Escolar Documentos

Profissional Documentos

Cultura Documentos

Dart Group Research Note

Enviado por

api-2494612420 notas0% acharam este documento útil (0 voto)

135 visualizações1 páginaTítulo original

dart group research note

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

135 visualizações1 páginaDart Group Research Note

Enviado por

api-249461242Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 1

08 March 2014

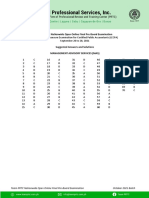

Summary company financials (m)

Year end March FY2012 FY2013 FY2014E FY2015E

Price 2.50 Revenue 683.0 869.2 1,116.2 1,259.6

Market cap (m) 363.6 25.8% 27.3% 28.4% 12.9%

Enterprise value (m) 109.7 EBITDA 62.9 83.4 109.9 98.5

9.2% 9.6% 9.8% 7.8%

Free float 61% Net income 22.7 31.2 35.9 24.4

Net cash -142.7 -212.4 -253.9 -272.4

EV/Sales 0.02 0.14 0.10 0.00

EV/EBITDA 0.3 1.5 1.0 0.0

PE 8.2 11.5 10.1 10.8

Dart Group plc

Revenue growth

EBITDA margin

We all like a high growth internet stock in theory, but it is rare to find examples trading at attractive valuation levels in practice. A

stock such as ASOS Plc may have an exciting growth story for example with 40% annual revenue growth, but its shares trade at a

heady 5.3x Enterprise Value to Revenue and more than 100x PE.

An exception, however, exists in one of the largest UK package holidays operators, internet site Jet2Holidays.com. The business is

set to comprise more than 50% of the revenue of AIM-listed, 12x PE, Dart Group Plc, and has had a remarkable growth trajectory.

Jet2Holidays.com (J2H) was launched by the parent company Dart Group Plc in 2007, and here is its annual growth since have

financials been broken out:

Year J2H customers Growth J2H Revenue % Dart Group revenue J2H EBITDA

2008 34,000

2009 36,000 6%

2010 64,000 78%

2011 98,000 53% 48m 9%

2012 216,000 120% 115m 17% 2.8m

2013 417,390 114% 245m 28% 6.8m

2014E* 848,500 103% 515m 48% 15.5m

*The estimated figures for full year to March 2014 are based on the H1 2014 disclosure from Dart Group Plc. Typically 75% of Jet2Holidays

revenue is contributed from the H1 period.

With the revenue from Jet2Holidays.com set to represent the majority of Dart Group revenues by mid calendar 2014, and growth

rates exceeding 100%, the low valuation rating of Dart looks set to become increasingly obvious.

The remaining divisions of Dart Group are not without their own value. Dart also operates the pan-European budget airline Jet2,

which, by owning 42 out of its 50 aircraft outright, is growing at 19% per annum without the operational leverage of some its

peers. Jet2 had revenues to FY March 2014 we estimate at 670m, flying 5.5m passengers. This still leaves ample room for growth,

and with Jet2 around 10% the size of Ryanair or EasyJet -- plus given Jet2s superior growth rates -- we would not discount Jet2

becoming a substantial player. Jet2 operating margins, at 5%, versus a comparable 12% margin at Ryanair and 11% margin at

EasyJet, may also have upside as this division matures.

Dart also owns logistics and distribution group Fowler Welch. At just 18% of group revenue, and with 2% growth, investors may

feel less excited about this division. It does however represent a cashflow positive contribution to the group offering stability in

periods of potential airline and travel revenue volatility. Dart guides a positive outlook for this division with a new distribution

centre allowing them to accept an encouraging pipeline of new business opportunities.

So to recap, Dart Group Plc the core value driver an internet package holidays website Jet2Holidays.com, in the forward financial

year Jet2Holidays to deliver more than 50% of group revenue and for the last 3 years been growing at c. 100% per annum. This

division is supported by businesses comprising a budget airline, and logistics, both of which are also posting positive revenue

growth.

Dart Group has net cash and a market capitalisation of 405 million. Since its listing in 1991, Dart has been led by 38% shareholder

and founder Philip Meeson. Investors looking for reassurance as to Philips ability as CEO should take comfort from Darts average

16% per annum operating profit and shareholders funds growth since 1991 (for comparison Berkshire Hathaway achieved 15% per

annum shareholders funds growth over the same period). Whilst there have been no dedicated equity raisings since IPO to finance

this growth, option issuance has increased share count by around 1% per annum. In his youth Philip was a pilot with the Royal

Airforce and also five times British Flight Aerobatics Champion. Philip has controlled Dart Group and its precursor companies since

1983 and our take is that he combines a rare combination of business pragmatism with risk taking, as well as having a lifetime of

experience in the airline and travel business sectors.

