportation Services 2,210,200

Water Services 1,112,000

Sewer Services 945,000

Drainage Services 6,527,900

Recreation and Cultural Services 1,968,500

Budgeted Reduction in Debt Principal 263,551

Budgeted Transfer to Own Reserves 7,166,711

Gain on Disposal of Tangible Capital Assets (Actual) (53,611)

20,971,251

Less: Budgeted Transfer from Own Reserves 9,337,440

Budgeted Proceeds from Borrowing 2,901,000

Amortization Expense (Actual) 4,81 0,081

17,048,521

Budget Surplus, as per Consolidated Statement of Operations $ 3,922,730

15. COMPARATIVE FIGURES

Certain comparative figures have been reclassified to conform to the current year presentation.

Surplus as

I

I. S

- 78 -

City of Pitt Meadows

Consolidated Schedule of Tangible Capital Assets and Accumulated Amortization

FortheYearEnded December31, 2013

Schedule I

2013

Cost

Amortization

2013 2012 Balance

Balance

Beginning of

Balance End of Beginning of

Balance End of Asset Category Year Additions Disposals Year Year Amortization Disposals Year Net Book Value Net Book Value

Buildings

$ 31,209,544

$ 1,276,582 $ 4,568 $ 32,481,558 $ 9,615,103 $ 1,098,426 $ 4,569 $ 10,708,960 $ 21,772,598 $ 21,594,441

Drainage Infrastructure 25,694,637 2,069,204 1,032 27,762,809 9,008,182 448,110 1,032 9,455,260 18,307,549 16,686,454

Dyking Infrastructure 12,026,612 -

- 12,026,612 - - - - 12,026,612 12,026,612

Equipment and Furnishings 4,400,551 393,401 170,679 4,623,273 2,711,161 387,301 170,608 2,927,854 1,695,419 1,689,389

Land

51,250,042 - - 51,250,042 - - - - 51,250,042 51,250,042

Land Improvements 8,635,565 187,362 - 8,822,927 1,704,978 348,286 - 2,053,264 6,769,663 6,930,586

Leasehold Improvements 1.302,970 -

- 1,302,970 97,723 130,297 - 228,020 1,074,950 1,205,247

Other Infrastructure 5,371,722 - - 5,371,722 521,934 91,553 - 613,487 4,758,235 4,849,788

Road Infrastructure 43,028,847 1,165,618 390,815 43,803,650 18,547,500 1,239,658 363,535 19,423.623 24,380027 24,481,348

Sewer Infrastructure 13,413,853 256,390 23,027 13,647,216 4,682,021 193,433 20,626 4,854,828 8,792,388 8,731,831

Vehicles

4,465,576 435,120 147,905 4,752,791 2,122,654 342,207 147,905 2,316,956 2,435,835 2,342,924

Water Infrastructure 30,756,778 1,165,499 423,361 31,498,916 11,662,057 530,809 383,662 11,809,204 19,689,712 19,094,722

TOTAL

$231,556,697 $ 6,949,176 $ 1,161,387 $ 237,344,486

$ 60,673,313 $ 4,810,080 $ 1,091,937 $ 64.391,456 $ 172,953,030 $ 170,883,384

- 79 -

City of Pitt Meadows

Consolidated Schedule of Municipal Property Taxes and Other Tax Levies

For the Year Ended December 31, 2013

Schedule 2

Schedule of Municipal Property Taxes:

2013 Budget 2Ol3Actual 2Ol2Actual

Real PropertyTaxes

Residential $ 9,651,951 $ 9,601,469 $ 9,232,696

Utilities 233,644 222,641 223,674

Majorlndustry 122,321 122,321 119,001

Light Industry 695,244 754,385 671,332

Business 4,333,593 4,098,516 4,292,573

Recreational/Seasonal 226,575 221,018 219,569

Farm 439,513 451,264 438,153

15,702,841 15,471,614 15,196,998

Prior Years Re-assessments - 48,084 - 28,130 2,527

Total Municipal Property Taxes $ 15,654,757 $ 15,443,484 $ 15,199,525

In addition to its own tax levies, the City is required to collect taxes on behalf of other taxing

authorities, and remit to those authorities. Total taxes levied and remitted are as follows:

2013 2012

Municipal Property Taxes

$ 15,443,484 $ 15,199,525

Levies for Other Authorities:

Provincial School Taxes 7,868,205 7,879,608

Greater Vancouver Transit Authority 1,480,019 1,552,768

British Columbia Assessment Authority 236,225 239,977

Greater Vancouver Regional District 223,660 214,446

Municipal Finance Authority of British Columbia 726 742

9,808,835 9,887,541

Total Tax Levies

$ 25,252,319 $ 25087,066

17

- 80 -

City of Pitt Meadows

Consolidated Schedule of Segment Disclosure

For the Year Ended December 31, 2013

Schedule 3

General

Government Protective

Services Services

2013 Actual

Utility, Solid

Waste and Recreation and

Transportation Dykirtg Cultural Planning

Services Services Services Services

REVENUES

Municipal Property and Other Taxes

Utility,Solici Waste and Dyking Levies

Sale of Services

Licenses, Permits, Penalties and Fines

Return on lnves1jients

Grants and Contributions

Gain (Loss) on Disposal of TCA (Note 9)

EXPENSES

Salaries and Benefits

Contracted Services

Supplies, Materials and Equipment

o Purchase of Water and Sewer Levy

Amortization

Interest Charges

Less: Internal Equipment Charges

2013 Budget

______________

Unallocated

$ - $ 15,735,622

$ - $ - $ - $

- -

- 8,415,407

356,704 57,199 109,490 1,100

- 235,086 1,292 16,273

111,997 18,048 545,966 1,767,999

- -

- 11,512 - 42,099

468,701 310.333 645,236 10,158,680

2,324,424 1335,719 1261,743 829,639

1,013,820 4,549,777 517,938 2,252,523

372,158 210,010 487,911 314,385

- -

- 3,395,914

648,927 156,567 1,531,054 1,172,353

262,785 - - -

4,622,114 6,252,073

$

1,151,944

449.545

1,601,489

4,455,281

30.970

1,301,179

186,667

479,912

258,167

16,660,368

_______________ _______________ _______________________________ _______________ _______________ _______________

Consolidated

_______________

$ 15,735,622

8,415,407

1,687,192

872,567

479,912

3,299,872

- 53,611

____________

______________ ______________ ______________ ______________ ______________ ______________ _____________

30,436,961

______________

- 6,091,011

- 12,813,036

- 1,421.824

- 3,395,914

- 4,810,080

- 262,785

_____________

3,798,646 7,964,814 5,787,430

- 28,794,650

- - -

- (511,443) (511,443) (641,596)

4,622,114 6,252,073 3,798,6.46 7,964,814 5,787,430 369,573 - 511,443 28283,207 29,183,097

10,755

433,249

148,150

592,154

339,486

23.697

6,390

Consolidated

(Note 14)

$ 15,945,628

8,453,110

1,899,146

649,625

758,600

5,453,129

53,611

33,105,827

6,308,952

13,407,741

1,517,953

3,533,828

4,810,081

246,138

29,824,693

369,573

ANNUAL SURPLUS

$ (4,153,413) -s 5,941,740 $ (3,153,410) $ 2,193,866 $ (4,185,941) $ 222,581 $ 17,171,811 $ 2,153,754 $ 3,922,730

- 81 -

City of Pitt Meadows

Consolidated Schedule of Segment Disclosure

For the Year Ended December 31, 2013

Schedule 3 (continued)

2012 Actual

General

Government Protective Transportation

Services Services Services

Utility, Solid

Waste and Recreation and

Dyking Cultural Planning

Services Services Services

$ $ - $

1,197,973

REVENUES

Murvcrpal Property and Other Taxes

litllity,SoHd Waste and Dyking Levies

Sale of Services

Licenses, Pennits, Penalties and Fines

Return on Investments

Grants and Contributions

Gain (Loss) on Disposal of TCA (NoteS)

EXPENSES

Salaries and Benefits

Contracted Services

Supplies, Materials and Equipment

o Purchase of Water and Sewer Levy

Amortization

Interest Charges

Less: Internal Equipment Charges

ANNUAL SURPLUS

8,005,391

3,743

10,243

399,210 912,739

8,418,587 2,110,712

$

114,865

2,276

747,832

864,973

1,212,560

548,658

530,672

1,485,203

$

309,101

222,793

12,220,961

12752,855

2,090,810

1,043,361

345,127

533,673

478,160

4,491,131

4,491,131

$ 8,261,724

$

62,820

205,736

52,630

321,186

1,349,372

4,786,573

247,425

147,778

6,531,148

6,531,148

$ (6,209,962)

