Escolar Documentos

Profissional Documentos

Cultura Documentos

Library Management

Enviado por

Alim MansooriDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Library Management

Enviado por

Alim MansooriDireitos autorais:

Formatos disponíveis

1

Summer Internship Report

Working Capital Management of Jaiprakash

Associates Limited (JAL).

Carried out during

Summer Internship Programme

At

BHILAI JAYPEE CEMENT LTD.,

BABUPUR, SATNA (M.P.)

GUIDE BY SUBMITED TO

MR. GIRIRAJ BHATTAR MR FAWAD KHAN & MR MANISH

FINANCE & ACCOUNT DEPT DEPUTY MANAGER

FINANCE & ACCOUNT

SUBMITED BY

VIVEK SINGH BAGHEL

V.N.S BUSINESS SCHOOL

2

1. DECLARATION

I, the undersigned, hereby declare that the project report entitled WORKING CAPITAL

MANAGEMENT IN JAIPRAKASH ASSOCIATES LIMITED. Written and submitted

by me to the college of V.N.S Business School Bhopal, in partial fulfillment of the

requirements for the award of degree of M.B.A Finance under the guidance of Mr. Giriraj

bhattar is my original work and conclusions drawn therein are based on the material

collected by myself.

Place: Satna M.P

Date: .

VIVEK SINGH BAGHEL

3

CERTIFICATE OF APPROVAL

The foregoing project entitled WORKING CAPITAL MANAGEMENT IN

JAIPRAKASH ASSOCIATES LIMITED (JAL), is hereby approved as a creditable

study of research topic and has been presented in satisfactory manner to warrant its

acceptance as prerequisite to the degree for which it is submitted.

It is understood that by this approval, the undersigned do not necessary endorse any

conclusion drawn or opinion expressed therein, but approved the project for he purpose for

which it is submitted.

(External Examiner)

Mr Fawad Khan & Mr manish

Deputy Manager

(Finance &Accounting)

BJCL, BABUPUR, SATNA.

4

ACKNOWLEDGEMENT

This project would have been difficult to complete without the invaluable contributions from

some important persons. Let us take this opportunity to thank them.

First of all, I would like to thank JAIPRAKASH ASSOCIATES LTD (JAL), for giving me

such challenging projects to work upon. I hope this challenge has brought the best out of us.

I am indebted to my project guide Mr. Fawad Khan & Mr manish, Deputy Manager

(Accounting and Finance), Resource Mobilization Unit, for the direction and purpose he

gave to this project through his invaluable insights, which constantly inspired us to think

beyond the obvious. His encouragement and co-operation helped us instill a great degree of

self-confidence to deliver a good work.

I am also thankful to all the employees of JAIPRAKASH ASSOCIATES LIMITED who

provided us with an environment conducive for learning during the last one month.

I hope I can build upon the experience and knowledge that we have gained here and make a

valuable contribution towards this industry in the coming future.

Vivek singh baghel

M.B.A 2

nd

sem Finance

5

PREFACE

Practice makes more perfect

In the field of management every time there is a requirement of understanding or

Practical aspect of the organization with managerial mind. There is requirement to go for

practical training of any subject supplement to the theoretical knowledge and clarified

concept.

It is more applicable in the field of the management especially a professional course like

MBA. (College of V.N.S Business School Bhopal) has prescribed 45 days project report

training during the 2

nd

Semester as a part of MBA. Programmers my training at the BHILAI

JAYPEE CEMENT PLANT Works is to comply with these requirements also.

6

CONTENTS

Ch. No. Particulars Page

No.

1

COMPANY PROFILE

1.1 Origin, Vision, Mission, Values

1.2 Historical milestone

1.3 Quality policy

1.4 Competitors

1.5 Business activities

- Civil engineering construction

- Hotel and hospitality

- Cement manufacturing

- Jaypee cement limited

- Jaypee power grid ltd

- Gujrat anjan cement ltd

- Jaypee infratech ltd

- Bhilai jaypee cement ltd

- Himalayan express ltd

- Madhya Pradesh Jaypee mineral ltd

1.6 Hydropower

1.7 Information technology

1.8 Integrated township

- Jaypee green

1.9 Education and welfare

1.10 Thermal

- Nigrie thermal project

- Captive thermal project

1.11 Expressway

1.12 Bokaro jaypee cement ltd

11-28

7

2

INTRODUCTION

2.1 Cement division

2.2 About jaypee cement and jaypee group

2.3 Manufacturing unit

2.4 Introduction of the Bhilai Jaypee Cement Limited(BJCL)

2.6 Cement manufacturing process

2.7 Sail background

2.8 Departmental profile

29-48

3

WORKING CAPITAL

3.1 Definition

3.2 Concept of working capital

a. Traditional or Balance sheet concept

- Gross working capital

- Net working capital

- Permanent working capital

- Variable working capital

b. Operating cycle concept

3.3 Significance of working capital

3.4 Effect of excessive working capital

3.5 Factors determining the working capital

3.6 Advantage of adequate working capital

3.7 Calculation of working capital

49-62

4

WORKING CAPITAL MANAGEMENT

4.1 Calculation of working capital management in JAL

a. Position of inventory

b. Sundry debtor analysis

c. Cash and bank analysis

d. Loan and advances analysis

e. Current liability analysis

- Position of other current liability

- Provision analysis

63-102

8

4.2 Working capital ratio

a. Receivable ratio

b. Payable ratio

c. Current ratio

d. Quick ratio

e. Working capital ratio

f. Stock turnover ratio

g. Debt equity ratio

4.3 Management of working capital

A. Cash management

- Meaning

- Objective of cash management

- Technique of cash management

a. Cash management planning

- Cash budget

- Characteristics of the cash budget

- Methods of cash budget

b. Cash management control

B. Inventory management

- Supply chain management

- Function of inventory management

- Position of inventory in JAL

- Motives of holding inventory

- Types of inventory

- Factors determine the optimum level of

inventory

- Objective of inventory management

- Technique of inventory management

C. Debtors management

- Sundry debtors analysis

- Objective of receivable

- Factor of receivable management

D. Marketable securities

9

5

RESEARCH METHODOLOGY

5.1 Methodology

5.2 Research objective

5.3 Research design

5.4 Sources of data

- Primary data

- Secondary data

5.5 Limitation of the study

103-105

6

CONCLUSION

106

7

BIBLIOGRAPHY

107

10

OBJECTIVE

Knowledge and awareness of the corporate environment, its components & functioning is a

must for tomorrows managers. The basic objectives of the summer internship program are:

To facilitate ourselves in testing what we have learnt in all the bridge courses during

MBA

To understand the internal functioning of the organization within finance and accounts

department.

To get an exposure to the corporate life and various interaction methods.

To have an analytical overview of working capital management at Jaiprakash

association ltd (LTD) by bringing into use various theoretical tools and skill which

have been studied and includes studying and analyzing various financial data over a

period of three year 2010-11, 2011-12, 2012-13

11

COMPANY PROFILE

ORIGIN

With a single minded focus in mind, to achieve pioneering myriads of feat in civil

engineering Shri Jaiprakash Gaur ji, the founding father of Jaiprakash Associates Limited

after acquiring a Diploma in Civil Engineering in 1950 from the University of Roorkee, had

a stint with Government of Uttar Pradesh and with steadfast determination to contribute in

nation building, branched off on his own, to start as a civil contractor in 1958.

MISSION

The companys solitary mission is to achieve excellence in every sector that it operates in,

be it Engineering & Construction, Cement, Real Estate or Consultancy, to augment our core

competencies and adopt the most comprehensive modern technology to overtake the

obstacles in its path of achievement and to obtain sustainable development and

simultaneously enhancing the shareholders value and fulfilling its obligations towards

building a better India.

VISION

As a group, Jaypee group is committed to strategic business development in infrastructure,

as the key to nation building in the 21st century. The group aims to achieve perfection in

everything it undertakes with a commitment to excel. It is the determination to transform

every challenge into opportunity; to seize every opportunity to ensure growth and to grow

with a human face.

VALUES

The Jaypee way of life can be best represented by the Indradhanush. The Indradhanush or the

rainbow of seven different colours stands for seven values. Seven values that form the pillars

of the entire Jaypee parivar are:

1. Collective Wisdom (VIOLET)

2. Excellence in Performance (INDIGO)

3. Credibility (BLUE)

4. Human Face (GREEN)

5. Conviction (YELOW)

6. Commitment (ORANGE)

7. Leadership by Example (RED)

12

HISTORICAL MILESTONES

1958 Undertook first entrepreneurial work as contractor in Mangrol in Kota

1979 Jaiprakash Associates Private Ltd. ( JAPL)

Uttar Rasayan Udyog Ltd. was formed for setting up Malathion Technical

Plant in Sikandrabad (U.P.). The company name was later changed to

Jaiprakash Enterprises Ltd.

