Escolar Documentos

Profissional Documentos

Cultura Documentos

ServicechargesCAD

Enviado por

dixesh0 notas0% acharam este documento útil (0 voto)

57 visualizações8 páginasRe: Revision in Service Charges relating to Credit Matters. Process fees on Working Capital and Upfront Fee on Term Commitments. Credit limits FB+NFB upto Rs.25000 / - Nil to Rs. Lakhs 0.25% of Sanctioned Limit. Above Rs. 1 Crore 0.10% of the limit with maximum of Rs.10,000/ - and maximum Rs.100,000/ - for each revalidation.

Descrição original:

Título original

1295590480029-ServicechargesCAD

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoRe: Revision in Service Charges relating to Credit Matters. Process fees on Working Capital and Upfront Fee on Term Commitments. Credit limits FB+NFB upto Rs.25000 / - Nil to Rs. Lakhs 0.25% of Sanctioned Limit. Above Rs. 1 Crore 0.10% of the limit with maximum of Rs.10,000/ - and maximum Rs.100,000/ - for each revalidation.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

57 visualizações8 páginasServicechargesCAD

Enviado por

dixeshRe: Revision in Service Charges relating to Credit Matters. Process fees on Working Capital and Upfront Fee on Term Commitments. Credit limits FB+NFB upto Rs.25000 / - Nil to Rs. Lakhs 0.25% of Sanctioned Limit. Above Rs. 1 Crore 0.10% of the limit with maximum of Rs.10,000/ - and maximum Rs.100,000/ - for each revalidation.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 8

Re: Revision in Service Charges relating to Credit Matters

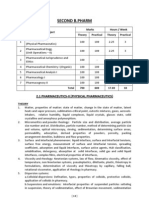

Process Fees on Working Capital & Upfront Fee on Term Commitments:

Existing

Short Term Loans ,

(Repayable within 12 months)

& Working Capital

Term Commitment

(Repayable in 3

years and above)

Credit limits FB+NFB FB+NFB

Upto Rs.25000/- Nil Nil

Rs.25001/- to Rs.2 lakhs 0.25% of Sanctioned Limit,

with a minimum of

Rs.100 /-

0.5% of Sanctioned

Limit, with a

minimum of

Rs.250 /-

Above Rs.2 lakhs 0.25% of Sanctioned Limit,

with a minimum of

Rs.500 /- and no

maximum ceiling.

1.25% of Sanctioned

Limit, without any

minimum or

maximum ceiling

charged at the time

of sanction. Review

fees of 0.10% of the

outstanding amount

at the time of review

of the account.

Short Term Loans repayable upto 1 year Upfront fee at 0.50% of the loan amount without any

ceiling

Adhoc Limits Normal process fee as applicable to WC should be

charged

Restructuring of Credit Limits As applicable to Working Capital and Term

Commitments

Process Fees for in-principle Sanction 25% of the normal process fees ( non refundable ) to

be charged.

Upfront Fee for Demand Loans(Repayable in over 12 months but less than 3 years)

Existing

Demand Loans(Repayable in over 12 months but upto 3 years) Upfront fee at 0.50% of the loan amount

without any ceiling

Slab Rate

Upto

Rs. 1 Crore

0.50% of the limit with

maximum of

Rs.10,000/- for each

revalidation

Revalidation of Sanctioned Terms and Conditions for all types of limits.

Above

Rs. 1 Crore

0.10% of the limit with

maximum of

Rs.10,000/- and

maximum Rs.100,000/-

for each revalidation

Modification of Terms of sanctioned Terms. Above

Rs. 1 Crore

0.02% of the loan

amount with a

minimum of Rs.1000/-

and maximum of Rs.5

lakhs

Upto

Rs. 2 lakhs

Nil Documentation Charges:

For all limits including Demand, Adhoc, limits where documents are

obtained as per guidelines Above

Rs.2 lahs

0.10% with a minimum

of Rs.500/- and

maximum of

Rs.25,000/-

Charges for copy of the documents for submission to any statutory

authority

Actual photocopying charges + Rs.1000/-

Charges if presence of bank official is required along with the documents

for obtention of photo copies

Actual photocopying charges + Rs.2000/- +

Out of pocket expenses

Charges for cancellation of Banks lien on Government Securities / LIC

Policies on closure of the Loan

1. Within one month from the date of closure

of the loan: at the rate of Rs.100/- per

instrument + Out of pocket expenses

2. After one month from the date of closure of

the loan: at the rate of Rs.200/- per

instrument + Out of pocket expenses

Lead Bank charges as Leader of Consortium on total assessed limits 0.30% of FB & NFB limits

Where entire non-fund based credit facilities under consortium on behalf

of member banks on risk sharing basis

30% of the commission should be retained

towards service charge and the remaining

70% should be shared among the consortium

banks, including our Bank.

Supervision Charges: -

Existing

Less than Rs.25000/- Nil

Above Rs.25000 0.05%, subject to

Minimum of Rs.100/- &

Maximum of Rs.50,000/- per quarter

Inland Guarantee Commission (Recoverable upfront)

Existing

Performance

Guarantees

Rs.120+0.50% per quarter with minimum of 1.00%

Other

Guarantees

Rs.100/- + 0.75% per quarter with a minimum of 1.5%

Modification in Guarantees, without any modification in amount and period Rs.200/- per amendment

Others:

Inland Letter of Undertaking 0.60% p.a. (as applicable to Financial

Guarantee)

Letter of Comfort 0.05% of the amount with a minimum of

Rs.500/- and maximum of Rs.5000/-

Capacity Certificate Re.1/- per Rs.1000/- with minimum of

Rs.100/-

Additional Capability Certificate in respect of the same student for applying

to other Universities / same university within 12 months from the issue of

original capability certificate

Rs.50/- per certificate

Solvency Certificate 0.10% with a minimum of Rs.500/- and

maximum of Rs.10000/- per certificate / Per

instance

Concessions in Inland Guarantee commission

Existing & Proposed

100% Margin in the form of Banks

Term Deposit Receipts

50% concession is permitted.

100% Margin in the form of Cash 75% Concession is permitted.

Refund of Guarantee Commission for unexpired period

Existing & Proposed

If unexpired period is less

than 1 quarter

Nil. However, in case of Bid Bond Guarantee for

tender deposit is returned within 1 month, 45 days

charges will be levied instead of 1 Quarter

If unexpired period is

more than 1 quarter

50% of commission for unexpired period

ISSUANCE OF INLAND LETTERS OF CREDIT:

Inland Sight / Usance / Revolving LC Charges

Usance

Period

(per quarter or part thereof)

Commission &

commitment charges

merged

Commitment

Charges

No commitment charge

proposed as the same

is merged into

commission

Commitment charge

(To be taken

separately)

0.30% per quarter with

a minimum of Rs.150/-

Usance

Charges

Usance Charges

Upto 7 days sight 0.25%

Bills

Sight LC &

Upto 90 Days

0.6% Over 7 days & upto 3

months

0.50%

Upto 120 Days 0.8%

Upto 150 Days 1%

Upto 180 Days 1.2%

Above 180

days

1.2%

Beyond 3 months 0.50% for first 3

months + 0.25% p.m.

in excess of 3 months

or part thereof

Concession in

Charges

50% concession on

applicable rate if 100%

margin is maintained in

TDR;

75% concession on

applicable rate if 100%

margin is maintained in

cash

Concession in

Charges

50% concession on

applicable rate if 100%

margin is maintained in

TDR;

75% concession on

applicable rate if 100%

margin is maintained in

cash

Revolving LCs Not specified.

Revolving LCs Usance Charges +

Commitment charges

on reinstated amount

as also reinstatement

charges on each

reinstatement with a

minimum of Rs.200/-

Advising

Charges

Flat charge of Rs.500/- Advising Charges 0.20% for advising

each LC with a

minimum of Rs.200/-.

