Escolar Documentos

Profissional Documentos

Cultura Documentos

Nego Cases

Enviado por

Charlene Lasala de Guinto0 notas0% acharam este documento útil (0 voto)

56 visualizações23 páginasThe document summarizes a Philippine Supreme Court case from 1971 regarding a disputed money order. The Philippine Education Company received a money order from a customer as payment but the order was later found to have been irregularly issued. The post office deducted the amount from the bank's clearing account. The company sued the postmaster and others seeking to overturn the deduction or be indemnified. The trial court ordered the deduction be countermanded or the company be indemnified. On appeal, the Supreme Court affirmed the dismissal, finding money orders are not negotiable instruments under Philippine law based on U.S. precedent, and the bank was bound by conditions imposed by the post office on redeeming money orders.

Descrição original:

nego cases under atty. busmente

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

DOC, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoThe document summarizes a Philippine Supreme Court case from 1971 regarding a disputed money order. The Philippine Education Company received a money order from a customer as payment but the order was later found to have been irregularly issued. The post office deducted the amount from the bank's clearing account. The company sued the postmaster and others seeking to overturn the deduction or be indemnified. The trial court ordered the deduction be countermanded or the company be indemnified. On appeal, the Supreme Court affirmed the dismissal, finding money orders are not negotiable instruments under Philippine law based on U.S. precedent, and the bank was bound by conditions imposed by the post office on redeeming money orders.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOC, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

56 visualizações23 páginasNego Cases

Enviado por

Charlene Lasala de GuintoThe document summarizes a Philippine Supreme Court case from 1971 regarding a disputed money order. The Philippine Education Company received a money order from a customer as payment but the order was later found to have been irregularly issued. The post office deducted the amount from the bank's clearing account. The company sued the postmaster and others seeking to overturn the deduction or be indemnified. The trial court ordered the deduction be countermanded or the company be indemnified. On appeal, the Supreme Court affirmed the dismissal, finding money orders are not negotiable instruments under Philippine law based on U.S. precedent, and the bank was bound by conditions imposed by the post office on redeeming money orders.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOC, PDF, TXT ou leia online no Scribd

Você está na página 1de 23

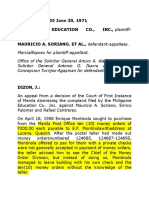

G.R. No.

L-22405 June 30, 1971

PHILIPPINE EDUCATION CO., INC., plaintiff-appellant,

vs.

AURICIO A. !ORIANO, ET AL., defendant-appellees.

Marcial Esposo for plaintiff-appellant.

Office of the Solicitor General Arturo A. Alafriz, Assistant Solicitor General Antonio G. Ibarra and Attorney Concepcion Torrios-

A!apinan for defendants-appellees.

DI"ON, J.:

An appeal from a decision of the Court of First Instance of Manila dismissing the complaint filed by the Philippine Education

Co., Inc. against Mauricio A. oriano, Enrico Palomar and !afael Contreras.

"n April #$, #%&$ Enri'ue Montinola sought to purchase from the Manila Post "ffice ten (#)* money orders of P+)).)) each

payable to E.P. Montinola ,ithaddress at -ucena, .ue/on. After the postal teller had made out money ordersnumbered

#+01$&, #+01$2-#+01%&, Montinola offered to pay for them ,ith a private chec3s ,ere not generally accepted in payment of

money orders, the teller advised him to see the Chief of the Money "rder 4ivision, but instead of doing so, Montinola managed

to leave building ,ith his o,n chec3 and the ten(#)* money orders ,ithout the 3no,ledge of the teller.

"n the same date, April #$, #%&$, upon discovery of the disappearance of the unpaid money orders, an urgent message ,as

sent to all postmasters, and the follo,ing day notice ,as li3e,ise served upon all ban3s, instructing them not to pay anyone of

the money orders aforesaid if presented for payment. 5he 6an3 of America received a copy of said notice three days later.

"n April +7, #%&$ one of the above-mentioned money orders numbered #+01$$ ,as received by appellant as part of its sales

receipts. 5he follo,ing day it deposited the same ,ith the 6an3 of America, and one day thereafter the latter cleared it ,ith the

6ureau of Posts and received from the latter its face value of P+)).)).

"n eptember +2, #%1#, appellee Mauricio A. oriano, Chief of the Money "rder 4ivision of the Manila Post "ffice, acting for

and in behalf of his co-appellee, Postmaster Enrico Palomar, notified the 6an3 of America that money order 8o. #+01$$

attached to his letter had been found to have been irregularly issued and that, in vie, thereof, the amount it represented had

been deducted from the ban39s clearing account. For its part, on August + of the same year, the 6an3 of America debited

appellant9s account ,ith the same amount and gave it advice thereof by means of a debit memo.

"n "ctober #+, #%1# appellant re'uested the Postmaster :eneral to reconsider the action ta3en by his office deducting the

sum of P+)).)) from the clearing account of the 6an3 of America, but his re'uest ,as denied. o ,as appellant9s subse'uent

re'uest that the matter be referred to the ecretary of ;ustice for advice. 5hereafter, appellant elevated the matter to the

ecretary of Public <or3s and Communications, but the latter sustained the actions ta3en by the postal officers.

In connection ,ith the events set forth above, Montinola ,as charged ,ith theft in the Court of First Instance of Manila

(Criminal Case 8o. 07$11* but after trial he ,as ac'uitted on the ground of reasonable doubt.

"n ;anuary $, #%1+ appellant filed an action against appellees in the Municipal Court of Manila praying for =udgment as

follo,s>

<?E!EF"!E, plaintiff prays that after hearing defendants be ordered>

(a* 5o countermand the notice given to the 6an3 of America on eptember +2, #%1#, deducting from the said

6an39s clearing account the sum of P+)).)) represented by postal money order 8o. #+01$$, or in the

alternative indemnify the plaintiff in the same amount ,ith interest at $-@A per annum from eptember +2,

#%1#, ,hich is the rate of interest being paid by plaintiff on its overdraft accountB

(b* 5o pay to the plaintiff out of their o,n personal funds, =ointly and severally, actual and moral damages in the

amount of P#,))).)) or in such amount as ,ill be proved andCor determined by this ?onorable Court>

eDemplary damages in the amount of P#,))).)), attorney9s fees of P#,))).)), and the costs of action.

Plaintiff also prays for such other and further relief as may be deemed =ust and e'uitable.

"n 8ovember #2, #%1+, after the parties had submitted the stipulation of facts reproduced at pages #+ to #& of the !ecord on

Appeal, the above-named court rendered =udgment as follo,s>

<?E!EF"!E, =udgment is hereby rendered, ordering the defendants to countermand the notice given to the

6an3 of America on eptember +2, #%1#, deducting from said 6an39s clearing account the sum of P+)).))

representing the amount of postal money order 8o. #+01$$, or in the alternative, to indemnify the plaintiff in the

said sum of P+)).)) ,ith interest thereon at the rate of $-@A per annum from eptember +2, #%1# until fully

paidB ,ithout any pronouncement as to cost and attorney9s fees.

5he case ,as appealed to the Court of First Instance of Manila ,here, after the parties had resubmitted the same stipulation of

facts, the appealed decision dismissing the complaint, ,ith costs, ,as rendered.

5he first, second and fifth assignments of error discussed in appellant9s brief are related to the other and ,ill therefore be

discussed =ointly. 5hey raise this main issue> that the postal money order in 'uestion is a negotiable instrumentB that its nature

as such is not in any,ay affected by the letter dated "ctober +1, #%0$ signed by the 4irector of Posts and addressed to all

ban3s ,ith a clearing account ,ith the Post "ffice, and that money orders, once issued, create a contractual relationship of

debtor and creditor, respectively, bet,een the government, on the one hand, and the remitters payees or endorses, on the

other.

It is not disputed that our postal statutes ,ere patterned after statutes in force in the Enited tates. For this reason, ours are

generally construed in accordance ,ith the construction given in the Enited tates to their o,n postal statutes, in the absence

of any special reason =ustifying a departure from this policy or practice. 5he ,eight of authority in the Enited tates is that

postal money orders are not negotiable instruments (6olognesi vs. E.. #$% Fed. 7%&B E.. vs. toc3 4ra,ers 8ational 6an3,

7) Fed. %#+*, the reason behind this rule being that, in establishing and operating a postal money order system, the

government is not engaging in commercial transactions but merely eDercises a governmental po,er for the public benefit.

It is to be noted in this connection that some of the restrictions imposed upon money orders by postal la,s and regulations are

inconsistent ,ith the character of negotiable instruments. For instance, such la,s and regulations usually provide for not more

than one endorsementB payment of money orders may be ,ithheld under a variety of circumstances (0% C.;. ##&7*.

"f particular application to the postal money order in 'uestion are the conditions laid do,n in the letter of the 4irector of Posts

of "ctober +1, #%0$ (EDhibit 7* to the 6an3 of America for the redemption of postal money orders received by it from its

depositors. Among others, the condition is imposed that Fin cases of adverse claim, the money order or money orders involved

,ill be returned to you (the ban3* and the, corresponding amount ,ill have to be refunded to the Postmaster, Manila, ,ho

reserves the right to deduct the value thereof from any amount due you if such step is deemed necessary.F 5he conditions thus

imposed in order to enable the ban3 to continue en=oying the facilities theretofore en=oyed by its depositors, ,ere accepted by

the 6an3 of America. 5he latter is therefore bound by them. 5hat it is so is clearly referred from the fact that, upon receiving

advice that the amount represented by the money order in 'uestion had been deducted from its clearing account ,ith the

Manila Post "ffice, it did not file any protest against such action.