1980 Hotel Siddhartha was set up

1982 Hotel Vasant Continental was set up

1986 Commissioning of 1

st

unit of 1 MTPA Jaypee Rewa Plant (JRP) in district

Rewa (M.P.)

Formation of Jaiprakash Industries Ltd. (JIL) by amalgamating JAPL into

Jaypee Rewa Cement Ltd.

1991 Commissioning of 2

nd

unit of 1.5 MTPA Jaypee Rewa Plant in district Rewa

(M.P.)

1992 Formation of Jaiprakash Hydro Power Ltd.(JHPL)

1995 Formation of Jaiprakash Power Ventures Ltd. (JPVL)

Hotel Jaypee Residency Manor set up

1996 Commissioning of 1.7 MTPA Jaypee Bela Plant in district Rewa (M.P.)

1999 Jaypee Palace Hotel, Agra set up

2000 Acquisition of land for Jaypee Greens Ltd.

2001 Commissioning of 0.6 MTPA Jaypee Cement Blending Unit in district

Allahabad (U.P.)- the 1

st

of its kind in the country

Jaypee Institute of Information Technology (JIIT- deemed university since

Nov 1, 2004) at Noida set up

2002 Commissioning of 1.0 MTPA Grinding Unit in district Ambedkar nagar

(U.P.)

Jaypee University of Information Technology (JUIT- state university),

Waknaghat set up

13

2003 Commissioning of 25 MW Captive Thermal Power Plant-I at JRP

Formation of Jaiprakash Associates Ltd. ( JAL) formed by merging JIL with

JCL

Jaypee Institute of Engineering Technology, Guna set up

2004 Commissioning of 25 MW Captive Thermal Power Plant-II at JBP

Commencement of work for setting up 3 MTPA Cement Plant at Baga and

Bagheri in district solan (H.P.) and 1.5 MTPA capacity Grinding Unit at

panipat

2005 Successful completion of the up gradation scheme enhancing the total

capacity of Rewa Operations to 7.0 MTPA

Shares of JHPL listed on BSE/NSE. First Hydropower Company to be

publicly held and listed in the country.

2006 Setting up of Madhya Pradesh Jaypee Minerals Ltd. (MPJML)

Commissioning of 38.5 MW Captive Thermal Power Plant at JRP

Railway siding operational at JBP

Commencement of work for setting up a new green field 1.5 MTPA Cement

Plant in district Sidhi (M.P.)

Acquisition of cement plants and assets of UP State Cement Corporation

Ltd. (in liquidation) of 2.5 MTPA capacity

Acquisition of Gujarat Anjan Cement Ltd. for setting up a green field

cement plant of 1.2 MTPA capacity in Bhuj, district Kutch, Gujarat

2007 Signing of MOU with Gujarat Mineral Development Corporation (GMDC)

for setting up a new green field cement plant of 1.2 MTPA capacity in JV,

district Kutch, Gujarat

Signing of MOU with government of HP for setting up a new green field

cement plant of 2.0 MTPA capacity in district Chamba (HP)

14

QUALITY POLICY

15

COMPETITORS

Ambuja Cements Ltd.

Ultratech Cement Ltd.- a subsidiary of Grasim Industries

Lafarge

ACC Ltd.

Birla Corporation Ltd.

Prism cement

Maihar cement

BUSINESS ACTIVITIES

The Jaypee Group is a well diversified infrastructural industrial conglomerate in India. Over

the decades it has maintained its salience with leadership in its chosen line of businesses -

Engineering and Construction, Cement, Private Hydropower, Hospitality, Real Estate

Development, Expressways and Highways. The group has been discharging its

responsibilities to the satisfaction of all its shareholders and fellow Indians, summed by its

guiding philosophy of "Growth with a Human Face".

JAL (Jaiprakash Associates Ltd.) is an acknowledge leader of river and valley dam and

bridge construction including hydropower projects on turnkey basis and has been in the

business for more than 3 decades. The company has unique distinction of executing

simultaneously 13 hydropower projects spread over 6 states and the neighboring country of

Bhutan for the generation of 10,290 MW of power.

JAL is a flagship company of the Jaypee group, one of the largest business conglomerates of

north India with annual revenue of over Rs 3000 crores, starting with a humble beginning in

1979 with construction activities, getting in to cement manufacturing was only a logical and

natural diversification for the group in the year 1986.

Today with the work force of more than 50,000 committed professional manpower and the

presence in almost all states of north India and countries like Nepal, Bhutan etc. The Jaypee

group has diversified interest with the motto of building nation in activities such as-

16

CIVIL ENGINEERING CONSTRUCTION

JAYPRAKASH

ASSOCIATES

LTD.

EDUCATION

INTEGRATED

TOWNSHIP

CONSTRUCTION

HOTEL AND

HOSPITALITY

CEMENT

DIVISION

HYDROPOWER

INFORMATION

TECHNOLOGY

THERMAL/

HYDEL

17

Initially, the Jaypee Group started as civil engineering contractors. Jaiprakash Associates

Ltd., the flagship company of the Group, is a leader in Construction of river valley and

hydropower projects on turnkey basis for more than 4 decades. The company is currently

executing various projects in hydropower / irrigation / other infrastructure fields and has had

the distinction of executing simultaneously 13 hydropower projects spread over 6 states and

the neighbouring country Bhutan for generating 10,290 MW of power.

Jaypee Group undertakes projects involving:-

led earth/rock fill

-mechanical equipment procurement and erection

The projects that have been commissioned or in the advance stages of completion have been

undertaken by it either as a successful EPC contractor or as a Non EPC contractor. The

group also has secured three BOT contracts in the private hydropower generation sector after

the opening up of the doors by the Government of India in 1991 for private sector power

generation companies.

It is not an embellishment to state that over the past three decades the company has not only

successfully executed large and prestigious projects, but in this process has acquired a pool

of knowledge, skills and experience in their field of technological excellence.

18

HOTEL AND HOSPITALITY

The group owns and operates four Five Star Deluxe hotels through jaypee hotel limited. A

subsidiary company and is a significant player in north of India. All the hotels enjoy the

patronage of most illustrious of the families, businessmen leaders and dignitaries from

around the world. This leading chain of deluxe hotels in India offers luxurious

accommodation, exquisite dining facilities, interesting leisure options and a pleasant

environment to provide a comfortable stay for our esteemed guests.

The first two five star hotels in the capital were set up in the back drop of the Asian Games

in 1980 - Hotel Siddharth and Hotel Vasant Continental. An ode to the cosmopolitan culture

of Delhi these two five star hotels unfold the finest lifestyle experiences. An exquisite

blend of business and pleasure makes them a perfect place to confer, relax or pamper your

senses.

Pioneering the concept of deluxe hotels Hotel Jaypee Palace Agra, is a hotel and

convention centre. The hotel is a fine blend of the Mughal architectural brilliance and it

combines classic qualities, simultaneously blending luxury and exclusivity with modern

style, flair and sophistication.

Jaypee Residency Manor, Queen of hills, Mussoorie is a tribute to the majesty and splendor

of the Mussoorie hills. Built on an individual hilltop, the Hotel offers an amazing 180

degrees of the most awe inspiring view of the hills.

Whether staying for business or for pleasure, whether running a conference or a meeting,

arranging receptions or any other special occasion, the Jaypee Hotels has it all to make that

affair a memorable one. Each visit is an experience of a lifetime.

19

CEMENT MANUFACTURING

Jaypee group is the 4th largest cement producer in the country. The groups cement facilities

are located in the Satna Cluster (M.P.), which has one of the highest cement production

growth rates in India.

JAYPEE CEMENT LIMITED (JCL)

JCL recently acquired Gujarat Anjan Cement with a capacity of 1.2MTPA

At Bhuj, Gujarat. The company is also exploring further opportunities of setting up /

acquiring new / existing cement plants in India.

JAYPEE POWER GRID LTD.(JPL)

JPL is a subsidiary of JHPL & a joint venture company of JHPL & Power Grid Corporation

of India (Ltd.) has been formed for execution of the transmission system between Wangtoo

in Kinnaur district of Himachal Pradesh & Abdullapur in Yamuna Nagar district of Haryana

for evacuation of 1000MW power from Karcham Wangtoo HEP in Himachal Pradesh.

www.jaypeepowergrid.com

20

GUJRAT AMBUJA CEMENT LTD (GACL)

This Company, a subsidiary of Jaypee Cement Limited, is setting up a cement plant of 1.2

MTPA capacity at village Vayor, Taluka Abdasa, Distt. Kutch in Gujarat.