Unallocated

$ 15,470,519

202,438

556,755

539,915

16,769,627

13,112

347.547

20,000

380,659

320,460

16,092

6,963

773,698

1,876,945

375,491

3,433,837

1,140,460

8,599

Consolidated

$ 15,470.619

8,005,391

1,701,614

768.240

556,755

2,895,119

12,220,961

41,618,599

5,769,749

12,648,055

1,528,921

3,433,837

4,591,381

486,759

28,458,702

22,849

4,377,426

23,243

1,284,267

Consolidated

$ 15,313,330

8,150,611

1,819,000

807,562

677,000

1,711,115

12,220,961

40,499,579

6,086,606

11,857,484

1,871,560

3,523,215

4,591,381

10,000

27,740,246

3,777,093 7,608,030 5,707,785

3,777,093

S (2,912,120)

343,516

7,608,030 5,707,785 343,515

$ 810,567 S (3,597,073) $ 37,144

(474,633) (474,633) (596,434)

(474,633) 27,984,069 27,143,812

$ 17,244,260 $ 13,634,530 $ 13,355,767

- 82 -

CITY OF PITT MEADOWS

SCHEDULE SHOWING THE REMUNERATION AND EXPENSES PAID TO OR ON BEHALF OF ELECTED OFFICIALS AND

EMPLOYEES

ELECTED OFFICIALS:

NAME

2013

POSITION

Benefits

Base Salary and Other Expenses

WALTERS, DEBRA

BELL, BRUCE

BING, DOUG

ELKERTON, JANIS

MIYASHITA, TRACY

MURRAY, DAVID

OCONNELL, GWEN

Mayor

Councillor

Councillor

Councillor

Councillor

Councillor

Councillor

67,002

25,126

10,484

25,126

25,126

25,126

25,126

3,863

2,630

1,940

2,630

2,630

2,630

2,630

TOTAL ELECTED OFFICIALS

OTHER EMPLOYEES (excluding those listed above):

$ 203,114 $ 18,952 $ 10,549

Benefits

Total of other employees with base salary + benefits and other less than $75,000

TOTAL EMPLOYEES

2,526,237 30,357 42,551

$ 4,498,578 $ 184,155 $ 103,939

*Benefits

and Other include taxable benefits (MSP, group life) and lump sum payments including leave balance payouts (ie banked

vacation, earned time, acting pay and overtime)

5,541

35

2,693

1,989

292

NAME POSITION

Base Salary and Other Expenses

Other employees with base salary + benefits and other greater than $75,000:

BROWN, MARTIN Network Specialist Support System 73,909 8,162 1,428

BRUCE, DAVE Building Inspector 73,909 1,419 407

CHATTON, ROBERT Assistant Fire Chief-Training Officer 103,245 2,548 330

CROWTHER, KELLY Utilities Operator-Water 66,806 8,522 1,622

DEBOER, YNTO (Ike) Engineering Services Coordinator 77,074 435 339

DOULL, MURRAY Foreman-Public Works 68,610 12,918 70

EVANS, RANDY Operations Superintendant 103,246 3,511 9,863

GEMPERLE, CHANTAL Building Inspector 73,909 1,664 1,571

GROUT, KIMBERLEY Deputy CAO/Director of Ops. & Dev. Services 149,481 1,083 8,589

HARDING, CHERYL Manager of Financial Services 102,476 6,675 2,842

JOLLEY, DONALD Director of Fire Services 121,469 892 4,338

JONES, LORNA Director of Human Resources/Communications 108,410 5,081 732

KENNEY, KELLY Manager of Legislative Services 84,063 1,706 4,368

KYLE, SCOTT Fire Safety Technician 76,190 14,467 -

LARSSON, MIKE Fire Safety Technician 76,190 13,228 1,501

PARR, DANA Planner II 87,446 1,576 1,156

PERRIE, BRAD Assistant Fire Chief 103,245 3,229 2,435

PHILP, DAVE Business Analyst/IT Coordinator 103,245 5,205 1,854

RUDOLPH, JAKE Chief Administrative Officer 149,110 32,867 12,797

WILLIAMS, BOB Utilities Foreman 69,847 16,800 1,726

ZANON, KATE Director of Corporate & Business Services 100,462 11,811 3,419

Prepared under the Financial Information Regulation, Schedule 1, section6(2), (3), (5)and (6) DM#1 18780 - 83 -

City of Pitt Meadows

Schedule of Payments to Suppliers of Goods and Services

2013

Supplier Name

ment to

____

-pIie.