Moreover, not being a party to the understanding eDisting bet,een the postal officers, on the one hand, and the 6an3 of

America, on the other, appellant has no right to assail the terms and conditions thereof on the ground that the letter setting

forth the terms and conditions aforesaid is void because it ,as not issued by a 4epartment ?ead in accordance ,ith ec. 2%

(6* of the !evised Administrative Code. In reality, ho,ever, said legal provision does not apply to the letter in 'uestion because

it does not provide for a department regulation but merely sets do,n certain conditions upon the privilege granted to the 6an3

of Amrica to accept and pay postal money orders presented for payment at the Manila Post "ffice. uch being the case, it is

clear that the 4irector of Posts had ample authority to issue it pursuant to ec. ##%) of the !evised Administrative Code.

In vie, of the foregoing, <e do not find it necessary to resolve the issues raised in the third and fourth assignments of error.

<?E!EF"!E, the appealed decision being in accordance ,ith la,, the same is hereby affirmed ,ith costs.

Concepcion, C."., #eyes, ".$.%., Ma&alintal, 'aldi(ar, )ernando, Teehan&ee, $arredo and *illa+or, ""., concur.

Castro and Makasiar, JJ., took no part.

CALTE# $PHILIPPINE!%, INC., petitioner,

vs.

COURT O& APPEAL! 'n( !ECURIT) *AN+ AND TRU!T COPAN), respondents.

$ito, %ozada, Orte!a , Castillo for petitioners.

-epo+uceno, .ofile/a , Guin!ona for pri(ate.

REGALADO, J.:

5his petition for revie, on certiorari impugns and see3s the reversal of the decision promulgated by respondent court on March

$, #%%# in CA-:.!. CG 8o. +71#&

1

affirming ,ith modifications, the earlier decision of the !egional 5rial Court of Manila,

6ranch H-II,

2

,hich dismissed the complaint filed therein by herein petitioner against respondent ban3.

5he undisputed bac3ground of this case, as found by the court a 0uo and adopted by respondent court, appears of record>

#. "n various dates, defendant, a commercial ban3ing institution, through its ucat 6ranch issued +$)

certificates of time deposit (C54s* in favor of one Angel dela Cru/ ,ho deposited ,ith herein defendant the

aggregate amount of P#,#+),))).)), as follo,s> (;oint Partial tipulation of Facts and tatement of Issues,

"riginal !ecords, p. +)2B 4efendant9s EDhibits # to +$)*B

CT1 CT1

1ates Serial -os. 2uantity A+ount

++ Feb. $+ %)#)# to %)#+) +) P$),)))

+1 Feb. $+ 201)+ to 201%# %) 71),)))

+ Mar. $+ 202)# to 2020) 0) #1),)))

0 Mar. $+ %)#+2 to %)#01 +) $),)))

& Mar. $+ 202%2 to %0$)) 0 #1,)))

& Mar. $+ $%%1& to $%%$1 ++ $$,)))

& Mar. $+ 2)#02 to %)#&) 0 #1,)))

$ Mar. $+ %)))# to %))+) +) $),)))

% Mar. $+ %))+7 to %))&) +$ ##+,)))

% Mar. $+ $%%%# to %)))) #) 0),)))

% Mar. $+ %)+&# to %)+2+ ++ $$,)))

III IIII

5otal +$) P#,#+),)))

JJJJJ JJJJJJJJ

+. Angel dela Cru/ delivered the said certificates of time (C54s* to herein plaintiff in connection ,ith his

purchased of fuel products from the latter ("riginal !ecord, p. +)$*.

7. ometime in March #%$+, Angel dela Cru/ informed Mr. 5imoteo 5iangco, the ucat 6ranch Manger, that he

lost all the certificates of time deposit in dispute. Mr. 5iangco advised said depositor to eDecute and submit a

notari/ed Affidavit of -oss, as re'uired by defendant ban39s procedure, if he desired replacement of said lost

C54s (58, February %, #%$2, pp. 0$-&)*.

0. "n March #$, #%$+, Angel dela Cru/ eDecuted and delivered to defendant ban3 the re'uired Affidavit of -oss

(4efendant9s EDhibit +$#*. "n the basis of said affidavit of loss, +$) replacement C54s ,ere issued in favor of

said depositor (4efendant9s EDhibits +$+-&1#*.

&. "n March +&, #%$+, Angel dela Cru/ negotiated and obtained a loan from defendant ban3 in the amount of

Eight ?undred eventy Five 5housand Pesos (P$2&,))).))*. "n the same date, said depositor eDecuted a

notari/ed 4eed of Assignment of 5ime 4eposit (EDhibit &1+* ,hich stated, among others, that he (de la Cru/*

surrenders to defendant ban3 Ffull control of the indicated time deposits from and after dateF of the assignment

and further authori/es said ban3 to pre-terminate, set-off and Fapply the said time deposits to the payment of

,hatever amount or amounts may be dueF on the loan upon its maturity (58, February %, #%$2, pp. 1)-1+*.

1. ometime in 8ovember, #%$+, Mr. Aranas, Credit Manager of plaintiff CalteD (Phils.* Inc., ,ent to the

defendant ban39s ucat branch and presented for verification the C54s declared lost by Angel dela Cru/

alleging that the same ,ere delivered to herein plaintiff Fas security for purchases made ,ith CalteD

Philippines, Inc.F by said depositor (58, February %, #%$2, pp. &0-1$*.

2. "n 8ovember +1, #%$+, defendant received a letter (4efendant9s EDhibit &17* from herein plaintiff formally

informing it of its possession of the C54s in 'uestion and of its decision to pre-terminate the same.

$. "n 4ecember $, #%$+, plaintiff ,as re'uested by herein defendant to furnish the former Fa copy of the

document evidencing the guarantee agreement ,ith Mr. Angel dela Cru/F as ,ell as Fthe details of Mr. Angel

dela Cru/F obligation against ,hich plaintiff proposed to apply the time deposits (4efendant9s EDhibit &10*.

%. 8o copy of the re'uested documents ,as furnished herein defendant.

#). Accordingly, defendant ban3 re=ected the plaintiff9s demand and claim for payment of the value of the C54s

in a letter dated February 2, #%$7 (4efendant9s EDhibit &11*.

##. In April #%$7, the loan of Angel dela Cru/ ,ith the defendant ban3 matured and fell due and on August &,

#%$7, the latter set-off and applied the time deposits in 'uestion to the payment of the matured loan (58,

February %, #%$2, pp. #7)-#7#*.

#+. In vie, of the foregoing, plaintiff filed the instant complaint, praying that defendant ban3 be ordered to pay

it the aggregate value of the certificates of time deposit of P#,#+),))).)) plus accrued interest and

compounded interest therein at #1A per annu+, moral and eDemplary damages as ,ell as attorney9s fees.

After trial, the court a 0uo rendered its decision dismissing the instant complaint.

3

"n appeal, as earlier stated, respondent court affirmed the lo,er court9s dismissal of the complaint, hence this petition ,herein

petitioner faults respondent court in ruling (#* that the sub=ect certificates of deposit are non-negotiable despite being clearly

negotiable instrumentsB (+* that petitioner did not become a holder in due course of the said certificates of depositB and (7* in

disregarding the pertinent provisions of the Code of Commerce relating to lost instruments payable to bearer.

4

5he instant petition is bereft of merit.

A sample teDt of the certificates of time deposit is reproduced belo, to provide a better understanding of the issues involved in

this recourse.

ECE!I5K 6A8L

A84 5!E5 C"MPA8K

122$ Ayala Ave., Ma3ati 8o. %)#)#

Metro Manila, Philippines

ECA5 "FFICEP 0,))).))

CE!5IFICA5E "F 4EP"I5

!ate #1A

4ate of Maturity FE6. +7, #%$0 FE6 ++, #%$+, #%MMMM

5his is to Certify that 6 E A ! E ! has deposited in this 6an3 the sum of PE"> F"E!

5?"EA84 "8-K, ECE!I5K 6A8L ECA5 "FFICE P0,))) N )) C5 Pesos, Philippine

Currency, repayable to said depositor 27# days. after date, upon presentation and surrender of

this certificate, ,ith interest at the rate of #1A per cent per annu+.

(gd. Illegible* (gd. Illegible*

IIIIIIIIII IIIIIIIIIII

AE5?"!IOE4 I:8A5E!E

5

!espondent court ruled that the C54s in 'uestion are non-negotiable instruments, nationali/ing as follo,s>

. . . <hile it may be true that the ,ord FbearerF appears rather boldly in the C54s issued, it is important to note

that after the ,ord F6EA!E!F stamped on the space provided supposedly for the name of the depositor, the

,ords Fhas depositedF a certain amount follo,s. 5he document further provides that the amount deposited

shall be Frepayable to said depositorF on the period indicated. 5herefore, the teDt of the instrument(s*

themselves manifest ,ith clarity that they are payable, not to ,hoever purports to be the FbearerF but only to

the specified person indicated therein, the depositor. In effect, the appellee ban3 ac3no,ledges its depositor

Angel dela Cru/ as the person ,ho made the deposit and further engages itself to pay said depositor the

amount indicated thereon at the stipulated date.