JAYPEE INFRATECH LIMITED (JIL)

A subsidiary of Jaiprakash Associates Ltd. which would undertake the implementation of

prestigious Taj Expressway Project comprising of 165 KM, 6/8 Lane Access Controlled

Expressway connecting Greater Noida with Agra.

BHILAI JAYPEE CEMENT LIMITED (BJCL)

Incorporated in the state of Chhattisgarh as a Joint Venture with Steel Authority of India Ltd.

(SAIL). The said company is to produce 2.2 MTPA of cement at Bhilai and Satna.

HIMALAYAN EXPRESS Ltd.

The Company will undertake the construction of Zirakpur-Parwanoo Highway connecting

Punjab, Haryana & Himachal Pradesh on BOT basis. The total length of the highway would

be 28.690 kms.

MADHYA PRADESH JAYPEE MINERAL LTD (MPJML)

A Joint Venture company between JAL and the Madhya Pradesh State Mining Corporation

Limited (MPSMCL) to develop the Amelia (North) Coal block.

21

AREAS OF WORK:-

Transforming challenges into opportunities has been the hallmark of the Jaypee Group, ever

since its inception four decades ago. The group is a diversified infrastructure conglomerate

and has a formidable presence in Engineering & Construction along with interests in the

power, cement and hospitality. The infrastructure conglomerate has also expanded into real

estate & expressways.

Its cement division has modern, computerized process control cement plants namely, Jaypee

Rewa Plant (JRP), Jaypee Bela Plant (JBP) with an aggregate capacity of 7.0 MTPA. With

its plans of adding capacities in different regions of the country, the Group is poised to be a

25 MTPA cement producer by the year 2010 and 30.5 MTPA by 2011. Thus, it is likely to be

third largest cement producer in the country.

HYDROPOWER

The water flowing through rivers of our country is not only a natural resource but liquid

gold which if harnessed properly can serve the nation in more than one way. Nature has

bestowed our country with a bounty of this resource readily available for exploitation for

the benefit of the common man.

The Jaypee group is working at their best to make the best use of the bounty of resource to

serve the nation as stated in the above statement made by Shri. Jaiprakash Gaur ji,

founding father of Jaypee Group. Some major hydro power projects of Jaiprakash

Associates Limited are:

Baspa-II, 300MW project undertaken by the groups subsidiary company JHPL.

Vishnu Prayag, 400MW project undertaken by its subsidiary company JPVL.

Karcham-Wangtoo, 1000MW project undertaken by its subsidiary company JKHCL.

22

JAIPRAKASH HYDRO-POWER LIMITED (JHPL), subsidiary of Jaiprakash

Associates Limited will venture into the development of transmission systems with

the Power Grid Corporation of India Ltd (PGCIL).

The Memorandum of understanding between PGCIL and JHPL has been signed

with the purpose of formation of a Joint Venture company to lay a 230 km (approx.)

long transmission system to evacuate power from the 1000 MW Karcham-Wangtoo

Hydro Electric Project in Himachal Pradesh. The project is located on river Baspa a

tributary of River Satluj. The transmission line is to be completed by 2011

coinciding with the commissioning of the Karcham Wangtoo Project and is likely to

cost Rs.10, 000 million.

INFORMATION TECHNOLOGY

We are living in an era of information driven enterprise. Focus is consistently placed on

automation techniques that increase the productivity and profitability of the enterprise with

reduced costs across various functional heads. IT is an enabler in this context. The Groups

InfoTech arm JIL Information Technology Limited (JILIT) specializes in providing services

in the area of:

IT Infrastructure Management

Software Development & Consultancy

Multimedia Services

Content Management, Security & Delivery

Multimedia based Educational Content Development

Agricultural Content Development

Learning Solution

23

JILIT manages the entire IT Infrastructure of the various Group companies that include over

10 construction sites in some of the remotest terrains of the country including 200 cement

locations in the interiors of India and 3 University Campuses that house over 7000 computers

and various servers.

The company has set up and operates the largest private network of VSATs in Northern

India that connect the Groups various project sites, cement locations and Hydropower

stations. This facilitates seamless connectivity for video conferencing of remote locations

and data connectivity for the ERP solutions of the E&C, Cement and Hydropower divisions

and Educational institutions.

JILIT is one of the leading education content providers for schools in India. A pioneering

initiative was taken in the year 2000 when JILIT conceptualized and developed the first of its

kind digital classroom teaching aid that serves to assists in teaching, difficult to visualize

topics and concepts in Science, Mathematics and Social Sciences. Today more than 10000

teachers in 500 schools across 152 cities and a few other countries for example Dubai,

Kuwait, Oman, Bahrain and South Africa trust our educational content for adding value to

their classroom teaching process and inturn providing benefit to over 150000 students. Other

innovative solution from JILIT includes Campus Connect (integrated resource planning

solution for academic institutions), online testing tools and Bizconnect.

INTEGRATED TOWNSHIP

Jaypee Group embarks one to take a journey to a place where nature and its surroundings

transcend human soul to reach and ask for tranquility in its every form. The Jaypee group has

vested interest in the development of real estate but with a different kind of fervor. The

premier way of expression is its real estate development property in Greater Noida.

24

JAYPEE GREEN

With its inception in the real estate industry in the year 2002 brought about a revolution in

the concept of golf centric real estate development in India. With this concept already very

popular abroad, in countries like the U.S., Europe, Middle-East, Australia etc, Jaypee Greens

were the pioneers in conceptualizing the idea of golf homes in India. The main idea was to

give the residents a feel of resort living at the Jaypee Greens residential community.

Despite being very new in the real estate industry Jaypee Greens successfully positioned

itself in the niche market as an aspirational product. It brought about a revolution in the

concept of urban living coupled with all luxuries that one can aspire for. After 4 years,

Jaypee Greens has now launched its second project in Noida which is 4 times as big as its

first project.

Launched in November 2007, this is Indias First Wish Town. If Jaypee Greens Greater

Noida was Indias First Golf Centric Real Estate Development then Jaypee Greens Noida is

Indias First Integrated Township spread over 1162 acres of land comprising one 18 hole and

two 9 hole golf facility, world class residences that caters to the high-end consumers and also

to the mid segment of the society, commercial complex, medical facilities, educational

facilities that range from Kindergarten to Pre-university levels, host of recreational facilities

like social clubs, entertainment zone etc.

EDUCATION AND WELFARE

Towards the aim of servicing the society and also acknowledging the fact that education

for all is the most important dimension in building the nation, the company is running

education centers under the aegis of Jaiprakash Sewa Sansthan (JSS) a non-profit

organization.

25

At Jaypee we firmly believe that Education is the cornerstone to economic development and

the strength of 1 billion Indians can be channelized by education alone to build India into a

developed nation. With this prospective in mind we believe that quality education on an

affordable basis is the biggest service we can provide to our country.

The 21st century has brought to our doorstep the technology of tomorrow, which when

harnessed effectively can lead to economic growth and prosperity of all mankind. With this

thought in mind the visionary beacon of light Sh. Jaiprakash Gaur, the Founder Chairman,

set up 3 technical institutes of engineering and information technology, in order to prepare

the youth of today for the challenges of tomorrow. These technical institutes host the best of

faculty, students and educational infrastructure to ensure creation, generation, dissemination

and application of knowledge through an innovative teaching learning process, to mould

the world leaders of tomorrow.

These world class centers of learning are:

Jaypee Institute of Information Technology University (JIIT), Noida, U.P. is a deemed

university.

Jaypee University of Information Technology (JUIT), Waknaghat, and H.P. is a state

university.

Jaypee Institute of Engineering and Technology (JIET), Guna M.P.

Besides setting up of technical institutes the group has also made endeavors in setting up

schools (primary and higher secondary), vocational technical training institutes and a degree

college which caters to the need of nearly 17,540students.

Engineering colleges at Noida, Solan and Guna.

Two degree colleges in Uttar Pradesh.

Primary & Secondary schools in U.P. & M.P.

A total of 17 villages around Jaypee Cement Ltd. Complex have been selected for all round

development of the area under a Programme named Comprehensive Rural Development

Programme (CRDP).

Education Balwadi, adult education, Young girls project.

Drinking water

Self employment

26

Village Roads

Socio Religious activities Temples, Schools, Baarat Ghar

Natural Calamity Relief activities Flood relief at Rewa & Gorakhpur, Orison cyclone

relief, Gujarat earthquake relief etc.