ACEE ,- 11 .13LTD.

___________________

50,1032

ATO.. D CRAYON viE DEVELOPMENT LTD 28,906.93

AURA OFFICE ENVIRONMENTS INC._____________________ 57,893.73

AVSOLUTIONS

_________________________

83,017.35

B.C. HYDRO & POWER AUTHORITY____________________ 544,598.53

B.C. PENSION CORPORATION . 710,125.41

BDODUNWOODY

____

37,003 00

BRANDT TRACTOR LTD.

____ _______

154,438.43

BRJTISH COLUMBIA LIFE & CASUALTY COMPANY___________ 36,966.61

CAN DO CONCRETE

___________

65,56200

CHEVRON CANADA LTD.

1

119,786.61

CITY OF SURREY

- J

37,013.40

COBRA ELECTRIC LTD.

_________

28,773.92

COLUMBIA BITULITHIC IA DIVISION OF LAFARGE

_______

914,014.30

CORIX WATER PRODUCTS LP

______

407,788.03

CROCKER EQUIPMENT CO. LTD.

______

115,279.36

DAMS FORD LINCOLN SLS LTD

______

124,758.05

DIRECT ENERGY BUSINESS

J

- 36,251.02

DIRKS LANDSCAPE DESIGN BUILD LTD.

1

70,350.00

DISTRICT OF MAPLE RIDGE t__3,316,769.30

DOMINIC TRANSPORT LTD. 43,465.08

FINNING (CANADA) A DIVISION OF FINNING 41,428.40

FORTIS BC- NATURAL GAS 35,265.97

FRASER RICHMOND SOIL AND FIBRE LTp. 107,817.58

FRASER VALLEY REONAL UBRARY - 873526.00

.kSIcKI LTD. -

I1.

7:787.1

GE INTELLIGENT PLATFORMS CANADA 31,373.80

GLE GREEN LANDSCAPE EXPERTS LTD. 29,941.85

GOLDEN MEADOWS BILLINGS DEVELOPMENT LTD. 198,447.14

GREATER VANCOUVER SEWERAGE & DRAINAGE______ 1,637,687.46

GREATER VANCOUVER WATER DISTRICT

______

1 1,687,128.34

HANKS TRUCKING & BULLDOZING

______

162,163.76

INNOVATIVE PARTS & SOLUTIONS LTD. 28,567.62

INSIGHT CANADA INC. . 55,462.77

INTERNATIONAL WATER SCREENS CO. 102,200.02

ISL ENGINEERING AND LAND SERVICES LTD . 518,630.52

JACK CEWE LTD. 182,118.32

JENT CONSTRUCTION LTD.

______

79,061.77

LEKO PRECAST LTD .

_____T

27,104.00

MAR-TECH UNDERGROUND SERVICES LTD. 171,934.33

MCRAES ENVIRONMENTAL SERVICES LTD. 50,652.92

MCRAES POWER SWEEPING LTD 30,075.26

MEIER & COMPANY INSURANCE E AGENCIES (MISSION)_LTD 26,780.00

MERLETTI CONSTRUCTION (1999) LTD.

______ ________

I

44,647.98

METRO VANCOUVER J 470,767.24

MILLS BASICS 28,740.42

MINiSTEROFRNANCE

t 60,621.50

MUNICIPAL INSURANCE ASSOCIATION 169,653.00

MURDY & MCALLISTER 55,205.76

NUSTADIA RECREATION INC. 25,101.86

ONE STOP SAFETY SERVICES CORPORATION 32,187.19

- 84 -

City of Pift Meadows

Schedule of Payments to Suppliers of Goods and Services

2013

Aggregate

Supplier Name

Payment to

Supplier

PACIFIC ACE SPORTS SURFACES & EQUIPMENT LTD 53 728 50

PACIFIC BLUE CROSS - 123 747 57

PAX CONSTRUCTION LTD 478,579.55

PITT RIVER QUARRIES DIV OF LAFARGE CANADA INC 39,984.55

POLAR INDUSTRIES LTD. 29,732.94

RAINCITY SUPPLIES LTD 41 489 27

RAYBERN ERECTORS LTD. 34031.96

RCMP - RECEIVER GENERAL 3,166,815.29

RECEIVER GENERAL - PAYROLL DEDUCTIONS 1,349,300.84

SANDPIPER CONTRACTING LTD 984,308.24

SCADA CONTROLS CENTRAL LTD 84,067.10

SOLIb FOUNDAtIONS CONSULTING LTD. 42,339.57

STROHMAI ERS EXCAVATING LTD. 795,753.25

SUDDEN SERVICE TECHNOLOGIES CORP 84,611.26

SULZER PUMPS WASTEWATER CANADA INC. 250,641.97

SUTTLE RECREATION INC.