,

<e disagree ,ith these findings and conclusions, and hereby hold that the C54s in 'uestion are negotiable instruments.

ection # Act 8o. +)7#, other,ise 3no,n as the 8egotiable Instruments -a,, enumerates the re'uisites for an instrument to

become negotiable, (iz>

(a* It must be in ,riting and signed by the ma3er or dra,erB

(b* Must contain an unconditional promise or order to pay a sum certain in moneyB

(c* Must be payable on demand, or at a fiDed or determinable future timeB

(d* Must be payable to order or to bearerB and

(e* <here the instrument is addressed to a dra,ee, he must be named or other,ise indicated therein ,ith

reasonable certainty.

5he C54s in 'uestion undoubtedly meet the re'uirements of the la, for negotiability. 5he parties9 bone of contention is ,ith

regard to re'uisite (d* set forth above. It is noted that Mr. 5imoteo P. 5iangco, ecurity 6an39s 6ranch Manager ,ay bac3 in

#%$+, testified in open court that the depositor reffered to in the C54s is no other than Mr. Angel de la Cru/.

DDD DDD DDD

Atty. Calida>

' In other ,ords Mr. <itness, you are saying that per boo3s of the ban3, the depositor referred

(sic* in these certificates states that it ,as Angel dela Cru/P

,itness>

a Kes, your ?onor, and ,e have the record to sho, that Angel dela Cru/ ,as the one ,ho

cause (sic* the amount.

Atty. Calida>

' And no other person or entity or company, Mr. <itnessP

,itness>

a 8one, your ?onor.

7

DDD DDD DDD

Atty. Calida>

' Mr. <itness, ,ho is the depositor identified in all of these certificates of time deposit insofar

as the ban3 is concernedP

,itness>

a Angel dela Cru/ is the depositor. -

DDD DDD DDD

"n this score, the accepted rule is that the negotiability or non-negotiability of an instrument is determined from the ,riting, that

is, from the face of the instrument itself. In the construction of a bill or note, the intention of the parties is to control, if it can be

legally ascertained. <hile the ,riting may be read in the light of surrounding circumstances in order to more perfectly

understand the intent and meaning of the parties, yet as they have constituted the ,riting to be the only out,ard and visible

eDpression of their meaning, no other ,ords are to be added to it or substituted in its stead. 5he duty of the court in such case

is to ascertain, not ,hat the parties may have secretly intended as contradistinguished from ,hat their ,ords eDpress, but ,hat

is the meaning of the ,ords they have used. <hat the parties meant must be determined by ,hat they said.

Contrary to ,hat respondent court held, the C54s are negotiable instruments. 5he documents provide that the amounts

deposited shall be repayable to the depositor. And ,ho, according to the document, is the depositorP It is the Fbearer.F 5he

documents do not say that the depositor is Angel de la Cru/ and that the amounts deposited are repayable specifically to him.

!ather, the amounts are to be repayable to the bearer of the documents or, for that matter, ,hosoever may be the bearer at

the time of presentment.

If it ,as really the intention of respondent ban3 to pay the amount to Angel de la Cru/ only, it could have ,ith facility so

eDpressed that fact in clear and categorical terms in the documents, instead of having the ,ord F6EA!E!F stamped on the

space provided for the name of the depositor in each C54. "n the ,ordings of the documents, therefore, the amounts

deposited are repayable to ,hoever may be the bearer thereof. 5hus, petitioner9s aforesaid ,itness merely declared that Angel

de la Cru/ is the depositor Finsofar as the ban3 is concerned,F but obviously other parties not privy to the transaction bet,een

them ,ould not be in a position to 3no, that the depositor is not the bearer stated in the C54s. Hen.e, /0e 12/u'/2on 3ou4(

5e6u25e 'n7 8'5/7 (e'42n9 32/0 /0e CTD1 /o 9o :e02n( /0e 84'2n 2;8o5/ o< 30'/ 21 352//en /0e5eon /o un5'=e4 /0e

'95ee;en/ o< /0e 8'5/2e1 /0e5e/o /05ou90 <'./1 aliunde. T021 nee( <o5 5e1o5/ /o e>/52n12. e=2(en.e 21 30'/ 21 1ou90/ /o

:e '=o2(e( :7 /0e Ne9o/2':4e In1/5u;en/1 L'3 'n( .'441 <o5 /0e '8842.'/2on o< /0e e4e;en/'57 5u4e /0'/ /0e

2n/e585e/'/2on o< o:1.u5e 3o5(1 o5 1/28u4'/2on1 2n ' .on/5'./ 10'44 no/ <'=o5 /0e 8'5/7 30o .'u1e( /0e o:1.u52/7.

The next query is whether petitioner can rightfully recover on the CTDs. This tie, the answer is in the negative. 5he

records reveal that Angel de la Cru/, ,hom petitioner chose not to implead in this suit for reasons of its o,n, delivered the

C54s amounting to P#,#+),))).)) to petitioner ,ithout informing respondent ban3 thereof at any time. Enfortunately for

petitioner, although the C54s are bearer instruments, a valid negotiation thereof for the true purpose and agreement bet,een it

and 4e la Cru/, as ultimately ascertained, re'uires both delivery and indorsement. For, although petitioner see3s to deflect this

fact, the C54s ,ere in reality delivered to it as a security for 4e la Cru/9 purchases of its fuel products. Any doubt as to

,hether the C54s ,ere delivered as payment for the fuel products or as a security has been dissipated and resolved in favor

of the latter by petitioner9s o,n authori/ed and responsible representative himself.

In a letter dated 8ovember +1, #%$+ addressed to respondent ecurity 6an3, ;... Aranas, ;r., CalteD Credit Manager, ,rote> F.

. . 5hese certificates of deposit ,ere negotiated to us by Mr. Angel dela Cru/ to !uarantee his purchases of fuel productsF

(Emphasis ours.* 5his admission is conclusive upon petitioner, its protestations not,ithstanding. Ender the doctrine of

estoppel, an admission or representation is rendered conclusive upon the person ma3ing it, and cannot be denied or disproved

as against the person relying thereon. A party may not go bac3 on his o,n acts and representations to the pre=udice of the

other party ,ho relied upon them. In the la, of evidence, ,henever a party has, by his o,n declaration, act, or omission,

intentionally and deliberately led another to believe a particular thing true, and to act upon such belief, he cannot, in any

litigation arising out of such declaration, act, or omission, be permitted to falsify it.

If it ,ere true that the C54s ,ere delivered as payment and not as security, petitioner9s credit manager could have easily said

so, instead of using the ,ords Fto guaranteeF in the letter afore'uoted. 6esides, ,hen respondent ban3, as defendant in the

court belo,, moved for a bill of particularity therein praying, among others, that petitioner, as plaintiff, be re'uired to aver ,ith

sufficient definiteness or particularity (a* the due date or dates of pay+ent of the alleged indebtedness of Angel de la Cru/ to

plaintiff and (b* ,hether or not it issued a receipt sho,ing that the C54s ,ere delivered to it by 4e la Cru/ as pay+ent of the

latter9s alleged indebtedness to it, plaintiff corporation opposed the motion. ?ad it produced the receipt prayed for, it could have

proved, if such truly ,as the fact, that the C54s ,ere delivered as payment and not as security. ?aving opposed the motion,

petitioner no, labors under the presumption that evidence ,illfully suppressed ,ould be adverse if produced.

Ender the foregoing circumstances, this dis'uisition in Inter!rated #ealty Corporation, et al. (s. 3hilippine -ational $an&, et al .

is apropos>

. . . Adverting again to the Court9s pronouncements in %opez, supra, ,e 'uote therefrom>

5he character of the transaction bet,een the parties is to be determined by their intention,

regardless of ,hat language ,as used or ,hat the form of the transfer ,as. If it ,as intended

to secure the payment of money, it must be construed as a pledgeB but if there ,as some other

intention, it is not a pledge. ?o,ever, even though a transfer, if regarded by itself, appears to

have been absolute, its ob=ect and character might still be 'ualified and eDplained by

contemporaneous ,riting declaring it to have been a deposit of the property as collateral

security. It has been said that a transfer of property by the debtor to a creditor, even if sufficient

on its face to ma3e an absolute conveyance, should be treated as a pledge if the debt

continues in ineDistence and is not discharged by the transfer, and that accordingly the use of

the terms ordinarily importing conveyance of absolute o,nership ,ill not be given that effect in

such a transaction if they are also commonly used in pledges and mortgages and therefore do

not un'ualifiedly indicate a transfer of absolute o,nership, in the absence of clear and

unambiguous language or other circumstances eDcluding an intent to pledge.

Petitioner9s insistence that the C54s ,ere negotiated to it begs the 'uestion. Ender the 8egotiable Instruments -a,, an

instrument is negotiated ,hen it is transferred from one person to another in such a manner as to constitute the transferee the

holder thereof, and a holder may be the payee or indorsee of a bill or note, ,ho is in possession of it, or the bearer thereof. In

the present case, ho,ever, there ,as no negotiation in the sense of a transfer of the legal title to the C54s in favor of petitioner

in ,hich situation, for obvious reasons, mere delivery of the bearer C54s ,ould have sufficed. ?ere, the delivery thereof only

as security for the purchases of Angel de la Cru/ (and ,e even disregard the fact that the amount involved ,as not disclosed*

could at the most constitute petitioner only as a holder for value by reason of his lien. Accordingly, a negotiation for such

purpose cannot be effected by mere delivery of the instrument since, necessarily, the terms thereof and the subse'uent

disposition of such security, in the event of non-payment of the principal obligation, must be contractually provided for.