Jal Sangrahan Yojana.

THERMAL

The Group in the recent years in order to diversify from the hydropower sector has taken up

the task of exploiting the rich coal resources that exist within the state of Madhya Pradesh.

To this effect the company has formed a Joint Venture company with Madhya Pradesh State

Mining Corporation Limited (MPSMCL) to undertake coal production and sale of coal from

coal block/blocks which might be allotted to MPSMCL. The company has been selected by

MPSMCL as a joint venture partner through competitive bidding process. The joint venture

has been formed in the name and style of MADHYA PRADESH JAYPEE MINERALS

LIMITED.

NIGRIE THERMAL PROJECT

The 1320 MW Nigrie Thermal project in the Singrauli district in the State of Madhya

Pradesh is expected to comprise two 660 MW units, each deploying supercritical technology

and is expected to be commissioned in 2012. This project will be developed by an associate

company of JAL. The Nigrie Thermal Project is expected to utilize coal from two captive

coal blocks, the Amelia (North) and Dongri Tal II coal block. We believe that these coal

blocks contain sufficient coal reserves to fuel the Nigrie Thermal project over the long term.

JAL is expected to develop and mine this coal in a joint venture with MPSMCL. The joint

venture has been allotted these two coal blocks solely for the purpose of supplying fuel to

our Nigrie Thermal Project.

27

CAPTIVE THERMAL POWER

The group currently has a Captive Thermal Power generation capacity of 88.5 MW at its

cement complex at M.P. With new cement plants coming up across India, will have Captive

Thermal plants from day one to ensure cost effective source of power, taking the total

captive generation to 308 MW by 2010.

EXPRESSWAY

India has the worlds second largest road network, aggregating over 3.34 million kilometers.

As Indian Economy grew in the early part of this decade, challenges & opportunities across

entire spectrum emerged and so was the case of large expressways with unique model of

ribbon development along it, which modeled as developed tracks of New India.

The Group has entered into construction of expressways with the Yamuna Expressway

project a 165 km access controlled 6 lane super expressways between Greater Noida and

Agra on Build Own Transfer basis. The project envisages ribbon development along the

expressway at 5 locations totaling 25 million square feet for

residential/industrial/institutional purposes and shall trigger multidimensional, socio-

economic development in Western U.P. besides strengthening the Groups presence in real

estate segment in this decade.

Recently, the Group successfully bid for and was awarded all packages (pkg. 1 to pkg.4) of

prestigious Ganga Expressway contract by the Government of Uttar Pradesh. This is the

largest private sector infrastructure project in India. The Company had emerged as the lowest

bidder, as it bid for the least land for development, which was the most important criteria for

bid evaluation. The 1047 km long 8 lanes Ganga Expressway would be developed on the left

bank of River Ganga, covering the stretch from Greater Noida to Ballia (Eastern Uttar

28

Pradesh). The project will be built on Built-Own-Transfer basis. The Group would also get

the rights for development of an estimated 30,000 acres of land along the expressway.

BOKARO JAYPEE CEMENT

SAIL proclaimed having entered into a partnership with Jaypee Associates for its proposed 2

MT cement plant at Bokaro, Jharkhand, reports Economic Times.

Both the companies will shortly enter into a joint venture (JV), in which Jaypee will hold the

majority stake.

This would be the companys second tie up with the Jaypee for a cement unit. The earlier

one was signed two months back for its 2.5 MTPA capacity plant at Bhilai.

The JV will help Jaypee to raise its production capacity to over 26 MTPA by 2011. Further

SAIL (Q, N,C,F)* will earn additional revenue with its venture into cement sector.

Shares of the company closed down Rs 5.30, or 4.07%, at Rs 125.00. The total volume of

shares traded was 3,009,616 at the BSE (Friday).

29

INTRODUCTION

CEMENT DIVISION

JAL-cement division (Jaypee Cement) today is the market leader in central zone of India;

and on all India bases it is one of the largest players having around 5% share of the total

cement market of the country. Such coveted position has been achieved through utmost

endeavor cum commitment towards quality and excellence in all facets of business

management.

JAL cement division has been certified for the internationally acclaimed ISO 9001:2000

certificate, which further shows its commitment towards achieving total customer

satisfaction and overall excellence.

Jaypee Cement with commissioned capacity of over 13.5 million tonnes per annum (MTPA)

is a brand leader in its current marketing zone, consisting of Central and parts of Northern

India. The Company has undertaken a bold expansion plan to achieve a 35 MTPA capacity

by 2011 one of the fastest organic expansions worldwide in the cement industry. Jaypee

Cement is poised to achieve a pan India presence and cement the dreams & aspirations of a

billion Indians, quite like the Master Blaster himself

ABOUT JAYPEE GROUP AND JAYPEE CEMENT

The Jaypee Group is a diversified industrial conglomerate with a turnover of over Rs. 5,500

Crores. From humble beginnings in the infrastructure sector 4 decades ago, the Group today,

driven by the vision of the Founder Chairman Mr. Jaiprakash Gaur, is a leader in the

Engineering & Construction sector with substantial interests in Cement, Power, Expressways

& Highways, Hospitality & Tourism, and Real Estate.

The Jaypee Group, over the last 7 years, has executed and dedicated 8840 MW of hydro

electric power to the nation. The Group was responsible for delivering 54% of the total

hydro-power generation envisaged in the 10th Five Year Plan (2002 2007). In the private

30

hydropower space, the Group has taken a pioneering initiative and is the largest player in the

country 700 MW of capacity. The Group also has the unique distinction of working on 2 of

the largest Expressway projects of the country on a Build, Own, Operate (BOO) basis the

165 kms long Yamuna Expressway project connecting Noida to Agra and the 1,047 kms

long Ganga Expressway Project connecting Greater Noida to Ballia, which is also the largest

private infrastructure project in the country till date.

In recent times, the Group has identified and included sports as a focus area where it would

like to support the nations efforts. The Group is responsible for bringing Formula 1 (F1)

racing to India and will host the first Indian Grand Prix in 2011. A state-of-art Sports arena

with Formula One Grand Prix Circuit and Go-Cart track is under development. The arena

will also have a 25,000 seating capacity Hockey Stadium, 100,000 seating capacity Cricket

Stadium, 18-hole Golf Course and a Sports Academy. The Group has also constructed a

world class Integrated Sports Complex in Greater Noida - spread over 15 acres, this complex

provides facilities conforming to international standards in the all disciplines of racket sports,

indoor & outdoor basketball and various track & field events. On the domestic front, the

Jaypee Group has developed an 18 hole Greg Norman Signature golf course housed amidst

450 acres of premium real estate at Jaypee Greens, Greater Noida.

The Cement Division of Jaiprakash Associates Ltd. (JAL) has 6 state-of-the-art, fully

computerized Integrated Cement Plants (ICPs), 3 Grinding Units & 1 Blending Unit with an

aggregate capacity of 13.5 million tonnes per annum (MTPA). JAL is in the process of

setting up new capacities in Northern, Central, Western & Southern parts of the country and

is targeting a capacity of 25 MTPA by 2010 and 35 MTPA by 2011, along with 375 MW of

Captive Thermal Power Plants (CPPs).

Once the expansion plans have been implemented, the Group will have 12 Integrated Cement

Plants, 9 split location plants (Grinding & Blending units), 11 Railway sidings and a captive

jetty across the states of Madhya Pradesh, Uttar Pradesh, Gujarat, Himachal Pradesh,

Haryana, Uttarakhand, Chhatisgarh, Jharkhand and Andhra Pradesh, giving the former a pan-

India presence in the cement sector and placing it in the top 3 cement companies in India and

within the top 10 cement companies in the World.

MANUFACTURING UNITS

Bhilai jaypee cement ltd (BJCL)

Jaypee Rewa Plant (JRP)

Jaypee Bela Plant (JBP)

31

Jaypee Cement Blending Unit (JCBU)

Jaypee Ayodhya Grinding Operation (JAAGO)

Jaypee Himanchal Cement Plant (JHCP)

Jaypee Sidhi Cement Plant (JSCP)

Dalla Cement Factory (DCF)

Chunar Cement Factory (CCF)

Jaypee Cement Grinding Unit (JCGU-Roorkee)

Jaypee Cement Grinding Unit (JCGU-Panipat)

Gujarat Anjan Cement Plant (GACL)

Jaypee group is the 3rd largest cement producer in the country. The groups cement facilities

are located in the Satna Cluster (U.P), which has one of the highest cement production

growth rates in India.