Amendment

Charges

Rs.500/- per

amendment

Advising

Amendments

Flat charge of

Rs.500/- per

amendment

Confirmation 0.125% - Minimum Confirmation Commitment charge +

Charges Rs.100/- Charges Usance Charge

0.01%

subject to a minimum

of Rs.250/-. Not to be

treated as negotiation

and hence regular

BP/BD rates would be

applicable

0.50% with a minim of

Rs.120/-

0.30% with a minim of

Rs.1250/-

Negotiation

Charge

In addition to above

charges, discount

charges at applicable

interest rate for the

period of negotiation

plus out of pocket

expenses if any will be

charged.

Overdue interest is to

be charged in all cases

of demand / usance

bills negotiated under

LCs and not paid on

due date

Negotiation Charge

For Bills upto Rs.2.50

lakh

For Bills over Rs.2.50

lakhs

In addition to above

charges, discount

charges at applicable

interest rate for the

period of negotiation

plus out of pocket

expenses if any will be

charged.

Overdue interest is to

be charged in all cases

of demand / usance

bills negotiated under

LCs and not paid on

due date

Charges for

giving

guarantee for

discrepant

document

Not stipulated Charges for giving

guarantee for

discrepant document

0.20% with a minimum

of Rs.100/-

Charges for

accepting Bills

Not stipulated Charges for

accepting Bills under

0.25% with a minimum

of Rs.100/-

under LCs LCs

Charges for

retirement of

Bills under LC

Not stipulated Charges for

retirement of Bills

under LC

0.25% with a minimum

of Rs.100/-

Charges for

Non-

acceptance

and Non-

payment of bills

on presentation

/ on due date

Not stipulated Charges for Non-

acceptance and Non-

payment of bills on

presentation / on due

date

0.05% with a minimum

of Rs.100/-

Out of pocket

expenses

In addition to above

charges, actual out of

pocket expenses

towards postages, fax,

telephone charges etc

should be recovered

Out of pocket

expenses

In addition to above

charges, actual out of

pocket expenses

towards postages, fax,

telephone charges etc

should be recovered

All the above charges are subject to change from time to time

***********************

Você também pode gostar

- Canara Bank ChargesDocumento8 páginasCanara Bank Chargesaca_trader100% (1)

- Processing Fees / Charges - SME ProductsDocumento17 páginasProcessing Fees / Charges - SME ProductsSanjay KumarAinda não há avaliações

- Annexure 2Documento77 páginasAnnexure 2Maheshkumar AmulaAinda não há avaliações

- RBI SBI Demand Draft Exchange RatesDocumento11 páginasRBI SBI Demand Draft Exchange RatesJithin VijayanAinda não há avaliações

- RetailServiceCharges Adv EnglishDocumento4 páginasRetailServiceCharges Adv EnglishMohit KumarAinda não há avaliações

- RI AnnexureDocumento6 páginasRI Annexurekaizen.hameshaAinda não há avaliações

- Service Charges 15-03-2011Documento13 páginasService Charges 15-03-2011AnandshingviAinda não há avaliações

- IOB-Commission ChartDocumento5 páginasIOB-Commission ChartSubham Pnb RoyAinda não há avaliações

- Home Loan Interest Rates 24052011Documento3 páginasHome Loan Interest Rates 24052011Nitin TyagiAinda não há avaliações

- Schedule of Fees and Charges August 17 2012Documento8 páginasSchedule of Fees and Charges August 17 2012nayanghimireAinda não há avaliações

- Monthly Average Balance Tex Basic - Rs 25,000 Tex Advantage - Rs 75,000Documento2 páginasMonthly Average Balance Tex Basic - Rs 25,000 Tex Advantage - Rs 75,000Shoaib MohammedAinda não há avaliações

- Housing Loan DetailsDocumento9 páginasHousing Loan DetailsPandurangbaligaAinda não há avaliações

- Rationalization ServiceDocumento5 páginasRationalization Servicesachin9984Ainda não há avaliações

- Standard Fee and Charges GIBL Nov 18 20191Documento10 páginasStandard Fee and Charges GIBL Nov 18 20191aashish koiralaAinda não há avaliações

- PK 4Documento15 páginasPK 4Instagram OfficeAinda não há avaliações

- BOI MCLR 8.35 % W.E.F. 10.08.2019 & RBLR 8.25 % W.E.F. 01.09.2019 (All Charges Are Exclusive of GST)Documento5 páginasBOI MCLR 8.35 % W.E.F. 10.08.2019 & RBLR 8.25 % W.E.F. 01.09.2019 (All Charges Are Exclusive of GST)AvunAinda não há avaliações