5he pertinent la, on this point is that ,here the holder has a lien on the instrument arising from contract, he is deemed a

holder for value to the eDtent of his lien. As such holder of collateral security, he ,ould be a pledgee but the re'uirements

therefor and the effects thereof, not being provided for by the 8egotiable Instruments -a,, shall be governed by the Civil Code

provisions on pledge of incorporeal rights, ,hich inceptively provide>

Art. +)%&. Incorporeal rights, evidenced by negotiable instruments, . . . may also be pledged. 5he instrument

proving the right pledged shall be delivered to the creditor, and if negotiable, must be indorsed.

Art. +)%1. A pledge shall not ta3e effect against third persons if a description of the thing pledged and the date

of the pledge do not appear in a public instrument.

Aside from the fact that the C54s ,ere only delivered but not indorsed, the factual findings of respondent court 'uoted at the

start of this opinion sho, that petitioner failed to produce any document evidencing any contract of pledge or guarantee

agreement bet,een it and Angel de la Cru/. Conse'uently, the mere delivery of the C54s did not legally vest in petitioner any

right effective against and binding upon respondent ban3. 5he re'uirement under Article +)%1 aforementioned is not a mere

rule of ad=ective la, prescribing the mode ,hereby proof may be made of the date of a pledge contract, but a rule of

substantive la, prescribing a condition ,ithout ,hich the eDecution of a pledge contract cannot affect third persons adversely.

"n the other hand, the assignment of the C54s made by Angel de la Cru/ in favor of respondent ban3 ,as embodied in a

public instrument. <ith regard to this other mode of transfer, the Civil Code specifically declares>

Art. #1+&. An assignment of credit, right or action shall produce no effect as against third persons, unless it

appears in a public instrument, or the instrument is recorded in the !egistry of Property in case the assignment

involves real property.

!espondent ban3 duly complied ,ith this statutory re'uirement. Contrarily, petitioner, ,hether as purchaser, assignee or lien

holder of the C54s, neither proved the amount of its credit or the eDtent of its lien nor the eDecution of any public instrument

,hich could affect or bind private respondent. 8ecessarily, therefore, as bet,een petitioner and respondent ban3, the latter has

definitely the better right over the C54s in 'uestion.

Finally, petitioner faults respondent court for refusing to delve into the 'uestion of ,hether or not private respondent observed

the re'uirements of the la, in the case of lost negotiable instruments and the issuance of replacement certificates therefor, on

the ground that petitioner failed to raised that issue in the lo,er court.

"n this matter, ,e uphold respondent court9s finding that the aspect of alleged negligence of private respondent ,as not

included in the stipulation of the parties and in the statement of issues submitted by them to the trial court. 5he issues agreed

upon by them for resolution in this case are>

#. <hether or not the C54s as ,orded are negotiable instruments.

+. <hether or not defendant could legally apply the amount covered by the C54s against the depositor9s loan

by virtue of the assignment (AnneD FCF*.

7. <hether or not there ,as legal compensation or set off involving the amount covered by the C54s and the

depositor9s outstanding account ,ith defendant, if any.

0. <hether or not plaintiff could compel defendant to preterminate the C54s before the maturity date provided

therein.

&. <hether or not plaintiff is entitled to the proceeds of the C54s.

1. <hether or not the parties can recover damages, attorney9s fees and litigation eDpenses from each other.

As respondent court correctly observed, ,ith appropriate citation of some doctrinal authorities, the foregoing enumeration does

not include the issue of negligence on the part of respondent ban3. An issue raised for the first time on appeal and not raised

timely in the proceedings in the lo,er court is barred by estoppel. .uestions raised on appeal must be ,ithin the issues framed

by the parties and, conse'uently, issues not raised in the trial court cannot be raised for the first time on appeal.

Pre-trial is primarily intended to ma3e certain that all issues necessary to the disposition of a case are properly raised. 5hus, to

obviate the element of surprise, parties are eDpected to disclose at a pre-trial conference all issues of la, and fact ,hich they

intend to raise at the trial, eDcept such as may involve privileged or impeaching matters. 5he determination of issues at a pre-

trial conference bars the consideration of other 'uestions on appeal.

5o accept petitioner9s suggestion that respondent ban39s supposed negligence may be considered encompassed by the issues

on its right to preterminate and receive the proceeds of the C54s ,ould be tantamount to saying that petitioner could raise on

appeal any issue. <e agree ,ith private respondent that the broad ultimate issue of petitioner9s entitlement to the proceeds of

the 'uestioned certificates can be premised on a multitude of other legal reasons and causes of action, of ,hich respondent

ban39s supposed negligence is only one. ?ence, petitioner9s submission, if accepted, ,ould render a pre-trial delimitation of

issues a useless eDercise.

till, even assuming ar!uendo that said issue of negligence ,as raised in the court belo,, petitioner still cannot have the odds

in its favor. A close scrutiny of the provisions of the Code of Commerce laying do,n the rules to be follo,ed in case of lost

instruments payable to bearer, ,hich it invo3es, ,ill reveal that said provisions, even assuming their applicability to the C54s in

the case at bar, are merely permissive and not mandatory. 5he very first article cited by petitioner spea3s for itself.

Art &0$. 5he dispossessed o4ner, no matter for ,hat cause it may be, +ay apply to the =udge or court of

competent =urisdiction, as3ing that the principal, interest or dividends due or about to become due, be not paid

a third person, as ,ell as in order to prevent the o,nership of the instrument that a duplicate be issued him.

(Emphasis ours.*

DDD DDD DDD

5he use of the ,ord FmayF in said provision sho,s that it is not mandatory but discretionary on the part of the Fdispossessed

o,nerF to apply to the =udge or court of competent =urisdiction for the issuance of a duplicate of the lost instrument. <here the

provision reads Fmay,F this ,ord sho,s that it is not mandatory but discretional. 5he ,ord FmayF is usually permissive, not

mandatory. It is an auDiliary verb indicating liberty, opportunity, permission and possibility.

Moreover, as correctly analy/ed by private respondent, Articles &0$ to &&$ of the Code of Commerce, on ,hich petitioner

see3s to anchor respondent ban39s supposed negligence, merely established, on the one hand, a right of recourse in favor of a

dispossessed o,ner or holder of a bearer instrument so that he may obtain a duplicate of the same, and, on the other, an

option in favor of the party liable thereon ,ho, for some valid ground, may elect to refuse to issue a replacement of the

instrument. ignificantly, none of the provisions cited by petitioner categorically restricts or prohibits the issuance a duplicate or

replacement instrument sans compliance ,ith the procedure outlined therein, and none establishes a mandatory precedent

re'uirement therefor.

<?E!EF"!E, on the modified premises above set forth, the petition is 4E8IE4 and the appealed decision is hereby

AFFI!ME4.

" "!4E!E4.

!arvasa, C.J., "adilla and !ocon, JJ., concur.

G.R. No. ---,, &e:5u'57 1-, 1991

ETROPOLITAN *AN+ ? TRU!T COPAN), petitioner,

vs.

COURT O& APPEAL!, GOLDEN !A@ING! ? LOAN A!!OCIATION, INC., LUCIA CA!TILLO, AGNO CA!TILLO 'n(

GLORIA CA!TILLO, respondents.

An!ara, Abello, Concepcion, #e!ala , Cruz for petitioner.

$en!zon, 'arra!a, -arciso, Cudala, 3ecson , $en!son for Ma!no and %ucia Castillo.

A!apito S. )aardo and "ai+e M. Cabiles for respondent Golden Sa(in!s , %oan Association, Inc.

CRU", J.:p

5his case, for all its seeming compleDity, turns on a simple 'uestion of negligence. 5he facts, pruned of all non-essentials, are

easily told.

5he Metropolitan 6an3 and 5rust Co. is a commercial ban3 ,ith branches throughout the Philippines and even abroad. :olden

avings and -oan Association ,as, at the time these events happened, operating in Calapan, Mindoro, ,ith the other private

respondents as its principal officers.

In ;anuary #%2%, a certain Eduardo :ome/ opened an account ,ith :olden avings and deposited over a period of t,o

months 7$ treasury ,arrants ,ith a total value of P#,2&&,++$.72. 5hey ,ere all dra,n by the Philippine Fish Mar3eting

Authority and purportedly signed by its :eneral Manager and countersigned by its Auditor. iD of these ,ere directly payable to

:ome/ ,hile the others appeared to have been indorsed by their respective payees, follo,ed by :ome/ as second indorser.

1

"n various dates bet,een ;une +& and ;uly #1, #%2%, all these ,arrants ,ere subse'uently indorsed by :loria Castillo as

Cashier of :olden avings and deposited to its avings Account 8o. +0%$ in the Metroban3 branch in Calapan, Mindoro. 5hey

,ere then sent for clearing by the branch office to the principal office of Metroban3, ,hich for,arded them to the 6ureau of

5reasury for special clearing.