The group produces special blend of Portland Pozzolana Cement under the brand name

Jaypee Cement (PPC). Its Cement Division currently operates modern, computerized

process control cement plants with an aggregate capacity of 13.5 MTPA. The company is in

the midst of capacity expansion of its cement business in Northern, Southern, Central,

Eastern and Western parts of the country and is slated to be a 24.30 MTPA cement producer

by the year 2010 and 26.80 MTPA by 2011 with Captive Thermal Power Plants totaling

327MW.

Keeping pace with the advancements in the IT industry, all the 140 cement dumps are

networked using TDM/TDMA VSATs along with a dedicated hub to provide 24/7

connectivity between the plants and all the 120 points of cement distribution in order to

ensure track the truck initiative and provide seamless integration. This initiative is the

first of its kind in the cement industry in India.

In the near future, the group plans to expand its cement capacities via acquisition and

Greenfield additions to maximize economies of scale and build on vision to focus on large

size plants from inception.

32

INTRODUCTION

Bhilai jaypee cement limited (BJCL) is a joint venture of steel Authority of India Limited

(SAIL) and Jaiprakash Associates Limited (JAL). BJCL is planning to develop a cement

complex by installing new clinker plant of capacity 1.09 MTPA produced clinker and cement

plant of capacity 0.6 MTPA at Babupur village, Tehsil Raghuraj nagar, District Satna,

Madhya Pradesh.

Project Brief

The proposed green field cement plant project details are given in Table-1

TABLE

DETAIL OF THE PROPOSED PROJECT

Sr.

No.

Unit Capacity

(MTPA)

Route of proposed

1 Clinker Plant 1.09 6-stage pre-heater/Pre-calciner

kiln and VRMs for coal and raw

material grinding

2 Cement Plant 0.6 By installing a new VRM for

cement grinding and packing

Unit with truck and wagon

loading

3 Captive Limestone Mines:

A. Captive Limestone Mine ML-

I (ML Area-590.522 ha)

B. Captive Limestone Mine

ML-II (ML Area-1033.99 ha)

0.6

1.5

To open up ML-I and ML-II for

feeding captive clinker plant

The supporting installation for the proposed project includes installation of limestone

crushing and storage facility at adjacent to plant and captive mines leases I & II area and new

railway siding at plant site to Sakaria railway station.

33

Size of the project

The project cost estimated for the proposed cement plant including utilities, offsite, auxiliary

services, margin money etc is Rs 364.5 crores. The anticipated capital expenditure for the in-

built pollution control measures is Rs. 36.0 crores. The total project cost for proposed mine

leases I and II is Rs. 35 crores. The anticipated expenditure for the pollution contril measures

is Rs. 0.70 crores.

Location of the project

The environmental setting of the cement plant complex and both the captive limestone mines

area is presented in Table-2. The vicinity map of plant and mines are shown in Figure-1.

34

VICINNITY MAP OF PROPOSED CEMENT PLANT AND CAPTIVE MINES I & II

Sr.

No.

Particulars

Details

ML I ML II Cement Plant

1 Location Spread over parts of

Barikhurd, Putondha,

Putondhi Sarwahna and

Nimi villages of Raghuraj

Nagar Tehsil, Satna

District, and Madhya

Pradesh.

Spread over parts of

Ramasthan,

khamariya

(Tiwarian), Jamorhi,

Atrahara, Mohana,

Sakaria, Sarwahana,

Barera, Lohora,

Babupur

35

Bharpurwa and

khamariya (Payasian)

Villages of Raghuraj

Nagar Tehsil,

Satna District,

Madhya Pradesh.

2 Latitude 24

0

36

33

"

to 24

0

38

25

"

North

24

0

35

20

"

to 24

0

37

28

"

North

24

0

36

01

"

to 24

0

36

52

"

North

3 Longitude 80

0

54

21

"

to 80

0

56

58

"

East

80

0

54

23

"

to 80

0

57

48

"

East

80

0

53

55

"

to 80

0

54

37

"

East

4 Current status

of land

Industrial use Industrial use Industrial use

5 Elevation

above Mean

Sea Level

Plain land of about 292-

313 m above mean sea

Level (MSL)

Plain land of about

292-313 m above

mean sea Level

(MSL)

Plain land of

about 292-313 m

above mean sea

Level (MSL)

6 Nearest

Highway

NH -75, 5.6 km (S) NH 75, 3.5 km

(S)

4.3 km, S

7 Nearest

Railway

Station

Satna R.S, 9.8 km, SW

direction

Satna R.S, 9.1 km,

SW direction

8.3 km, SW

8 Nearest

Airport

Khajuraho, 100 km NW Khajuraho, 100 km

NW

Khajuraho, 100

km NW

9 Reserved/Pro

tected Forest

within 10-km

radius

1) Jumori R.F, 1.2

km, SE,

2) Naro P.F, 10.5

km, S

Jumori R.F, 0.6 km,

SE,

Naro P.F, 8.4 km, S

Jumori R.F, 4.6

km, E, Naro P.F,

9.5 km, S

10 Nearest

Township

Satna, 9.3 km, SW Satna, 8.3 km, SW Satna, 7.3 km,

SW

11 Rivers/Lakes Tamas or Tonnes River,

2.9 km, SE

Simarawal Nadi, 5.1 km,

NE

Tamas or Tonnes

River, 1.3 km, SE

Simarawal Nadi, 4.8

km, NE

Tamas or Tonnes

River, 3.5 km,

SSE

Simarawal Nadi,

8.8 km, NE

12 Seismic Zone Zone-II as per IS-1893

(Part-1)-2002

Zone-II as per IS-

1893 (Part-1)-2002

Zone-II as per IS-

1893 (Part-1)-

2002

36

PROJECT DESCRIPTION

Details Proposed Plant Facilities

The cement and clinker manufacturing in the plant is proposed through dry process.

The proposed project details are given in Table-3

TABLE-3

DETAILS OF THE PROJECT

Sr.

No.

Parameter Description

1 Clinker production 1.09-MTPA

2 Cement production 0.6- MTPA Cement

3 Lime stone

production details

ML I : 0.6 MTPA

ML II: 1.5 MTPA

4 Mineral reserves ML I ML II

Lime stone : 37.37 MT

Overburden: 12.18 Million m

3

Top Soil : 0.18 Million m

3

Mineable reserve: 23.32 MT

Lime stone : 154.84 MT

Overburden: 54.07 Million

m

3

Top Soil : 19.82 Million

m

3

Mineable reserve: 69.56 MT

5 Process 6 stage preheater/precalciner kiln for calcinations

VRMs for coal and raw material grinding

6 Land requirement Cement plant : 87.45 ha

ML I : 590.522 ha

ML II : 1033.99 ha

7 Water requirement

and source

Water requirement and entire cement plant complex : 1400

m

3

/day

Water requirement for plant Activity :1200 m

3/

day

Water requirement for

Mine Activity (ML I & ML II) : 200 m

3/

day

Water source : Ground water resources initially and thereafter

from Reservoir created in mined out area

8 Raw material

requirement for

cement plant

Limestone : 2.1 MTPA

Laterite : 0.07 MTPA

Coal : 0.18 MTPA

Gypsum : 0.05 MTPA

37

Slag : 0.20 MTPA

9 Power requirement

and source

22 MW (Including Plant and township)

1 MW for Mine Activity

Source: Madhya Pradesh State Electricity Board (MPSEB) grid

Standby DG set for emergency Purposes : 10 MW

10 Main equipment

details

Raw mill: 1 300 tph (Vertical Roller Mill)

Pyro process : 3300 tpd (dry process twin string 6 stage)

Coal Mill: 30 ph (Vertical Roller Mill)

Clinker silo : 1 25,000 t

Limestone crusher : 750 tph (impactor with pre & post

screening)

11 Pollution control Plant: Bag dust collectors (emission below 50 mg/Nm

3

)

Mines: Dust Suppression and Green belt development with in the

Mine Lease Area

12 Storage capacities Finished product (Clinker): 1 25,000 t RCC Silo

Blending Silo : 12,000 t RCC Silo

Limestone : Stockpile : 2 3000 t, covered

Coal: 1 10,000 t, linear

13 Total manpower

requirement

581 persons for entire plant complex, Additional contract labor

required for auxiliary services like loading and unloading of

materials, general cleaning work and security

Land requirement

An area of 87.45 ha including railway siding has been earmarked for the cement plant

project. The land use of proposed plant is given in Table 4

TABLE 4

LAND USE OF PROPOSED PLANT SITE

Sr. No. Land use Area (hectares)

1 Plant area 45.10

2 Administrative building, etc. 0.63

3 Railway siding 5.76

38

4 Landscaping and greenbelt area 27.00

5 Truk parking 1.00

6 Raw material storage 7.96

Total 87.45

Raw Material Requirement and Transportation Details

The major raw materials used in the manufacturing of the clinker are limestone, laterite and

black coal. The raw material like limestone and laterite will be transported to site through

roadway by dumpers. The outflow of finished products from plant will be 1.09 MTPA

clinker and 0.60 MTPA cement. The lime stone wil be transported through dumpers from

crusher to plant. The detail of raw material requirement and transportation are given in

Table-5

TABLE 5

LAND MATERIAL REQUIREMENT & TRANSPORTATION

Sr.