Você também pode gostar

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- Social Media Marketing Secrets 2020 3 Books in 1 B088QN6CFRDocumento324 páginasSocial Media Marketing Secrets 2020 3 Books in 1 B088QN6CFRmusfiq100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- ACLC College Tacloban Marketing PrinciplesDocumento70 páginasACLC College Tacloban Marketing PrinciplesSherwin HidalgoAinda não há avaliações

- Otis - FujitecDocumento2 páginasOtis - Fujitecapi-249461242Ainda não há avaliações

- After The Storm FinalDocumento106 páginasAfter The Storm FinalNye Lavalle100% (2)

- Goodwill Questions and Their SolutionsDocumento13 páginasGoodwill Questions and Their SolutionsAMIN BUHARI ABDUL KHADER100% (7)

- Ohsms Lead Auditor Training: Question BankDocumento27 páginasOhsms Lead Auditor Training: Question BankGulfam Shahzad100% (10)

- PRTC-FINAL PB - Answer Key 10.21 PDFDocumento38 páginasPRTC-FINAL PB - Answer Key 10.21 PDFLuna VAinda não há avaliações

- Mondelez Research Note 1Documento1 páginaMondelez Research Note 1api-249461242Ainda não há avaliações

- 4831 S2016 PS2 AnswerKeyDocumento9 páginas4831 S2016 PS2 AnswerKeyAmy20160302Ainda não há avaliações

- Its Activists Not Buffett Who Can Change Corporate America - NytimesDocumento4 páginasIts Activists Not Buffett Who Can Change Corporate America - Nytimesapi-249461242Ainda não há avaliações

- Carl Icahn What I Do Is Good For AmericaDocumento3 páginasCarl Icahn What I Do Is Good For Americaapi-249461242Ainda não há avaliações

- Somnomed Research NoteDocumento2 páginasSomnomed Research Noteapi-249461242Ainda não há avaliações

- Viasat Research NoteDocumento1 páginaViasat Research Noteapi-249461242Ainda não há avaliações

- SbryDocumento60 páginasSbryapi-249461242Ainda não há avaliações

- Theravance Research NoteDocumento1 páginaTheravance Research Noteapi-249461242Ainda não há avaliações

- Songbird Estates Research NoteDocumento1 páginaSongbird Estates Research Noteapi-249461242Ainda não há avaliações

- What Ive Learned About InvestingDocumento5 páginasWhat Ive Learned About Investingapi-249461242Ainda não há avaliações

- Coca Cola HellenicDocumento2 páginasCoca Cola Hellenicapi-249461242Ainda não há avaliações

- Collins Foods Research NoteDocumento1 páginaCollins Foods Research Noteapi-249461242Ainda não há avaliações

- Zooplus Research NoteDocumento1 páginaZooplus Research Noteapi-249461242Ainda não há avaliações

- Lands EndDocumento1 páginaLands Endapi-249461242Ainda não há avaliações

- Miko Research NoteDocumento1 páginaMiko Research Noteapi-249461242Ainda não há avaliações

- Proto Corp Research NoteDocumento1 páginaProto Corp Research Noteapi-249461242Ainda não há avaliações

- Thorntons Research NoteDocumento2 páginasThorntons Research Noteapi-249461242Ainda não há avaliações

- Athens Water Supply and Sewerage Research NoteDocumento1 páginaAthens Water Supply and Sewerage Research Noteapi-249461242Ainda não há avaliações

- Aegean Airlines Research NoteDocumento2 páginasAegean Airlines Research Noteapi-249461242Ainda não há avaliações

- Ebay Research NoteDocumento1 páginaEbay Research Noteapi-249461242Ainda não há avaliações

- Fujitec Research Note 3Documento2 páginasFujitec Research Note 3api-249461242Ainda não há avaliações

- Rocketfuel Research NoteDocumento2 páginasRocketfuel Research Noteapi-249461242Ainda não há avaliações

- Stef Research Note 1Documento1 páginaStef Research Note 1api-249461242Ainda não há avaliações