2

More than t,o ,ee3s after the deposits, :loria Castillo ,ent to the Calapan branch several times to as3 ,hether the ,arrants

had been cleared. he ,as told to ,ait. Accordingly, :ome/ ,as mean,hile not allo,ed to ,ithdra, from his account. -ater,

ho,ever, FeDasperatedF over :loria9s repeated in'uiries and also as an accommodation for a Fvalued client,F the petitioner

says it finally decided to allo, :olden avings to ,ithdra, from the proceeds of the

,arrants.

3

5he first ,ithdra,al ,as made on ;uly %, #%2%, in the amount of P&)$,))).)), the second on ;uly #7, #%2%, in the

amount of P7#),))).)), and the third on ;uly #1, #%2%, in the amount of P#&),))).)). 5he total ,ithdra,al ,as P%1$.))).)).

4

In turn, :olden avings subse'uently allo,ed :ome/ to ma3e ,ithdra,als from his o,n account, eventually collecting the

total amount of P#,#12,&)).)) from the proceeds of the apparently cleared ,arrants. 5he last ,ithdra,al ,as made on ;uly

#1, #%2%.

"n ;uly +#, #%2%, Metroban3 informed :olden avings that 7+ of the ,arrants had been dishonored by the 6ureau of 5reasury

on ;uly #%, #%2%, and demanded the refund by :olden avings of the amount it had previously ,ithdra,n, to ma3e up the

deficit in its account.

5he demand ,as re=ected. Metroban3 then sued :olden avings in the !egional 5rial Court of Mindoro.

5

After trial, =udgment

,as rendered in favor of :olden avings, ,hich, ho,ever, filed a motion for reconsideration even as Metroban3 filed its notice

of appeal. "n 8ovember 0, #%$1, the lo,er court modified its decision thus>

ACC"!4I8:-K, =udgment is hereby rendered>

#. 4ismissing the complaint ,ith costs against the plaintiffB

+. 4issolving and lifting the ,rit of attachment of the properties of defendant :olden avings and -oan

Association, Inc. and defendant pouses Magno Castillo and -ucia CastilloB

7. 4irecting the plaintiff to reverse its action of debiting avings Account 8o. +0%$ of the sum of P#,2&0,)$%.))

and to reinstate and credit to such account such amount eDisting before the debit ,as made including the

amount of P$#+,)77.72 in favor of defendant :olden avings and -oan Association, Inc. and thereafter, to

allo, defendant :olden avings and -oan Association, Inc. to ,ithdra, the amount outstanding thereon

before the debitB

0. "rdering the plaintiff to pay the defendant :olden avings and -oan Association, Inc. attorney9s fees and

eDpenses of litigation in the amount of P+)),))).)).

&. "rdering the plaintiff to pay the defendant pouses Magno Castillo and -ucia Castillo attorney9s fees and

eDpenses of litigation in the amount of P#)),))).)).

" "!4E!E4.

"n appeal to the respondent court,

,

the decision ,as affirmed, prompting Metroban3 to file this petition for revie, on the

follo,ing grounds>

#. !espondent Court of Appeals erred in disregarding and failing to apply the clear contractual terms and

conditions on the deposit slips allo,ing Metroban3 to charge bac3 any amount erroneously credited.

(a* Metroban39s right to charge bac3 is not limited to instances ,here the chec3s or treasury ,arrants are

forged or unauthori/ed.

(b* Entil such time as Metroban3 is actually paid, its obligation is that of a mere collecting agent ,hich cannot

be held liable for its failure to collect on the ,arrants.

+. Ender the lo,er court9s decision, affirmed by respondent Court of Appeals, Metroban3 is made to pay for

,arrants already dishonored, thereby perpetuating the fraud committed by Eduardo :ome/.

7. !espondent Court of Appeals erred in not finding that as bet,een Metroban3 and :olden avings, the latter

should bear the loss.

0. !espondent Court of Appeals erred in holding that the treasury ,arrants involved in this case are not

negotiable instruments.

5he petition has no merit.

From the above undisputed facts, it ,ould appear to the Court that Metroban3 ,as indeed negligent in giving :olden avings

the impression that the treasury ,arrants had been cleared and that, conse'uently, it ,as safe to allo, :ome/ to ,ithdra, the

proceeds thereof from his account ,ith it. <ithout such assurance, :olden avings ,ould not have allo,ed the ,ithdra,alsB

,ith such assurance, there ,as no reason not to allo, the ,ithdra,al. Indeed, :olden avings might even have incurred

liability for its refusal to return the money that to all appearances belonged to the depositor, ,ho could therefore ,ithdra, it any

time and for any reason he sa, fit.

It ,as, in fact, to secure the clearance of the treasury ,arrants that :olden avings deposited them to its account ,ith

Metroban3. :olden avings had no clearing facilities of its o,n. It relied on Metroban3 to determine the validity of the ,arrants

through its o,n services. 5he proceeds of the ,arrants ,ere ,ithheld from :ome/ until Metroban3 allo,ed :olden avings

itself to ,ithdra, them from its o,n deposit.

7

It ,as only ,hen Metroban3 gave the go-signal that :ome/ ,as finally allo,ed

by :olden avings to ,ithdra, them from his o,n account.

5he argument of Metroban3 that :olden avings should have eDercised more care in chec3ing the personal circumstances of

:ome/ before accepting his deposit does not hold ,ater. It ,as :ome/ ,ho ,as entrusting the ,arrants, not :olden avings

that ,as eDtending him a loanB and moreover, the treasury ,arrants ,ere sub=ect to clearing, pending ,hich the depositor

could not ,ithdra, its proceeds. 5here ,as no 'uestion of :ome/9s identity or of the genuineness of his signature as chec3ed

by :olden avings. In fact, the treasury ,arrants ,ere dishonored allegedly because of the forgery of the signatures of the

dra,ers, not of :ome/ as payee or indorser. Ender the circumstances, it is clear that :olden avings acted ,ith due care and

diligence and cannot be faulted for the ,ithdra,als it allo,ed :ome/ to ma3e.

6y contrast, Metroban3 eDhibited eDtraordinary carelessness. 5he amount involved ,as not trifling I more than one and a half

million pesos (and this ,as #%2%*. 5here ,as no reason ,hy it should not have ,aited until the treasury ,arrants had been

clearedB it ,ould not have lost a single centavo by ,aiting. Ket, despite the lac3 of such clearance I and not,ithstanding that it

had not received a single centavo from the proceeds of the treasury ,arrants, as it no, repeatedly stresses I it allo,ed

:olden avings to ,ithdra, I not once, not t,ice, but thrice 5 from the uncleared treasury ,arrants in the total amount of

P%1$,))).))

Its reasonP It ,as FeDasperatedF over the persistent in'uiries of :loria Castillo about the clearance and it also ,anted to

FaccommodateF a valued client. It FpresumedF that the ,arrants had been cleared simply because of Fthe lapse of one ,ee3.F

-

For a ban3 ,ith its long eDperience, this eDplanation is unbelievably naive.

And no,, to gloss over its carelessness, Metroban3 ,ould invo3e the conditions printed on the dorsal side of the deposit slips

through ,hich the treasury ,arrants ,ere deposited by :olden avings ,ith its Calapan branch. 5he conditions read as

follo,s>

6indly note that in recei(in! ite+s on deposit, the ban& obli!ates itself only as the depositor7s collectin! a!ent,

assu+in! no responsibility beyond care in selectin! correspondents, and until such time as actual payment

shall have come into possession of this ban3, the ri!ht is reser(ed to char!e bac& to the depositor7s account

any a+ount pre(iously credited, 4hether or not such ite+ is returned. This also applies to chec&s dra,n on

local ban3s and ban3ers and their branches as ,ell as on this ban3, 4hich are unpaid due to insufficiency of

funds, forgery, unauthori/ed overdraft or any other reason. (Emphasis supplied.*

According to Metroban3, the said conditions clearly sho, that it ,as acting only as a collecting agent for :olden avings and

give it the right to Fcharge bac3 to the depositor9s account any amount previously credited, ,hether or not such item is

returned. 5his also applies to chec3s F. . . ,hich are unpaid due to insufficiency of funds, forgery, unauthori/ed overdraft of any

other reason.F It is claimed that the said conditions are in the nature of contractual stipulations and became binding on :olden

avings ,hen :loria Castillo, as its Cashier, signed the deposit slips.

4oubt may be eDpressed about the binding force of the conditions, considering that they have apparently been imposed by the

ban3 unilaterally, ,ithout the consent of the depositor. Indeed, it could be argued that the depositor, in signing the deposit slip,

does so only to identify himself and not to agree to the conditions set forth in the given permit at the bac3 of the deposit slip.

<e do not have to rule on this matter at this time. At any rate, the Court feels that even if the deposit slip ,ere considered a

contract, the petitioner could still not validly disclaim responsibility thereunder in the light of the circumstances of this case.

In stressing that it ,as acting only as a collecting agent for :olden avings, Metroban3 seems to be suggesting that as a mere

agent it cannot be liable to the principal. 5his is not eDactly true. "n the contrary, Article #%)% of the Civil Code clearly provides

that I

Art. #%)%. I 5he agent is responsible not only for fraud, but also for negligence, ,hich shall be =udged 9,ith

more or less rigor by the courts, according to ,hether the agency ,as or ,as not for a compensation.