No.

Material Quantity

(MTPA)

Source Mode of

transport

Quantity store

at site (tones)

1 Limestone 2.1 Captive limestone

Quarry, adjoining to

the plant site

Road dumpers Stockpile: 2

36,000 t, linear

2 Laterite 0.07 Katni, Madhya

Pradesh

Road 13000 t, covered

3 Coal 0.18 Central coal fields Covered

rail/truks

110,000 t, linear

Water requirement

The break-up of water requirement for different units for the proposed project is given in

Table-6

TABLE-6

WATER REQUIREMENT

39

Sr.

No.

Water Consumption Quantity (m

3

/day)

1 Cement Plant 1100

2 Township 100

3 Greenbelt development (Re-circulated from STP) 80

Total 1200

Water is required for equipment cooling and for domestic purpose. The total fresh water

requirement of proposed plant to meet the requirement of cooling of equipment and domestic

purpose is about 1200-m

3

/day. The water requirement will be met from ground water

sources.

Power requirement

The power requirement of the proposed clinker plant and mining activities will be about 22

MW and 1 MW respectively. The power will be sourced for

Manpower

The total manpower requirement for the proposed project during construction phase is 2000

nos. including skilled and unskilled workers. About 393 people will be employed during

operation of cement plant. Contract labour shall be employed for auxiliary services like

loading of cement bags, unloading of stores & miscellaneous materials and general cleaning

work.

Township

A full-fledged township will be developed to accommodate plant, mines and security

personnel and supporting staff. Other amenities such as community center, guest house,

health center, shopping complex, post office, bank etc. will be established. The location of

township is in the NE direction to the plant and also adjacent to the ML I boundary.

Details of Captive Limestone Mines

The salient features of the captive limestone mining areas are presented in Table-7

TABLE-7

SALIENT FEATURES OF LIMESTONE MINE LEASES

40

Sr.

No.

Description Details

1 Name of the Mine lease ML I ML II

2 Extent of Mine lease (ML)

area

590.522 1033.99 ha

3 Type of ML area Non forest land Non forest land

4 Method of mining Fully mechanized opencast Fully mechanized

opencast

5 Rated capacity of mine 0.6 MTPA limestone

production

1.5 MTPA limestone

production

6 Expected life of mine 39 years 47

7 Date of expiry of ML 31.10.2021 3.01.2027

8 Average stripping ratio 1 : 0.94 1:1

9 Geological reserves 37.37 Million Tonnes

(15094378m

3

)

154.825 Millions

10 Recoverable reserves 74.0. Millions

11 Mineable reserves 23.32 Million Tonnes 69.56 Millions

12 Mineable overburden 12.18 million m

3

67.07 Millions m

3

13 Average no. of working days 330 days/annum 330 days/annum

14 Number of shifts per day 3 shifts/day 3 shifts/day

15 Working hours per day 8 hrs 8 hrs

16 Mining blocks 1 1

17 No. of benches 2 2

18 Average Bench height for

top soil

1.0 m 0 1.5 m

19 Average Bench height for

over burden (OB)

1 6 m 1.5 8.0 m

20 Bench height for limestone 6 8 m 6.0 8.0 m

21 Ultimate depth of mine 25 m below GL (approx.

313 m above MSL)

313 m above MSL (15

25 m BGL)

22 Topsoil to be generated

during entire life of mine

About 2.5 lakh tones in 5

years

6.0 lakh tones in 5 years

23 Overburden to generated

during entire life of mine

18.36 Million m

3

54.07 million m

3

24 No. of waste dumps planned Nil (temporary dump will

be maintained

No separate Over burden

dump planned

25 Power requirement 1 MW (Including ML 1 MW (Including ML I

41

II ) form power grid )

26 Water requirement 75 m

3

/day from mine

sump

125 m

3

/day

27 Transport of OB Dumpers of capacity 22 to

32 T

22/35 t capacity dumper

28 Transport of limestone from

mine face to crushing plant

Dumpers of capacity 22 to

32 T

35 t/50 t capacity

dumper

29 Distance to mine face to user

point

Crusher is located at a

distance of 3 km from the

working face within ML

area

Clinker plant is adjacent to

the ML II and from mine

crushing plant

Method of Mining

The choice of mining method has been considered as opencast mining for quarrying the

limestone from the mines. The mining operation will be fully mechanized. The sequence of

operation in quarrying will be drilling, blasting, loading and transportation.

All the rock types occurring within the area are fully exposed. There is hardly any top soil

that occurs on the surface and hence separate dozing of top soil would not be required.

Drilling and blasting will be carried out for excavation of OB and limestone. For OB, 115

mm size drills will be used for drilling and shovel combination with 32/22 tone capacity

dumper will be used to transport the OB blasted material from the face to dump area.

For limestone, 115 mm size drills will be used for drilling. Crawler mounted hydraulic

excavator with bucket capacity of 3.8 m

3

and 4.1 m

3

capacity will be used for loading

and in combination with 32/22 tones capacity dumpers shall be used to transport the

blasted material from the mines leases.

Mining Equipment

There are four types of equipment systems available for open cast mining

Bucket wheel excavator mining;

Draggling mining;

Shovel dumper combination; and

42

Surface miners.

The mining machinery will be placed in a phased manner till the operations continue at the

same rate of production in this mine. The machinery will be shifted gradually to the other

captive mine lease of ML II the detail of the proposed major mining machineries are given

in Table 8

TABLE 8

DETAIL OF MINING MACHINERY

Sr.

No

Description No of

Units

size/Capa

city

Make Motive

power

H.P

1 Bull Dozer 1 - BEML Diesel 400

2 4

"

/6

"

dia drill 1 4

"

/6

"

dia IG/Atlas Diesel 180 to 400

3 Hydraulic excavator 1 3.8 to 4.2

m

3

Komatsu/L Diesel 295 to335

4 Dumpers 6 22 to 32 Volvo/Tata Diesel -

Site Services

Lime crusher and ancillary facilities

The limestone crushing plant and ancillary facilities are mainly consists of 750 TPH

capacity jaw crusher, 800 TPH capacity hamper crusher, stacker and declaimer.

Fuel requirement

Drilling and mining operations, 1.0 KLD of diesel is being used to operate the dumpers and

other transport vehicles in mine lease to transport the lime stone, over burden, sprinkling of

water and other mining operation and no additional requirement of fuel is envisaged.

Water requirement

Industrial water required for mining operations/establishment mainly for sprinkling haulage

roads and at faces for suppression of dust. Water is also required for washing and servicing

utilities for equipment. The average daily water requirement for the proposed mines lease I

& II during operation is 200m

3,

which will be met from the rainwater accumulated in the

mine sump except for potable water. However, potable water will be sourced from the

43

clinker plant. No additional water requirement is envisaged in mining operations and also in

potable water.

CEMENT MANUFACTURING PROCESS

MINING

The cement manufacturing process starts from the mining of limestone, which is the

main raw material for making cement. Limestone is excavated from open cast mines

after drilling and blasting and loaded on to dumpers, which transport the material and

unload into hoppers of the limestone crushers.

CRUSHING STACKING & RECLAIMING OF LIMESTONE

The Limestone (LS) Crushers crush the limestone to 80 mm size and discharge the

material onto a belt conveyor which takes it to the stacker via the Bulk material

analyzer. The material is stacked in longitudinal stockpiles. Limestone is extracted

transversely from the stockpiles by the reclaimers and conveyed to the Raw Mill

hoppers for grinding.

CRUSHING STACKING & RECLAIMING OF COAL

The process of making cement clinker requires heat. Coal is used as the fuel for

providing heat. Raw Coal received from the collieries is stored in a coal yard. Raw

Coal is dropped on a belt conveyor from a hopper and is taken to and crushed in a

crusher. Crushed coal

discharged from the Coal Crusher is stored in a longitudinal stockpile from where it is

reclaimed by a reclaimer and taken to the coal mill hoppers for grinding of fine coal.