1

70,425.96

TELUS 38,840.79

TELUS MOBILITY 30 251 64

TELUS SERVICES INC

1

34,540.80

TIMES NEWSPAPER 25,294.26

TOURISM MAPLE RIDGE AND PITT MEADOWS 47,982.52

TRB ARCHITECTURE AND INTERIOR DESIGN INC. 239,450.56

TUNDRA PLUMBING LTD. 29,476.31

URBAN SYSTEMS 53 97746

VADIM SOFTWARE 29,045.83

VERMEER OF BC EQUIPMENT LP 25 189 92

WASTE MANAGEMENT OF CANADA CORP 1,276,441.80

WESBROOKE RETIREMENT LIMITED PARTNERSHIP 1,529,506.00

WHOLESALE FIRE & RESCUE LTD. 27,307.19

WILLIS CANADA (1999) INC. 149,304.00

WINVAN PAVING LTD. 72,085.29

WOLF FLAGGING 27,509.44

WORKSAFE BC - WORKERS COMPENSATION BOARD 51 39545

TOTAL AMOUNT PAID TO SUPPLIERS WHO RECEIVED

AGGREGATE PAYMENTS EXCEEDING $25,000 FOR GOODS AND

SERVICES

$25,382,101.73

TOTAL AMOUNT PAID TO SUPPLIERS WHO RECEIVED

AGGREGATE PAYMENTS OF $25,000 OR LESS

$2,531,197.67

TOTAL AMOUNT PAID TO SUPPL_ EXCEEDING

$25,000

$0.00

TOTAL PAYMENTS TO SUPPLIERS FOR C .. .D SERVICES $27,913,299.40

- 85 -

CORPORATION OF THE CITY OF PITT MEADOWS

STATEMENT OF SEVERANCE AGREEMENTS

There were no severance agreements made between the City of Pitt Meadows and its

non-unionized employees during fiscal year 2013.

Prepared under the Financial Information Regulation, Schedule 1, subsection 6(8). #119579v1

- 86 -

CORPORATION OF THE CITY OF PITT MEADOWS

STATEMENT OF CONTRACTS WITH COUNCIL MEMBERS OR FORMER COUNCIL MEMBERS

There were no contracts made between the City of Pitt Meadows and its Council Members or

former Council Members during fiscal year 2013.

#1 19580v1

- 87 -

City of Pitt Meadows

Supplier Payments over $25,000

COUNCIL

50,103.62! Maclean Park Excavating

I 57,893.73 City Hall Workstations

83,017.35 Council Chambers & Annex Audio Visual

- .... -.:.. -..

____

154,438.43 John Deere Backhoe

65 562 00 Vanous Sidewalk/Concrete

_

- -. - ....

28 (1) Traffic & St Light Repairs &Maintenance

914,014.301

__________

(1) Road Patching, Asphalt, Duraphalt

407,788.03 (1) Water Meter Program/Misc Waterworks

_j

115,279.36! !Zamboni

J_

124,758.05 One Ton Crew Cab/Chassis

7030,,tMacLeanPark Landscaping

-----!---

-..

117,787.19 (1). Culvert Replacement & Fill Site Maintenance

31,373.80 Scada Software Upgrades & License

29,941.85 (1) Parks & Street Landscaping

162,163.76, (1) Culverts & Katsie Slough Ditch Cleaning

28,567.62 (1) FireHall Training Ground & Water Treatment

102,200.02: McKechnie Trash Racks

- 518,630.52:

.__.._

,Engineering Capital Works

182,118.32. Various Roadworks

79,061.77 PM Park Caretaker Residence

27,104.00 North Bonson/Somerset Park Wsshrooms

3433

Sewer Inspection

_____________

44,647.98! PRV-Lougheed/Old Dewdney Tr Rd

-

Arena Equipment

..387A9

. ...