5he negligence of Metroban3 has been sufficiently established. 5o repeat for emphasis, it ,as the clearance given by it that

assured :olden avings it ,as already safe to allo, :ome/ to ,ithdra, the proceeds of the treasury ,arrants he had

deposited Metroban3 +isled :olden avings. 5here may have been no eDpress clearance, as Metroban3 insists (although this

is refuted by :olden avings* but in any case that clearance could be implied from its allo,ing :olden avings to ,ithdra,

from its account not only once or even t,ice but three ti+es . 5he total ,ithdra,al ,as in eDcess of its original balance before

the treasury ,arrants ,ere deposited, ,hich only added to its belief that the treasury ,arrants had indeed been cleared.

Metroban39s argument that it may recover the disputed amount if the ,arrants are not paid for any reason is not acceptable.

Any reason does not mean no reason at all. "ther,ise, there ,ould have been no need at all for :olden avings to deposit the

treasury ,arrants ,ith it for clearance. 5here ,ould have been no need for it to ,ait until the ,arrants had been cleared before

paying the proceeds thereof to :ome/. uch a condition, if interpreted in the ,ay the petitioner suggests, is not binding for

being arbitrary and unconscionable. And it becomes more so in the case at bar ,hen it is considered that the supposed

dishonor of the ,arrants ,as not communicated to :olden avings before it made its o,n payment to :ome/.

5he belated notification aggravated the petitioner9s earlier negligence in giving eDpress or at least implied clearance to the

treasury ,arrants and allo,ing payments therefrom to :olden avings. 6ut that is not all. "n top of this, the supposed reason

for the dishonor, to ,it, the forgery of the signatures of the general manager and the auditor of the dra,er corporation, has not

been established.

9

5his ,as the finding of the lo,er courts ,hich ,e see no reason to disturb. And as ,e said in M< v.

Court of Appeals>

10

Forgery cannot be presumed (iasat, et al. v. IAC, et al., #7% C!A +7$*. It must be established by clear,

positive and convincing evidence. 5his ,as not done in the present case.

A no less important consideration is the circumstance that the treasury ,arrants in 'uestion are not negotiable instruments.

Clearly stamped on their face is the ,ord Fnon-negotiable.F Moreover, and this is of e'ual significance, it is indicated that they

are payable from a particular fund, to ,it, Fund &)#.

5he follo,ing sections of the 8egotiable Instruments -a,, especially the underscored parts, are pertinent>

ec. #. I )or+ of ne!otiable instru+ents. I An instrument to be negotiable must conform to the follo,ing

re'uirements>

(a* It must be in ,riting and signed by the ma3er or dra,erB

(b* Must contain an unconditional pro+ise or order to pay a su+ certain in +oneyB

(c* Must be payable on demand, or at a fiDed or determinable future timeB

(d* Must be payable to order or to bearerB and

(e* <here the instrument is addressed to a dra,ee, he must be named or other,ise indicated therein ,ith

reasonable certainty.

DDD DDD DDD

ec. 7. 8hen pro+ise is unconditional. I An un'ualified order or promise to pay is unconditional ,ithin the

meaning of this Act though coupled ,ith I

(a* An indication of a particular fund out of ,hich reimbursement is to be made or a particular account to be

debited ,ith the amountB or

(b* A statement of the transaction ,hich gives rise to the instrument =udgment.

$ut an order or pro+ise to pay out of a particular fund is not unconditional.

5he indication of Fund &)# as the source of the payment to be made on the treasury ,arrants ma3es the order or promise to

pay Fnot unconditionalF and the ,arrants themselves non-negotiable. 5here should be no 'uestion that the eDception on

ection 7 of the 8egotiable Instruments -a, is applicable in the case at bar. 5his conclusion conforms to Abuba3ar vs. Auditor

:eneral

11

,here the Court held>

5he petitioner argues that he is a holder in good faith and for value of a negotiable instrument and is entitled to

the rights and privileges of a holder in due course, free from defenses. 6ut this treasury ,arrant is not ,ithin

the scope of the negotiable instrument la,. For one thing, the document bearing on its face the ,ords Fpayable

from the appropriation for food administration, is actually an "rder for payment out of Fa particular fund,F and is

not unconditional and does not fulfill one of the essential re'uirements of a negotiable instrument (ec. 7 last

sentence and section Q#(b*R of the 8egotiable Instruments -a,*.

Metroban3 cannot contend that by indorsing the ,arrants in general, :olden avings assumed that they ,ere Fgenuine and in

all respects ,hat they purport to be,F in accordance ,ith ection 11 of the 8egotiable Instruments -a,. 5he simple reason is

that this la, is not applicable to the non-negotiable treasury ,arrants. 5he indorsement ,as made by :loria Castillo not for the

purpose of guaranteeing the genuineness of the ,arrants but merely to deposit them ,ith Metroban3 for clearing. It ,as in fact

Metroban3 that made the guarantee ,hen it stamped on the bac3 of the ,arrants> FAll prior indorsement andCor lac3 of

endorsements guaranteed, Metropolitan 6an3 N 5rust Co., Calapan 6ranch.F

5he petitioner lays heavy stress on ;ai Alai Corporation v. 6an3 of the Philippine Islands,

12

but ,e feel this case is

inapplicable to the present controversy. 5hat case involved chec3s ,hereas this case involves treasury ,arrants. :olden

avings never represented that the ,arrants ,ere negotiable but signed them only for the purpose of depositing them for

clearance. Also, the fact of forgery ,as proved in that case but not in the case before us. Finally, the Court found the ;ai Alai

Corporation negligent in accepting the chec3s ,ithout 'uestion from one Antonio !amire/ not,ithstanding that the payee ,as

the Inter-Island :as ervices, Inc. and it did not appear that he ,as authori/ed to indorse it. 8o similar negligence can be

imputed to :olden avings.

<e find the challenged decision to be basically correct. ?o,ever, ,e ,ill have to amend it insofar as it directs the petitioner to

credit :olden avings ,ith the full amount of the treasury chec3s deposited to its account.

5he total value of the 7+ treasury ,arrants dishonored ,as P#,2&0,)$%.)), from ,hich :ome/ ,as allo,ed to ,ithdra,

P#,#12,&)).)) before :olden avings ,as notified of the dishonor. 5he amount he has ,ithdra,n must be charged not to

:olden avings but to Metroban3, ,hich must bear the conse'uences of its o,n negligence. 6ut the balance of P&$1,&$%.))

should be debited to :olden avings, as obviously :ome/ can no longer be permitted to ,ithdra, this amount from his

deposit because of the dishonor of the ,arrants. :ome/ has in fact disappeared. 5o also credit the balance to :olden avings

,ould unduly enrich it at the eDpense of Metroban3, let alone the fact that it has already been informed of the dishonor of the

treasury ,arrants.

<?E!EF"!E, the challenged decision is AFFI!ME4, ,ith the modification that Paragraph 7 of the dispositive portion of the

=udgment of the lo,er court shall be re,orded as follo,s>

7. 4ebiting avings Account 8o. +0%$ in the sum of P&$1,&$%.)) only and thereafter allo,ing defendant

:olden avings N -oan Association, Inc. to ,ithdra, the amount outstanding thereon, if any, after the debit.

" "!4E!E4.

-ar(asa, Gancayco, Gri/o-A0uino and Medialdea, ""., concur.

G.R. No. -9252 '7 24, 1993

RAUL !E!*REAO, petitioner,

vs.

HON. COURT O& APPEAL!, DELTA OTOR! CORPORATION AND PILIPINA! *AN+, respondents.

Sal(a, *illanue(a , Associates for 1elta Motors Corporation.

#eyes, Salazar , Associates for 3ilipinas $an&.

&ELICIANO, J.:

"n % February #%$#, petitioner !aul esbreSo made a money mar3et placement in the amount of P7)),))).)) ,ith the

Philippine Ender,riters Finance Corporation (FPhilfinanceF*, Cebu 6ranchB the placement, ,ith a term of thirty-t,o (7+* days,

,ould mature on #7 March #%$#, Philfinance, also on % February #%$#, issued the follo,ing documents to petitioner>

(a* the Certificate of Confirmation of ale, F,ithout recourse,F 8o. +)0%1 of one (#* 4elta Motors Corporation

Promissory 8ote (F4MC P8F* 8o. +27# for a term of 7+ days at #2.)A per annu+B

(b* the Certificate of securities 4elivery !eceipt 8o. #1&$2 indicating the sale of 4MC P8 8o. +27# to

petitioner, ,ith the notation that the said security ,as in custodianship of Pilipinas 6an3, as per 4enominated

Custodian !eceipt (F4C!F* 8o. #)$)& dated % February #%$#B and

(c* post-dated chec3s payable on #7 March #%$# (i.e., the maturity date of petitioner9s investment*, ,ith

petitioner as payee, Philfinance as dra,er, and Insular 6an3 of Asia and America as dra,ee, in the total

amount of P7)0,&77.77.

"n #7 March #%$#, petitioner sought to encash the postdated chec3s issued by Philfinance. ?o,ever, the chec3s ,ere

dishonored for having been dra,n against insufficient funds.