RAW MEAL DRYING / GRINDING & HOMOGENIZATION

Reclaimed limestone along with some laterite stored in their respective hoppers is fed

to the Raw Mill for fine grinding. The hot gasses coming from the clinkerisation

section are used in the raw mill for drying and transport of the ground raw meal to the

Electrostatic Precipitator / Bag House where it is collected and then stored and

homogenized in the concrete silo. Raw Meal extracted from the silo (now called Kiln

feed) is fed to the top of the pre-heater for pre-processing.

CLINKERIZATION

Cement Clinker is made by pre-processing of Kiln feed in the pre-heater and the rotary

kiln. The limestone is heated at 1400 C into furnace, fine coal is fired as fuel to

provide the necessary heat in the kiln and the precalciner located at the bottom of the

5/6 stage preheater. Hot clinker discharged from the Kiln drops on the grate cooler and

gets cooled. The cooler discharges the clinker onto the pan / bucket conveyor and it is

44

transported to the clinker stockpiles / silos. The clinker is taken from the stockpile /

silo to the ball mill hoppers for cement grinding. At the end of each sampling process

there is a sampling procedure by the quality control lab every 2 hours, the report is

send to the CCR which varies the process parameters depending upon the sampling

feedback.

CEMENT GRINDING AND STORAGE

Clinker and Gypsum (for OPC) and also Pozzolona (for PPC) are extracted from their

respective hoppers and fed to the Cement Mills. These Ball Mills grind the feed to a

fine powder and the Mill discharge is fed to an elevator, which takes the material to a

separator, which separates fine product and the coarse. The latter is sent to the mill

inlet for regrinding and the fine product is stored in concrete silos. Its capacity is about

14000 tones.

PACKING

Cement extracted from silos is conveyed to the automatic electronic packers where it

is packed in 50 Kgs polythene bags and dispatched in trucks or rail.

ELECTRICAL POWER

For total power requirement of 90 MW (Jaypee Rewa Plant and Jaypee Bela Plant)

they have three CPPs and four DG sets to provide an emergency backup.

CPP 1 - 25.0 MW

CPP 2 - 25.0 MW

CPP 3 - 38.5 MW

BJCL proposes to set up a Greenfield cement plant in joint venture with SAIL at Satna with a

clinker capacity 1.09 mio tpa along with a split grinding unit with capacity 2.2 mio tpa at

Bhilai of Chhattisgarh.

45

Overall view of Plant

SAIL BACKGROUND:-

STEEL AUTHORITY OF INDIA LTD

Is a major player in the business of Steel Manufacturing? The blast furnace slag generated

by the Integrated Steel Plant of SAIL at Bhilai is granulated, which forms a major constituent

for manufacture of Slag Cement (Portland Slag Cement). SAIL, with an objective of using

this waste by-product generated in their Bhilai Steel Plant (BSP) at Bhilai and utilizing

limestone of their mines at Satna, opted for tendering route way back in the first quarter of

2006. They invited Bidders for participating in a proposed Joint Venture with SAIL to set up

a cement plant.

JAIPRAKASH ASSOCIATION LTD

A major player of the cement industry became a successful bidder in the Bid submitted by

various cement players on 31

st

March, 2006. Thereafter various agreements were discussed

and formulated between the two corporate SAIL and JAL over a year.

Jaiprakash Associates Limited (JAL) and Steel Authority of India Limited (SAIL) have

signed a Share Holders Agreement on the 21

st

March 2007. It is the Biggest Joint Venture of

SAIL with a Private Corporate till date. SAIL shall contribute 26% of the total equity, while

the balance 74% shall be contributed by JAL.

The new JV Company formed in the name of Bhilai Jaypee Cement Limited (BJCL) was

incorporated on 11

th

April 2007. Bhilai Jaypee Cement Limited is setting up split-location

cement project, with the clinkerisation cum grinding unit to be set up near the limestone

deposit, Ispat Limestone Quarry (ILQ) mine in Village Babupur at Satna in the state of

46

Madhya Pradesh, called the Bhilai Jaypee Cement Plant and a Grinding Unit located

within the Bhilai Steel Plant premises to be set up at Bhilai in Chhattisgarh, called the

Bhilai Jaypee Grinding Plant.

BJCL shall mainly produce Portland Slag Cement (PSC) at Bhilai. Clinker shall be

transported from Satna to Bhilai for producing PSC at Bhilai.

Railway sidings are proposed to be set up at both the plant locations to ensure smooth

transport of inter-alia clinker between the two split-located units.

DEPARTMENTAL PROFILE

The finance and accounts department works as judicious manager in distribution of

available funds in an optimal manner for the organization as a whole on daily, monthly and

annual basis and also a conscious book-keeper for the company going through every

transaction having financial implication with complete thoroughness before acceptance of

liability. It looks after the information requirements of the company and various statutory

authorities in compliance of the applicable statutory provisions. The bonus of ensuring

companies various assets adequately insured is also with this department. For effective and

efficient management of finances, there are adequate teams for finance and accounts

activities in the plant location.

FINANCE AND ACCOUNTS DEPARTMENT

FINANCE

ACCOUNTS

SALES

GENERAL

INSURANCE

M.I.S

RAW MATERIAL AND STORE

ACCOUNTING

PERSONNEL

ACCOUNTING

47

FINANCE CELL

The long, medium short term financial planning and assessment is done in context of the set

objectives and targets for the current year and projected years, considering various factors

such as-

Capacity expansion

Technology up gradation

Manpower training

New machineries

Tools and Equipments

Addition in infrastructure

ACCOUNTS CELL

The cement industry is one of the industries prescribed for COST-AUDIT under the

companies act. It casts a statutory obligation on the company to get the final accounts

statement audited by statutory financial and cost authorities.

The entire operation of the plant is divided into various cost centers based on the processes

involved, in addition to the accounts codes for accounts heads. The accounts function is

totally computerized with well proven in house established accounts package, catering to the

needs of the company. ERP-PACKAGE is broadly used. The base data of each transaction

is entered only once with relevant account code and cost code with both quantitative and

financial information making the financial and cost records updated at the same time in the

system.

This cell has following sections:

a) GENERAL ACCOUNTS

Is sub divided in to two subsections to take care of accounting related to two vital

resources of organization:-

Raw material & Stores accounting

Personnel accounting.

48

b) SALES ACCOUNTS

The sales accounts department is one of the most important departments of any company.

It has the main function to handle sales accounting of the company. The department

performs its functions through following divisions:

1. Invoicing

2. Collections

3. Stock Records

4. Freight

INVOICING: Under invoicing first of all Price Feeding is done then it is cross checked

with the challan being approved. Then FEG i.e. Financial Entry Generation and G/L i.e.

General Ledger is prepared.

COLLECTIONS: Collection is related to the receivables from the various Sales

Promoters and Traders. All the payments are majorly obtained in form of Demand Drafts

and handled by Punjab National Bank.

STOCK RECORDS: Stock Records are being maintained in company on daily basis.

FREIGHT: Freight is charged according to the contract made between company and the

customers. The freight if paid by the company then TDS is also calculated.

c) INSURANCE

Companies associated with Jaypee are:

ICICI Lombard.

IFFCO TOKYO

Bajaj Allianz

United India Insurance

Oriental Insurance

49

d) MIS AND BUDGET

This section is responsible for collecting the data from various departments and analyzing

them and then reproducing them as per the requirement in the form of reports.

The most significant part is the preparation of cash budget

Monthly budget

Annual budget

Weekly actual against monthly budget

50

WORKING CAPITAL

WORKING CAPITAL is the amount of fund necessary to cover the cost of operating the

enterprise. Working capital is the part of firms capital which is required for financing short

term or current assets such as inventories, debtors, marketable securities and cash. Funds

invested in these current assets keep revolving with relative rapidly. Hence is also known as

circulating or revolving capital or short term capital or liquid capital.

Every running business needs working capital. Even a business which is fully equipped with

all types of fixed assets required are bound to collapsed without-

i) Adequate supply of raw material for processing.

ii) Cash to pay for wages, power and other costs.

iii) Creating stock of finished goods to feed the market demand regularly.

iv) The ability to grant credit to its customers.

51

CONCEPT OF WORKING CAPITAL

There is a lot of difference of opinion among accountants, financial experts, entrepreneur and

economists.

1) TRADITIONAL AND BALANCE SHEET CONCETS-

According to this concept working capital depicts the position of the firm at certain

point of time. With this point of view working capital is of two types-

A) GROSS WORKING CAPITAL

The gross working capital is financial or going concern concept. According to this

concept all the current assets of the business financed by long term funds or short term

funds form the working capital of the firm.