_.(1)f

icFiagging

53,728.50 . Parks Improvements

Renovations - Rec Centre & Police Office

I 39,984.55 Gravel/Road Base Materials

29,732.94 (1) HVAC Repairs & Maintenance

_______

34,031.96 Fencing-Various Locations

36,251.02: Natural Gas Charges

3,316,769.30,RCMP Housing & Support/Parks & Leisure Services

43,465.08 Off Road Ditch & Salt Transportation Services

41,428.40 Sewer Pump Station Maintenance

35,265.97: Natural Gas Charges

107,817.58Curbside Organics Tipping Fees

673,526.00LibraryLevy -

________

198,447.14 Library Lease

1637,687.46. Sewer Levy & Solid Waste Tipping Fees

T 1687,128.34 Water Purchases

55,462.77 Microsoft License & Maintenance

- T

- .

- _i___

60652 92 Operations Hydro Vac Services C)

30,075.26, Operations - Street Sweeping

26,780.00!Fleet Insurance Broker- Meier Insurances

______

m

_________

470,767.24Principal & Interest Debt Payments

_____________ ___________

28,740.42!Omce Supplies

__________ ___________

ip1Ierpittarcs.: Medical Services Plan

- ._.L6JLffSS -.

I

W

- :

123,747.57: Payroll Remittance - Medical

41,489,27 Facilities - Janitorial Services

3.166.815,29:RCMP Services -

I CAPITAL EXPENDITURES OPERATING

Aggregate . .

Supplier Name Payment to CONTRACTOR OTHER . CONTRACTOR. OTHER

# Supplier /CONSULTANT 1 VENDORS ! PROJECT /CONSULTANT VENDORS DESCRIPTION

-. ,,,

28,906,93 iT Website Support

544 598 53!

Hydro Services

710,125.41 Payroll Remittance -Pension

_________

37,003.00 City Audit Services

________

36,966.61 Payroll Remittance-Life Ins/ADD

119,786.61 Vehicle & Equipment Fuel

37,013.40!Fire Dispatch Services

1 ACE EXCAVATING LTD. 50,103.62

2ATOMlC CRAYON WEB DEVELOPMENT LTD 28906.93

3 AURA OFFICE ENVIRONMENTS INC

:

57,893.73

4 AV SOLUTIONS - ,83 01735

5 B.C.HYDRO&POWERAUTHORITY

6 B.C. PENSION CORPORATION 710,125.41

7 .BDODUNW000Y

-

8 BRANDT TRACTOR LTD - 1 154,438.43

9 ,BRITISH COLUMBIA LIFE & CASUALTY COMPANY 36,966.61

10 CAN DO CONCRETE

__[,

65,562.00

11 CHEVRON CANADA LTD.

- j

119,786.61

12 CITY OF SURREY 37,013.40

13 COBRA ELECTRIC LTD 28,773.92

14, COLUMBIA BITULITI-HC IA DIVISION OF LAFARGE - 914,014:30

15 CORIX WATER PRODUCTSLP 407,788.03

16 CROCIcER EQUIPMENT CO. LTD. 115,279.36

17 DAMS FORD LINCOLN SLS LTD 1258.05

18 DIRECT ENERGY BUSINESS

] 36,251.02

19 DIRKS LANDSCAPE DESIGN BUILD LTD

_______

350.00

20 DISTRICT OF MAPLE RIDGE

1

3,316,769.30

21, DOMINIC TRANSPORT LTD 43,465.08

22 FiNNING (CANADA) A DIVISION OF FINNING 41,428.40

23 FORTIS BC- NATURAL GAS

I

35,265.97

24 FRASER RICHMOND SOIL AND FIBRE LTD r107,817.58

25 FRASER VALLEY REGIONAL LIBRARY

J

873,526.00

26 G. KOSICKI LTD. - - 1 117,787.19

27 GE INTELLIGENT PLATFORMS CANADA - l 31 373.80

28 GLE GREEN LANDSCAPE EXPERTS LTD. 29,941.85

29 GOLDEN MEADOWS BILLINGS DEVELOPMENT LTD 1 198,447.14

30 GREATER VANCOUVER SEWERAGE & DRAINAGE 1637 687 46

31 GREATER VANCOUVER WATERDISTRICT 1,687,128.34

:

HANKS TRUCKING & BULLDOZING 162,163.76

33 INNOVATIVE PARTS &SOLUTIONS LTD -

..! 28,567.62

34 INSIGHT CANADA INC

J

5546277

35 INTERNATIONAL WATER SCREENS CO. 102,200.02

36 . ISL ENGINEERING AND LAND SERVICES LTD 518,630.52

37 JACK CEWE LTD. - , 182,118.32

38 JENT CONSTRUCTION LTD. 79,061.77

39LEKO PRECAST LTD

127104.00

40 MAR-TECH UNDERGROUND SERVICES LTD. 171,934.33

41 MCRAES ENVIRONMENTAL SERVICES LTD. - - 50652.92

42 MCRAES POWER SWEEPING LTD - 30,075.26

MEIER & COMPANY INSURANCE E AGENCIES (MissIoN> LTD 26,780.05

44 MERLETTI CONSTRUCTION (1999) LTD. , 44,647.98

45 METRO VANCOUVER -. - - - - , 470,767.24

46 MILLS BASICS - - - 28,740.42

47 5I3 OF FINANCE

______

60,621.55

48 MUNICIPAL INSURANCE ASSOCIATION - 169,653.oC

49 MURDY & MCALLISTER - - 55,205.76

50 NUSTADIA RECREATION INC. 25,101.86

51 ONE STOP SAF TY SERVICES CORPORATION - ,! 32,187,if

52 ,PACIFIC ACE SPORTS SURFACES&EQUIPMENT LTD. 53,728.55

53 PACIFIC BLUE CROSS I 123,747.57

54 RAJ( CONSTRUCTION LTD 478,579.55

55 PITT RIVER QUARR!ES DIV OF LAFARGE CANADA INC - 39,984.55

56 POLAR INDUSTRIES LTD.

F 29,732.94

57 RAINCITY SUPPLIES LTD - 41,489.27

58 RAYBERN ERECTORS LTD. 34,031.96

59 RCMP-RECEIVERGENERAL 3.166.815.25

1 of 2 DML1VE-#1t9365vt-2e13_sOFi_Suppiier_Listing..pvw_825_CsO.XLS

- 88 -

ATTACHMENT B

City of Pitt Meadows

2013 Supplier Payments over $25000

COUNCIL

CAPITAL EXPENDITURES

OPERATING

Aggregate

Supplier Name Payment to CONTRACTOR OTHER CONTRACTOR OTHER

#

Supplier /CONSULTANT VENDORS PROJECT !CONSULTANT VENDORS DESCRIPTION

60 RECEIVER GENERAL- PAYROLL DEDUCTIONS 1,349,300.84

..- . .

1,349,300.84 Payroll Remittance

61 SANDPIPER CONTRACTING LTD 984,308.24 984,308.24: Various Roadwork Construction

62 SCADA CONTROLS CENTRAL LTD - 84,067.10 84,067.10 (1):SCADA Upgrades & Maintenance -- . . -

63 SOLIDFOUNDATIONSCONSLILTINGLTD - 42339.57 ,-

----- -. -- -

42,339.57 - :SustainabitityConsultanl

64 STROHMAIERS EXCAVATING LTD 795,753.25 795,753.25 McKechnie Drainage -

65 SUDDEN SERVICE TECHNOLOGIES CORP 84,61 1.26 84,61 1.26 (1) IT Support Services

66 SULZER PUMPS WASTEWATER CANADA INC 250,641.97 250,641.97 Baynes Rd Pump

67 SUTTLE RECREATION INC . 70,425.96 70,425.96 . Harris Park Bleachers . I

68 TELUS

38,840.79

.. - ... . ._j-.

38,840.79Telephones -

69 TELUS MOBILITY

-. ...

30,25 64Mobility Services

70 TELUS SERVICES INC

- ._L.

34,540.80!lntemetServices

71 TIMES NEWSPAPER . 25,294.26

. - . 25,294.26 Various Advertising Requirements

72 TOURISM MAPLE RIDGE AND PITT MEADOWS -- 47,982,52 -

-U-- - -

47,98252 - - Economic Development - Visitor Operation Centre

73 TRB ARCHITECTURE AND INTERIOR DESIGN INC - 239,450.56 239,450.56 Renovations - Rec Centre & Police Office

74 TUNDRA PLUMBING LTD 29.476.j 29,476 -- . (1) :Variou9 Facility Plumbitg Services . -. --

75 URBAN SYSTEMS

-

53977.48 TransportafionMasterPlan - _ -

-

76 VADIM SOFTWARE

. -. . . . 29,045E3LFinancial System Software License & Support

77VERMEEROFBCEQUIPMENTLP

j_25.j89 25,169.9?: :BrushChipper

. -

78 WASTE MANAGEMENT OF CANADACORP .

Zi.P

. 1,276,441.80SoIid Wsste & Recyctng Collection Services

79 WESBROOKE RETIREMENT LIMITED PARTNERSI-tlP j9,506.00 . - . - i

,- -. .