- RetailServiceCharges Adv EnglishDocumento4 páginasRetailServiceCharges Adv EnglishYogesh PangareAinda não há avaliações

- Particulars Sanman Savings Bank Account Standard Charges (RS.)Documento2 páginasParticulars Sanman Savings Bank Account Standard Charges (RS.)Bella BishaAinda não há avaliações

- New ROIDocumento2 páginasNew ROIswapndeoAinda não há avaliações

- July 2013: Current, Call and Savings AccountsDocumento1 páginaJuly 2013: Current, Call and Savings AccountsBala MAinda não há avaliações

- Service Charges and FeeDocumento10 páginasService Charges and Feehgfh hgfAinda não há avaliações

- Service Charges and Fees Wef 01st Oct 2022Documento12 páginasService Charges and Fees Wef 01st Oct 2022ranjith ananthAinda não há avaliações

- Federal Bank Service ChargesDocumento11 páginasFederal Bank Service ChargesAlbin GeorgeAinda não há avaliações

- Service Charges Final - 03.06.2017for Circular IssuingDocumento39 páginasService Charges Final - 03.06.2017for Circular IssuingshivaAinda não há avaliações

- SUPERCARD Most Important Terms and Conditions (MITC)Documento14 páginasSUPERCARD Most Important Terms and Conditions (MITC)Diwana Hai dilAinda não há avaliações

- IOB9540Foot Service Charges 01.07.2017 PDFDocumento39 páginasIOB9540Foot Service Charges 01.07.2017 PDFHarishPratabhccAinda não há avaliações

- Mitc RupifiDocumento13 páginasMitc RupifiKARTHIKEYAN K.DAinda não há avaliações

- Service Charges 01st OCT 2022Documento11 páginasService Charges 01st OCT 2022SpeakupAinda não há avaliações

- Service Charges and Fees-Federal BankDocumento10 páginasService Charges and Fees-Federal Bankakhil kurianAinda não há avaliações

- LoansDocumento5 páginasLoansshamsherbaAinda não há avaliações

- Personal Loan: Why Avail A Personal Loan From HDFC Bank?Documento6 páginasPersonal Loan: Why Avail A Personal Loan From HDFC Bank?Ramana GAinda não há avaliações

- Important Terms and Conditions: To Get The Complete Version, Please Visit WWW - Hsbc.co - inDocumento10 páginasImportant Terms and Conditions: To Get The Complete Version, Please Visit WWW - Hsbc.co - inDeepak GuptaAinda não há avaliações

- Value Added Subscription PlansDocumento1 páginaValue Added Subscription PlansChetna SharmaAinda não há avaliações

- Most Important Terms and Conditions - 2Documento10 páginasMost Important Terms and Conditions - 2Mohit AroraAinda não há avaliações

- Value Based Current Accounts Schedule of ChargesDocumento2 páginasValue Based Current Accounts Schedule of ChargesDhawan SandeepAinda não há avaliações

- Important TNCDocumento20 páginasImportant TNCsanthoshsk3072002Ainda não há avaliações

- HBL - Updated Charges Wef From 1-Jan-2018Documento3 páginasHBL - Updated Charges Wef From 1-Jan-2018Mubin AshrafAinda não há avaliações

- Banking Operations - Bank of IndiaDocumento21 páginasBanking Operations - Bank of IndiaEkta singhAinda não há avaliações

- SuperCard MITC PDFDocumento47 páginasSuperCard MITC PDFPrudhvi RajAinda não há avaliações

- Tariff Sheet For HDFC Bank Individual Demat Account - Regular / Basic Services Demat AccountDocumento1 páginaTariff Sheet For HDFC Bank Individual Demat Account - Regular / Basic Services Demat AccountpanduranganraghuramaAinda não há avaliações

- Mitc For Amazon Pay Credit CardDocumento7 páginasMitc For Amazon Pay Credit Cardsomeonestupid19690% (1)