The following arguments are placed in favour of this concept-

1) It enables the enterprise to provide correct amount of working capital at the right

time.

2) Every management is more interested in the total current asset with which it has to

operate rather than the sources from it is financed.

TYPES OF

WORKING

CAPITAL

ON THE BASIS OF

B/S CONCEPT

GROSS

WORKING

CAPITAL

NET WORKING

CAPITAL

ON THE BASIS OF

TIME

REGULAR

WORKING

CAPITAL

TEMPORARY

WORKING

CAPITAL

SEASONAL

WORKING

CAPITAL

SPECIFIC

WORKING

CAPITAL

52

3) The gross concept of working capital takes into consideration that every increase in

the funds of the enterprise would increase the working capital.

4) The concept of gross working capital is more useful in determining the rate of

return on investment.

B) NET WORKING CAPITAL-

Net working capital is the difference between CURENT ASSETS & CURENT

LIABILITY. A part of funds required to maintain CURENT ASSETS is provided by

CURENT LIABILITY & the balance is provided by long term funds.

Therefore net working capital may also be defined as that part of firms CURENT

ASSETS which is financed with long terms funds. The following arguments are put in

favour of this concept.

1) Excess of CURENT ASSETS over CURENT LIABILITY is an indicator of financial

soundness and the ability to face depression and contingencies.

2) It indicates the margin of protection available to the short term creditor that is the

excess of CURENT ASSETS over CURENT LIABILITY.

3) It is an indicator of the financial soundness of the enterprise.

4) It suggests the need to financing a part of the working capital requirements out of the

permanent sources of funds.

In the company, in year 2011-2012 the current assets are Rs 563676 lacks and current

liability is Rs 365514 lacks, and in year 2012-2013 the current assets are Rs 848017

lacks and current liabilities are Rs 503670 lacks, this shows that in both the year

current assets are more than current liabilities, which shows positive move in company

position and the net working capital ratio in year 2011-2012 is 1.54:1 and in year

2012-2013 ratio is 1.68:1. Suggested ratio by chore and tendon committee is 1.33:1.

53

C) PERMANENT OR FIXED WORKING CAPITAL

A minimum level of current assets, which is continuously required by a firm to carry

on its business operations, is referred to as permanent or fixed working capital.

D) VARIABLE OR FLUCTUATING WORKING CAPITAL

The extra working capital needed to support the changing production and sales

activities of the firm is referred to as fluctuating or variable working capital.

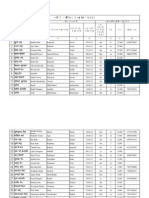

STATEMENT SHOWING CHANGES IN WORKING CAPITAL IN JAL

PARTICULARS 2010-11 2011-12 2012-13 INC.

(IN10-

11 TO

11-12)

DEC.

(IN 10-

11 TO

11-12)

INC.

(IN 11-

12 TO

12-13)

DEC.

(IN 11-

12 TO

12-13)

CURRENT

ASSTES

INVENTORIES 80616 98130 122862 17514 24734

SUNDRY

DEBTOR

45205 58618 102204 13413 43586

CASH & BANK

BALANCE

142981 181544 290859 38563 109315

OTHER

CURRENT

ASSTES

1253 3190 1282 1937 1908

LOANS AND

ADVANCES

109850 222194 330810 112344 108616

TOTAL (A) 379899 563676 848017

CURRENT

LIABILITIES

CURRENT

LIABILITY

202624 334909 455439 132285 120530

PROVISIONS 30407 30605 48231 198 17626

TOTAL (B) 233031 365514 503670

CA-CL (A-B) 146868 198162 344347

54

INTERPRETATION

By analyzing the data from 2010-2011 TO 2011-2012 we come to the conclusion that the

difference between current assets and current liabilities in year 10-11 TO 11-12 is from

146868 to 198162, which shows that working capital is increases in year 11-12. The

increase in working capital indicates that the company position is improved than previous

year. The reason for this improvement is the value of inventory, debtors, cash and

balance, other current assets, loans and advances increase from the previous year which

indicates that all the assets are properly utilized in the company.

By analyzing the data from 2011-2012 TO 2012-2013 we come to the conclusion that the

different between current assets and current liabilities more increases in the comparison

of previous year which indicates that the position of the company is more improving from

the previous year. The reason for such improvement is company also properly utilized the

all assets in the company in the year 2012-2013.

2) OPERATING CYCLE CONCEPT

The working capital requirement of firm depends, to a greater extent upon the operating

cycle of the firm. The duration of time required to complete the sequence of events right

from purchase of raw material/goods for cash to the realization of sales in cash is called

working capital cycle or operating cycle.

DETERMINING THE OPERATING CYCLE FOR THE YEAR 2013

AMOUNT OPENING BAL. CLOSING BAL.

RAW MATERIAL 37931 51497

WORK IN PROGRESS 43418 50238

DIRECT EXPENSE 198858

FINISHED GOODS 3215 3733

SALES 614793

PROFIT BEFORE TAX 35397

DEBTORS 102204 58618

CREDITORS 70102 88063

RAW MATERIAL

CONSUMED

306640

55

RAW MATERIALSTORAGE PERIOD(R)

= AVERAGE STOCK OF RAW MATERIALS

AVERAGE COST OF PRODUCTION PER DAY

= (37931+51497)/2 = 44714 =53DAYS

(201140/365) 840

WORK IN PROGRESS (W)

= AVERAGE WORK IN PROGRESS INVENTORY

AVERAGE COST OF PRODUCTION PER DAY

(50238+43418)/2 = 46828 =68 DAYS

(50238+198858)/365 682

FINISHED GOODS STORAGE PERIOD (F)

= AVERAGE STOCK OF FINISHED GOODS

AVERAGE COST OF GOODS SOLD PER DAY

= (3215+3733)/2 = 3474 =2DAYS

(614793-35397)/365 1587

DEBTORS COLLECTION PERIOD (D)

= AVERAGE BOOK DEBTS

AVERAGE CREDIT SALES PER DAY

= (58618+102204)/2 = 80411 = 48DAYS

(427389/365) 1684

CREDITORS PERIOD AVAILED (C)

= AVERAGE TRADE CREDITORS

AVERAGE CREDIT PURCHASES PER DAY

= (70102+88063)/2 = 79082.50 = 87 DAYS

(306640+122862-98130)/365 907.9

NET OPERATING CYCLE PERIOD

OC= M+W+F+D-C

= 53+ 68+ 2+ 48- 87 = 84

56

DETAILS

1) The data required for the calculation of operating cycle period has been extracted from

annual report for the year 2009.

2) Number of days is taken as 365 days.

3) The figure of average daily consumption is taken as raw material consumed divided by

number of days.

4) The figure of cost of goods sold is obtained from profit and loss account

COGS=SALES- PROFIT BEFORE TAX

5) As the credit sales figure is not given so the figure of sales is taken.

6) The figure of credit purchase is calculated as-

CREDIT PURCHASE= RAW MATERIAL+CLOSING STOCK-OPENING

STOCK

INTERPRETATION

From the above calculation it has been found that the net operating cycle period is 89days,

which indicate that the finished goods take 89days to be converted into cash. The operating

cycle indicates the minimum number of days for realization of cash. If the period of

operating cycle is lesser then it will make the business more effective.

57

OPERATING CYCLE

SIGNIFICANCE OF WORKING CAPITAL

Working capital is as essential for the smooth and efficient running of a business, as

circulation of blood is essential in the human body for maintaining life.

1) IMMEDIATE PAYMENT TO SUPPLIERS

Adequate working capital enables a firm to pay its suppliers immediately that ensures

regular supply of raw material.

In JAYPEE GROUP at the year of 2007-2008 the working capital is Rs 198162 lacks and

in year 2008-2009 the working capital is Rs 344347 lacks. This shows that the capital is

properly utilized in the company and which indicate the financial soundness of the

company, it enables the firm to make immediate payment to its suppliers.

CASH

(PURCHASE)

RAW MATERIAL

(PRODUCTION

PROCESS)

WORK IN

PROGRESS

(PRODUCTION

PROCESS)

ACCOUNT

RECEIVABLE

(SALE)

ACCOUNT

RECEIVABLE

(REALIZATION)

58

2) BENEFIT OF CASH DISCOUNT

The firm can avail the advantage of cash discount this will result in reducing the cost of

production, where by firm can reduce its selling prices and attract more customers by

allowing trade discount.

3) ADEQUATE DIVIDEND DISTRIBUTION

Firm short of working capital plough back their profit in their business to make up the