1,529,506.00Seniors Centre 40 year Prepaid Lease

80 WHOLESALEFIRE&RESCUE LTD.

-

-

. - - . -

27,307t9Vadous Fire Services Supplies

8 WII,LIS PAlPDA(199?)..l4C . -

-

140400

149,304.OoProperty!nsurance

82 WINVAN PAVING LTD 72,085.29 72,085.29, Various Road& Drainage Works - -

83 WOLF FLAGGING

27,509.44 27,509.44 (1) Traffic Flagging Services

4

.

. - -

51,395.45 PayrollRemittance

tOTAL AMOUNT PAID TO SUPPLIERS WHO RECEIVED

AGGREGATE PAYMENTS EXCEEDING $25,000 FOR GOODS AND

-

SERVICES

. $25,382,101.73 5,527,356.39 1,450,996.87 - . - - - - 297,433.02 18,106,315.45

IUIALAMOUNI t-AIU tO UFi-LIhtfS WHO t?.ELbIVELJ

AGGREGATE PAYMENTS OF $25,000 OR LESS

TOTAL AMOUNT PAID TO SUPPLIERS FOR GRANTS EXCEEDING . - :

-

$25,000

$0.00 -

IT0TPAYMENTSTOSUPPLlERSF0RGO0DSANDSERVlcES

$27913299401

.---.-.--,...-------

- -J --

- __:___

- -- -

1. Note: Contractors who provide a combination of both capital and operating services have been reported in the Capital Expenditure section rather than being separated between Capital and Operating due to financial reporting System limitations.

2 of 2

DMUVE41193e.2s_sOF_Sppber_Usrng_over_S2S_5OO.xLE

$2,531,197.67

- 89 -

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Pitt Meadows Secondary Newsletter - 20 Aug. 2014Documento4 páginasPitt Meadows Secondary Newsletter - 20 Aug. 2014Monisha Caroline MartinsAinda não há avaliações

- Katzie Slough Year Two 2013 Report RedactedDocumento55 páginasKatzie Slough Year Two 2013 Report RedactedMonisha Caroline MartinsAinda não há avaliações

- Katzie First Nation - Financial Statements 2013Documento32 páginasKatzie First Nation - Financial Statements 2013Monisha Caroline MartinsAinda não há avaliações

- Display Binary DataDocumento2 páginasDisplay Binary DataMonisha Caroline MartinsAinda não há avaliações

- Servio Family Statement - 25 Nov. 2013Documento2 páginasServio Family Statement - 25 Nov. 2013Monisha Caroline MartinsAinda não há avaliações

- Joseph Paul Stephane Marion - B.C. Teachers Regulation Board AgreementDocumento5 páginasJoseph Paul Stephane Marion - B.C. Teachers Regulation Board AgreementMonisha Caroline MartinsAinda não há avaliações

- Noise Control Manual - Wakefield AcousticsDocumento100 páginasNoise Control Manual - Wakefield AcousticsMonisha Caroline MartinsAinda não há avaliações

- Forsaken ReportDocumento2.465 páginasForsaken ReportThe Vancouver SunAinda não há avaliações

- Ipsos Reid Report - City of Pitt Meadows 2012 Citizen SurveyDocumento56 páginasIpsos Reid Report - City of Pitt Meadows 2012 Citizen SurveyMonisha Caroline MartinsAinda não há avaliações

- Pitt Rave Victim Impact Statement - 6 February 2013Documento14 páginasPitt Rave Victim Impact Statement - 6 February 2013Monisha Caroline MartinsAinda não há avaliações

- Vancouver Coast and MountainsDocumento1 páginaVancouver Coast and MountainsMonisha Caroline MartinsAinda não há avaliações

- Red Hood Project LetterDocumento2 páginasRed Hood Project LetterMonisha Caroline MartinsAinda não há avaliações

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Case No. 16-Cv-4014 CATERBONE v. The United States of America, Et - Al., COMPLAINT UPDATED December 12, 2016 Ver 2.0Documento107 páginasCase No. 16-Cv-4014 CATERBONE v. The United States of America, Et - Al., COMPLAINT UPDATED December 12, 2016 Ver 2.0Stan J. Caterbone0% (1)

- Contract To SellDocumento3 páginasContract To SellTheodore0176Ainda não há avaliações

- Bond Lodgement Form NZDocumento2 páginasBond Lodgement Form NZJordyCarterAinda não há avaliações