- Crossrail The Impact On Londons Property MarketDocumento20 páginasCrossrail The Impact On Londons Property Marketapi-249461242Ainda não há avaliações

- FTD Companies Research Note 1Documento1 páginaFTD Companies Research Note 1api-249461242Ainda não há avaliações

- Good Energy Research NoteDocumento2 páginasGood Energy Research Noteapi-249461242Ainda não há avaliações

- Notice of Revisions To Mid-Term Management PlanDocumento1 páginaNotice of Revisions To Mid-Term Management Planapi-249461242Ainda não há avaliações

- Global Brass and Copper Holdings Research Note 1Documento2 páginasGlobal Brass and Copper Holdings Research Note 1api-249461242Ainda não há avaliações

- Crossrail Property Impact StudyDocumento224 páginasCrossrail Property Impact Studyapi-249461242Ainda não há avaliações

- MOB Unit-3Documento32 páginasMOB Unit-3Balijepalli Srinivasa RavichandraAinda não há avaliações

- Practice Test 1 PMDocumento34 páginasPractice Test 1 PMNguyễn Lê Minh NhậtAinda não há avaliações

- Bbsg4103marketing Management & StrategyDocumento18 páginasBbsg4103marketing Management & Strategydicky chongAinda não há avaliações

- 1625426853empresas Que Emitiram Vistos de Trabalho Na Irlanda - Jul 2021Documento76 páginas1625426853empresas Que Emitiram Vistos de Trabalho Na Irlanda - Jul 2021Marina Fenato Mariani XuAinda não há avaliações

- Financial Performance of Western India Plywoods LtdDocumento105 páginasFinancial Performance of Western India Plywoods LtdMeena SivasubramanianAinda não há avaliações

- Parties & Their Role in Project FinanceDocumento15 páginasParties & Their Role in Project FinanceBlesson PerumalAinda não há avaliações

- Food and Beverage OperationsDocumento6 páginasFood and Beverage OperationsDessa F. GatilogoAinda não há avaliações

- Affordable Lawn Care Financial StatementsDocumento8 páginasAffordable Lawn Care Financial StatementsTabish TabishAinda não há avaliações

- EU-28 - SBA Fact Sheet 2019Documento52 páginasEU-28 - SBA Fact Sheet 2019Ardy BAinda não há avaliações

- Accounting transactions and financial statementsDocumento3 páginasAccounting transactions and financial statementsHillary MoreyAinda não há avaliações

- SCM Project - Final ReportDocumento10 páginasSCM Project - Final Reportmuwadit AhmedAinda não há avaliações

- E-Commerce Survey of Kalyan, Ulhasnagar, Ambernath & BadlapurDocumento16 páginasE-Commerce Survey of Kalyan, Ulhasnagar, Ambernath & BadlapurSupriya RamAinda não há avaliações

- Enterprise Structure OverviewDocumento5 páginasEnterprise Structure OverviewAnonymous 7CVuZbInUAinda não há avaliações

- Small Business Term Paper on Opportunities in BangladeshDocumento25 páginasSmall Business Term Paper on Opportunities in BangladeshMaisha MaliatAinda não há avaliações

- Customs Unions and Free Trade AreasDocumento6 páginasCustoms Unions and Free Trade AreasÖzer AksoyAinda não há avaliações

- 1ST AssDocumento5 páginas1ST AssMary Jescho Vidal AmpilAinda não há avaliações

- Managerial Accounting: Mariia Chebotareva, PHDDocumento27 páginasManagerial Accounting: Mariia Chebotareva, PHDSpam SpamovichAinda não há avaliações

- Prelim Quiz 1 System IntegDocumento11 páginasPrelim Quiz 1 System IntegMark RosellAinda não há avaliações

- Accountancy Answer Key Class XII PreboardDocumento8 páginasAccountancy Answer Key Class XII PreboardGHOST FFAinda não há avaliações

- Career Objective For HR/Management/Public AdministrationDocumento4 páginasCareer Objective For HR/Management/Public AdministrationSana ShahidAinda não há avaliações

- Mohd Arbaaz Khan Digital Marketing UAEDocumento2 páginasMohd Arbaaz Khan Digital Marketing UAEArbaaz KhanAinda não há avaliações

- Tutorial 3 QuestionsDocumento2 páginasTutorial 3 QuestionsHà VânAinda não há avaliações

- Everyday EthicsDocumento2 páginasEveryday EthicsJess HollAinda não há avaliações