- Revision of Service Charges Wef 01042023Documento53 páginasRevision of Service Charges Wef 01042023kkrandy01Ainda não há avaliações

- Service Charges and FeesDocumento10 páginasService Charges and FeesBella BishaAinda não há avaliações

- Mitc For Amazon Pay Credit CardDocumento7 páginasMitc For Amazon Pay Credit CardBlain Santhosh FernandesAinda não há avaliações

- Schedule of Fees & ChargesDocumento1 páginaSchedule of Fees & ChargesKazi HasanAinda não há avaliações

- Service Charges and FeeDocumento10 páginasService Charges and FeeShanAinda não há avaliações

- Saadiq SOCDocumento28 páginasSaadiq SOCAamir ShehzadAinda não há avaliações

- Canara Bank Charges 2019Documento3 páginasCanara Bank Charges 2019Dr GoherAinda não há avaliações

- HDFC Bank LTD Icici Bank LTDDocumento1 páginaHDFC Bank LTD Icici Bank LTDshubhamg95Ainda não há avaliações

- New Schedule of Charges For Current AccountDocumento2 páginasNew Schedule of Charges For Current AccountKishan DhootAinda não há avaliações

- Axis Offer Latter For SalariedDocumento4 páginasAxis Offer Latter For Salariedyoursmanish8312Ainda não há avaliações

- Saadiq SOCDocumento31 páginasSaadiq SOCjoshmalikAinda não há avaliações

- Msme Loan - Upto 2lakhs: NF-546 NF-998 NF-588 NF-855 NF-803 NF-482 NF-373 NF-368Documento4 páginasMsme Loan - Upto 2lakhs: NF-546 NF-998 NF-588 NF-855 NF-803 NF-482 NF-373 NF-368Santosh KumarAinda não há avaliações

- Bajaj Tiger CC MITC NewDocumento12 páginasBajaj Tiger CC MITC NewMinatiAinda não há avaliações

- CBQ - Tariff of ChargesDocumento9 páginasCBQ - Tariff of Chargesanwarali1975Ainda não há avaliações

- Business LoanDocumento1 páginaBusiness Loank kaulAinda não há avaliações

- Account Tariff Structure Basic Savings AccountDocumento1 páginaAccount Tariff Structure Basic Savings Accountgaddipati_ramuAinda não há avaliações

- A Haven on Earth: Singapore Economy Without Duties and TaxesNo EverandA Haven on Earth: Singapore Economy Without Duties and TaxesAinda não há avaliações

- What The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeNo EverandWhat The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeAinda não há avaliações

- BGECLS ConfirmationDocumento1 páginaBGECLS ConfirmationdixeshAinda não há avaliações

- Token No: 9:13AM QT Rt. AMT 5 140 5Documento1 páginaToken No: 9:13AM QT Rt. AMT 5 140 5dixeshAinda não há avaliações

- Annexure I DBUSURDocumento1 páginaAnnexure I DBUSURdixeshAinda não há avaliações

- Comparative Study OF V/S: Project Report of Research Methodology OnDocumento47 páginasComparative Study OF V/S: Project Report of Research Methodology OndixeshAinda não há avaliações

- 1ST BLCC June 2023Documento5 páginas1ST BLCC June 2023dixeshAinda não há avaliações

- GCET Based MBA CollegesDocumento7 páginasGCET Based MBA CollegesdixeshAinda não há avaliações

- B-Pharm Syllabus GUDocumento35 páginasB-Pharm Syllabus GUdixeshAinda não há avaliações

- Berhanu BelayDocumento78 páginasBerhanu BelayJiregnaAinda não há avaliações

- Elizabeth ShewayeDocumento53 páginasElizabeth ShewayeSolomon NegaAinda não há avaliações

- Receivables TheoriesDocumento8 páginasReceivables TheoriesIris MnemosyneAinda não há avaliações

- Islamic Banking: A Brief Summary of The IndustryDocumento6 páginasIslamic Banking: A Brief Summary of The IndustryAbimbola Adewale MonsurAinda não há avaliações

- American Empower B1 Unit Progress Test 3 - Version BDocumento12 páginasAmerican Empower B1 Unit Progress Test 3 - Version Bkaren-gioviruAinda não há avaliações