"n +1 March #%$#, Philfinance delivered to petitioner the 4C! 8o. #)$)& issued by private respondent Pilipinas 6an3

(FPilipinasF*. It reads as follo,s>

PI-IPI8A 6A8L

Ma3ati toc3 EDchange 6ldg.,

Ayala Avenue, Ma3ati,

Metro Manila

February %, #%$#

IIIIIII

GA-EE 4A5E

5" !aul esbreSo

April 1, #%$#

IIIIIIII

MA5E!I5K 4A5E

8". #)$)&

4E8"MI8A5E4 CE5"4IA8 !ECEIP5

5his confirms that as a duly Custodian 6an3, and upon instruction of P?I-IPPI8E E84E!<!I5E FI8A8CE

C"!P"!A5I"8, ,e have in our custody the follo,ing securities to you QsicR the eDtent herein indicated.

E!IA- MA5. FACE IEE4 !E:I5E!E4 AM"E85

8EM6E! 4A5E GA-EE 6K ?"-4E! PAKEE

+27# 0-1-$# +,7)),$77.70 4MC P?I-. 7)2,%77.77

E84E!<!I5E!

FI8A8CE C"!P.

<e further certify that these securities may be inspected by you or your duly authori/ed representative at any

time during regular ban3ing hours.

Epon your ,ritten instructions ,e shall underta3e physical delivery of the above securities fully assigned to you

should this 4enominated Custodianship !eceipt remain outstanding in your favor thirty (7)* days after its

maturity.

PI-IPI8A 6A8L

(6y Eli/abeth 4e Gilla

Illegible ignature*

1

"n + April #%$#, petitioner approached Ms. Eli/abeth de Gilla of private respondent Pilipinas, Ma3ati 6ranch, and handed her a

demand letter informing the ban3 that his placement ,ith Philfinance in the amount reflected in the 4C! 8o. #)$)& had

remained unpaid and outstanding, and that he in effect ,as as3ing for the physical delivery of the underlying promissory note.

Petitioner then eDamined the original of the 4MC P8 8o. +27# and found> that the security had been issued on #) April #%$)B

that it ,ould mature on 1 April #%$#B that it had a face value of P+,7)),$77.77, ,ith the Philfinance as FpayeeF and private

respondent 4elta Motors Corporation (F4eltaF* as Fma3erBF and that on face of the promissory note ,as stamped F8"8

8E:"5IA6-E.F Pilipinas did not deliver the 8ote, nor any certificate of participation in respect thereof, to petitioner.

Petitioner later made similar demand letters, dated 7 ;uly #%$# and 7 August #%$#,

2

again as3ing private respondent Pilipinas

for physical delivery of the original of 4MC P8 8o. +27#. Pilipinas allegedly referred all of petitioner9s demand letters to

Philfinance for ,ritten instructions, as has been supposedly agreed upon in Fecurities Custodianship AgreementF bet,een

Pilipinas and Philfinance. Philfinance did not provide the appropriate instructionsB Pilipinas never released 4MC P8 8o. +27#,

nor any other instrument in respect thereof, to petitioner.

Petitioner also made a ,ritten demand on #0 ;uly #%$#

3

upon private respondent 4elta for the partial satisfaction of 4MC P8

8o. +27#, eDplaining that Philfinance, as payee thereof, had assigned to him said 8ote to the eDtent of P7)2,%77.77. 4elta,

ho,ever, denied any liability to petitioner on the promissory note, and eDplained in turn that it had previously agreed ,ith

Philfinance to offset its 4MC P8 8o. +27# (along ,ith 4MC P8 8o. +27)* against Philfinance P8 8o. #07-A issued in favor of

4elta.

In the meantime, Philfinance, on #$ ;une #%$#, ,as placed under the =oint management of the ecurities and eDchange

commission (FECF* and the Central 6an3. Pilipinas delivered to the EC 4MC P8 8o. +27#, ,hich to date apparently

remains in the custody of the EC.

4

As petitioner had failed to collect his investment and interest thereon, he filed on +$ eptember #%$+ an action for damages

,ith the !egional 5rial Court (F!5CF* of Cebu City, 6ranch +#, against private respondents 4elta and Pilipinas.

5

5he trial

court, in a decision dated & August #%$2, dismissed the complaint and counterclaims for lac3 of merit and for lac3 of cause of

action, ,ith costs against petitioner.

Petitioner appealed to respondent Court of Appeals in C.A.-:.!. CG 8o. #&#%&. In a 4ecision dated +# March #%$%, the Court

of Appeals denied the appeal and held>

,

6e that as it may, from the evidence on record, if there is anyone that appears liable for the travails of plaintiff-

appellant, it is Philfinance. As correctly observed by the trial court>

5his act of Philfinance in accepting the investment of plaintiff and charging it against 4MC P8

8o. +27# ,hen its entire face value ,as already obligated or earmar3ed for set-off or

compensation is difficult to comprehend and may have been motivated ,ith bad faith.

Philfinance, therefore, is solely and legally obligated to return the investment of plaintiff,

together ,ith its earnings, and to ans,er all the damages plaintiff has suffered incident thereto.

Enfortunately for plaintiff, Philfinance ,as not impleaded as one of the defendants in this case

at barB hence, this Court is ,ithout =urisdiction to pronounce =udgement against it. (p. ##,

4ecision*

<?E!EF"!E, finding no reversible error in the decision appealed from, the same is hereby affirmed in toto.

Cost against plaintiff-appellant.

Petitioner moved for reconsideration of the above 4ecision, ,ithout success.

?ence, this Petition for !evie, on Certiorari.

After consideration of the allegations contained and issues raised in the pleadings, the Court resolved to give due course to the

petition and re'uired the parties to file their respective memoranda.

7

Petitioner reiterates the assignment of errors he directed at the trial court decision, and contends that respondent court of

Appeals gravely erred> (i* in concluding that he cannot recover from private respondent 4elta his assigned portion of 4MC P8

8o. +27#B (ii* in failing to hold private respondent Pilipinas solidarily liable on the 4MC P8 8o. +27# in vie, of the provisions

stipulated in 4C! 8o. #)$)& issued in favor r of petitioner, and (iii* in refusing to pierce the veil of corporate entity bet,een

Philfinance, and private respondents 4elta and Pilipinas, considering that the three (7* entities belong to the Filverio :roup of

CompaniesF under the leadership of Mr. !icardo ilverio, r.

-

5here are at least t,o (+* sets of relationships ,hich ,e need to address> firstly, the relationship of petitioner (is-a-(is 4eltaB

secondly, the relationship of petitioner in respect of Pilipinas. Actually, of course, there is a third relationship that is of critical

importance> the relationship of petitioner and Philfinance. ?o,ever, since Philfinance has not been impleaded in this case,

neither the trial court nor the Court of Appeals ac'uired =urisdiction over the person of Philfinance. It is, conse'uently, not

necessary for present purposes to deal ,ith this third relationship, eDcept to the eDtent it necessarily impinges upon or

intersects the first and second relationships.

I.

<e consider first the relationship bet,een petitioner and 4elta.

5he Court of appeals in effect held that petitioner ac'uired no rights (is-a-(is 4elta in respect of the 4elta promissory note

(4MC P8 8o. +27#* ,hich Philfinance sold F,ithout recourseF to petitioner, to the eDtent of P7)0,&77.77. 5he Court of Appeals

said on this point>

8or could plaintiff-appellant have ac'uired any right over 4MC P8 8o. +27# as the same is Fnon-negotiableF

as stamped on its face (EDhibit F1F*, negotiation being defined as the transfer of an instrument from one person

to another so as to constitute the transferee the holder of the instrument (ec. 7), 8egotiable Instruments

-a,*. A person not a holder cannot sue on the instrument in his o,n name and cannot demand or receive

payment (ection &#, id.*

9

Petitioner admits that 4MC P8 8o. +27# ,as non-negotiable but contends that the 8ote had been validly transferred, in part to

him by assignment and that as a result of such transfer, 4elta as debtor-ma3er of the 8ote, ,as obligated to pay petitioner the

portion of that 8ote assigned to him by the payee Philfinance.

4elta, ho,ever, disputes petitioner9s contention and argues>

(#* that 4MC P8 8o. +27# ,as not intended to be negotiated or other,ise transferred by Philfinance as

manifested by the ,ord Fnon-negotiableF stamp across the face of the 8ote

10

and because ma3er 4elta and

payee Philfinance intended that this 8ote ,ould be offset against the outstanding obligation of Philfinance

represented by Philfinance P8 8o. #07-A issued to 4elta as payeeB

(+* that the assignment of 4MC P8 8o. +27# by Philfinance ,as ,ithout 4elta9s consent, if not against its

instructionsB and

(7* assuming (ar!uendo only* that the partial assignment in favor of petitioner ,as valid, petitioner too3 the

8ote sub=ect to the defenses available to 4elta, in particular, the offsetting of 4MC P8 8o. +27# against

Philfinance P8 8o. #07-A.

11

<e consider 4elta9s arguments seriati+.