- Credit Transactions Sarona First ExamDocumento77 páginasCredit Transactions Sarona First ExamCnfsr KayceAinda não há avaliações

- When To Use This Form: Servicesaustralia - Gov.au/centrelinkuploaddocsDocumento10 páginasWhen To Use This Form: Servicesaustralia - Gov.au/centrelinkuploaddocsLyley YAYAinda não há avaliações

- SG 01 FM Cost of CapitalDocumento67 páginasSG 01 FM Cost of CapitalAbhijeet PatilAinda não há avaliações

- Project of T.Y BbaDocumento49 páginasProject of T.Y BbaJeet Mehta0% (1)

- Bhel ProjectDocumento25 páginasBhel ProjectamitlalchandaniAinda não há avaliações

- Interlocking Directors - Koruga - v. - Arcenas - Jr.Documento15 páginasInterlocking Directors - Koruga - v. - Arcenas - Jr.JV DeeAinda não há avaliações

- I. Summary of "A Damaged Culture: A New Philippines?" by James FallowsDocumento15 páginasI. Summary of "A Damaged Culture: A New Philippines?" by James FallowsDhanne Jhaye Laboreda100% (1)

- Dhani Loans and Services Limited Foreclosure/Closure Simulation ReportDocumento1 páginaDhani Loans and Services Limited Foreclosure/Closure Simulation Reportshobhna sharmaAinda não há avaliações

- OECD Policy Paper On Seed and Early Stage Finance 1Documento82 páginasOECD Policy Paper On Seed and Early Stage Finance 1BruegelAinda não há avaliações

- Financial Literacy: Anne A. Alban Family Welfare OfficerDocumento66 páginasFinancial Literacy: Anne A. Alban Family Welfare OfficerMaritessAinda não há avaliações

- PPP Law ReviewDocumento23 páginasPPP Law ReviewTommy DoncilaAinda não há avaliações

- Financial Statement Analysis (Fsa)Documento32 páginasFinancial Statement Analysis (Fsa)Shashank100% (1)

- Case Digest - General Banking ActDocumento15 páginasCase Digest - General Banking ActAiko DalaganAinda não há avaliações

- Superior Court of Virginia County of AblemarleDocumento10 páginasSuperior Court of Virginia County of AblemarleRobert WatkinsAinda não há avaliações

- G.R. No. 201264, January 11, 2016 FLORANTE VITUG, Petitioner, v. EVANGELINE A. ABUDA, Respondent. Decision Leonen, J.Documento136 páginasG.R. No. 201264, January 11, 2016 FLORANTE VITUG, Petitioner, v. EVANGELINE A. ABUDA, Respondent. Decision Leonen, J.Ronna Faith MonzonAinda não há avaliações

- United States Court of Appeals, Eleventh CircuitDocumento14 páginasUnited States Court of Appeals, Eleventh CircuitScribd Government DocsAinda não há avaliações

- Munoz Vs RamirezDocumento16 páginasMunoz Vs Ramirezdominicci2026Ainda não há avaliações

- 3.1 70. Exercise Loan Schedule UnsolvedDocumento8 páginas3.1 70. Exercise Loan Schedule UnsolvedAniket KarnAinda não há avaliações

- Msme Reserve Bank of India PDFDocumento6 páginasMsme Reserve Bank of India PDFAbhishek Singh ChauhanAinda não há avaliações

- Partnership 2Documento64 páginasPartnership 2Anis AlwaniAinda não há avaliações

- EEE Final ReportDocumento32 páginasEEE Final ReportZen AlkaffAinda não há avaliações

- Cost and Benefit Analysis BookDocumento361 páginasCost and Benefit Analysis Book9315875729100% (7)

- Yes Bank ProjectDocumento30 páginasYes Bank ProjectShehzin SharafAinda não há avaliações

- Liquidity RiskDocumento25 páginasLiquidity RiskWakas Khalid100% (1)

- Unaudited Condensed Consolidated Income Statement: Misc BerhadDocumento20 páginasUnaudited Condensed Consolidated Income Statement: Misc BerhadAzizi JaisAinda não há avaliações