Firstly, it is important to bear in mind that the ne!otiation of a negotiable instrument must be distinguished from the assi!n+ent

or transfer of an instrument ,hether that be negotiable or non-negotiable. "nly an instrument 'ualifying as a negotiable

instrument under the relevant statute may be ne!otiated either by indorsement thereof coupled ,ith delivery, or by delivery

alone ,here the negotiable instrument is in bearer form. A negotiable instrument may, ho,ever, instead of being negotiated,

also be assi!ned or transferred. 5he legal conse'uences of negotiation as distinguished from assignment of a negotiable

instrument are, of course, different. A non-negotiable instrument may, obviously, not be negotiatedB but it may be assigned or

transferred, absent an eDpress prohibition against assignment or transfer ,ritten in the face of the instrument>

5he ,ords 9not ne!otiable,9 stamped on the face of the bill of lading, did not destroy its assi!nability, but the

sole effect ,as to eDempt the bill from the statutory provisions relative thereto, and a bill, though not

ne!otiable, +ay be transferred by assi!n+entB the assignee ta3ing sub=ect to the e'uities bet,een the original

parties.

12

(Emphasis added*

4MC P8 8o. +27#, ,hile mar3ed Fnon-negotiable,F ,as not at the same time stamped Fnon-transferableF or Fnon-assignable.F

It contained no stipulation ,hich prohibited Philfinance from assigning or transferring, in ,hole or in part, that 8ote.

4elta adduced the F-etter of AgreementF ,hich it had entered into ,ith Philfinance and ,hich should be 'uoted in full>

April #), #%$)

Philippine Ender,riters Finance Corp.

6enavide/ t., Ma3ati,

Metro Manila.

Attention> Mr. Alfredo ". 6anaria

GP-5reasurer

:E85-EME8>

5his refers to our outstanding placement of P0,1)#,111.12 as evidenced by your Promissory 8ote 8o. #07-A,

dated April #), #%$), to mature on April 1, #%$#.

As agreed upon, ,e enclose our non-negotiable Promissory 8ote 8o. +27) and +27# for P+,))),))).)) each,

dated April #), #%$), to be offsetted QsicR against your P8 8o. #07-A upon co-terminal maturity.

Please deliver the proceeds of our P8s to our representative, Mr. Eric Castillo.

Gery 5ruly Kours,

(gd.*

Florencio 6. 6iagan

enior Gice President

13

<e find nothing in his F-etter of AgreementF ,hich can be reasonably construed as a prohibition upon Philfinance assigning or

transferring all or part of 4MC P8 8o. +27#, before the maturity thereof. It is scarcely necessary to add that, even had this

F-etter of AgreementF set forth an eDplicit prohibition of transfer upon Philfinance, such a prohibition cannot be invo3ed against

an assignee or transferee of the 8ote ,ho parted ,ith valuable consideration in good faith and ,ithout notice of such

prohibition. It is not disputed that petitioner ,as such an assignee or transferee. "ur conclusion on this point is reinforced by

the fact that ,hat Philfinance and 4elta ,ere doing by their eDchange of their promissory notes ,as this> 4elta invested, by

ma3ing a money mar3et placement ,ith Philfinance, approDimately P0,1)),))).)) on #) April #%$)B but promptly, on the same

day, borro,ed bac3 the bul3 of that placement, i.e., P0,))),))).)), by issuing its t,o (+* promissory notes> 4MC P8 8o. +27)

and 4MC P8 8o. +27#, both also dated #) April #%$). 5hus, Philfinance ,as left ,ith not P0,1)),))).)) but only P1)),))).))

in cash and the t,o (+* 4elta promissory notes.

Apropos 4elta9s complaint that the partial assignment by Philfinance of 4MC P8 8o. +27# had been effected ,ithout the

consent of 4elta, ,e note that such consent ,as not necessary for the validity and enforceability of the assignment in favor of

petitioner.

14

4elta9s argument that Philfinance9s sale or assignment of part of its rights to 4MC P8 8o. +27# constituted

conventional subrogation, ,hich re'uired its (4elta9s* consent, is 'uite mista3en. Conventional subrogation, ,hich in the first

place is never lightly inferred,

15

must be clearly established by the une'uivocal terms of the substituting obligation or by the

evident incompatibility of the ne, and old obligations on every point.

1,

8othing of the sort is present in the instant case.

It is in fact difficult to be impressed ,ith 4elta9s complaint, since it released its 4MC P8 8o. +27# to Philfinance, an entity

engaged in the business of buying and selling debt instruments and other securities, and more generally, in money mar3et

transactions. In 3erez (. Court of Appeals,

17

the Court, spea3ing through Mme. ;ustice ?errera, made the follo,ing important

statement>

5here is another aspect to this case. <hat is involved here is a money mar3et transaction. As defined by

-a,rence mith Fthe money mar3et is a mar3et dealing in standardi/ed short-term credit instruments (involving

large amounts* ,here lenders and borro,ers do not deal directly ,ith each other but through a middle manor a

dealer in the open mar3et.F It involves Fcommercial papersF ,hich are instruments Fevidencing indebtness of

any person or entity. . ., ,hich are issued, endorsed, sold or transferred or in any manner conveyed to another

person or entity, ,ith or ,ithout recourseF. 5he fundamental function of the money mar3et device in its

operation is to match and bring together in a most impersonal manner both the Ffund usersF and the Ffund

suppliers.F The +oney +ar&et is an 9i+personal +ar&et9, free fro+ personal considerations. 9The +ar&et

+echanis+ is intended to pro(ide 0uic& +obility of +oney and securities.9

5he impersonal character of the money mar3et device overloo3s the individuals or entities concerned. The

issuer of a co++ercial paper in the +oney +ar&et necessarily &no4s in ad(ance that it 4ould be

e:penditiously transacted and transferred to any in(estor;lender 4ithout need of notice to said issuer. In

practice, no notification is !i(en to the borro4er or issuer of co++ercial paper of the sale or transfer to the

in(estor.

DDD DDD DDD

5here is need to individuate a money mar3et transaction, a relatively novel institution in the Philippine

commercial scene. It has been intended to facilitate the flo4 and ac0uisition of capital on an i+personal basis.

And as specifically re'uired by Presidential 4ecree 8o. 12$, the in(estin! public +ust be !i(en ade0uate and

effecti(e protection in a(ailin! of the credit of a borro4er in the co++ercial paper +ar&et.

1-

(Citations

omittedB emphasis supplied*

<e turn to 4elta9s arguments concerning alleged compensation or offsetting bet,een 4MC P8 8o. +27# and Philfinance P8

8o. #07-A. It is important to note that at the ti+e 3hilfinance sold part of its ri!hts under 1MC 3- -o. <=>? to petitioner on @

)ebruary ?@A?, no co+pensation had as yet ta&en place and indeed none could ha(e ta&en place. 5he essential re'uirements

of compensation are listed in the Civil Code as follo,s>

Art. #+2%. In order that compensation may be proper, it is necessary>

(#* 5hat each one of the obli!ors be bound principally, and that he be at the sa+e ti+e a principal creditor of

the otherB

(+* 5hat both debts consists in a sum of money, or if the things due are consumable, they be of the same 3ind,

and also of the same 'uality if the latter has been statedB

(7* That the t4o debts are dueB

(0* 5hat they be li'uidated and demandableB

(&* 5hat over neither of them there be any retention or controversy, commenced by third persons and

communicated in due time to the debtor. (Emphasis supplied*

"n % February #%$#, neither 4MC P8 8o. +27# nor Philfinance P8 8o. #07-A ,as due. 5his ,as eDplicitly recogni/ed by 4elta

in its #) April #%$) F-etter of AgreementF ,ith Philfinance, ,here 4elta ac3no,ledged that the relevant promissory notes ,ere

Fto be offsetted (sic* against QPhilfinanceR P8 8o. #07-A upon co-ter+inal +aturity.F

As noted, the assignment to petitioner ,as made on % February #%$# or from forty-nine (0%* days before the Fco-terminal

maturityF date, that is to say, before any compensation had ta3en place. Further, the assignment to petitioner ,ould have

prevented compensation had ta3en place bet,een Philfinance and 4elta, to the eDtent of P7)0,&77.77, because upon

eDecution of the assignment in favor of petitioner, Philfinance and 4elta ,ould have ceased to be creditors and debtors of each

other in their o,n right to the eDtent of the amount assigned by Philfinance to petitioner. 5hus, ,e conclude that the

assignment effected by Philfinance in favor of petitioner ,as a valid one and that petitioner accordingly became o,ner of 4MC

P8 8o. +27# to the eDtent of the portion thereof assigned to him.

5he record sho,s, ho,ever, that petitioner notified 4elta of the fact of the assignment to him only on #0 ;uly #%$#,

19

that is,

after the maturity not only of the money mar3et placement made by petitioner but also of both 4MC P8 8o. +27# and

Philfinance P8 8o. #07-A. In other ,ords, petitioner notified 1elta of his ri!hts as assi!nee after co+pensation had ta&en

place by operation of la4 because the offsettin! instru+ents had both reached +aturity. It is a firmly settled doctrine that the

rights of an assignee are not any greater that the rights of the assignor, since the assignee is merely substituted in the place of

the assignor

20

and that the assignee ac'uires his rights sub=ect to the e'uities I i.e., the defenses I ,hich the debtor could

have set up against the original assignor before notice of the assignment ,as given to the debtor. Article #+$& of the Civil Code

provides that>

Art. #+$&. 5he debtor ,ho has consented to the assignment of rights made by a creditor in favor of a third

person, cannot set up against the assignee the compensation ,hich ,ould pertain to him against the assignor,

unless the assignor ,as notified by the debtor at the time he gave his consent, that he reserved his right to the